What kind of MEME is more likely to run the curve, and what are the characteristics behind top MEMEs?

Written by: PANews, Frank

MEME coins have become an important business card in the crypto world, filled with stories of wealth and the ups and downs of trending topics. On the other hand, the MEME culture has become increasingly complex with the influx of large amounts of capital, and the perspective of speculation has even shifted from internet trends to various abstract cultures. For many who aspire to find the wealth code in this market, it seems to have reached an epic level of understanding difficulty.

Compared to the consistently high popularity, the MEME sector still lacks some macro tools to analyze the overall development situation. People seem more obsessed with the stimulation of PVP, but rarely think about what kind of MEME is more likely to run the curve, or what characteristics lie behind those top MEMEs.

PANews aims to restore the truth about leading MEMEs through the overall data of MEMEs.

Dog Series MEMEs Become the Final Winners

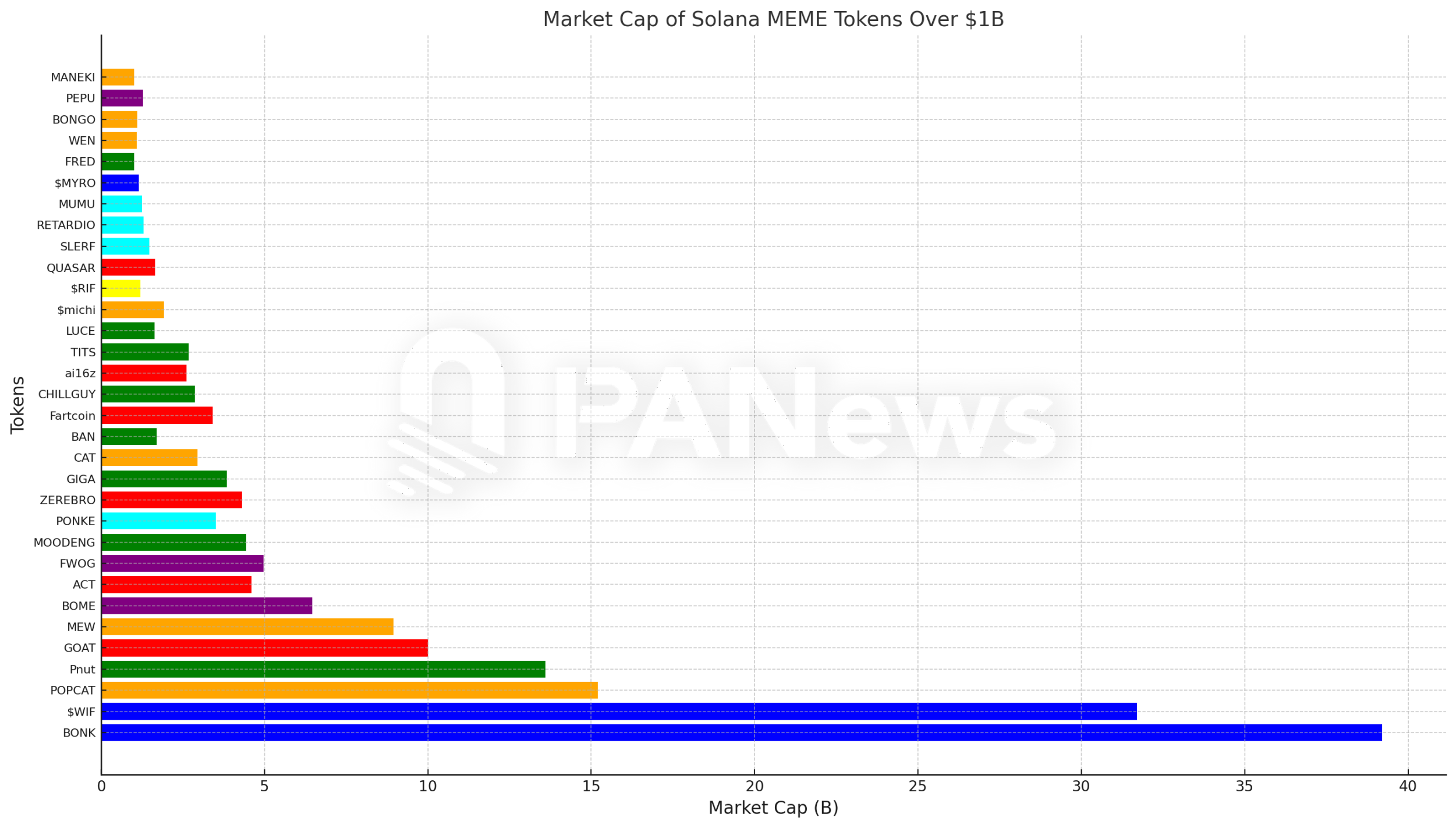

As of November 21, there are a total of 32 MEME coins on the Solana chain with a market value of over 100 million, among which the highest market value MEME coin is BONK, a dog-themed token issued in 2023.

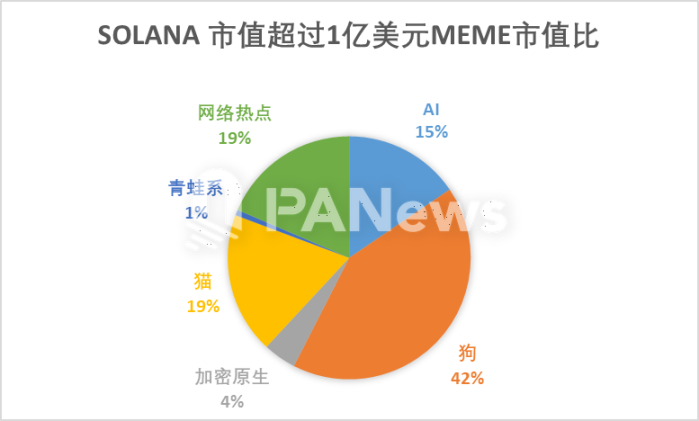

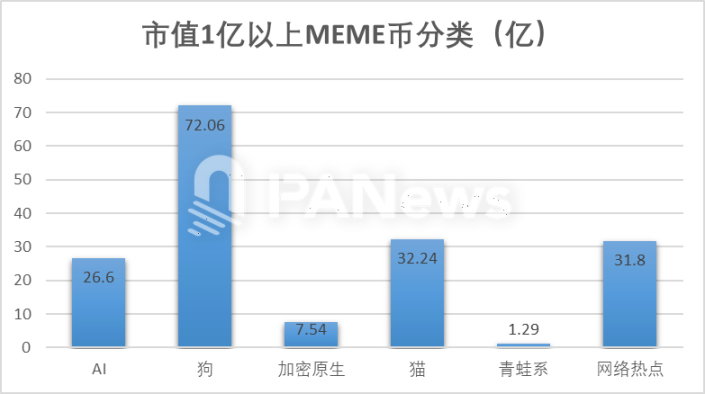

PANews categorizes these tokens as follows: crypto-native (crypto original content), frog series (similar to PEPE), cats, dogs, internet trends (from TIKTOK or other internet social trends), AI, DeSci.

According to this classification, we can see that among the MEME coins with a market value of 100 million dollars, the number of tokens in the internet trends and cat series is the highest, with 8 and 7 respectively. The number of AI-themed tokens is 6. However, in terms of total market value, the dog series MEMEs have the highest total market value, reaching 7.206 billion dollars, accounting for 42% of the total market value.

The market value of cat series tokens is approximately 3.224 billion dollars, indicating that in the current cat-dog battle, the dog series is leading.

AI Triggers MEME "October Revolution"

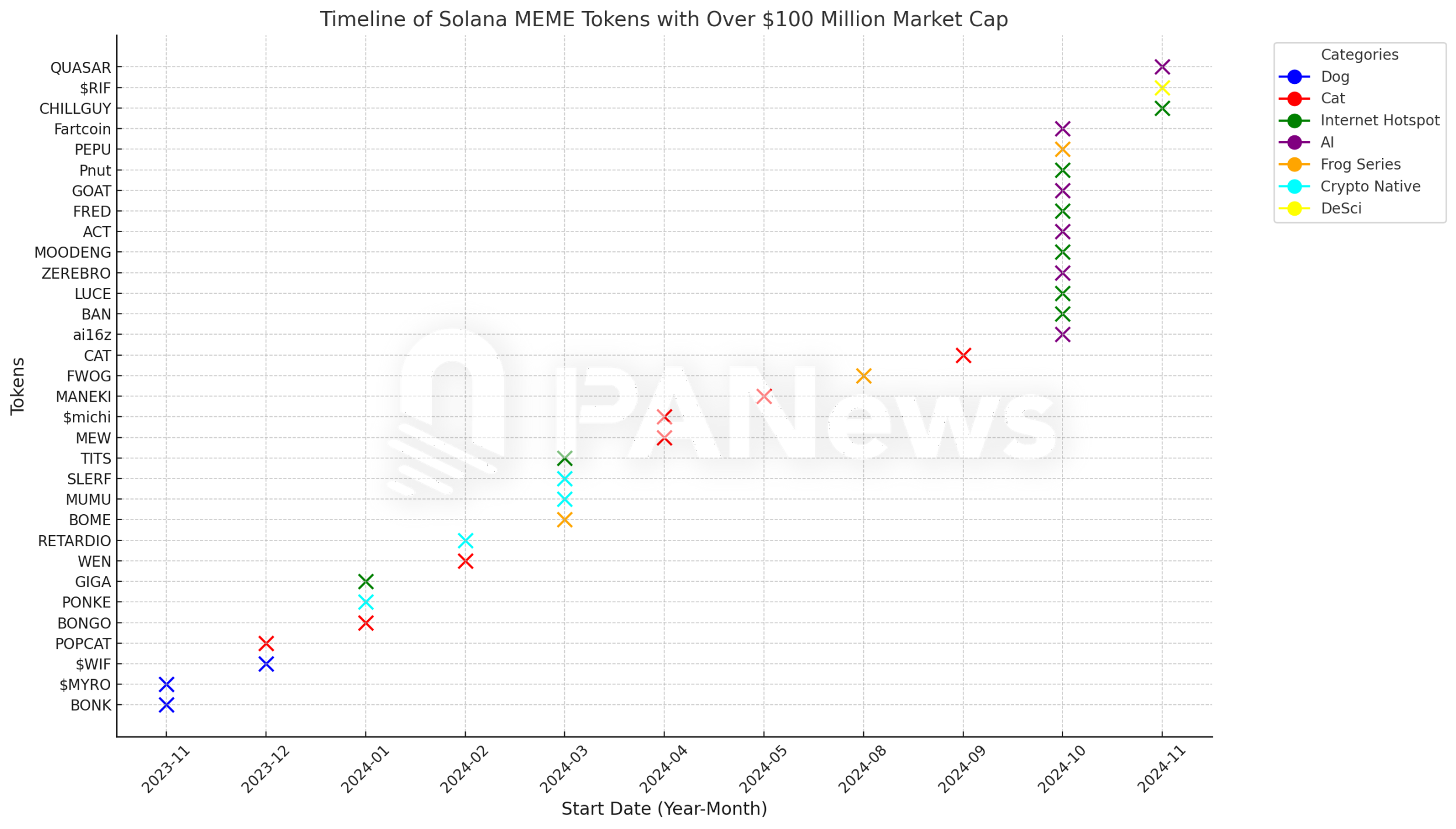

In addition to market value comparisons, the timeline can also reflect the overall market heat. The following chart compares the issuance time of MEME tokens with a market value of over 100 million dollars. From this comparison, it is evident that there are significant thematic preferences in the MEME market during each time period.

Dog series tokens are the earliest to gain fame on the Solana chain, with issuance times almost all concentrated in 2023. Since November 2023, there have still been 3 dog series MEMEs with a market value exceeding 100 million dollars, among which BONK ranks first on the Solana chain with a market value close to 4 billion dollars. $WIF ranks second on Solana. It appears that the dog series remains the most popular material in the MEME world.

The cat series appeared later than the dog series, but its popularity seems to have been maintained until September, during which several cat series tokens became new MEME darlings. Overall, from April to May, Solana can be said to be the market for cats. However, in terms of average market value, the average market value of the cat series reached 1.295 billion dollars, ranking second only to the dog series. This also indirectly indicates that the cat-dog battle remains the biggest winner on Solana.

October was the month when Solana entered the peak of MEME popularity, during which the most MEME coins with a market value of over 100 million dollars were born, totaling 11. The majority of these were from the AI series and internet trends. The representative tokens for this month include MOODENG (internet trend) and GOAT (AI).

In the overall hot crypto market of November, although the MEME perspective changes daily, it seems that there has not been a strong momentum formed so far. In November, 3 tokens reached a market value of 100 million, still mainly from AI and internet trends. Recently, the much-discussed DeSci perspective only had one token, $RIF, reach a market value of over 100 million. In November, the most eye-catching was undoubtedly Pnut, which, with the help of Musk and Binance, became the youngest token to reach a market value of 1 billion dollars.

From the overall time span, the highest market value MEMEs on the Solana chain are still those tokens issued earlier, with only Pnut among the top ten tokens having an issuance time of less than one month. Perhaps from this perspective, leading tokens generally need to undergo a period of time to consolidate consensus.

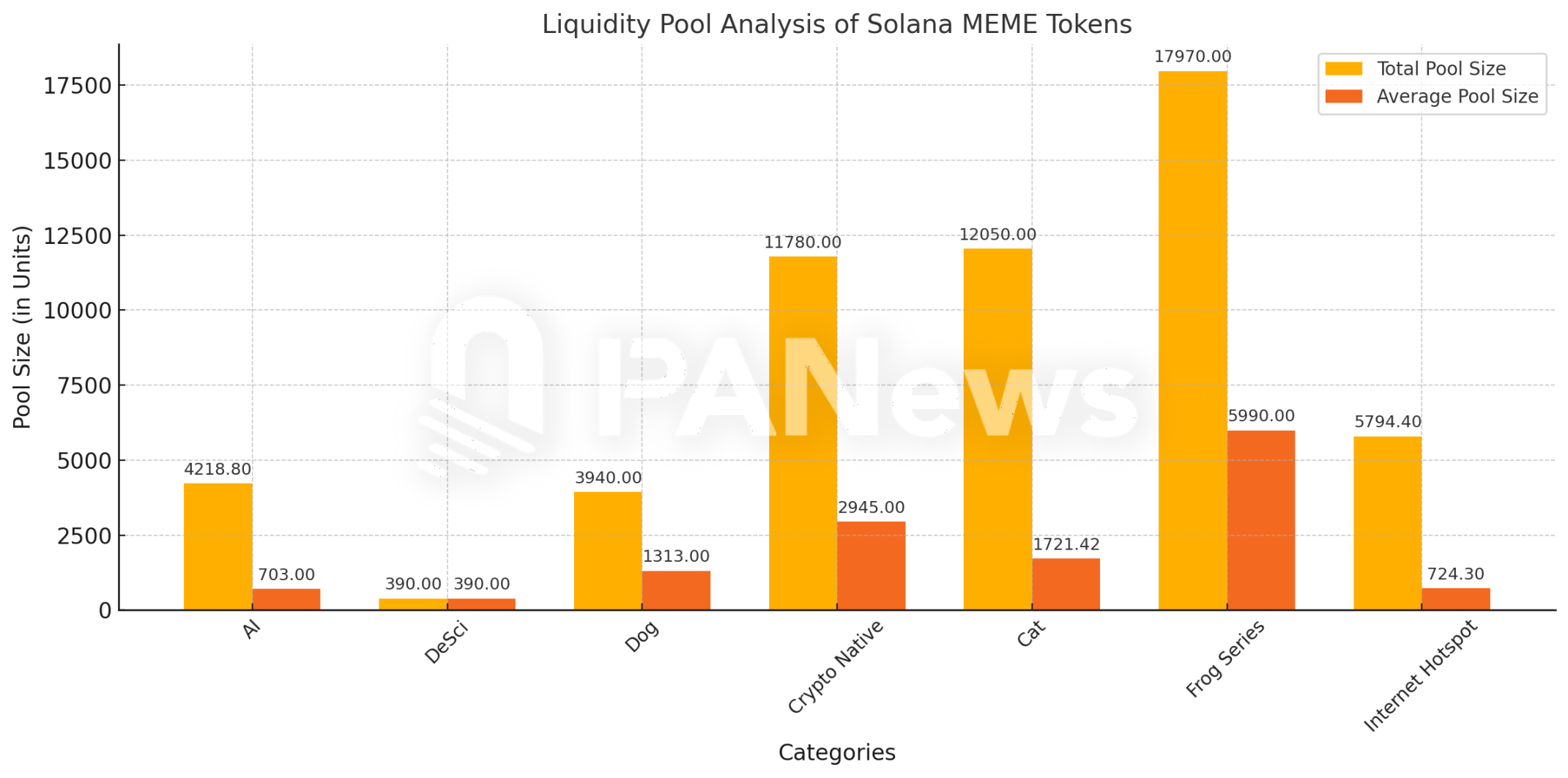

A Thick Capital Pool Allows Frog Series to Hold a Place

In searching for the reasons why these tokens can maintain a market value of over 100 million dollars, PANews found some unique phenomena that may explain the issue. In terms of overall market value and social media heat, frog series tokens do not seem to be popular, yet there are still 3 frog series tokens occupying a market value of over 100 million dollars.

Observing the liquidity pool amounts of all these tokens, it can be found that frog series tokens have the largest liquidity pool, with the liquidity of 3 tokens exceeding all other series, reaching 179 million, averaging 59.9 million dollars per frog liquidity pool, with an average liquidity / market value ratio of 11.53%. Sufficient liquidity may be a testament to the persistence of large funds. In contrast, the average liquidity of the AI series seems to be the thinnest (excluding DeSci), at only 7.03 million dollars, with a liquidity / market value ratio of only 1.49%. Such liquidity may be difficult to maintain over a longer period, but currently, the AI series seems to still be in a stage of competition, and with the outcome yet to be determined, large funds have not yet entered the liquidity pool.

One in Ten Thousand to Catch a 100 Million Dollar Golden Dog

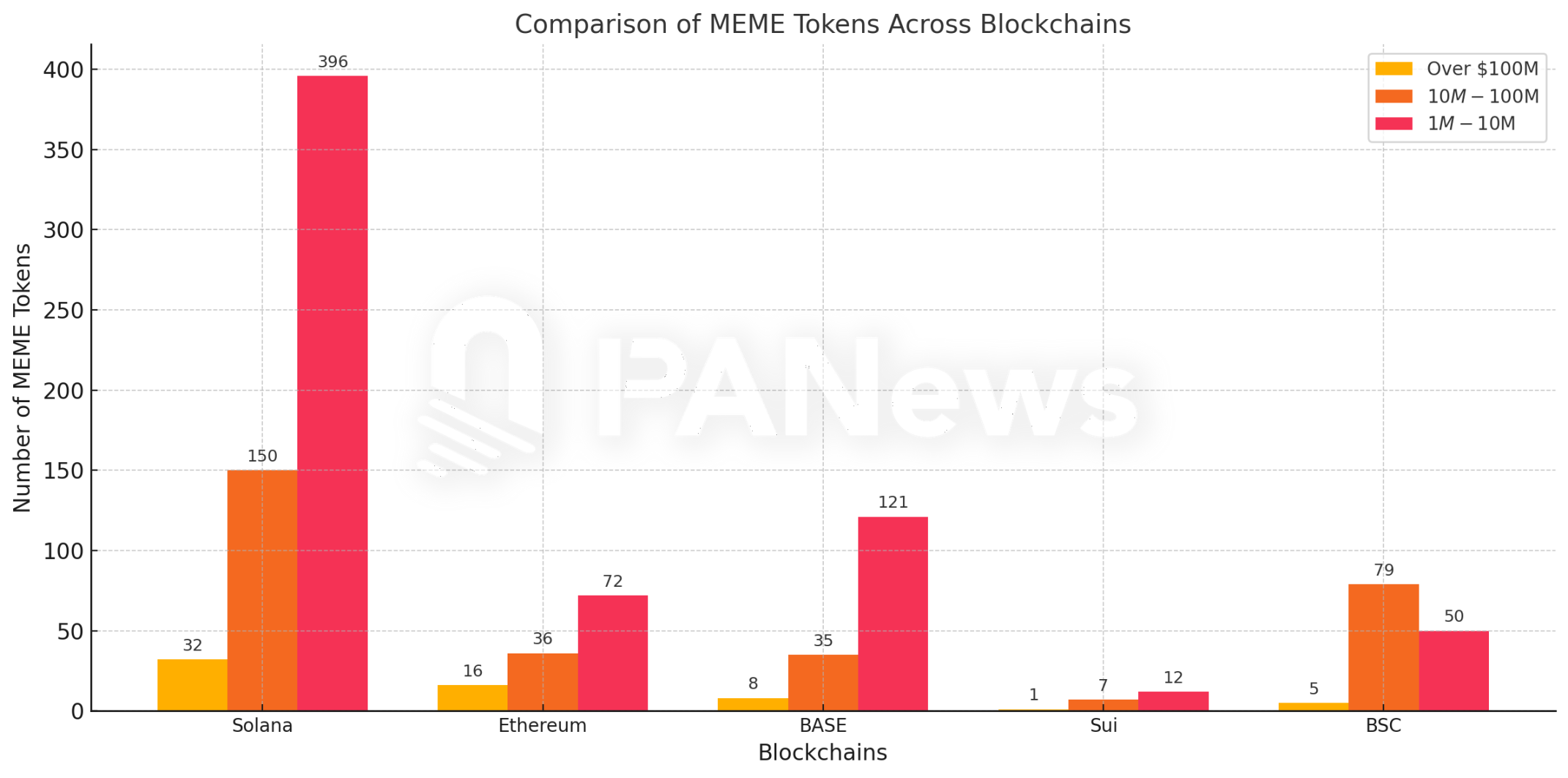

So, how many tokens can actually emerge as a true MEME gold mine? As of November 21, Pump.fun has issued a total of 3.59 million tokens, a scale that far exceeds the total token issuance in the past decade of the crypto world. Among these, the number of tokens that graduated (fully filled the curve on Raydium) is 50,389, accounting for about 1.4%. The number of tokens with a market value over 100 million dollars is 32.

The number of MEMEs with a market value between 10 million and 100 million is 154, with a probability of about 0.00089%, less than one ten-thousandth. The proportion of graduated tokens is about six ten-thousandths. The number of tokens with a market value between 1 million and 10 million is 396, accounting for 0.79% of graduated tokens, while the number of tokens between 10 million and 100 million is 150, accounting for 0.29%.

From this data proportion, obtaining a wealth code and successfully profiting is no less than the probability of winning the lottery. However, it seems to be higher than the probability of winning the first prize in the lottery (about 1 in 17.72 million). It is no wonder that the crypto community refers to MEME investments as lottery-style investments.

Besides Solana, which public chains are also MEME hotspots?

In our impression, Ethereum and BSC chains were once MEME paradises. According to current data, besides Solana, the prosperity of the Base chain seems to be quietly happening.

In terms of quantity, the number of MEMEs on Base between 1 million and 10 million has reached 121, second only to Solana, while BSC is more concentrated between 10 million and 100 million, becoming a gathering place for middle forces in MEMEs. Ethereum still has the most top MEMEs besides Solana, with a total of 16 MEMEs over 100 million. The highest market value among them is PEPE, reaching 8.74 billion dollars, making it the highest market value MEME among the analyzed chains (excluding DOGE and SHIB). Overall, on Coingecko, among the top 100 tokens by market value, 11 are MEMEs.

To have a deeper discussion on the development and methodology of MEME coins, PANews will launch a series of in-depth content, analyzing the chip data of leading projects in different categories of MEME coins.

Do these MEMEs that become gold mines have a lot of wash trading? How long can early chips hold? At what points do large holders build positions, etc., we strive to use data to restore the financial truth of these MEMEs. Stay tuned!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。