Author | Wenser Odaily Planet Daily

In a previous article titled "Overview of the Top 25 Public Companies by BTC Holdings, Seeking the Secret to Mastering 'Coin-Stock Dual Cultivation'," we systematically sorted the top 25 public companies by BTC holdings. Among them, MicroStrategy (MSTR) saw its stock price surge from around $194 to nearly $500 in just about a month, an increase of approximately 150%. Additionally, as the BTC price broke through $97,000 and continued to reach new highs, its cumulative profit from BTC holdings has now approached $15.7 billion, continuing to lead the public companies' BTC profit rankings.

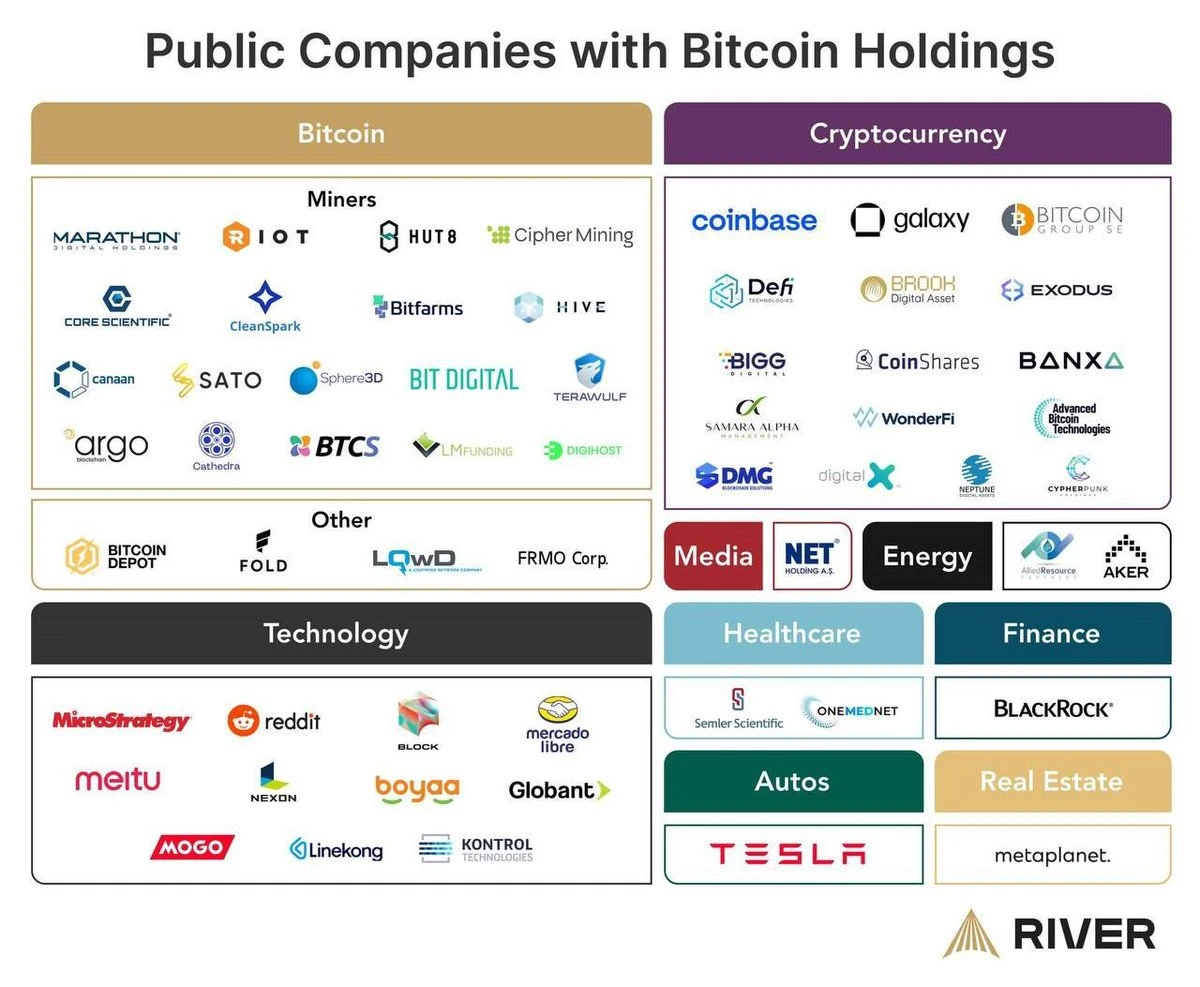

Moreover, the world-renowned tech giant Microsoft previously revealed that its shareholders have begun preliminary voting on whether the company should invest in Bitcoin. According to NCPPR, "If Microsoft decides not to invest in Bitcoin, subsequent price increases may expose it to shareholder lawsuits." Considering various factors, it is as we previously predicted: more and more public companies will join the ranks of Bitcoin strategic reserves. After all, in the current accelerating process of Bitcoin mainstreaming, buying BTC leads to rising stock prices, while rejecting BTC results in weak stock prices; the choice is becoming increasingly clear.

Odaily Planet Daily will summarize the top 15 public companies by BTC profit rankings in this article for investors' reference. (Note: For the sake of business type differentiation, this ranking does not include publicly listed companies related to crypto mining. We will choose an opportunity to re-sort this later, and the data in this statistics comes from BitcoinTreasuries.Net, which may differ from the public company announcement data and is for reference only.)

Top 15 Public Companies by BTC Profit: MicroStrategy Leads, Coinbase in Second, Tesla in Third

According to the information statistics from BitcoinTreasuries.Net, the list of the top 15 public companies by total BTC profit is as follows—

Top Three Players: Bitcoin Leveraged Concept Stocks, First Crypto Exchange Stock, New Energy + Musk Concept Stock

Among them, MicroStrategy (MSTR) ranks first with a total profit of nearly $15.7 billion, including:

- BTC holdings of 331,200 coins;

- Total value of approximately $3.22 billion;

- Average purchase price of $49,874;

- Current stock price of $473.83;

- Profit growth multiple of about 1.95 times.

Coinbase (COIN) ranks second with a total profit of $804 million, including:

- BTC holdings of 9,480 coins;

- Total value of approximately $920 million;

- Average purchase price of $12,342;

- Current stock price of $320.01;

- Profit growth multiple of about 7.88 times.

Tesla (TSLA) ranks third with a total profit of $607 million, including:

- BTC holdings of 9,720 coins;

- Total value of approximately $945 million;

- Average purchase price of $34,722;

- Current stock price of $342.03;

- Profit growth multiple of about 2.8 times.

High Multiple Players: German Public Companies Share the Spotlight

If the above three companies are known for their "profit scale," the next companies excel in "multiple growth."

Among them, a private equity and consulting company from Germany, Bitcoin Group SE, has achieved an astonishing profit growth multiple of 29.6 times. According to Yahoo Finance, it operates a digital currency trading platform under Bitcoin.de, engaging in cryptocurrency and blockchain business globally. Founded in 2008, it is a subsidiary of Priority AG. It is known that the company has held Bitcoin since December 31, 2021, currently holding 3,589 BTC with an average cost of only $3,285. The current stock price is $68.67 (65.20 euros), and the last trading operation occurred at the end of June 2022, selling 179 BTC at $20,109, after which its holdings remained unchanged.

Coincidentally, another company from Germany, Advanced Bitcoin Technologies AG, has also achieved a profit growth multiple of 10.98 times. According to Yahoo Finance, this software company, established in 2015, mainly develops cryptocurrency and artificial intelligence software products in the fintech sector and also provides cryptocurrency payment services. It is known that its BTC holdings are 242.2 coins, with a total value of $23.55 million, but its average purchase price is only $8,853. Meanwhile, its stock price is only $0.20 (0.19 euros).

Hong Kong Stock Twins: Boyaa Interactive and Meitu

For Hong Kong-listed companies, the gaming company Boyaa Interactive (0434) and the internet company Meitu (1357) successfully made the list with 1,100 BTC and 940.9 BTC, respectively.

Among them, Boyaa Interactive's average purchase price for BTC is $41,790, with a cumulative profit of $60.99 million, and its stock price is $0.55 (4.25 Hong Kong dollars);

Meitu's average purchase price for BTC is $52,609, with a cumulative profit of $41.99 million, and its stock price is $0.42 (3.24 Hong Kong dollars).

Of course, the above is only the statistical data from BitcoinTreasuries.Net. Previously, Boyaa Interactive officially announced that as of November 12, it had held 2,641 BTC, with a total cost of approximately $142,722,654, and an average cost of about $54,027 per BTC. If based on this data, its cumulative profit has already reached $113 million. Moreover, the founder of Meitu, Cai Wensheng, is a well-known Bitcoin whale, and the company's actual BTC holdings should be significantly higher.

The Biggest Beneficiary Following the "BTC Strategic Reserve": Japanese Public Company Metaplanet

In the previous article "Overview of the Top 25 Public Companies by BTC Holdings, Seeking the Secret to Mastering 'Coin-Stock Dual Cultivation'," we mentioned that the Japanese public company Metaplanet (3350.T) is a follower of the "MicroStrategy BTC Strategic Reserve" and also the biggest beneficiary: since it began buying BTC, its stock price has surged by as much as 468%, when its stock price was only $7.50. A month later, its BTC holdings have increased from 861.4 coins to 1,142 coins, and its stock price has skyrocketed to $16.54, an increase of over 220%, making it another example of a "BTC leveraged concept stock." Meanwhile, although its average purchase price is $65,972, its cumulative profit still stands at $35.71 million, ranking 11th.

Followers Continue to Join: U.S. Public Companies Rush to Enter the "BTC Strategic Reserve" Ranks

Yesterday, MicroStrategy (MSTR) successfully entered the top 100 U.S. public companies, ranking 97th, thanks to its soaring stock price. On Tuesday, its stock price surged by 12%, breaking the $400 mark, closing at $430, jumping 29 places, with its stock price increasing by over 500% this year.

Previously, reliable statistics indicated that over 60 public companies have adopted Bitcoin strategies, and thousands of private companies are following suit.

Overview of Leading Public Companies Executing BTC Strategy

As November began, with Trump successfully elected as the 47th President of the United States, the crypto market surged under favorable stimuli. Just as the gradual introduction of custodial exchanges, publicly listed trusts, futures, and spot ETFs welcomed a new type of capital allocator, a new class of Bitcoin investors has also emerged in large numbers. This also signifies that this month has ushered in another peak of Bitcoin products: corporate leverage. Four public companies—MicroStrategy, MARA Holdings, Semler Scientific, and MetaPlanet—have added billions of dollars in collective debt to their balance sheets to purchase Bitcoin.

Naturally, this has led to a continuous influx of "strategic followers"—

On November 19, U.S. public company Genius Group Limited (GNS) announced it had invested $10 million to buy 110 BTC at an average price of $90,932. This purchase marks the company's official establishment of a Bitcoin reserve. This purchase followed the company's announcement of a "Bitcoin-first" strategy on November 12, which promises to hold 90% or more of existing and future reserves in Bitcoin, with an initial goal of holding $120 million in Bitcoin;

On the same day, LQR House Inc. (LQR), a niche e-commerce platform focused on the spirits and beverage industry, announced that its board had approved the purchase of $1 million worth of Bitcoin as part of its fund management strategy. Additionally, the company will now accept cryptocurrency payments on CWSpirits.com, allowing customers to flexibly use digital currency to purchase alcoholic beverages. As part of this plan, LQR House has adopted a policy to retain up to $10 million in crypto payments as Bitcoin.

On November 20, U.S. publicly listed biopharmaceutical company Acurx Pharmaceuticals (ACXP) approved the purchase of $1 million in Bitcoin as reserve assets; on the same day, another U.S. public company, Hoth Therapeutics (HOTH), announced that its board approved the purchase of up to $1 million in Bitcoin, with CEO Robb Knie stating, "We believe that Bitcoin's anti-inflation characteristics may make it a reliable asset with value storage capabilities."

It is evident that many public companies have fully recognized the value storage function of BTC and its role in boosting stock prices, joining this "BTC strategic reserve competition."

Conclusion: Buy BTC or Miss BTC? That is the Question

In 2022, the market experienced a series of black swan events and crises that led to a period of silence. During that time, MicroStrategy CEO Michael Saylor continued to buy BTC, while another national-level BTC strategic reserve decision-maker, El Salvador President Nayib Bukele, was ridiculed by many as "the sleeping dragon and the phoenix." Now, as the BTC price approaches the $100,000 mark, it is undeniable that buying BTC has made both of them "equally brilliant."

Now, for retail investors and public companies that have not yet bought BTC, the choice before them is similar: whether to buy stocks of public companies that have already established BTC reserves VS whether to watch BTC prices fluctuate and miss the opportunity to boost stock prices through BTC strategic reserves?

Survival or death, in terms of investment, this is indeed a question.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。