Author: Nakamao, BlockBeats

"I will buy all the SOL you have at the market price of $3 right now, feel free to sell, and then you can leave." This was a reply from SBF, the founder of FTX, to a trader who was skeptical about Solana on Twitter on January 10, 2021. "A huge buy order is coming for SOL because every billionaire in the world is calling me and SBF (to inquire about Solana)." On December 1 of the same year, Kyle Saman, managing partner of Multicoin Capital, made a statement on Twitter. At that time, the price of SOL had already exceeded $230, with an annual increase of over 150 times, becoming a star in the entire crypto industry.

"Here are the reasons why the Solana chain will disappear and the SOL token will go to zero." This was a tweet from ETH maximalist James Spediaccid predicting that SOL would be wiped out from the crypto market in December 2022, a year later. At that time, SOL was affected by the crypto winter and the bankruptcy announcement of FTX, dropping to a low of $8, with a decline of over 96% in more than a year, nearly going to zero.

"Only Possible On Solana," as the community collectively shouted this slogan, on November 22, 2024, the price of SOL soared to $260, breaking the previous bull market's peak. From the low to the high, it increased by over 30 times, completing a phoenix-like rebirth.

The First Half of Solana's Life

The Story of Solana's Birth

A hundred billion dollar start doesn't seem too uncommon. Anatoly Yakovenko, a Ukrainian former Qualcomm engineer, wanted to create an on-chain order book trading platform. He quickly realized that Ethereum could not support such a large throughput of on-chain transactions. One night, after drinking three cups of coffee and unable to sleep, Anatoly got up and wrote the initial code for Solana.

According to Mable, the Chief Revenue Officer of STEPN and former partner at Multicoin Capital, Solana did not have a smooth fundraising phase. In 2018, the Solana team went to Asia for fundraising, coinciding with a bear market in the crypto space, and the market had already been hurt multiple times by the rhetoric of high-performance public chains, so Solana faced many obstacles in fundraising in China, South Korea, and Japan.

By 2019, Anatoly had already gained some fame by attending Blockchain Week in Shanghai, where new chains like Solana and Near were constantly appearing at various peripheral events. Anatoly repeatedly explained what Solana was, but most people did not pay much attention, much like Vitalik a few years earlier in China.

Ultimately, after multiple rounds of fundraising, the Solana team raised a total of $25.53 million. This was far less than the hundreds of millions raised by star public chains today and lower than the amounts raised by Near and Avalanche during the same period.

The Rise of Solana — SBF's Choice

In fact, after the mainnet launch, Solana did not attract much attention; for example, the network experienced interruptions due to certain issues, and the community did not notice. It wasn't until the second half of 2020 that Solana began to officially enter the public eye. The reason was simple: SBF, the founder of FTX, arrived. Solana's true rise was absolutely inseparable from SBF's support. According to Mable, the meeting between SBF and Solana was not just a coincidence but felt more like a mutual choice.

At that time, FTX had just been established for a year and quickly occupied its territory in the trading arena. Coming from Wall Street, SBF indeed showed the crypto industry something different, not only in trading tools that differed from other competitors but also by deeply engaging in the industry, participating in every hot topic.

In the early days of DeFi Summer, SBF wanted to move as much trading as possible on-chain. So, the SBF team proactively reached out to star public chains like Polygon, Avalanche, and Near. At that time, rumors in the market suggested that FTX was most interested in Near, but their mainnet launch would take some time, and SBF couldn't wait. After Kyle from Multicoin learned about this, he found a way to introduce Anatoly to SBF.

In the early hours of July 2020, Kyle had a three-hour conversation with SBF, who became interested. The next day, the Solana chain suddenly suffered a dust attack, with countless small transactions occurring simultaneously and for an extended period on Solana. Yes, it was SBF who wanted to personally test the actual performance of the Solana chain, and ultimately, Solana withstood the massive amount of spam transactions from SBF's team. On the same day, SBF decided to invest in Solana. A few days later, the design of Serum, a decentralized order book matching engine incubated by FTX, was born.

Subsequently, the Solana ecosystem experienced explosive growth.

The Ecological Rise of Solana

First, Serum's circulating market cap exceeded $1 billion at its peak, while Solana ecosystem projects like Raydium, Oxygen, and Star Atlas landed on FTX.

Moreover, FTX's support meant that other centralized trading platforms had to start integrating and supporting this new Layer 1 network, significantly elevating the priority of Solana-related matters on major centralized trading platforms. SBF also personally created a group for Anatoly and Jeremy, the CEO of USDC's parent company Circle, to support USDC's integration with the Solana chain.

In addition to SBF's support, the Solana team was also actively hosting hackathons to attract developers from around the world. It can be said that today's Solana hackathons have become an important source of vitality for the Solana ecosystem. With performance advantages and SBF's unprecedented ability to drive the market, the Solana token SOL rose from under $1 to a peak of $248 in 2021, creating a myth.

At that time, Solana ranked behind the top Ethereum and BSC; it cannot be said to be the absolute king of public chain ecosystems, but compared to contemporaries like Avalanche and Near, Solana had fundamentally changed with FTX's support, though no one expected SBF would run into trouble.

The Curtain Falls

In 2022, the crypto winter arrived, and with the collapse of the Terra (Luna) ecosystem and Three Arrow Capital (3AC), market panic continued to spread. Ultimately, under the combined pressure of internal and external factors, Solana's biggest supporter, and the most powerful supporter in the industry at the time, also fell — FTX declared bankruptcy.

The bankruptcy of FTX and Alameda severely impacted the entire Solana ecosystem. Not only did it cause the Solana Foundation to suffer over $180 million in crypto asset losses, but it also directly destroyed the important underlying protocol of the Solana DeFi ecosystem, Serum. Because important permissions were held by FTX, this foundational protocol quickly announced its invalidation.

As a result of this series of "devastating" events, Solana's TVL (Total Value Locked) plummeted from a bull market peak of $10 billion to around $200 million, with a series of star projects choosing to leave the Solana ecosystem and migrate to EVM chains.

Worse still, Solana's technology frequently encountered issues. In mid-2022, the network experienced multiple interruptions due to a surge in transaction volume. All of this led to doubts about the reliability of its technology. Downtime seemed to become a term exclusive to Solana.

The community was in despair, and the SOL token plummeted, as if Solana was already "beyond saving."

The Rebirth of Solana

On the fifth day after the SOL token dropped to $8, Ethereum founder Vitalik Buterin posted a tweet.

"Some smart people told me that Solana has a genuinely smart developer community, and now those terrible opportunistic funds have been washed away, this chain has a bright future.

It's hard for me to judge from the outside, but I hope the community gets a fair opportunity to develop."

Vitalik's words seemed to serve as a reassurance, and the SOL token rose in response. The panic in the Solana community was alleviated by the subsequent continuous rise.

In the following days, besides Multicoin continuing to firmly support Solana, Chris from Placeholder has been publicly advocating for Solana since December 2022, while another partner, Joel Monegro, who once wrote about the Fat Protocol at USV, published a comparative article on Ethereum and Solana in October 2023, pointing out that Ethereum is like Android, while Solana is more like iOS.

As for what happened in 2024, everyone knows that the dust attack SBF tested in the early morning became a reality, and a grand era of hundreds of new assets being issued every minute and tens of thousands of transactions occurring simultaneously truly arrived, with only Solana able to perfectly support this massive trading feast. Accompanied by the birth of meme assets worth billions of dollars, SOL rose from $8 to a historical high, reaching a market cap of hundreds of billions.

Why Did Solana Reach New Heights?

Precise Rhythm Control by the Team and Foundation

In the darkest moments after the collapse of FTX, Solana's fate seemed predetermined. FTX was not only an investor in Solana but also one of its most important ecosystem promoters. However, the collapse of FTX not only caused Solana to lose its strongest ally but also pushed it to the edge of market trust.

In the face of such a crisis, the Solana Foundation chose a pragmatic path to revival. They quickly disclosed all assets related to Alameda, demonstrating financial transparency, while significantly optimizing network infrastructure. By improving the verification mechanism and controlling transaction flow, they effectively reduced downtime incidents. This steadfastness, unshaken by external pressures, helped Solana regain some trust from the community.

However, what truly brought the market's attention back to Solana was not just its technological improvements, but the value it created for developers and users through concrete actions.

Hackathons: The Engine of the Solana Ecosystem

Starting from the end of 2022, the Solana Foundation intensified its efforts in hosting hackathons, attracting the attention of developers worldwide. These events not only enhanced community vitality but also incubated a number of highly promising projects.

According to incomplete statistics, over the past three years of hackathons, more than 60,000 developers participated in Solana's hackathons, over 4,000 projects were launched, and a total of more than $600 million was raised, giving birth to star projects like Jito, Tensor, io.net, Marinade, and Solend.

Hackathons are not just a platform for developer交流; they are also an important source of innovation for the Solana ecosystem. Many projects quickly realized their potential after the hackathons, injecting strong momentum into the ecosystem's prosperity.

The Victory of Pragmatism

Mable, who witnessed Solana's rise, mentioned when summarizing the reasons for Solana's success, "The ego of Solana's founders is very small, and the entire team has a very pragmatic style. They don't have too many obsessions and don't feel the need to have a set of doctrines that must be followed. They try whatever can help the project gain more attention and recognition; they are not afraid of embarrassment or failure."

Solana did not shout slogans like "disrupt" or "change the world," but instead focused on improving efficiency and reducing costs. With the ability to process over 65,000 transactions per second and transaction costs as low as $0.00025, Solana became the preferred network for MEME trading. This focus on practical applications has also allowed Solana's ecosystem to exhibit vast diversity, covering all aspects of users' lives, from payment tools to Web3 social applications to consumer-grade devices.

This pragmatic technological style is not only popular in the crypto world but has also gained recognition from traditional financial institutions. Financial giants like Visa have already piloted cross-border payments on the Solana chain, validating the potential of Solana's technology. These collaborations not only expand Solana's application scenarios but also open the door for it to penetrate the mainstream financial world.

Conclusion

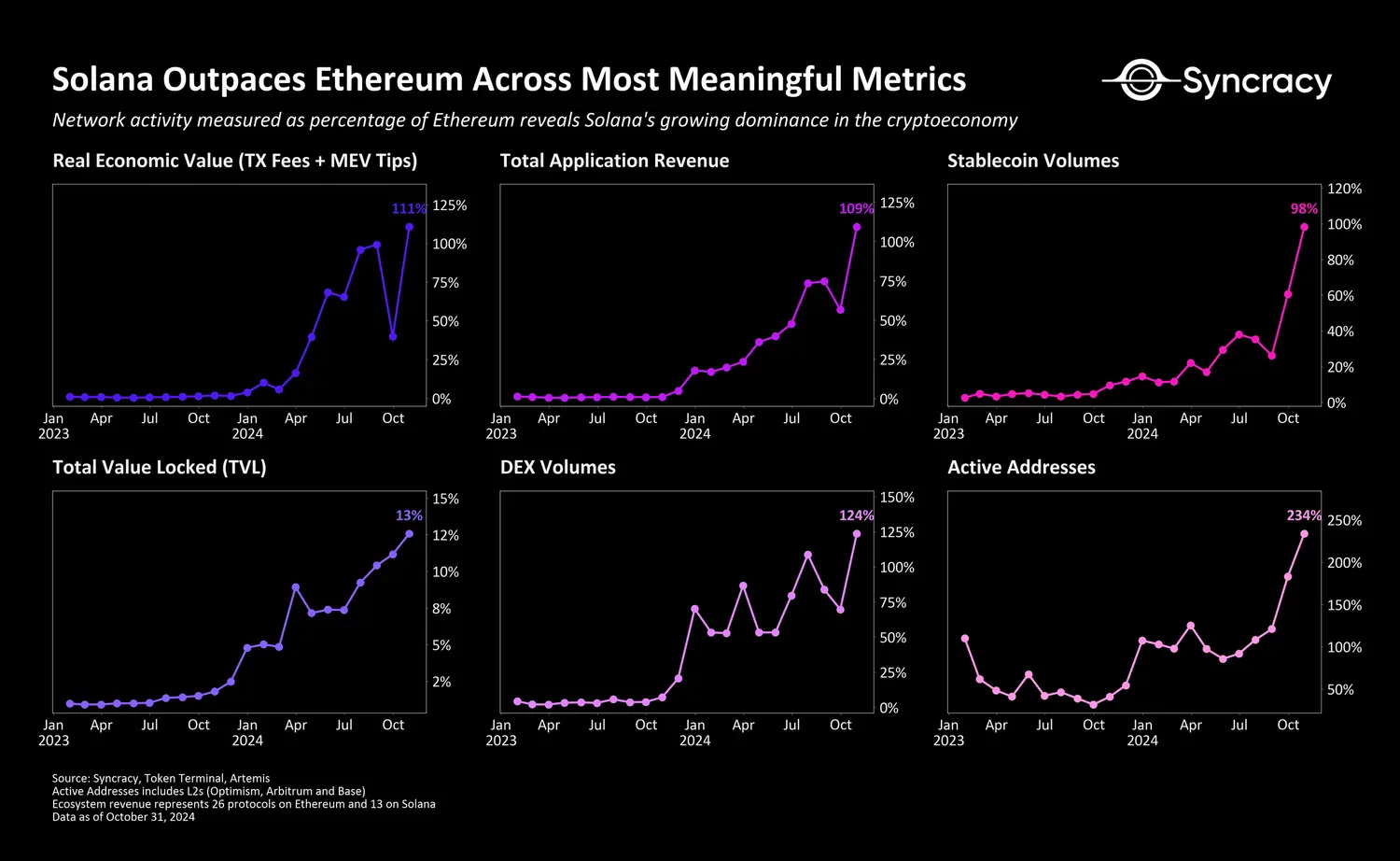

Solana's performance in 2024 has been remarkable, showcasing strong on-chain economic vitality, even approaching or surpassing Ethereum on several key metrics. Relying on its extremely high transaction throughput and very low transaction costs, Solana has become an excellent choice for high-frequency trading on-chain. The number of active user addresses and on-chain transaction volume continues to rise, especially driven by the MEME coin craze, with pumpfun attracting a large number of new users, making Solana the center of secondary market trading.

From hitting rock bottom to standing at the peak again, Solana's story may not just be a victory for a project but a symbol of resilience in the crypto industry. In terms of price performance, SOL's market cap has reached 33% of Ethereum's, soaring over 18 times from the bear market low. This growth not only reflects the market's recognition of Solana's technological advantages but also showcases its strong ecological recovery ability and market appeal. Whether in payments, DeFi, or the trading frenzy of MEME coins, Solana is proving with real data that "from zero to peak, Only Possible On Solana."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。