Compiled by: Fairy, ChainCatcher

Last Week's Performance of Crypto Spot ETFs

US Bitcoin Spot ETF Net Inflow of $3.378 Billion

The US Bitcoin spot ETF has seen a continuous inflow trend for seven weeks, with a net inflow of $3.378 billion last week, setting a record high since its launch, bringing the total net asset value to $107.49 billion. This week, trading volume was strong, with an average daily trading volume of $5.016 billion.

BlackRock's IBIT had the highest net inflow at $2.053 billion, followed by Fidelity's FBTC with a net inflow of $772 million. Only Grayscale's GBTC experienced a net outflow, amounting to $52.9 million.

Data: SoSoValue

US Ethereum Spot ETF Net Outflow of $6.84 Million

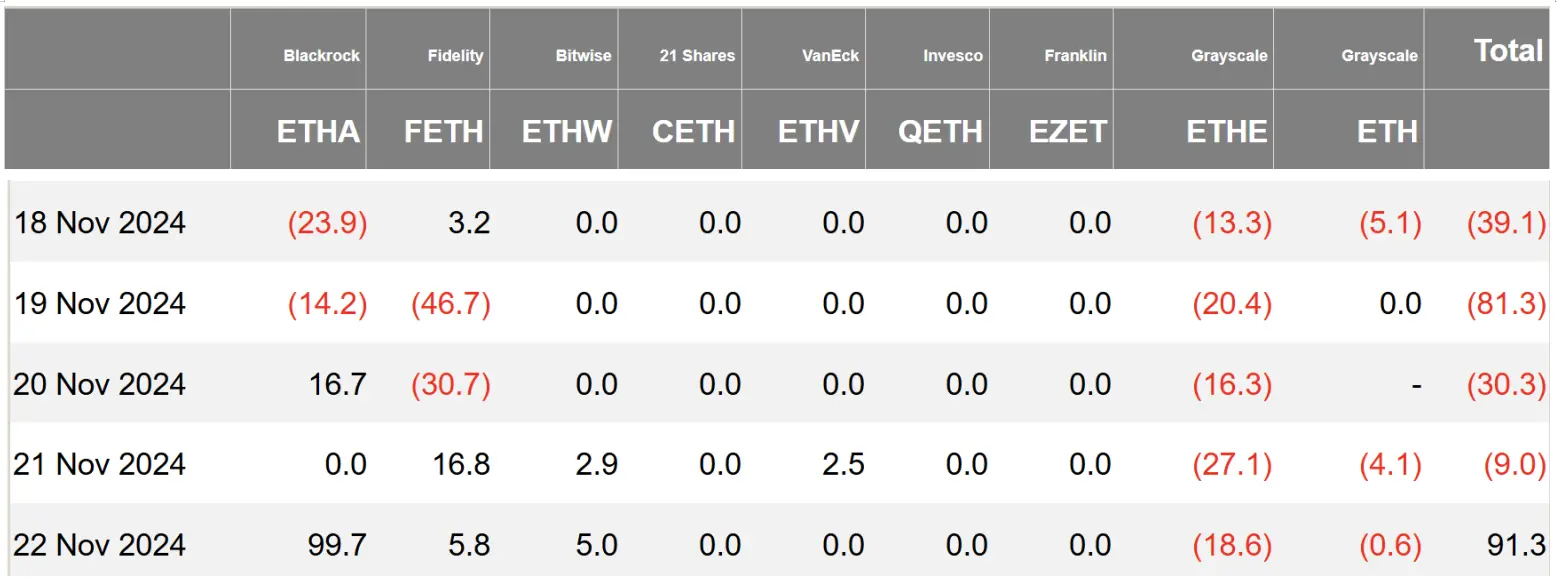

Last week, the US Ethereum spot ETF shifted from net inflow to net outflow, amounting to $6.84 million, with a total net asset value now at $9.69 billion. Three ETFs experienced net outflows, with Grayscale's ETHE seeing the largest outflow of $9.57 million; Fidelity's FETH and Grayscale's ETH had outflows of $5.16 million and $980,000, respectively. Additionally, three other ETFs had no fund movement.

Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 178.23 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net inflow of 178.23 Bitcoins, with a net asset value of $45.7 million. On November 18, the Bitcoin spot ETF saw a net inflow of 238.68 Bitcoins, setting a new high since August 22.

The Hong Kong Ethereum spot ETF had no fund movement, with a net asset value of $5.14 million. On November 21, the total trading volume reached $26.28 million, marking a new high since August 5.

Data: SoSoValue

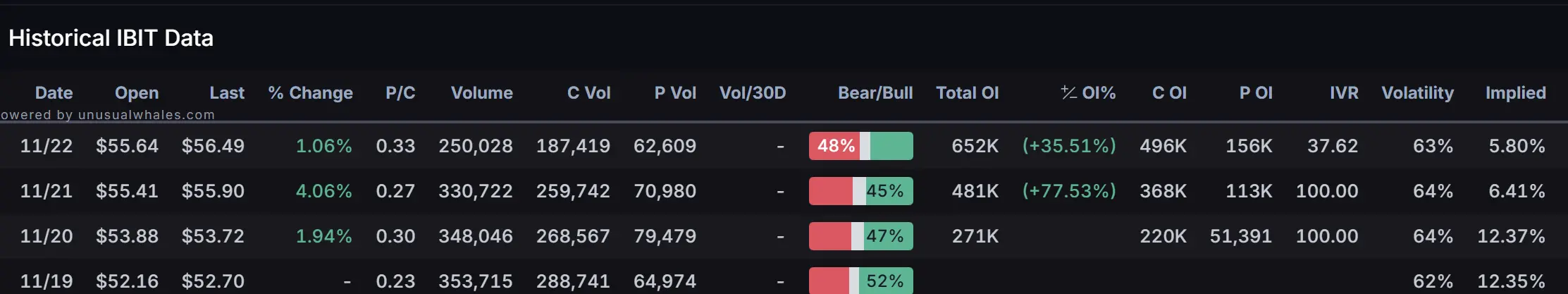

Performance of Crypto Spot ETF Options

BlackRock's Bitcoin spot ETF options debuted on November 19, with a total of 128 contracts traded last week. On the first day of trading, 354,000 contracts were traded, with a nominal trading volume of $1.86 billion. Volatility remained high, ranging from 62% to 64%, indicating active market fluctuations. Implied volatility was at 12.3% on November 20 and November 19, then dropped to 5.8%. As of November 22, total open interest (OI) reached 652,000.

In contrast, Grayscale's Bitcoin spot ETF GBTC options trading was lackluster, with 4,380 contracts traded on the first day and a total of 8,137 contracts traded last week. As of November 22, total open interest (OI) reached 6.124 million.

Data: Unusual Whales

Overview of Last Week's Crypto ETF Developments

South Korea Refuses to Approve Virtual Asset Investment ETFs

South Korea's financial regulatory agency has explicitly prohibited the issuance of cryptocurrency spot and futures ETFs, while also rejecting fund applications from crypto companies, including exchanges.

A head of an asset management company revealed that they have been preparing to invest in virtual asset companies since the end of last year but have yet to receive regulatory approval. An FSS official acknowledged the increasing market demand for Bitcoin investments but emphasized that regulatory policies will not be relaxed at this stage unless the government changes its stance.

Grayscale Completes Reverse Stock Split for Bitcoin and Ethereum Mini Trust ETFs

Grayscale has completed a reverse stock split for its Bitcoin mini trust ETF and Ethereum mini trust ETF, aimed at optimizing trading costs. The reverse stock split was implemented at 22:00 UTC on November 19:

- Bitcoin Mini Trust ETF: Every five shares were consolidated into one share, with the price rising to five times the NAV per share before the split.

- Ethereum Mini Trust ETF: Every ten shares were consolidated into one share, with the price increasing to ten times the NAV per share before the split.

The stock split was completed automatically, and shareholders did not need to take any action; the adjusted results took effect on the trading day of November 20.

SEC Delays Decision on Franklin Crypto Index ETF

The US SEC has delayed its decision on the Franklin Crypto Index ETF, which will hold Bitcoin and Ethereum and plans to list on the Cboe BZX exchange, with Coinbase Custody providing custody services. The SEC stated that it needs more time to evaluate the relevant proposals, with the final decision date yet to be determined.

Grayscale Submits Bitcoin Miner ETF: Grayscale has submitted an application expected to take effect on January 27, 2025, with the trading code to be determined.

Cboe Submits Applications for Four Solana Spot ETFs: The issuers include VanEck, 21Shares, Canary Capital, and Bitwise, with the SEC's final ruling expected to be completed by early August 2025.

Progress in SEC Negotiations with Solana ETF Issuers

According to sources, the SEC has made "progress" in the approval process with the issuers of the Solana spot ETF, and exchange representatives may submit the next 19b-4 filing within days. There are optimistic expectations that the Solana ETF may be approved in 2025, a development also supported by the incoming government that favors crypto policies.

Views and Analysis on Crypto ETFs

The ETF Store President: Solana ETF Likely to be Approved by End of Next Year

Nate Geraci, President of The ETF Store, stated: "I believe the likelihood of the Solana ETF being approved by the end of next year is very high. The SEC is likely currently in discussions with the issuers regarding this product, which is clearly a positive signal."

Given that industry leaders like Bitwise have already submitted applications, Alexander Blume, CEO of Two Prime Digital Assets, also agrees with this view. "If they didn't have a good feeling about success, they wouldn't waste time and money doing this," Blume said, noting that the success and precedents set by spot Bitcoin and spot Ethereum ETFs, combined with a more crypto-friendly regulatory environment, will lead to the emergence of the SOL ETF within the year.

The ETF Store President: Applications for ADA or AVAX Spot ETFs May Soon Appear

Nate Geraci, President of The ETF Store, mentioned that in addition to the listings of Grayscale and Bitwise's crypto index funds, there are currently spot ETF applications for SOL, XRP, and HBAR.

He anticipates that issuers may soon attempt to launch spot ETF applications for ADA or AVAX, further expanding the market scope for cryptocurrency ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。