Today (November 25), BTC has dropped to $97,578, a 2.39% pullback from its peak of $99,588. However, many analysts and the gambling industry remain optimistic about BTC's upward trend in the bull market.

BTC Pullback, Whales Accumulate BTC at Low Points

According to AICoin market data, BTC is currently reported at $97,578, having dropped to a low of $90,000 since its peak on November 23. AICoin monitors indicate that this decline is mainly due to traders taking profits as BTC approached the psychological threshold of $100,000.

Image source: AICoin

It is noteworthy that this price pullback has not triggered panic in the market; instead, it has provided some investors with a buying opportunity at lower prices. Market observations show that whales have withdrawn over 1,110 BTC from exchanges during the price drop, indicating that there is still a long-term optimistic sentiment towards BTC in the market.

KOL Perspectives

Analysts from the well-known investment firm VanEck recently released a report stating that the next bull market for BTC is "gradually unfolding." VanEck specifically pointed out that a more favorable regulatory environment in the U.S. and the increasing participation of institutional investors are important factors driving the future rise in BTC prices.

VanEck predicts that BTC's price could reach $180,000 within the next 18 months, stating that the current market is still in the early stages of a bull market. The report highlights that key indicators such as recent funding rates, relative unrealized profit (RUP), and retail interest for Bitcoin all show a strong upward trend.

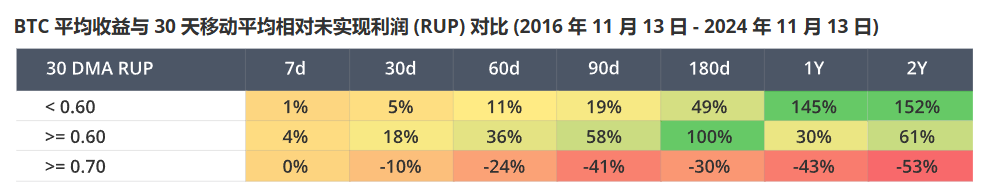

Investors are advised to pay attention to the 30-day moving average (DMA) RUP indicator. VanEck states that a 30 DMA RUP level between 0.60 and 0.70 often yields the highest short-term to mid-term returns (7 days to 180 days). This range typically reflects the mid-stage of a bull market, where optimism is rising but not yet excessive. In contrast, an overall RUP >0.70 is consistently associated with negative returns across all time frames, and RUP >0.70 is a strong sell signal.

Image source: VanEck report

In addition to VanEck, other cryptocurrency analysts also hold positive expectations for BTC's future trend. The AI investment committee of Intelligent Alpha predicts that under certain favorable conditions, BTC's price could reach $140,000. This prediction is also based on the macroeconomic environment of the market and the widespread demand for BTC.

Georgii Verbitskii also noted that BTC could rise to between $100,000 and $120,000 by the end of 2024 or early 2025, eventually reaching $180,000 by the end of 2025. Verbitskii stated that as more investors enter the market, the upward price trend of BTC will be further sustained.

Trader and market analyst Peter Brandt shared the current parabolic characteristics of Bitcoin, indicating that the upward momentum may continue into January.

Gambling Market Predictions

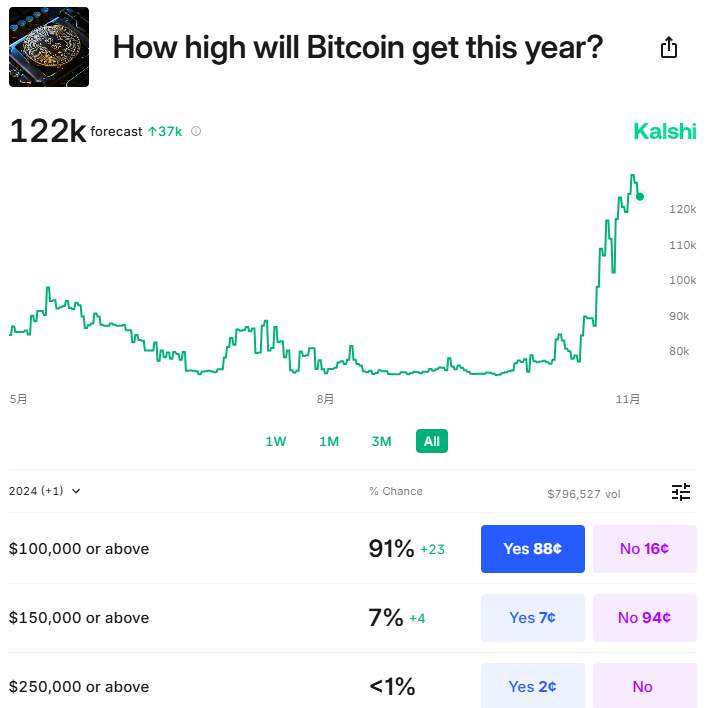

According to data from the gambling platform Kalshi, the probability of BTC reaching $100,000 or higher in 2024 is 91%.

Predictions from the gambling market are often seen as an indicator of market sentiment, and many investors adjust their investment strategies based on this data. The optimistic expectations in the gambling market suggest that the market generally believes BTC's price will continue to rise in the near future.

Conclusion

Overall, despite short-term market fluctuations, most analysts maintain an optimistic outlook on BTC's long-term development due to improvements in the macroeconomic environment, friendlier regulatory policies, and active participation from institutional investors. Predictions from VanEck, AI analysis from Intelligent Alpha, and expectations from the gambling market all indicate that BTC may reach new highs in its future price trajectory. Investors should remain cautious in the face of these positive expectations, thoroughly assess market dynamics and potential risks, and develop more robust investment strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。