Recently, the continuous rise of BTC has excited investors, with today's (November 22) highest price reaching $99,408, quickly approaching the $100,000 mark. Today's greed index is also very high, reaching 94, the highest value since February 2012.

BTC Approaching $100,000, Indicators Support Upward Trend

According to AICoin data, Bitcoin's current price has surpassed $99,000, with a 24-hour increase of 2.15% and a weekly increase of 13.3%, peaking at $99,408 and currently priced at $99,028. This wave of growth not only sets a new high for Bitcoin's price but also brings the total market capitalization of the entire cryptocurrency market to a record $3.4 trillion.

Image source: AICoin

Technical indicators show that in the 4-hour cycle, the MACD histogram remains positive and is gradually increasing, indicating strengthening bullish momentum. The MACD indicator suggests that if a golden cross occurs, Bitcoin may immediately challenge the psychological barrier of $100,000.

The DIF line continues to diverge upward after crossing the DEA line, supporting the current upward trend. The RSI value is above 70, in the overbought range, but no signs of a pullback have appeared, indicating a strong market. The short-term EMA (7) is above the medium to long-term EMAs (30, 120), and all three are showing upward divergence, further confirming the upward trend.

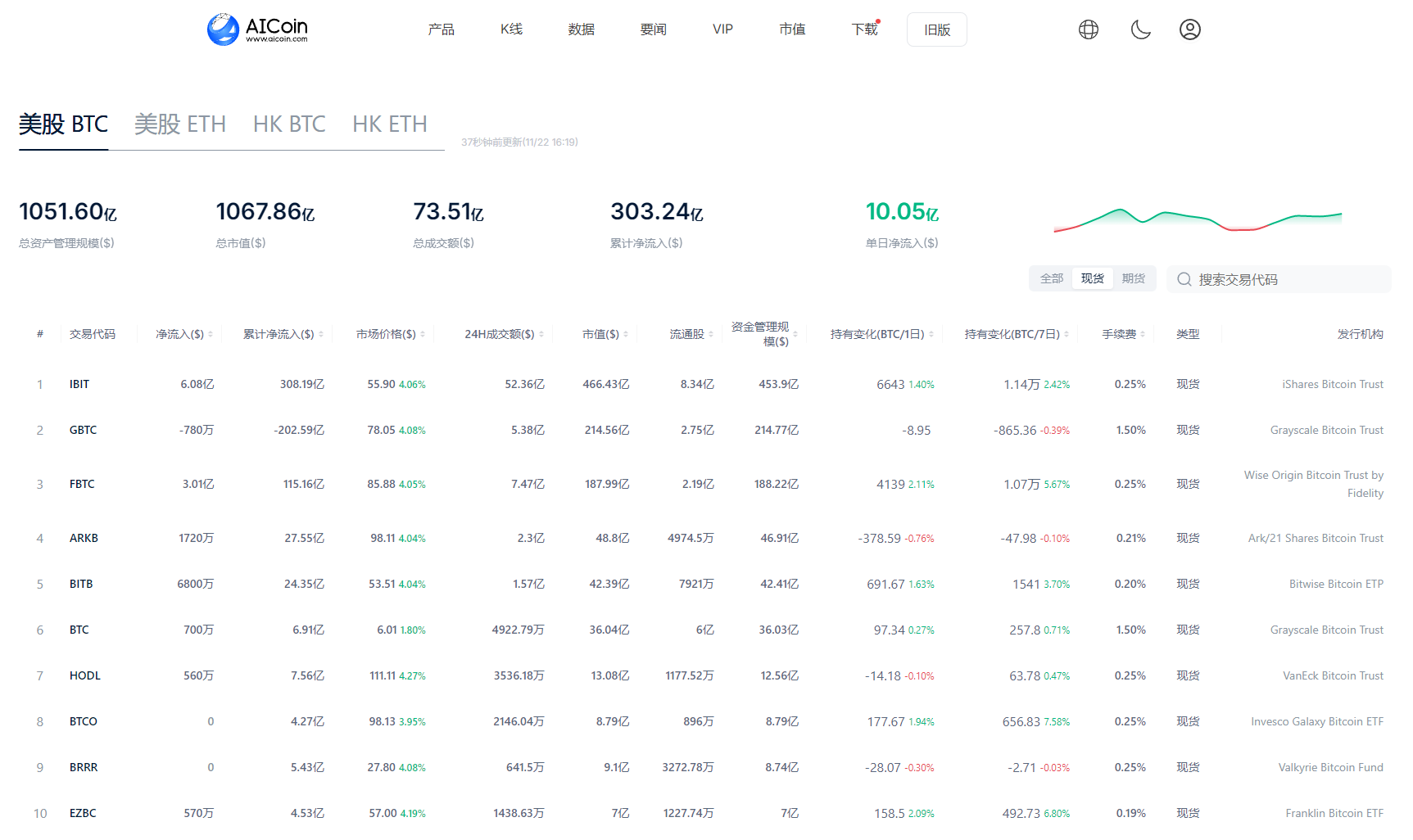

BTC Spot ETF Continues to See Net Inflows

The inflow of funds into Bitcoin spot ETFs also reflects market enthusiasm. According to AICoin's monitoring, yesterday (November 21), the net inflow amount for the U.S. spot BTC ETF reached $1.005 billion, the highest single-day net inflow of the week. Among these, BlackRock's IBIT contributed the most, with an inflow of $608 million, followed by Fidelity's FBTC, which saw an inflow of $301 million. Bitcoin spot ETFs have achieved net inflows for four consecutive days, with a total inflow of $2.863 billion from November 18 to November 21, during which BTC's price rose from $89,000 to the current $99,000.

Source: https://www.aicoin.com

The inflow of funds from large institutions will drive up Bitcoin prices and reflect market confidence in crypto assets. ETF products, as an investment tool, provide institutional investors with a convenient channel to enter the Bitcoin market.

Greed and Fear Index Hits Three-Year High

With the rapid rise in Bitcoin prices, the greed index in the crypto market has also reached its highest point in three years. According to AICoin monitoring, today's greed and fear index is as high as 94, indicating extreme greed. The surge in the greed index suggests that investors are generally optimistic about Bitcoin's future performance and are willing to increase their positions at high levels.

Image source: AICoin

Matrixport Predicts BTC Will Reach $125,000 in December

Matrixport's latest weekly report indicates that the progress of the fifth Bitcoin bull market aligns closely with its July 2023 prediction, forecasting that Bitcoin will reach $125,000 by December 2024. As Bitcoin approaches the $100,000 mark, this prediction becomes increasingly credible.

Image source: Matrixport

The report also suggests that institutional investors should allocate both Bitcoin and gold. A potential sell-off in gold after the U.S. elections may present a good buying opportunity, based on the Black-Litterman asset allocation model, which is expected to achieve a return rate of 15.6% with a Sharpe ratio of 1.6.

Conclusion

Bitcoin is at a historic moment, with prices approaching the $100,000 mark and market sentiment soaring. Amid the surge in the greed and fear index and fluctuations in technical indicators, investors must cautiously assess risks while chasing returns. The future market direction will depend on a combination of various factors, including policy changes, market liquidity, and investor sentiment, making rational investment decisions particularly important.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。