Source: CryptoVizArt, UkuriaOC, Glassnode

Compiled by: Bai Shui, Golden Finance

Summary

- Strong capital inflows from ETFs and the spot market have driven Bitcoin to $93,000. Over $62.9 billion has entered the market in the past 30 days, with BTC dominating the demand inflow.

- The increase in unrealized profits among long-term holders has triggered massive spending activity, with 128,000 Bitcoins sold between October 8 and November 13.

- U.S. spot ETFs have played a key role, absorbing about 90% of the selling pressure from long-term holders during the analysis period. This highlights the growing importance of ETFs in maintaining liquidity and stabilizing the market.

Surge in Capital Inflows

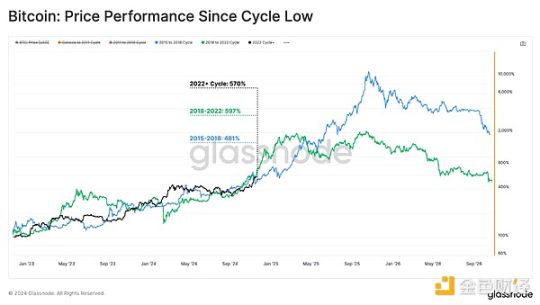

Since early November, Bitcoin's price performance has been outstanding, continuously setting new ATHs throughout the month. When comparing the current cycle's price performance with the 2015-2018 (blue) and 2018-2022 (green) cycles, an astonishing and persistent similarity can be observed. Despite significant differences in market conditions, the magnitude and duration of the rebound have been surprisingly consistent.

This long-term consistency across cycles remains intriguing, providing insights into Bitcoin's macro price behavior and cyclical market structure.

Historically, past bull markets have lasted from 4 to 11 months starting from the current point, providing a historical framework for assessing cycle duration and momentum.

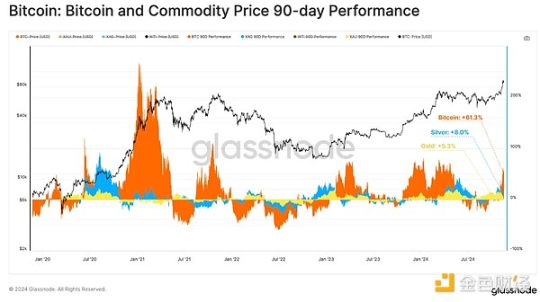

A new ATH was set this week at $93,200, bringing Bitcoin's quarterly performance to an impressive +61.3%. This outperforms gold and silver by an order of magnitude, with gold and silver's quarterly gains at +5.3% and +8.0%, respectively.

This stark contrast suggests that capital may be shifting from traditional value asset commodities to Bitcoin, a younger, emerging, and digital asset.

Bitcoin's market cap has also expanded to an astonishing $1.796 trillion, making it the seventh-largest asset globally. This positions Bitcoin above two globally significant assets: silver, valued at $1.763 trillion, and Saudi Aramco, valued at $1.791 trillion.

As of now, Bitcoin is only 20% behind Amazon, making it the next significant milestone in its ascent among the world's most valuable assets.

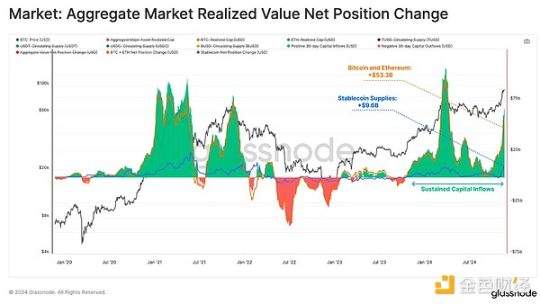

Following Bitcoin's impressive 90-day performance, the broader digital asset market has begun to experience a significant influx of funds. In the past 30 days, total inflows reached $62.9 billion, with Bitcoin and Ethereum networks absorbing $53.3 billion, while the supply of stablecoins increased by $9.6 billion.

This is the highest level since peaking in March 2024, reflecting a recovery in confidence following the U.S. presidential election and new demand.

Expanding on the observed capital inflows, the vast majority of the $9.7 billion in stablecoins minted in the past 30 days was directly deployed to centralized exchanges. This inflow is closely related to the total capital flow of stablecoin assets during the same period, highlighting its critical role in stimulating market activity.

The surge in exchange stablecoin balances reflects strong speculative demand from investors capitalizing on the trend, further reinforcing the bullish narrative and post-election momentum.

Investigating Investor Profitability

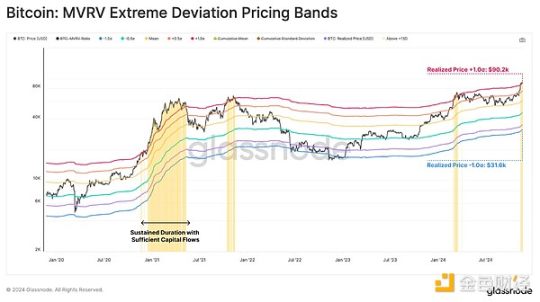

So far, we have explored the trend of rising market liquidity that supports Bitcoin's outstanding performance. In the next section, we will utilize the MVRV ratio to assess how this price behavior affects the unrealized profitability of market investors (paper gains).

By comparing the current value of the MVRV ratio (orange) with its annual moving average (blue), we can see an accelerated growth in investor profitability. This phenomenon typically supports sustained market momentum but also creates conditions where investors are more likely to start taking profits to realize paper gains.

As market investor profitability increases, the potential for new selling pressure also rises. By overlaying the MVRV ratio with ±1 standard deviation bands, we can construct a framework to assess overheated and underheated market conditions.

- Overheated (warm colors): MVRV trades above +1SD

- Underheated (cool colors): MVRV trades below -1SD

Bitcoin's price recently broke through the +1σ range, at $89,500. This indicates that investors currently hold statistically significant unrealized profits and suggests an increased likelihood of profit-taking activity.

However, historically, the market has remained in this overheated state for extended periods, especially when supported by sufficiently large capital inflows to absorb selling pressure.

Extreme Spending by Long-Term Holders

During the thriving phase of market cycles, the behavior of long-term investors becomes crucial. LTHs control a significant portion of the supply, and their spending dynamics can greatly impact market stability, ultimately forming local and global tops.

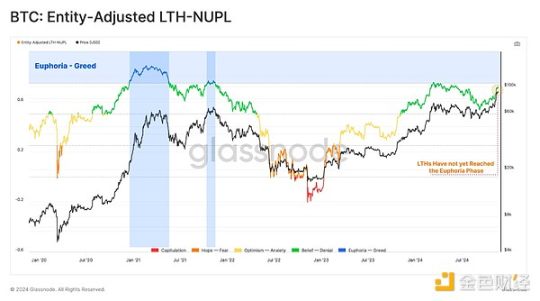

We can utilize the NUPL metric to assess the unrealized profits held by LTHs, which currently stands at 0.72, slightly below the threshold of belief (green) to excitement (blue) at 0.75. Despite the significant price increase, the sentiment among these investors remains lower compared to previous cycle tops, indicating that there may still be room for further growth.

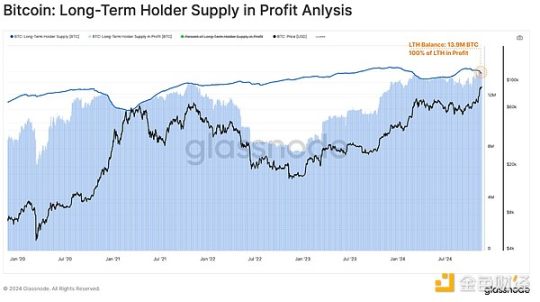

As Bitcoin surpassed $75,600, the 14 million Bitcoins held by long-term holders converted to 100% profit, stimulating accelerated spending. Since the ATH breakout, this has led to a balance decrease of +200k BTC.

This is a classic and recurring pattern; as long as the price trend is strong and demand is sufficient to absorb profits, long-term holders begin to take profits. Given that LTHs still hold a significant amount of Bitcoin, many LTHs are likely waiting for higher prices before releasing more Bitcoin back into circulation.

We can use the long-term holder spending binary indicator to assess the intensity of LTH selling pressure. This tool evaluates the percentage of days in the past two weeks where the group’s spending exceeded the days accumulated, leading to a net decrease in their holdings.

Since early September, as Bitcoin's price has risen, long-term holder spending has steadily increased. With the recent surge to $93,000, this indicator reached a value indicating that LTH balances decreased on 11 out of the past 15 days.

This highlights the increasing distribution pressure from long-term holders, although it has not yet reached the levels observed around the peaks in March 2021 and March 2024.

After identifying the increased spending behavior of long-term holders, we can refer to the next tool for a deeper understanding of their activities around key market points. The interaction between profit-taking and unrealized profits helps highlight their role in shaping cycle transitions.

The chart visually displays:

- LTH realized price (blue): The average acquisition price of long-term holders.

- Profit/Loss pricing range (blue): Ranges representing extreme profit levels (+150%, +350%) and loss levels (-25%), which typically trigger significant spending activity.

- Profit-taking (green): The phase where long-term holders hold over 350% profit and increase spending.

- Sell-off (red): High spending periods for long-term holders in a -25%+ loss state.

Bitcoin's price has surged into the over 350% profit range (at $87,000), prompting significant profit-taking behavior from this group. As the market rises, distribution pressure may increase, and these unrealized gains may expand accordingly. Historically, this marks the beginning of the most extreme phases of previous bull markets, with unrealized profits growing to over 800% in the 2021 cycle.

Institutional Buyers

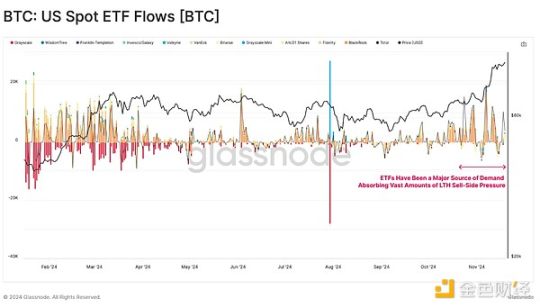

Now we will turn our attention to the role of institutional buyers in the market, particularly through U.S. spot ETFs. In recent weeks, ETFs have been a major source of demand, absorbing most of the selling from long-term holders. This dynamic also highlights the growing influence of institutional demand in shaping the modern Bitcoin market structure.

Since mid-October, weekly ETF inflows have surged to between $1 billion and $2 billion. This represents a significant increase in institutional demand and is one of the most notable periods of capital inflow to date.

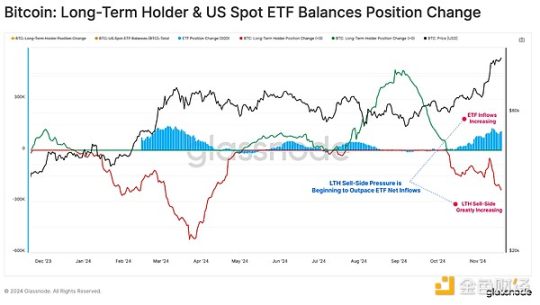

To visualize the balance of LTH selling pressure and ETF demand, we can analyze the 30-day changes in Bitcoin balances for each group.

The chart below shows that from October 8 to November 13, ETFs absorbed approximately 128,000 BTC, accounting for about 93% of the 137,000 BTC net selling pressure exerted by LTHs. This highlights the critical role of ETFs in stabilizing the market during periods of increased selling activity.

However, since November 13, LTH selling pressure has begun to exceed ETF net inflows, echoing the pattern observed in late February 2024, when supply-demand imbalances led to increased market volatility and consolidation.

Summary

Bitcoin's rise to $93,000 is supported by strong capital inflows, with approximately $6.29 billion entering the digital asset space in the past 30 days. This demand is led by institutional investors through U.S. spot ETFs, even as capital flows out of gold and silver.

ETFs have played a key role, absorbing over 90% of the selling pressure from long-term holders. However, as unrealized profits reach more extreme levels, we can expect LTH spending to increase, with their inflows likely surpassing ETF inflows in the short term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。