As Bitcoin's price once again breaks through historical highs, MicroStrategy's stock price has surged significantly, increasing by over 2500% since mid-2020. This performance far exceeds Bitcoin's approximate 660% increase during the same period and even outperforms AI leader Nvidia.

Last night, MicroStrategy's stock price soared by 15% during trading, reaching a peak of $498.89, setting a new historical record. Its market capitalization also surpassed $100 billion for the first time. Currently, MicroStrategy ranks among the top 100 U.S. publicly traded companies by market capitalization, standing at 33rd on the Nasdaq, 89th on the S&P 500 index, and 85th overall in U.S. stocks.

As of now, MicroStrategy and its subsidiaries hold approximately 331,200 Bitcoins, with a total cost of about $16.5 billion and an average purchase price of $49,874. According to data from Bitcoin Treasuries, MicroStrategy is the publicly traded company with the most Bitcoin globally, far surpassing Bitcoin mining companies like Marathon, Riot, and leading crypto exchange Coinbase, which are more "crypto-native" in their business operations. Analysts point out that MicroStrategy still has $15.3 billion in funds available for further Bitcoin purchases, and its aggressive accumulation strategy may continue until the end of the year.

Statistics on MicroStrategy's Bitcoin purchase dates, prices, stock prices, and market capitalization; Data source: bitcointreasuries, mstr-tracker

In addition, the company's founder and CEO, Michael Saylor, personally holds over 17,000 Bitcoins and owns 14% of the company. If Bitcoin's price reaches $100,000, Saylor's personal assets will amount to $11.1 billion, enough to elevate his global billionaire ranking by nearly 200 places, surpassing Peter Thiel.

This year, in his sixtieth year, Michael Saylor has not only gone all-in on the company by aggressively buying Bitcoin but has also leveraged his investments, fundamentally changing his and MicroStrategy's fate through a bold gamble.

Since 2020, Saylor has been acquiring Bitcoin as a strategic reserve in the company's name. Originally focused on business intelligence, data analytics, and cloud computing, the company has transformed into the publicly traded company with the most Bitcoin globally due to its bold investment strategy.

However, this staunch Bitcoin advocate once claimed ten years ago that "Bitcoin won't last long; it's only a matter of time before it meets the same fate as online gambling." At that time, he believed Bitcoin would either be declared illegal and completely banned or would not measure up to other cryptocurrencies, thus fading into obscurity.

So, what exactly happened over the past decade that transformed Michael Saylor from a Bitcoin skeptic into one of its most ardent believers and advocates?

Playing Games with God: The First Half of Business Genius Michael Saylor's Life

"My belief is that if you're going to play a game, you might as well go all in, with no exceptions. I don't believe those who hold back will end up winning."

Like other internet company founders, Saylor has an almost legendary life story. His father was a sergeant in the U.S. Air Force, and his mother was the daughter of a country singer.

"My father was the typical, disciplined military man," Saylor recalls. "If you decide to do something, you must do it to the best of your ability, you understand? He was an absolutely honest person. I have never seen him lie; he never cut corners with anyone or anything. It wasn't until I grew up that I realized how unique this quality is. Many people like to take shortcuts and bargain, but my father never did; he never took shortcuts."

In a color photograph, his mother, Phyllis, beams with a smile. "My father taught me what character is, while my mother taught me what charm is."

His father told him that some things must be done; his mother told him that he could do anything he wanted because he was smart. In seventh grade, he was named the paperboy of the year, and his mother pulled him aside and whispered in his ear, "You will make a great contribution to society when you grow up because you are talented and smart—so make sure to make good use of those talents."

Saylor was an excellent student, learning to fly gliders in high school and graduating at the top of his class. Later, he received a ROTC scholarship to attend the Massachusetts Institute of Technology (MIT), where he studied the history of technology and aerospace. However, due to a heart murmur discovered during a physical examination, Saylor had to give up his dreams of becoming a pilot or astronaut.

The Ups and Downs of Entrepreneurship

After working for a while as a computer simulation planner at DuPont, 24-year-old Saylor co-founded MicroStrategy with his MIT roommate and fraternity brother, Sanju Bansal, in 1989.

At that time, Saylor realized that the internet had powerful data analysis capabilities that could help businesses analyze vast amounts of data about products and markets. Soon, clients began paying MicroStrategy hundreds of thousands of dollars each year to create intuitive charts that displayed consumer trends, such as which consumers preferred specific beverages or insurance products.

The turning point for the startup came when MicroStrategy signed a $10 million contract with McDonald's, which funded the development of applications to assess the effectiveness of promotional measures, playing a crucial role in MicroStrategy's early growth.

In 1992, 27-year-old Michael Saylor celebrated MicroStrategy's first client, McDonald's, securing a $10 million contract; Image source: Instagram @michael_saylor.

By 1998, when Saylor conducted an 11-day roadshow for the IPO, he was already performing exceptionally well. He even invited a reporter from The Washington Post to document the entire process. Saylor's sales style relied on passion, stage presence, and grand narratives rather than numbers; his captivating presentations were far more engaging than any PowerPoint.

Wall Street generally viewed Saylor as arrogant but undeniably charismatic. According to news reports from that time, Saylor had a tremendous passion for data analysis technology and painted a compelling roadmap for its future, with investors signing on almost entirely based on their confidence in him.

One software investor on Wall Street loved to disparage the CEOs of software companies during meetings, claiming they were "all garbage," but Saylor managed to get him to sign on the dotted line with his persuasive rhetoric. At Bear Stearns, Saylor secured a 10% stake from the company's owner in just 20 minutes. The world's largest mutual fund company, Fidelity, was known as the industry's toughest nut to crack, but according to Saylor, he broke into the company "like a slam dunk," effortlessly.

MicroStrategy was also a pioneer in enterprise data analysis technology, enabling retail companies, pharmaceutical giants, banks, insurance companies, and government agencies to uncover significant trends from vast amounts of data through data analysis software. With this expertise, MicroStrategy secured over 300 long-term clients, including giants like KFC, Pfizer, Disney, Allianz, Lowe's, and ABC.

After going public in June 1998, MicroStrategy quickly became Wall Street's darling. By March 2000, its stock price had reached 16 times its initial offering price, with a market capitalization of nearly $18 billion.

However, at this time, MicroStrategy became embroiled in an accounting scandal, with its stock price plummeting 62% in a single day. Saylor lost $6 billion in personal wealth overnight and even became the answer to a trivia question in the game "Who Wants to Be a Millionaire": "Who lost the most money in a single day?"

In March 2000, MicroStrategy's auditing firm, PricewaterhouseCoopers, required it to restate its revenue and profits for the previous two years. After the re-audit, MicroStrategy's performance for 1998 and 1999 went from a profit of $28 million to a loss of $37 million. Saylor, along with another founder and the company's CFO, chose to pay a $11 million fine to the SEC to settle the related charges, with Saylor personally paying $8.3 million, although he and others involved in the scandal did not admit to any wrongdoing.

Saylor appeared on the front page of the March 21, 2000, Daily News.

By mid-2002, MicroStrategy's market capitalization had plummeted to around $40 million, a 98% decline from its peak.

However, at this point, Saylor had another idea, which ultimately led to MicroStrategy's resurgence. He foresaw explosive growth in mobile devices and believed that programs could be developed to help clients analyze the vast amounts of data collected from users' iPhones and laptops.

Around 2009, Saylor offered his software for free to Facebook's new COO, Sheryl Sandberg. MicroStrategy's technology was crucial for Facebook, enabling salespeople to understand how much revenue each product could generate. Facebook eventually became a stable client for MicroStrategy, bringing in millions of dollars in revenue each year, and Saylor capitalized on the mobile trend to achieve sustained profitability.

Becoming a Revered Thought Leader

Although the business was not particularly large, Saylor's personal life was quite luxurious. He owns a villa in Miami Beach with 13 bedrooms and 12 bathrooms. He also has a $47 million Bombardier jet and two yachts, one of which is named "Hal," commemorating the ship that brought his ancestors from Rotterdam, Netherlands, to Philadelphia in 1736.

Saylor is also a party enthusiast. In 2010, he celebrated his birthday at the W Hotel in Washington, organizing a wildlife-themed party where he posed for photos with a Burmese python draped around his neck. Every year before Thanksgiving, he hosts a rock festival in Manhattan's SoHo, encouraging guests to dress up as rock stars.

In an interview with Fortune, Saylor's former colleagues noted that aside from his glamorous social life, he aspired to have a broad influence in the tech world and wanted to become a renowned thought leader. As one former employee put it, he aimed to "become a revered thought giant."

However, according to former colleagues, Saylor was known for being moody and detail-oriented in management, with some saying he was "too strict." Saylor is an extremely confident person, believing he could handle everything himself, which made him reluctant to delegate authority to his subordinates.

Yet, it has been proven that Saylor is adept at spotting major trends. In 2012, he published a bestselling book titled "The Mobile Wave: How Mobile Intelligence Will Change Everything," in which he predicted how mobile devices would trigger revolutions across various sectors, from retail to banking.

Saylor established at least two notable new businesses within MicroStrategy. One former colleague remarked, "He has the ability to foresee the future."

In the late 2000s, Saylor developed a monitoring platform that allowed homes and businesses to monitor their security systems through the website Alarm.com. In 2008, he sold this business for $28 million. In the early 2010s, Saylor developed the first cloud-based automated voice response systems for call centers, naming it Angel. In 2013, Genesys acquired Angel for $110 million.

His former colleagues stated, "Saylor does not allow people to do things their own way; however, without that freedom to operate, people cannot grow. Of course, I think the benefits outweigh the drawbacks. Just think, if you followed his investments every step of the way, first in the internet, then in mobile technology and cloud computing!"

However, Saylor's emotional and unpredictable style also placed significant pressure on management, hindering the company's development to some extent. Since 2018, he has changed three marketing directors, and one CFO left after just a year. Saylor struggled to retain top talent, which explains why he did not scale up successful ideas like Angel and Alarm.com but instead sold them to other companies.

Michael Saylor's favorite game is Dungeons & Dragons, and he has always insisted on being the Dungeon Master because he "likes to create and control the situation," much like how his business journey has repeatedly validated his correct choices, all stemming from his judgment of circumstances.

His entrepreneurial experiences in the first half of his life provided Saylor with ample risk-taking experience. Saylor is a Christian and has been baptized, but he views life in the real world as akin to playing a game with God. "Look at my ring—there's a dam, right? And a beaver. This beaver is playing a game with God amidst the waves. Edison was also playing a game with God. Rockefeller, Carnegie… these people are just like me; this life is just a game."

Michael Saylor's second act has begun.

Calling Musk to the Car: Why Did Saylor Buy Bitcoin?

In 2015, MicroStrategy generated $134 million in revenue, but after that, the company's revenue declined year by year. By 2018, revenue had plummeted to $3.981 million, and in 2019, it reported a loss of $1 million. In the first three quarters of 2020, MicroStrategy incurred a revenue loss of approximately $14.02 million.

At that time, the world was in the midst of a pandemic-induced crisis, and Saylor had an epiphany. MicroStrategy had a large amount of cash on hand, and Saylor was concerned that the Federal Reserve's loose monetary policy would exacerbate inflation, leading to a significant devaluation of the cash he held.

During the quarterly meeting in July 2020, Saylor announced that MicroStrategy planned to purchase Bitcoin, gold, and other assets to replace the cash still held on its balance sheet.

A month later, MicroStrategy used $250 million in cash reserves to buy 21,454 Bitcoins. In September and December 2020, MicroStrategy spent $175 million and $50 million, respectively, to purchase more Bitcoin.

In December 2020, to further expand its Bitcoin holdings, MicroStrategy issued $650 million in convertible bonds, which typically have longer maturities, most maturing in 2027-2028, with some even being zero-coupon bonds. This allowed the company to maintain low financing costs in the coming years and quickly use the bond financing to purchase Bitcoin, directly adding it to the company's balance sheet.

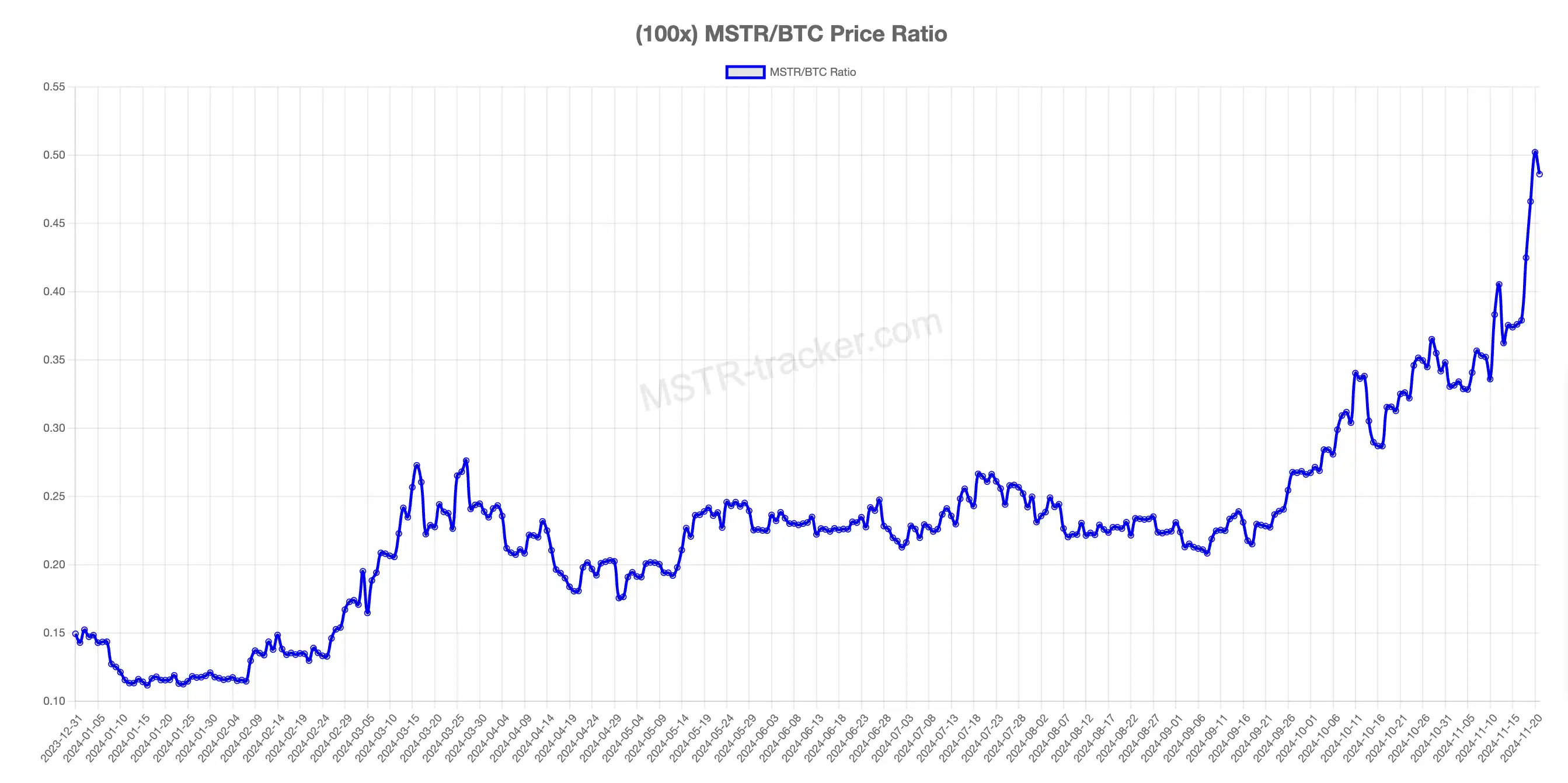

Through bond financing, MSTR continuously increased its Bitcoin holdings, which not only increased the number of Bitcoins on its balance sheet but also significantly impacted the market price of Bitcoin. As the proportion of Bitcoin in MSTR's asset portfolio increased, the correlation between the company's stock market value and Bitcoin prices strengthened. According to MSTR Tracker, the correlation coefficient between MSTR stock price and Bitcoin price surged to 0.55 recently, setting a historical high.

Since the latter half of last year, MicroStrategy adopted a new method of acquiring Bitcoin by issuing and selling its own MSTR stock to buy more Bitcoin. This "sell stock to buy Bitcoin" strategy may initially seem foolish, as it could hurt the stock price and even threaten MSTR's "leveraged Bitcoin" market positioning. However, upon closer analysis of the logical chain, it becomes clear that the issuance would not negatively impact MSTR's price; rather, it would make MSTR more valuable.

Related Reading: "Why Did MSTR's Premium Suddenly Surge Despite the 'Bond Financing to Buy Bitcoin' Strategy Remaining Unchanged?"

When MicroStrategy issues stock to purchase Bitcoin, the newly issued shares typically trade at a price above their net asset value. Leveraging this premium, MicroStrategy can acquire more Bitcoin than what each share of MSTR truly represents when selling each share.

For example, calculating the correlation coefficient between MSTR and Bitcoin, 36% of the value of each MSTR share symbolizes the Bitcoin backed by the company. Without a premium, when MicroStrategy sells MSTR, it can only exchange for 36% of Bitcoin from the market. However, currently, MSTR's premium over Bitcoin is around 2.74, meaning that every time MicroStrategy sells a share of MSTR, it can exchange for approximately 98% of Bitcoin.

This means the company can use funds above the net asset value of Bitcoin to increase its Bitcoin holdings, thereby expanding its Bitcoin position on the balance sheet. The core of this strategy lies in MSTR financing through high premiums, which enhances the speed and scale of Bitcoin accumulation, far exceeding the previous "bond financing to buy Bitcoin" pace.

According to the latest 8-K filing, MicroStrategy achieved a 41.8% Bitcoin yield in 2024, which translates to a net gain of 79,130 Bitcoins for shareholders, averaging about 246 Bitcoins per day—without incurring the high costs associated with mining. If all miners worldwide were to achieve the same results, it would take approximately 176 days.

Thus, Saylor pioneered two firsts: first, making MicroStrategy the first publicly traded company in history to purchase Bitcoin and incorporate it into its capital allocation strategy, and second, being the first company to dare to use borrowed money to buy Bitcoin.

"Repairing the World's Balance Sheets"

Not only did Saylor buy for himself, but he also encouraged his business magnate friends to buy.

Now, "Comrade Ma Baoguo," who is on friendly terms with Trump, had not yet deeply engaged with cryptocurrency four years ago. In December 2020, Musk posted a somewhat teasing image of a monk with hands clasped, gazing upward in reverence, yet unable to resist the allure of Bitcoin. Saylor replied to Musk, suggesting he do "something worth $100 billion for Tesla shareholders" by converting Tesla's balance sheet from dollars to Bitcoin.

Musk asked, "Is such a large transaction possible?" Saylor responded, "Of course, I have purchased over $1.3 billion in BTC in the past few months and would be happy to share my trading strategy with you privately."

In February 2021, Musk's Tesla disclosed that it had used cash on its balance sheet to purchase $1.5 billion in Bitcoin and announced that it would begin accepting Bitcoin as a payment method for its products.

In October of this year, Saylor called out Microsoft CEO Satya Nadella, stating, "If you want to make another trillion dollars for Microsoft shareholders, please contact me." According to a filing with the SEC, Microsoft is preparing to discuss potential Bitcoin investments at its shareholder meeting in December.

Time magazine once interviewed Saylor, and the reporter opened by asking if Bitcoin is a form of irrational exuberance, "Even if people don't believe something has value, they may blindly join the gamble out of envy for others' success."

In response to this sharp question, Saylor confidently answered, "No, quite the opposite. Bitcoin is a textbook case of a rational response to inflation. 'Rational behavior' means finding a store of value that can preserve and increase wealth. Speculation, on the other hand, is about suppressing opponents through short selling and squeezing, and that is what speculation is. Investing in Bitcoin is not speculation at all! Bitcoin is a brand new technology, comparable to Facebook and Google in the financial world, with enormous potential for appreciation in the future."

The reporter posed an even more challenging question: "If that's the case, why does Bitcoin have such a bad reputation?"

"A new paradigm means a complete change in how we view the world, and vested interests often do not accept new things. Our only hope lies with the next generation. Because unless there is a war or a very serious event, these vested interests will not change their views, while young people are different."

The reporter asked, "Do you have any ambitions?"

Saylor simply stated, "I want to repair the world's balance sheets."

Michael Saylor's enthusiasm for Bitcoin is not just a business gamble; it is a belief. From a pioneer in data analysis to a staunch advocate for Bitcoin, he has driven the transformation of MicroStrategy with his strong personal will and business insight, while also demonstrating to the market how to reshape a company through extreme risk-taking.

However, this gambling strategy has also raised market skepticism. Some analysts are concerned that MicroStrategy's high leveraged exposure to Bitcoin could amplify the impact of market volatility on the company, especially in the event of significant price fluctuations in Bitcoin. Furthermore, while Saylor claims to want to repair the world's balance sheets, whether such a vision can truly withstand the test of time remains to be seen.

Saylor once said, "Life is a game," and it is clear that he has no intention of stopping this game about Bitcoin.

References:

https://fortune.com/2022/08/03/michael-saylor-microstrategy-stock-bitcoin-bet-debt-outlook/

https://time.com/5947722/microstrategy-ceo-bitcoin/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。