The "Altseason" is a short-term phenomenon where altcoins surpass Bitcoin and bring high returns. The key indicators predicted for 2025 are BTC.D, ETH/BTC, USDT.D, and OTHERS/BTC.

Author: Cryptowrit3r

Translation: Blockchain in Plain Language

One of the most discussed topics in the cryptocurrency space has always been "Altseason." This is because during this brief period, there are usually crazy returns. Altseason is considered a major source of attraction for crypto tourists, as it helps bring newcomers into the crypto space. Today, we will explore the top four indicators predicting Altseason in 2025.

1. What is Altseason in cryptocurrency?

Altseason is a phenomenon in the crypto space known for generating insane profits. This phenomenon occurs with all cryptocurrencies except Bitcoin, which are known as altcoins. So think about your Solana, your BNB, your SUI, and so on. When Altseason arrives, all these tokens start to outperform Bitcoin across various metrics, and their prices soar. Some tokens double in price within hours, while others see a 1000% increase in less than a week.

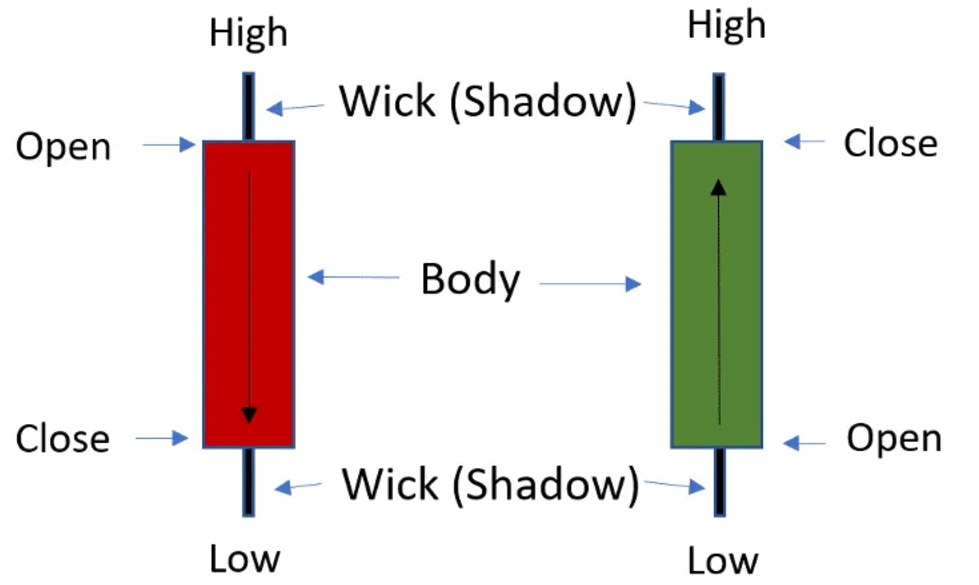

But all good things must come to an end. This is why Altseason is usually followed by a severe sell-off, marking the peak of the bull market cycle. We will see a disruption in the upward trend, with prices plummeting due to massive whale sell-off pressure. When Altseason occurs during a bear market, it is often referred to as a relief rally and tends to be short-lived. The sell-off begins when tokens hit their high time frame (HTF) resistance levels. In high time frames, each candle represents a day, a week, or a month. This is often referred to as a trap bull, a term favored by Capo in the crypto space.

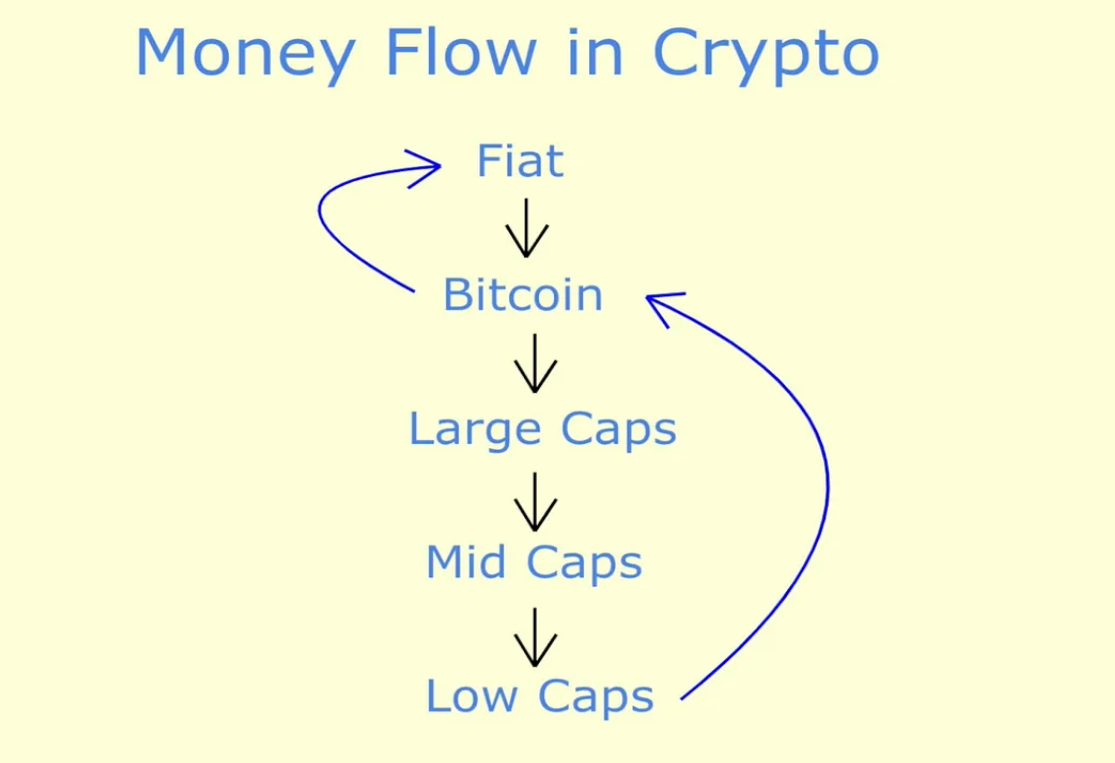

Recently, there have been significant changes in the cryptocurrency market. This is because there are now millions of crypto projects operating, which means that when funds flow into the market, there are a plethora of projects to choose from. This could lead to diluted returns during the upcoming Altseason in 2025, leaving many token holders disappointed. The flow of funds typically looks like the diagram below.

Let’s discuss the top indicators, the four key indicators for Altseason in 2025. We believe there are four indicators that will play a crucial role in the Altseason of 2025:

Bitcoin Dominance (BTC.D)

ETH/BTC

USDT Dominance

OTHERS/BTC

Let’s analyze each indicator one by one.

2. Why is BTC.D important?

BTC.D represents Bitcoin Dominance (market share). This indicator is crucial for predicting our position in the market cycle. It measures Bitcoin's share of the entire cryptocurrency market. If BTC.D is 61%, then Bitcoin controls 61% of the cryptocurrency market. Naturally, this means that 61% of the liquidity is specifically allocated to Bitcoin. This indicates that it is currently Bitcoin's season, and we should expect altcoins to weaken relative to Bitcoin. When BTC.D starts to decline, it is a good sign for altcoins. This is when things get interesting, as liquidity flows more towards other crypto assets like Ethereum, blue chips, and altcoins.

Notice that Bitcoin Dominance (BTC.D) has reached a significant resistance level on the weekly chart. This suggests we can expect it to peak between 62-63%. If it does not peak, it may continue to rise until it approaches 70% before potentially peaking again. A drop below 58% on the daily chart, followed by a test of 60% that fails to close above 60%, may indicate that this "big brother" (chad) has peaked.

The blue circles on the chart indicate the Altseason of 2021, during which many famous crypto millionaires were born.

2. ETH/BTC Oracle

If you ask any crypto expert, they will tell you that ETH/BTC is one of the most important charts to watch closely. When ETH declines relative to BTC, altcoins often weaken and experience distribution (a fancy term for large-scale selling). However, when ETH gains momentum relative to BTC, you can expect the arrival of Altseason in 2025.

It is well known that ETH is the largest ecosystem in the crypto space, with the highest Total Value Locked (TVL). TVL is as important to blockchain as deposits are to banks. This is why when it rises, everything tends to rise quickly, and we see green candles everywhere. Observing high time frame charts, you will notice that ETH/BTC has been declining for a long time. It is now facing a strong support level around 0.031, which could start to reverse upwards. This could trigger Altseason. ETH/BTC may also reverse if it fails to drop below 0.033 and closes above 0.04.

Pro Tip: When plotting these types of indicators, be sure to use HTF candlestick charts, such as monthly and weekly, or at least daily.

3. USDT.D and Liquidity Flow

USDT.D is the market share of the US dollar stablecoin USDT in the crypto market. Tether issues USDT, which we know is the largest stablecoin in the crypto space. This means that whenever there is buying pressure, people will buy by exchanging USDT for various crypto assets.

Generally, when USDT.D declines, people sell USDT to buy cryptocurrencies, whether Bitcoin or altcoins. In tough times, people flock to Bitcoin but will buy during Bitcoin season (remember BTC.D), as Bitcoin's price will rise. However, if you see USDT.D declining while altcoin prices are rising, it indicates that liquidity is flowing more towards altcoins rather than Bitcoin.

There is also a chart called OTHERS that you can find on Tradingview. This chart represents all altcoins except for blue chips and the top ten projects. If this chart rises while USDT.D declines, it simply means that Altseason is coming in 2025.

A decline in USDT.D may also indicate that investors are cashing out profits or panicking. If you see TOTAL1, which is the total market capitalization of the crypto market, also declining when this indicator drops, it means something serious is happening.

You want to see this indicator drop below 4% and close below this level weekly to confirm that liquidity is flowing into crypto assets. If this coincides with a decline in BTC.D, then it’s time to act!

4. OTHERS/BTC Secret Weapon

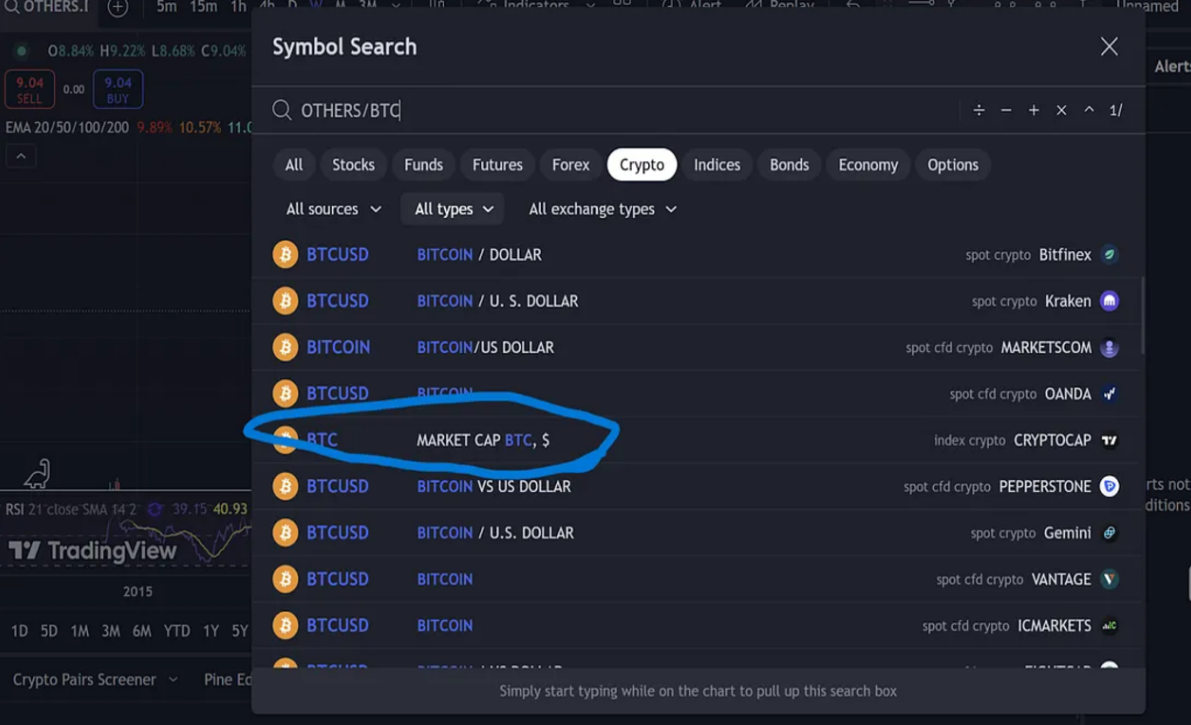

We talked about OTHERS, which includes all altcoins except blue chips. A better chart is to look at the performance of these altcoins (OTHERS) relative to Bitcoin. To get this chart on Tradingview, just open the search bar, type OTHERS/BTC as shown in the image, and then look for the marked indicator and click on it.

You will be able to plot the performance of altcoins relative to Bitcoin. Simply put, whenever these altcoins gain momentum relative to Bitcoin, it is Altseason. Whenever Bitcoin gains momentum, it is Bitcoin season. The best time to buy altcoins is when they form long-term lows relative to Bitcoin, just as they are doing now.

Conversely, the best time to sell altcoins is when they peak, as was the case in early 2022.

5. Conclusion

Remember, no one can predict the market's top or bottom. The best we can do is make rational guesses. These indicators help us make those guesses, but we can never pinpoint the long-term lows that everyone is waiting for. The cryptocurrency market is extremely volatile and unpredictable. Never forget that. Please remember that this is educational content and should not be considered financial advice.

Article link: https://www.hellobtc.com/kp/du/11/5550.html

Source: https://medium.com/coinmonks/4-indicators-to-watch-for-the-upcoming-altseason-in-2025-553716327662

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。