According to Reuters, Trump's "Cryptocurrency Advisory Committee" is expected to establish a committed Bitcoin reserve. The Greed and Fear Index is close to its previous high at 94, indicating an extreme greed phase.

The weekly chart shows three consecutive bullish candles. From the Fibonacci extension line, after breaking 94,700, the next resistance is around 107,000, with the current high also reaching over 99,000.

Ethereum has ended a week of consolidation and has chosen to break upwards, with the highest point at 3,386, less than 100 points away from 3,444, increasing the probability of a breakout. As long as Bitcoin does not experience a significant pullback, it is not ruled out that it could reach around 4,000. Every time Bitcoin surges rapidly, Ethereum not following and even dropping has been criticized. In my view, this is a normal trend and logic; just be patient and wait.

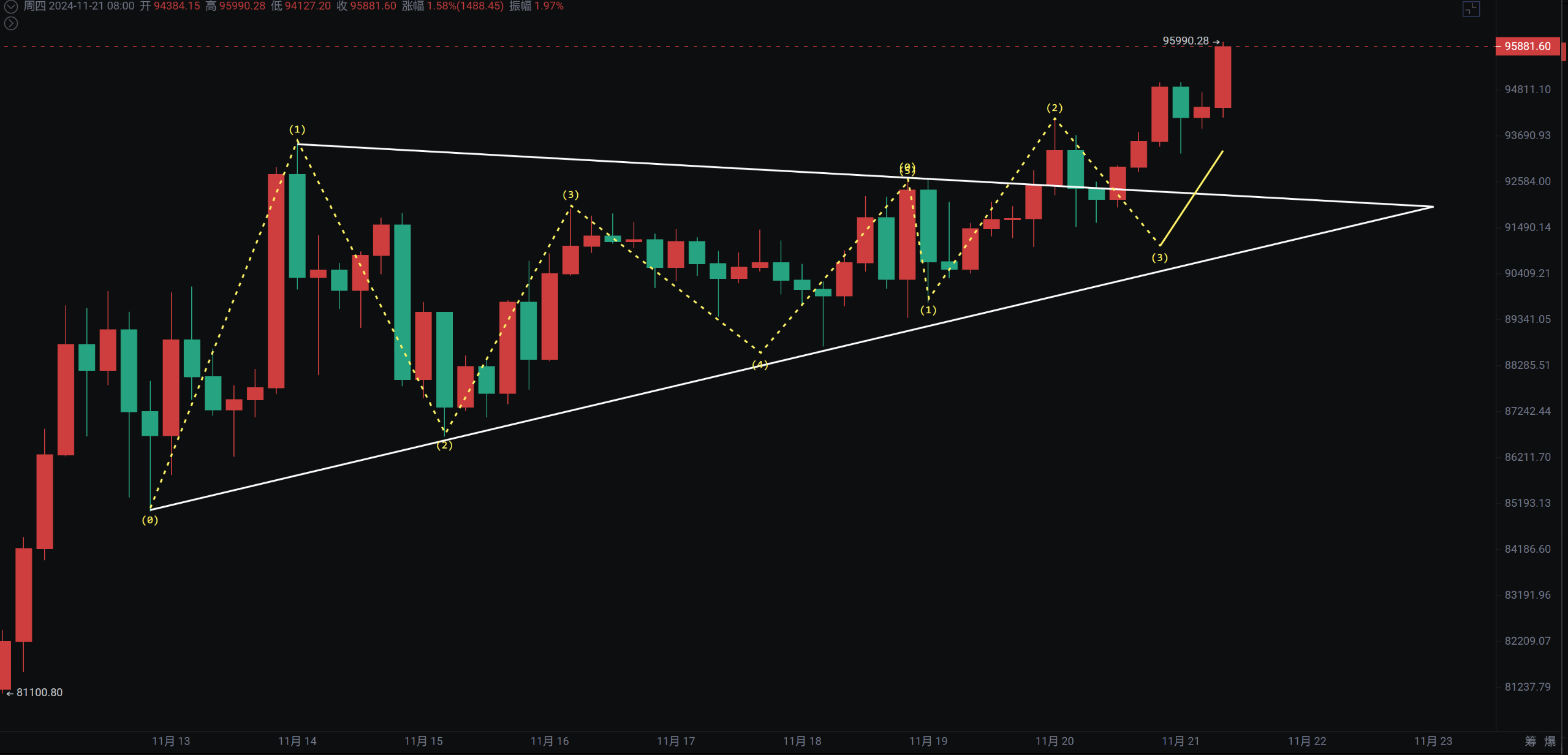

Bitcoin

After breaking out of the ascending triangle on the daily chart, it has formed three consecutive bullish candles. After a pullback to 95,600 last night, it continued to rise. In the short term, we still look for pullback rebounds. There are no obvious signals of a top on the daily chart, so pay attention to the 4-hour upward trend that should not break down; if it does, we need to be cautious.

FOMO sentiment is high, and the Greed and Fear Index has reached extreme greed. The higher it goes, the greater the risk, which aligns with our statement to take profits when it reaches over 90,000. For medium to long-term positions, we need to wait for a wave of adjustment before entering.

Support: Resistance:

Ethereum

Ethereum has entered a phase of catching up, first focusing on L2, ARB, OP, METIS… and also re-staking ETHFI, SSV, LDO, etc.

SOL is facing a breakthrough to a new high, currently at 259.9, near the previous bull market high. Earlier, we mentioned that this bull market is an institutional bull market and also an ETF bull market for BTC and ETH (which have already passed). There is potential for SOL, XRP, and LTC (potentially passing), with the other two showing significant gains besides LTC.

Bitcoin's second layer, ORDI, SATS, RATS, has performed very poorly in this wave; keep an eye on whether there is an opportunity for a catch-up. (The consistent approach is not to chase highs but to ambush low-priced varieties.)

Support: Resistance:

If you like my views, please like, comment, and share. Let's navigate through the bull and bear markets together!!!

The article is time-sensitive and for reference only; it is updated in real-time.

Focusing on K-line technical research, sharing global investment opportunities. Public account: Trading Prince Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。