Bitcoin national reserves may be established, SEC Chairman to resign, SOL ETF progress, Trump Media Group enters crypto payments… Overnight, favorable policies have elevated the crypto fundamentals to new highs!

Written by: Alex Liu, Foresight News

In the early hours of November 22, as the Asian time zone was quiet, U.S. media broke several major positive news for the crypto industry, further strengthening an already hot market — SOL approached new highs, and Bitcoin neared the important psychological threshold of $100,000.

What are the specific positive news? Is the impact sustainable? Please read on.

Trump's proposed crypto advisory committee may establish a committed Bitcoin national reserve

According to Reuters, Trump's "Crypto Advisory Committee" is expected to establish a committed Bitcoin reserve.

Two insiders indicated that the cryptocurrency committee may belong to the White House National Economic Council, which is responsible for coordinating and implementing presidential economic policies, or it could be a separate White House agency. Leaders from Ripple, Kraken, a16z, Paradigm, and other cryptocurrency companies are vying for seats on the council.

In addition to the cryptocurrency advisory committee, Trump's transition team has proposed a new White House role called "Crypto Czar," which could be the first role in the White House specifically focused on cryptocurrency.

The proposal to establish a Bitcoin national reserve commits to purchasing over a million Bitcoins within a few years, and if the U.S. takes the lead, it will inevitably prompt other countries to follow suit. Therefore, if this can be realized, Bitcoin's price is likely to see exponential growth.

Trump hints at support for the cryptocurrency agenda, SEC Chairman Gary Gensler to resign

According to a statement from the U.S. Securities and Exchange Commission (SEC), its chairman Gary Gensler plans to resign on January 20, 2025. Gensler stated that working with SEC colleagues has been "a lifetime honor."

After taking enforcement actions against major industry players like Coinbase, Binance, and Kraken, Gensler has become a "public enemy" in the crypto industry.

Gensler announced his resignation after President-elect Donald Trump promised to fire him if elected. Trump's presidential term will begin on January 20.

The potential candidates for the SEC chair are all supportive of cryptocurrencies, which means the regulatory environment for the industry will significantly improve afterward.

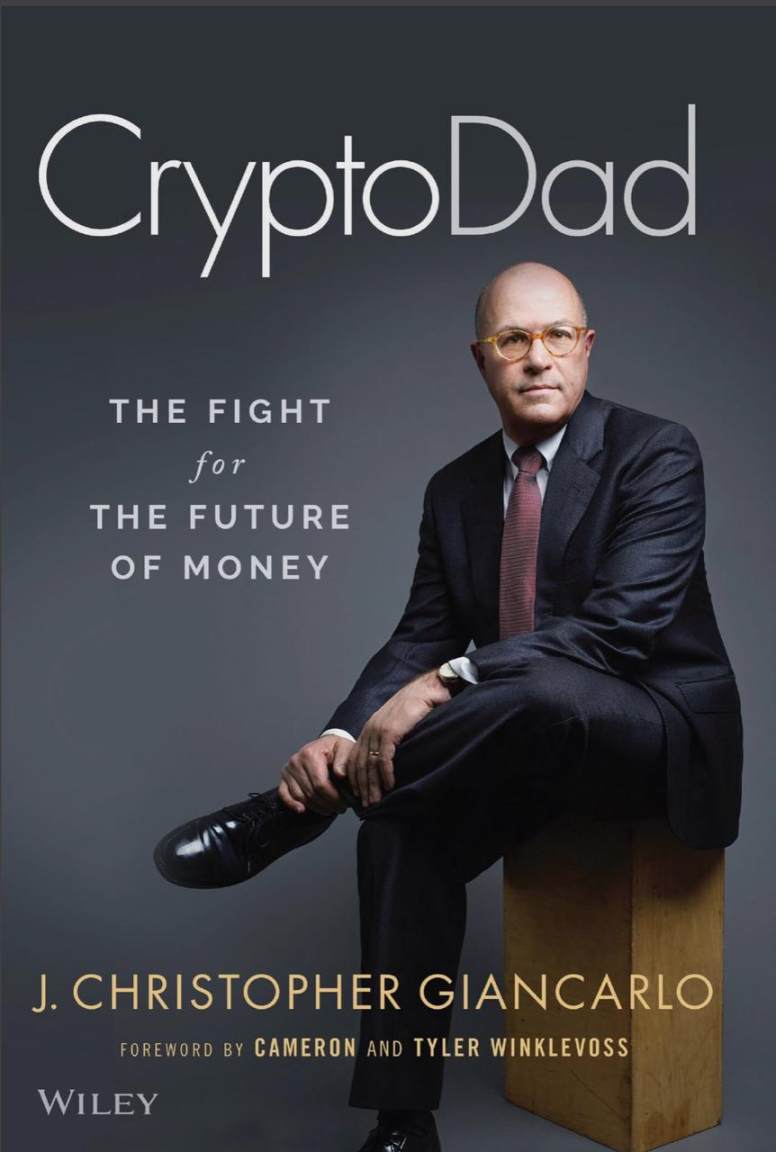

Fox: Former CFTC Chairman Chris Giancarlo is the top contender for the White House "Crypto Czar"

According to Fox Business Report, Chris Giancarlo, often referred to as the "father of cryptocurrency" for his open attitude towards the industry, is the frontrunner for a position in the White House dedicated to cryptocurrency policy.

If Giancarlo secures this position, he will become the first "Crypto Czar." The term "Czar" is a political term used to describe a senior official overseeing specific policy initiatives. Bloomberg reported on Wednesday that President-elect Donald Trump's team is considering establishing this position, which would also be the first of its kind in the White House.

From March 2017 to April 2019, Giancarlo led the U.S. Commodity Futures Trading Commission (CFTC), overseeing the launch of the first Bitcoin futures products. He later published a book on Bitcoin derivatives titled "CryptoDad: Fighting for the Future of Money." The former CFTC chairman also co-founded the Digital Dollar Project, a forum exploring digital innovations, including central bank digital currencies, and in May, he joined the board of Paxos (a stablecoin company).

What other reasons could there be to deny that the industry will welcome the most favorable policy environment in four years, with someone who helped launch Bitcoin futures products now serving on the board of a well-known stablecoin company?

Trump's media company files trademark application for crypto payment service "TruthFi"

According to The New York Times, the Trump Media & Technology Group, in which President-elect Trump holds a 53% stake, has submitted a trademark application for "TruthFi," which will be used for trading digital assets and other payment processing services. The document also mentions services for "downloadable computer software for use as a digital wallet."

On the same day the application was submitted, reports emerged that the Trump Media & Technology Group is in "high-level negotiations" to acquire Bakkt, a cryptocurrency platform that provides licensed and regulated digital asset custody and trading.

This year, Trump has positioned himself as a candidate supportive of cryptocurrencies, and shares of Trump Media & Technology Group (stock code DJT) rose 4% due to Thursday's news. So far this year, the company's stock price has increased by 78%, with a market capitalization nearing $7 billion.

Is the U.S. president personally entering the crypto exchange and launching crypto payment services? If realized, the industry will further "enter the mainstream" and flourish.

SEC is "engaging" with Solana ETF applicants

Fox News reporter Eleanor Terrett cited two insiders stating that the SOL ETF is making progress, and the SEC is "engaging" with the S-1 application. An insider from an ETF issuer confirmed to the media that the SEC has begun discussions with them regarding this matter.

The SEC's proactive approach undoubtedly validates the view of the "policy fundamentals" changing mentioned above.

Terrett noted that these issuers recently expressed that "the involvement of staff, along with the incoming pro-crypto White House government, has rekindled optimism about the possibility of the Solana ETF being approved in 2025." After Trump's inauguration in 2025, will we also see Dogecoin ETF, SUI ETF, and so on?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。