On November 21, the trading volume of MSTR exceeded the total of the U.S. spot Bitcoin ETFs, accounting for a large portion of the trading volume in the U.S. stock market that day.

Written by: Jiang Zihan

Source: Wall Street Watch

Under the "Bitcoin Frenzy (BITSANITY)," the leading Bitcoin company MicroStrategy (MSTR) has also become increasingly popular.

On Thursday, November 21, MSTR's trading volume surpassed the total of the U.S. spot Bitcoin ETFs, dominating the trading volume in the U.S. stock market that day. The stock price surged by as much as 14.6% during the day, reaching a historic high, but then plummeted sharply, crashing over 25% from the day's peak of $536.7 per share to close at $397.28 per share.

On the same day, the price of Bitcoin rose by 5% to reach a historic high of $98,311; the total trading volume of the "Bitcoin Industrial Complex" (including U.S. spot Bitcoin ETFs, MSTR, Coinbase, and other stocks) hit a record $70 billion, far surpassing the previous day's record of $55 billion; the asset size of the U.S. spot Bitcoin ETFs broke the $100 billion mark.

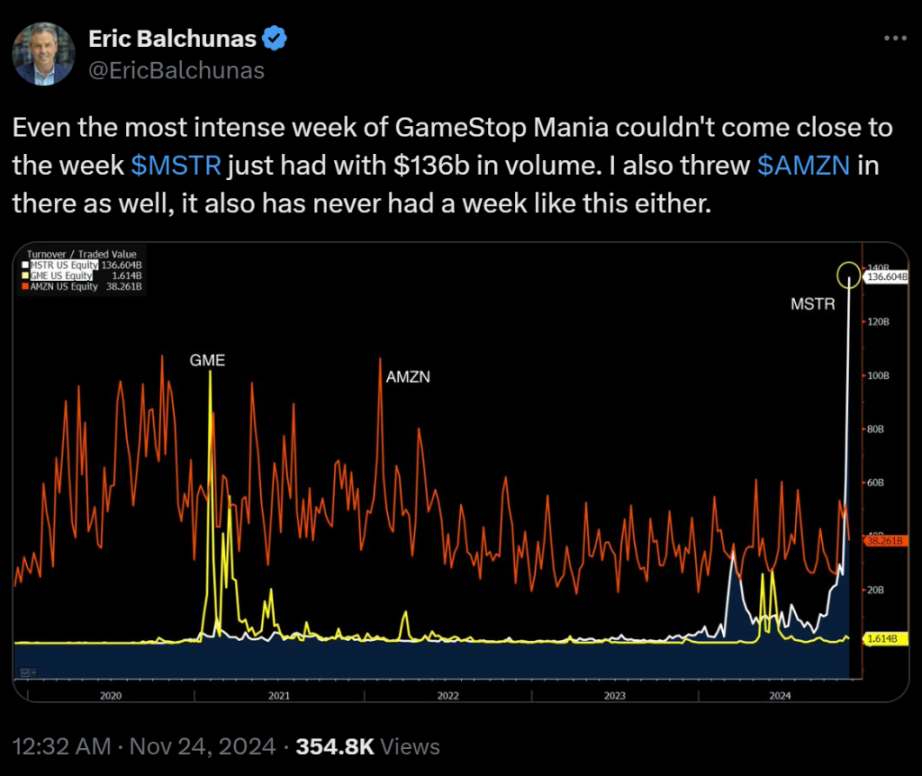

On November 24, Bloomberg ETF analyst Eric Balchunas posted on social platform X:

Even the most intense week of GameStop Mania (referring to the investment frenzy around the video game retailer GameStop stock in early 2021) could not come close to MSTR's trading volume of $136 billion last week! Amazon has never seen a week like MSTR!

As of Friday's market close, MSTR was at $421.88 per share, and since the beginning of the year, MSTR's stock price has risen over 500%.

From the perspective of ETFs, the "Bitcoin Frenzy" is even more pronounced.

On November 21, the asset size of the U.S. spot Bitcoin ETFs surpassed the $100 billion mark. According to Farside Investors data, since the U.S. securities regulator approved the launch of spot Bitcoin ETFs on January 11 of this year, a total of $29.3 billion has flowed in.

Among them, the iShares Bitcoin Trust ETF (IBIT) issued by BlackRock has performed the best among all Bitcoin products, attracting $30.2 billion in inflows, while the Fidelity Wise Origin Bitcoin Fund and ARK 21Shares Bitcoin ETF ranked second and third with inflows of $11.2 billion and $2.7 billion, respectively.

Balchunas pointed out that the size of the U.S. spot Bitcoin ETFs has reached 82% of that of gold ETFs; however, gold ETFs have been trading in the U.S. market since November 2004, nearly 20 years earlier than Bitcoin ETFs.

Balchunas described this astonishing data as:

"Bitcoin Frenzy!"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。