Original | Odaily Planet Daily (@OdailyChina)

Author | Fu Ruo (@vincent31515173)

The crypto market seems no longer dominated solely by Bitcoin, as funds are flowing into mainstream altcoins.

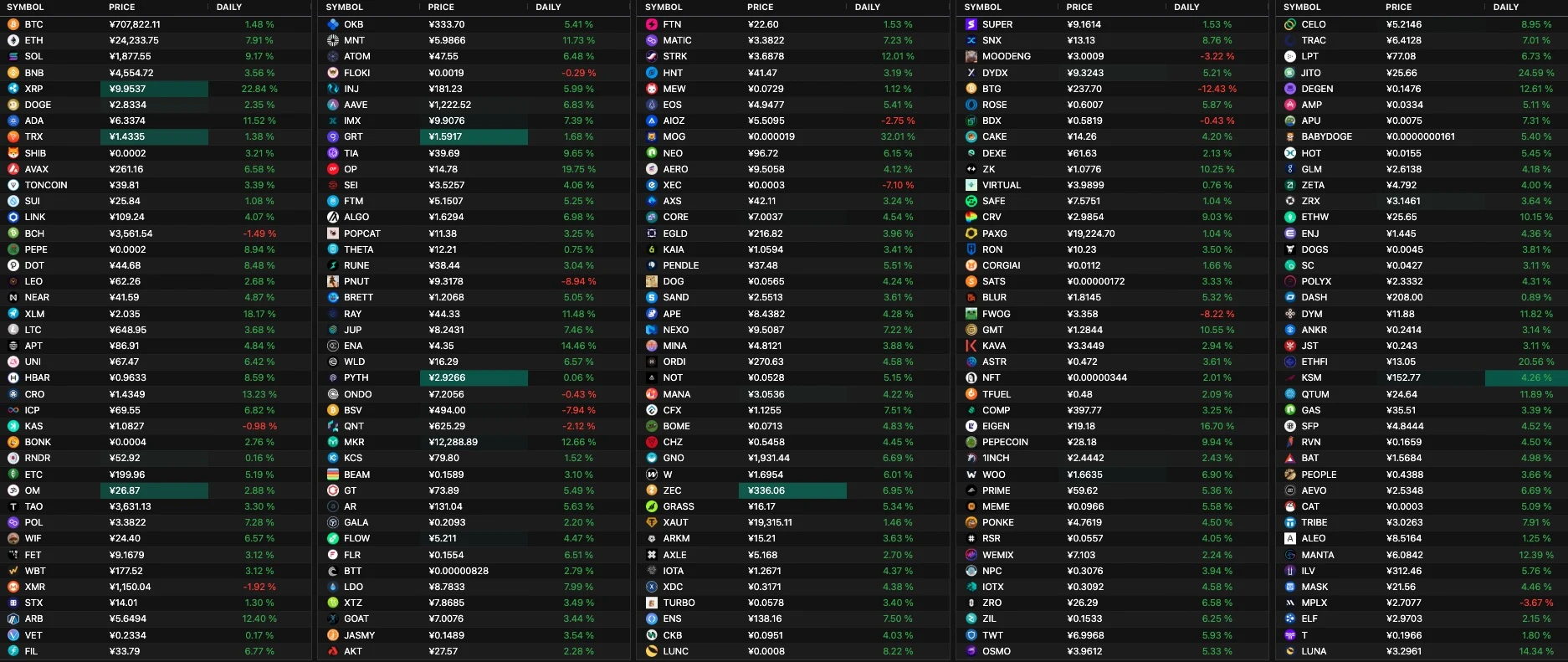

According to Quantify Crypto data, in the past 24 hours, among the top 200 cryptocurrencies by market capitalization, 185 tokens have risen, while only 15 tokens have declined. Among the top 100 cryptocurrencies by market cap, most have seen increases of over 8%, with ETH breaking through 3400 USDT, a 24H increase of nearly 10%; SOL surpassing 260 USDT, reaching an all-time high; and Ethereum Layer 2 tokens OP and ARB both rising over 15%. Many users on social media are calling out that "altcoin season" has finally arrived.

But has altcoin season truly arrived? To explore this, Odaily Planet Daily will explain the reasons behind the price recovery of altcoins and analyze whether it can be sustained. (Odaily Planet Daily Note: The author separates on-chain memes from the altcoin category, categorizing memes on major exchanges as altcoins.)

Why Are Altcoins Rising?

Decline in Trading Volume and Community Discussion of Well-Known On-Chain Memes

Previously, as Bitcoin's price continuously broke new highs, altcoins did not rise but instead fell, leading some users to be skeptical about this round of the bull market for altcoins, especially those facing large-scale unlocks of VC tokens.

As a result, the market's attention has shifted to launching fairer meme segments, causing most funds to flow into on-chain PVP, where former mainstream altcoins face a situation of having high market caps but lower liquidity than newly emerged meme projects. For instance, currently, some of the top 100 tokens have 24-hour trading volumes that are even lower than the recently popular CHILL GUY.

However, the high-intensity PVP of memes has also deterred some investors, making it inevitable for funds to return to altcoins, gradually evolving into a new mechanism: Bitcoin breaks through first, followed by a rotation of funds between memes and altcoins. One reason for the recent rise in altcoins is the decline in the popularity of on-chain memes, including:

The trading volume of well-known meme coins has started to decline, such as ai16z, RIF, and ELIZA, which were previously popular meme coin representatives. According to GMGN data, most trading volumes have nearly halved.

Community discussion has decreased; most meme communities I am part of have shifted from discussing which meme projects to invest in to now talking about how to patiently wait for the next wave of meme speculation.

SEC Chairman's Upcoming Departure Sparks Altcoin Frenzy

Since the approval of Bitcoin and Ethereum spot ETFs, the crypto market has been on a continuous rise, with the market anticipating the next cryptocurrency to go mainstream.

Today, Bloomberg senior ETF analyst James Seyffart stated: "Cboe has submitted applications for 4 Solana spot ETFs to the SEC, with issuers being VanEck, 21Shares, Canary Capital, and Bitwise. If the SEC does not reject these applications, the final deadline will be around early August next year."

The application for cryptocurrency spot ETFs requires issuers to prepare two documents, namely S-1 and 19b-4. This time it is the S-1 document, representing the application for the listing of the SOL spot ETF, while the documents that truly face review difficulties are mostly concentrated in 19b-4, so the SOL spot ETF is just getting started.

However, SEC Chairman Gary announced on X platform that he will officially resign on January 20, and the new SEC chairman may expedite the review process for the SOL spot ETF, possibly not extending to the final deadline like the previous Bitcoin and Ethereum ETFs.

Additionally, Gary's impending departure has also provided a breather for altcoin projects that have been heavily regulated. Ripple, which has had a contentious relationship with the SEC, saw its token XRP rise nearly 30% in a single day.

With the regulatory landscape and the push for the SOL spot ETF, it is reasonable for altcoins to experience a rise.

Can Altcoins Continue to Rise?

Whether the altcoin frenzy can be sustained still requires observation and verification from multiple dimensions.

From historical experience, altcoin markets are often driven by short-term hype, but whether they can truly maintain price increases depends on the long-term development capabilities of the projects and the overall market environment. Although there are calls for an "altcoin season" in the current market, if there are no new technological breakthroughs, practical applications, or ecological development support, this wave of market activity may be more of a temporary rotation of funds rather than a trend-driven rise.

Therefore, both institutions and individual investors need to remain vigilant in the face of this round of altcoin activity. On one hand, it is essential to monitor changes in the flow of funds in the market, such as key indicators like on-chain token transfer data; on the other hand, it is also necessary to guard against the risk of a pullback after short-term gains, especially as the funding movements of leading projects may become important indicators for subsequent market trends. At present, "altcoin season" remains a battleground of opportunities and risks, and investors should stay calm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。