Written by: @CumberlandLabs

Compiled by: Blockchain in Plain Language

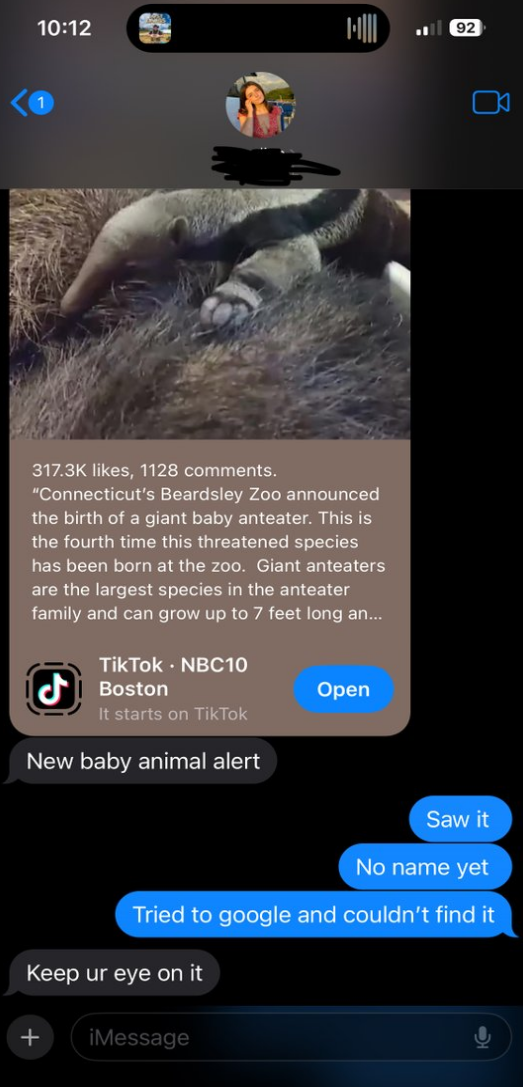

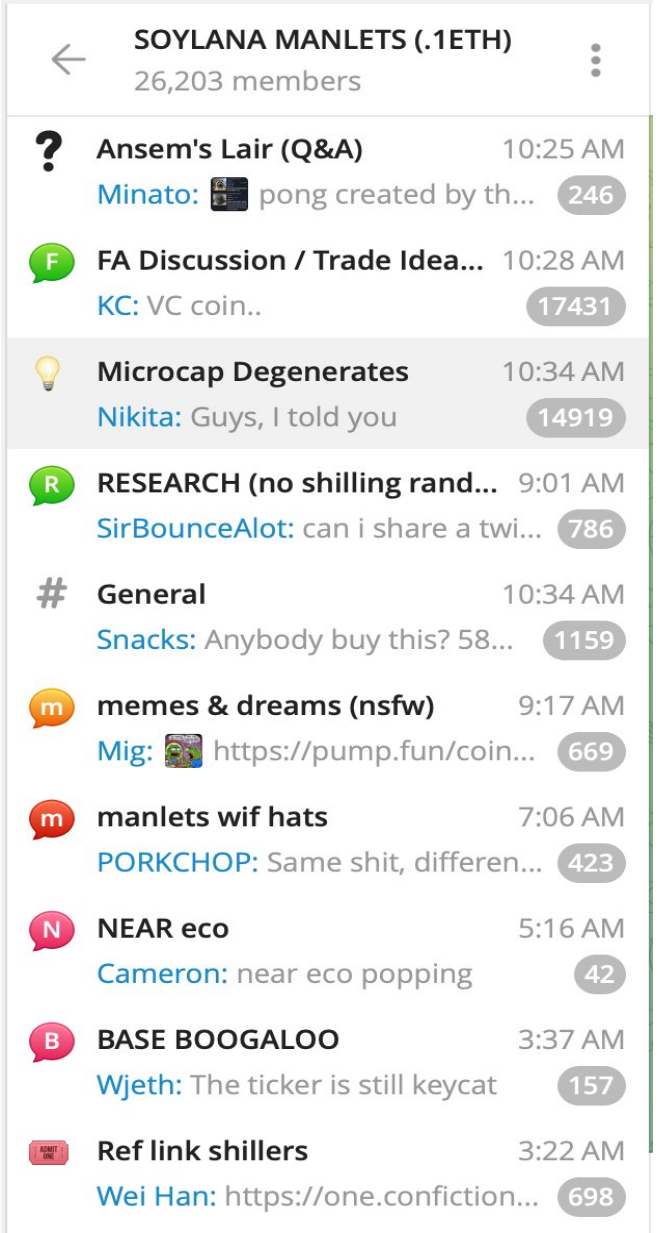

After weeks of lurking on Discord, observing Telegram groups, browsing Twitter, and communicating with several research analysts and traders, I have gained a comprehensive understanding of various perspectives on memecoins—from algorithmic trading professionals to my wife's brother. Throughout this process, my research covered everything from how to improve the UI/UX of limit orders and complex order execution to asking friends if they think "Moo Deng" is really cute or if they have heard of "Peanut the Squirrel."

In-depth research from Discord

What you will see next is a result based on field research, summarizing existing public data surrounding this field and including anonymous feedback on this narrative. We at Cumberland Labs believe that this narrative is both compelling and will continue for many years to come. On the surface, it may seem like a shallow and overly simplistic narrative, but in reality, it represents a shift in user behavior—whether these token traders realize it or not, this shift will drive billions of dollars of idle funds onto the blockchain.

In-depth research from my wife

1. What is Memecoin?

The story of memecoins is an evolving journey. From the birth of DOGE as a parody of Bitcoin that caught Elon Musk's attention, to SHIB and PEPE igniting the imagination of retail investors, to the current phenomenon of fair issuance based on Solana—we have witnessed the continuous self-reinvention of this market.

The first tweet related to Doge posted by @elonmusk

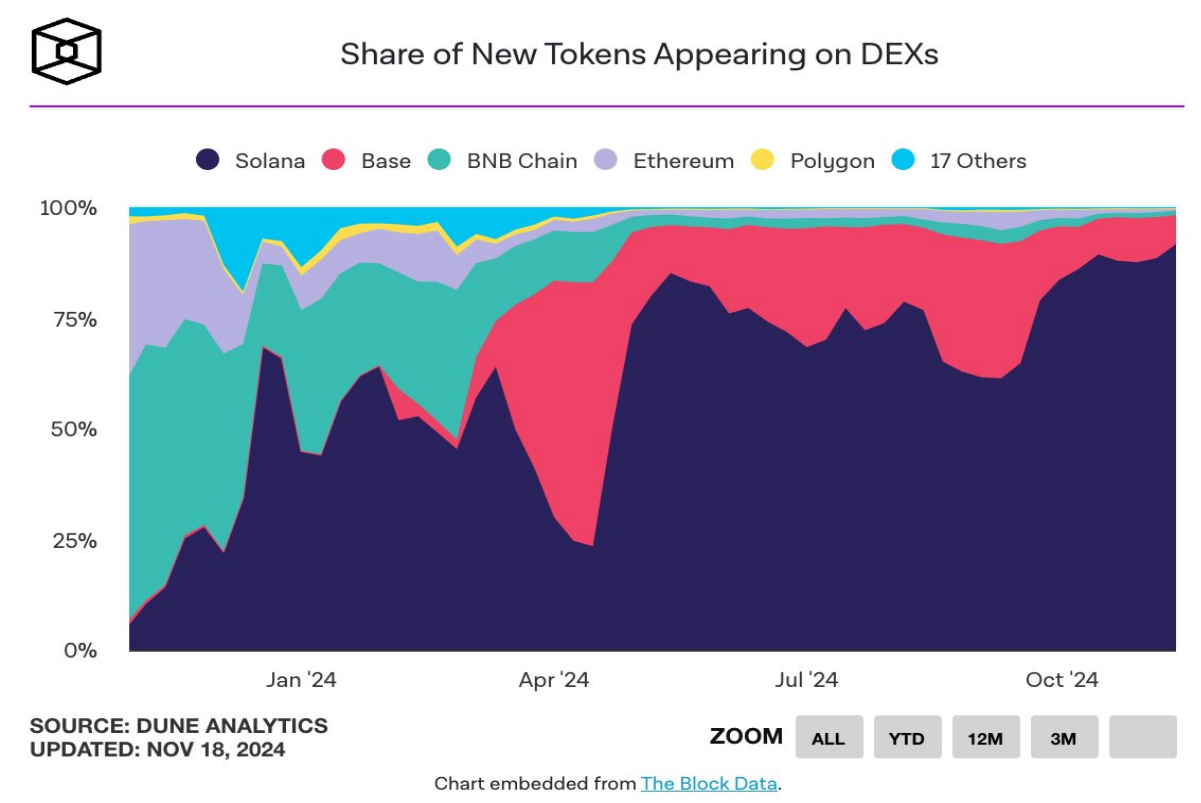

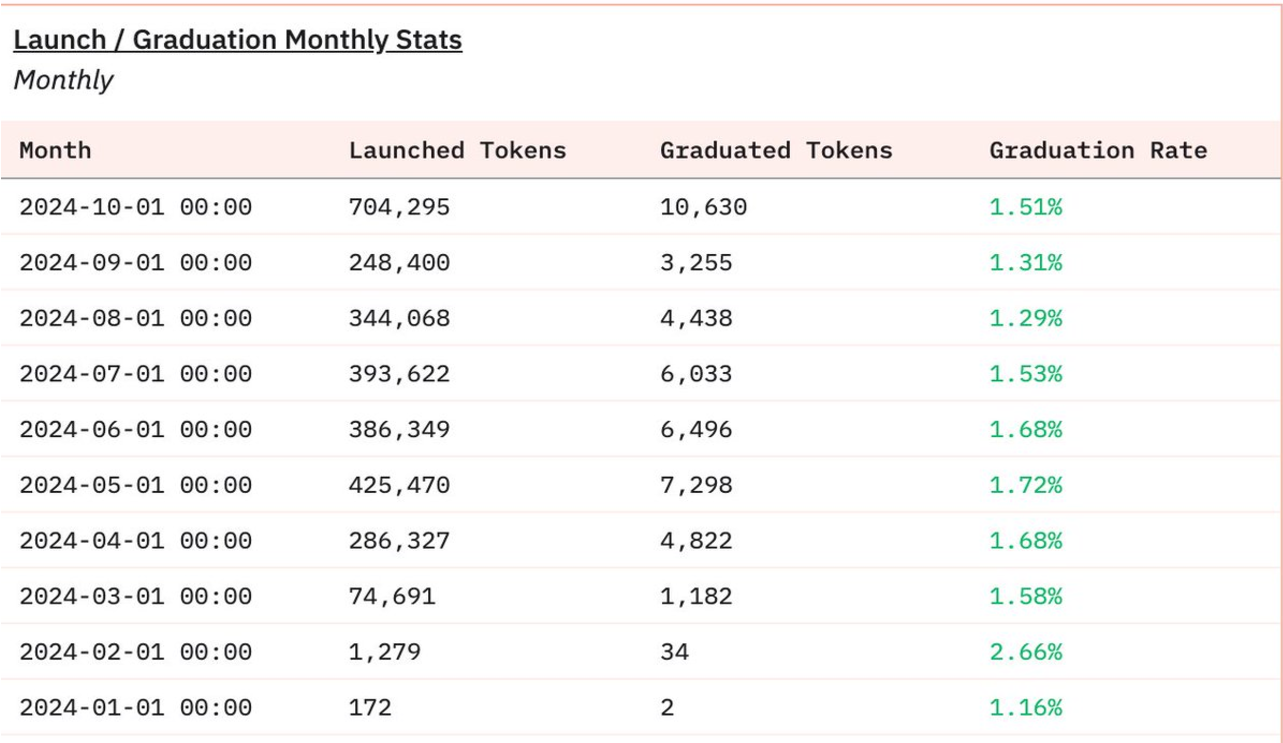

Today, Solana dominates this space, supporting 89% of new token issuances. Just last week, 181,000 new tokens were launched on decentralized exchanges (DEX). This is not just a growth in numbers but an increase in accessibility. Platforms like pump.fun have made token issuance accessible to everyone, but the success rate reveals an important fact: less than 2% of tokens can enter Raydium, and only 0.0045% of tokens maintain a market cap of over one million dollars.

Source: @TheBlock__

So, what is the difference between memecoins and "shitcoins"? The key lies in the core characteristics of success:

The most successful tokens—from DOGE to Moo Deng—share some common elements: strong meme propagation potential, attention-grabbing catalysts, and high community engagement. DOGE stood out due to Elon Musk's attention and first-mover advantage, while Moo Deng sparked imagination through viral social media influence. But most importantly, they built communities that transformed ordinary bystanders into passionate supporters.

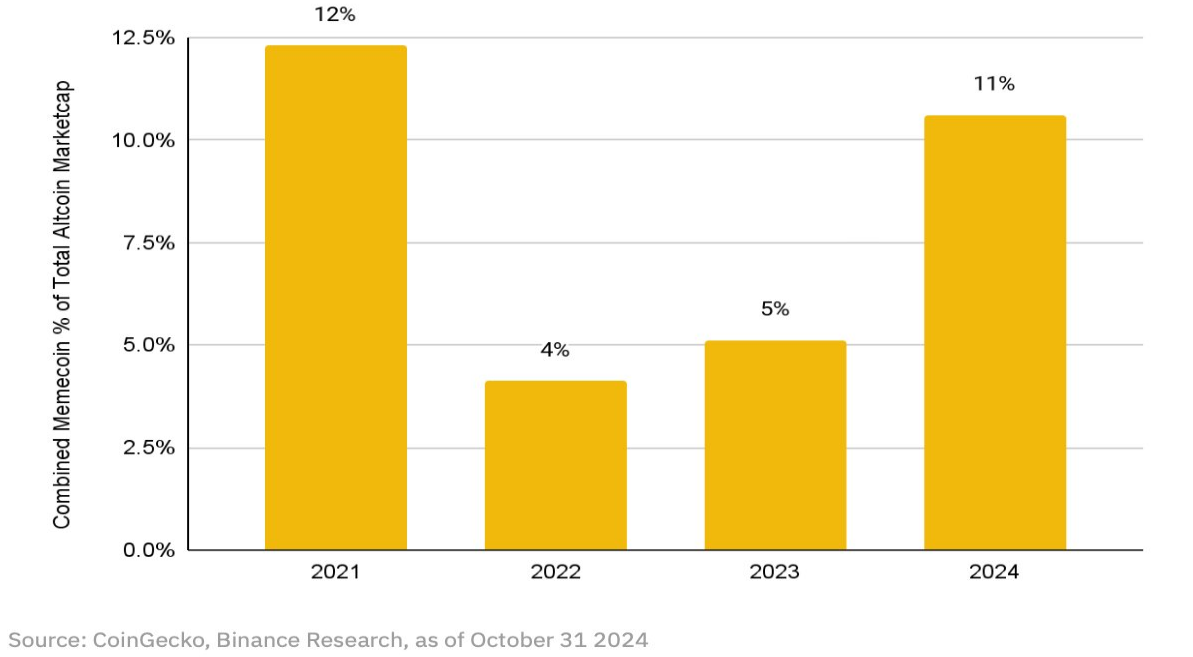

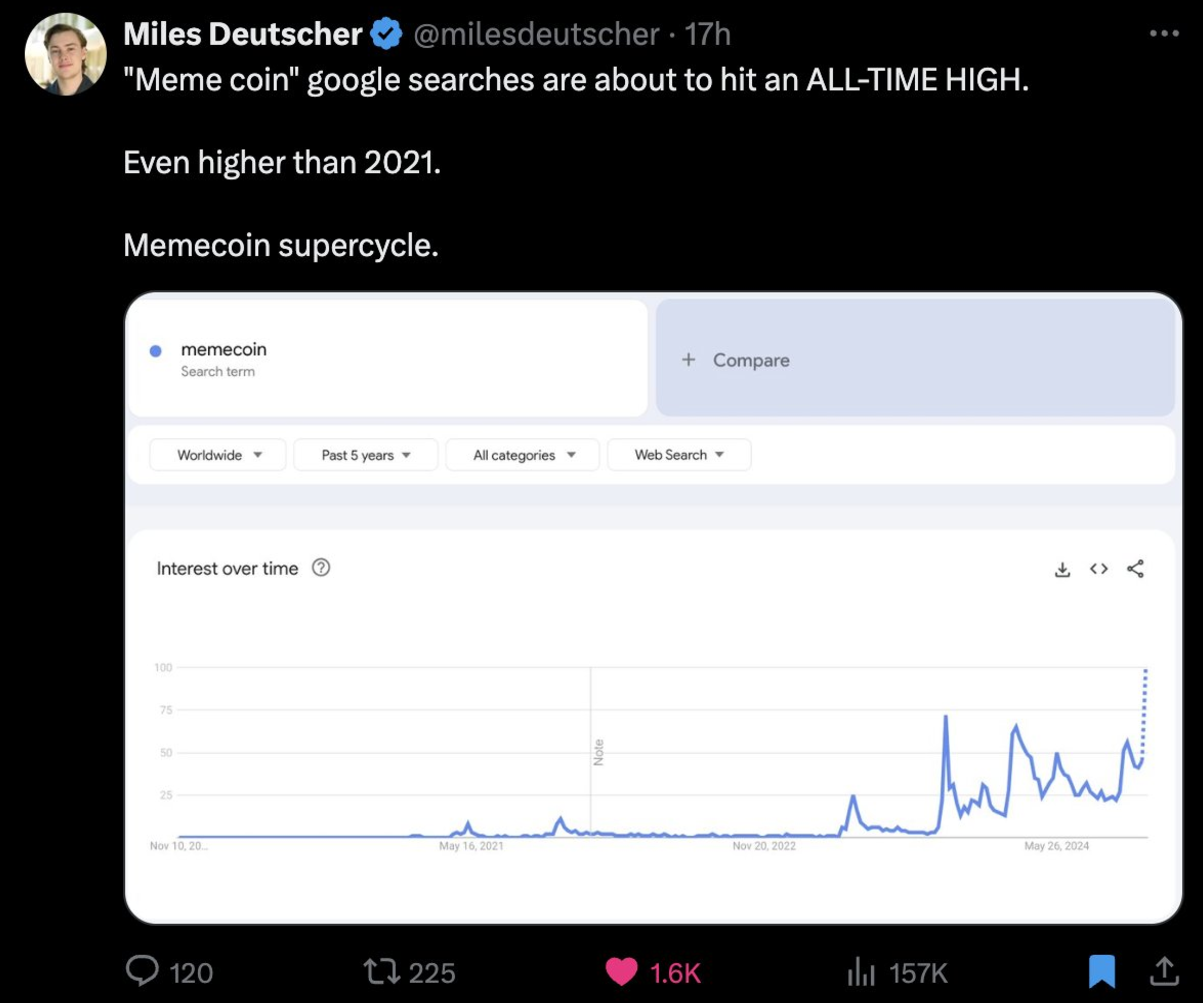

2. Data Doesn't Lie

The recent growth of memecoins is far from a flash in the pan. According to data from BN Research, since 2022, the market cap of memecoins as a percentage of non-BTC/ETH/stablecoin assets has skyrocketed from 4% to 11% in just two years, nearly tripling its market share and achieving significant growth in a competitive market.

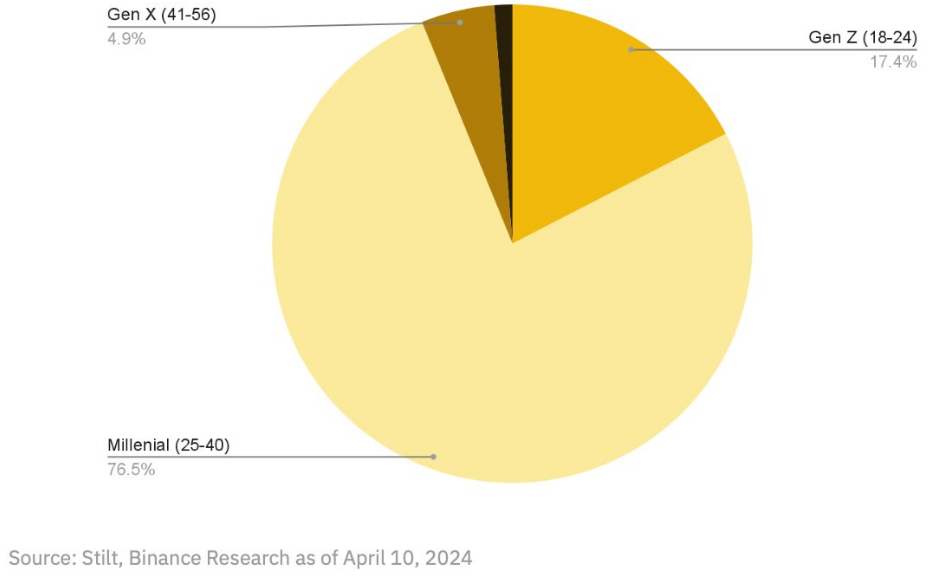

Millennials and Gen Z now account for 94% of digital asset buyers. This is not just a demographic coincidence but a response from an entire generation to their environment. They are not just buying tokens; they are rejecting the traditional paths to financial security pursued by their parents' generation. On the surface, memecoins may seem like a joke, but for these traders, they represent a real opportunity to break free from a traditional system that has consistently disappointed them.

Andrew Edgecliffe-Johnson summed it up best: "It's hard to blame people for wanting to get rich quick when they've lost faith in slowly getting rich." This confidence has been eroding for years. In 1963, buying a house required an average of 4.4 years of salary, while now it takes 8.1 years. Coupled with soaring inflation in recent years, with rates reaching 7% in 2021, it is clear that the younger generation is seeking alternative financial opportunities.

This trend is not just about chasing a quick fortune (though that element is certainly present). More importantly, they are expressing their protest against a system they have already lost trust in through their own funds. The memecoin phenomenon is a high-risk, high-reward game, and it is precisely this characteristic that strongly attracts today's traders. This is not just a game; it is a vote of distrust against the old ways of accumulating wealth.

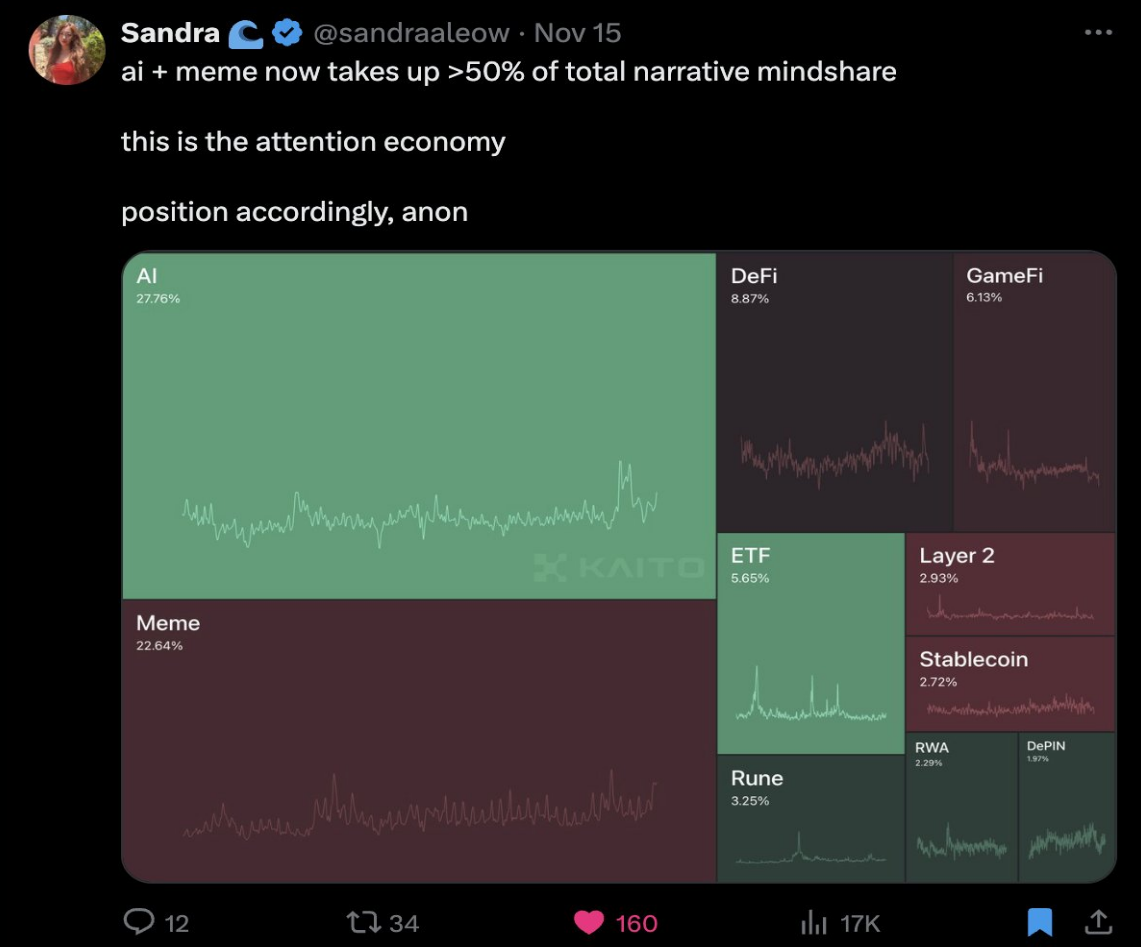

@sandraaleow

3. Interpreting the Memecoin Phenomenon

The speed of evolution in this market is astonishing. Our research shows that $BOME reached a market cap of $1 billion in just 2 days, $PNUT took 14 days, $WIF took 104 days, SHIB took 279 days, while DOGE took a full eight years. Capturing and maintaining traders' attention is key to success.

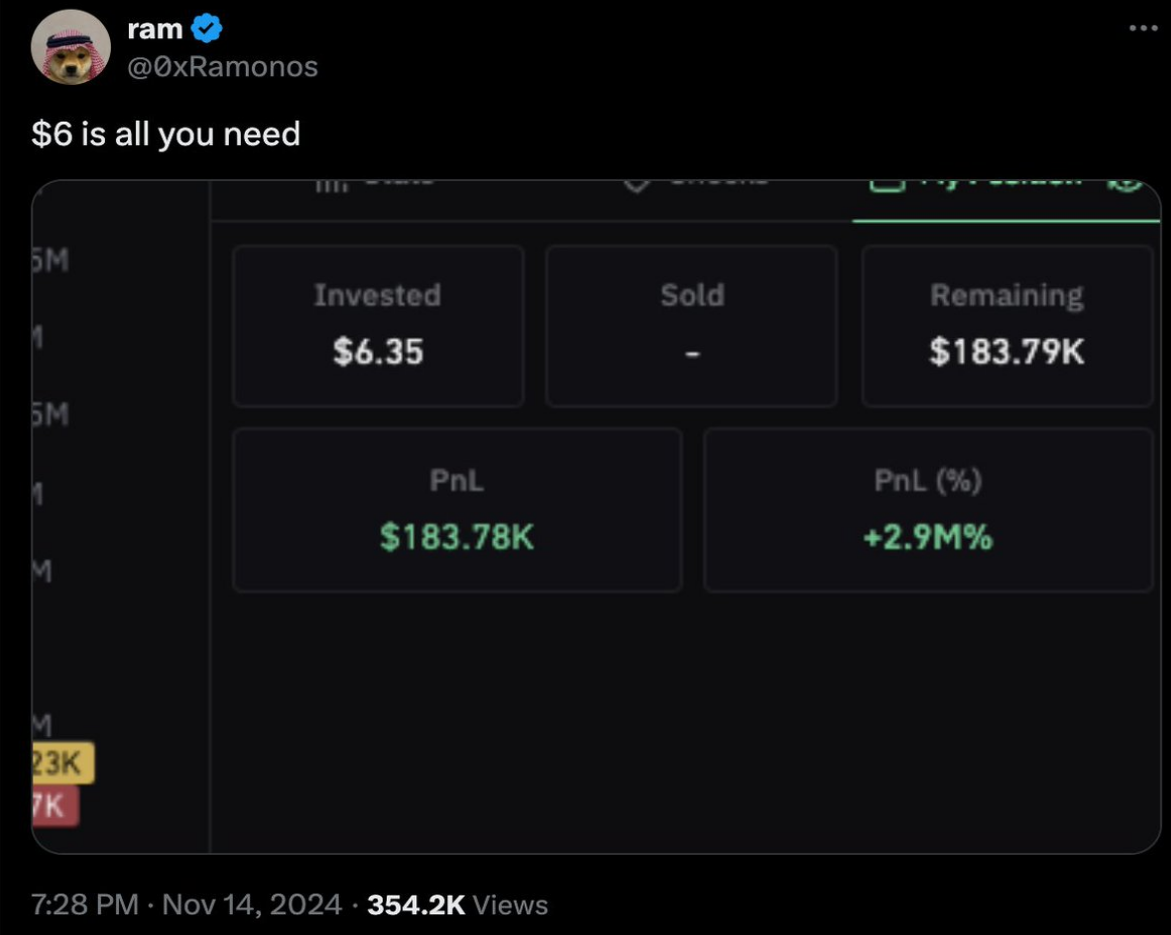

Screenshots of Phantom wallets displayed on X platform show returns of 633 times and +10,520%, highlighting a broader theme: accessibility and fairness have become central. Looking back at the ICO boom of 2017, one of its notable features was widespread participation—no fundraising rounds, no VC allocations, and no complex unlocking plans.

@0xRamonos

Today's memecoin traders are pushing back against what a Discord user referred to as the "VC exit liquidity simulator" in modern token issuance. A new memecoin with no team allocation and market-driven pricing has reintroduced a fair competitive environment reminiscent of the early cryptocurrency era, where community and network effects are key.

@paulemmanuelng

When viewing the memecoin craze as a fair competitive opportunity free from concerns about VC unlocks and token unlocks, it makes more sense. People are tired of being treated as exit liquidity tools, and fair issuance platforms like pump.fun allow anyone to easily launch tokens, giving everyone a chance to participate.

4. Achieving Escape Velocity—Anatomy of 100x

What distinguishes the successful from the thousands of failed issuances? The numbers are very clear—less than 2% of tokens from pump.fun make it to Raydium, and only a minuscule 0.0045% maintain a market cap of over one million dollars. Yet, some tokens have achieved what we call "escape velocity," breaking free from the gravitational pull of anonymity.

Success stories follow observable patterns. The most powerful tokens excel in at least one of the following seven key areas: meme potential, attention catalysts, innovation, humor, community, distribution, and development. Look at any successful memecoin, and you will find these elements at play, with attention catalysts, meme potential, community, and distribution being the most critical factors.

Source: https://dune.com/queries/4048901/6817482/

Take Moo Deng as an example—its success is no accident. The project attracted significant attention through its social media presence on Twitter, Telegram, and TikTok. Its cute and meme-friendly character continuously appeared in feeds, creating a viral cycle of recognition and sharing. While it may not be particularly humorous, its strong attention catalysts and distribution strategies generated sustained momentum.

@himgajria

The role of Solana in this evolution cannot be overlooked. The network now supports 89% of new token issuances, processing approximately 41 million non-voting transactions. This dominance is not coincidental—Solana's low fees and fast transaction times create an environment conducive to rapid experimentation, even if most experiments fail.

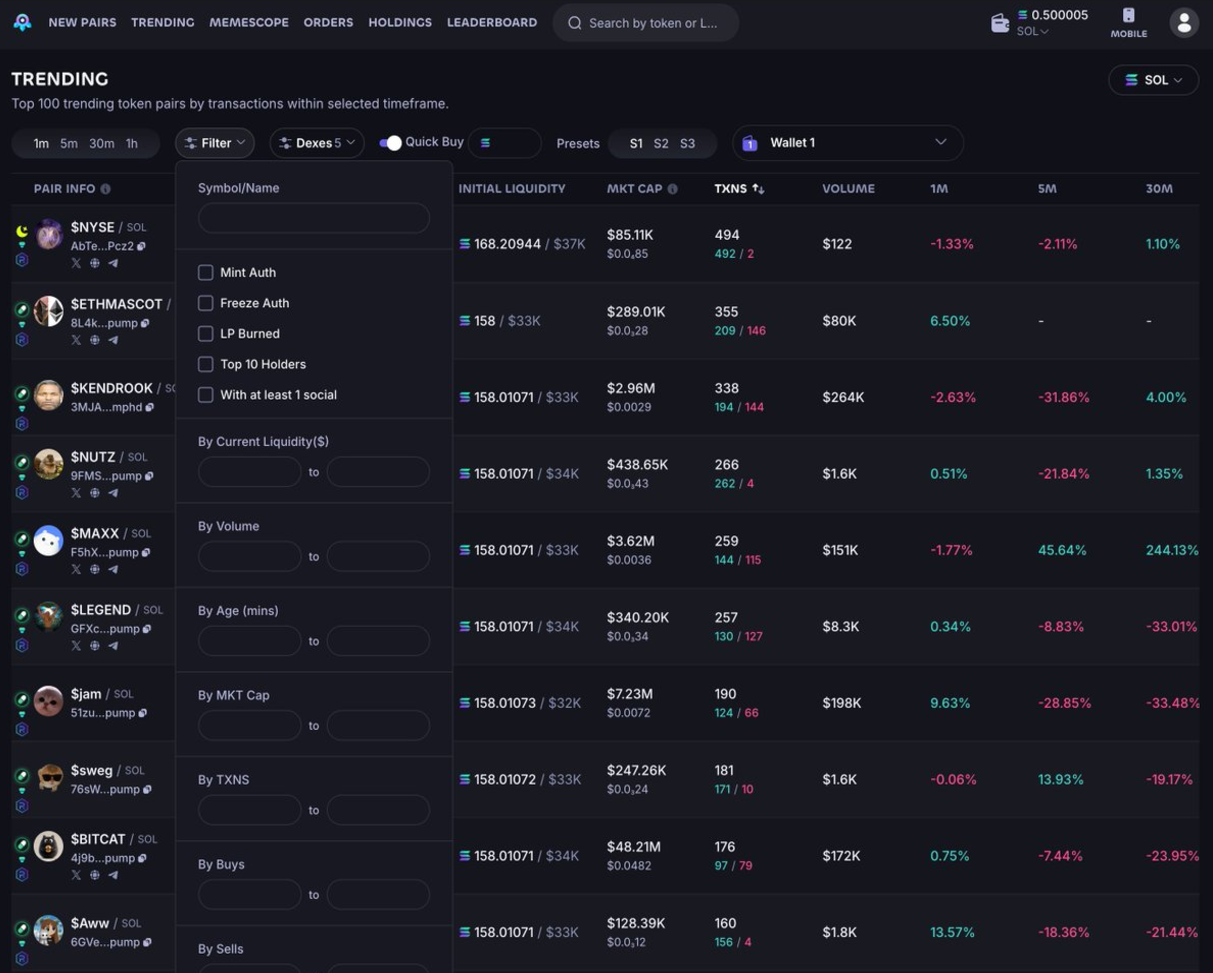

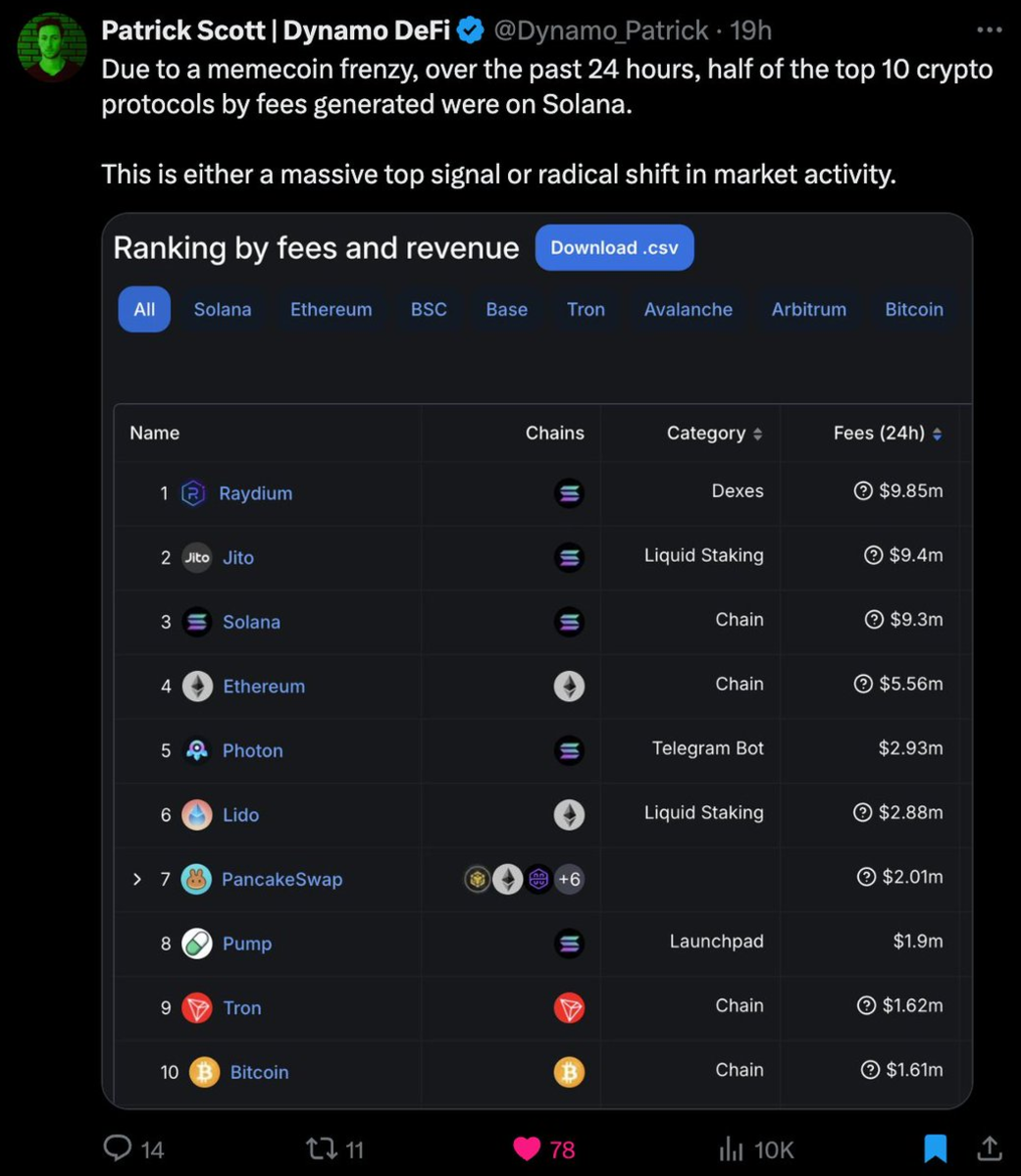

5. Current Market Landscape: A Data-Driven Perspective

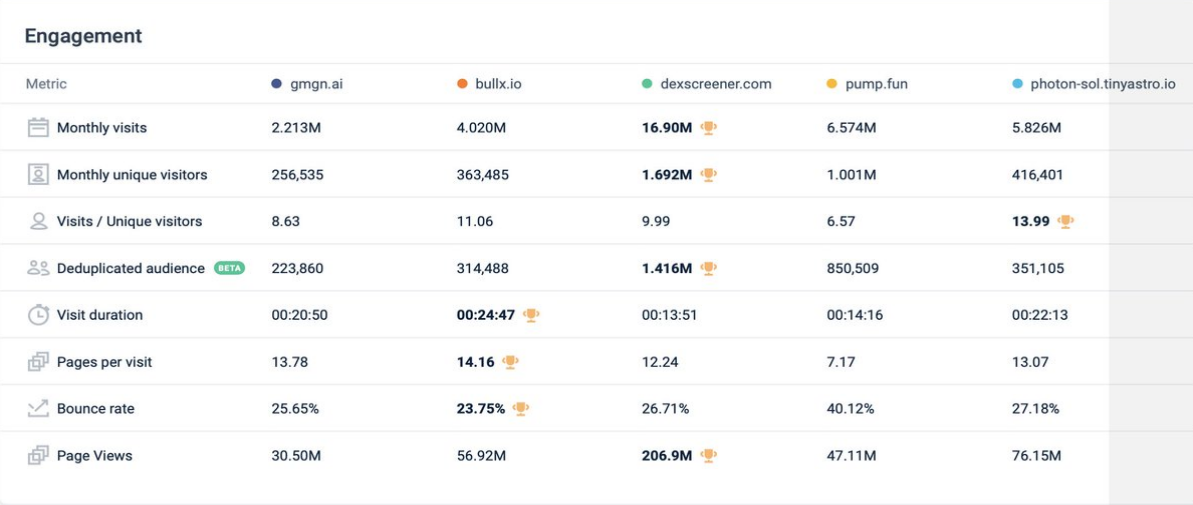

Data provides valuable insights, revealing how traders interact with different memecoin platforms and highlighting key gaps in the market.

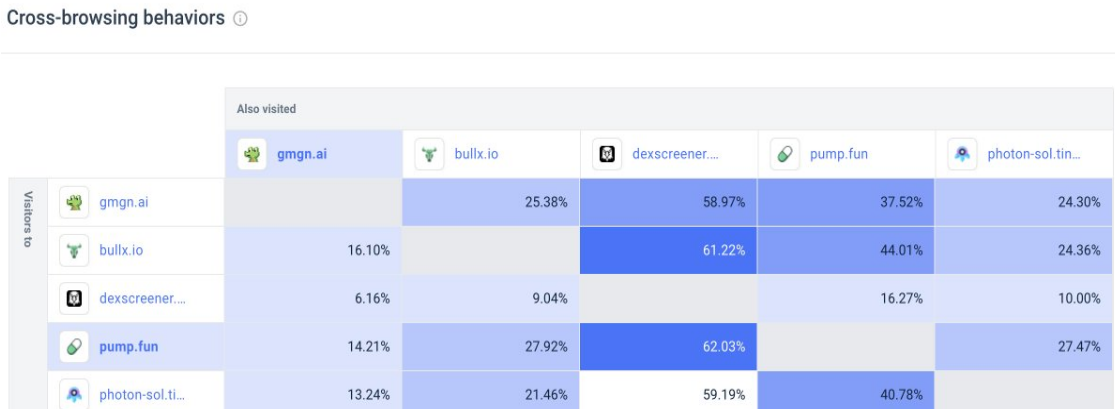

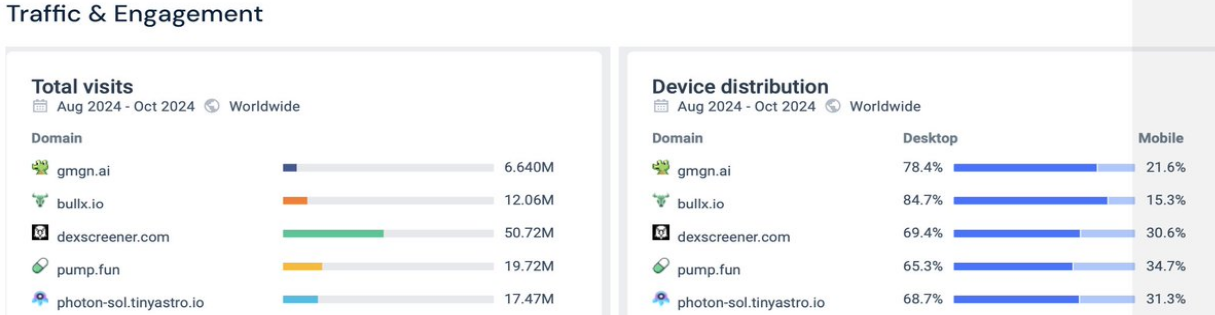

First, it is noteworthy that about 60% of users still visit DexScreener after using their preferred trading terminal. They use DexScreener for its insights, advanced filters, and analytical tools, indicating that existing platforms fail to fully meet their needs. However, even though these terminals outperform DexScreener's interface in terms of customization and parameterization, only 10-12% of DexScreener users ultimately use trading and execution terminals. This shows a gap in user satisfaction—these trading terminals may have better features but are not being fully utilized.

Source: SimilarWeb

When comparing mobile and desktop usage, Photon stands out. Among the three major trading terminals—gmgn.ai, BullX, and Photon—Photon has the highest usage on mobile, while BullX has the most desktop users. Despite BullX's large desktop user base, a significant portion of its traffic comes from Telegram links. This indicates that even when distributed on the mobile-centric platform Telegram, users ultimately interact with BullX on desktop. This suggests the complexity of these terminals and indicates that users prefer to operate in an environment where they can more comfortably manage all functionalities.

Source: SimilarWeb

This trend points to a broader issue: the complexity of existing trading terminals. Their dominance on desktop indicates that these terminals are too cumbersome for mobile, and there is a lack of a trading terminal that can be seamlessly used across devices. Traders want powerful tools that can be accessed on mobile and flexibly switch to a simplified interface when needed. The market needs an integrated solution—an intuitive platform that combines advanced features with ease of use, regardless of whether users are on desktop or mobile.

The current experience is fragmented, both inefficient and inconvenient. Traders have to switch between multiple platforms to gain the insights they need and execute trades effectively. A unified solution that provides depth and functionality while being accessible on mobile and featuring adaptive UI would significantly improve the trading experience.

@TaikiMaeda2 @MustStopMurad

6. In-Depth Exploration: The Trader's Perspective

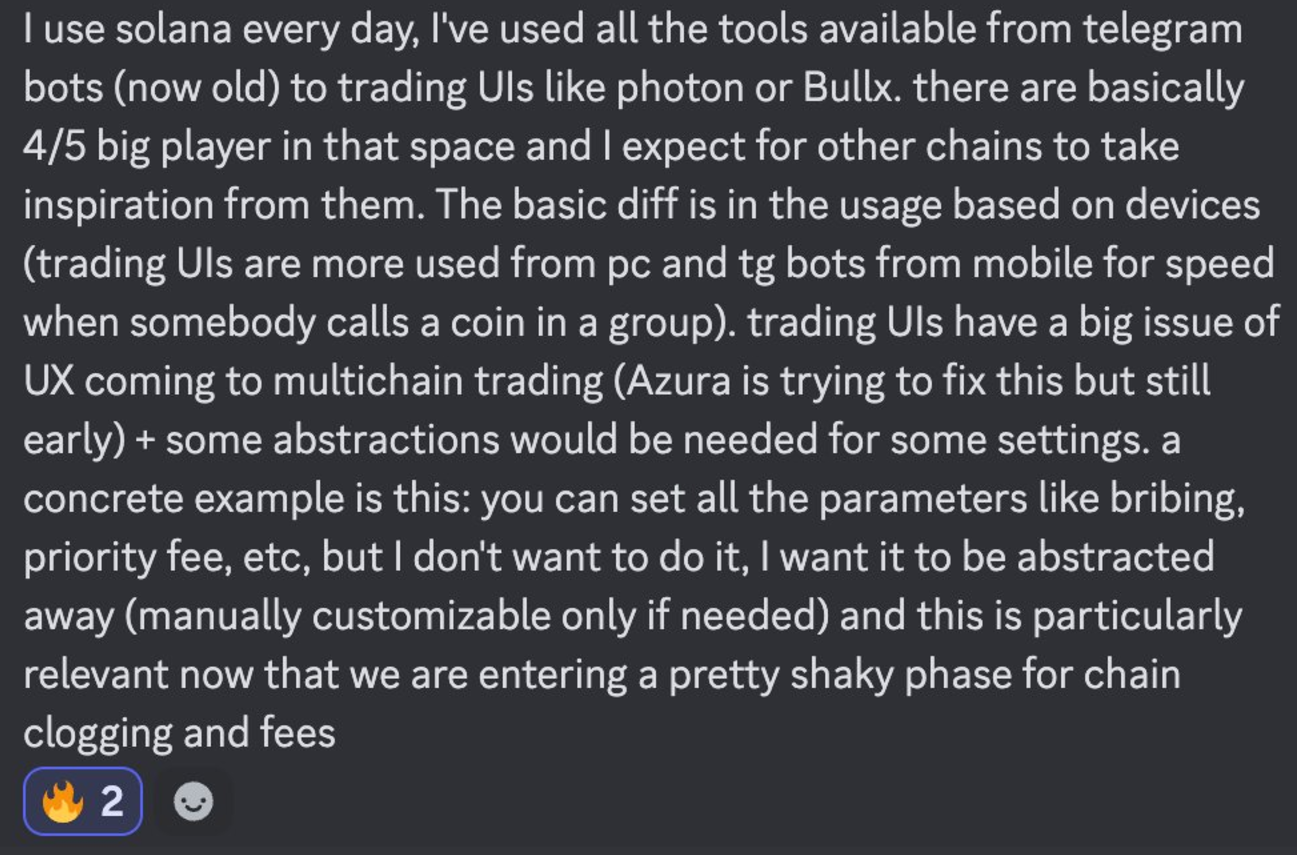

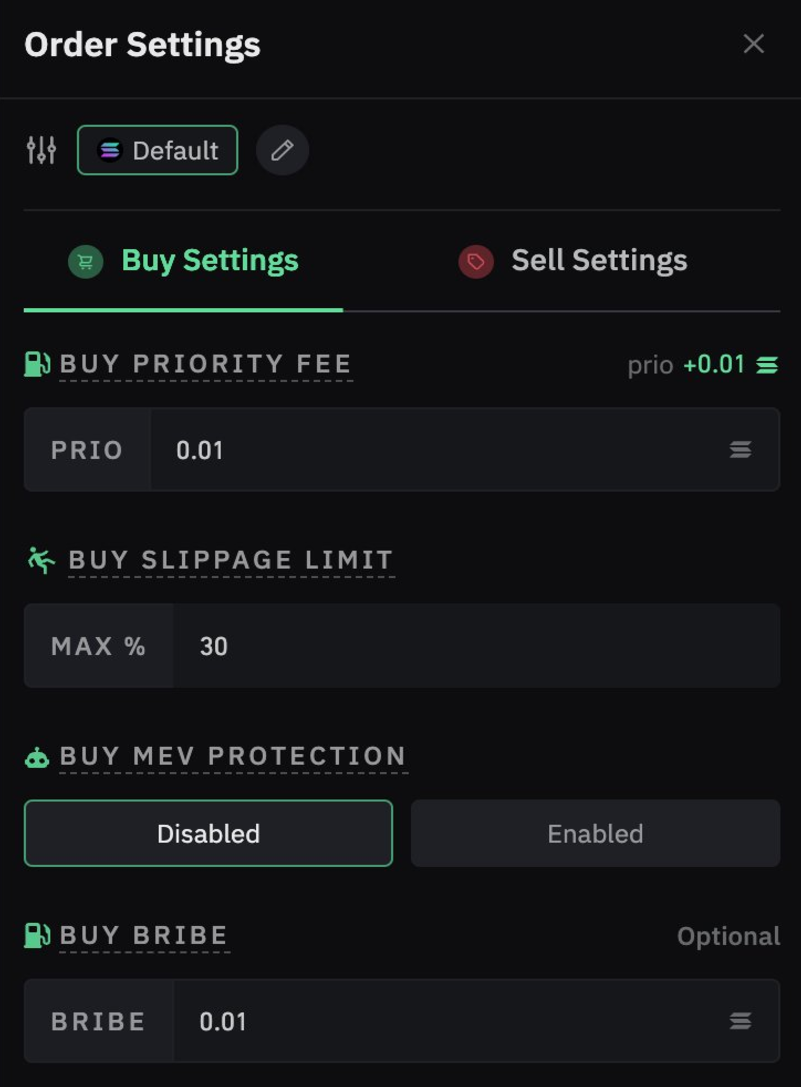

Conversations with traders reveal a consistent theme—they want powerful features without complexity. "When the network is congested, I still need to set priority fees and bribes," one trader explained. "I want smart defaults that I can use right away but can adjust when needed."

This balance between simplicity and control repeatedly emerges. Existing platforms either simplify everything or throw all complexity onto the user. There is no middle ground that allows for out-of-the-box functionality while providing in-depth customization when needed.

"Some interfaces would be better if they could integrate swaps, charts, and recent transaction lists into one interface. Fewer clicks, all key information in one place," a high-frequency trader told me. Another trader mentioned spending hours explaining basic concepts to the team, such as gas fee optimization—time that could have been spent actually trading.

@blankspac_e

A recurring complaint centers around limit orders. "I executed my trade, but all the positive slippage was swallowed by the platform," one trader pointed out. Another trader mentioned that limit orders on one platform always seem to execute before others, creating an unfair situation that no one understands.

7. Market Structure: The Real Issues

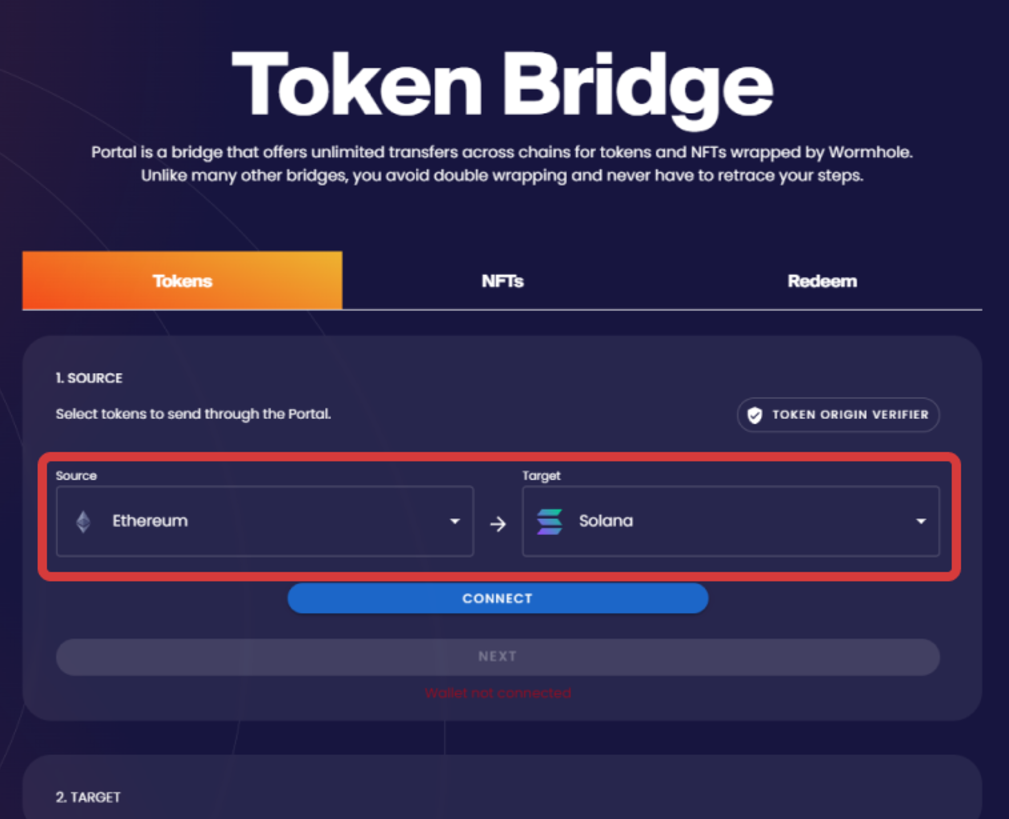

Current platforms are designed for crypto-native users and on-chain traders who already understand terms like "slippage tolerance," "priority fees," and "bribes." But most traders just want to know how much they will pay in fees and whether their trades will execute. A trader managing over 100 wallets told me he can't even keep track of his positions anymore.

The mobile experience is even worse. While Telegram bots fill some gaps, they are not a true solution. They are merely a temporary patch for a system that needs to be fundamentally rethought.

This fragmentation incurs real costs. Traders jump between different interfaces, missing opportunities due to failed trades and losing funds due to poor execution. The current ecosystem forces users to choose between expensive tools and poor performance—there is no middle ground.

8. Building Solutions: Beyond Temporary Fixes

The current memecoin trading environment feels like a patched-together system that, while barely satisfactory, could be significantly improved. When a trader tells us, "If someone could develop a tool to customize LP strategies, that would be great," or complains about "having to set priorities and bribes when fees are high," or "hoping for better execution on stop-loss and take-profit order strategies," they are pointing out a fundamental issue: the existing solutions are not true solutions at all.

Most platforms feel designed for those already familiar with on-chain trading, bridging, and DeFi, with the resulting complexity. However, after speaking with several different traders, it seems that traders want access to complex features without a complicated interface. The existing "advanced" interfaces still do not provide the functional parameterization that complex traders need, while the default interfaces are too simplistic, hiding features that could significantly impact profits and losses. For example, as one trader said, even a feature that "automatically tells me how much this trade (including gas and fees) will cost to ensure the trade goes through smoothly" could allow professional users to say, "Hmm, that fee looks high; I might not want to pay that much," while also helping ordinary users understand roughly how much they are about to pay in fees.

The solution is not just to simplify the interface—it is to fundamentally rethink how traders interact with these markets. When someone compares memecoin trading to a "game," they are not oversimplifying anything. They actually want elements associated with a gamified experience. They want analytical tools that can display win rates, reasonable performance tracking systems, and tools that help them understand trading patterns.

The Path Forward: The Vision of Cumberland Labs

We are not here to build another trading terminal or launch another Telegram bot. The opportunity we see is much greater: to create an interface that bridges the gap between Moonshot simplicity and the powerful features of advanced trading terminals. A platform that evolves with user needs, providing an easy entry point while meeting the demands for depth and complexity from experienced traders. More retail traders mean more trading volume, deeper liquidity, and better opportunities—from seasoned on-chain traders to newcomers just entering the space.

This means:

- Abstracting complexity without stripping away functionality—smart defaults with full customization when needed

- A unified trading experience that integrates charts, execution, and analysis into one window

- Practically usable cross-chain portfolio management

- Real-time performance tracking to help traders understand their strategies

- Providing protection against obvious risks without limiting opportunities

The current platforms have laid a solid foundation for today's crypto-native on-chain traders. However, the next wave of retail traders will need something different—a platform that starts simple and grows with them. They need an intuitive interface that educates them while they trade, gradually introducing more complex features until they are ready. The existing "advanced" and "default" UI settings can be improved to better accommodate these two goals. This is not just about simplification—it is about creating multiple layers of complexity that users can explore at their own pace.

The memecoin market is evolving faster than ever. While 75% of memecoins were created in the past year, we see an opportunity to build tools that welcome newcomers while empowering experienced traders.

@Dynamo_Patrick

9. Beyond Trading: Building Community

Trading is just one piece of the puzzle. Community, education, and shared experiences drive the development of the memecoin ecosystem. While there are already some forms of integration through existing platforms like Discord and Telegram, the idea of bringing the community onto the platform for execution is a novel concept. One reason existing Telegram bots are active on mobile is their ability to copy contract addresses from TG groups to the bot, completing purchases faster than on trading interfaces.

@blknoiz06 Telegram Group

We envision a more integrated approach. Imagine being able to track progress with other traders, share strategies when needed, and build reputations based on actual performance. Not metrics set out of thin air, but real insights into what works and what doesn’t.

This social aspect is not about creating another echo chamber for cryptocurrency but providing the context and understanding that helps traders make better decisions. Whether it’s examining how different entry points affect returns, understanding performance patterns before and after migrations, or learning successful strategies, each feature is closely tied to improving trading outcomes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。