Master Discusses Hot Topics:

Just over the weekend, many fans asked me, "Master, is a major correction coming soon?" I shook my head upon hearing this, thinking it truly reflects the typical psychology of retail investors.

Whenever the market rises quickly, fear begins to creep in. People feel that once a certain psychological threshold is breached, the market will experience a significant drop, perhaps by tens of thousands of points.

But in reality, a correction is a gradually accumulating process; where does such an exaggerated crash come from? If you look at things too pessimistically, it's like setting a time bomb in your mind, and you never know when it will explode.

I have emphasized in previous articles that a so-called major correction is not a random event. It requires the accumulation of minor corrections, along with a sudden major negative factor to trigger it.

Currently, the housing market is only undergoing an hourly adjustment, with small fluctuations and no obvious bearish patterns. So there is no need to panic; just follow the market's rhythm and buy on dips as usual.

Every time a new high is reached, adjust your take-profit point, maintain your previous targets during sideways movements, and when a correction hits a key support level, adjust your take-profit target in line with market changes.

Moreover, today, as the last week of the month, there are no particularly negative signals. The interest rate cuts in December and some minor market fluctuations are unlikely to trigger a major correction. So everyone can relax; looking back from April to October this year, the market has been oscillating for so long that a prolonged sideways trend is likely to lead to a breakout.

Monthly three consecutive bullish candles and five consecutive bullish candles are almost routine, and the upward momentum of the MACD is gradually strengthening; market sentiment is not as pessimistic as it seems. If there are signals of a major correction, I will definitely remind everyone in advance to prepare.

Additionally, I strictly implement defensive measures on the short term, and risk control is already very well managed. Therefore, there is currently not much risk, and everyone can feel at ease.

As for the market's decline, I personally believe it does not represent a major crisis. The drop over the weekend was merely some investors exiting, related to insufficient liquidity; after all, the shortage of market maker funds has led to a bit of tightness in market liquidity.

However, from the URPD data, especially below $80,000, many profit-taking positions have emerged, and this group of investors has not shown panic, indicating that the market remains in a stable state.

So right now, the overall market does not show particularly large risks; at most, the FOMO sentiment is gradually fading, and people's greed is receding.

In the short term, the typical correction for Bitcoin is generally around 3,000 to 5,000 points. Why this limit? Because current corrections mostly belong to small fluctuations within the daily chart. As long as the 4-hour MACD does not break below the zero line, there is no need to blindly short. Short-term market fluctuations can be understood, but if you chase shorts too aggressively or blindly, you are simply asking for trouble. The real opportunities in the market lie in capturing stable trends, not in repeatedly chasing short-term fluctuations.

As mentioned earlier, this week is the last week of the month, and it is expected that the buying power in the market may converge after Tuesday. After all, the surge on Friday and Saturday has overly excited the market, and last night’s correction to $95,800 is a healthy pullback, giving the market some breathing space.

If it dips to the $95,000 level, as long as it does not break below, I will not turn bearish. The 4-hour MACD is already close to the zero line and is turning right, with strong support between $96,000 and $95,800, so it is unlikely to encounter major issues.

As for the many fans asking about small altcoins, it is best to refrain from touching them for now. The volatility at the end of the month may intensify, especially when market sentiment is weak, so it is better to focus on major coins. Bitcoin and Ethereum are two good choices; even if they occasionally dip below their lows, the market will rebound quickly.

You can also gain quick floating profits during the rebound. Altcoins have greater volatility, and their sharp reactions during corrections can be more severe, leading to potential losses if not careful. Therefore, unless you can strictly grasp the trend, it is best to operate cautiously with small altcoins.

As for Ethereum, from a technical perspective, the upper edge of the 4-hour central pivot is around $3,524, while $3,600 is just a round number. A daily top formation signal has appeared, indicating a potential end to the rebound. Ethereum should still break through the $3,498 high to complete a small rebound, but if it cannot break through, it will continue to test the lows, so everyone should pay attention to changes in structure.

So do not let the panic of a major correction lead you astray; the market is not as apocalyptic as it seems. As long as you maintain a clear mind and adjust your take-profit targets in a timely manner, following the market's trend, victory often belongs to those rational and steady retail investors.

Moreover, even if there are slight fluctuations in the short term, this is just the market accumulating strength for a larger rise. So do not scare yourself, and do not start worrying at the first sign of market adjustments. This is just a process; stabilize your mindset, go with the flow, and market opportunities will continue to arise.

Master Looks at Trends:

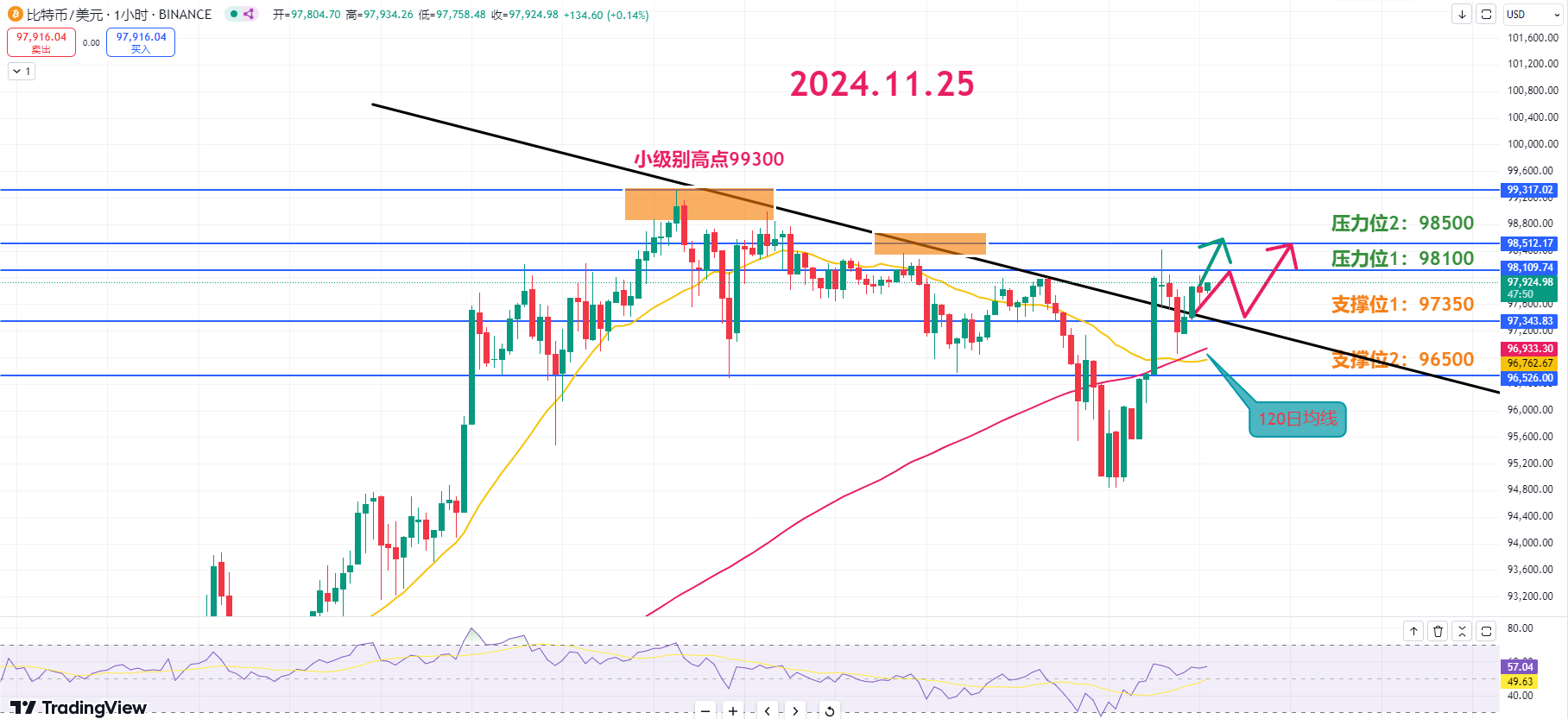

The market is still full of expectations for Bitcoin to break through $100,000, but due to the strong resistance at this psychological price level, prices may experience fluctuations up and down.

From historical experience, within the range of creating historical highs, there is usually a rebound after a sharp drop, so one can look for entry opportunities in the sharp drop range.

Resistance Levels Reference:

First Resistance Level: 98,100

Second Resistance Level: 98,500

Support Levels Reference:

First Support Level: 97,350

Second Support Level: 96,500

Today's Suggestions:

If Bitcoin can hold the first support level during the day, the rebound view can continue to be maintained. It is recommended to pay attention to the 120-day moving average trend mentioned by Master yesterday.

Although yesterday's important support was briefly broken, a rebound occurred shortly after. The drop over the weekend has been partially recovered, and it is currently judged that a short-term low has formed, so the rebound view can still be maintained.

11.25 Master’s Trading Plan:

Long Entry Reference: 95,900 light long; if it retraces to the 95,400-94,800 range, go long directly. Defense: 94,400. If it briefly breaks below 94,400, then reduce positions appropriately; additional positions can be added around 93,800. Target: 97,350-98,500.

Short Entry Reference: Not applicable.

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen), with the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above); other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。