Funds can focus on acquiring liquidity tokens and leverage their expertise and networks to scale projects from "1 to 10."

Authors: hedgedhog7, c0xswain, 0xkinnif, 0xlaiyuen, 0xZhouYeMen

Compiled by: Deep Tide TechFlow

Current State of Cryptocurrency Venture Capital

Recently, the performance of meme coins has outpaced many VC-backed projects, leading to criticism from market participants regarding venture capital and its investments. While some criticisms are valid, others lack a deep understanding of the complexities of the private market.

Typically, projects scale their products through multiple rounds of financing before a token generation event (TGE). In return for early high-risk capital investments, VCs can participate in investments at lower token valuations. The resources obtained from strategic capital, including marketing support, token economics consulting, and access to the VC network, are often unavailable to small retail investors. As fundraising progresses and valuations change, the types of participating VCs may also vary, as each VC has different risk preferences and fund sizes.

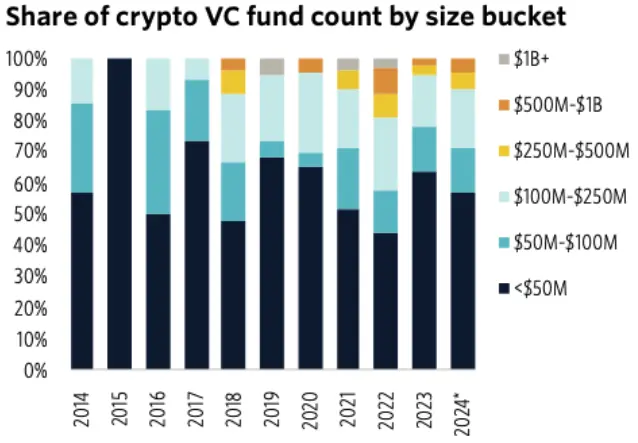

Segmentation of Crypto Venture Capital and Its Scale

Source: PitchBook

Most crypto VCs manage assets of less than $50 million, so they tend to invest in projects that have not yet launched products and have lower valuations. To ensure that the long-term interests of VCs align with those of other stakeholders, tokens obtained through private markets typically have lock-up periods and vesting terms.

The Trade-off Between VC Risks and Returns

During the token vesting period, VCs often see significant unrealized gains, which they may realize through derivatives hedging or over-the-counter (OTC) trades with private buyers. However, they face challenges in implementing hedging strategies due to investment authorizations, capital requirements, and liquidity constraints. Additionally, some VCs lack the execution knowledge and risk management frameworks necessary to manage liquid positions, making effective hedging more difficult.

As a result, OTC trading has become the primary means for VCs to realize profits before a token generation event (TGE). Unlike the information-transparent secondary market, OTC market transactions are conducted privately, making it difficult to uniformly track global trading data. While it is challenging to accurately estimate the size of the OTC market, activity reports from OTC desks can reveal some trends.

STIX is an OTC desk supported by Fisher8 Capital, which has processed over $200 million in trading volume since its establishment at the end of 2023. STIX primarily trades assets of the top 200 altcoins. Over the past year, OTC activity has been frequent, including liquidations (such as the sale of locked $WLD and $SOL by FTX) and direct trades from token foundations (such as $SUI, $AVAX, etc.). We expect this market to continue to grow, primarily due to VCs wanting to realize profits early and the capital needs of projects post-TGE.

OTC Market: Price Discovery in Private Rounds

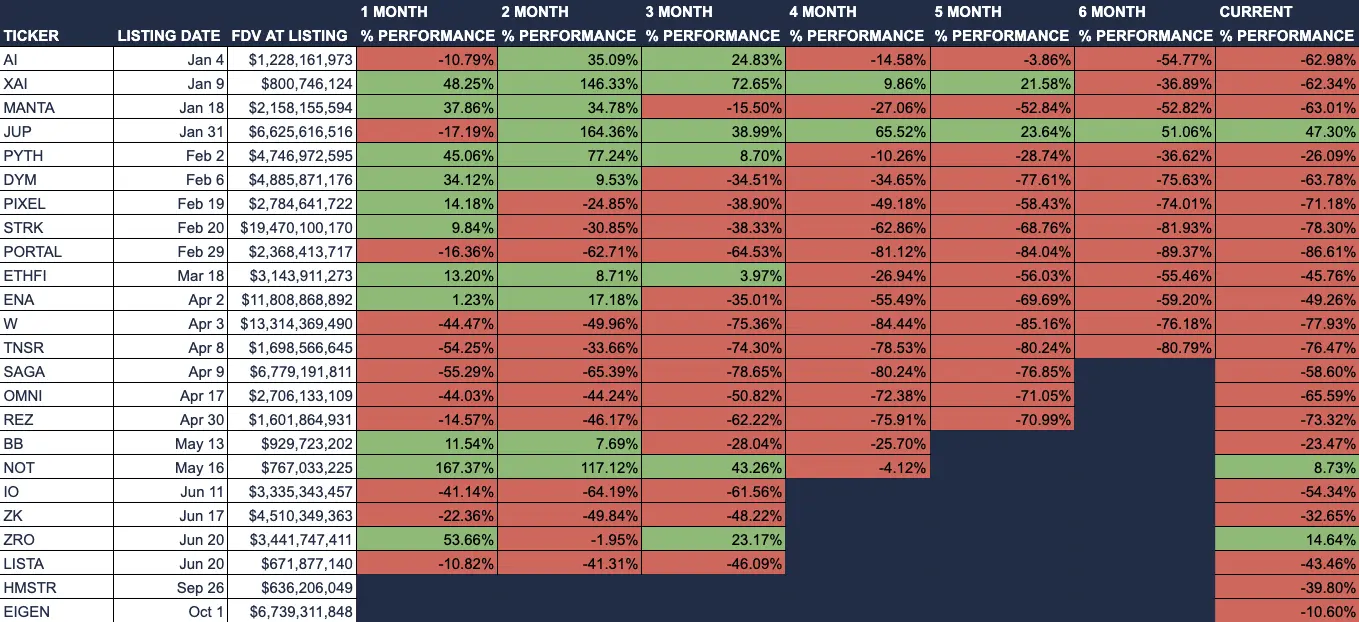

Below are some VC-backed tokens and their performance since the TGE. Most tokens struggle to maintain high valuations three months later, making it difficult for VCs to realize investments at the highest FDV at the start of the vesting period. Such price trends are unfavorable for market participants, as investors and VCs who bought at high prices become sellers together at the end of the vesting period.

Performance of Tokens After Issuance on Binance in 2024

Source: Artemis

The frequent practice of raising valuations during fundraising has led to market returns and optimism being primarily concentrated in the private sector. This situation results in retail investors facing the risk of price declines after a token generation event (TGE). Without sufficient incentives to support projects, public market participants may find themselves in a lose-lose situation. As the market trends toward fair value, both VCs and retail investors will face challenges in the long term.

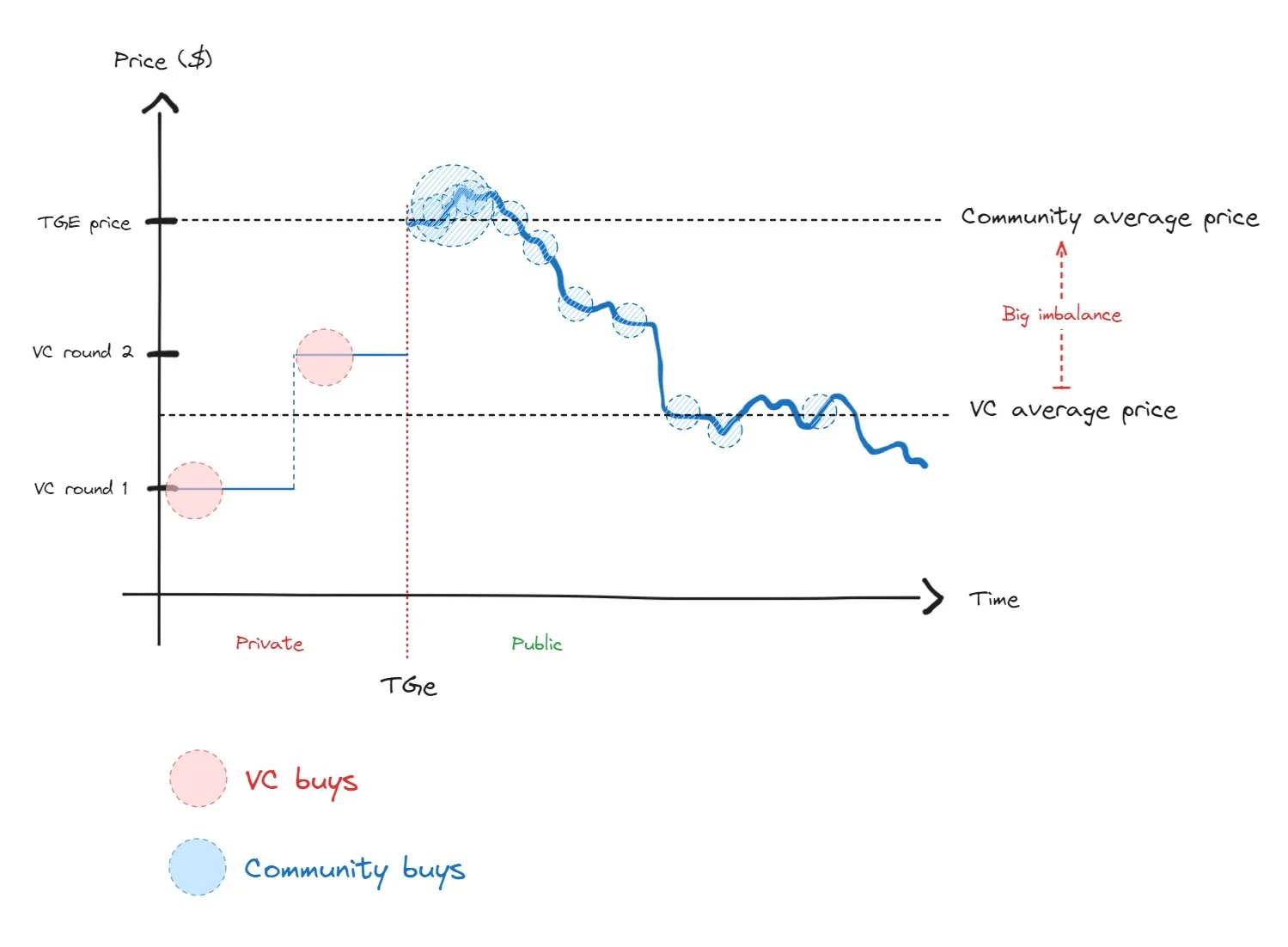

Example of Token Performance

Source: 0xLouis

We believe that leaving room for secondary market appreciation helps build a stronger support base, thereby extending the lifespan of projects. One existing approach is to assist retail investors in price discovery before the TGE through spot and/or pre-market trading. In pre-market trading, tokens on the spot market are treated as a commitment note (i.e., IOU tokens) that can be exchanged for actual assets at the TGE. On the other hand, perpetual contract pre-markets are synthetic markets designed to track asset price movements, often hedged through call options issued by foundations.

Pre-market trading can occur on accessible derivatives platforms such as Aevo, Whales Market, and major centralized exchanges (CEX). However, these products carry liquidity and delta risks. When liquid market buyers purchase tokens before the TGE, the trading platform acts as the counterparty, which may incur significant losses if the tokens perform well post-TGE. Additionally, participants must consider counterparty risks, such as the lack of legal claims to the underlying assets or the exchange's inability to cover losses from profitable pre-market participants.

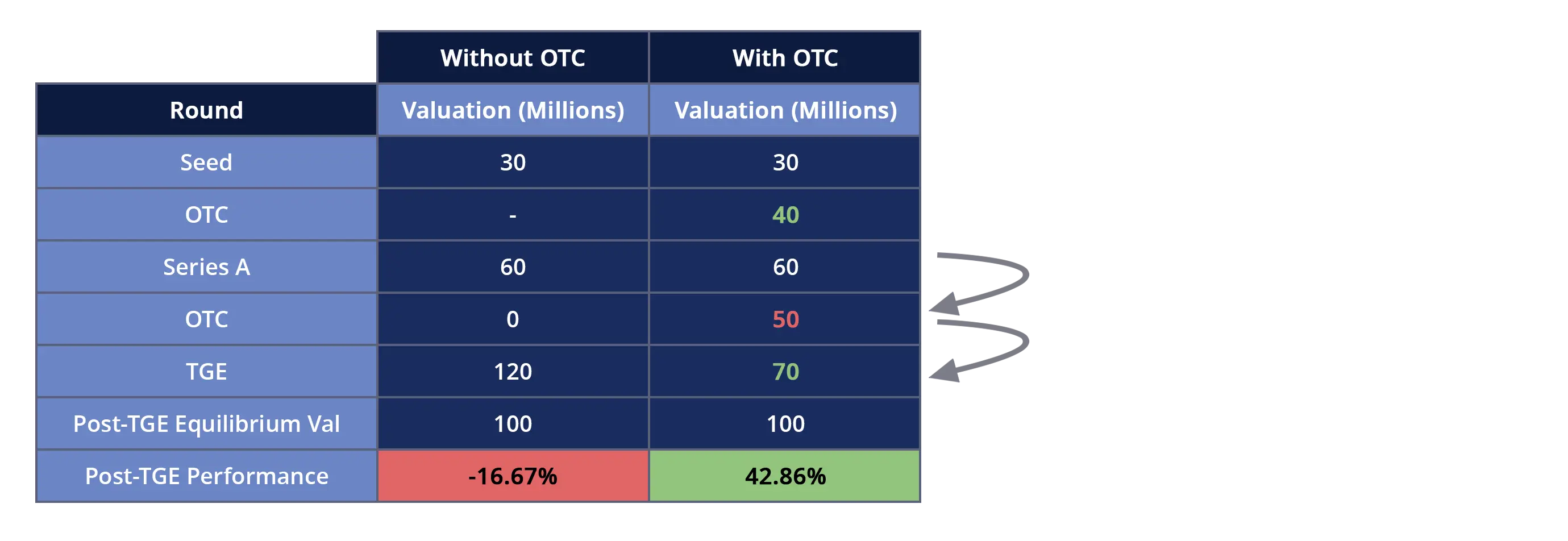

Hypothetical Performance of Tokens Through OTC Between Financing Rounds

Another way to facilitate price appreciation in the secondary market is to allow the private market to experience price declines before the token generation event (TGE). This can reduce the valuation gap between financing rounds. The chart above presents a simplified comparison of two hypothetical projects, illustrating the potential benefits of OTC trading on post-TGE performance. If a down round occurs between Series A and the TGE, existing investors selling their holdings below cost may alert the team that their TGE price should be lower than originally planned. Such adjustments help align project valuations more closely with market expectations.

If the project ultimately succeeds and reaches the expected post-TGE price level, having more profitable token holders from the liquid market can provide more sustainable support for the project.

In-depth Analysis of Crypto OTC Desks

While allowing for more price declines in the private market may seem ideal, this process is not straightforward due to legal barriers and the complexity of transaction types. OTC trading is primarily divided into two types: pure self-directed buying and funding rate arbitrage.

Self-directed buying typically attracts investors sensitive to valuations who seek direct market exposure to the underlying assets. This involves taking over SAFT/SAFE contracts from previous investors or purchasing tokens directly from the project team. When purchasing SAFT/SAFE contracts from early investors, transactions are usually priced at face value or come with a 25-30% premium before the TGE.

Funding rate arbitrage buyers have a weaker relationship with valuations. Their profits depend on the difference between the spot discount and hedging costs, which are influenced by the funding rates of perpetual contracts during the token vesting period. According to STIX reports, these buyers can typically purchase at prices 60-65% lower than spot prices, executing a neutral risk strategy. However, this opportunity has three prerequisites: first, there must be perpetual contracts for the underlying asset; second, the market needs sufficient liquidity to execute trades; and third, the hedging costs (i.e., opportunity costs of collateral) must not exceed the gains from the spot discount. To avoid liquidation when conducting short-term perpetual hedging, these buyers need to prepare substantial collateral, as any short squeeze leading to liquidation could render the trade unprofitable.

Due to the varying types of OTC buyers, large OTC trades announced by token foundations should be approached with caution. These trades may reflect arbitrage opportunities more than genuine long-term demand at current prices.

Challenges in the OTC Market

A complex issue facing OTC trading is the presence of reverse transfer clauses in contracts. These clauses restrict investors from transferring their shares to third parties (i.e., new OTC buyers) without the consent of the founders. According to STIX reports, such clauses exist in 30%-45% of SAFTs.

If the foundation blocks OTC trading, buyers will have to bear additional counterparty risks. In the absence of the legal protections provided by "formalized transactions," buyers have very limited recourse against seller misconduct. This risk is particularly pronounced for smaller funds, as they may not face the reputational risks that larger, well-known VC funds do.

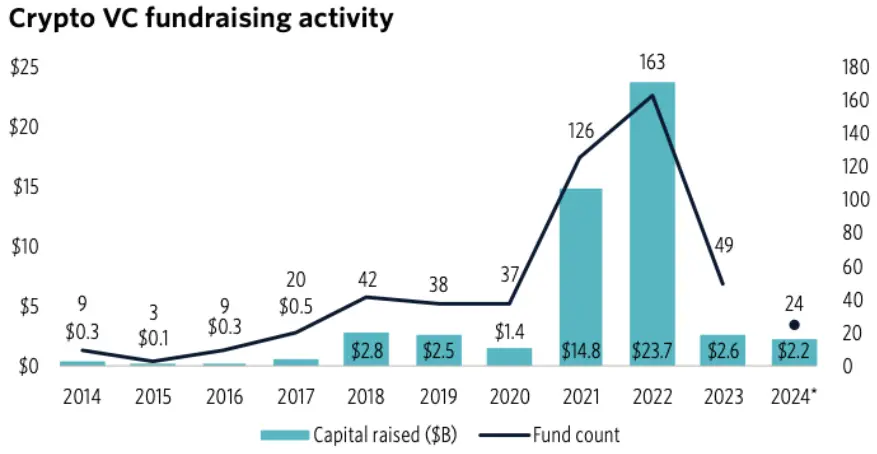

Crypto VC Fundraising Activities

Source: Pitchbook

In 2021 and 2022, fundraising levels reached historic highs, driven by pandemic stimulus policies and the high return promises from previous fundraising. During this period, transactions progressed rapidly due to the abundance of venture capital funds eager to invest. However, the bear market of 2022/2023 brought significant changes. Down rounds became more common, investor risk preferences decreased, and delays in TGEs became the norm. Changes in market dynamics and high-profile collapse events such as Terra, FTX, and 3AC led to stagnation in fund performance and a decrease in capital inflow to crypto venture capital.

PitchBook's report shows that investor interest in venture capital has declined, with the time taken to raise new funds increasing from 6 months in 2021 to 21 months in 2024. Additionally, venture capital funds adopting a 4 + 2 structure in 2021 and 2022 will enter the divestment phase, leading to structural sellers in the secondary market.

Due to the poor performance of crypto venture capital funds, they are beginning to explore alternative strategies, such as investing in liquidity tokens or engaging in OTC trading. Although OTC trading typically involves lock-up periods and vesting terms, its investment horizons are generally shorter than traditional venture capital, making it more suitable for investors focused on investment timelines. If OTC trading becomes more prevalent in the industry, platforms like STIX may benefit from the comprehensive services they offer, addressing the fragmentation in the market.

Future Directions of Venture Capital

The current trend of reduced crypto venture capital funding poses challenges for the industry. One possible way out is to adopt a proactive investment strategy. Instead of seeking the next "from scratch" opportunity, funds can focus on acquiring liquidity tokens and leverage their expertise and networks to scale projects from "1 to 10."

If you are interested in this proactive investment strategy, STIX is actively seeking more venture funds to join. If you are interested, please visit STIX.co or contact taran_ss on X for more information.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。