Now, MicroStrategy's biggest competitors are only those ancient Bitcoin whales.

Written by: 0xTodd

First of all, let's get excited about Bitcoin reaching $98,000!

Undoubtedly, the heroes behind the $40K-$70K range are Bitcoin ETFs, while the heroes behind the $70K-$100K range are MicroStrategy.

Many people now liken MicroStrategy to the BTC version of Luna, which makes me a bit uncomfortable because Bitcoin is my favorite cryptocurrency, while Luna happens to be my least favorite.

I hope this post helps everyone better understand the relationship between MicroStrategy and Bitcoin.

First, a few conclusions at the beginning:

- MicroStrategy is not Luna; it has a much thicker safety cushion.

- MicroStrategy increases its Bitcoin holdings through bonds and stock sales.

- MicroStrategy's next debt repayment date is in 2027, which is still more than 2 years away.

- The only soft threat to MicroStrategy is Bitcoin whales.

MicroStrategy is not Luna; it has a much thicker safety cushion

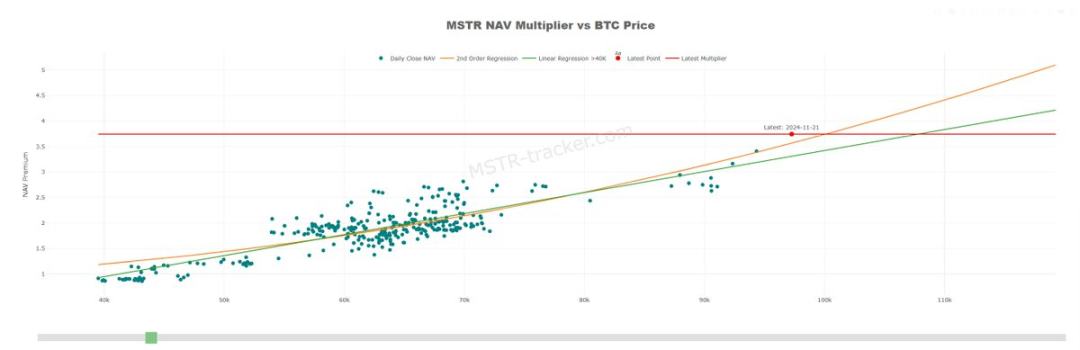

MSTR Net Worth vs Bitcoin Price

MicroStrategy was originally a software company with a lot of unrealized gains and did not want to invest in production anymore, so it began to shift from real to virtual, starting in 2020, using its own funds to buy Bitcoin.

Later, MicroStrategy bought up all the cash on its balance sheet and began to leverage. Its method of leveraging is through over-the-counter (OTC) leverage, determined to borrow money to buy Bitcoin by issuing corporate bonds.

The essential difference between it and Luna is that Luna and UST printed money for each other; essentially, UST is meaningless unanchored printing, barely maintained by a fake 20% interest.

However, MicroStrategy is essentially dollar-cost averaging at the bottom + leverage, which is a standard way of borrowing money to go long, and it has bet in the right direction.

The adoption of Bitcoin far exceeds that of UST, and MicroStrategy's impact on Bitcoin is significantly lower than Luna's impact on UST. It's a simple principle: a daily interest rate of 2% is a Ponzi scheme, while an annual interest rate of 2% is a bank; quantitative changes lead to qualitative changes, and MicroStrategy is not the only factor determining Bitcoin, so MicroStrategy is definitely not Luna.

MicroStrategy increases its Bitcoin holdings through bonds and stock sales

To quickly raise funds, MicroStrategy has issued multiple debts totaling $5.7 billion (for a more intuitive understanding, this is equivalent to 1/15 of Microsoft's debt).

Almost all of this money is used to continuously increase Bitcoin holdings.

Everyone has used on-exchange leverage; you need to use Bitcoin as collateral for the exchange (and other users in the exchange) to lend you money. But OTC leverage is different.

All creditors are only worried about one thing: not being repaid. Without collateral, why are people willing to lend money to MicroStrategy OTC?

MicroStrategy's bond issuance is quite interesting; over the past few years, it has issued a type of convertible debt.

This convertible bond is interesting; let’s take an example:

Bondholders have the right to convert their bonds into MSTR stock, divided into two phases:

1. Initial Phase:

- If the trading price of the bond drops >2%, creditors can exercise their rights to convert the bond into MSTR shares and sell to recoup their investment;

- If the trading price of the bond remains normal or even rises, creditors can sell the bond in the secondary market at any time to recoup their investment.

2. Later Phase: As the bond approaches maturity, the 2% rule no longer applies; bondholders can take cash and walk away or directly convert the bond into MSTR stock.

Let’s analyze this; for creditors, this is generally a risk-free business.

- If Bitcoin drops and MSTR has cash, creditors can get cash back.

- If Bitcoin drops and MSTR has no cash, creditors still have a final safety net, which is to convert to stock and liquidate to recoup their investment;

- If Bitcoin rises, MSTR will rise, and creditors can give up cash to get more stock returns.

In short, this is a business with a high lower limit and a very high upper limit, so MicroStrategy has successfully raised money.

Fortunately, or rather, loyally, MicroStrategy chose Bitcoin.

Bitcoin has not let it down.

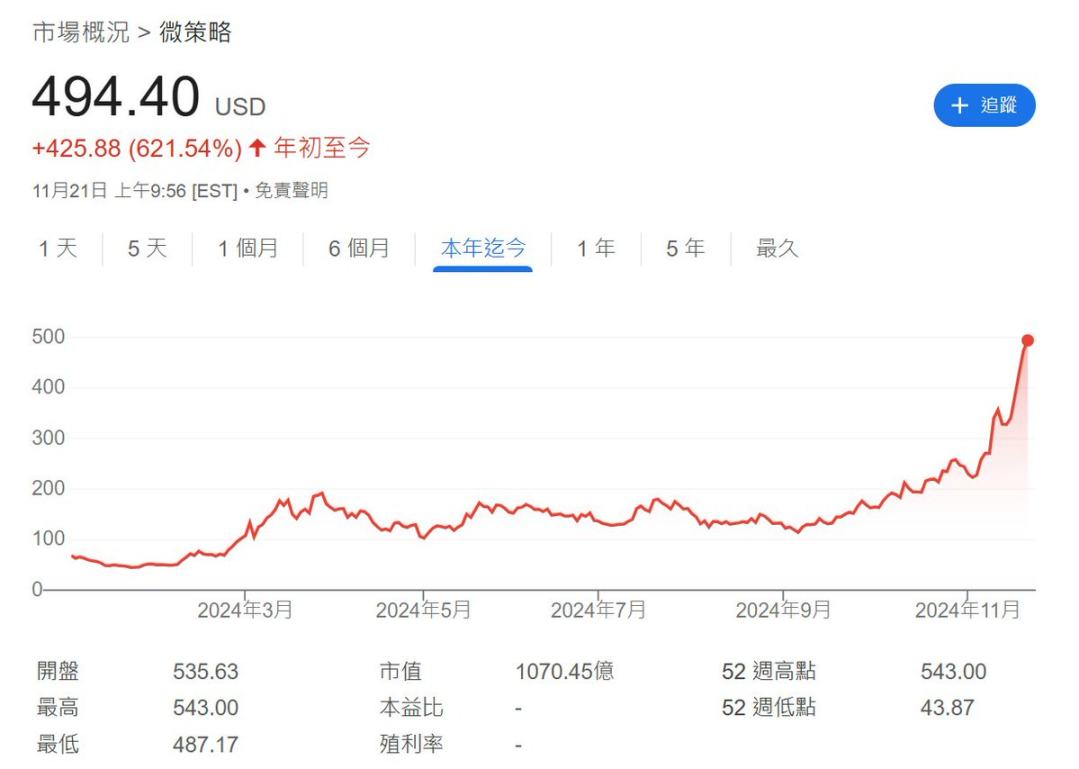

2024 MicroStrategy Stock Price Trend

As Bitcoin continues to rise, the Bitcoin that MicroStrategy accumulated early on has also increased in value. According to the ancient and classic stock principle, the more assets a company has, the higher its market value should be.

Therefore, MicroStrategy's stock price has skyrocketed.

MicroStrategy's daily trading volume has now surpassed that of this year's absolute star, Nvidia. Thus, MicroStrategy now has more options.

Now, MicroStrategy not only relies on issuing bonds but can also directly issue additional shares for sale to raise money.

Unlike many meme coins or Bitcoin developers who do not have minting authority, traditional companies can issue additional shares after following the relevant processes.

Last week, Bitcoin rose from just over $80K to its current $98K, thanks in part to MicroStrategy's efforts. Indeed, MicroStrategy issued additional shares, raising $4.6 billion.

PS: Companies with trading volumes exceeding Nvidia naturally have this liquidity.

Sometimes, you admire a company for making great profits; you need to respect its great courage.

Unlike many companies in the crypto space that sell off for immediate cash, MicroStrategy maintains a grand vision as always. MicroStrategy reinvested all the money from selling these shares back into Bitcoin, pushing Bitcoin to $98K.

By now, you should have understood MicroStrategy's magic:

Buy Bitcoin → Stock price rises → Borrow to buy more Bitcoin → Bitcoin rises → Stock price further rises → Borrow more debt → Buy more Bitcoin → Stock price continues to rise → Issue more shares for sale to raise money → Buy more Bitcoin → Stock price continues to rise…

Presented by the great magician MicroStrategy.

MicroStrategy's next debt repayment date is in 2027; we still have at least 3 years

As with any magician, there comes a time when the magic is revealed.

Many MSTR shorts believe we have now reached the standard left side, even suspecting it has reached the Luna moment.

But is that really the case?

According to recent statistics, MicroStrategy's average cost for Bitcoin is $49,874, meaning it is currently close to a 100% unrealized gain, which is a super thick safety cushion.

Let’s assume the worst-case scenario; even if Bitcoin were to drop 75% (which is almost impossible), down to $25,000, what would happen?

MicroStrategy borrowed through OTC leverage, which has no liquidation mechanism. Angry creditors can at most convert their bonds into MSTR stock at the specified time and then angrily dump it into the market.

Even if MSTR were to drop to zero, it still does not need to be forced to sell these Bitcoins because the earliest debt MicroStrategy borrowed needs to be repaid by February 2027.

Mark my words, this is not 2025, nor 2026; it is Tom's 2027.

This means that we have to wait until February 2027, and if Bitcoin crashes, if no one wants MicroStrategy's stock anymore, then MicroStrategy will only need to sell a portion of its Bitcoin in February.

All things considered, there are still more than 2 years to continue the music and dance.

This is the magic of OTC leverage.

You might ask, could MicroStrategy be forced to sell Bitcoin due to interest?

The answer is still no.

Due to MicroStrategy's convertible bonds, creditors generally have a risk-free investment, so its interest rates are quite low. For example, the bond maturing in February 2027 has an interest rate of 0%.

Creditors are purely interested in MSTR stock.

The subsequent debts it issued also have interest rates of 0.625%, 0.825%, and only one is at 2.25%, which has a minimal impact, so there is no need to worry about its interest.

MicroStrategy's Main Bond Interest Rates, source: Bitmex

MicroStrategy's only soft threat is Bitcoin whales

At this point, MicroStrategy and Bitcoin have become mutually causal.

More companies are preparing to start learning from the great maneuvering of Bitcoin's David Copperfield (Saylor).

For example, a listed Bitcoin mining company, MARA, has just issued $1 billion in convertible bonds specifically to buy the dip.

So I think shorts should proceed with caution; if more people start to emulate MicroStrategy, Bitcoin's momentum will run wild, as there is a vacuum above.

Thus, MicroStrategy's biggest competitors now are only those ancient Bitcoin whales.

As many have predicted before, the Bitcoin in retail hands has already been handed over; after all, there are too many opportunities, such as the meme trend; I refuse to believe everyone is empty-handed.

So in the market, there are only these whales; as long as these whales do not move, this momentum is hard to stop. If we are a bit luckier, if the whales form some subtle understanding with MicroStrategy, it will be enough to push Bitcoin towards a greater future.

This is also a major difference between Bitcoin and Ethereum: Satoshi theoretically owns nearly 1 million early-mined Bitcoins but has been silent to this day; while the Ethereum Foundation, for some reason, sometimes just wants to sell 100 ETH to test liquidity.

As of the day of writing, MicroStrategy has achieved an unrealized gain of $15 billion, relying on loyalty and faith.

Since it is making money, it will increase its investment; it cannot turn back, and more people will follow suit. According to the current momentum, $170K is the mid-term target for Bitcoin (not financial advice).

Of course, we are used to seeing conspiracy groups design schemes every day in memes, and occasionally witnessing a truly top-level grand scheme is genuinely admirable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。