In the past year, the intersection of AI and cryptocurrency has become a hot area of consumer interest, driving the launch of numerous new projects.

Written by: Karen Shen

Translated by: Block unicorn

In this article, we will explore the potential opportunities for collaboration between cryptocurrency and consumer-level AI (artificial intelligence). The article is divided into three parts:

- Why choose crypto x consumer-level AI?

- Overview of the traditional consumer-level AI market

- Opportunities in crypto x consumer-level AI

Why choose crypto x consumer-level AI

In the past year, the intersection of AI and cryptocurrency has become a hot area of consumer interest, driving the launch of numerous new projects. The vast majority of attention and capital has been focused on the infrastructure layer of AI, such as computing power, training processes, inference techniques, intelligent agent models, and data infrastructure.

While many of these projects are ambitious and may yield large-scale results, the technology has not yet reached production-level status (currently), and the likelihood of widespread commercialization in the short term is low. This leaves a gap in the market for more directly impactful technological applications, particularly at the consumer level.

Consumer-level AI refers to AI products designed for everyday users rather than enterprise or business-specific applications. These products include AI-driven general assistants and recommendation systems, generative tools, and creative software. With the rapid development of AI technology, consumer-level applications are becoming more intuitive, personalized, and easier for the average user to utilize.

Current popular consumer-level AI applications

Unlike enterprise-level AI, which typically requires precision and deterministic results, consumer-level AI benefits from flexibility, creativity, and adaptability—areas where current AI excels.

Although still in its early stages, the combination of crypto technology and consumer-level AI is undoubtedly a fascinating topic. It is rare to see two technologies advancing toward maturity simultaneously, making it worth exploring—despite the difficulty in predicting outcomes.

In the field of crypto technology, there is currently an urgent need for more consumer-facing applications to provide new and interesting ways to interact with the underlying technology. Over the past decade, blockchain investment has driven significant advancements in infrastructure, including faster block generation times, lower gas fees, better user experience (UX), and a substantial reduction in the user onboarding barriers that were common a few years ago.

You can intuitively feel how far the industry has progressed by simply trying to join applications like Moonshot, where you can use Apple Pay to instantly purchase meme coins. However, there is still a lack of founders and developers willing to tackle interesting consumer crypto problems.

Meanwhile, consumer-level AI is market-ready, providing developers with a mature opportunity to combine these two technologies to build applications that shape how we interact with, own, and engage with digital assets and AI systems.

Overview of the traditional consumer-level AI market

First, let’s utilize two resources to help us quickly understand the experiments within the traditional (non-crypto) consumer-level AI space:

- a16z's "Top Consumer Products Ranked by Web Traffic" (3rd Edition)

- YC team's latest W24 project batch

a16z's "Top Consumer Products Ranked by Web Traffic"

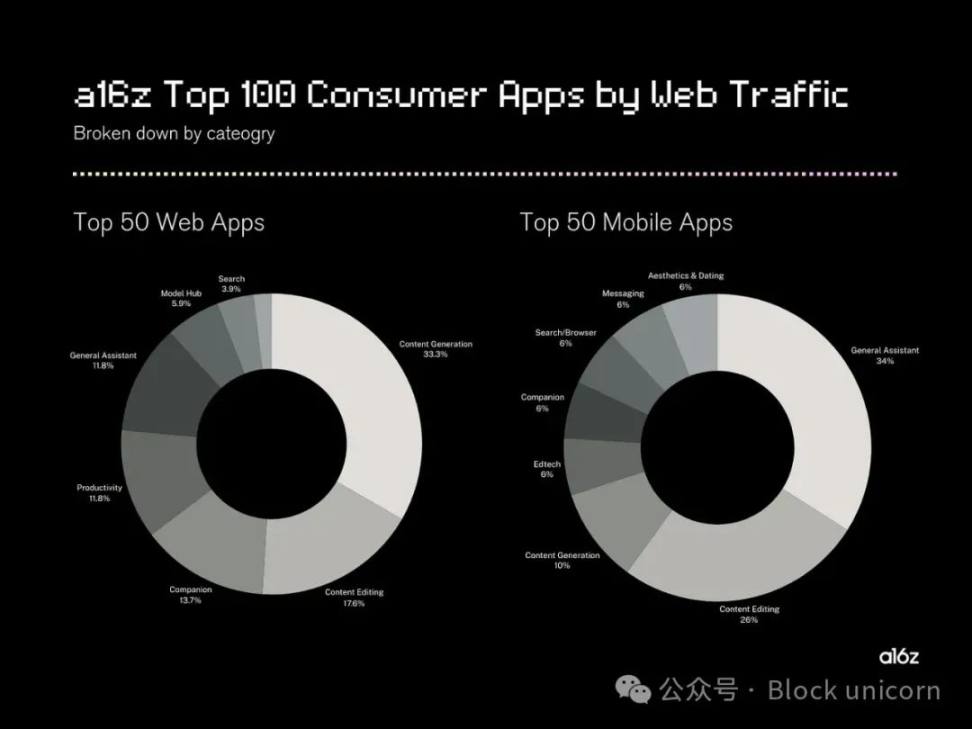

This report from a16z ranks the highest-traffic consumer-level AI web pages and mobile applications every six months by analyzing web traffic data for consumer-level AI products.

By analyzing this data, they identify trends in how consumers are actively engaging with consumer-level AI technology, which categories are gaining attention, which are declining, and the early leading projects within each category.

Here are the top 100 consumer-level AI products as of August 2024, categorized into web and mobile applications.

Clearly, content generation and editing tools are leading the consumer-level AI space.

These applications now account for 52% of the top 50 web applications and 36% of the top 50 mobile applications. Notably, this category is expanding from text generation to include video and music generation, further broadening the potential for AI-driven creative expression.

Popular categories like general assistants, companionship tools, and productivity tools remain stable in the top 100 list, reflecting ongoing demand. The third edition of the a16z report introduced a new category, "Aesthetics and Dating," which includes three projects that made the list.

It is worth mentioning that a cross-category crypto project also successfully made the list. The anime companion app Yodayo (now Moescape AI) ranked 22nd in the web application list.

Moescape AI

Comparing a16z's latest report with previous ones reveals that while the core consumer-level AI categories remain stable, about 30% of the top 100 projects are new, highlighting the ongoing development in the field.

YC team's latest W24 project batch

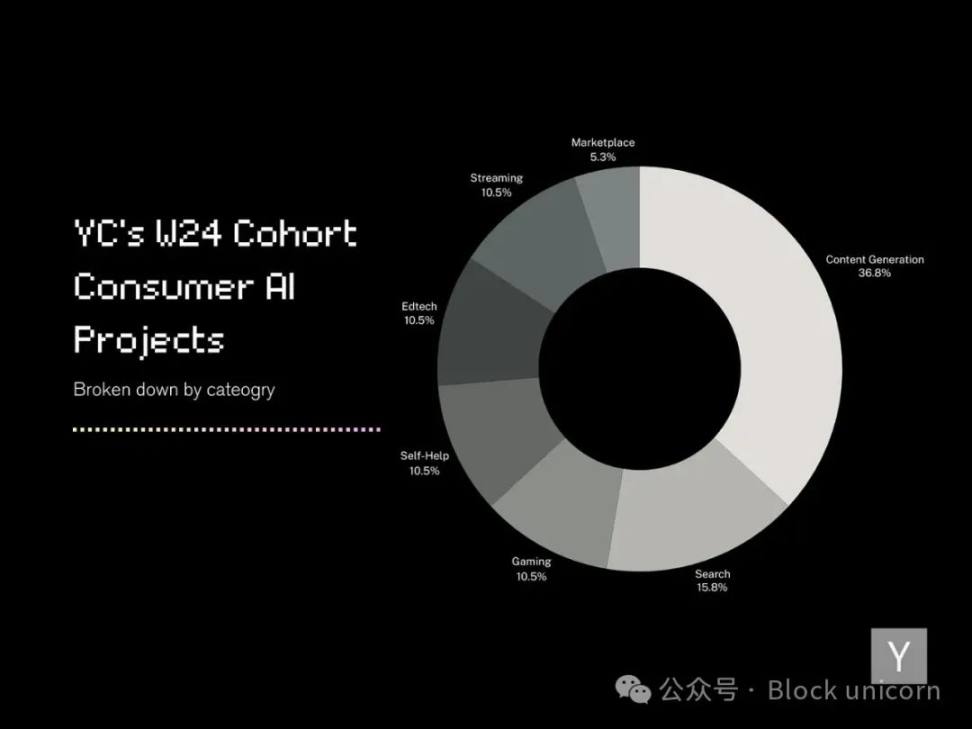

Next, let’s review the YC W24 project batch (latest version) as a resource to help identify emerging consumer-level AI projects and categories that, while already in the market, may not have enough traction to appear in a16z's top 100 web traffic list.

The idea here is that, despite uncertainty about actual consumer demand for these products, this information can help us predict consumer-level AI trends over the next 6-12 months.

Among the recent 235 projects, 63% focus on AI, with 70% built on the application layer. Only about 14% of application layer projects are identified as consumer-focused.

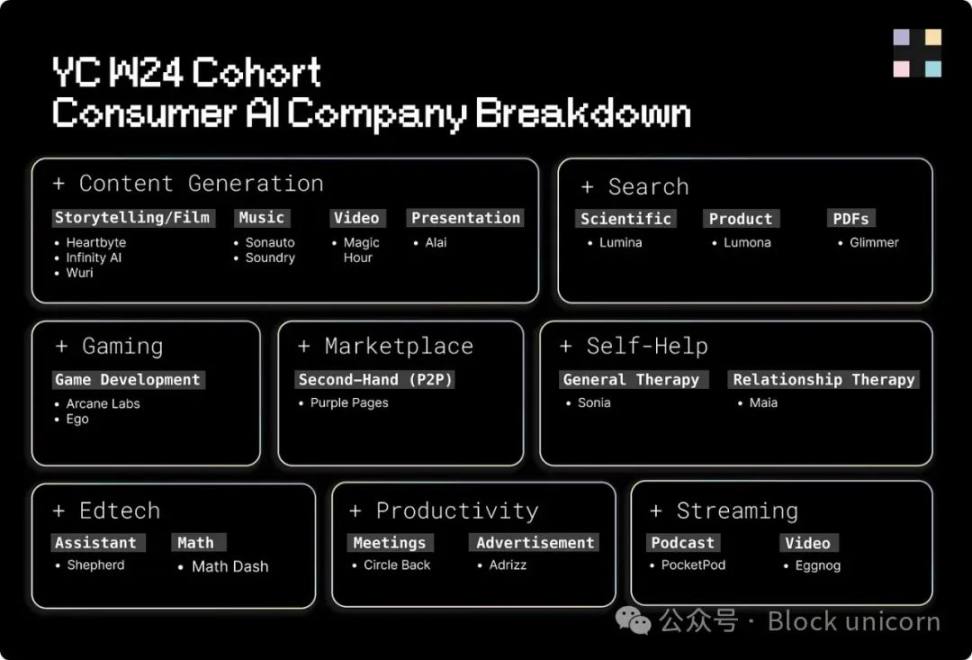

Here is our attempt to categorize consumer-level AI projects.

Similarly, content generation remains the most popular category among founders, with new projects continually pushing the boundaries of creative possibilities.

In line with the trends in the a16z report, the latest batch of YC entrepreneurs is exploring advanced content types, including storytelling, script-to-film generation, music, video, and presentation-based content.

In addition to content generation, founders are also focusing on search, productivity, and educational technology. These three categories align with the a16z report, although most companies in YC are developing more targeted, industry-specific solutions in these areas.

Finally, categories like gaming, automation, marketplaces, and streaming appear in this group, marking some new directions not seen in the a16z report.

Opportunities in cryptocurrency x consumer AI

Now that we have introduced the background trends of the traditional consumer-level AI market, let’s turn our attention to consumer-level crypto AI.

First, let’s briefly introduce how AI can be useful for crypto products, or how crypto can be beneficial for consumer-level AI products, which may be helpful.

Crypto and AI offer very different value propositions.

It can be argued that there is a conflict in the values of these two technologies—crypto focuses on decentralization, privacy, and personal ownership, while AI often centralizes power and control in the hands of those who develop and own the most advanced models.

However, with the emergence of decentralized and open-source AI, these boundaries are beginning to blur.

The core innovation of AI in consumer products is generating novel content, mimicking and extending human creativity while learning from vast datasets, using advanced neural network architectures to simulate complex relationships and produce high-quality outputs.

Early signs indicate that AI applications exhibit strong user retention and monetization potential. However, they also face a "tourist problem," where user traffic is high, but the conversion rate from free users to paid users is below average.

On the other hand, crypto technology encompasses a design space that includes decentralization, cryptoeconomic incentives, and hyper-financialization characteristics. It is a distributed ledger that allows the value of any digital object to be stored in a transparent and traceable manner.

Crypto technology is highly effective in coordinating activities, aggregating decentralized infrastructure, and creating frictionless markets, easily establishing markets where none previously existed. However, aside from financial infrastructure, crypto technology has yet to create a compelling and sustainable consumer-level application.

AI may be one of the key factors in unlocking the broader consumer potential of crypto technology. A recent study highlighted the rapid adoption of generative AI, which has surpassed that of PCs and the internet—about 32% of U.S. residents use AI weekly. Given this pace of development, developers of consumer-level applications in crypto technology who can experiment and innovate in sync with the accelerated adoption of AI will have a significant advantage.

We believe that through innovative consumer-level applications, combining the powerful capabilities of AI with the unique abilities of decentralized and financialized networks enabled by crypto technology, breakthrough results will emerge.

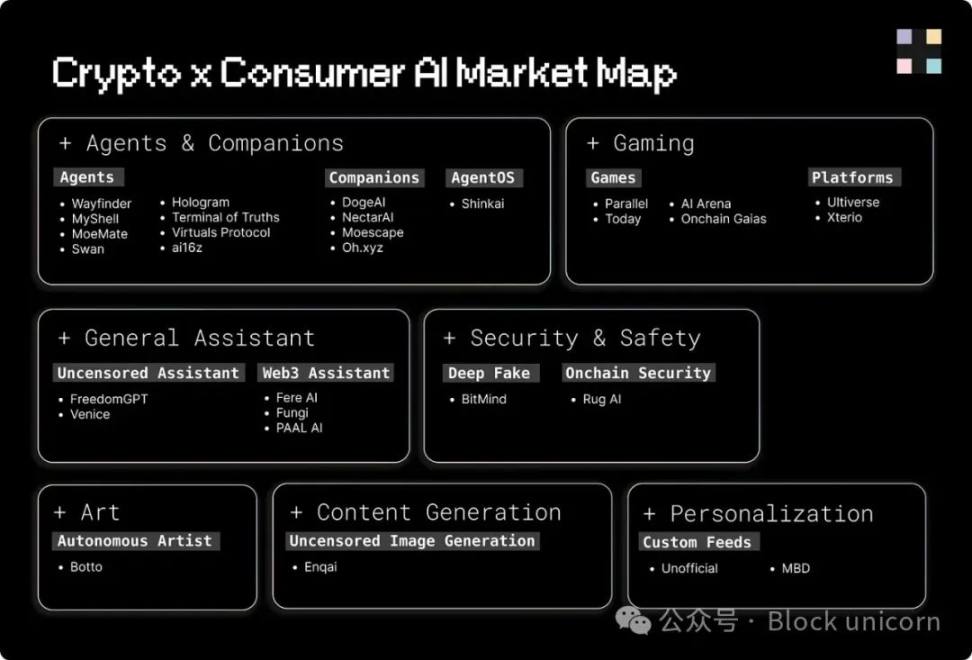

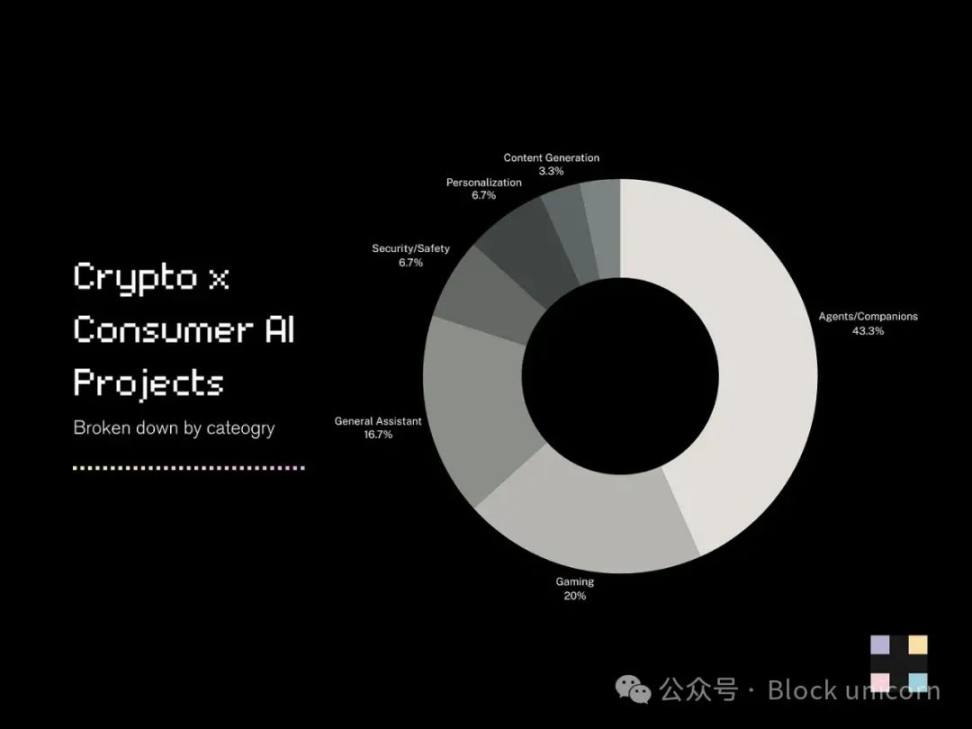

Market Overview

The number of consumer-focused projects operating at the intersection of crypto and AI remains relatively low, with our research estimating around 28, although this is not a final number.

In this crowdsourced decentralized AI market map, consumer-level categories account for only about 13% of the total decentralized AI market, indicating that we still have significant room for growth. As a quick comparison, about 60-70% of products in the tech market are at the application layer, with about 70-80% being consumer-facing applications.

Although we only cover a small portion of projects in this report, we have been able to identify some early insights.

We have identified some early ideas from teams integrating crypto with AI. These insights have been distilled into the following broader use cases, some of which show potential while others may be less sustainable.

- Incentive Mechanisms: Cryptocurrency serves as a way to incentivize and reward users for activities on AI platforms/apps. For example, one use of Wayfinder's native token is to reward agents and participants for creating valuable on-chain paths as AI agents traverse the blockchain. For Botto, the automated AI artist requires its community to provide feedback on its artistic creations. Botto distributes a portion of its art sales in the form of $BOTTO tokens to reward this participation.

- Financialization: The ability to trade, own, and generate income from AI assets on the blockchain. For example, Virtuals Protocol provides a platform where anyone can purchase and own a share of AI agents and benefit from the income generated by the AI agents they trust. Ownership is represented in token form.

- Attribution: Allowing intellectual property holders to track, verify, and claim royalties on the blockchain. For instance, uncensored companion projects like Oh.xyz are using crypto technology to create digital twin NFTs for creators on their platform to verify content authenticity and claim royalties in the future.

- In-app or In-game Economy: Cryptocurrency serves as in-app/in-game currency. For example, games like Parallel and Today will have in-game economies where players and their AI agents can trade resources using their respective tokens.

- Decentralization: Decentralized networks, services, and models. For example, BitMind is a subnet on Bittensor that is building the first decentralized deepfake detection system. By leveraging Bittensor, they can encourage open competition among AI developers to contribute to building the best deepfake detection model.

- Anti-censorship: Removing censorship from generative AI content creation. For example, Venice is a private and permissionless generative AI assistant built on Morpheus's decentralized universal agent network. Unlike traditional AI assistants, Venice does not censor AI content or download your conversations.

- Membership Systems: Cryptocurrency as a means to access premium features. For example, MyShell's ecosystem token has multiple use cases, one of which is to grant holders access to premium features.

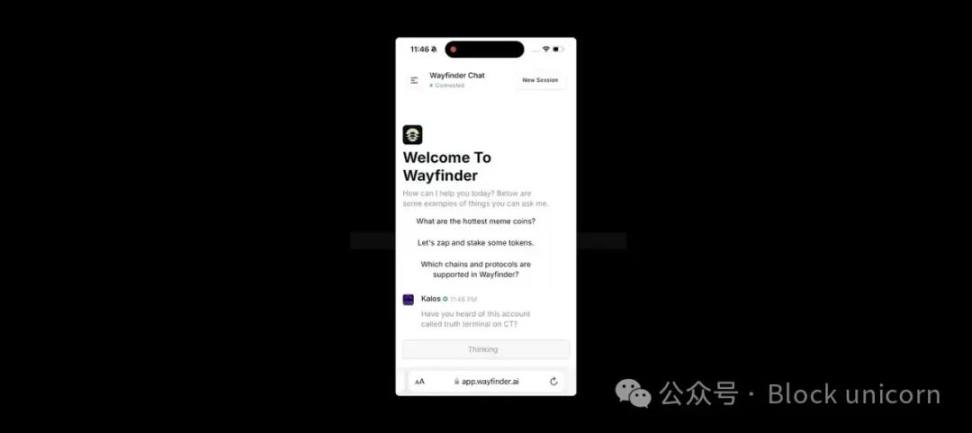

- Assistants: AI as a way to facilitate interactions between people and cryptocurrency. For example, Wayfinder, Fere AI, Fungi, and PAAL AI are vertical general assistants or bots aimed at making the crypto experience more convenient for end users.

- Contextualization: AI as a way to contextualize and personalize content on the blockchain. For example, Unofficial aims to build a discovery engine for on-chain social interactions using zkTLS and RAG on Farcaster.

After examining the current cryptocurrency and consumer AI market—including the applications of cryptocurrency and AI, as well as the status of established and emerging categories in the traditional consumer-level AI space—the next section will explore the most promising design spaces in this intersection for developers to consider.

Games and Agents/Companions

Games and agents/companions have become the two most popular categories for founders in this intersection for a reason: they provide the most suitable environment for AI and cryptocurrency experimentation.

Games and agents typically operate in fictional realms with the purpose of entertaining consumers. Their outcomes do not usually need to be deterministic and often have minimal impact on real life. This creates perfect conditions for experimentation.

Today's surreal gaming environments

So far, games like Parallel Colony and Today have used AI as the core experience of the product, where AI NPC characters in the game behave like real humans, exhibiting autonomy and the ability to converse.

Cryptocurrency is being used as a financial channel for in-game payments, agent-to-agent payments, or unlocking character ownership.

Crucially, this new digital economy is an advantage of these crypto games compared to the many AI games that are about to launch.

AI is a transformative technology, and there is no doubt it will be a key part of future game development and gaming experiences—but we believe that teams building AI games targeting a digitally native economy will have the greatest competitive advantage.

AI agents in games are interesting, but cryptocurrency unlocks the ability to introduce an economic system that replicates human experiences in games for the first time. NPCs in games cannot open their own bank accounts, conduct transactions, or make real economic decisions. Therefore, many unprecedented behaviors and opportunities may arise.

As Kalos, the founder of Parallel, stated on Twitter:

Today, this is best exemplified in fictional environments like games.

Projects building AI agents and companions share similarities when using AI and cryptocurrency—AI as the core experience, cryptocurrency as the financial infrastructure. However, while agents in games operate in a limited environment, allowing for more complex interactions with almost no real-life consequences, agents and companions are currently limited to one-on-one or one-to-many relationships.

For example, using MyShell, Virtuals Protocol, or MoeMate, end users interact with AI chatbots through chat or voice features—interactions are limited to you and the chatbot (or other medium). The chatbot is an LLM wrapper with limited features that can be customized by the bot's creator, such as the tone of communication, the appearance of the agent, etc. Therefore, your interactions with these chatbots are also limited in creativity.

Experience with MoeMate's Draco Malfoy AI chatbot

While similar to their competitors, a16z adopts an open-source, bottom-up approach focused on building on-chain AI agent infrastructure, providing tools for a multi-agent future.

In both gaming and agent domains, there are still many areas worth exploring, such as multi-agent experiences or infinite game modes. Consumer experiences involving many-to-many AI agents interacting with humans, while complex, could lead to more dynamic and engaging interactions, as well as more complex crypto economic systems. This area remains underexplored outside of gaming environments.

We still believe this is one of the areas of greatest interest for founders, and we can't wait to see what innovations the future will bring.

General Assistants and Content Generation Tools

General assistants and content generation tools dominate the traditional consumer-level AI space. However, fierce competition makes entering this market challenging and costly, which also explains why these categories are not as strongly represented on the crypto market map as they are in traditional AI.

Nevertheless, the demand for these tools remains strong, consistently ranking high in a16z's web traffic analysis. For founders in the intersection of crypto and AI, these categories still hold promise, especially for products tailored specifically for crypto users. By focusing on the specific needs of the crypto space, it is possible to create unique value without competing in a saturated traditional market.

Here are some examples:

AI-supported crypto assistants: It is well known that crypto can be difficult to navigate. Whether you are trying to buy or swap tokens on-chain or meet the conditions required to participate in games or social experiences, there are many obstacles.

Are you on the right network? How do you switch networks? Do you have the correct gas tokens? How do you transfer funds to the target network?

For newcomers, the learning curve is steep. Even for those familiar with cryptocurrency, these tasks can still be time-consuming.

While the industry has primarily improved in areas like account abstraction, intents, and other UI/UX aspects so far, AI is more likely to integrate these developments and push these changes forward. Some teams, such as Wayfinder, Fungi, PAAL AI, and Fere AI, are already exploring solutions, although none have made significant progress yet—leaving room for more competitors and specialization.

Overview of Wayfinder's crypto assistant

The needs of experienced Solidity developers may differ from those of newcomers. We believe that teams that consider specific user groups when building (tailoring experiences entirely based on the issues of that user group), provide refined user experiences (leveraging advancements in account abstraction and intents), and offer personalized services (based on users' previous on-chain activities) are most likely to succeed.

AI-supported asset generation: In the crypto space, content generation can be viewed as asset generation. These assets can take the form of tokens and digital assets in ERC20, ERC721, ERC1155, or other standard forms, with nearly limitless ways to generate them. Similar to how Midjourney and DALL-E generate images, or how SUNO creates music, AI can also play a key role in generating crypto assets.

Examples of early AI-driven crypto asset generation include Truth Terminal's $GOAT token, Wayfinder's asset deployment agent, Swan's upcoming gamified asset generation marketplace, and Virtuals Protocol's AI agent launch platform.

In addition to generating assets, AI can also shape narratives, create marketing assets, and give them a "voice." For specific asset types like meme coins (which have no external dependencies), AI can efficiently streamline the end-to-end asset development process.

In a world where AI agents can frictionlessly generate countless crypto assets, the opportunity for developers lies in identifying the flow of value and attention. For instance, the strategy adopted by Virtuals Protocol is to shift speculative behavior to the creator level, allowing consumers to predict the ability of AI agents to attract attention and create interesting assets.

We are currently in the early stages of a crazy new reality where AI can generate real financial value in the form of crypto assets, and humans can enjoy and speculate on the development of these assets. While the future of this trend is hard to predict, there is vast experimental space in this field, and we will closely monitor its direction.

Miscellaneous

There are many categories in the intersection of crypto and consumer-level AI that remain underexplored. With the rapid development of AI, these categories are likely to grow and evolve quickly. Although many categories may be fleeting and those suitable for crypto collaboration may be fewer, there is still ample experimental space in this area—which we welcome!

One way to think about it is to consider crypto-equivalent versions of traditional consumer-level AI projects, especially those that currently have no crypto intersection. For example, we apply crypto technology to two categories from the a16z and YC lists and add an additional category for discussion.

Edtech is a popular consumer-level AI category that can benefit from crypto technology at different layers of the stack. Education covers regions, subjects, languages, education levels, and teaching methods. In this case, rather than taking a centralized approach, it would be better to advance edtech through open-source development and collaboration with global contributors. In this context, an edtech-focused subnet on Bittensor could help build these models.

Crypto technology can also be applied to the incentive layer of edtech applications. Beyond traditional gamification strategies (like Duolingo's daily streak mechanism), crypto technology allows teachers and students to be rewarded for their contributions and efforts on both the supply and demand sides.

For self-help, the potential of cryptocurrency in achieving data ownership and monetization could be very appealing. Due to various reasons such as cost, social stigma, lack of awareness, and a shortage of professionals, it remains difficult for many to access. Projects like Sonia and Maia (both recently incubated in the latest YC batch) have begun to demonstrate the potential for affordable AI-driven mental health counseling solutions. Traditionally, therapists' notes are stored in paper or digital files in the office, making the data inaccessible. However, for AI therapists, data can be stored privately online, unlocking new applications from individuals' mental health data.

Imagine if you could truly own the data from AI therapy sessions. You could choose to keep it confidential, monetize it, or even anonymously contribute it to a health data network to support meaningful research. Crypto-native projects like Vana are making this possible, allowing people to have a stake in their own data.

In the entertainment sector, projects like Unlonely are experimenting with crypto-native live streaming, where users can speculate on and influence the outcomes of live streams through tokens on the trading platform. Currently, this is limited to real-life events, but it could extend to AI-generated content. This could enable 24/7 live streaming, giving users greater control over the narrative of the live stream. MineTard AI is a recently emerged early example. It is an AI agent that live streams Minecraft 24/7 on Kick, and the agent can be influenced by $MTard holders.

Last year, a viral trend emerged on TikTok where creators played NPCs, performing specific actions based on the "gifts" they received. While this type of content is fleeting, it clearly indicates consumer interest in interactive live experiences. With advancements in AI-driven NPC technology, similar gamified interactions may be suitable for crypto-native live streaming, where AI NPCs can respond to user input in real-time.

Hot NPC trend on TikTok

These are just some rough ideas on how to apply crypto and AI to consumer-level applications. In this report, we have not covered all possible applications, and as the industry rapidly evolves, we expect to see more such innovations.

Closing Remarks

You may have noticed that we are very excited about the possibilities at the intersection of crypto and consumer-level AI. The projects currently being built in this space represent only a small fraction of the potential.

With the parallel development of these two technologies, founders have a unique window to create a new wave of consumer-level applications that could change how we interact with and engage with digital assets and synthetic intelligence.

For those building in this space, we encourage you to continue pushing boundaries and exploring unconventional applications of these technologies. We also hope that for some, this resource can provide assistance on their journey.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。