As EIP-4844's "data block Blobs" reshapes the economic model of Ethereum's Layer 2 networks, the debate over long-term scalability versus the short-term value of ETH is intensifying.

Author: Donovan Choy

Translation: Blockchain in Plain Language

The operational costs of Ethereum L2 have historically been very high, with L2 needing to pay millions of dollars for L1's data availability. This all changed after the Dencun hard fork (EIP-4844) in March 2024.

The hard fork introduced a block space expansion called "data blocks" (blobs), allowing L2 to publish bulk data to L1 at a very low cost. The data block space has a fee market independent of L1, costing about one-tenth of L1 block space, becoming a key component of Ethereum's Rollup-centric roadmap.

For example, according to TokenTerminal data, Base's related fees reached $9.34 million in Q1 2024 but sharply dropped to $699,000 in Q2 and further declined to $42,000 in Q3.

However, (bad news may be good news?) as on-chain activity increases during the bull market, the price of data block space has risen again.

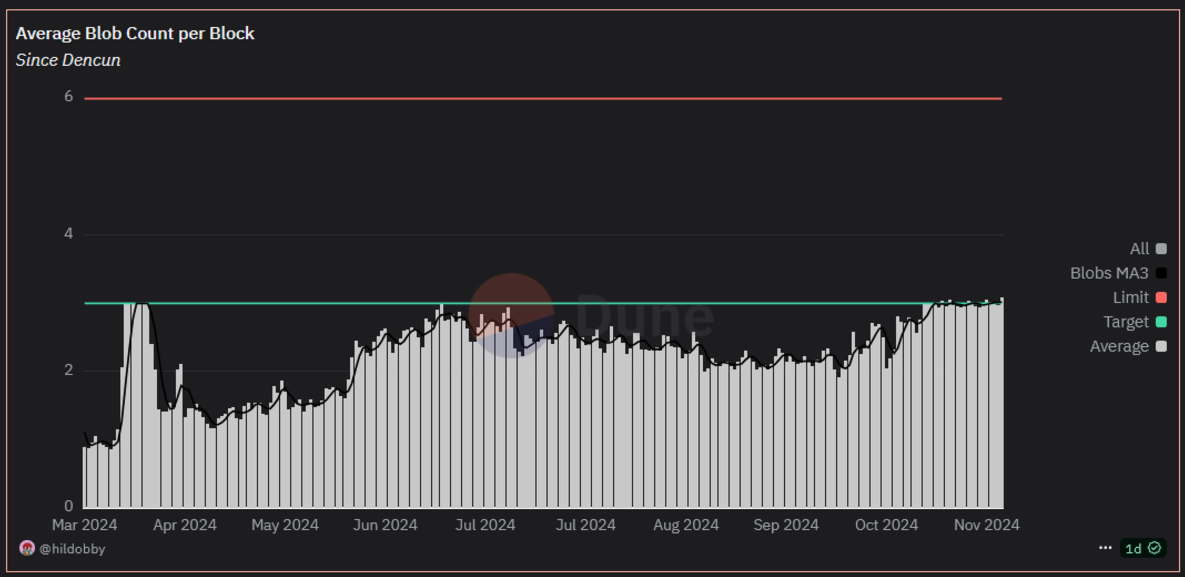

Currently, each mainnet block is limited to a maximum of 6 data blocks. When the usage rate of data blocks reaches 50% (i.e., 3), a base fee will be introduced to adjust the demand from hundreds of L2s. When the usage rate reaches 4 data blocks, the base fee will further increase, potentially raising the next block by up to 12.5%.

This is exactly what has started happening in the past few weeks (see the chart below).

Source: Dune

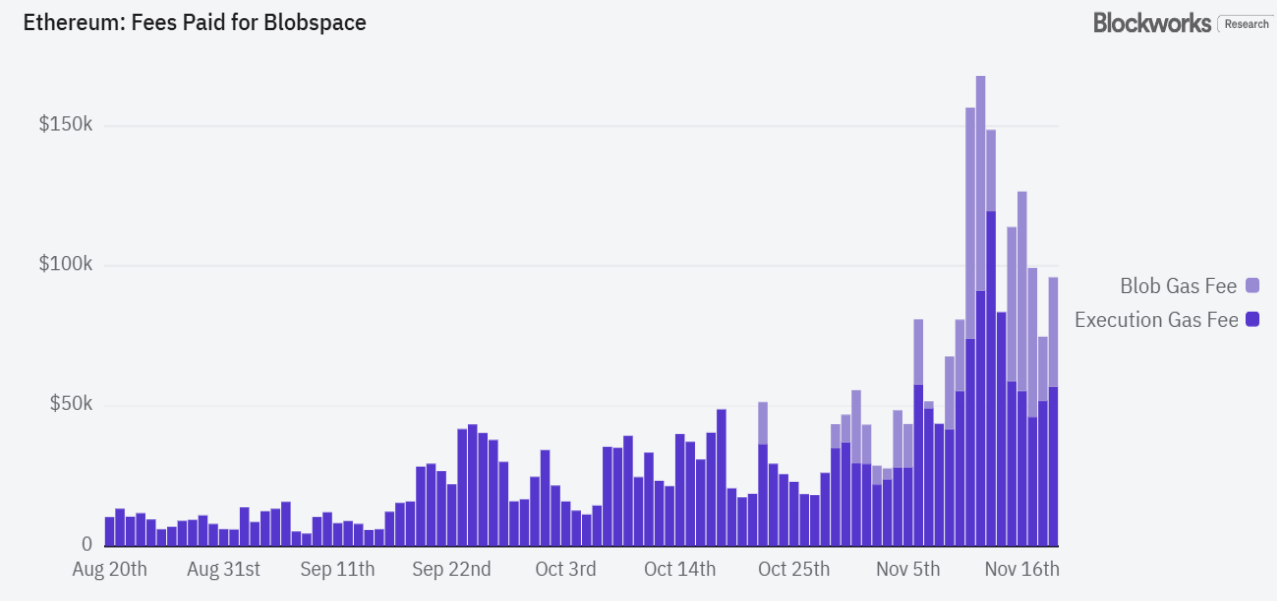

In short, blobs are no longer free, and L2s need to start paying "rent." According to ultrasound.money, the blob fees burned in the past 30 days amounted to about 212 ETH, generating substantial blob fee revenue for the Ethereum mainnet.

Source: Blockworks Research

**Overall, the introduction of *blobs* is a good thing: the operational costs for L2 have decreased, which is undoubtedly a benefit for L2 users.**

However, some (in other words, ETH holders) are not very satisfied, as L2s seem to be paying very little to L1, which also means that the value derived from the ETH asset has diminished.

This dissatisfaction mainly stems from two pessimistic expectations, namely that the usage of blobs is insufficient to bring returns to L1:

1) L2s are essentially commercial entities. They will choose cheaper data availability providers, such as Celestia or EigenDA, or even worse, a less secure centralized Data Availability Committee (DAC).

2) When the blob market fees rise, L2s may delay sending data back to L1, as has been reflected in the past operations of Scroll and Taiko.

In discussions about blobs at Devcon, Ethereum researcher Ansgar Dietrichs acknowledged the misalignment of incentives for L2s but countered that as more L2 networks form trust bottlenecks around Ethereum's data availability (DA), Ethereum's DA will become more important in the long run.

Tim Robinson from Blueyard proposed the view that blobs are a "customer acquisition strategy." He pointed out that although the current revenue from blobs is limited, due to its economic design, it will quickly generate significant value in the future, bringing substantial returns to Ethereum. According to Robinson's blob simulator, assuming an Ethereum L1 processing 10,000 TPS with a blob size of 16 MB (currently, the blob size is 125 KB), it could burn 6.5% of ETH annually.

**This is also why *blobs* have fundamental benefits for Ethereum in the long run.** Limiting the number of blobs or increasing blob fees to extract more value from L2 in the short term is actually a poor "rent-seeking" behavior.

Ethereum researchers are also actively supporting this view. In a research article published two days ago, Toni Wahrstätter called for a conservative increase in the number of blobs from 4/6 to a higher 6/9.

In ACDE #197, Vitalik also proposed increasing the blob space by 33% in the next Pectra hard fork. He warned that this adjustment is crucial; otherwise, users may migrate to other chains.

In summary, the complex debate surrounding blobs boils down to one question: Should Ethereum prioritize ordinary L2 users and their "Ethereum ecosystem-friendly" L2 systems, or should it prioritize the value accumulation of the ETH asset?

Ethereum researchers believe that overemphasizing the latter may lead users and developers to migrate to cheaper chains, so they choose to continue expanding blob space to pave the way for long-term development. However, this also undermines the attractiveness of ETH as an economic asset, leaving ETH holders feeling dissatisfied in the short term.

Regardless, this is a complex issue that requires precise predictions about the future and weighing various possibilities of "what if." Only time will tell which path is more correct.

Article link: https://www.hellobtc.com/kp/du/11/5546.html

Source: https://blockworks.co/news/ethereum-blobs-balancing-act

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。