171 projects (disclosed) have raised a total of $2.3 billion, far exceeding last month's $870 million.

Author: Cheeky Rolo

Translation: Deep Tide TechFlow

Comments from @cheeky_rolo:

It's quite profound. November has indeed been a bustling month, with Bitcoin continuously hitting new all-time highs, which is exciting. But what about October… I remember a lot of funny memes. I think I'm a bit confused. The financing market for Web3 startups also seems a bit perplexed. While there are clear signs of improvement, it shouldn't be over-interpreted. Moreover, the monthly snapshot of the financing market is more like a record of investors' mindsets over the past few months rather than a current market barometer. I've written about this before. The financing deals completed in October were the result of months of effort by founders. There is a certain lag between the performance of the broader crypto market and the actual investment of venture capital funds. Considering our understanding of the crypto market in November, will the number of deals and the amount raised by startups significantly increase in the next two months? Typically, November and December are not active trading periods. This time is usually for wrapping up and looking forward to re-evaluating with a new perspective in the new year. New deals are still being considered, but the time to make decisions on projects discovered before the Christmas holidays often extends into the first quarter of the following year. The question is, will the bull market in the crypto market shorten the decision-making cycle for the Web3 venture market? Of course, we also need to consider the situation in the U.S. A new government and the recently ousted controversial SEC officials (who should not have been nominated) seem to indicate that investors may choose to wait and see until after the first month of 2025 to assess the true direction of the market.

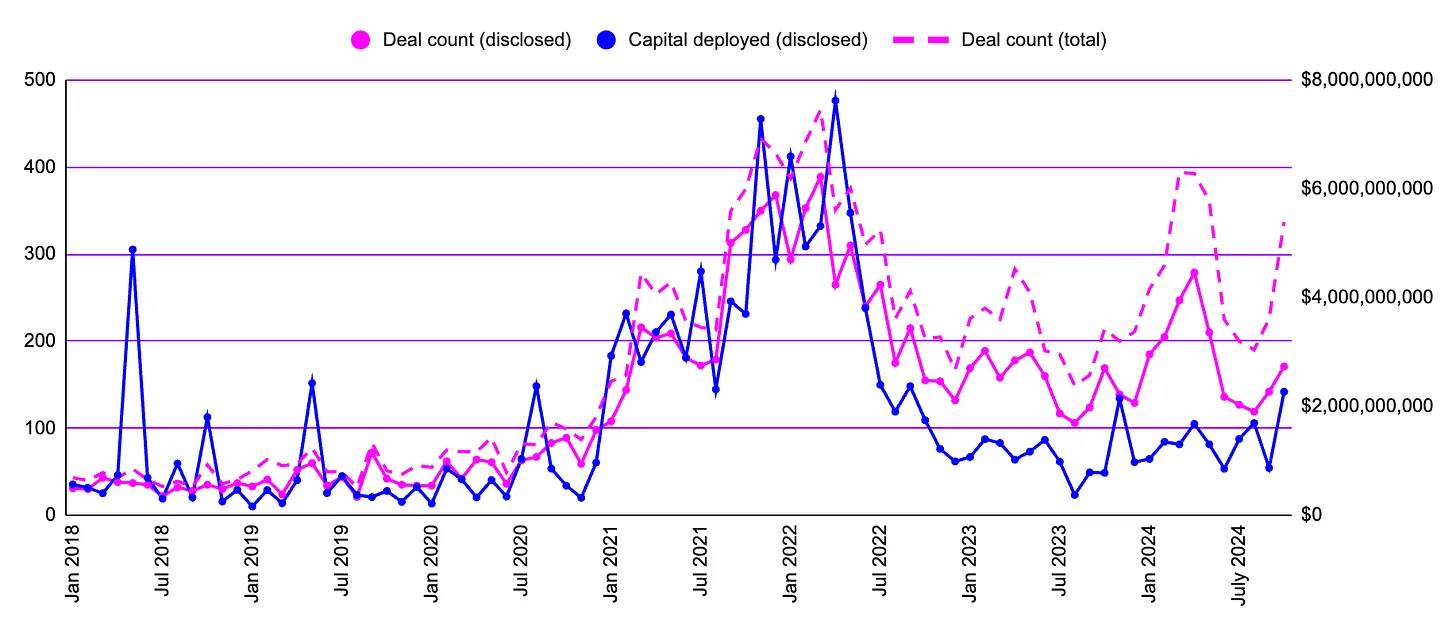

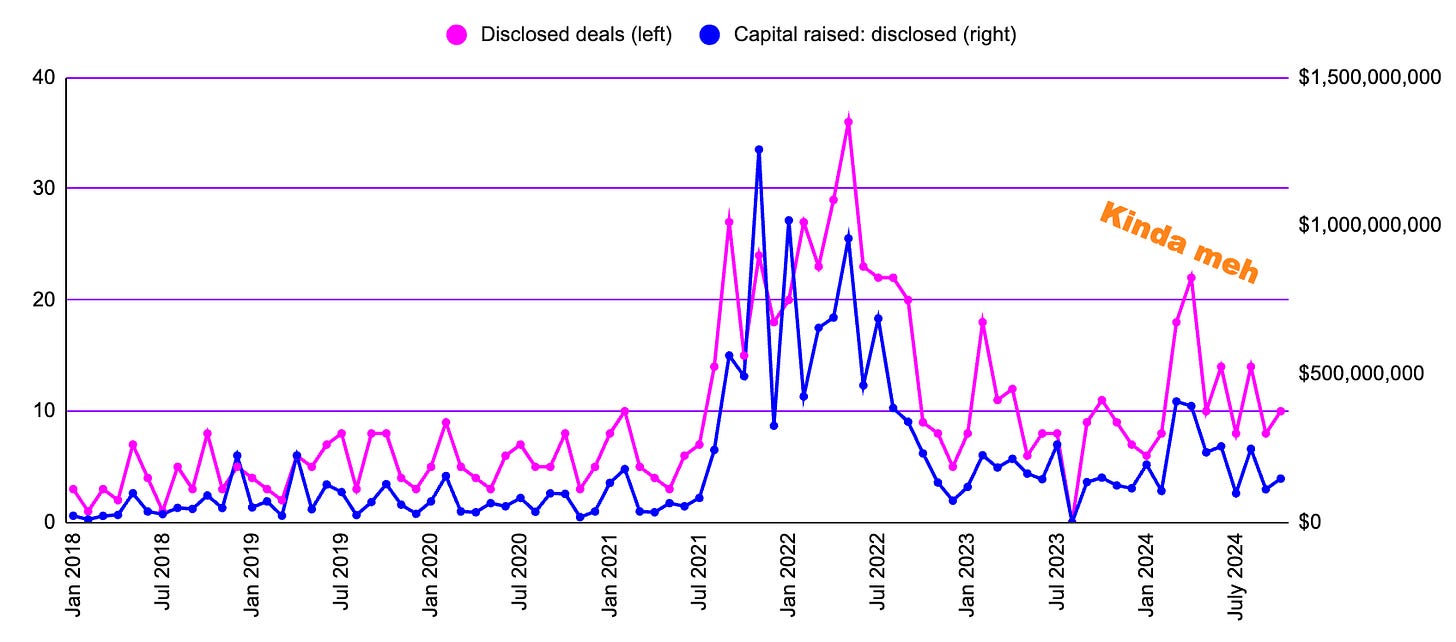

Web3 Market Overview: Company Financing by Stage Since 2018

Source: Messari

Data is updated monthly, and the numbers from the previous month may be adjusted (for example, financing not previously included in the data, or removal of duplicates, etc.)

Key Data for October 2024:

171 projects (disclosed) have raised a total of $2.3 billion, far exceeding last month's $870 million.

This sets a new monthly financing record for 2024. Previously, the highest monthly financing this year was in August ($1.7 billion).

The total number of deals this month reached 337, a 49% increase from September 2024. Based on this, the total amount raised across all stages is estimated to be around $4.5 billion. April remains the month with the most deals in 2024 (disclosed deal count of 279, totaling 393).

So far in 2024, 1,821 projects (disclosed) have raised a total of $13.8 billion.

- The total number of deals is 2,873, with an estimated total amount raised in 2024 so far of $17.2 billion.

Market Highlights for This Month:

- The $525 million raised by Praxis is significant for the Web3 ecosystem as it represents a bold attempt to combine decentralized technology with large-scale applications in the real world. By leveraging real-world assets (RWA) to fund a future city in a special economic zone, Praxis demonstrates the potential of crypto-native financing mechanisms to break through regulatory, financial, and cultural barriers. The project aims to attract top talent and achieve breakthroughs in fields such as AI, crypto technology, and biotechnology, showcasing Web3's ability to drive real-world impact beyond digital assets. If successful, Praxis could enhance confidence in large-scale blockchain projects and set a precedent for Web3-driven urban development.

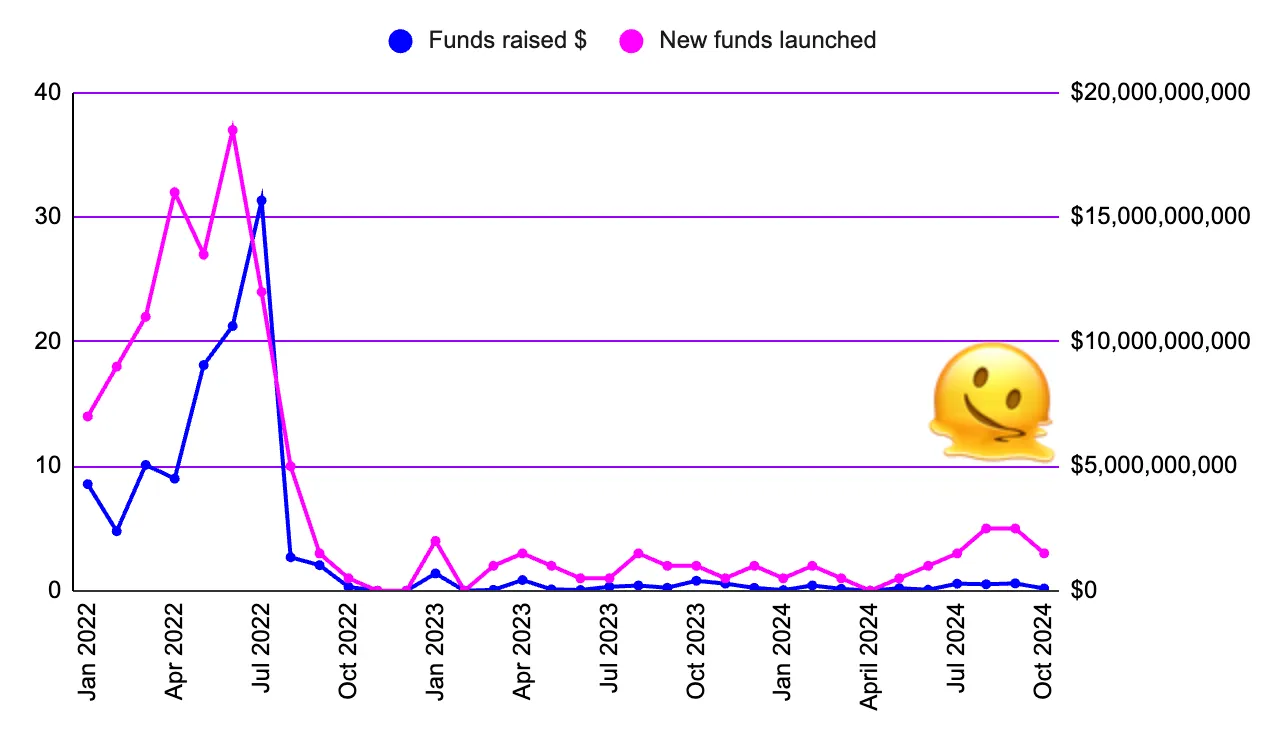

Crypto Venture Capital Funds Launched Since 2022

Three funds launched have raised a total of $90 million:

GnosisDAO is launching a $40 million venture fund targeting real-world assets, crypto infrastructure, and payments.

VanEck has launched a new $30 million venture fund focused on crypto and AI startups.

Gate Ventures, Movement Labs, and Boon Ventures will launch a $20 million crypto fund supporting protocols focused on the Move programming language and interoperability with the Ethereum ecosystem.

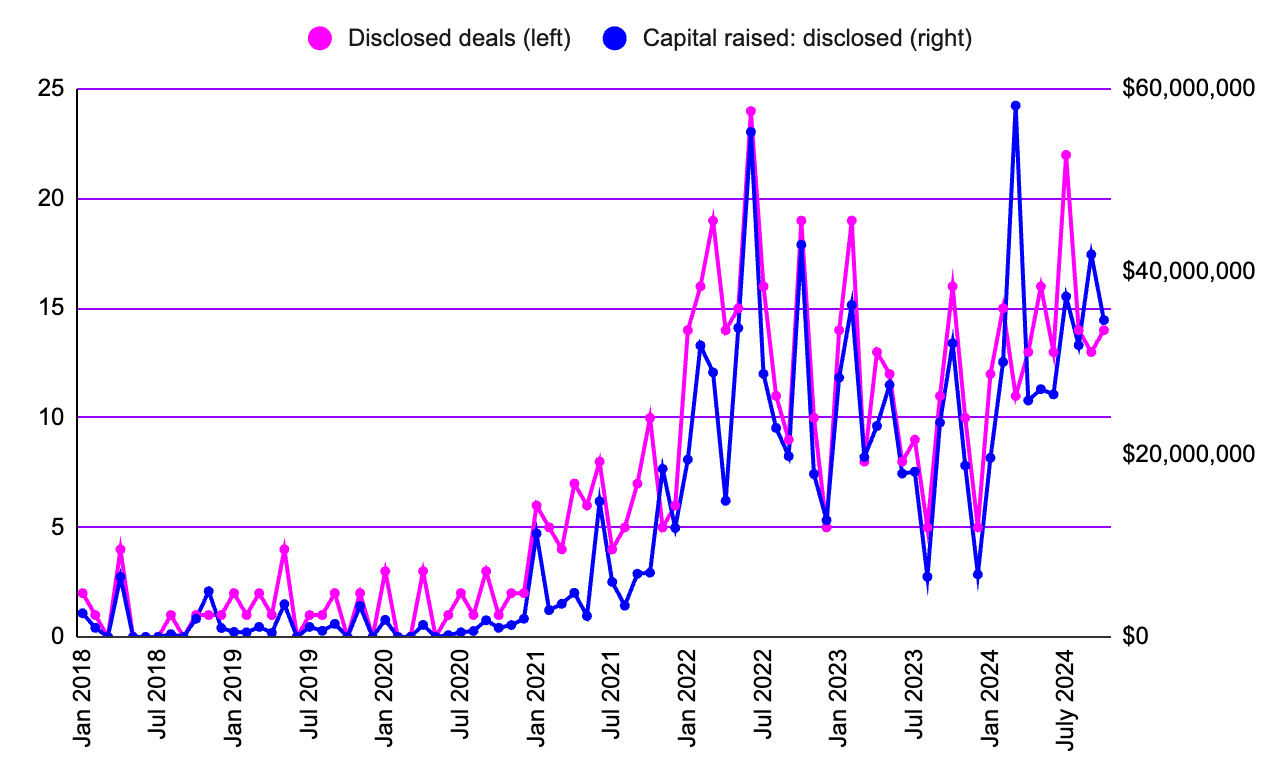

Initial Seed Round Financing Since 2018

$34.7 million has been raised, a 17% decrease from last month, involving 14 disclosed initial seed stage financing projects.

- The total number of deals is 18, an increase from 15 in September 2024: all deals are expected to raise approximately $42 million.

The average financing size for initial seed stage this month is $2.5 million.

- The average financing size for initial seed companies since 2018 is $1.6 million.

Highlights of Initial Seed Rounds This Month:

- The $7 million initial seed funding recently raised by Kiva AI is significant for the Web3 ecosystem as it reflects the growing demand for high-quality, scalable, and cost-effective data solutions specifically designed for certain AI applications. With support from well-known Web3 investors like CoinFund and Hashkey, Kiva AI is expected to enhance the capabilities of decentralized AI systems that rely on robust data labeling and human-machine interaction feedback to improve performance. By expanding its global network of human experts and enhancing its solutions, Kiva AI can address critical challenges in industries such as finance and law, aligning with Web3's vision of transparency, reliability, and decentralization, thereby driving innovation and trust-based applications in these fields.

Seed Round Financing Since 2018:

$214 million has been raised, an 18% increase from last month, involving 39 disclosed seed stage companies.

- The total number of deals is 43, up from 38 in September 2024; all deals are expected to raise approximately $235 million.

The average financing size for seed stage this month is $5.5 million.

- The average financing size for initial seed companies is $4.6 million.

Highlights of Seed Rounds This Month:

- Ithaca's $20 million financing, led by Paradigm, is a significant milestone for the Web3 ecosystem as it empowers an experienced development team to accelerate innovation in the crypto technology stack while supporting open-source public goods. With expertise in providing industry-leading tools like Reth and Foundry, Ithaca is able to address key bottlenecks in Layer 2 scalability, user onboarding, and developer functionality. Their first project, Odyssey, introduces cutting-edge features and experimental EIPs before the Ethereum mainnet upgrade, helping developers build faster and smarter. By collaborating with major L2 and infrastructure providers and pushing the boundaries of crypto and EVM innovation, Ithaca's work lays the foundation for the next generation of applications, driving mainstream adoption and unlocking new consumer experiences in the crypto space.

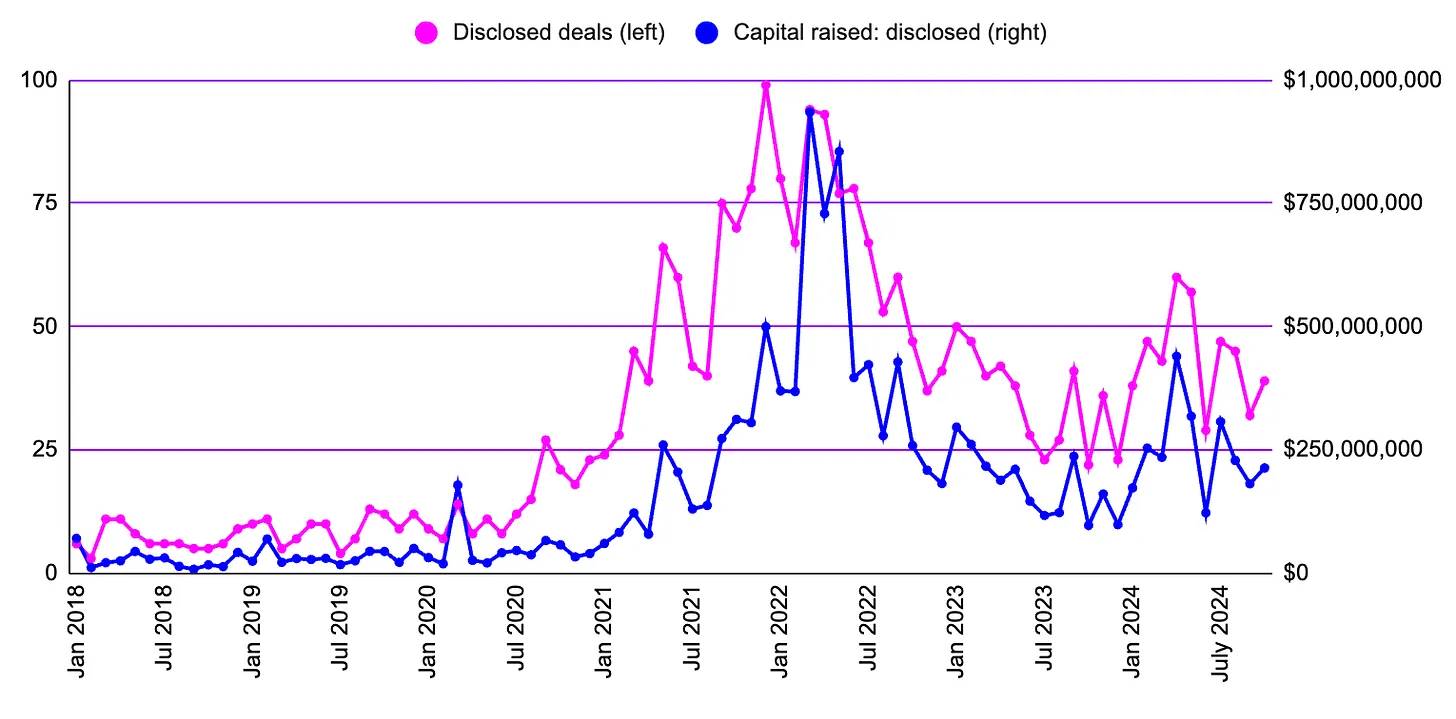

Series A Financing Since 2018

10 Series A stage companies have raised a total of $147 million (disclosed).

- The total number of deals is 11: all deals in this stage are expected to raise approximately $163 million.

The average financing size for Series A this month is $15 million.

- The average financing size for Series A companies is $17.5 million.

Market Highlights This Month:

- The $42.7 million Series A financing recently obtained by Azra Games is significant for the Web3 ecosystem as it showcases the integration of blockchain technology with mainstream gaming, emphasizing how digital ownership and immersive economies are redefining player experiences. With support from well-known investors like Pantera Capital and a16z crypto, this financing validates the potential of integrating Web3 principles (such as decentralized economies and player empowerment) into highly scalable and engaging mobile RPGs. Azra focuses on leveraging AI for scalable content creation and developing "fourth-generation" RPGs (comparable to PC and console experiences), marking a paradigm shift in the mobile gaming space and positioning blockchain-supported games as a competitive force in the broader gaming industry, potentially accelerating mainstream adoption of Web3 technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。