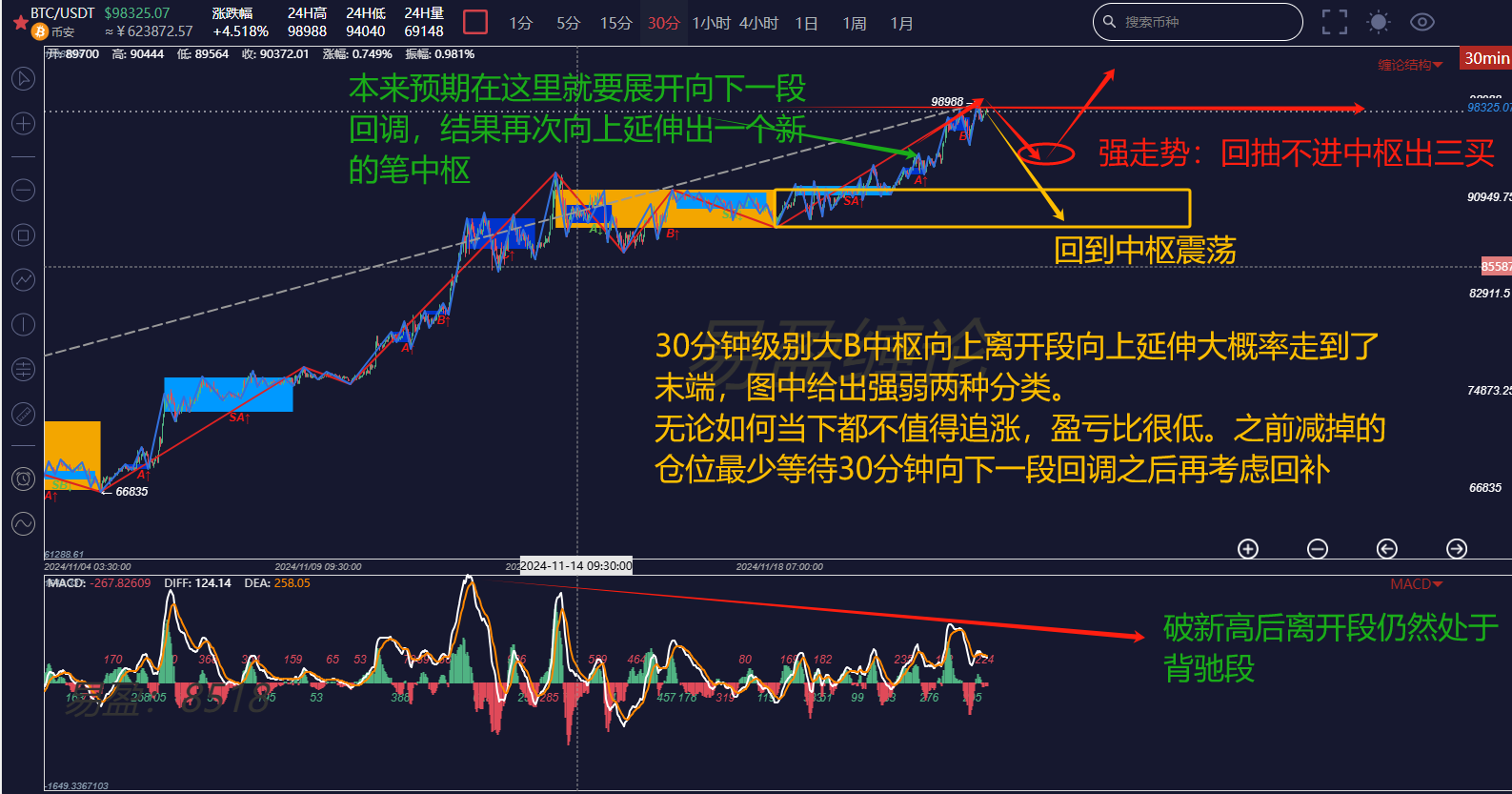

The strength of BTC has exceeded expectations. Initially, it was anticipated to at least pull back for 30 minutes before moving down, but it refused to retrace. The upward movement of the second central zone on the 30-minute chart has extended all the way to 98,988, just a step away from the 100,000 mark!

Looking solely at the 30-minute chart of BTC, the expected downward pullback will still come, and it is important to pay attention to the strength of this downward pullback. Currently, chasing highs is clearly not a favorable risk-reward ratio. The portion of the position that was previously reduced should at least wait for the next downward segment to appear and observe its strength before deciding whether to replenish. If a red trend appears, it indicates that the bullish strength remains strong, and there is hope to challenge the 100,000 mark!

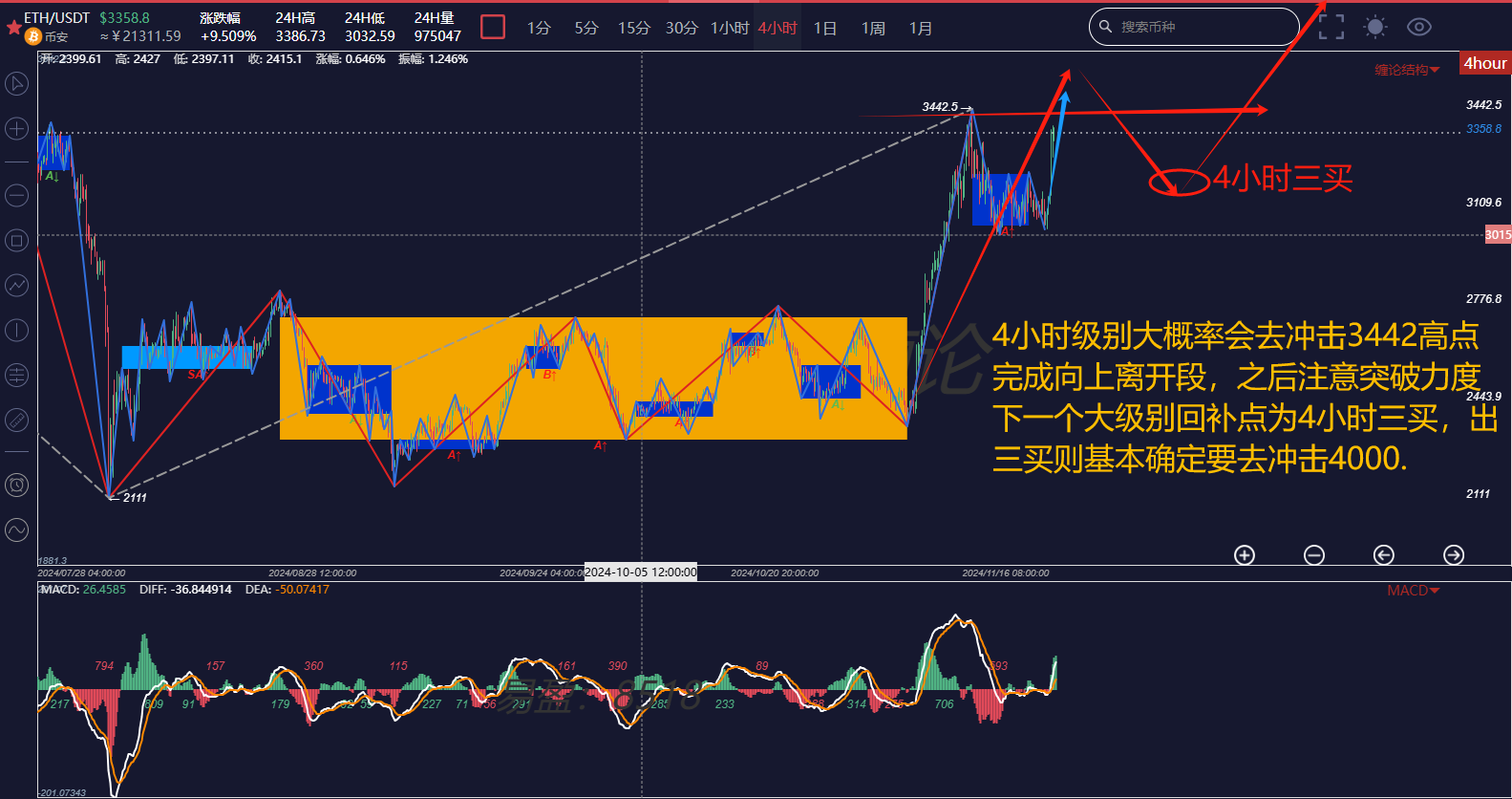

As BTC's upward movement continues, the king of altcoins, ETH, also started to gain momentum last night. Around 8 PM, it experienced a surge in volume, and other altcoins also saw a rebound. ETH has been suppressed for too long, and from a broader perspective, it will eventually return to its original position.

Looking directly at the 4-hour chart, what is currently running is the upward departure segment from the central zone. After a period of consolidation, it is highly likely to break through 3,442 to complete this segment. After the conclusion of the upward segment on the 4-hour chart, there will likely be another opportunity to enter at a larger scale: a third buy on the 4-hour chart, aiming to challenge historical highs.

From multiple transitions between bull and bear markets, it is equally difficult to bottom out and guess the peak each time. One thing is certain: no one can buy at the lowest point, and no one can sell at the highest point. Of course, the bull market is only in its mid-stage, and there is still a long way to go before the climax ends. A common occurrence in bull markets is selling too early, so maintaining a good mindset is very important to avoid chasing highs and cutting losses.

Whether to hold a full position and wait for a large-scale selling signal or to maintain a certain proportion of the position for short-term trades completely depends on individual skills and mindset. In a bear market, most participants can completely relax and do nothing, but in a bull market, it is the opposite. The bull market will stimulate endless desires and greed, causing individuals to forget about risks and completely disregard them. Ultimately, a large wave of retail investors will be left stranded at the peak!

The above analysis is for reference only and does not constitute any investment advice!

Friends, if you are interested in the theory of trading, want to obtain free learning materials, watch public live broadcasts, participate in offline training camps, improve your trading skills, build your trading system to achieve stable profit goals, and use trading techniques to escape peaks and bottom out in a timely manner, you can scan the QR code to follow the public account and privately chat to get and add this WeChat account!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。