BTC experienced a slight pullback after rising to around $99,000 last night, continuing its upward trend with the potential to test $100,000. Recently, BTC's movements have been relatively independent, but there has been some correlation with U.S. stocks in the evening. The U.S. dollar index has also been relatively strong, reaching a new high since October of last year, and is expected to challenge the highs before November 2022. This indicates market expectations of a favorable outcome with Trump returning to power, a logic that is also reflected in Bitcoin, especially with Trump's positive commitments to the crypto industry. There are still nearly two months until the power transition, which could be a period for speculation.

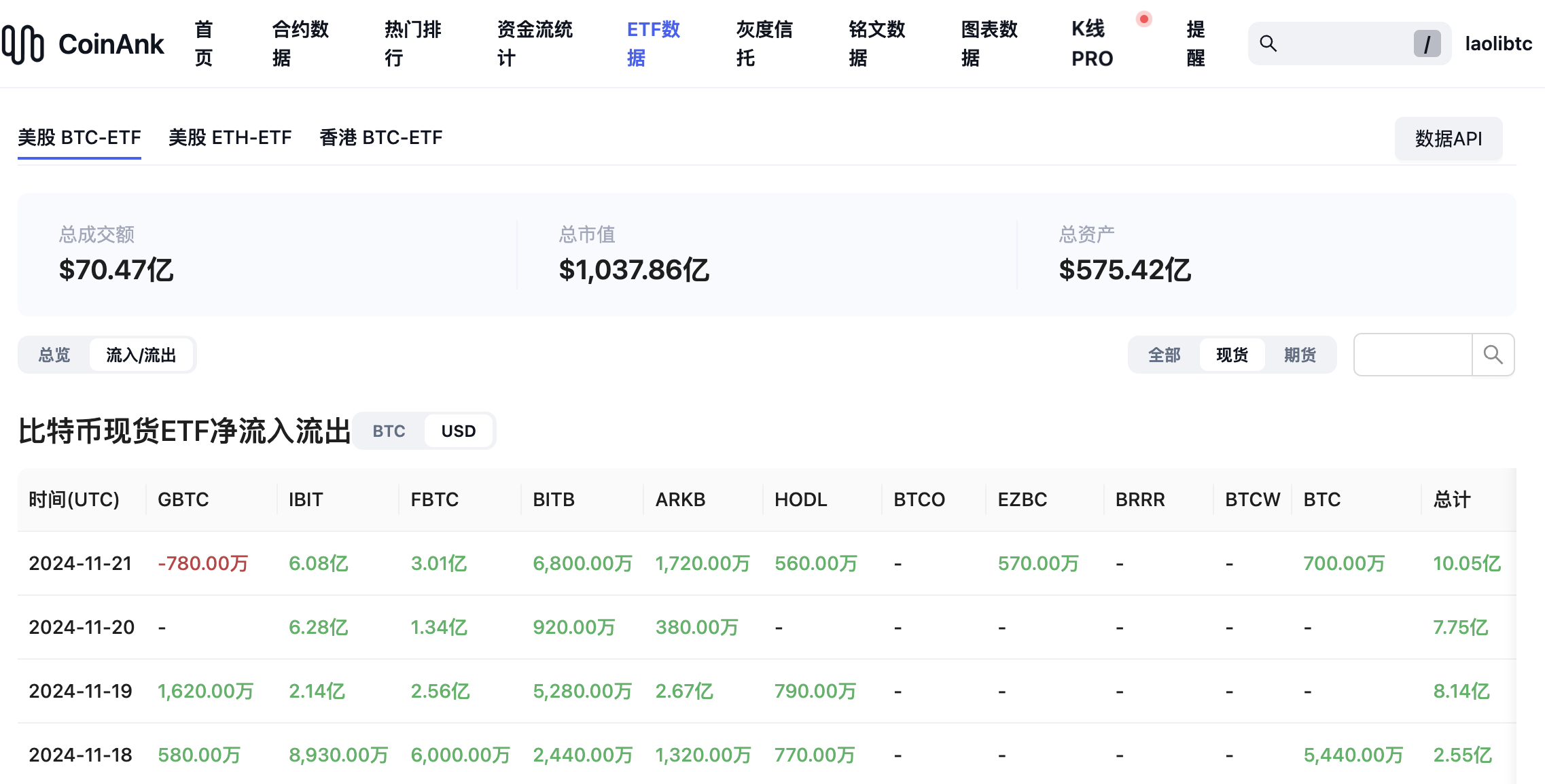

According to CoinAnk data, ETF funds have continued to see net inflows this week, driving up coin prices, with over $1 billion flowing in last night:

BTC's daily chart closed with a long bullish candle, and it is expected to continue rising after some adjustments. The strategy is to buy on the right side during pullbacks, holding onto spot positions, and timely switching between altcoins. There is no pressure above the historical high, and future heights are subjective predictions; only when reversal/top signals appear can we make judgments, at which point market sentiment will change.

November 22 Hot Topics:

- SEC Chairman Gensler confirmed his departure date as January 20 next year;

- Cboe submitted applications for four Solana spot ETFs to the U.S. SEC;

- Market news: FTX's restructuring plan is expected to take effect in early January 2025;

- Trump's "Crypto Advisory Committee" will establish the previously promised Bitcoin reserve;

- MicroStrategy completed a $3 billion convertible note issuance to purchase more Bitcoin.

Analysis of the U.S. Dollar Index Trends

On November 22, the U.S. dollar index rose to 107.16, reaching a new high since October of last year, with an increase of about 3% since November. The chart shows an overall upward trend recently, gradually climbing from September to November, reaching the current high of 107.1685, with a low of 106.9943, marking a 5.71% increase this year.

Reasons for the rise in the dollar index: Changes in market expectations regarding the Federal Reserve's interest rate cuts: There is an increasing expectation that the Federal Reserve may slow down the pace of rate cuts, with market expectations for a pause in rate cuts in December heating up. According to CME's FedWatch tool, the current market expectation for a pause in rate cuts has risen from 17% last week to 44%. This change reflects the market's ongoing digestion of the future impact of U.S. government policies and the cautious attitude of Federal Reserve officials regarding the future path of monetary policy easing.

Weak Euro Support: The Euro has been weakening since October, providing support for the dollar index. Europe is facing geopolitical factors, slowing economic growth, and pressure regarding the 2025 budget, and under the "impact of slowing exports," the European Central Bank may loosen monetary policy more than usual. It is expected that by the end of 2025, the exchange rate between the Euro and the dollar will remain close to 1:1.

Statements from Federal Reserve officials and their impact: Michelle Bowman expressed dissent when the Federal Reserve significantly cut rates by 50 basis points in September, emphasizing this week the need for caution in advancing rate cut policies, suggesting that the pace of cuts should be better assessed in relation to the distance from the ultimate goal, while pointing out that inflation is a key reason for rate cuts, and recent inflation progress has stagnated.

Lisa Cook noted that the pace and magnitude of rate cuts depend on economic data and outlook, emphasizing a gradual transition to a neutral policy stance over time.

Powell stated in November that the Federal Reserve has no "urgency" regarding rate cuts, and the current strong economic performance allows for cautious decision-making. These statements further strengthened market expectations for a pause in rate cuts in December.

Future trends for the dollar: Views from some institutions: Some institutions believe the dollar will remain strong in the short term but will struggle to maintain strength in 2025.

UBS's perspective: The dollar's strength stems from investors' expectations of favorable policies, but the recent rise does not match historical interest rates. It is expected that by the end of 2025, U.S. rates will be cut by another 125 basis points (market expectation is 72 basis points), and the dollar may correct its excessive rise, with the Euro gradually appreciating.

J.P. Morgan's view: The dollar is structurally overvalued, and under the future expansionary fiscal policies in the U.S. leading to increased deficits, it may weaken further. Investors are advised to use the dollar's strength to reduce exposure to dollar assets, such as hedging risks, shifting investments to other currency assets, or using options strategies to sell dollar appreciation risks for profit.

Written by: laolibtc

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。