The operation of stablecoins is inseparable from blockchain.

Authors: Andrew Van Aken & Jon Ma

Translation: Deep Tide TechFlow

Abstract

Stripe acquired Bridge.XYZ for $1 billion, a company that raised $50 million from Sequoia, Ribbit Capital, and Haun Ventures less than a year ago. This means that Series A investors achieved nearly 10 times their return in less than a year.

Yellow Card completed a $33 million Series C funding round, planning to transition to B2B payment services for stablecoins, and announced that it has served over 30,000 businesses with revenue reaching eight figures.

Meanwhile, on-chain data for stablecoins is breaking or nearing historical highs. In a report in collaboration with Castle Island Ventures and Visa, we present both quantitative and qualitative analyses of this data.

In the past, investors generally believed that stablecoin issuers were the biggest beneficiaries of stablecoin adoption.

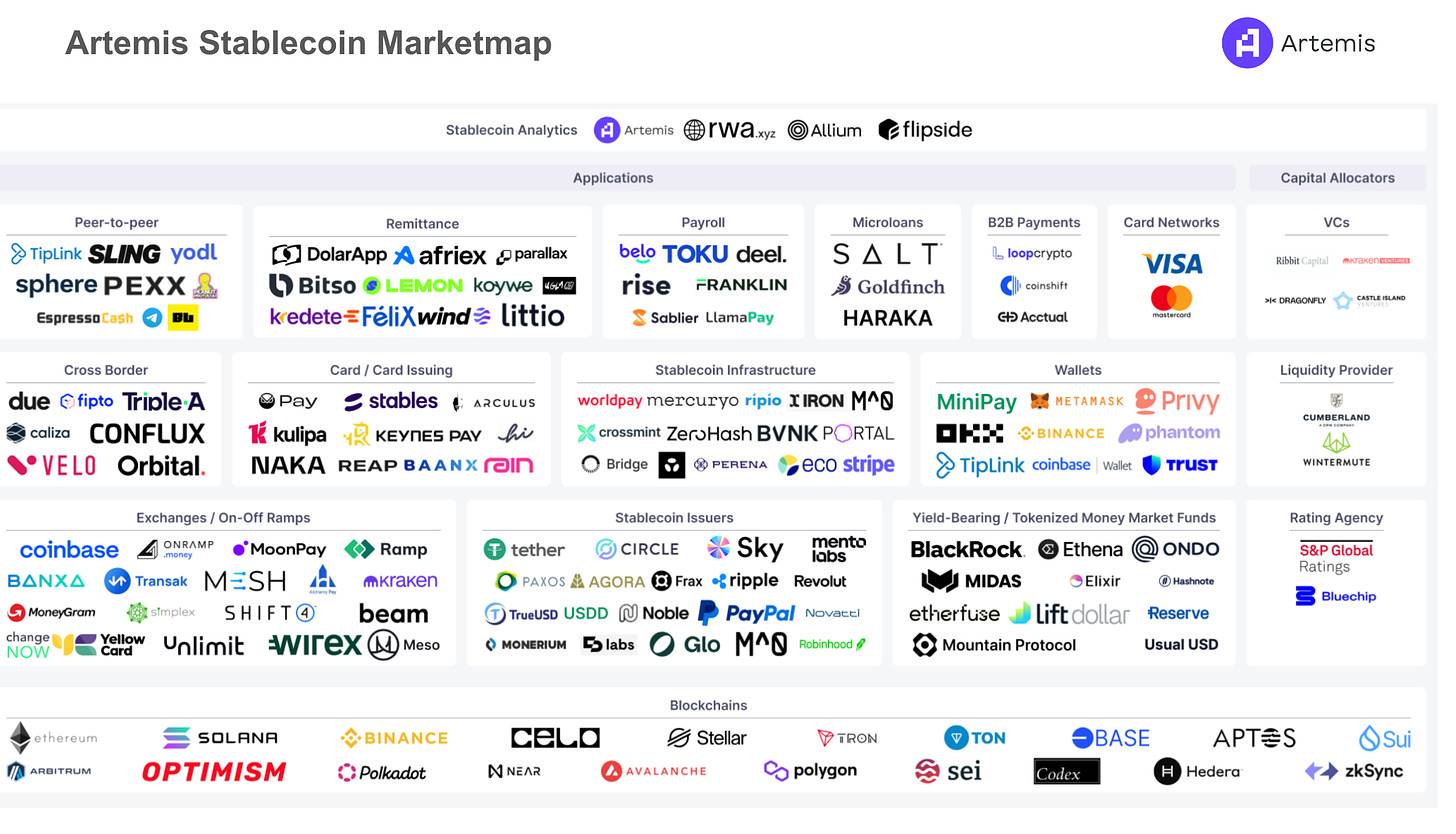

However, 2024 has brought a new change: with the popularity of stablecoins, fintech applications, payment networks, infrastructure development, fiat on/off ramps, and data analytics tools are gradually becoming the main drivers of value accumulation.

We have identified many companies that will benefit from the adoption of stablecoins. Today, we share these research findings with other members of the community.

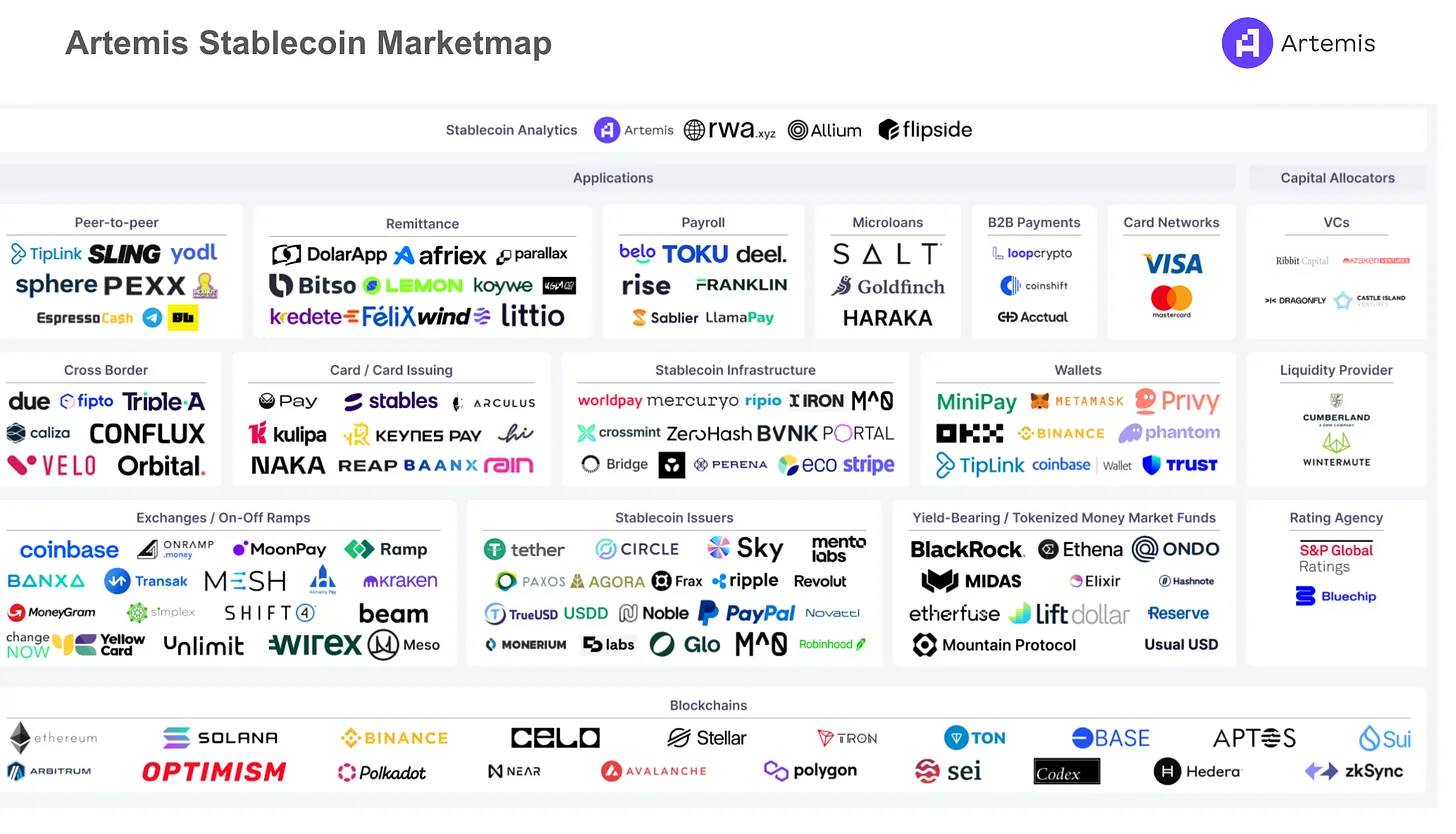

Here is a live-updated open-source market map: If you would like to recommend a company, please contact Crystal Tai.

Introduction

“Even if we only get stablecoins, it is still a very significant achievement.” — Nic Carter

Satoshi Nakamoto proposed a fully decentralized peer-to-peer electronic cash system in his white paper, which does not rely on central servers or trusted third parties. We believe that 2024 will bring us closer to this vision, and stablecoins are the killer application of blockchain networks.

The emergence of stablecoins allows global users to easily transfer funds, make payments, and effectively cope with the challenges of high inflation. On-chain data indicates that the supply, transfer volume, and number of active addresses for stablecoins are all significantly increasing. To validate these trends, we interviewed some users in Lebanon, India, and the United States, and their feedback further confirmed the authenticity of this data. Castle Island Ventures recently released a report titled “Stablecoins: The Emerging Market Story” that showcases the practical applications and rapid growth of stablecoins in emerging markets through Artemis's on-chain data.

Stablecoins are gradually moving towards the mainstream market.

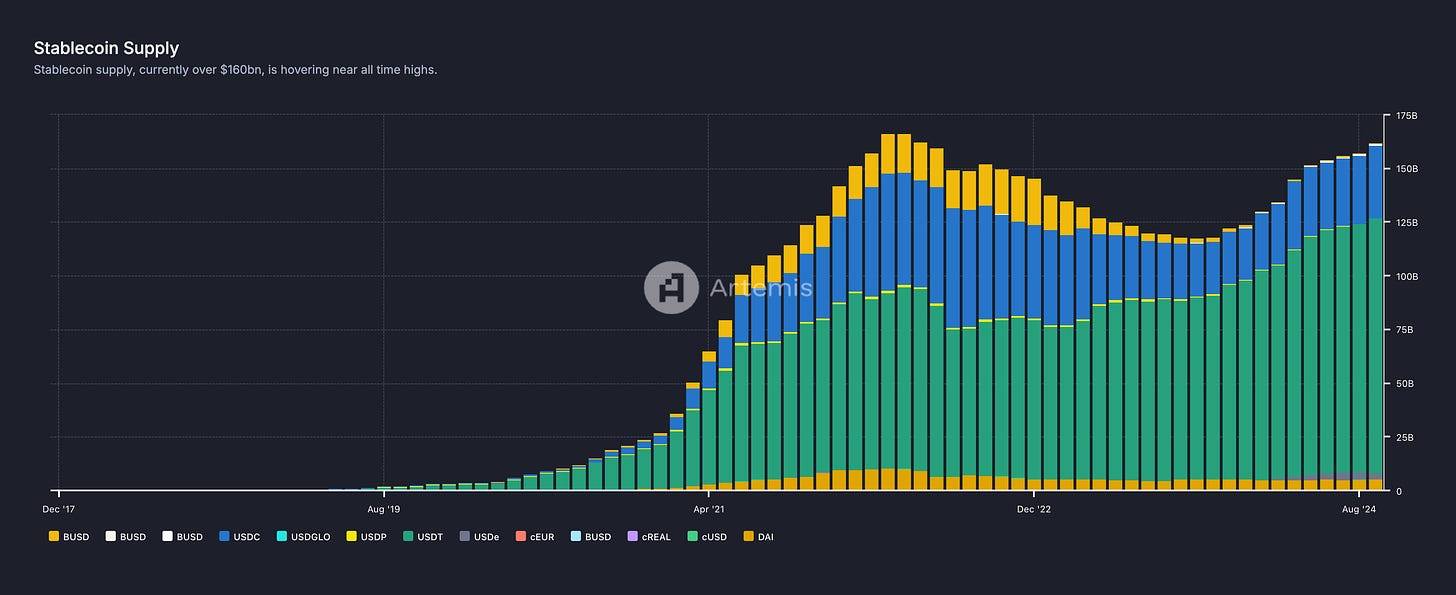

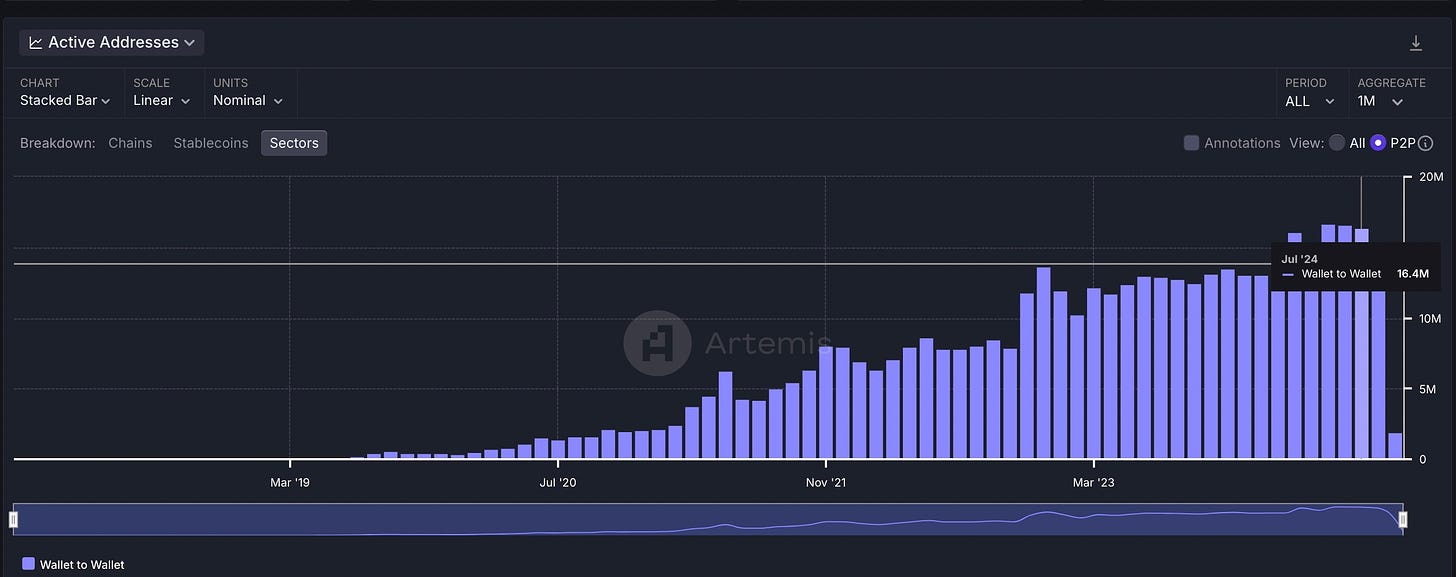

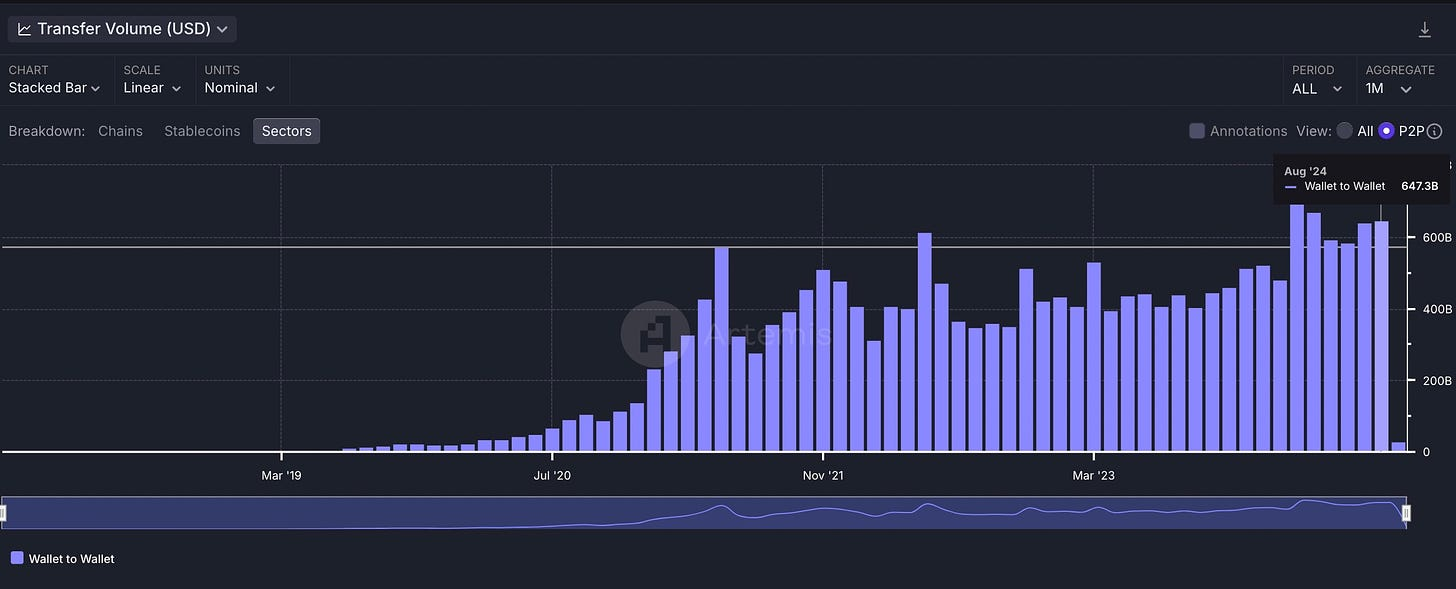

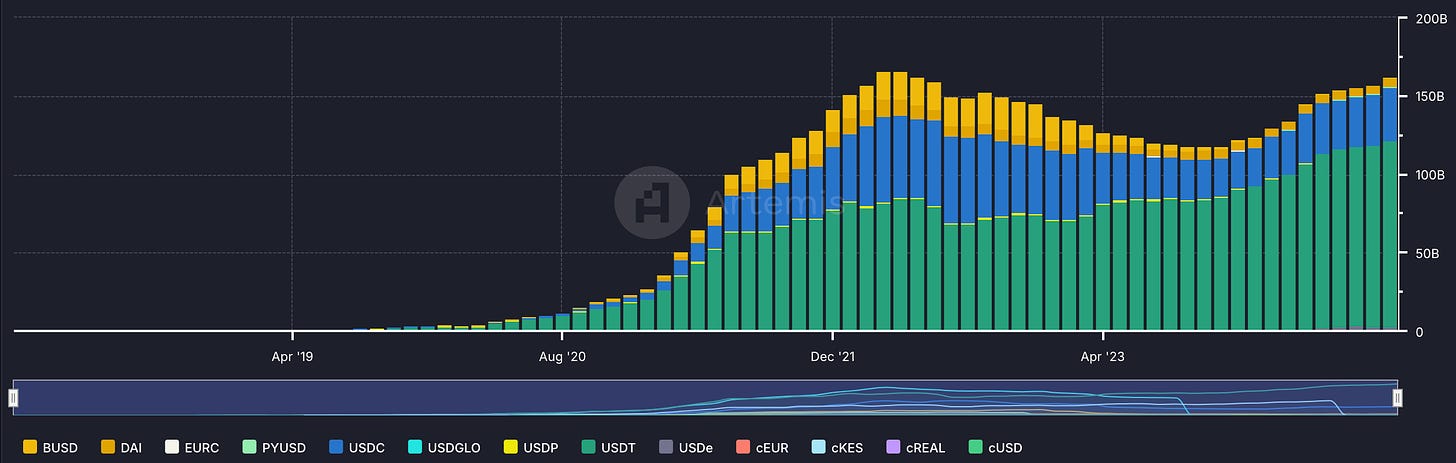

While the cryptocurrency market has experienced alternating bull and bear phases, several key metrics for stablecoins continue to break or approach historical highs:

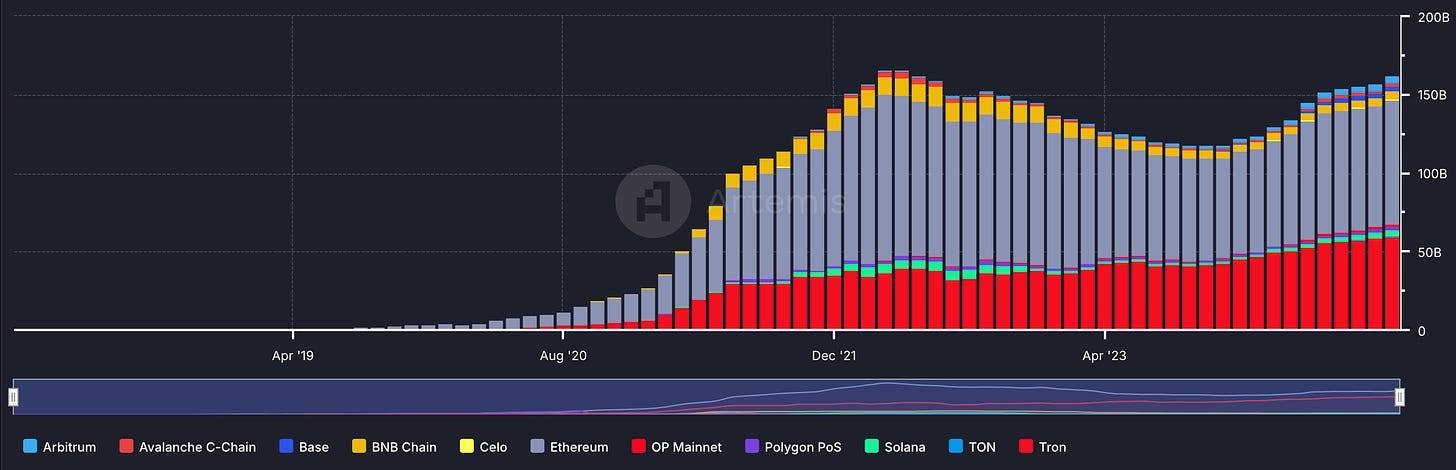

- The total supply of stablecoins has exceeded $160 billion, nearing its all-time high.

Stablecoin Supply - Real-time Dashboard

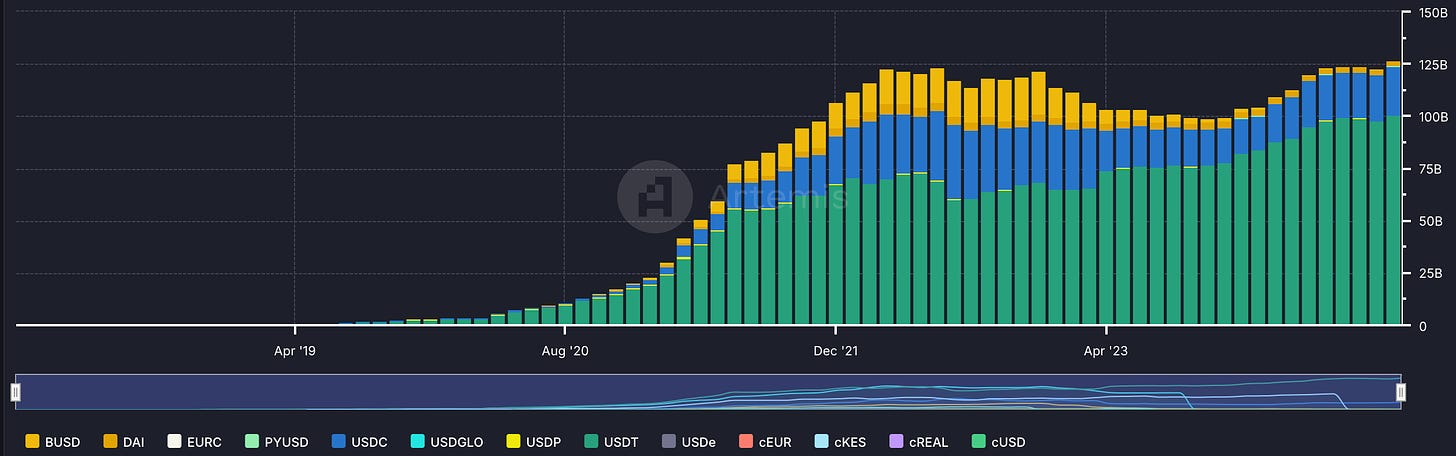

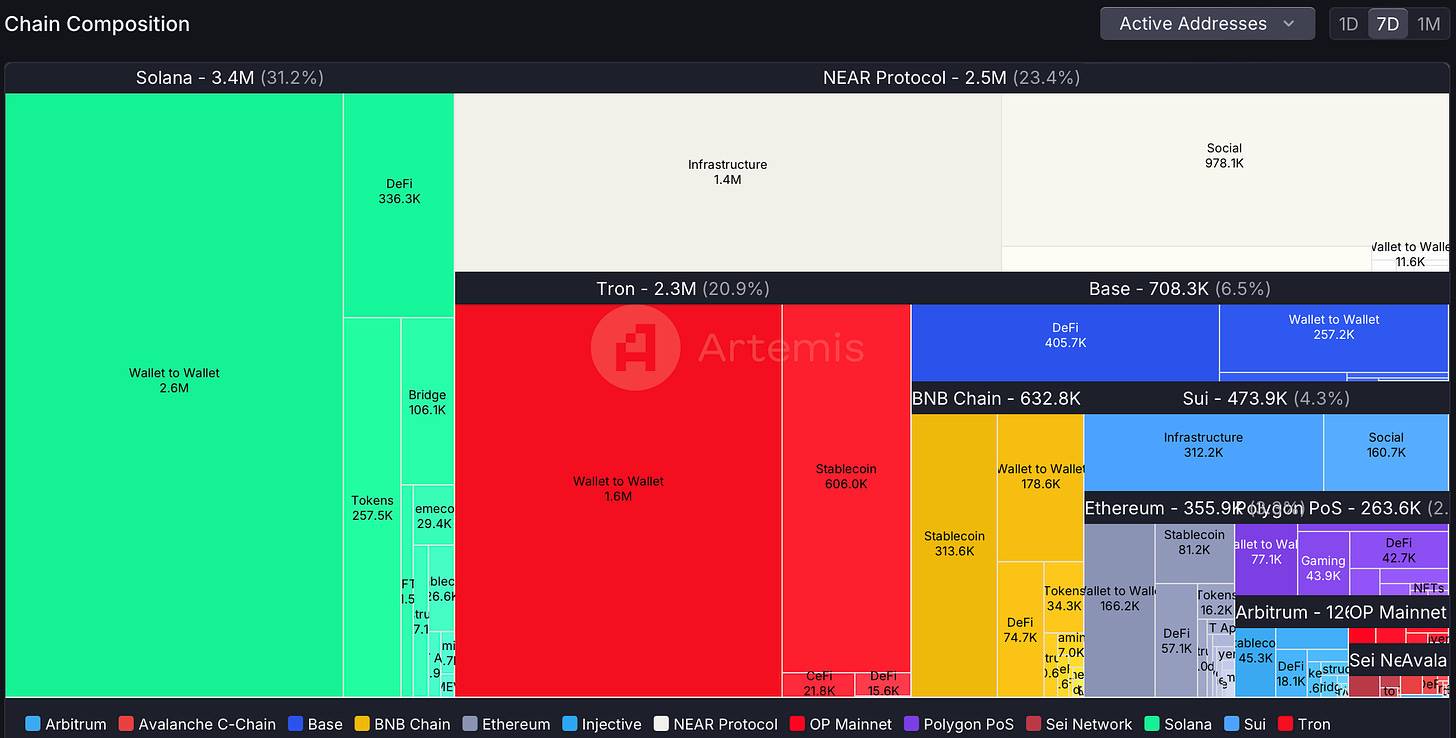

- From May to July 2024, there were 16 million active addresses per month, with users transferring stablecoins between wallets, demonstrating behavior similar to peer-to-peer payments, reaching an all-time high.

- The volume of peer-to-peer stablecoin transfers surpassed $700 billion in March 2024, setting another record.

Investors are Paying Attention

The traditional view holds that investing in stablecoins is somewhat challenging: because the value of stablecoins is essentially pegged to fiat currencies. In most discussions with investors, the focus often centers on how stablecoin issuers (like Circle and Tether) benefit from this.

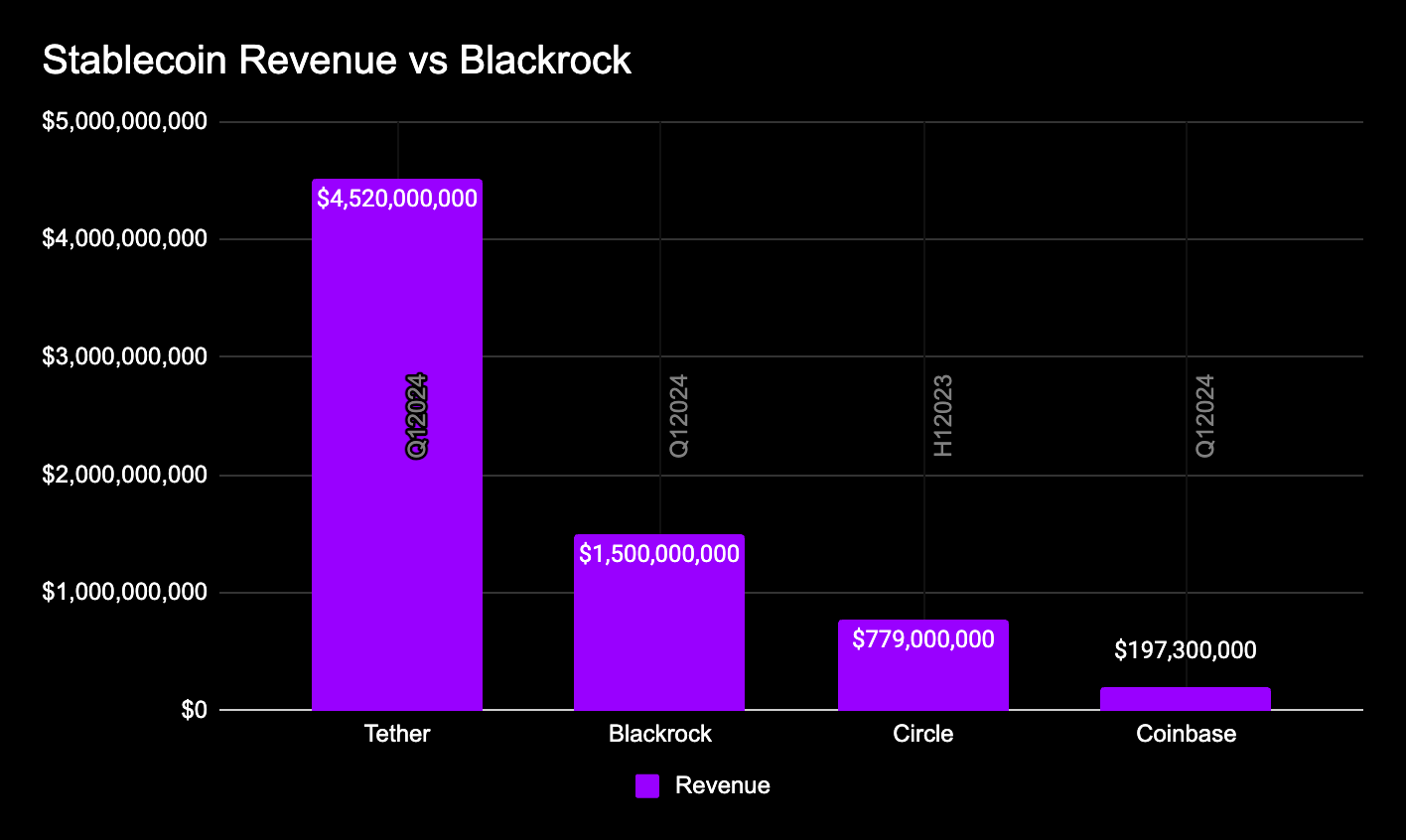

For example, Circle disclosed that it achieved $779 million in revenue in the first half of 2023, while Tether reported a net profit of $4.52 billion in the first quarter of 2024—this figure is three times the net profit of Blackrock during the same period ($1.5 billion).

However, this situation is changing. In August 2024, several payment companies related to cryptocurrency announced they had secured over $100 million in funding. For instance, Bridge.xyz stated that its clients include SpaceX and Bitso, indicating that the market demand for stablecoin-related products is growing.

Through research, we have identified many companies accumulating value in the stablecoin space. Today, we share these research findings with the broader community.

In our market map, we aim to show investors and the community that supporting the global adoption of stablecoins is not limited to a single approach. In addition to investing in private companies, opportunities in public blockchains or related tokens can also be explored.

Stablecoin Value Accumulation Chain

Blockchain

The operation of stablecoins is inseparable from blockchain.

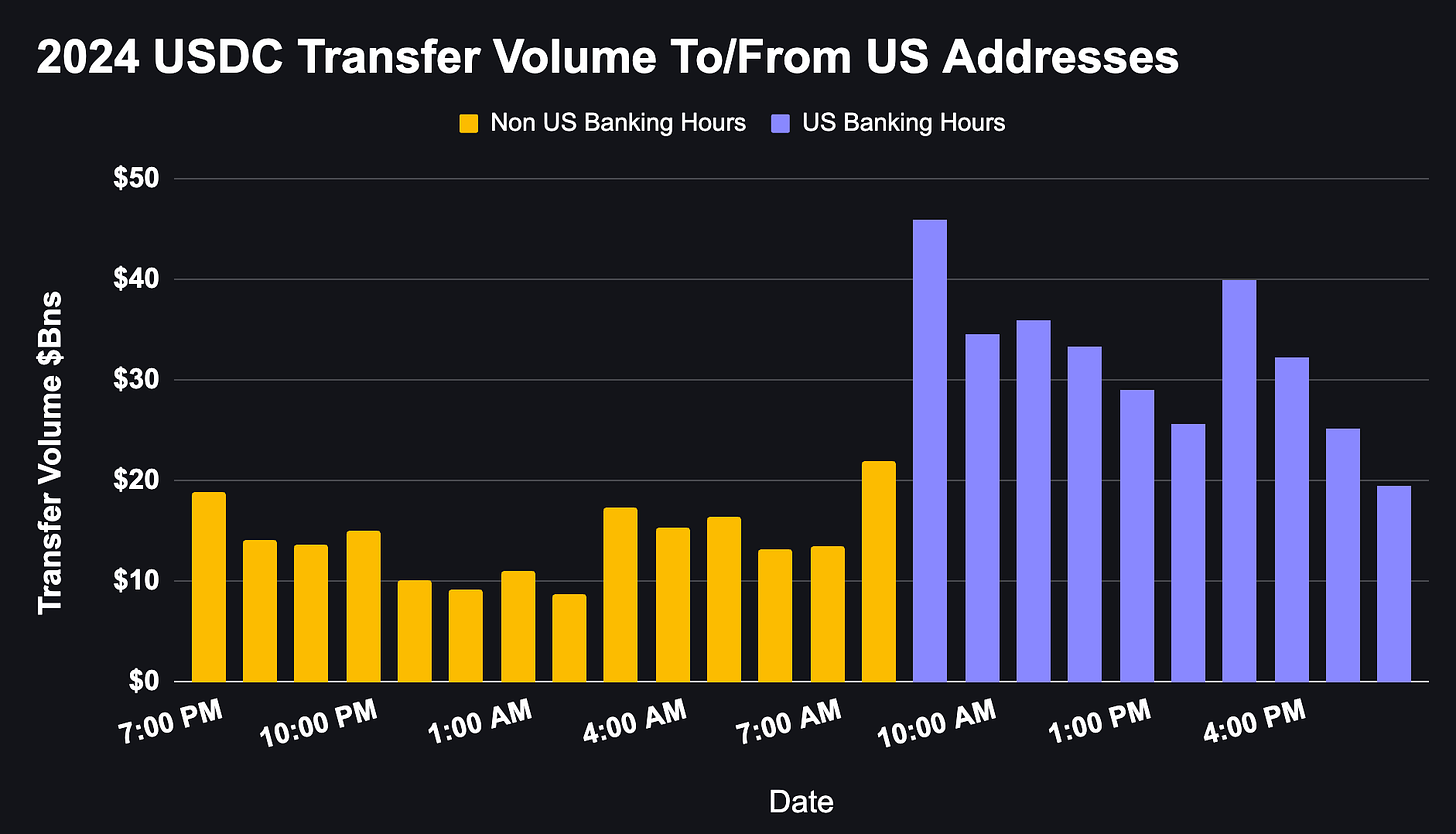

Blockchain plays a crucial role in the transactions of stablecoins. As a public and transparent ledger, blockchain not only supports the final settlement of stablecoins but also allows anyone to verify transaction information. The blockchain operates around the clock without interruption. For example, in the case of USDC's transfer volume in the United States, we observed that its transaction activity peaks during U.S. banking hours but maintains a high level of activity even when banks are closed.

Source: Internal Artemis Data

Although Ethereum remains the primary platform for stablecoin transactions, new blockchains with faster block generation times and lower fees are driving further growth in stablecoins. These blockchains include Solana, Tron, TON, Base, Celo, Stellar, and BNB Chain. Additionally, new blockchains are continuously emerging, such as Sui, which recently announced a partnership with Circle.

Stablecoin Supply by Chain

Another question worth exploring is: How does a blockchain accumulate value? When the supply of stablecoins on a network increases, does the value of that network also increase? Taking TRON as an example, its price shows a high correlation with circulating supply in the context of stablecoin supply growth, indicating a potential positive relationship between the two.

Stablecoin Issuers

Stablecoin issuers are the entities responsible for creating, distributing, and managing stablecoins. To ensure the stability of stablecoin value, issuers typically back each stablecoin with reserve assets (such as cash or equivalents). Their main responsibilities include issuing and redeeming stablecoins, managing reserve assets, ensuring transparency, and complying with relevant regulations.

Currently, Tether is one of the major issuers in the stablecoin space, reportedly having exceeded $5 billion in net profit in the first half of 2024. Meanwhile, Circle is also considering launching an IPO at a valuation of around $5 billion.

Additionally, there are some stablecoin issuers that offer yields, such as Mountain Protocol (with a circulating supply of about $48 million). These issuers profit from the spread between the assets they hold and the interest paid to token holders, while providing users with additional returns.

Stablecoin Supply by Issuer

Stablecoin Infrastructure

To help stablecoin issuers quickly issue stablecoins in compliance with regulations, while allowing applications that wish to utilize stablecoins to easily convert between fiat and cryptocurrencies, a robust infrastructure is needed to support the stablecoin ecosystem. These companies form the infrastructure layer within the stablecoin ecosystem.

On the fiat side, companies like Bridge.xyz and Brale.xyz provide APIs and infrastructure tools for developers and enterprise teams, enabling smooth fund flows between fiat and stablecoins. These fiat-stablecoin infrastructure companies assist businesses in achieving cross-border payments, issuing their own stablecoins, and providing convenient fund management tools. At the same time, they handle complex regulatory, compliance, and technical tasks, which are often costly and time-consuming.

Time Savings: For example, Glo Dollar (a stablecoin focused on funding public welfare projects) successfully issued Glo Dollar within weeks using this infrastructure, while traditional processes could take up to 6 months.

24/7 Service: Users can now transfer stablecoins at any time, while companies like Bridge.xyz serve as backend infrastructure, ensuring services run 24/7.

On the on-chain side, companies like Perena and M^0 help stablecoin issuers achieve scalable growth through decentralized protocols while avoiding liquidity fragmentation issues. These protocols position themselves as "fund middleware" for stablecoin issuers, providing efficient on-chain support.

OnRamps

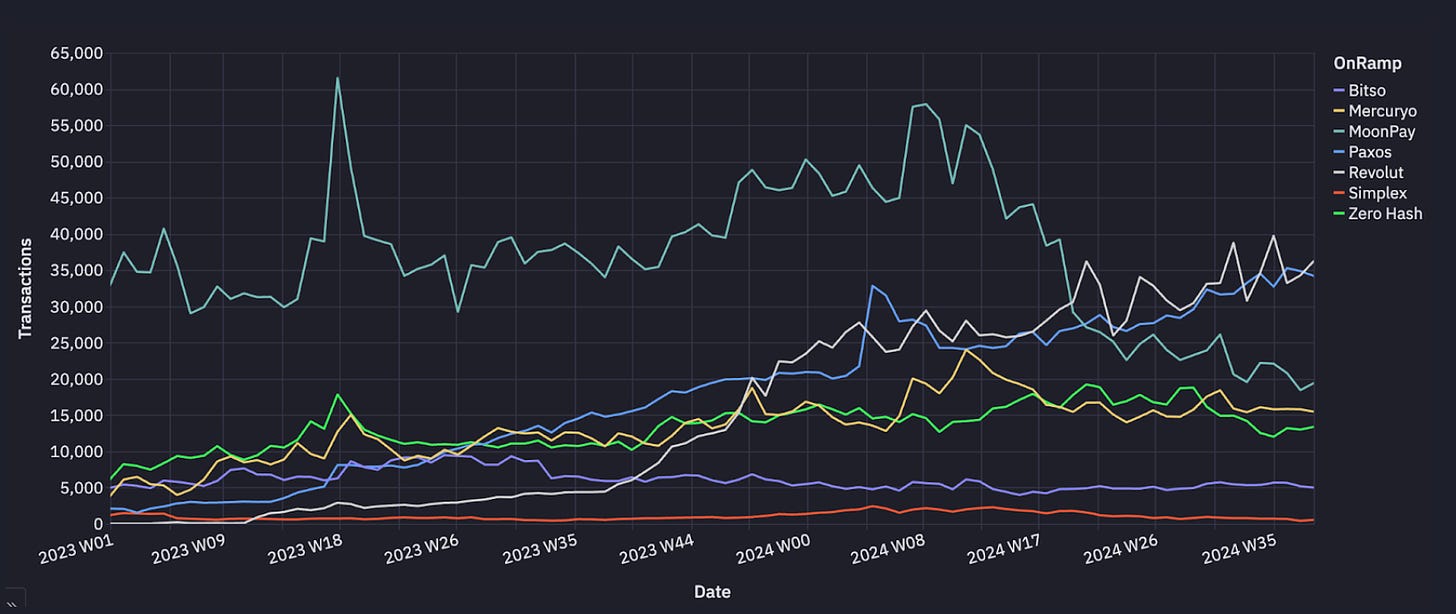

Cryptocurrency fiat on-ramp services (such as MoonPay and Transak) allow users to directly purchase cryptocurrencies using traditional payment methods (like credit cards, bank transfers, or mobile payments). These services typically deposit users' cryptocurrencies directly into digital wallets like MetaMask and Coinbase Wallet, without going through traditional cryptocurrency exchanges. Such companies usually charge a small fee to cover infrastructure operations, KYC (Know Your Customer) processes, and other service costs. As shown in the chart below, cryptocurrency fiat on-ramp activity on Ethereum has shown a steady growth trend since 2023.

Cryptocurrency Fiat On-Ramp Activity on Ethereum

Source: Internal Artemis Data

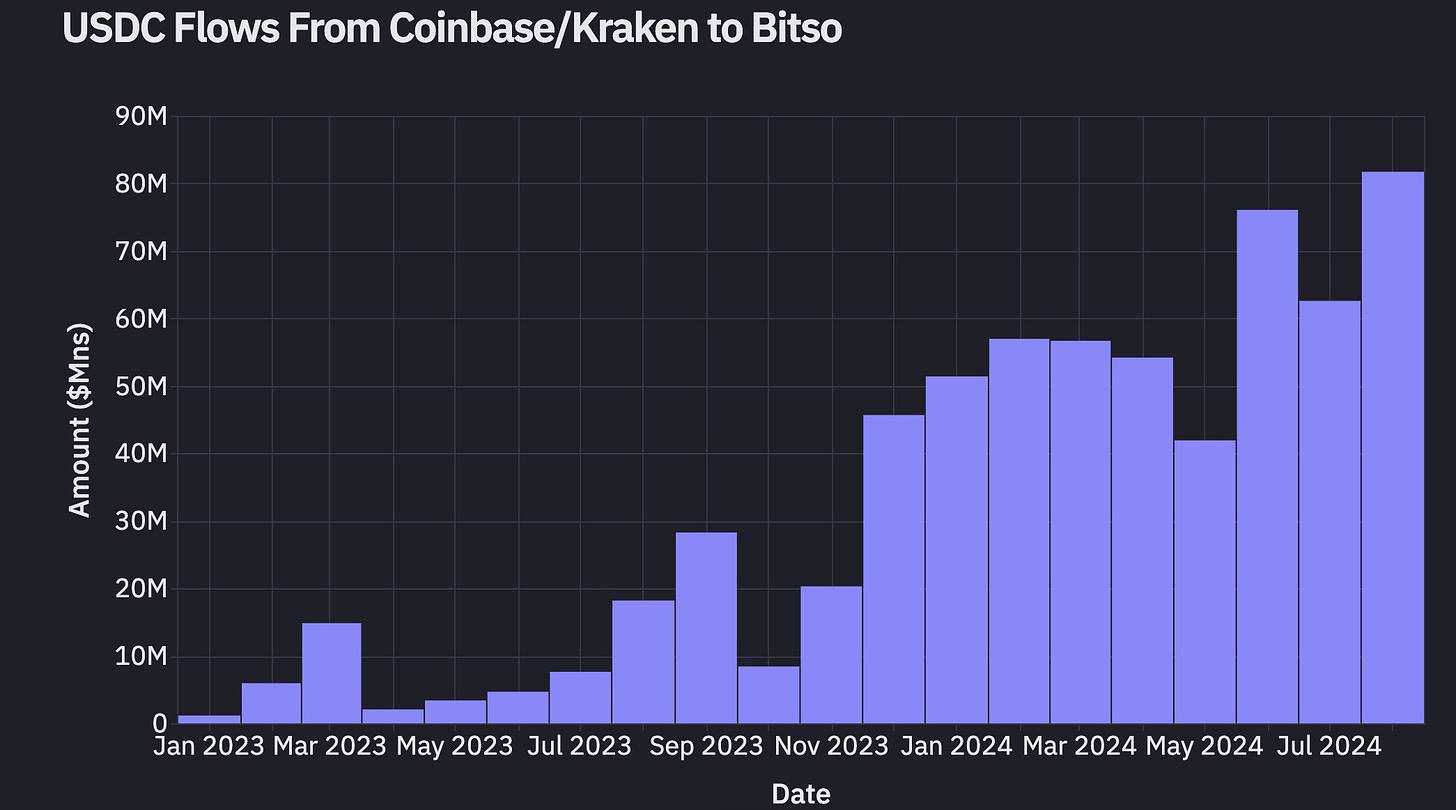

Cross-Border Payments/Remittances/P2P Payments

Many companies are simplifying cross-border payments and remittance processes through stablecoin technology. These applications are often designed to be very intuitive, hiding the underlying cryptocurrency technology, allowing users to complete transactions without needing to understand the technical details. The fees charged by these companies are typically much lower than those of traditional remittance companies, while also providing more competitive exchange rates. For example, the volume of stablecoin transactions from Coinbase or Kraken to Bitso (a Mexico City exchange) is gradually increasing, indicating that the application of stablecoins in cross-border remittances is expanding.

Source: Internal Artemis Data

Peer-to-peer (P2P) cryptocurrency transactions, often referred to as the "global version of Venmo," provide users with a convenient way to transfer funds globally. Companies like TipLink and Sling offer extremely simple user interfaces, allowing anyone to easily receive payments through cryptocurrency networks. More importantly, users of these products often do not realize they are using cryptocurrency, achieving a truly seamless user experience.

Monthly P2P Stablecoin Transfer Volume by Stablecoin

Wallet

Cryptocurrency wallets provide users with a self-custodial way to have complete control over their digital assets. These wallets typically support multiple blockchain networks, allowing users to store and manage various types of crypto assets. Moreover, many wallets also have built-in fiat-to-crypto on-ramp services, making it easier for users to purchase cryptocurrencies. According to Artemis data, transfers between wallets are currently one of the largest use cases for blockchain.

Data Source: Artemis

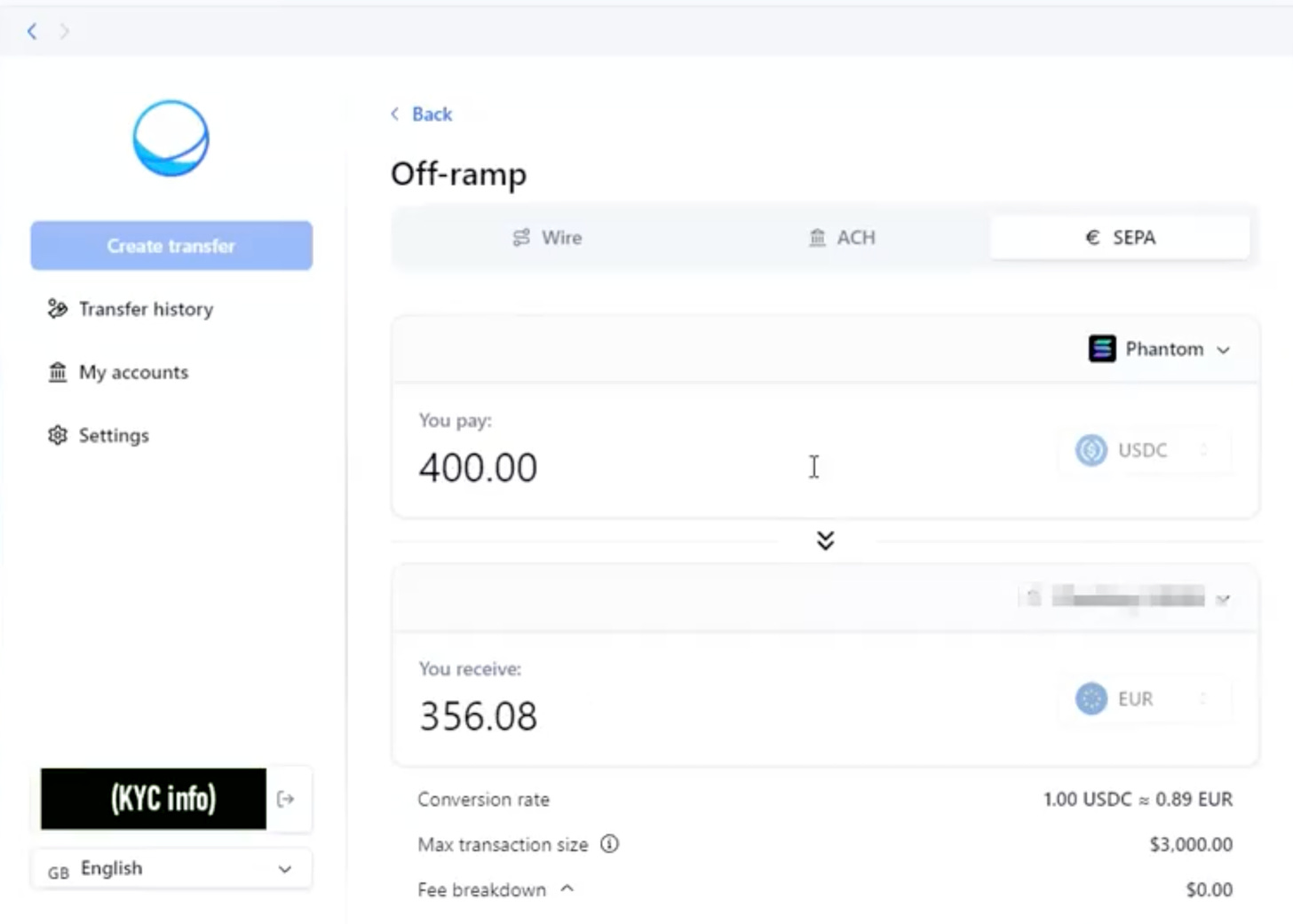

Here is an example of seamless transfers through Sphere. Users can select the type of transaction (such as fiat to crypto exchange or exchange between cryptocurrencies), then choose the payment method (like Wire transfer, ACH, or SEPA), and the entire transaction process can be settled in just a few minutes, making it quick and efficient.

Cards and Payment Processors

Cryptocurrency credit cards and payment processors are collaborating to provide users with the convenience of spending cryptocurrencies. The significance of this service is that users can make payments directly within the cryptocurrency ecosystem without needing to convert cryptocurrencies back to fiat. For example, Visa allows consumers to settle transactions using stablecoins between merchants and acquiring institutions.

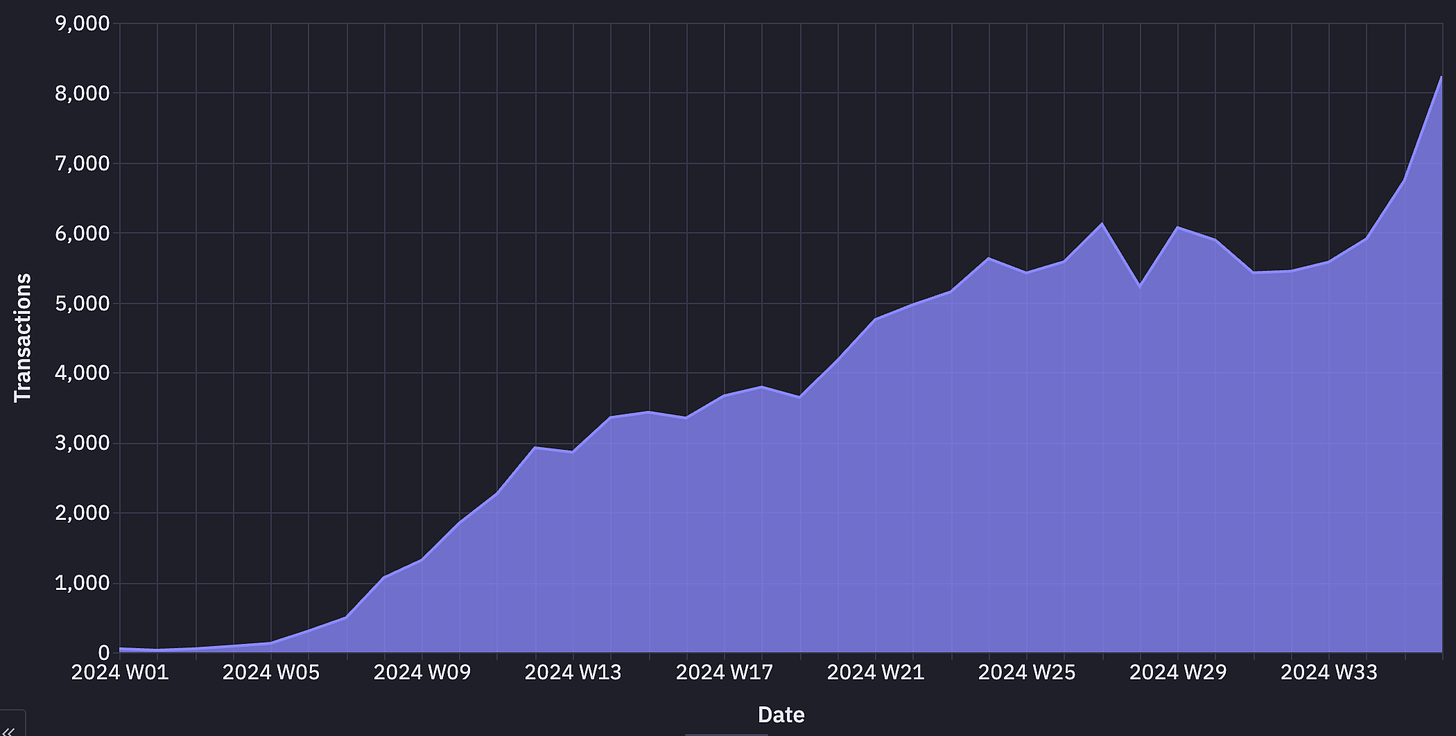

Last year, Gnosis Pay launched a Visa card that allows European users to make credit card transactions directly through the Gnosis Safe wallet. Although the user base is currently small, various metrics for Gnosis Pay show a continuous growth trend.

Gnosis Pay Weekly Transaction Volume

MicroLending

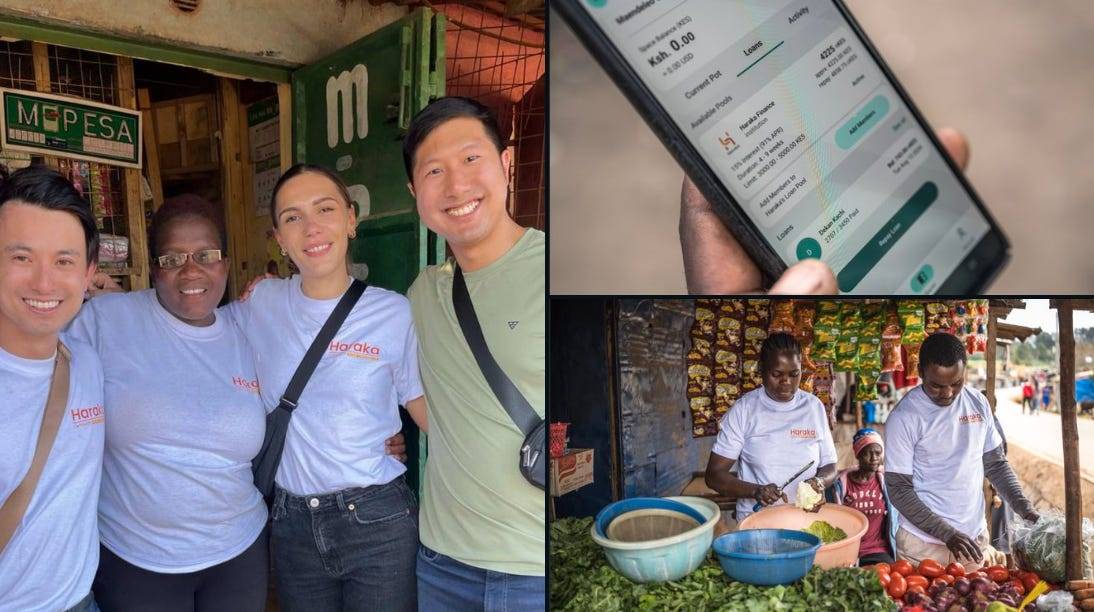

We traveled to Nairobi and witnessed the actual operation of blockchain-based micro-lending services, which was impressive.

These companies provide loans to small businesses or individuals through blockchain technology. Companies like Haraka and Goldfinch focus on offering lower interest rate loans to businesses in emerging markets. Due to the characteristics of blockchain technology, funds can be almost instantly available, and transaction costs are significantly reduced, providing a new solution for markets that traditional banks cannot cover.

Payroll

An increasing number of companies are beginning to support employees receiving their salaries in cryptocurrency. As the global economy expands and remote work becomes more prevalent, establishing a global financial system that can quickly and efficiently pay salaries has become particularly important. Some systems are experimenting with real-time payment features, allowing employees to receive their salaries weekly, daily, or even by the second.

Ravi Kiran (Head of Growth) shared a story about a freelancer who chose stablecoin payments:

“I once worked with a freelancer from an emerging country who recently received a payment in USDC. She kept saying that this payment method was much better than using the local currency (saving on taxes, stable value, and worth more than the local currency). It was at that moment I realized that every payment has a story behind it. Two months later, she completely switched to stablecoin payments. I believe that as business payments become more widespread, the influence of Circle and Tether will further expand.”

Stablecoin Analytics

Artemis, in collaboration with partners like Allium, RWA.xyz, and Flipside, provides in-depth analytical services regarding stablecoins to the market. Allium has partnered with Visa to launch the Visa On-Chain Analytics Dashboard, while the RWA platform offers many key data metrics about stablecoins and their issuers.

We believe that as the stablecoin market continues to expand, the demand for understanding the driving factors behind stablecoin usage will also grow.

What’s Next for Stablecoins?

As inflation rates continue to rise in 2024, the application of stablecoins is rapidly expanding. According to the CIV / Visa / BHD stablecoin report, stablecoins have become the second-largest application scenario after cryptocurrency trading. We predict that the adoption rate of stablecoins will continue to rise in the future.

This growth may create network effects: when friends, family, or businesses in a region start widely using stablecoins, it will attract more locals to join, much like a “global version of Venmo”. This expansion of user scale will further enhance the liquidity of the entire network. Additionally, we expect the U.S. to introduce relevant regulations to support the global demand for the dollar through stablecoins.

Although the current supply of stablecoins in the market is primarily denominated in dollars, we are also seeing a gradual increase in the adoption of non-dollar stablecoins. For example, euro-based stablecoins are gradually increasing their circulation, and Bitso recently launched a stablecoin based on the Mexican peso, MXNB, marking the potential of regional stablecoins being tapped.

Meanwhile, yield-bearing stablecoins are receiving increasing attention. These stablecoins not only provide users with opportunities for asset appreciation but also become an important source of funding for U.S. Treasury holders. For instance, Ethena has launched an innovative “Delta Neutral Yield Generation Mechanism” that maximizes returns through unique strategies, making it one of the fastest-growing stablecoins.

How Artemis Can Help

Artemis is committed to providing in-depth analysis in the stablecoin field, helping users and businesses better understand the usage trends and market dynamics of stablecoins. We have collaborated with Nic Carter and his Castle Island Venture team to complete the most comprehensive stablecoin analysis report to date by providing on-chain data support.

If you are interested in the stablecoin market or need help analyzing the adoption of stablecoins, feel free to contact us! You can find us on X.com or reach us via email at team@artemis.xyz.

Special thanks to Anna from Perena, Isaiah Washington, Peter Schroeder from Castle Island Ventures, EffortCapital, and others for their contributions to this article! We also thank all the users on Twitter who provided suggestions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。