Despite facing potential obstacles of being classified as a security and lacking the support of a mature futures market, Solana's ETF application process is steadily advancing in anticipation of a new regulatory environment.

Written by: Weilin, PANews

The BZX exchange of the Chicago Board Options Exchange (Cboe) recently submitted applications for four Solana ETFs. With the U.S. election day concluded and Trump set to take office, SEC Chairman Gary Gensler announced he will resign in January next year, which is expected to bring significant changes to the regulatory environment for cryptocurrency ETFs, creating new opportunities for the approval of Solana ETFs.

Analysts believe that the SEC will shift from a "law enforcement-based" to an "information disclosure-based" regulatory model. If the Solana ETF is approved, it will stimulate huge demand in the crypto ETF market. As the fourth largest cryptocurrency by market capitalization, Solana is making steady progress in its ETF application process despite lacking the support of a mature futures market and facing potential classification as a security.

Four institutions are competing to apply for the Solana ETF, which was previously considered "almost impossible."

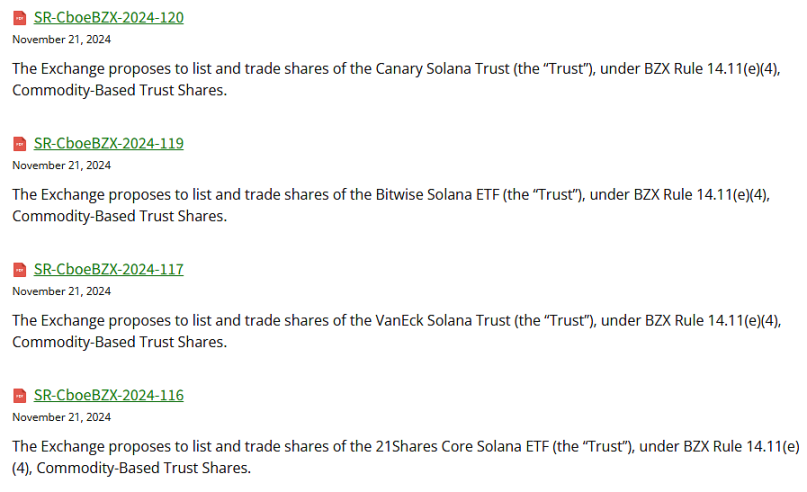

On November 22, Cboe BZX exchange documents showed that the exchange proposed to list and trade four types of Solana ETFs on its platform. These ETFs are initiated by Bitwise, VanEck, 21Shares, and Canary Funds, classified as "commodity-based trust fund shares," submitted under Rule 14.11(e)(4). If the SEC formally accepts the applications, the final approval deadline is expected to be in early August 2025.

In addition to Bitcoin and Ethereum, the following cryptocurrencies are also awaiting ETF approval:

- XRP ETF: Canary Capital, Bitwise, and 21Shares have submitted applications.

- Solana ETF: Canary Capital, 21Shares, Bitwise, and VanEck are seeking approval.

- Litecoin ETF: Canary Capital has submitted an application.

- HBAR ETF: Canary Capital has submitted an application.

Nate Geraci, president of ETF Store, stated on November 21 that there are reports that at least one issuer is also attempting to apply for an ETF for ADA (Cardano) or AVAX (Avalanche).

Currently, some industry insiders believe that the chances of the Solana ETF being approved are higher than those of other ETFs.

However, just three months ago, public reports indicated that CBOE had removed the 19b-4 applications for two potential Solana ETFs from the "Pending Rule Changes" page on its website. At that time, Bloomberg ETF analyst Eric Balchunas commented that after Cboe removed the 19b-4 applications for Solana ETFs from its website, the chances of Solana ETFs being approved were almost nonexistent. But now, the new regulatory environment may bring significant changes.

Expected Regulatory Changes: SEC Will Return to Information Disclosure-Based Regulation

After the U.S. election day, the elected president Trump and the historically most crypto-friendly Congress are set to take office. Meanwhile, SEC Chairman Gary Gensler, who has faced criticism from the crypto industry, will resign on January 20, 2025, bringing more optimism to crypto supporters.

Nate Geraci, president of ETF Store, expressed his belief that the Solana ETF is very likely to be approved by the end of next year. "It seems that the SEC is communicating with the issuers regarding this product, which is clearly a positive signal."

Alexander Blume, CEO of Two Prime Digital Assets, agreed with this view, stating that if the issuers were not confident of success, they would not waste time and money pursuing it.

Matthew Sigel, head of digital asset research at VanEck, the first to apply for the Solana ETF, stated, "It was the SEC under Gary Gensler's leadership that broke the long-standing rule-based traditional process and regulated through enforcement. Returning to a disclosure-based regulatory system will bring more possibilities for innovation. I believe the likelihood of launching a Solana ETF by the end of next year is very high."

However, contrary to VanEck's optimistic attitude, Robert Mitchnik, head of BlackRock's digital asset division, which has the largest Bitcoin ETF, stated that the company is not very interested in other crypto products besides Bitcoin and Ethereum.

SEC Chairman Gary Gensler will step down in January 2025

On January 20, Gensler will leave his position as SEC Chairman, coinciding with Trump's inauguration. Recently, these news have boosted the crypto market, with Bitcoin prices continuously hitting historical highs while approaching the $100,000 mark.

Data shows that the SEC set a historical record in the 2024 fiscal year, initiating 583 enforcement actions and obtaining $8.2 billion in financial compensation orders, the highest amount in SEC history. This represents a 14% increase in enforcement actions compared to 2023. Cases involving cryptocurrencies, private equity funds, and other high-risk financial misconduct are priorities for the agency. Now, Gensler's resignation is expected to reverse the crypto regulatory environment.

Alexander Blume mentioned, "Through regulated traditional financial channels such as banks and exchanges, institutional and retail investors will be able to access cryptocurrencies through ETFs, which will open up previously non-existent pools of capital. It's like replacing a (small) pool hose with a (large) fire hose, meaning potential market momentum is enhanced, and speculative trading may have a greater impact."

Solana's Growth Momentum is Strong, but What Potential Application Challenges Does It Face?

Boosted by meme trends, Solana's growth momentum this year has been significant. Solana's native token, SOL, broke its previous all-time high of $259.96 set at the end of 2021 on November 23, reaching $263.83, with a market capitalization of $121.1 billion, making it the fourth largest cryptocurrency.

What application obstacles might the Solana ETF encounter? Looking back at previous Ethereum ETF applications, the SEC adopted an analytical framework called the "Ark Analysis Test" in its approval statement for the Ethereum ETF, provided by Ark Funds and adopted by the SEC. This framework listed several key reasons that ultimately led to the approval of the Ethereum ETF: first, the existence of futures trading; the approval of a spot ETF must be based on a mature futures trading market, particularly on officially recognized exchanges like the CME (Chicago Mercantile Exchange). Second, the price deviation between futures ETFs and spot prices cannot be too large, proving that the market will not be manipulated by the spot ETF. Additionally, a certain level of market maturity is required. Futures ETFs have been operating for a while and performing stably, further supporting the maturity and stability of the spot market.

Rob Marrocco, CBOE's Vice President and Global Head of ETF Listings, pointed out that the only feasible way to bring the Solana ETF to market is to first launch a Solana futures ETF and then pave the way for the spot ETF. He further stated that even if the Solana futures ETF is launched, it will need to trade for a period to establish a performance record, which could take a long time and ultimately require a significant amount of time to complete.

While Bitcoin ETFs and Ethereum ETFs have been approved, they have a significant difference from Solana: Bitcoin and Ethereum trade futures on regulated exchanges like the CME, which the SEC can monitor. In contrast, Solana was listed as one of the 19 unregistered securities when the SEC sued Binance and Coinbase Global Inc. in 2023, which also presents legal obstacles for the approval of the Solana ETF.

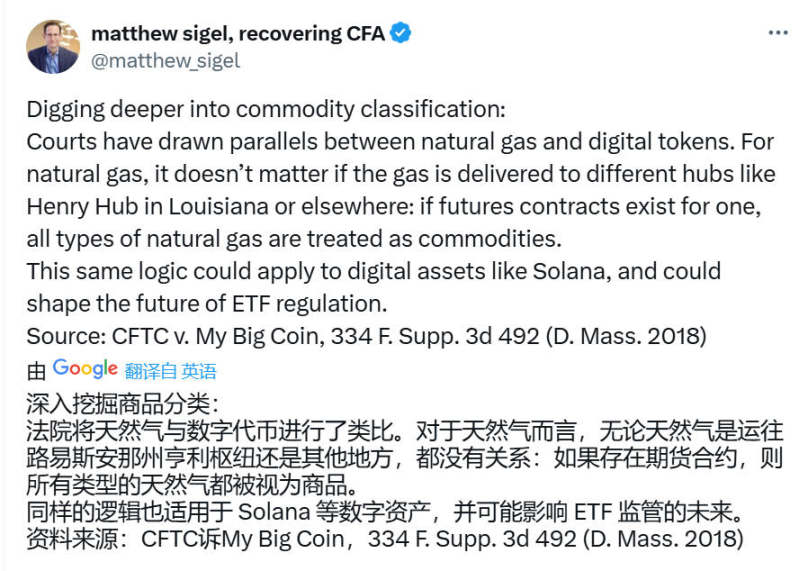

Despite this, Matthew Sigel, head of digital asset research at VanEck, previously pointed out that VanEck considers Solana (SOL) to be a commodity, similar to Bitcoin (BTC) and Ethereum (ETH). This view is based on an evolving legal perspective, as courts and regulators have begun to recognize that certain crypto assets may behave as securities in the primary market but more like commodities in the secondary market.

Sigel further mentioned that Solana has made significant progress in decentralization over the past year; currently, the top 100 holders control about 27% of the supply, a significant decrease from a year ago. The top 10 addresses now hold less than 9% of the supply. Solana has over 1,500 validator nodes distributed across 41 countries, operating more than 300 data centers, with a decentralization coefficient of 18, surpassing most networks it monitors. The upcoming Firedancer client will further enhance decentralization, ensuring that no single entity can dominate the blockchain. He believes these advancements make Solana's decentralized characteristics more pronounced, resembling digital commodities like Bitcoin and Ethereum.

Sigel also mentioned a key legal precedent—the 2018 case of the Commodity Futures Trading Commission (CFTC) v. My Big Coin. In this case, the defense argued that the token was not a commodity because there were no futures contracts associated with it. However, the U.S. District Court disagreed, stating that the definition of a commodity under the Commodity Exchange Act (CEA) is very broad, encompassing all goods, items, and all services, rights, and interests related to those goods, and that these goods may have futures contracts in the future.

Sigel believes this precedent may apply to Solana, indicating that even if Solana does not have futures contracts, it can still be considered a commodity. This classification is crucial for the approval of the Solana ETF, as it provides a legal basis for Solana to be recognized as a commodity, allowing it to enter the approval process for commodity ETFs.

Thus, he stated that ETF approval does not necessarily require an active futures market. Although the trading volume in the relevant futures market is not large, ETFs for shipping, energy, and uranium already exist. "We believe it can be approved even without CME futures contracts," he stated, suggesting that exchanges could replace them with market monitoring sharing agreements.

If approved, the next question is how much demand there will be for the spot Solana ETF. Grayscale Investments is already operating the Grayscale Solana Trust, currently managing assets of about $70 million. Bloomberg analyst James Seyffart believes that since Solana's market capitalization is about 6% of Bitcoin's, the demand for this ETF will grow proportionally, with total demand expected to reach about $3 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。