Author: Nianqing, ChainCatcher

Is attention everything in crypto?

This year's narrative may belong solely to Memes, with their frenzy surging in waves, even overwhelming one another.

Bitcoin continues to set new records, while altcoins have not seen the expected rise; value investing has turned out to be in vain, and founders are raising their hands in surrender, self-mockingly stating, "We can also be Memes."

If Memes are a playground for adventurers, it is filled with stories of crossing classes and overnight wealth, laden with survivor bias. In the dark side of this playground, it ruthlessly washes away participants who go with the flow, with "diamond hands" seizing most of the wealth, while "paper hands" are left with nothing.

Perhaps we can view value investing as a game for honest people. It must be acknowledged that technology and application innovation are still underpinning the entire crypto industry.

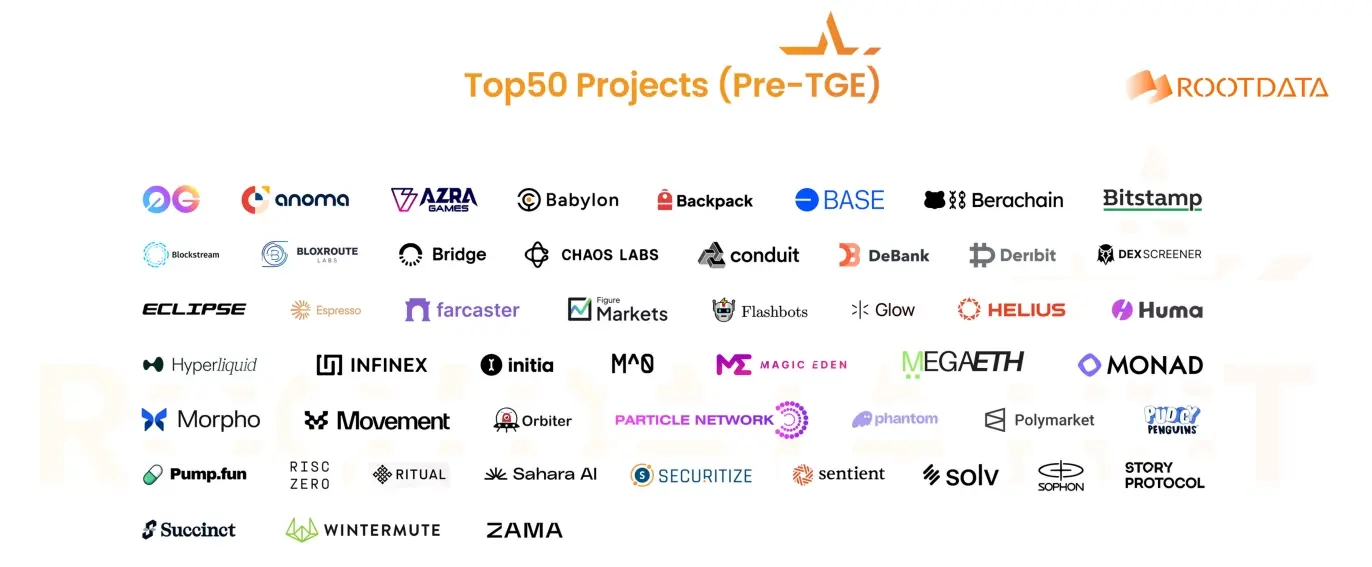

Last week, during the "DeInsight 2024" annual summit held in Bangkok at Devcon, the Web3 data platform Rootdata officially announced the RootData List for 2024. The list includes five categories: Top 50 Projects (launched tokens), Top 50 Projects (unlaunched tokens), Crypto VC Top 50 Investment Institutions, Top 10 Angel Investors, and Top 20 Best CEOs.

We believe the most noteworthy category on the list is "Top 50 Projects (unlaunched tokens)," as these 50 projects may represent the most significant investment opportunities in the crypto market for the foreseeable future. This article will outline the fundamentals and recent developments of these 50 projects.

Overview

The median financing amount for projects selected in the "Top 50 Projects (unlaunched tokens)" list is $25.71 million, with an average of 2 funding rounds. Seven projects have reached a valuation of $1 billion (inclusive), and four projects have not publicly disclosed their funding.

Most of the listed projects cover 26 sectors, with a significant proportion in modularization, DeFi, infrastructure, and AI. Over the past four quarters, although the GameFi, CeFi, and NFT sectors have stagnated, some projects continue to innovate and have made significant progress this year.

The 50 projects on the list:

Chains: Roll Performance, Roll Ecology, Roll Community

Since the first half of 2023, emerging public chains and Layer 2 solutions have surged. The competition among public chains has gradually evolved into a battle for market liquidity, leading to an oversupply of infrastructure and the emergence of ghost towns in public chains, lacking real users and consumer applications. However, some new chains centered around concepts like chain abstraction, privacy, intent, modularization, and parallelism have still managed to stand out in fierce competition.

Anomanetwork is a leading project in the intent sector, creating a privacy architecture centered on intent, introducing a new paradigm for building infrastructure layers and a new operating system for decentralized applications, allowing existing web2.5 dApps to be fully decentralized. Anoma founders Brink, Awa Sun Yin, and Christopher Goes previously worked at Cosmos development company All in Bits and got acquainted there.

The Anoma Foundation has received recognition from institutions like Polychain and Coinbase, completing seed, Series A, and Series B funding rounds, with a total financing amount of $57.8 million. Recently, insiders revealed that Anoma is negotiating a new round of financing, with a valuation potentially reaching $1 billion.

Anoma has not yet launched its testnet, but its first fractal instance, the privacy public chain Namada, has announced its tokenomics and opened validator node applications in October, currently testing IBC asset transfers and shielding.

EspressoSystems is an EVM-compatible blockchain that provides scaling and privacy systems for Web 3 applications. By combining PoS consensus protocols with zk Rollup mechanisms, it packages multiple transactions in a more resource-efficient manner. Its configurable asset privacy smart contract applications can provide users with customizable privacy regarding sender and receiver addresses, as well as the quantity and type of assets held or transferred. These elements can be set to public, private, or transparent only to selected parties.

Espresso Systems announced on November 11 that the Espresso Network has launched on the mainnet, but the current mainnet is still in the initial (0) phase, with plans to launch mainnet 1 and mainnet 2 in the first quarter of next year, gradually integrating the new stack and transitioning to PoS next year.

In March of this year, Espresso Systems completed a $28 million Series B funding round. Previously disclosed funding also includes a $32 million seed round completed in 2022. Its investors include a16z, Electric Capital, Graylock, and Coinbase Ventures.

Monad aims to become a high-performance blockchain capable of parallel processing within the EVM. Monad's goals extend beyond merely accelerating consensus mechanisms. It seeks to fundamentally change the execution environment, introducing parallel processing and improving data storage methods to build a truly fast EVM chain, giving EVM performance akin to Solana.

In April of this year, Monad Labs completed a funding round of up to $225 million, one of the largest crypto project financings of 2024, with participation from well-known institutions such as Paradigm, IOSG Ventures, SevenX Ventures, and Electric Capital. In addition to attracting capital interest for itself, projects within the Monad ecosystem, such as Kintsu, Kuru, Monad Pad, and aPriori, have also received support from numerous institutions.

Monad has recently begun to phase in its testnet. In March, Monad launched its development network, achieving 10,000 transactions per second in internal testing.

Movement differs from other new public chains based on Move; its first Ethereum L2 based on the Move language shifts from being an "Ethereum killer" to a fusion solution that "joins Ethereum." It aims to leverage the execution performance and security advantages of Move while further integrating the ecological advantages of EVM, allowing developers to launch Solidity projects on M2 without writing Move code.

In April of this year, Movement completed a $38 million Series A funding round, with investment from Polychain Capital, Binance Labs, OKX Ventures, Hack VC, and others. At the end of July, Movement announced the launch of the public testnet Parthenon.

Berachain is a high-performance EVM-compatible public chain built on a proof-of-liquidity consensus. Originating from a Rebase NFT project called Bong Bears, it was subsequently launched by several DeFi OGs. The name "Bera" pays homage to the classic crypto meme "HODL," thus rewriting Bear as Bera. The Berachain community has very distinct characteristics of Ponzi culture, Meme culture, and NFT culture.

Berachain innovatively proposes the PoL mechanism, aiming to attract liquidity by rewarding tokens for on-chain liquidity, avoiding the ghost town dilemma faced by existing public chains. In April of this year, Berachain announced the completion of a $100 million Series B funding round, co-led by the Abu Dhabi branch of Brevan Howard Digital and Framework Ventures, with participation from Polychain Capital, Hack VC, and Tribe Capital.

Berachain is currently still in the testnet phase, with plans to launch the mainnet and tokens by the end of 2024.

Sophon is an entertainment-centered ecosystem. Sophon is built on Validium, utilizing ZKsync's Elastic Chain as a modular aggregator. It provides the necessary infrastructure for high-throughput applications (such as social, AI, and gaming).

Sophon believes there is still significant room for innovation at the application level. Its goal is not to directly provide end products but to focus on creating platforms and products that support user self-expression. Therefore, Sophon emphasizes ecological construction, with its founders revealing in interviews that many new applications, such as bidding for space seats NFTs and AI girlfriends, are being experimented with within the ecosystem.

In October of this year, Binance Labs announced an investment in Sophon, bringing its total financing to over $70 million. In March, Sophon completed a $10 million funding round, with participation from Paper Ventures, Maven 11, The Spartan Group, SevenX Ventures, OKX Ventures, and HTX Ventures. The Sophon mainnet is expected to launch in November, with tokens set to be deployed soon.

ParticleNetwork is developing a modular L1 blockchain that enables each user to have a single, unified on-chain address and balance across all blockchains through chain abstraction. It also extracts gas and unifies liquidity, allowing existing L1 and L2 to collaborate seamlessly across ecosystems, addressing the issue of liquidity fragmentation in multi-chain ecosystems and eliminating manual multi-chain interactions in user experiences.

Particle's Universal Accounts are currently limited on the mainnet and are undergoing final testing. At the recently concluded Bangkok Devcon, the team demonstrated its Universal Accounts for the first time. Particle has also promoted the establishment of the Chain Abstraction Coalition, which has over 60 participants.

In June of this year, Particle Network announced the completion of a $15 million Series A funding round, with participation from Spartan Group, Gumi Cryptos Capital, SevenX Ventures, Morningstar Ventures, Flow Traders, and HashKey Capital. In August, Binance Labs announced an investment in Particle.

RISCZero is building the next generation of scalable blockchains using zero-knowledge proof technology and RISC-V zkVM. RISC Zero allows developers accustomed to programming in Rust, Go, C++, and other standard programming languages to build ZK applications.

Recently, RISC Zero launched the universal ZK protocol and verifiable computing layer Boundless, providing decentralized ZK infrastructure capable of handling proof generation, aggregation, data availability, and settlement on any chain. This allows developers to use Steel to execute Solidity contracts off-chain, saving 99.99% on gas fees. Boundless has entered early testing and will open access to developers in the fourth quarter. RISC Zero also recently introduced a hybrid architecture for Kailua OP Rollups, providing finality for OP chains within one hour without ongoing ZK proof costs.

RISC Zero has publicly disclosed three rounds of financing, totaling $54 million. The most recent round was a $40 million Series A completed in July last year, bringing its valuation to $300 million, with participation from Blockchain Capital, Galaxy Digital, IOSG, and others.

Succinct is building a decentralized prover network so that anyone can create trustless applications and infrastructure. Succinct unifies the proof supply chain, providing highly available proof generation infrastructure and top-tier pricing for Rollups, co-processors, and other applications using zero-knowledge proofs.

In August of this year, Succinct launched SP1, a high-performance open-source zero-knowledge virtual machine (zkVM) for verifying the execution of arbitrary Rust (or any LLVM-compiled language) programs. Projects such as Polygon, Celestia, Avail, Hyperlane, Taiko, and Sovereign have adopted SP1. In September, Succinct also collaborated with the OP Labs team to combine OP Stack and zkVM SP1 to create OP Succinct, enabling existing OP Stack chains to utilize ZKP, completing in just one hour.

Succinct has raised a total of $55 million, with participation from Paradigm, Robot Ventures, Bankless Ventures, Geometry, ZK Validator, and others.

Base is an Ethereum L2 developed by Coinbase based on the open-source OP Stack from Optimism, aimed at bringing the next billion users into Web3, with plans to gradually decentralize over the next few years. In just one year, Base has rapidly grown into a significant on-chain player due to its integration with Coinbase, an active developer and user ecosystem, and key partnerships with major players like Stripe. At one point, Base became the largest L2, surpassing Arbitrum.

The Base ecosystem is very active, covering applications in DeFi, NFTs, and social platforms. Its partnership with Stripe to launch stablecoin services has made it a hub for launching Layer 3 (L3) solutions. Unlike other major L2 chains, Base has not yet launched a token and has not disclosed plans to do so in the future.

Additionally, Base has not conducted public financing. However, Base has been known for its high yields from sequencers, earning over $50 million so far this year, with expectations to reach around $60 million by the end of the year.

Eclipse is a customizable modular Rollup solution focused on providing developers with flexible blockchain scaling tools. Its technology allows for selection and combination across multiple execution environments (such as EVM, SVM, MoveVM) and data availability layers (such as Celestia, Polygon Avail). This enables Eclipse to adapt to various application scenarios, including DeFi, Web3 gaming, and on-chain asset management.

Eclipse has raised $65 million to date, completing a $50 million Series A funding round in March of this year, led by Placeholder and Hack VC, with participation from OKX Ventures and Solana co-founder Anatoly Yakovenko, among others. On November 7, Eclipse launched its mainnet.

Initia is a full-chain Rollup network designed to build an interwoven network for multi-chain interoperability to simplify users' cross-chain experience. Initia has built an entire new technology stack from 0-1, developing both Layer 1 and Layer 2. Having a complete technology stack will enable Initia to implement chain-level mechanisms to coordinate the economic interests of users, developers, Layer 2 application chains, and Layer 1 itself.

In September, Initia completed a $14 million Series A funding round and a $2.5 million community funding round, bringing its total financing to $25 million. Theory Ventures, Hack VC, and others participated, and in October last year, Initia completed a $7.5 million seed round with participation from Binance Labs, Delphi Ventures, and Hack VC.

Initia launched its public testnet in May of this year and plans to complete its mainnet launch and TGE in Q4.

MegaETH is a fully Ethereum-compatible Layer 2 focused on reducing execution redundancy through node specialization and improving performance by real-time compiling and parallel executing EVM. The goal is to achieve over 100,000 transactions per second, building "the first real-time blockchain" to make DApp response speed and functional logic comparable to ordinary Web2 applications.

In June, MegaETH completed a $20 million seed round, with participation from Dragonfly, Figment Capital, Robot Ventures, Big Brain Holdings, and angel investors including Vitalik, ConsenSys founder Joseph Lubin, EigenLayer founder Sreeram Kannan, ETHGlobal co-founder Kartik Talwar, and Helius Labs co-founder Mert Mumtaz.

The public testnet for MegaETH was originally planned to launch this fall, with the mainnet expected to go live by the end of the year or early 2025.

Consumer-Facing Applications: Prediction Markets and Meme Platforms

Polymarket is a blockchain-based prediction market platform founded in 2020 by Shayne Coplan, who was just 22 years old at the time. Its timely launch quickly attracted significant attention during the 2020 U.S. election cycle. Despite subsequent volatility in the crypto market, Polymarket has survived resiliently and is returning with even greater popularity during the 2024 U.S. election cycle.

In May of this year, Polymarket completed a $45 million Series B funding round, led by Founders Fund. It raised a total of $70 million across two funding rounds (with $25 million in Series A), with supporters including Ethereum co-founder Vitalik Buterin. Additionally, recent reports suggest that Polymarket is negotiating to raise over $50 million in new funding and plans to launch a token.

In October, Polymarket's website traffic reached 35 million visits, double that of popular betting sites like FanDuel. The cumulative trading volume on the Polymarket platform for the U.S. presidential election surpassed $3.6 billion, and its predictions for the U.S. election have been frequently cited by mainstream media such as The Wall Street Journal and Bloomberg.

Pump.Fun is a token issuance tool and community platform focused on meme coins. It launched on Solana in January 2024 and shortly after its mainnet launch added support for Ethereum L2 Blast. Pump.Fun simplifies the token issuance process and lowers the technical barrier, providing users with an easy and low-cost way to deploy and issue tokens. Users only need to pay a fee of 0.02 SOL and can easily use the platform without any development experience. This simplification and low-cost feature has quickly made Pump.Fun popular. Compared to traditional token issuance platforms, Pump.Fun not only offers a fairer issuance model but also combines token issuance with social attributes, which is a significant innovation.

Pump.Fun has rapidly attracted meme traders due to its "godly picks" after launch, making it the largest money-making machine in this wave of meme frenzy and sparking similar projects on other chains. As the fastest-growing application in crypto economic history, it achieved $100 million in revenue in just 217 days.

Pump.Fun has not yet conducted any public financing. Co-founder Sapijiju revealed plans for future tokens and airdrops in October. In the same month, Pump.Fun also supported video token issuance, allowing users to upload videos and create tokens, enabling other users to access them on the front end.

DeFi: A Severely Undervalued Sector in This Cycle

DeFi experienced a summer boom in 2021, but as the hype and bubble faded, it began to decline in 2022. Over the past two years, DeFi has gradually matured and entered a new stage of productivity, preparing for long-term scalability. Arthur, founder of DeFiance Capital, pointed out in a recent article that after two years of adjustment, key metrics such as the total locked value (TVL) of DeFi protocols are rebounding, and it is expected that DeFi's market share will grow to 10% in the next two years. Specifically, in the subfields of DeFi infrastructure, areas such as MEV, Perps (decentralized perpetual contract exchanges), and DePIN are likely to be among the few that are certain to have value, with many innovative projects emerging this year.

bloXroute is a DeFi trading acceleration tool that has built a blockchain distribution network (BDN) for DeFi traders, allowing users to bypass network congestion and receive key information instantly, including buy and sell orders, pricing, positions, liquidations, and oracle updates. bloXroute's unique network architecture can increase block propagation speed by 2 seconds, transaction propagation speed by 1 second, and transaction detection speed by 50-400 milliseconds. By providing mempool services and transaction/block propagation facilities, these services help DeFi traders win more trades.

In 2022, bloXroute completed a $70 million Series B funding round, with a valuation of $410 million. Participating institutions included SoftBank Vision Fund II, Blindspot, Dragonfly, Flow Traders, Flybridge, GSR, Jane Street, Lightspeed, and others.

Flashbots is a research and development company focused on MEV, dedicated to mitigating the negative impacts of MEV and avoiding the risks it may pose to blockchains like Ethereum. Flashbots has three main focuses: Flashbots Auction, a privacy communication channel between miners and searchers for transparent and efficient MEV extraction; Flashbots Data, a set of tools to enhance MEV transparency and reduce information asymmetry; and Flashbots Research, aimed at addressing both short-term and long-term research issues related to MEV.

In July last year, Flashbots completed a $60 million Series B funding round with a valuation of $1 billion, with early investors including well-known institutions such as Paradigm, Pantera Capital, Dragonfly, and OKX Ventures.

FigureMarkets combines the liquidity of traditional finance with decentralized asset control, providing investors with a variety of blockchain-native assets, including cryptocurrencies, stocks, bonds, and credit. Figure Markets has launched a decentralized crypto asset custody marketplace, Figure Markets Exchange, which utilizes decentralized multi-party computation (MPC) wallets for custody and offers remote bankruptcy custody solutions, with USD deposits from domestic users held in FDIC-insured banks.

In March of this year, Figure Markets spun off from its parent company, Figure Technologies, and announced the completion of a $60 million Series A funding round, led by Jump Crypto, Pantera Capital, and Lightspeed Faction. Other participants included Distributed Global, Ribbit Capital, and CMT Digital.

Hyperliquid is a decentralized perpetual exchange operating on its own Layer 1, offering functionalities similar to traditional centralized exchanges. It primarily features an order book exchange that trades using USDC as collateral. It is characterized by supporting the trading of many long-tail assets and is one of the few projects that support leveraged or perpetual contract trading for certain specific assets on-chain.

The recent Memecoin craze has led players to prefer DEXs with higher odds and more diverse gameplay, making Perp DEXs like Hyperliquid the biggest beneficiaries of on-chain liquidity accumulation. Over the past three months, Hyperliquid has become the largest Perp DEX by market share and the most popular Perp DEX in the English-speaking region. In October, Hyperliquid announced the establishment of Hyper Foundation, with TGE approaching.

Hyperliquid has not disclosed any public financing yet and is one of the few well-known projects on the RootData List 2024 that is not VC-backed.

Infinex is a decentralized perpetual contract trading platform launched by Synthetix, which officially opened account creation and deposit channels in May of this year. The project's vision is to bridge the experiential gap between CeFi and DeFi through its own created on-chain experience layer, and then provide users with more tokens, more derivatives, and more innovative yield products by integrating on-chain DeFi protocols, ultimately serving its customers more effectively.

In October of this year, Founders Fund invested in Infinex's new "sponsorship" fundraising model, which sold Patron NFTs to venture capitalists, angel investors, and the community, raising a total of $67.7 million. Participants in this investment included Wintermute Ventures, Framework Ventures, Solana Ventures, Ethereum co-founder Vitalik, Solana co-founder Anatoly Yakovenko, and Aave founder Stani Kulechov.

Morpho is a lending protocol that combines the current liquidity pool model used in Compound or AAVE with the capital efficiency of a P2P matching engine used in order books. As a peer-to-peer (P2P) layer built on top of lending pools like Compound and Aave, Morpho allows users to borrow and lend at better rates by matching P2P and P2Pool, addressing the high borrowing rates and low supply rates caused by low utilization of lending pools, thus improving capital efficiency. At the same time, Morpho maintains the same liquidity and liquidation guarantees as the underlying protocols, allowing users to earn the annual percentage yield (APY) of the underlying pool or better P2P APY.

The total deposits of Morpho's core product, Morpho Markets, have surpassed $2 billion. Recently, preparations for the governance token MORPHO of the Morpho protocol have been completed, and the token transfer function will be enabled on November 21.

In August of this year, Morpho completed a $50 million financing round, with participation from Ribbit Capital, Hack VC, IOSG, Rockaway, L1D, Mirana, Cherry, Semantic, Fenbushi, Leadblock Bitpanda, and Robot Ventures.

SolvProtocol is a decentralized Bitcoin staking protocol, also a project built by well-known crypto KOL Meng Yan. It unlocks the full potential of Bitcoin assets through liquidity consensus infrastructure. By addressing the fragmentation, yield opportunities, and custody solutions of BTC assets, Solv provides Bitcoin holders with a gateway to BTCFi, continuously establishing pathways and confidence for traditional funds to enter the cryptocurrency world.

In October of this year, Solv Protocol completed a $11 million financing round with a valuation of $200 million, with participation from companies such as Laser Digital, Blockchain Capital, and OKX Ventures. Last August, Solv Protocol completed a $6 million financing round, with participation from Laser Digital, Bytetrade Labs, and others.

Glow is establishing a Proof of Physical Work (PoPW) protocol for carbon credits, incentivizing the creation of carbon credits by rewarding solar panel operators with tokens and replacing unclean energy from the grid. Its ultimate goal is to build the world's largest solar network. Glow uses GLW tokens and stablecoins (such as USDC) to reward the electricity output of solar power plants and verified carbon credits. Glow is one of the most profitable DePIN projects, generating over $5 million in revenue since its launch in 2023.

At the end of October this year, Glow completed a $30 million financing round, led by Framework and Union Square Ventures. This round of financing includes $6.5 million for the company and $23.5 million for solar investments. These funds will support its expansion into regions like India, with Glow's infrastructure expected to meet the energy needs of 34,000 households in India.

AI+Web3

0G is the first modular artificial intelligence chain, featuring a scalable programmable DA layer suitable for AI dapps. Its modular technology will enable frictionless interoperability between chains while ensuring security, eliminating fragmentation, and maximizing connectivity to achieve a weightless and open metaverse.

On November 13, Zero Gravity Labs (0G Labs) announced the completion of a $40 million seed funding round, backed by investors including Hack VC, Delphi Digital, OKX Ventures, Samsung Next, Bankless Ventures, and Animoca Brands, with the 0G Foundation (the independent governing body of the 0G protocol) receiving a $250 million token purchase commitment.

The funds will be used to develop the world's first decentralized AI operating system (dAIOS), which aims to reform the use cases of big data, achieving GB-level on-chain data transmission per second, supporting high-performance application scenarios such as AI model training, and enabling seamless integration of Layer 2 and modular AI into the Web3 ecosystem. On the same day as the funding announcement, 0G also opened public sales for nodes (a total of 175,000 nodes, with approximately half sold in the community presale).

Ritual is a distributed AI computing platform that brings together a network of distributed nodes, allowing access to computation and model creators, and enabling creators to host their models on these nodes. Users can then access any model on the network using a universal API. The architecture of Ritual is built on a set of sovereign modular execution layers called the Ritual Superchain. These layers are designed to handle various types of arbitrary computation, primarily focusing on AI models.

Ritual has a strong lineup of investors. In April, Ritual received a multi-million dollar investment from Polychain Capital. Last November, it completed a $25 million financing round, with participation from Archetype, Accomplice, Robot Ventures, and angel investors including Balaji Srinivasa, Worldcoin research engineer DC Builder, EigenLayer Chief Strategy Officer Calvin Liu, and Monad co-founder.

On November 19, Ritual launched the Ritual Chain testnet, which will provide a platform for building AI-native applications. The team also announced the establishment of an independent Ritual Foundation.

Sahara is a decentralized, privacy-centric AI network infrastructure. On this platform, contributors can receive fair compensation, maintain the sovereignty of data and models, and securely create, share, and trade AI assets while protecting privacy and promoting inclusivity. Its first launched products, Sahara Knowledge Agent (KA) and Sahara Data, are two cornerstone offerings. Sahara KA is an AI that far exceeds conversational capabilities, automatically analyzing external and internal proprietary data to provide reliable decision-making based on specific needs. Sahara Data offers high-value data services for AI model training, addressing security and privacy issues in data processing.

Sahara is set to launch its testnet and AI marketplace soon, and the team also plans to aim for a mainnet launch in Q4. In August of this year, Sahara announced the completion of a $43 million Series A funding round, led by Binance Labs, Pantera Capital, and Polychain Capital, with participation from Samsung, Matrix Partners, Thailand's Kasikorn Bank, dao5, Alumni Ventures, Geekcartel, Nomad Capital, Mirana Ventures, and others.

Sentient is an AI research organization dedicated to building a new open AGI economy for AI builders and creators. It enables open-source AI developers to monetize their models, data, and other innovations, allowing AI platforms to collaborate openly and transcend the boundaries of traditional single and closed API-based AI platforms. Its core contributors include Polygon co-founder Sandeep Nailwal.

Sentient completed a significant $85 million seed funding round in July this year, co-led by Founders Fund, Pantera Capital, and Framework Ventures, with participation from Ethereal Ventures, Robot Ventures, LD Capital, Symbolic Capital, Delphi Ventures, Hack VC, Arrington Capital, HashKey Capital, Canonical Crypto, and Foresight Ventures.

In September, Sentient released the OML (Open, Monetizable and Loyal) white paper and recently launched the OML 1.0 fingerprinting feature, which supports fingerprint recognition for AI models to verify the identity of AI model developers. Additionally, the team previously planned to launch a testnet this year.

Infrastructure and Tools

ChaosLabs is an automated economic security tool, initially focused on stress testing DeFi protocols and simulating worst-case scenarios through "chaos engineering." As the security landscape in the crypto space becomes increasingly complex, Chaos Labs has expanded its business types to include risk management, risk oracles, analytical tools, incentive optimization, and witch detection. It has served over 20 leading protocols, including Aave, GMX, Arbitrum, and Jupiter.

In August, Chaos Labs completed a $55 million Series A funding round, with investors including Haun Ventures, PayPal Ventures, and Coinbase Ventures. Chaos Labs also received support from angel investors such as Solana's Anatoly Yakovenko and Phantom's Francesco Agosti. In 2023, Chaos Labs secured $20 million in seed funding led by PayPal Ventures and Galaxy Digital. To date, the company has raised a total of $75 million.

Conduit is a Rollup-as-a-Service project that enables teams to quickly scale their dApps with Rollup characteristics by providing production-grade Rollup solutions based on the OP technology stack. Conduit has supported over 300 Rollups covering both mainnet and testnet. The total value locked (TVL) in mainnet Rollups running on Conduit is approximately $1.2 billion.

In June of this year, Conduit completed a $37 million Series A funding round, co-led by Paradigm and Haun Ventures, with participation from Bankless Ventures, Coinbase Ventures, and others. Conduit had previously completed a $7 million seed funding round in March last year, led by Paradigm.

In August, Conduit launched the new Conduit Marketplace, aimed at providing a one-stop integration solution for Rollup teams, gathering tools from 48 partners. Recently, Conduit introduced the Conduit G2 sequencer, which boasts 10 times the performance of existing sequencers. It is 100% compatible with OP Stack and Arbitrum Orbit.

Helius is a developer platform focused on the Solana ecosystem, regarded as a key tool for advancing Solana's ecosystem.

It aims to help developers quickly build high-performance crypto applications by simplifying the development process and optimizing the toolchain. Founded in 2022 by a team of former engineers from Coinbase and Amazon Web Services (AWS), Helius provides a range of tools to eliminate the complexities of developing Solana applications and enhance network performance.

In September, Helius completed a $21.75 million funding round, with participation from Haun Ventures, Founders Fund, Foundation Capital, 6th Man Ventures, Chapter One, and Spearhead.

OrbiterFinance is a decentralized cross-Rollup bridge for transferring Ethereum's native assets, supporting the rapid transfer of assets across multiple Layer 2 networks (such as zkSync, Arbitrum, etc.). Earlier this year, Orbiter Finance rebranded itself as ZK-based Orbiter Rollup, considering the growing market demand for an intent-centric comprehensive Rollup solution, focusing on ultimate interoperability and improving capital efficiency.

Last year, Orbiter Finance completed a Series A funding round, the amount of which was not disclosed; in 2022, Orbiter Finance completed a $3.2 million seed funding round. Its investors include OKX Ventures, Tiger Global, Matrixport Ventures, and others. Orbiter has stated plans to launch a native token this year and will gradually announce its tokenomics and distribution plans. In June of this year, it announced the O-Points ranking system and the latest rankings in preparation for an airdrop.

Zama is one of the most representative startups in the global FHE (Fully Homomorphic Encryption) space, building open-source homomorphic encryption tools for developers. FHE is a technology that allows data to be processed without decryption, enabling the creation of privacy-preserving smart contracts on public, permissionless blockchains, where only specific users can see transaction data and contract states. Zama's founder, Pascal Paillier, is a renowned cryptographer and one of the inventors of fully homomorphic encryption (FHE) technology, which is the core technology of Zama. Since its early research, Zama has achieved a 100-fold performance improvement, and its goal now is to achieve another 1,000-fold performance improvement to support large applications.

In March of this year, Zama completed a $73 million Series A funding round, co-led by Multicoin Capital and Filecoin developer Protocol Labs, with participation from Metaplanet, Blockchange Ventures, Vsquared Ventures, and Stake Capital. Additionally, angel investors including Filecoin founder Juan Benet, Solana co-founder Anatoly Yakovenko, and Ethereum co-founder and Polkadot co-founder Gavin Wood also participated in this round of investment.

DeBank is a multi-chain asset management and data analysis platform that supports DeFi protocols across multiple chains, enabling users to manage their portfolios more efficiently, explore DeFi projects, and compare interest rates across different protocols.

In 2021, DeBank completed a $25 million equity financing round, achieving a valuation of $200 million. Sequoia China led the round, with other participants including Dragonfly Capital, Hash Global, Youbi Capital, as well as well-known institutions such as Coinbase Ventures, Crypto.com, and Ledger.

DEXScreener is a comprehensive analysis platform that aggregates information from over 80 blockchain networks, including Ethereum, BSC, Solana, Arbitrum, Avalanche, and Polygon. DexScreener provides real-time data streams, allowing users to view data charts every five minutes. Additionally, the DexScreener iOS and Android applications can enable push notifications based on percentage changes, target prices, or price changes over set time periods, supporting users in real-time tracking and charting DEX data.

DefiLlama founder 0xngmi disclosed in August that by tracking DEX Screener's fees on DefiLlama, it was found that the platform earns between $150,000 to $250,000 daily by charging $300 for adding information to each token, such as TG links and images. Currently, DexScreener has not announced any financing or public token issuance plans due to its own profitable model.

In June of this year, DexScreener launched a Solana-based launch platform called Moonshot, similar to pump.fun. Moonshot officially went live on July 18 and became one of the biggest winners in this meme craze within just four months, even being dubbed the "Binance of the meme world," becoming a key driving force behind the rise of major meme coins.

Bitcoin Ecosystem

Blockstream is a Bitcoin ecosystem development platform founded in 2014. Blockstream's core focus is on developing new infrastructure for traditional financial systems, with key developments revolving around Bitcoin sidechains and other blockchain-related applications. Core technologies include the Lightning protocol and the Elements Project, a blockchain platform supporting open-source sidechains. Blockstream has launched Bitcoin's first sidechain, the Liquid Network, and the Bitcoin wallet Blockstream Green, among other products, and also provides hosting services for Bitcoin mining operations.

Dr. Adam Back, co-founder and CEO of Blockstream, is a British cryptographer and computer scientist known for inventing Hashcash in 1997, which later became the foundation of Bitcoin's proof-of-work system. Back had communicated with Satoshi Nakamoto before Nakamoto wrote the groundbreaking white paper in 2008. Recently, a documentary by HBO suggested that Satoshi Nakamoto might be Back, but Back has repeatedly denied being Satoshi and stated that it was just a joke.

In October of this year, Blockstream completed a $210 million convertible note financing, led by Fulgur Ventures. The funding will be used to accelerate market adoption of its Bitcoin Layer 2 technology, expand its mining business, and increase Bitcoin reserves. Blockstream recently opened a new R&D center in Lugano, Switzerland, aimed at promoting fintech innovation on the Bitcoin Liquid and Lightning networks. On November 21, Blockstream established an asset management department to bridge the gap between Bitcoin and mainstream finance.

Babylon is a protocol that leverages Bitcoin's security to provide security guarantees for other PoS chains. Babylon can offer secure, non-cross-chain, non-custodial native staking solutions for PoS chains, including BTC layer2, enhancing the security of PoS chains, shortening the staking cycle of PoS chains through Bitcoin's timestamp mechanism, and promoting cross-chain interoperability. It is often compared to Eigenlayer in the Ethereum ecosystem. Babylon was founded by Professor David Tse from Stanford University.

In May of this year, Babylon raised $70 million in funding, led by Paradigm, with participation from Polychain Capital and the venture capital arm of cryptocurrency exchange Bullish; in December last year, Babylon completed an $18 million Series A funding round, led by Polychain Capital and Hack VC, with participation from Framework Ventures, Polygon Ventures, IOSG Ventures, Castle Island Ventures, OKX Ventures, and others.

Babylon launched its mainnet in August this year, and after successfully launching the first phase of the Cap-2 mainnet and staking 24,000 Bitcoins in early October, the Cap-3 mainnet is planned for launch in early December, with a longer staking time window and higher staking limits per transaction.

Wallets

Phantom is a multi-chain non-custodial crypto wallet originally designed for the Solana blockchain, now supporting Ethereum and Polygon networks, expanding its utility for users of decentralized applications (DApps), DeFi protocols, and NFTs. Launched in 2021, Phantom quickly gained attention for its elegant and smooth user experience, despite MetaMask already establishing a foothold in the wallet market, and its product optimization updates are relatively fast.

In early 2022, Phantom completed a $109 million Series B funding round at a valuation of $1.2 billion, with participation from Paradigm, a16z, Variant Fund, Jump Capital, DeFi Alliance, and Solana Ventures.

On November 20, Phantom acquired Web3 firewall technology provider Blowfish, with the Blowfish team set to introduce new security features for Phantom, including intuitive transaction previews and real-time fraud insights. Phantom's ranking has rapidly risen this month, placing second in the free utility app rankings in the U.S. App Store, just behind Google; Phantom reached a historic high in the iOS free app rankings, ranking ninth, surpassing WhatsApp and Instagram.

Backpack is a next-generation cryptocurrency exchange and multi-chain wallet that offers a self-custody solution integrated with multi-party computation (MPC) technology to ensure fund security. The team initially developed the wallet for its launched xNFT protocol, but Backpack is more like building a crypto ecosystem rather than just a "wallet." Rooted in the Solana ecosystem, Backpack has strong integration capabilities within the Solana ecosystem, making it one of the beneficiaries of Solana's rise.

In April last year, Backpack launched the first xNFT series Mad Lads on the Solana ecosystem. This NFT project gained immense popularity, with its trading volume once ranking first across the entire network, even surpassing the blue-chip NFT project BAYC in the Ethereum ecosystem. In October last year, Backpack launched the Backpack Exchange and obtained a VASP license issued by the Dubai Virtual Assets Regulatory Authority. This year, Backpack has begun to frequently expand into other popular ecosystems such as Base, Monad, and Polygon.

In February of this year, Backpack completed a $17 million Series A funding round at a valuation of $120 million, led by Placeholder VC, with participation from Wintermute, Robot Ventures, Selini Capital, Amber Group, and others.

Payments

The PayFi network built by HumaFinance is a leading use case in the Solana ecosystem, focusing on building a Payment Financing Layer aimed at the multi-trillion-dollar commercial payment, trade financing, and remittance scenarios. Its current core application, Arf, addresses the issue of prepayments through blockchain and stablecoins, processing over $2 billion in on-chain transactions.

The Huma Finance team has backgrounds from Google, Meta, and other internet companies. Engineer Richard Liu worked at Google for nearly eight years and was involved in the founding of well-known products such as Google Trusted Stores and Google Fi. His startup Leap.ai was acquired by Facebook (now Meta).

In September, Huma Finance raised $38 million in funding led by Distributed Global, with participation from Hashkey Capital, Folius Ventures, Stellar Development Foundation, and the venture capital arm of Turkey's largest private bank, İşbank, TIBAS Ventures.

Bridge is building a stablecoin-driven liquidity platform aimed at helping businesses accept stablecoin payments. By providing a range of software tools (such as APIs) for seamless conversion between fiat currencies and stablecoins, it supports businesses in integrating stablecoin-based cross-border payments, exchanges, and other services, and even allows businesses to issue their own stablecoins.

In August of this year, Bridge announced the completion of $58 million in funding, with investors including Sequoia Capital, 1confirmation, Index, Haun Ventures, Ribbit Capital, among others, marking Bridge's first public appearance. Just two months later, the payment unicorn Stripe ultimately acquired Bridge for $1.1 billion, becoming the largest acquisition in crypto history and Stripe's largest acquisition to date.

Recently, Bridge acquired the Web3 wallet infrastructure platform Triangle. As part of the deal, the Triangle team will join Bridge to help build a scalable stablecoin system.

M^0 is a decentralized stablecoin issuance protocol designed to provide cryptocurrency issuance solutions based on high-quality collateral (such as U.S. Treasury bonds) for financial institutions and developers. Users of M^0 can earn yields from their held collateral while using dollar-pegged stablecoins. The protocol was initially launched on Ethereum and will later expand to other L1 and L2 networks. The core team of M^0 comes from projects like MakerDAO and Circle. M^0 plans to issue a stablecoin, $M, that is compatible and composable with any DeFi service or architecture.

In June of this year, M^0 completed a $35 million Series A funding round, led by Bain Capital, with participation from Galaxy Ventures, Wintermute Ventures, GSR, and others. Earlier in 2023, M^0 raised $22.5 million in seed funding led by Pantera Capital.

CeFi

Deribit is currently the largest cryptocurrency options exchange, with over 80% of the market's total trading volume in Bitcoin options and over 90% in Ethereum options. Deribit officially launched in June 2016 as a fully dedicated BTC trading platform and gradually added other categories such as ETH contracts. Users can trade perpetual contracts, futures, and options contracts on Deribit. Additionally, the data on the Deribit platform has become an important industry benchmark, such as Bitcoin options open interest, options expiration dates, and large transaction data.

In September 2022, Deribit completed $40 million in funding, and in 2021, Deribit completed $100 million in funding. Its investors include Mechanism Capital, Zee Prime Capital, QCP Capital, and others.

Yesterday, Bitcoin futures contracts on the Deribit trading platform reached a historic milestone of $100,000, with trading prices exceeding spot prices.

Bitstamp was founded in 2011 and is a well-established cryptocurrency exchange, considered one of the more compliant exchanges. It operates in locations such as Luxembourg, the UK, Slovenia, Singapore, and the United States. It is not only one of the four cryptocurrency companies approved by the UK's FCA in the past year but also the first European cryptocurrency exchange to receive in-principle approval in Singapore. Bitstamp has also been a favored exchange for Ethereum founder Vitalik.

In June of this year, Robinhood acquired Bitstamp for $200 million to expand its international footprint. Recently, Bitstamp announced that it has obtained a MiFID MTF license issued by the Slovenian securities regulator, allowing Bitstamp to offer more complex products to institutional and retail investors, including crypto derivatives.

Securitize was established in 2017 as a compliant RWA tokenization platform for issuing, managing, and trading digital asset securities in accordance with existing U.S. regulatory frameworks, boasting a community of over 1.2 million investors and 3,000 companies. In simple terms, it helps businesses tokenize their assets, allowing real-world assets to be seamlessly converted into digital tokens.

Securitize's tokenized on-chain assets have exceeded $1 billion. In October, Securitize announced the launch of a conversion service between Circle's stablecoin (USDC) and the U.S. dollar, specifically for BlackRock's dollar institutional digital liquidity fund (BUIDL). It also recently launched a new fund management service, Securitize Fund Services, to streamline operational and compliance tasks related to creating new blockchain-based real-world asset products.

In May of this year, Securitize completed a $47 million strategic financing round, led by BlackRock, with participation from Hamilton Lane, ParaFi Capital, Tradeweb Markets, Aptos Labs, Circle, and Paxos.

Wintermute is a cryptocurrency market maker based in London, founded in 2017. Wintermute's primary business is to provide liquidity services to cryptocurrency trading platforms, institutions, and individuals, while also offering market-making services in some cryptocurrency derivatives markets.

After the collapse of Alameda, Wintermute began to emerge. In this bull market, Wintermute has been involved with almost all high-market-cap tokens, participating in market-making for the "Four Kings" (OP / ARB / STRK / ZK), with the exception of ZK, which lacks clear data support. Additionally, Wintermute has become the second-largest market-making institution for Robinhood, with trading revenue accounting for as much as 10%.

Furthermore, Wintermute has not missed out on the meme craze, with recent data showing it holds 19 MEME coins valued over $1 million, with a total holding value exceeding $100 million. Most of these MEME coins come from Ethereum and Solana, and many are from popular projects, most of which have already been listed on Binance.

Wintermute's most recent funding round was a $20 million Series B round completed in 2022, with investors including Lightspeed Venture Partners, Pantera Capital, Sino Global Capital, Hack VC, and others.

Recently, Wintermute launched a new prediction market called OutcomeMarket, which is now live on Ethereum, Base, and Arbitrum.

Social, NFT, and GameFi

Farcaster is a decentralized social media protocol focused on interoperability, user autonomy, and privacy protection. Unlike traditional social networks, Farcaster does not rely on central servers and aims to create a censorship-free environment where users have complete control over their social data and social graphs, interacting across different applications on the network with a single ID. Farcaster is open-source and permissionless, allowing anyone to build applications through its API. Since its launch, Farcaster has attracted over 700,000 users. Warpcast is a major application on Farcaster and the first Farcaster client.

Farcaster has received multiple praises from Vitalik. In May of this year, Farcaster raised $150 million in a Series A funding round led by Paradigm, achieving a valuation of $1 billion.

Farcaster today announced its work roadmap, with its 14-person team responsible for protocol, cryptocurrency, and social aspects. In terms of protocol, it will build and migrate to Snapchain to expand the protocol and provide a new FIP for FC Connect; in cryptocurrency, as part of Frames v2, it is working to improve the trading user experience; in social, it will continue to enhance application performance, channel iteration, and user experience.

StoryProtocol is an on-chain IP ecosystem that aims to create, manage, and license on-chain IP in a completely new way. It provides a simplified framework to manage the entire lifecycle of IP development, supporting features such as source tracking, frictionless licensing, and revenue sharing. Applications built on Story Protocol are designed for creators of all media (prose, images, games, audio, etc.), enabling writers and artists to track the provenance of their works, allowing anyone to contribute and remix while capturing the value of their contributions.

In August of this year, Story Protocol developer PIP Labs completed an $80 million Series B funding round, led by a16z crypto, with participation from Polychain, Scott Trowbridge (SVP and board member at Stability AI), Adrian Cheng (founder of K11), digital art collector Cozomo de'Medici, No Capital, and others.

Currently, Story Protocol has launched an IP-focused Layer 1 public testnet called Iliad and an IP marketplace called Color, where users can buy, sell, and discover IP assets and licenses. The co-founders of Story Protocol revealed in a recent interview that they are in discussions with many top NFT projects and are also engaging with some of Hollywood's most famous creators.

MagicEden is a cross-chain NFT marketplace. Established in 2021, Magic Eden has evolved over three years from a single NFT trading platform on the Solana chain into a comprehensive ecosystem that integrates NFT trading, wallet services, token swaps, and cross-chain functionality. Currently, Magic Eden has integrated ecological assets from multiple chains, including Solana, Bitcoin, Ethereum, Polygon, Base, Arbitrum, and ApeChain, supporting various NFTs, tokens, and other assets for trading on its platform.

In 2022, Magic Eden completed a $130 million Series B funding round at a valuation of $1.6 billion, co-led by Electric Capital and Greylock.

Recently, Magic Eden announced its ME tokenomics, with a total supply of 1 billion ME tokens, and the token distribution will be released over four years, with 50.2% allocated to the community. The TGE will launch in a few weeks, and community-first features will be introduced to reward loyal users, allowing them to earn ME tokens through daily use of Magic Eden products.

PudgyPenguins is a collection of 8,888 NFTs that accelerates Web3 innovation through IP utilization and community empowerment, with each holder gaining exclusive access to experiences, events, and intellectual property licensing opportunities. The CEO of Pudgy Penguins is referred to by the community as a "marketing genius," and after being acquired for $2.5 million in 2022, Pudgy Penguins began its journey into IP.

Amid a backdrop of many NFT projects underperforming in the market, with the floor prices of Bored Apes and Crypto Punks continuously declining and no longer being mentioned, Pudgy Penguins has been finding ways to keep things interesting.

Earlier this year, Pudgy Penguins launched the beta version of its IP licensing platform OverpassIP; in May, Pudgy Penguins announced a partnership with game studio Mythical Games to develop an immersive mobile game set to launch in 2025. In the same month, its plush toys sold over 1 million units, and it plans to collaborate with retailers including Walmart, Target, Smiths, and Hot Topic; in June, Pudgy Penguins and its NFT licensing platform OverpassIP co-founded a parent company named Igloo; in July, it launched a consumer-centric Layer 2 called "Abstract" and went live on the testnet, with plans to launch the mainnet later this year; in September, it introduced the Pudgy Penguin Soulbound Token for the 1,000-day Penguin Club (Pengus Club); in October, Pudgy Penguins announced a collaboration with Mythical Games to launch a Web3 mobile game (iOS & Android) called Pudgy Party next year.

In July of this year, Pudgy Penguins' parent company Igloo announced the completion of a $11 million funding round, led by Founders Fund. Other participants included Distributed Capital, 1kx, Everest Ventures Group, and Selini Capital. This funding will primarily be used to build its Layer 2 network, Abstract.

AzraGames is a blockchain gaming company aiming to create a mainstream collectible battle RPG. Its first game, Project Arcanas, is a fantasy collectible and fighting arena RPG. Azra Games has been developing its flagship game, Project Legends, since last year, and this game completed its first closed beta test in early October.

Most of the core team members of Azra Games come from EA. Founder Mark Otero is a former general manager at the renowned American gaming company EA, where he led the development of Star Wars: Galaxy Heroes. Michael Noriega was the technical art director for Star Wars: Galaxy Heroes and now serves as the game director at Azra Games.

In October of this year, Azra Games completed a $42.7 million Series A funding round, with participation from Pantera Capital, a16z crypto, A16Z GAMES, and NFX, bringing Azra's total funding to $68.3 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。