Bitcoin is just one step away from a historic new high! The $100,000 mark is not only a key psychological point in the battle between bulls and bears but also a milestone for Bitcoin in this century. If it can successfully break through, it will undoubtedly lead the crypto market to new heights! According to AICoin data, current multi-dimensional factors indicate that a Bitcoin breakout is imminent!

1. Large Holder Layout

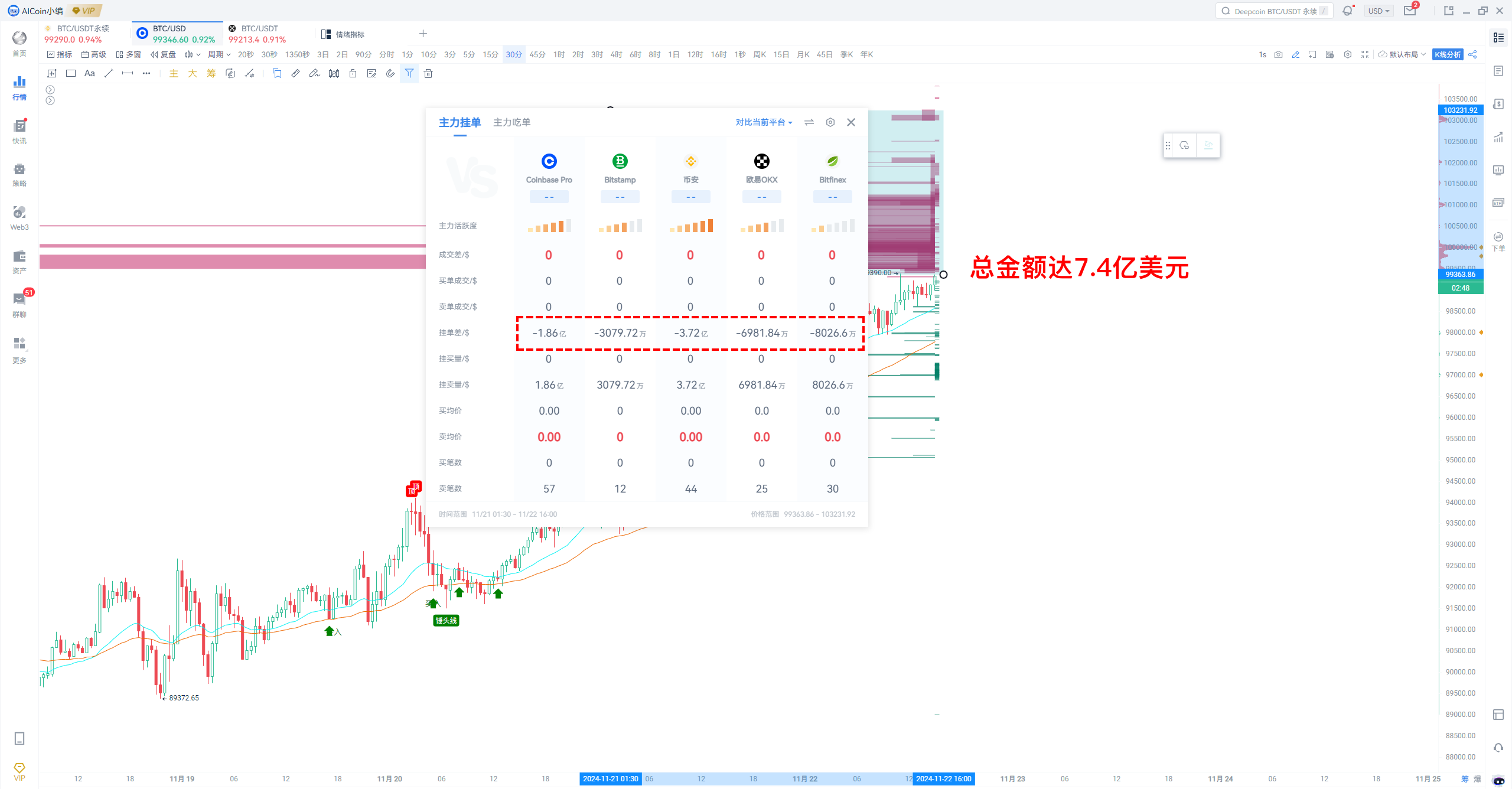

According to statistics on large orders, spot large holders are bullish, with the total sell orders amounting to an astonishing $740 million, primarily concentrated in the $98,945~$103,300 range. The layout of large holders on major trading platforms is as follows:

• Coinbase large holders are heavily betting on $100,000, with a layout of $60.15 million, and the sell orders have been active for over 27 hours, which is quite rare.

• Binance large holders are heavily betting in the $99,000~$100,000 range, with total sell orders exceeding $260 million, including one super large holder frequently placing and withdrawing orders amounting to $100 million at the $100,000 mark.

• OKX large holders have set a bullish target at $100,000, with a rare sell order exceeding $21 million that has been active for over 19 hours.

• Bitstamp large holders are firmly betting on $99,500, with a sell order that has been active for over 10 days and amounts to $17.46 million.

• Bitfinex large holders are focusing on the $100,880~$101,080 range, with cumulative sell orders of $43.62 million.

2. Market Sentiment

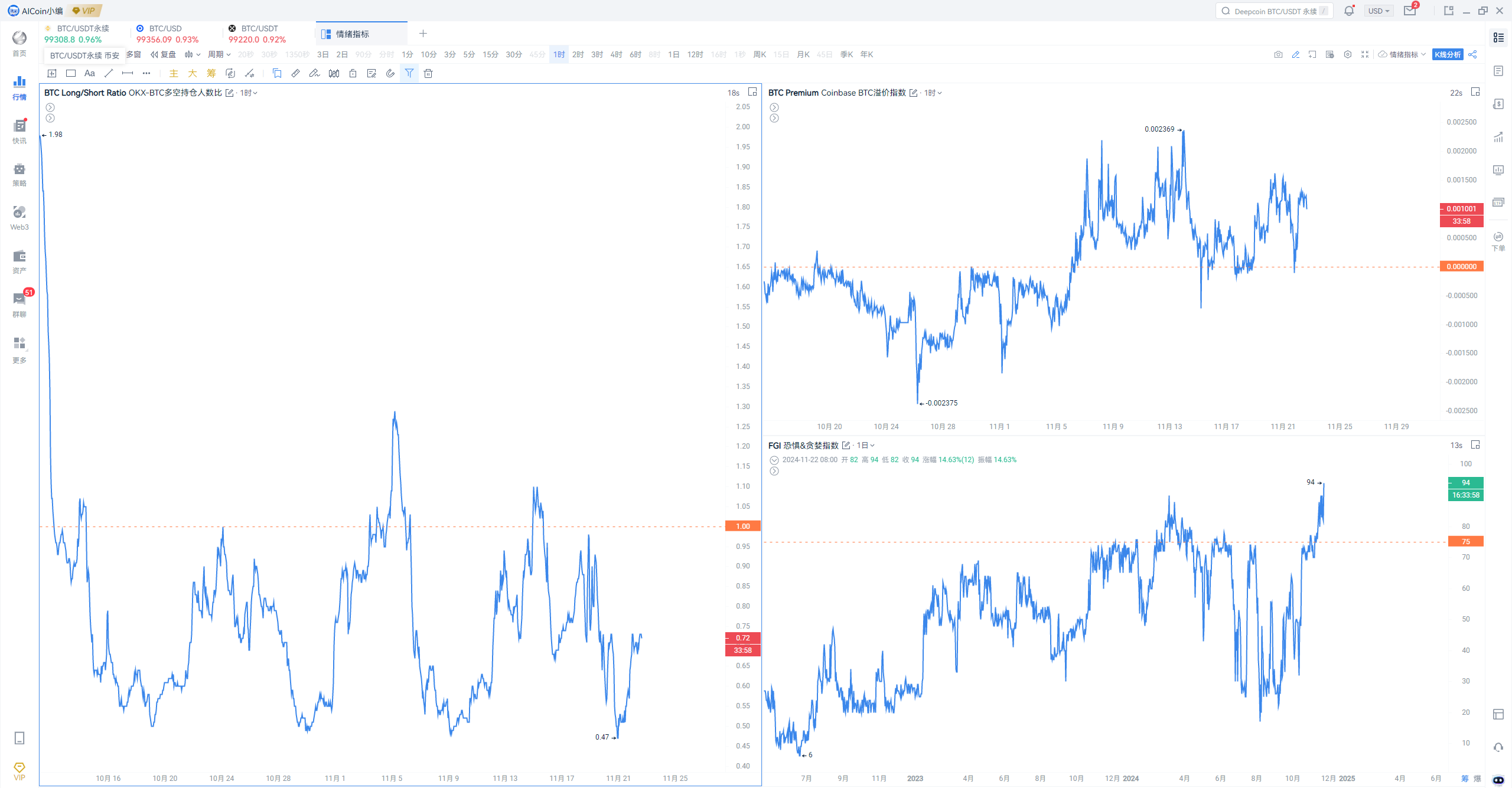

• The ratio of long to short positions in OKX BTC remains below 1.0, having briefly hit a new low of 0.49, indicating that the sentiment among major players is leaning bullish.

• Coinbase BTC maintains a positive premium, with major players in the US market continuing to buy, further confirming the bullish sentiment in the market.

• The Fear and Greed Index has surged to 94, reaching its highest level since mid-February 2021, indicating that the market is in a state of extreme greed.

3. On-Chain Data

From on-chain data, investors holding 100 to 1000 BTC have been active recently. Statistics show that from October 6 to now, the number of addresses in this holding range has increased by 373, with a cumulative increase of approximately 310,600 BTC, bringing the total balance to 429.31 BTC, accounting for 21.7% of the total circulation.

Notably, super whales are also actively increasing their Bitcoin holdings. In the past 10 days, they have cumulatively added 49,786.7 BTC, bringing their total balance to 3.0157 million BTC, accounting for 15.2% of the market share.

The activity of short-term holders is on the rise, with the proportion of Bitcoin held for 0 to 6 months increasing from 19.7% to 24.52%. Meanwhile, the steadfast holding attitude of long-term holders is becoming increasingly evident, with the proportion of Bitcoin held for over 10 years reaching 16.82%, setting a historical high.

4. Capital Changes

MicroStrategy continues to increase its Bitcoin holdings, with the institution currently holding a total of 331,200 BTC at an average purchase price of $50,071.86. Based on the current BTC price, the value of its holdings has reached $32.65 billion, with an unrealized profit of $16 billion. Additionally, the company recently completed a $3 billion convertible note issuance, planning to further purchase Bitcoin. According to AICoin index data, MicroStrategy's stock price (MSTR) has risen to $397.28, reaching a high for the past quarter.

The capital scale of spot Bitcoin ETFs is also continuously expanding, with a cumulative net inflow of $7.22 billion since November 6.

Market capital demand is growing in tandem, with the OTC price of USDT rising from 6.9 yuan in October to the current 7.22 yuan, while the issuance of USDT has increased by 10.2 billion since November 6.

5. Tips for Seizing Opportunities

1. MACD Structural Adjustment

• Signal 1: The MACD has formed a death cross above the zero axis, while the fast and slow lines return to the zero axis, but the BTC price remains above the EMA24 and shows a slow upward trend. This is a strong adjustment structure; if the MACD forms a golden cross again above the zero axis, BTC is likely to experience a strong upward trend.

• Signal 2: If BTC retraces but does not break the EMA52 moving average, while the MACD DEA line remains above the zero axis and returns towards it, this is a good rebound signal.

2. Pin Bar Volume Increase

• Top Signal: If a clear upward pin bar appears with increased trading volume, this is usually a good signal for a top, especially if accompanied by major players selling.

• Rebound Signal: If a clear downward pin bar appears with increased trading volume, this is usually a good signal for a rebound, especially if accompanied by major players bottom-fishing.

3. OBV Combined with Volume Moving Average

When OBV remains above MAOBV, if the 10-day volume moving average crosses above the 40-day volume moving average, it can be seen as a good bullish signal.

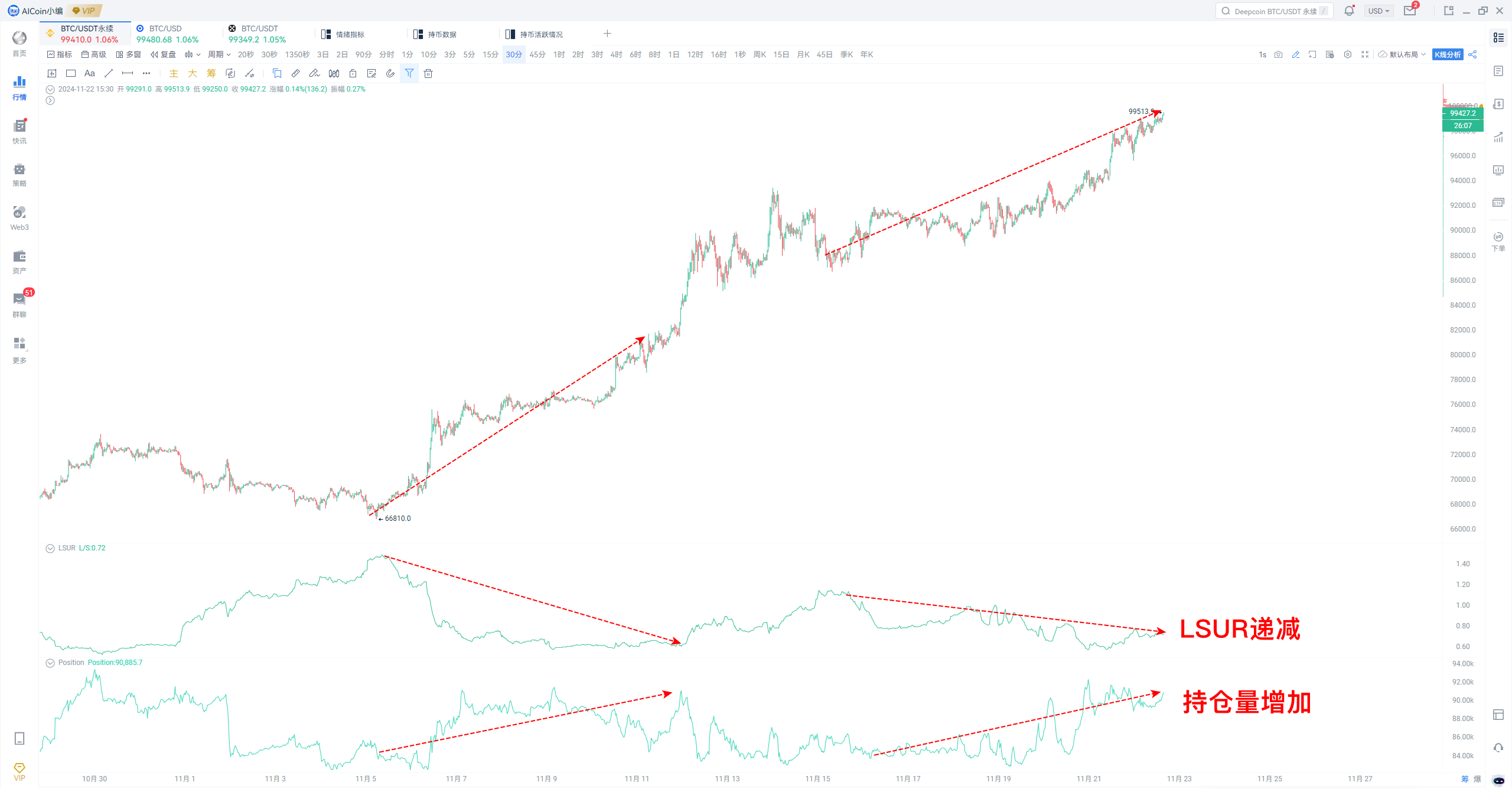

4. LSUR + Position Volume

When LSUR continues to decline while Position volume rises, it indicates that major players are bullish and continuously increasing their positions, usually suggesting that the upward trend may continue.

5. Breakout Hunter or False Breakout Strategy

The self-developed warning strategy can effectively identify true and false breakout trends in custom periods of 45 and 90 minutes.

In summary, the deep strategies of large holders, the extreme changes in market sentiment, and the potential trends in capital flow all release positive sentiments. If BTC can stabilize above $99,000, it is expected to sprint towards the historic high of $100,000!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。