Original | Odaily Planet Daily (@OdailyChina)

Author | Fu Ruo He (@vincent 31515173)

Bitcoin does not seem to be the only star, as funds begin to flow into mainstream altcoins.

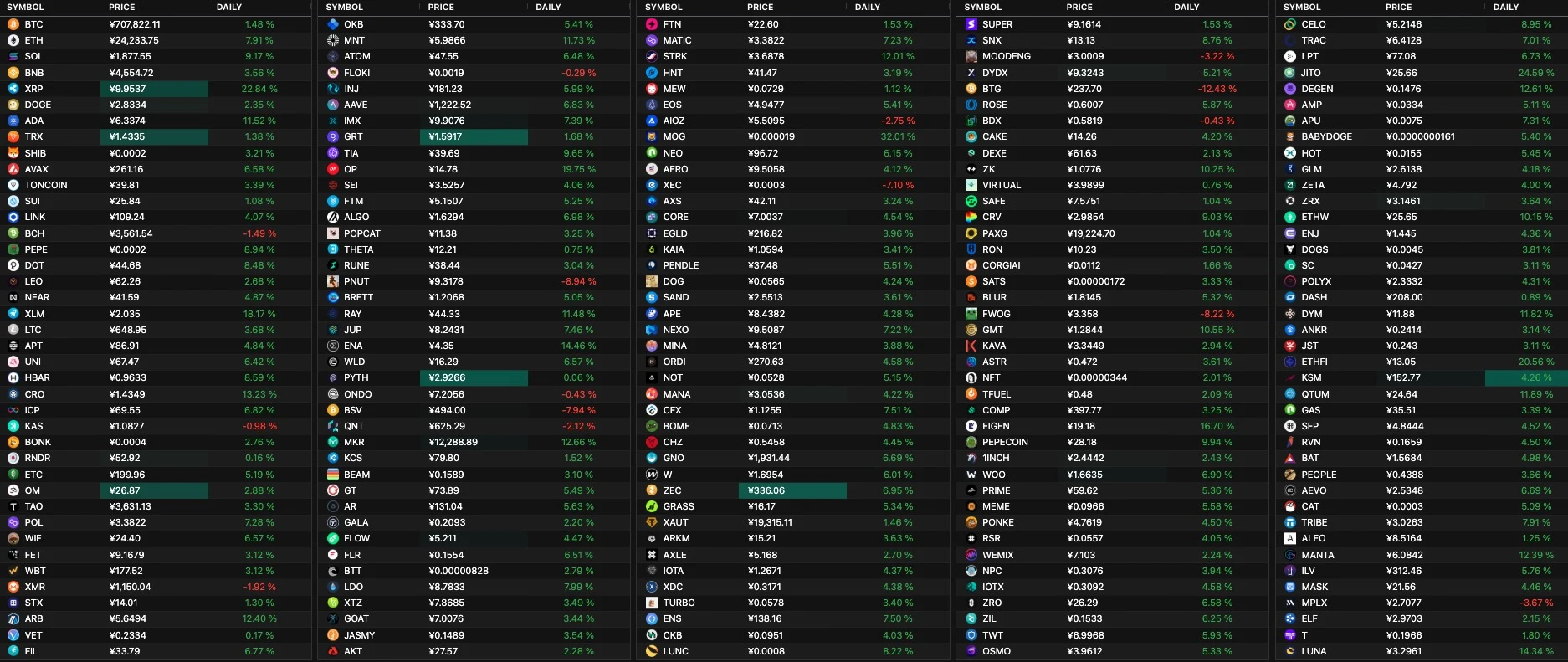

According to Quantify Crypto data, in the past 24 hours, among the top 200 cryptocurrencies by market capitalization, 185 tokens have risen, while only 15 tokens are in a downtrend. Among the top 100 cryptocurrencies by market capitalization, the increase exceeds 8%, with ETH breaking through 3400 USDT, a 24H increase of 9.7%; SOL surpassing 260 USDT, reaching an all-time high; and Ethereum Layer 2 tokens OP and ARB both rising over 15%. Many investors on social media are calling out that the "altcoin season" has finally arrived.

Has the altcoin season arrived? Odaily Planet Daily will explain the reasons for the price rebound of altcoins and analyze whether it can be sustained. (Note: The author separates on-chain memes from the altcoin category, categorizing memes listed on top exchanges as altcoins.)

Why are altcoins rising?

Decreased trading volume and community discussion around well-known on-chain memes

Previously, as Bitcoin's price continuously broke new highs, altcoins not only failed to rise but also fell, leading to a general market pessimism regarding this round of the bull market for altcoins, especially for some VC tokens facing large-scale unlocks.

As a result, market attention has shifted to launching fairer meme segments, with most funds going on-chain for PVP, while former mainstream altcoins have high market capitalizations but lack liquidity compared to newly emerged meme projects. For instance, currently, some of the top 100 tokens have daily trading volumes that are even lower than the recently popular CHILL GUY.

However, the high-intensity PVP of memes has also deterred some, making it inevitable for funds to return to altcoins, leading to a rotation of funds between memes and altcoins. One reason for the rise of altcoins this time is the decline in the popularity of on-chain memes, including:

- The trading volume of well-known meme coins has started to decline, such as ai16z, RIF, and ELIZA, which were previously popular meme coin representatives. According to GMGN data, most trading volumes have now halved.

- The discussion and sentiment in meme communities have decreased. In some meme groups I belong to, discussions have shifted from which projects to chase to how to persist and wait for the next wave of meme trends.

SEC Chairman Gary Gensler is about to leave, bringing a celebration for altcoins

Since the approval of Bitcoin and Ethereum spot ETFs, the cryptocurrency market has been on the rise, and the market is looking forward to the next cryptocurrency that will go mainstream.

Today, Bloomberg senior ETF analyst James Seyffart stated: "Cboe has submitted applications for 4 Solana spot ETFs to the SEC, with issuers being VanEck, 21Shares, Canary Capital, and Bitwise. If the SEC does not reject these applications, the final deadline will be around early August next year."

The application for cryptocurrency spot ETFs requires issuers to prepare two documents, namely S-1 and 19b-4. This time it is the S-1 document, representing the application for the listing of the SOL spot ETF, while the documents that truly face review difficulties are mostly concentrated in 19b-4, so the SOL spot ETF is just getting started.

However, SEC Chairman Gary announced on platform X that he will officially leave on January 20. The new SEC chairman may accelerate the review process for the SOL spot ETF, and it may not need to extend to the final deadline like the previous Bitcoin and Ethereum ETFs.

Additionally, Gary's impending departure has also provided a breather for altcoin projects that have been under regulatory scrutiny. Ripple, which has had a long-standing feud with the SEC, saw its token XRP rise nearly 30% in a single day.

With the regulatory environment and the push from the SOL spot ETF, it is reasonable for altcoins to experience a rise.

Can the rise of altcoins be sustained?

Whether the rise of altcoins can be sustained still requires observation and verification from multiple dimensions.

Moreover, based on historical experience, the market for altcoins is often driven by short-term hype, but whether the price increase can truly be maintained depends on the long-term development capabilities of the projects and the overall market environment. Although there are calls for an "altcoin season" in the current market, if there is a lack of new technological breakthroughs, application implementations, or ecological development support, this wave of market activity may be more of a temporary rotation of funds rather than a trend-driven rise.

Therefore, both institutional and individual investors need to remain vigilant in the face of this round of altcoin activity. On one hand, they should pay attention to changes in the flow of funds in the market, such as key indicators like on-chain token transfer data; on the other hand, they also need to guard against the risk of a pullback after short-term gains, especially as the funding movements of leading projects may become important indicators for subsequent market trends.

At present, the "altcoin season" remains a battleground of opportunities and risks, and investors should stay calm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。