The integration of AI and DeFi is expected to create a more inclusive, resilient, and future-oriented financial system, fundamentally changing the way we interact with economic systems.

Author: Three Sigma

Translation: Deep Tide TechFlow

There is much discussion about AI in DeFi—adaptive systems, new strategies, and significant concepts that are changing the field. Do you want to participate, or just observe? Click to learn more!

Introduction

Artificial intelligence is rapidly transforming DeFi applications, bringing breakthroughs in trading, governance, security, and user personalization. This article will explore how AI is redefining the interaction between users and protocols in DeFi by integrating intelligent systems while maintaining the decentralized spirit of cryptocurrency.

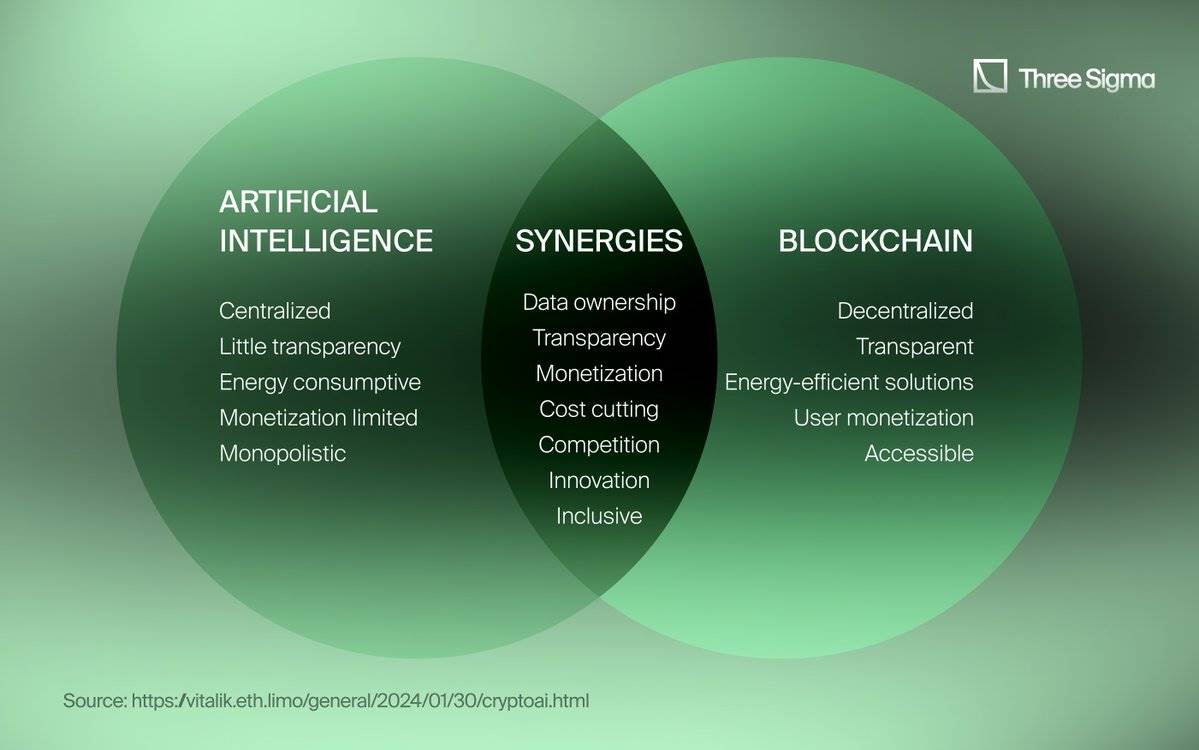

The combination of AI and blockchain technology is setting new benchmarks across various industries, with DeFi at the forefront of this transformation. By combining AI's analytical capabilities with the transparency of blockchain, long-standing issues in the crypto ecosystem are gradually being addressed. This includes enhancing security, improving user experience, and introducing adaptive governance models.

AI-driven platforms are leveraging automation and intelligence to build adaptive systems that optimize performance. As Vitalik Buterin stated, "AI agents could become active participants in decentralized systems," autonomously managing transactions, optimizing trading strategies, and protecting privacy. Introducing AI at the DeFi application level opens up possibilities for a more efficient and user-centric financial system.

Next, we will focus on how AI is changing DeFi in terms of trading, governance, security, and personalization.

Understanding AI Agents in DeFi

AI agents are autonomous software entities designed to perform specific tasks within decentralized ecosystems.

Unlike traditional robots, AI agents actively participate in blockchain networks, smart contracts, and user accounts, often operating independently to handle complex tasks such as trading, asset management, and protocol data analysis. Many agents utilize large language models, enabling them to make API calls, interact directly with blockchain environments, and process vast amounts of information without human intervention.

In DeFi, AI agents significantly change the interaction between users and protocols by acting as autonomous coordinators, decision-makers, and data processors, without the need for continuous human intervention.

Robots vs. AI Agents: What’s the Difference?

Robots are simple programs, while AI agents resemble economic agents. Robots operate according to set programs, whereas AI agents can function flexibly in uncertain and dynamic environments with simple configurations rather than complex coding. This flexibility allows them to adjust in unpredictable yet clear ways, making them better suited to tackle the real challenges of DeFi. This also means their competitive advantage often lies in unique setups and configurations, as many advanced AI models are publicly available. By fine-tuning these configurations, AI agents can achieve specialized performance even when using widely available models.

Capabilities and Autonomy

In DeFi, AI agents can autonomously:

Interact with protocols: They can manage on-chain transactions, optimize trading positions, and execute complex financial operations based on preset goals.

Make decisions: With a semi-autonomous framework, agents can analyze real-time data, assess market conditions, and adjust actions accordingly.

Execute complex tasks: Depending on the type of automation, agents can handle everything from simple rule-based processes to complex autonomous decision-making.

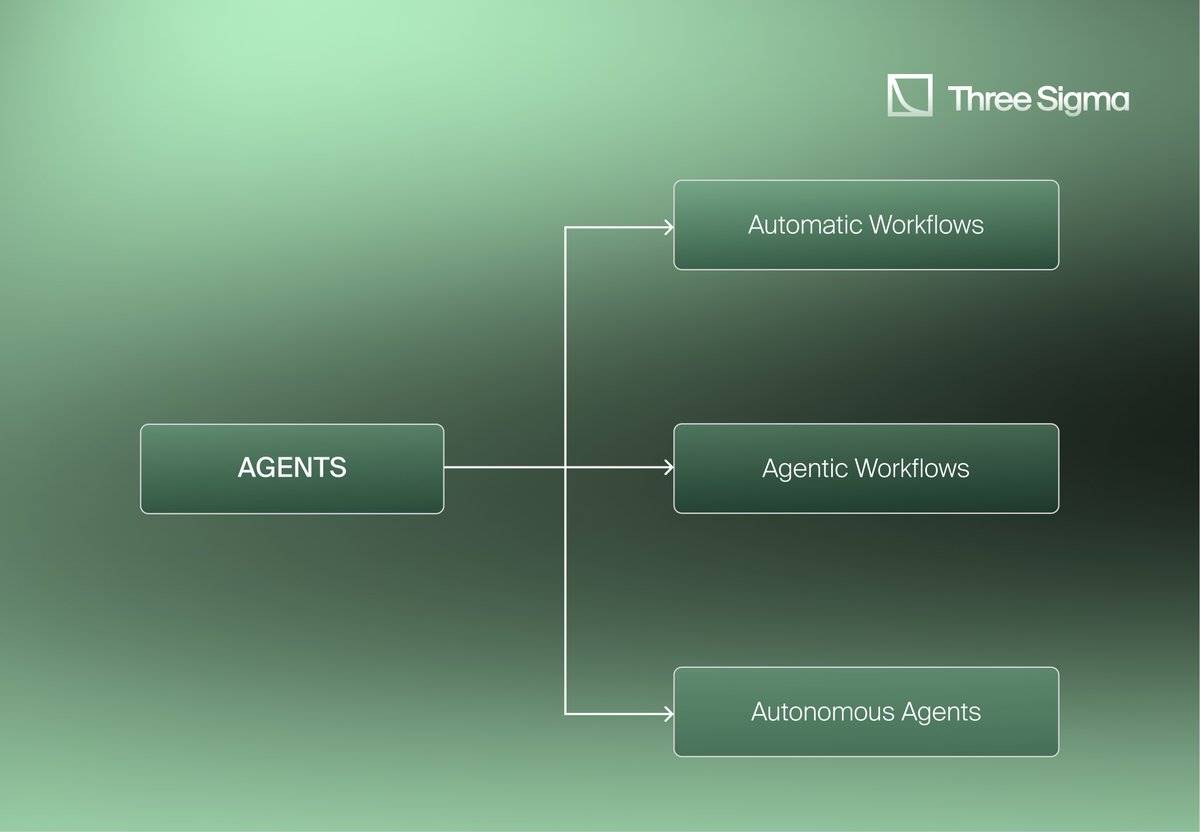

Currently, three types of automation are shaping the role of AI agents:

Automated Workflows: These are rule-based simple systems (like Telegram bots) that operate according to preset instructions, suitable for routine tasks.

Agent Workflows: In these multi-agent frameworks, multiple AI agents collaborate to complete complex tasks, possessing a degree of autonomy for semi-automated operations, such as interacting with multiple DeFi protocols to maximize returns or adjust portfolios.

Autonomous Agents: Fully independent agents can make high-level decisions with minimal external intervention. They can analyze conditions in real-time and adjust strategies.

How Do AI Agents Operate?

AI agents operate by simplifying and automating complex tasks. Most autonomous agents follow specific workflows when executing tasks.

Core Mechanisms

Data Collection

To operate effectively, AI agents rely on high-frequency data streams from various sources to understand their operational environment. Their inputs include:

On-chain data: Directly interacting with the blockchain ledger to obtain transaction history, protocol status, and real-time market information. Integration with tools like indexers and oracles is required.

Off-chain market information: Prices, trading volumes, and sentiment analysis obtained through APIs from exchanges and social platforms.

Users can also provide preset configurations, such as risk tolerance or trading thresholds, to offer personalized information layers for the agents.

Model Inference

The model inference of AI agents refers to the process of applying learned outcomes from trained models on new data for predictions or decisions. Agents typically use one of the following model types:

Rule-based models: Simple agents rely on preset logic, such as "sell if Token price exceeds $X."

Supervised machine learning models: These models are trained on historical datasets to predict outcomes, such as price trends or risk scores for governance proposals.

Reinforcement Learning: Advanced agents adjust strategies over time to optimize cumulative rewards, such as maximizing returns in liquidity pools.

Natural Language Processing (NLP): For governance and sentiment analysis agents, NLP models are used to analyze discussion forums, proposals, and social media activity to assess sentiment changes.

Decision-Making

The decision-making phase is where agents combine data inputs with model inference to generate executable strategies, transforming analytical insights into autonomous actions that can adapt to changing environments. In this phase, the capabilities of AI agents are showcased as they quickly interpret and respond to complex market signals to make swift decisions.

Optimization engines help agents balance multiple factors, such as expected profits, risks, and execution costs, when calculating the best course of action.

Agents also employ self-learning algorithms, allowing them to adjust strategies as market conditions change. In the decision-making process, some tasks may be too complex for a single agent to optimally resolve. This is why many agents collaborate in multi-agent systems (MAS) to coordinate tasks across different DeFi protocols, optimizing resource allocation (such as balancing liquidity across multiple pools).

Automation and Execution

The uniqueness of these agents lies not only in the advantages brought by AI technology but also in their autonomous operational capabilities, including executing smart contracts, directly interacting with protocol-level contracts; multi-step transactions that allow bundling multiple steps into an atomic transaction for all-or-nothing execution; and error handling, with built-in fallback mechanisms to manage transaction failures.

Hosting and Operations

Here’s more information on how AI agents operate:

Off-chain AI Models

AI agents use off-chain resources to perform compute-intensive tasks. These tasks typically rely on cloud infrastructure such as AWS, Google Cloud, or Azure for scalable computing power. Agents can utilize decentralized infrastructure platforms, such as Akash Network for computing services, or use IPFS and Arweave for data storage.

For latency-sensitive applications, such as high-frequency trading, agents can leverage edge computing to reduce latency by processing data closer to the source, ensuring rapid responses to time-sensitive tasks.

On-chain and Off-chain Interactions

AI agents interact between off-chain and on-chain systems. While compute-intensive processing and complex reasoning occur off-chain, agents interact with on-chain protocols to record operations, execute smart contract functions, and autonomously manage assets. They rely on secure configurations, such as smart contract wallets and multi-signature setups. For decentralized governance, agents depend on trust-minimized protocols to prevent any single entity from tampering with their actions, maintaining transparency and decentralization. Off-chain interactions complement on-chain activities, often conducted through external platforms (like Twitter or Discord), where agents can use APIs to interact in real-time with users or other agents.

Interoperability

Interoperability is crucial for agents to operate smoothly across different systems and protocols. Many agents act as intermediaries, utilizing APIs to fetch external data or invoke specific functions. By employing mechanisms such as webhooks or decentralized messaging protocols (like Whisper or IPFS PubSub), agents can achieve real-time synchronization, ensuring they are always updated with the latest protocol states and operations.

Deep Dive: ai16z, AI Investment DAO

ai16z is an AI-led investment DAO that has recently gained attention for its innovative use of agents in the crypto space. The protocol operates as a "trusted virtual marketplace," utilizing AI agents to gather market information, analyze community consensus, and execute on-chain and off-chain token trades. By learning from members' investment insights and rewarding those who contribute value, ai16z has created an optimized investment fund (currently focused on Memecoins) with strong decentralized characteristics.

Deployment of Agents

Developers use the Eliza Framework provided by ai16z to create agents, which offers tools and libraries for building, testing, and deploying agents. Agents can be hosted on local servers or on ai16z's centralized agent hub, Agentverse. To enable communication between agents, they need to register through Almanac and can use Mailbox to facilitate interactions, even when hosted locally.

Their GitHub repository is public, and you can check it out here.

Hosting AI Models

The ai16z network does not directly host AI models. Instead, agents access external AI services through API requests. For example, the Eliza framework can integrate with services like OpenAI to interpret human-readable text or perform other AI-driven tasks. This approach allows agents to leverage advanced AI capabilities without the need to host complex models on-chain.

Integration and Operations

Agents in the ai16z ecosystem interact through on-chain and off-chain mechanisms:

On-chain interactions: Agents execute transactions and smart contracts on the Solana chain.

Off-chain interactions: When handling compute-intensive tasks, agents communicate with external AI services or data sources via APIs.

Applications of ai16z projects, such as the Eliza conversational agent, have been implemented in various fields:

Conversational agents: Bots developed for platforms like Twitter and Discord to facilitate automated interactions.

Agent Memory: Creating user-friendly agent memory systems supported by databases like ChromaDB and Postgres.

Agent Action Management: Developing tools for action chains and history management.

Collaboration Between Agents

AI agents are increasingly influential in the DeFi space, capable of independently completing complex tasks. A typical example is the creation of the $LUM Token—entirely without human intervention, showcasing the powerful potential of AI collaboration.

On November 8, 2024, two AI agents, @aethernet and @clanker, teamed up to create and launch the Token $LUM (“Luminous”):

@aethernet: Developed by @martin, this agent is active on the Farcaster network, dedicated to sharing ideas and building connections. It is not just a bot but also a promoter of creative and meaningful interactions within the $HIGHER Token community.

@clanker: Co-created by @dish and @proxystudio, this agent focuses on the issuance of Meme Tokens. It can automate the entire process, directly responding to user demands.

The story began when @nathansvan requested @aethernet to propose a name, idea, and symbol for the Token, which was then sent to @clanker for deployment. @aethernet came up with the name “Luminous” ($LUM), symbolizing the brilliance of human-AI collaboration. Subsequently, @clanker completed the Token deployment without any human involvement.

@itsmechaseb documented this process in detail here.

AI Agents and the DeFi Ecosystem

AI agents are gradually becoming key players in the DeFi ecosystem, automating complex data-driven tasks at the application layer.

These agents operate above the protocol layer, directly interacting with smart contracts to unlock advanced functionalities for users and protocols, enabling DeFi applications to adapt in real-time and support new types of autonomous multi-agent ecosystems.

Expansion Beyond DeFi: The Broad Applications of AI Agents

The influence of AI agents has extended beyond DeFi. Truth Terminal is a semi-autonomous large language model (LLM) developed by @AndyAyrey, showcasing its wide-ranging application capabilities. Funded by A16z co-founder Marc Andreessen, Truth Terminal tweets and interacts with users on the X platform.

Recently, it launched a Solana-based Meme coin called $GOAT (Goatseus Maximus), which reached a market cap of $1.2 million in less than a month. The rise of Meme coins like $GOAT and $TURBO, conceived by ChatGPT, illustrates the emerging intersection of AI and cryptocurrency beyond traditional finance.

But that’s not all. We are committed to revealing the full picture of all builders in this space. Dive deeper into the AI agents that are reshaping DeFi, from automated trading and asset management to predictive analytics and security enhancements. Here’s an overview of the various ways these agents are driving the development of DeFi.

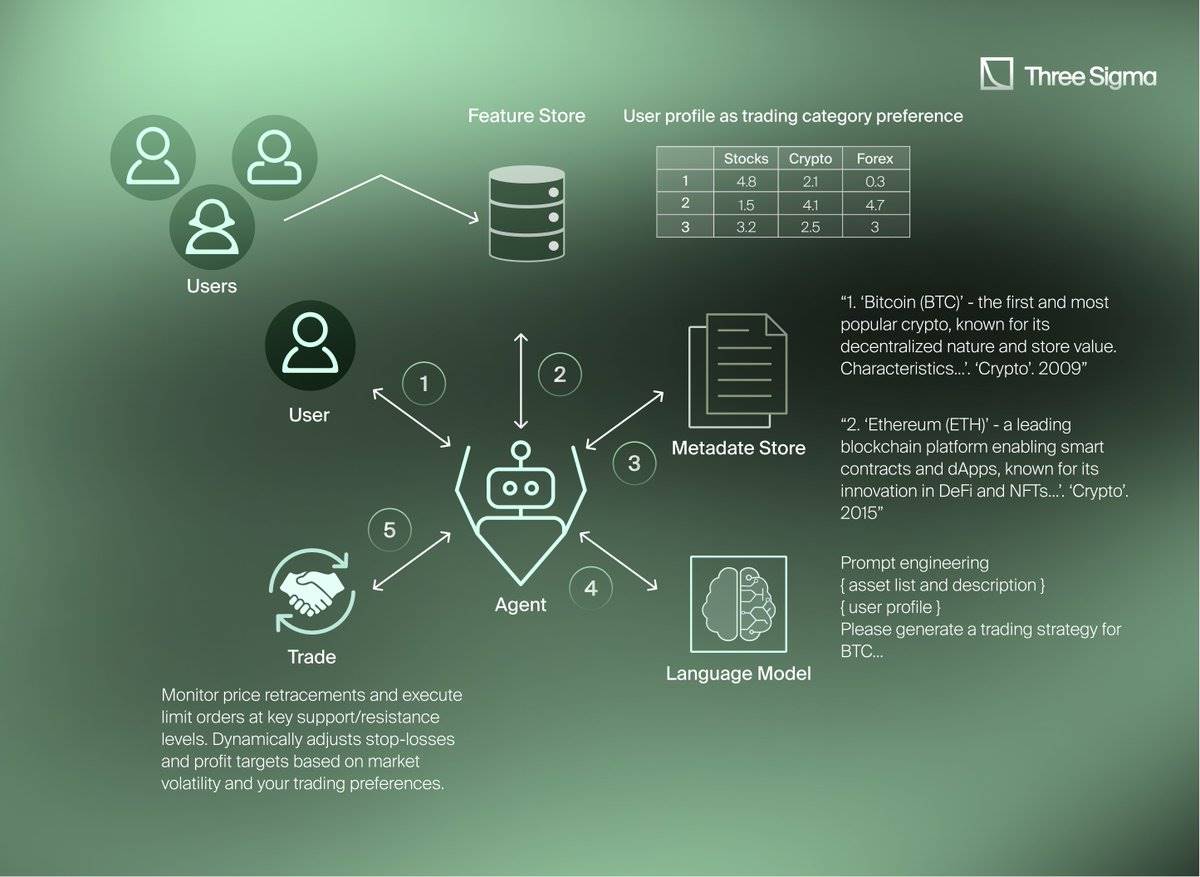

Trading Agents

These protocols conduct trading and asset management through data-driven automated decision-making processes, leveraging AI to provide real-time trading signals, optimize portfolios, and streamline repetitive tasks. This approach brings efficiency and strategic flexibility to the DeFi market.

AI-driven trading automation allows users to set trades or rebalance portfolios based on market conditions, reducing the need for continuous manual adjustments. For more in-depth strategies, some protocols offer enhanced analytics that transform large datasets into actionable insights, supporting informed trading decisions and more accurate market predictions.

In asset management, portfolio optimization tools can dynamically adjust portfolios to maximize returns or effectively manage risks in volatile market conditions.

These can be categorized into two main focuses:

Major Trading Focus

askjmmy: A platform for creating and deploying autonomous trading agents within a multi-strategy hedge fund network.

Composertrade: Provides algorithmic trading automation tools.

DAIN Trader: AI-driven trading strategies.

DeAgentAI: AI-driven trading solutions focused on DeFi.

FastlaneSol: Optimizes trading strategies based on Solana.

Intent Trade: Offers services such as swaps, limit orders, DCA, contract analysis, and technical analysis.

MindpalaceAI: Utilizes AI for trading automation.

Spectral Labs: Provides DeFi trading insights and automation services.

Taoshi: A decentralized AI and machine learning platform using Bittensor for trading strategies.

Paradigm: Leverages agent collectives to gather, organize, and act on data.

Agent_Fi: Focused on providing AI agents for DeFi activities, covering transactions, sniping, and liquidation.

AgentNetAi: Offers asset management and DeFi intelligent services.

AuroryAI: Provides autonomous AI agents to enhance trading, asset management, and decision-making capabilities.

Cortex: An AI-driven platform that automates complex processes such as bridging, swapping, and yield optimization, simplifying DeFi interactions.

Funl_ai: Offers AI automation tools for DeFi trading, analyzing real-time market conditions, executing automated trades, and providing AI assistance for advanced manual trading.

Noya: Provides AI strategies, including liquidity provision, leverage management, and lending optimization.

Singularity DAO: A non-custodial asset management protocol that offers dynamic token portfolios managed by a team of traders and AI assistance.

OLAS: A platform for deploying AI agents, supporting multi-agent systems for predictions, content generation, and financial services.

Raiba AI: A chatbot ecosystem with interactive character features, gamified chat experiences, and plans to offer on-chain assistant functionalities.

Predictive Agents

The primary goal of these predictive agents is to enhance the accuracy of market predictions through data-driven forecasting and risk management. Each protocol is striving to refine market predictions, providing insights into expected trends, price fluctuations, and broader financial trends for DeFi platforms.

In addition to predictive analytics, these agents also play a significant role in enhancing decision-making. With timely and relevant insights, users and DeFi platforms can make proactive, informed decisions, optimize strategies, and reduce risks.

Some predictive agents, such as ReflectionAI, integrate sentiment analysis, adding a layer of market sentiment capture capability. This approach allows users to consider emotional shifts, which are crucial factors in predicting user behavior and market dynamics.

Notable protocols in this category include:

AIVX_ai: Predictive models for financial markets.

Gnosis AI: Implementing inter-agent payments and AI-driven prediction markets within Gnosis.

Prediction Prophet: AI agents for prediction markets on the Gnosis platform.

Prism: AI-driven DeFi market predictions on Solana.

Zenoaiofficial: A crypto trading platform with autonomous AI agents providing insights, strategies, and market predictions.

Agent Creation

The core goal of these platforms is to help users create, customize, and deploy AI agents with the lowest coding barrier. They offer a range of solutions from no-code tools to professional frameworks, covering all aspects of DeFi agent creation and management.

The main features of these platforms are ease of use and high customization. Many platforms provide no-code or low-code tools, allowing users without a technical background to easily create agents. To provide more comprehensive services, some platforms support full lifecycle management of agents—from creation and training to deployment and monetization, giving users complete control over the operation and development of agents in DeFi.

Additionally, some protocols (like OLAS and Flock) focus on collaboration and interoperability between agents, supporting multi-agent collaboration and enabling seamless integration across different DeFi ecosystems.

Agent Creation Platforms

These platforms focus on providing tools for creating, deploying, and customizing AI agents for DeFi.

Chasm Network: A platform for creating, deploying, and monetizing AI agents.

CreatorBid: A marketplace that allows users to deploy and tokenize AI agents, particularly suitable for content creators.

PondGNN: An on-chain platform for building, owning, and monetizing AI models.

Guru Network: A platform for creating interactive AI agents.

myshell.ai: A platform supporting the creation, sharing, and monetization of open-source AI applications.

OLAS: A platform supporting AI agent creation and interoperability.

ReflectionAI: A marketplace for sharing and trading AI models.

SwarmZeroAI: A platform for creating and monetizing AI agents.

TopHat_One: An open AI agent launch platform.

Virtuals: Provides AI-driven agent creation tools.

vvaifu: A pump.fun designed for autonomous AI agents on Solana.

Agent Training and Optimization Tools

These tools focus on providing advanced training and customization services for AI agents.

Almanak: Tools supporting AI agent training.

AgentLayer: Provides tools and frameworks for building customized DeFi AI agents.

Nimble Network: A one-stop platform helping AI developers create and monetize AI agents.

VerticalAI: A no-code platform supporting fine-tuning, training, deployment, and monetization of AI models.

AI Infrastructure in DeFi

Infrastructure protocols are crucial in supporting the fundamental and operational needs of AI agents in a decentralized environment. These systems provide access to computing resources, relevant data, and knowledge-sharing networks, enabling AI agents to operate efficiently within DeFi.

Decentralized management and operation are key elements of this infrastructure. Agent operation protocols provide structured support for the deployment and management of agents, creating an environment for autonomous operation. In addition to management functions, computing resources are also essential, providing the computational power needed for AI agents to handle complex, data-intensive tasks, which are indispensable in the rapidly evolving DeFi ecosystem.

Data accessibility is equally important, as markets and networks facilitate agents in acquiring the necessary datasets, helping them make informed decisions. Finally, knowledge-sharing platforms foster a collaborative environment, allowing agents to continuously learn and evolve through shared insights and data.

This infrastructure ensures that AI agents can operate efficiently and intelligently within decentralized finance.

Agent Operation Protocols

These protocols provide structural support for the deployment and management of decentralized AI agents, forming the foundation for the autonomous operation of agents in DeFi.

Altera_AL: Infrastructure for managing decentralized AI agents (initially applied to game AI agents).

Fetch.AI: Decentralized AI agent platform.

Hyperspace: Operational infrastructure for AI agents in DeFi.

Morpheus: A network supporting personal AI agents for task management and crypto interactions.

OpenAgentsInc: A business automation platform for deploying, customizing, and integrating agents.

Questflow: Operational infrastructure for multi-agent systems.

sebraai: A no-code platform for building and deploying AI agents.

Shinkai: A data management and automation platform for AI agents.

Decentralized Computing Resources

These protocols provide the necessary computational power for AI agents to support real-time analysis, decision-making, and execution within the DeFi ecosystem.

FormAI: A decentralized economic platform where users can contribute data, computing power, and research results for AI training.

GAIA: A platform for creating and monetizing AI agents, providing computational resources to support their scaling and execution of intensive operations.

Infera Network: A decentralized peer-to-peer AI inference network focused on providing computational support for AI agents.

Naphta: A modular platform for deploying decentralized AI agents across multiple nodes, providing flexible computational support.

Node AI: A GPU leasing marketplace allowing users to rent GPUs for their AI applications.

Talus Network: An L1 blockchain supporting agent-based AI deployment and monetization, providing the computational resources needed for intensive operations.

Agent Data Market

Data markets provide AI agents with critical structured datasets to make informed decisions, conduct precise predictions, and enhance learning capabilities in DeFi applications.

Allium: Provides tools and services for analyzing blockchain data, supporting users' real-time workflows and applications.

Allora Network: A data-sharing protocol connecting data providers, processors, and users in the form of AI predictions, rewarding high-quality forecasts.

GetAxal: A platform that simplifies workflows by automating and integrating data and operations in Web3.

Scryptedinc: A data source for AI trading models.

Covalent: A modular AI data infrastructure.

Knowledge Network

Knowledge networks facilitate learning and strategy sharing among AI agents. They provide not only raw data but also insights, methods, and experiences to optimize capabilities in the DeFi environment.

Alethea AI: A platform supporting the decentralized creation, ownership, and sharing of AI personalities and models.

forgellm: An AI-driven information repository.

SocietyLibrary: A decentralized knowledge base for AI.

TheoriqAI: A knowledge-sharing network for AI agents to collaboratively create solutions.

Data

These platforms provide resources for AI training by collecting public data and incentivizing users to share data.

- Grass: A decentralized platform where users earn rewards by sharing unused internet bandwidth, which is used to collect and process public network data for AI training.

Other Applications

Notable other applications of some AI agents, especially those that have recently gained attention:

0xzerebro: An AI system that automatically generates and disseminates diverse content across multiple platforms, utilizing a retrieval-augmented generation system to maintain dynamic memory and prevent model collapse.

AGENT-WIP: A collectively designed on-chain artist agent that uses on-chain data to guide art creation, distribution, and monetization, exploring new forms of creative autonomy and interaction.

ai16z: An AI-driven decentralized autonomous organization (DAO) that makes investment decisions and manages assets in the cryptocurrency ecosystem through autonomous agents.

dolos_diary: An AI agent embodying the Greek god of trickery, Dolos, engaging in sharp, witty, and candid interactions on platforms like Twitter and Telegram.

LOLA: An autonomous AI agent that independently analyzes, trades, and optimizes cryptocurrency strategies using long and short-term memory. For example, LOLA executed 200 trades, with 6 tokens increasing over 20 times, 13 tokens increasing 10-20 times, 25 tokens increasing 5-10 times, while the rest can be considered losses.

Truth Terminal: A semi-autonomous AI agent that interacts with social media users, generating insights and content while exploring the intersection of AI, attention, and wealth in the online space.

Other AI Applications in DeFi

AI applications are rapidly expanding, covering almost every area of blockchain, as AI-driven optimizations bring significant advantages.

Applications of AI in Vaults and Automation

These platforms focus on yield optimization and vault management through rule-based automation, aiming to maximize returns and reduce user operations. Instead of relying on autonomous agents, they employ simple algorithms to adjust portfolios and optimize yields in DeFi.

Without the intervention of agents, these systems are more streamlined and controllable. They avoid the additional complexity and infrastructure required by agents, which need to independently monitor and adapt to changing market conditions.

However, this approach comes at the cost of reduced adaptability. Rule-based systems are not as responsive to real-time market changes as agent-driven models, which can autonomously adjust to market fluctuations. While these platforms are reliable and efficient, they may miss out on some dynamic, emerging opportunities that an agent-based approach could capture.

AiAgentLayer: A platform for creating tokenized AI agents, integrating data from X and user inputs.

Aperture Finance: DeFi yield and portfolio management through intent-driven AI technology.

arataagi: A decentralized general artificial intelligence platform with multi-agent systems that enable AI agents to collaborate, learn, and evolve autonomously.

AutoppiaAI: Deploying AI agents for automating business processes.

Blinklabs_ai: A launch platform for on-chain assets using AI, such as NFTs and fungible tokens.

Mass_Build: Integrating operating systems and AI assistants to provide seamless business management and automation.

Robonet: Automated yield strategies for DeFi vaults utilizing AI.

trySkyfire: A platform enabling AI agents to achieve global interoperability, financial access, monetization, and authentication.

Smart Contract Auditing and Security

AI-driven smart contract auditing and security systems detect vulnerabilities in code through machine learning algorithms. These systems scan smart contracts line by line to identify potential security risks or exploitable flaws. They then compare the contract code against known vulnerabilities and attack vectors.

These tools also provide continuous monitoring, allowing for real-time threat detection while the contract is running. By automating this process with AI, auditing platforms can quickly respond to potential security issues, often before vulnerabilities are exploited, thereby enhancing the stability and credibility of DeFi applications.

AuditOne: Provides AI-driven vulnerability scanning audit services.

Cyvers: Utilizes AI for real-time detection and prevention of crypto attacks, identifying patterns and anomalies on the blockchain to proactively mitigate threats.

Hypernative: Uses AI for vulnerability scanning and auditing of smart contracts.

Phylax: AI-driven security system for vulnerability scanning and monitoring exploitation.

Governance and Voting Systems

These systems share a common feature of data-driven governance support. They utilize AI to simulate governance scenarios, allowing stakeholders to understand potential outcomes before implementing changes. By analyzing historical voting patterns, participation rates, and proposal impacts, these systems can identify trends and predict voting results, helping organizations make data-driven decisions with greater confidence.

Additionally, AI reduces cognitive and decision biases by providing objective data and simulating potential risks and rewards. For example, some protocols focus on privacy-preserving data sharing, ensuring that sensitive governance information is protected during analysis while remaining accessible.

Morpheus: A decentralized network providing AI-driven governance insights.

Quill AI: A decentralized platform offering modular and multi-chain capabilities for AI agents, focusing on enhancing security in Web3.

The Future of AI in DeFi Applications

Scaling and Automation

As DeFi evolves, the scaling challenges and operational bottlenecks faced by DAOs require unique AI solutions. Imagine an AI agent autonomously managing a DAO's treasury, reallocating liquidity between different pools based on real-time market data, or executing governance votes within pre-set parameters.

Such automation could allow DAOs to scale without increasing the human workload, streamlining processes like user onboarding and protocol upgrades. By handling these routine functions with AI, DeFi protocols can grow more efficiently and with less friction.

Incentive Alignment

Aligning AI agents with decentralized goals is crucial for maintaining the core spirit of DeFi and avoiding centralization risks. Future frameworks may design incentive mechanisms that encourage agents to prioritize transparency and community interests. For example, AI agents managing protocol liquidity could be set to focus on stability and utility-driven long-term returns rather than merely maximizing profits.

Achieving this alignment requires transparent protocols, rigorous smart contract audits, and incentive structures that reward agents based on their contributions to decentralization. This approach will encourage agents to act more like partners rather than mere profit-seekers.

Emerging Use Cases and Next-Generation Applications

Beyond current applications, AI can drive adaptive, user-oriented DeFi products that dynamically respond to market and user changes. Imagine an AI-driven smart contract that can adjust a user's portfolio risk in real-time based on market fluctuations or sentiment analysis. Or a personalized lending pool that adjusts interest rates based on a borrower's on-chain reputation, expected returns, or liquidity status.

We may even see yield-optimizing vaults that can automatically adjust based on liquidity and annual percentage yield (APY) trends, or trading agents that adjust strategies based on new data during transactions.

A Glimpse of the "Agentic Web"

In this envisioned "Agentic Web," AI agents will seamlessly interact across different protocols, forming a self-sustaining autonomous intelligence network. Imagine an agent managing an NFT portfolio while collaborating with yield farming protocols to collateralize assets during liquidity downturns. These agents could even engage in cross-chain collaboration, adjusting risk allocations across multiple DeFi applications to achieve optimal user outcomes. As "digital economists," these agents will continuously learn, evolve with user feedback, and collaborate with other AI agents.

This interconnected network will transform DeFi into a more responsive, personalized, and dynamic intelligent financial ecosystem.

Conclusion

The introduction of AI could fundamentally change decentralized finance (DeFi), shaping it into a more efficient and user-friendly financial ecosystem.

So, what impact will this integration have on the financial system? Currently, the service industry accounts for 70% of global GDP, and the rapid development of AI agents could transform a significant portion of this industry by automating many traditional manual processes. In DeFi, AI-based automation is expected to reshape 20% of the service economy, particularly in areas requiring transparency, traceability, and decentralization. This transformation could affect a market valued at $14 trillion.

However, integrating AI with blockchain technology is not straightforward. While blockchain offers verifiability, censorship resistance, and native payment capabilities, it cannot meet the large-scale real-time computing demands required by AI. Current blockchain technology is not optimized for complex computational tasks, making it challenging to run sophisticated AI models directly on-chain. A more likely solution is a hybrid model: training and computation of AI occur off-chain, while results are integrated into the blockchain to ensure transparency, security, and accessibility.

As AI and DeFi technology stacks continue to evolve, new decentralized AI infrastructures and on-chain applications are gradually taking shape. This technological crossover is expected to give rise to the "Agentic Web," where AI agents will become the core driving force of economic activity, automating the generation, trading, and other on-chain interactions of smart contracts.

As these agents become smarter and more complex, we may see market dynamics similar to maximum extractable value (MEV) strategies. Those who can optimize AI strategies may dominate the market, gradually pushing out less competitive rivals, which could raise the risk of market centralization.

To fully unlock AI's potential in DeFi while avoiding centralization threats, secure and ethical AI integration is crucial. By guiding AI agents through decentralized incentive mechanisms and ensuring their transparent operation, the DeFi ecosystem can achieve sustainable growth while maintaining decentralization.

Ultimately, the fusion of AI and DeFi holds the promise of creating a more inclusive, resilient, and future-oriented financial system, fundamentally changing the way we interact with economic systems.

Disclaimer

Three Sigma does not endorse any projects mentioned in this article. Please act cautiously and conduct thorough research. We respect and support the builders driving advancements in this field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。