In today's 75 Bitcoin L2s, only 3-5 participants may ultimately capture the largest market share.’

Written by: Gabe Parker, Galaxy

Translated by: Wu Zhu, Jinse Finance

Abstract

Since 2021, Bitcoin-based Layer 2 (L2) projects have increased more than sevenfold, from 10 to 75. Over 36% of all venture capital in Bitcoin L2 was allocated in 2024, and since 2018, crypto venture capital firms have invested a total of $447 million in Bitcoin L2 projects. Bitcoin L2 will leverage the raised funds to develop robust applications and new use cases for BTC, aimed at attracting significant liquidity from local BTC holders and the existing wrapped BTC market. The report estimates that by 2030, over $47 billion of BTC may connect to Bitcoin L2. Our analysis of the total addressable market (TAM) for Bitcoin L2 considers the current market share of all wrapped versions of BTC used in DeFi, as well as native BTC stored in Bitcoin L2 and BTC locked in staking protocols. As of November 20, 2024, these portions account for 0.8% of all circulating BTC. By 2030, we estimate that 2.3% of the circulating supply of BTC will bridge to Bitcoin L2 to interact with the new Bitcoin DeFi ecosystem, alternative tokens, payment applications, and more.

Introduction

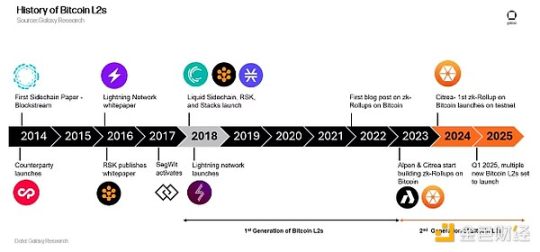

Since the inception of Bitcoin, discussions about its future have included the concept of layered scaling. Hal Finney described the concept of a "Bitcoin bank" in 2010, where "Bitcoin-backed banks… [could issue] their own digital cash currency." Tether launched on the Omni Network (one of the earliest Layer 2 networks) in 2014, a move described as "Bitcoin 2.0." The debate over whether Bitcoin should scale the base layer or focus on high-performance L2 peaked during the "block size debate," which was largely resolved with the activation of SegWit on Bitcoin in August 2017 and the separate launch of Bitcoin Cash. SegWit enabled the payment-centric Lightning Network, which has been the most well-known L2 for years. In 2018, two notable sidechains were launched—Blockstream's Liquid (focused on asset issuance and payment privacy) and Rootstock (an EVM-compatible sidechain).

The rise of Ordinals brought tokenization activities back to Bitcoin's base layer in 2023 and helped rekindle interest in building applications on Bitcoin. This renewed interest, combined with advancements in Rollup development within the Ethereum developer community, sparked a new wave of Bitcoin Layer 2 projects, primarily utilizing Rollup technology (optimistic and zero-knowledge). While the Lightning Network has achieved some success in enabling fast, cheap payments, developers have struggled to create yield-generating applications for BTC directly on the blockchain. A significant part of the difficulty arises from Bitcoin's inability to support general-purpose smart contract applications. The base layer of Bitcoin is not Turing complete, thus unable to execute the smart contract logic required by most DeFi applications. However, future upgrades may enable improved multi-party custody features, facilitating more robust bridging and second-layer architectures. Although upgrades enabling Turing completeness for Bitcoin have not yet been realized and are unlikely to be, some Bitcoin holders are already operating in DeFi with their BTC or earning yields by bridging assets to other Turing-complete chains, rather than relying on high-performance and trust-minimized second layers—like complete blockchains such as Ethereum. Wrapped Bitcoin (WBTC) on Ethereum accounts for the largest share (62%) of all wrapped versions of BTC. The wrapped versions of BTC used in Ethereum DeFi represent a large group of BTC holders seeking more efficient BTC use cases.

The over $9 billion in wrapped BTC (WBTC, tBTC, cbBTC) on Ethereum may indicate user demand for using BTC in DeFi applications. Holders of WBTC, tBTC, and other bridged BTC are more likely than other groups to transfer and use BTC on new Bitcoin L2s, as they are familiar with operating wrapped BTC assets on other chains. Bitcoin L2s may prioritize developing attractive yield-generating applications priced in BTC to entice existing wrapped BTC users on Ethereum to move their funds to new Bitcoin L2s. Wrapped BTC holders may also use Bitcoin L2s because they have already shown a preference for utility over decentralization. All launched Bitcoin L2s will be more centralized systems compared to Bitcoin L1, although some systems will have decentralization features comparable to existing Ethereum L2s.

The ability to use BTC in DeFi applications without exiting the Bitcoin ecosystem is a significant selling point for Bitcoin L2s. It may reduce friction in the user experience of bridging BTC and provide a more secure alternative for using BTC in DeFi beyond existing solutions. A major benefit of Bitcoin DeFi on Bitcoin L2 is that BTC serves as both the native gas asset and the focal point for DeFi development. Historically, native assets have shown greater utility on their local blockchains compared to external networks. For example, the substantial lending demand for ETH in Ethereum DeFi applications stems from its indispensable role as Ethereum's native gas token and its widespread adoption as the primary unit of account for NFT and fungible token transactions. The evolution of DeFi ecosystems on platforms like Ethereum and Solana illustrates an important principle: robust DeFi economies are built around the native assets of the blockchain.

This report defines the key characteristics of Bitcoin L2 and provides a high-level overview of different types of Bitcoin scaling solutions. The report also details the $447 million in cryptocurrency venture capital invested in Bitcoin L2 since 2018 and offers a TAM analysis for emerging Bitcoin L2s. Finally, the report shares important insights regarding the future prospects of Bitcoin modularity.

What is Bitcoin Layer 2?

Bitcoin L2s provide higher transaction throughput than Bitcoin L1 by implementing larger and faster blocks. Bitcoin L2s act as their own execution environments, allowing them to circumvent the technical limitations present on Bitcoin L1, such as the lack of Turing completeness. By serving as independent execution environments, Bitcoin L2s can utilize their own consensus mechanisms, security frameworks, and virtual machines. For example, most Bitcoin L2s in production are EVM-equivalent or compatible, enabling them to integrate applications from other EVM blockchains. (For more information on EVM equivalence and compatibility, please read Christine Kim's report on Ethereum ZK-Rollups).

Another key determinant of Bitcoin L2s is their bridging mechanisms, which dictate how users transfer BTC from the base layer to L2. Bitcoin L2s utilize a variety of bridging frameworks, including multi-signature and multi-party custody (MPC) wallet schemes, as well as third-party bridge operators. Some Bitcoin L2s use multi-signature/MPC wallet schemes with BitVM, a Turing-complete virtual machine compatible with Bitcoin. At a higher level, the BitVM bridge involves a 1-of-n trust assumption, where only one honest bridge operator needs to be online for users to exit the bridge. MPC and multi-signature bridges typically require more than 50% of signers to be honest for users to exit the bridge.

The main difference between Bitcoin L2 bridges and Ethereum L2 bridges is that the latter involve smart contract accounts, while the former use Bitcoin public key addresses. However, in both cases, the smart contract accounts on Ethereum and the Bitcoin public key addresses are typically controlled by a set of private keys. Another key distinction is that Bitcoin L2 bridges for sidechains and Rollups do not allow unilateral exits, meaning users cannot exit L2 without trusting an intermediary. Ethereum Rollups may include a feature called forced withdrawal, which allows anyone to submit their transaction directly to L1 to extract funds from the Rollup if the sequencer is offline or unable to include user transactions. State channels are the only Bitcoin L2s with trustless unilateral exits. The construction of Lightning Network bridges is designed to allow users to seamlessly withdraw funds back to L1 as long as they have the latest balance state.

Bitcoin Rollups and Sidechains

There are two categories of Bitcoin L2 solutions that can support general application development: Rollups and Sidechains. State channels are another L2 solution developed on Bitcoin, most notably the Lightning Network, but this technology is primarily used to enable faster and cheaper peer-to-peer transactions on Bitcoin and currently does not support Turing-complete smart contracts.

Sidechains: Sidechains are essentially independent blockchains that run in parallel with the base layer through embedded connections with their own node operators and security mechanisms. Sidechains scale the base layer by creating independent compatible blockchains with larger blocks and faster block times. This allows for more transactions to be processed in a shorter amount of time. Since sidechains use their own consensus models, they do not rely on a data availability layer but instead function as closed and independent execution environments. Because sidechains use their own consensus models, some critics argue that they are not technically "Layer 2" solutions but rather separate Layer 1 scaling solutions. However, sidechains can be designed in various ways, making it important to distinguish between those that are aligned with the base layer and those that are not. Sidechains can publish the hash of block headers or other data to L1 as a way to "checkpoint" their own state to L1.

Rollups: Rollups are blockchains that offload transactions from the base layer and execute them on a secondary layer. As a result, Rollups provide users with 10 to 100 times cheaper and faster transactions. By using transaction data compression algorithms that batch multiple transactions together, Rollups can achieve higher transaction throughput than sidechains.

Rollups also utilize the parent blockchain for data availability. The parent blockchain stores the state root, transaction data, or state differences of the Rollup. The data stored on the parent blockchain allows any full node to reconstruct the latest state of the Rollup. Rollups can be designed to support a single application or provide general functionality and host multiple applications.

Rollups update the state root in two ways. Validity Rollups (also known as zk-Rollups) create succinct cryptographic proofs that L1 immediately verifies upon receiving the update, proving that the update is consistent with the correct execution of those transactions. Optimistic Rollups push the Optimistic correct state root updates to L1 and provide a defined time window for validators to challenge the state root updates.

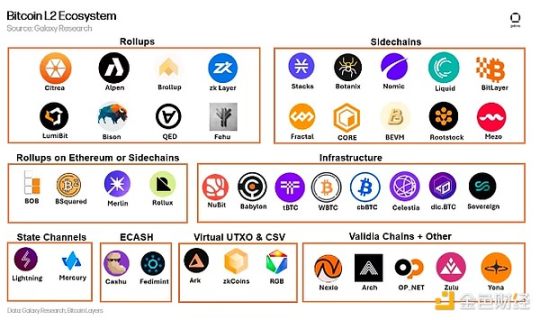

The classification of the market map above follows these main characteristics:

- Bitcoin Rollup: Publishes proofs and state difference data or transaction data to the execution layer in Bitcoin blocks.

- Non-Bitcoin Rollup: Publishes proofs and state difference data or transaction data to the execution layer on Ethereum or alternative DA layers.

- Sidechain: An independent execution layer compatible with the Bitcoin base layer that does not require DA from the parent chain.

- Infrastructure: Data availability protocols and any wrapped BTC providers.

- State Channel: An off-chain execution environment without a global state, only submitting the initial and final states of account balances.

- ECASH: A custodial state channel solution based on David Chaum's Ecash proposal.

- Virtual UTXO and CSV: New iterations of client-validated state channels and execution layers.

- Valid Chain: An execution layer compatible with BTC, using off-chain or alternative DA.

The market map does not include all projects in each category and serves as a reference for the construction of different types of projects within the Bitcoin L2 ecosystem. As of November 20, 2024, the Bitcoin L2 market consists of 40 Rollups and 25 sidechains. This report does not cover state channels, CSV, Drivechain, or ECash protocols, which collectively represent 10 projects.

Bitcoin L2 Venture Capital

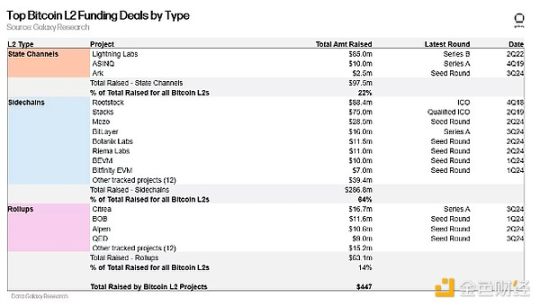

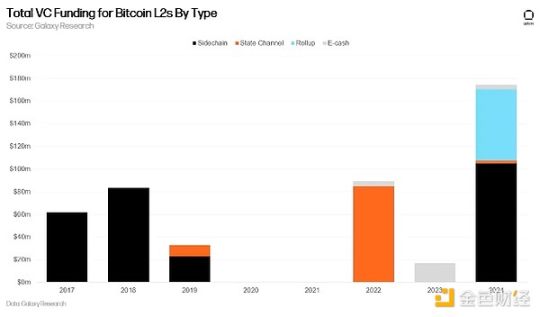

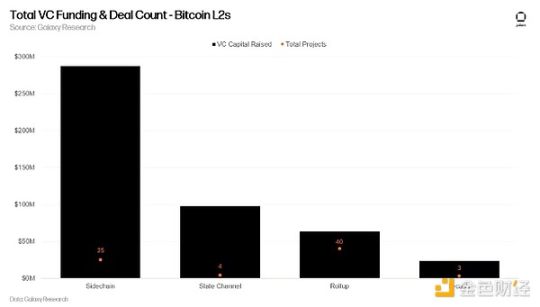

As of September 2024, Bitcoin L2 has raised $174 million from cryptocurrency venture capital firms. Among them, sidechains received the largest allocation of $105 million, followed by Rollups at $63 million. Notably, 39% of historical venture capital for Bitcoin L2 occurred in 2024 alone. A significant shift occurred in Q2 2024, with Bitcoin L2 capturing 44% of all cryptocurrency venture capital invested in L2 solutions across the industry, a staggering 159% quarter-over-quarter increase. In 2024, cryptocurrency venture capital investment in Bitcoin L2 surged, highlighting that traditional cryptocurrency venture capital (excluding Bitcoin-focused funds) had little exposure to the Bitcoin ecosystem before the early fundraising and development stages of 2024. As of November 2024, Bitcoin L2 has undergone two rounds of Series A financing, involving 30 disclosed transactions.

Since 2018, Bitcoin Layer 2 has attracted significant investment, with sidechains leading the way. Of the total $447 million invested in Bitcoin L2, sidechains accounted for the largest share at 64%. State Channels followed closely at 22%, while Rollups accounted for 14%. Notably, ECASH-based protocols like Cashu and Fedimint are not included in the table above, having collectively received $27.2 million in venture capital. Electronic cash projects do not meet our definition of Bitcoin L2 but are worth considering as potential infrastructure in the Bitcoin L2 space.

Potential Market for Bitcoin L2

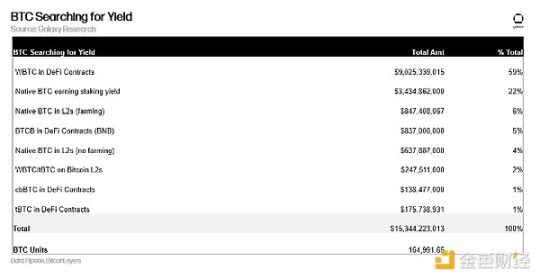

We believe the directly addressable market for Bitcoin L2 consists of the wrapped versions of BTC in DeFi contracts, native BTC bridged to L2, and the total supply of BTC in staking protocols. The demographics of "active" BTC supply are the focus of our TAM analysis. We believe this group of holders is most likely to connect BTC with new L2s in search of yield opportunities.

As of November 20, approximately 0.8% of the circulating BTC supply (164,992 BTC) is actively in use. For the wrapped BTC market, $10 billion is locked in DeFi smart contracts, and $247 million is locked in Bitcoin L2. For native Bitcoin, $3.4 billion is locked in staking protocols (Babylon, Bouncebit), and $1.5 billion is locked in Bitcoin L2.

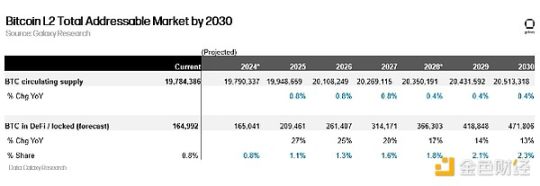

If we assume that the share of circulating BTC supply used in DeFi, L2, and staking increases by 0.25% annually over six years, we estimate that by the end of 2030, the "active BTC supply" could grow to 471,806 BTC (approximately tripling).

In contrast, 2.3% of the circulating supply of Ethereum (ETH, WETH, stETH, wstETH) is locked in DeFi smart contracts (excluding staking protocols). Based on current prices as of November 20, 2024, this model estimates that by 2030, the TAM for Bitcoin L2 could reach $44 billion.

If Bitcoin reaches $100,000 by 2030, the TAM for Bitcoin L2 could potentially reach $47 billion, assuming that 2.3% of the total Bitcoin supply is locked in Bitcoin L2 by 2030.

Please note that this analysis provides a rough estimate of how much BTC supply could flow into Bitcoin L2 for yield; it does not account for the potential growth of the Bitcoin L2 ecosystem, which includes other crypto assets that will be issued on top of these L2s, such as Runes, Ordinals, stablecoins, etc. Our TAM estimates rely on two key assumptions. First, we assume that the percentage of BTC supply locked in Bitcoin L2 could grow by 0.25% annually from now until 2030; second, we assume that the price of BTC could reach $100,000 by 2030. Our view is that these are conservative estimates of future demand and Bitcoin prices for Bitcoin L2 users over the next six years.

Also, note that our predictions depend on the progress of Bitcoin's DeFi and staking ecosystems on L2, while establishing legitimacy over the next six years. Crucially, if the DeFi yields on new Bitcoin L2s are not attractive enough, the wrapped BTC supply on Ethereum may remain within the Ethereum ecosystem. The following section will focus on the minimum yield levels required for DeFi applications on Bitcoin L2 to compete with DeFi applications on Ethereum that accept wrapped BTC.

Gaining Market Share from BTC DeFi on Ethereum

Although new wrapped versions of BTC are used in DeFi, this section focuses solely on WBTC, as this token accounts for 62% of the wrapped BTC market.

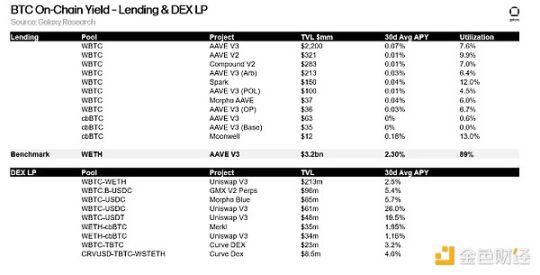

To capture significant market share from WBTC, lending protocols on Bitcoin L2 must 1) provide higher supply yields by increasing BTC utilization (users borrowing BTC), and 2) offer sufficient stablecoin liquidity for lending. Approximately 72% of all WBTC locked in DeFi contracts is deposited in lending protocols. The large proportion of WBTC in lending protocols indicates that this group of BTC holders is primarily interested in lending applications. Additionally, for every $100 of WBTC deposited on the two major lending protocols on Ethereum, Aave and MakerDAO, about $50 of stablecoins are borrowed.

By observing the average utilization rates of these deposit pools, it is clear that there is significant stablecoin borrowing against WBTC on AAVE and Maker. On AAVE, the average utilization rate for WBTC is 7.7%, meaning that 92.3% of deposited WBTC is used as collateral for stablecoin borrowing. As of November 2024, the average annual interest rate for WBTC deposits on AAVE is only 0.04%. For reference, the utilization rate for WETH on AAVE is 89%, generating an annualized yield of 2.3%.

The utilization rate of ETH/WETH is significantly higher than that of WBTC. The use cases for WETH include DeFi, perpetual trading, staking, and NFTs. Lending applications on Bitcoin L2 aim to enhance the utility of BTC by building a dedicated ecosystem for the asset, thereby providing higher yields. Some examples include ordinal and alternative token protocols built on Bitcoin L2.

The following table highlights the yields from depositing wrapped BTC into lending protocols and DEX pools on Ethereum.

Although depositing WBTC into DEX pools can provide higher yields compared to lending pools, the risks of impermanent loss and yield volatility make DEX pools an unreliable source of income. As a result, 72% of WBTC in DeFi contracts is allocated to lending protocols. If lending protocols on Bitcoin L2 can increase the utilization of the underlying asset, they will offer higher yields than the borrowing activity of WBTC on Ethereum.

Summary

DeFi applications on Bitcoin L2 need to provide higher yields than Bitcoin DeFi on Ethereum to capture market share from the wrapped BTC market. Bitcoin L2 can only succeed by taking market share from DeFi applications that accept tokenized versions of BTC, such as WBTC, tBTC, and cbBTC. A vibrant DeFi ecosystem on Bitcoin L2 is the most important development for the long-term adoption of L2. This is evident when looking at the top applications by TVL on Ethereum L2 (Arbitrum, Optimism, and Base), which include lending, DEX, and derivatives platforms.

The trust assumptions of the new Bitcoin L2 bridge designs are not weaker than those of the WBTC, cBTC, and tBTC bridge designs. WBTC holders need to trust BitGo's consortium, a centralized entity, while BTC holders on Bitcoin L2 need to trust a relatively more decentralized group of bridging operators. Although there are no unilateral exits for any Bitcoin Rollup or sidechain, once this feature is developed, the bridging on the new Bitcoin L2 will be less trustworthy than WBTC, cBTC, and tBTC.

In 2024, Bitcoin L2 secured $174 million in venture capital, providing a platform for these projects to execute market strategies. The well-funded Bitcoin L2 will establish ecosystem funds and use this capital to install existing EVM applications. Continued investment in the Bitcoin L2 ecosystem will play a crucial role in the industry's growth over the next six years. Once Bitcoin L2 goes live on the mainnet, cryptocurrency venture capital firms may shift their focus to investing in early native applications.

The emergence of Ordinals and BRC-20 in 2023 signaled to cryptocurrency venture capital firms that Bitcoin may have another investment avenue beyond digital gold. As Bitcoin L2 matures and its user base expands, cryptocurrency venture capital firms will continue to deploy funds into the Bitcoin ecosystem.

Among the 75 Bitcoin L2s today, only 3-5 participants are likely to capture the largest market share. There will not be enough users, liquidity, and attention to be distributed across 75 Bitcoin L2s. We emphasized this point in previous reports regarding Bitcoin Rollups using Bitcoin for DA. The L2s with the most liquidity and yield-generating applications may be the only projects able to survive in the next six years. Therefore, partnerships in infrastructure, liquidity provisioning, and market-making are crucial in determining which Bitcoin L2s will lead over others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。