Author: Jaleel Jia Liu, BlockBeats

"If I only look at altcoins and not Bitcoin, I would think it's 312." This is a lament from a community member.

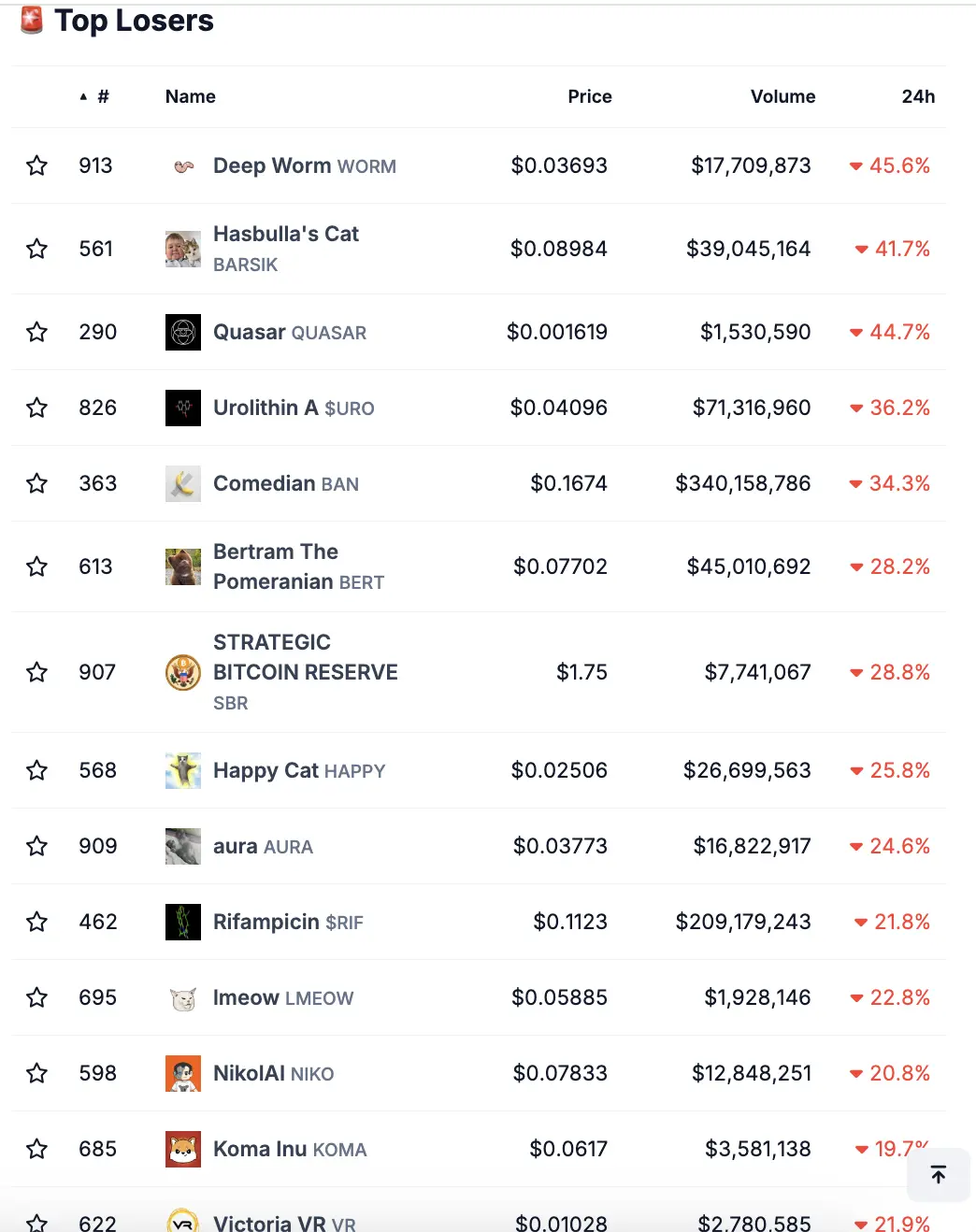

This sentiment is not unfounded. On-chain data presents a grim picture: the red downward trend ruthlessly devours the community's hopes, leaving a trail of despair. Taking the BIO ecosystem as an example, $URO has plummeted by 36.2%, and $RIF is not far behind, dropping by 21.8%.

The Flood of Profit-Taking

Since Trump confirmed his return to the White House, the altcoin season has surged like a tsunami, with wild price increases and fierce PVP. The waves have sifted through the sand, creating a new generation of wealthy individuals in the crypto space.

For instance, a smart money address "GcYC1…quyt6" built a position in $RIF at a low point in late September before the DeSci Meme narrative took off, turning an initial investment of $14,000 into a profit of $1.05 million, achieving a return of 7400%. This is a myth that no trading market would dare to imagine, only possible in the crypto world.

Another example, according to Lookonchain monitoring data, within just 20 days, a trader bought URO for $800 and ultimately made a profit of $572,000; he also purchased RIF for $300, earning $957,000. This means he turned an initial capital of $1,100 into a position worth $1.62 million, achieving astonishing growth of 3503 times and 714 times, respectively.

Such examples are countless. These profits were gradually sold off during the altcoin rally, leading to a crash in altcoins, ushering in today's "altcoin 312."

And where will these profits go? Today's market has provided us with an answer.

As altcoins collapsed en masse, Bitcoin's price broke $97,000, reaching a new high. Funds flowed out of the altcoin market, back to trading platforms, and ultimately into Bitcoin. Bitcoin once again reasserted itself as the stabilizing force in this market through its price.

The End of Altcoins is Bitcoin

At this moment, I am reminded of the story of SBF wanting to keep BTC below $20,000.

In the trial regarding the FTX incident, Caroline Ellison, CEO of Alameda Research and SBF's former girlfriend, testified that SBF had instructed Alameda to continuously sell Bitcoin if it exceeded $20,000, attempting to keep the price of Bitcoin below $20,000.

As for the reasons behind this, although they were not mentioned in court, insiders in the community provided an answer: "The common practice of market makers on trading platforms is to pump up Crypto (mainly targeting a few Top 20 coins like ETH) while suppressing the Crypto/BTC exchange rate. This is not just FTX's approach; other trading platforms do the same."

This strategy can gradually erode people's confidence in Bitcoin, attracting all funds to Crypto. Once users' trading habits are cultivated, they can smoothly offload massive amounts of junk coins to lower-tier players.

After all, after getting used to the explosive trends and overnight gains in the crypto space, how many people have the patience to hold onto Bitcoin, even when it is almost certain to double?

Today, the principle remains the same. The unique fervor and impatience of crypto enthusiasts have never changed. Those truly large capital players have long understood the value of Bitcoin, exchanging junk altcoins for the Bitcoin in your hands, strategically positioning themselves for long-term gains.

The best example is MicroStrategy. As of the time of writing on November 21, MicroStrategy's Bitcoin holdings have reached a new all-time high: 331,200 Bitcoins, with an average purchase price of $49,874. They are easily profiting more than double their cost price.

Not to mention Wall Street giants like BlackRock; if they started buying Bitcoin in advance while applying for a Bitcoin ETF, their costs would likely be controlled between $20,000 and $60,000, and no one knows how many chips they have accumulated in the process.

Perhaps, for ordinary investors, the wisest choice is: hold onto Bitcoin, and have fewer fantasies of overnight wealth. Use a large position to invest in Bitcoin, and only a small portion of funds for "gambling." Do you really think you are smarter than Wall Street elites like BlackRock and MicroStrategy?

Finally, let me conclude with a story I saw on Twitter today:

"When Bitcoin was at $100,000, looking at the altcoin in your hand that was still down 30%, you felt mixed emotions as you retweeted the news of Bitcoin breaking $100,000. Your friends and family all liked your post, saying you must have made a fortune by entering early, and you replied with tears in your eyes: 'Not much profit, just a small gain.'"

I hope this is not a reflection of most of us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。