Zhou Yanling: The $100,000 Bitcoin Milestone is Approaching, and Dips Can Be Used to Go Long!

Bitcoin has recently shown a terrifying upward momentum, successfully breaking through the $99,000 mark today, once again setting a historical high. It is now very close to the $100,000 milestone predicted by Yanling earlier. Recently, everyone should have seen the news that Gary Gensler, the chairman of the U.S. Securities and Exchange Commission (SEC), has faced fierce resistance from Wall Street and the cryptocurrency industry due to his ambitious agenda. He plans to step down on January 20 of next year (the day Trump was sworn in as president). The SEC chairman chosen by the upcoming Trump administration may attempt to further loosen Gensler's landmark rules and adopt a more cryptocurrency-friendly enforcement approach. The policies for the digital asset industry could undergo significant changes, which is certainly a positive transformation that we in the crypto community would like to see, haha. Therefore, from a political perspective, the long-term development prospects for the crypto space still look quite promising, and we will continue to wait and see.

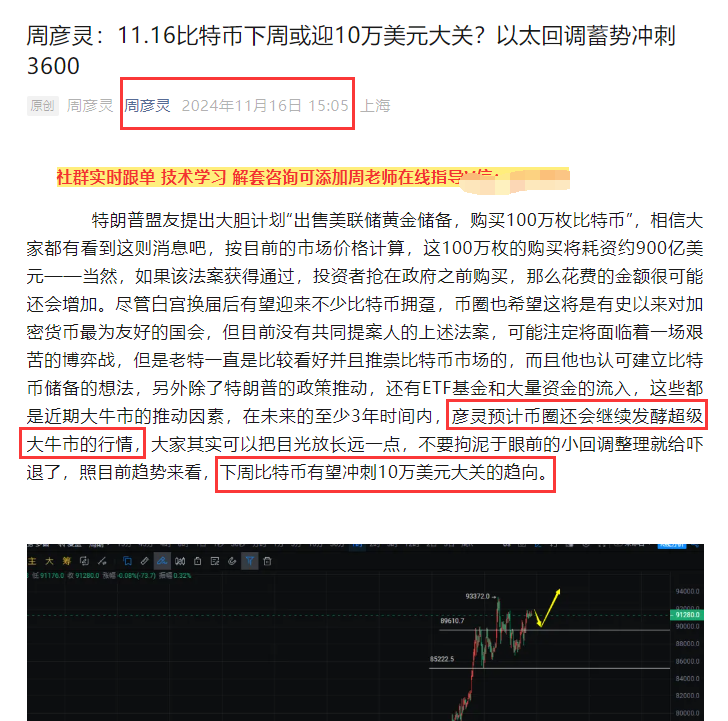

In terms of market operations, the recent trend is definitely to continue going long. Even though we are nearing the $100,000 mark, Yanling's view remains to continue buying on dips. As mentioned in the analysis on the 16th, Bitcoin is definitely going to test the $100,000 level this week, and it seems we can see that today. Once this level is breached, it will mark a milestone historical price. Currently, the technical indicators show a clear upward trend in the recent candlestick patterns with no signs of weakening. The 4-hour cycle has also seen multiple consecutive bullish candles, indicating strong buying power. Both the DIF and DEA are in positive territory, and the MACD histogram remains positive, suggesting that the market is still in a bullish sentiment. The RSI14 is above 70, nearing the overbought zone, but has not yet entered extreme overbought territory, indicating that there is still some upward space available; the EMA7, EMA30, and EMA120 are all in a bullish arrangement, with short-term moving averages above long-term moving averages, supporting the current upward trend. Therefore, from any perspective, there are only reasons to go long.

11.22 Bitcoin Trading Strategy:

Buy on dips at 98,500-99,000, reserving space to add positions around 97,800, with a stop loss set below 97,400, targeting 99,500-100,000, and continuing to look for a breakout towards 102,000.

11.22 Ethereum Trading Strategy:

Buy at 3,300-3,340, with a stop loss below 3,260, targeting 3,420-3,460, and continuing to look for a breakout towards 3,560.

Sell at 3,560-3,520, with a stop loss above 3,600, targeting 3,430-3,400.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article's review and publication may have delays, and the strategies may not be timely. Specific operations should follow Yanling's real-time strategies.】

This content is exclusively shared by senior analyst Zhou Yanling (WeChat public account: Zhou Yanling). The author has been engaged in financial market investment research for over ten years, currently mainly analyzing and guiding BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV, and other cryptocurrency contract/spot operations. For more real-time community guidance, consultation on position liquidation, and learning trading skills, you can follow the teacher's public account: Zhou Yanling to find the teacher.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。