Bitcoin is heading towards $100,000, yet the cryptocurrency trading groups are surprisingly quiet. After Trump's election, everyone was anticipating an influx of liquidity; however, aside from the meme trading sentiment activated by Binance, all altcoins have been left far behind by BTC. Why? Why do altcoins drop when Bitcoin rises, and they still drop when Bitcoin falls?

The answer may lie in the stock $MSTR.

MicroStrategy's purchase of Bitcoin is not new in the crypto space; it has become the BTC index in the U.S. stock market since the last cycle. However, in September this year, MSTR once again attracted market attention. This time, it was because MSTR actually started ahead of the Bitcoin price increase and maintained a continuous premium over Bitcoin in the subsequent market.

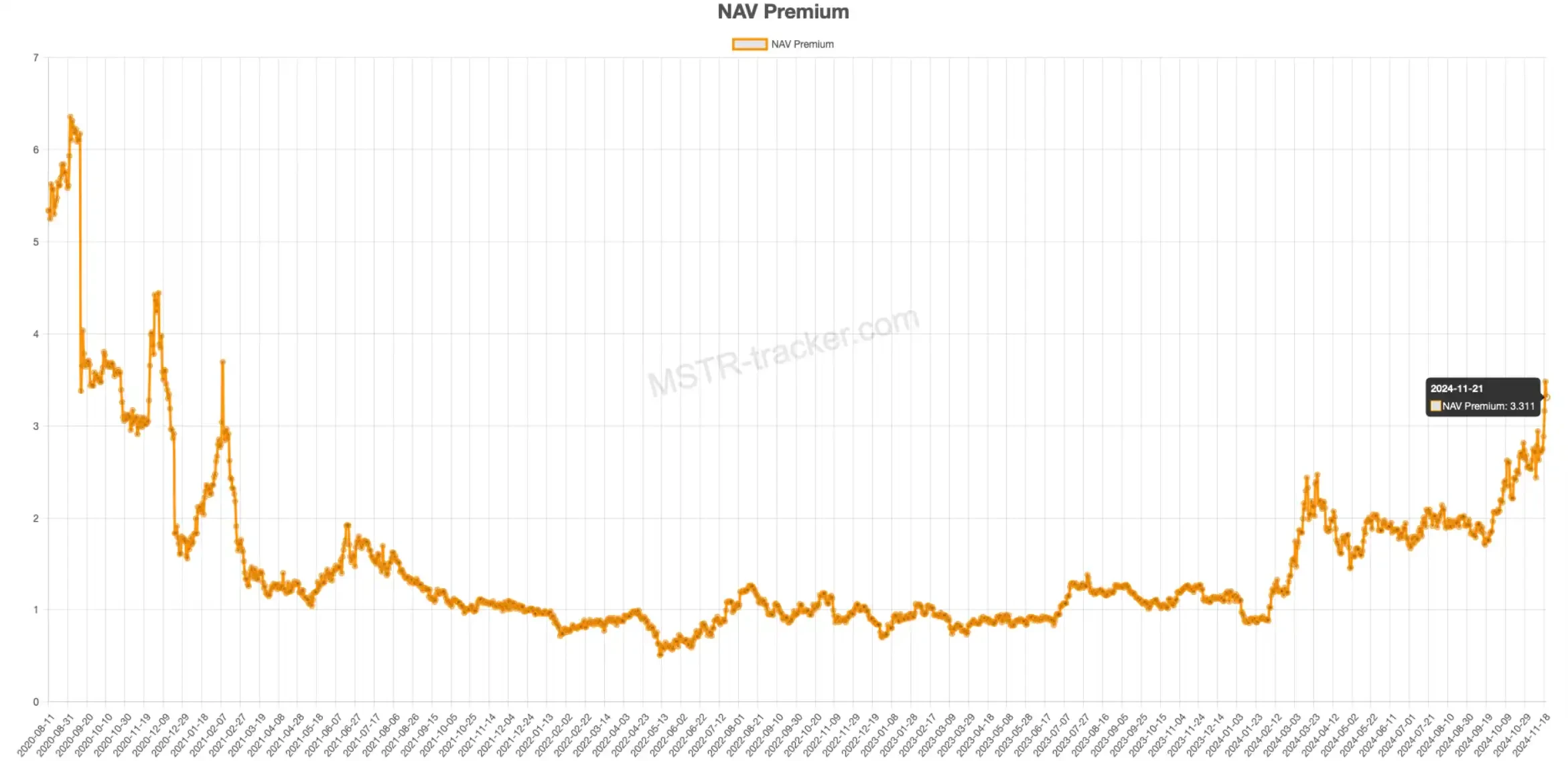

BlockBeats notes that the NAV premium coefficient (Net Asset Value Premium) is highly correlated with MicroStrategy's stock issuance activities. Once MSTR issues more shares, the premium coefficient tends to rise shortly thereafter. According to MSTR Tracker, the current NAV premium has reached around 3.3.

As a result, many people have started discussing "why MSTR has a premium." In fact, MicroStrategy quietly began a new coin-buying strategy in the latter half of last year, called "premium issuance."

Related reading: "The strategy of 'issuing bonds to buy coins' hasn't changed, why has MSTR's premium suddenly skyrocketed?"

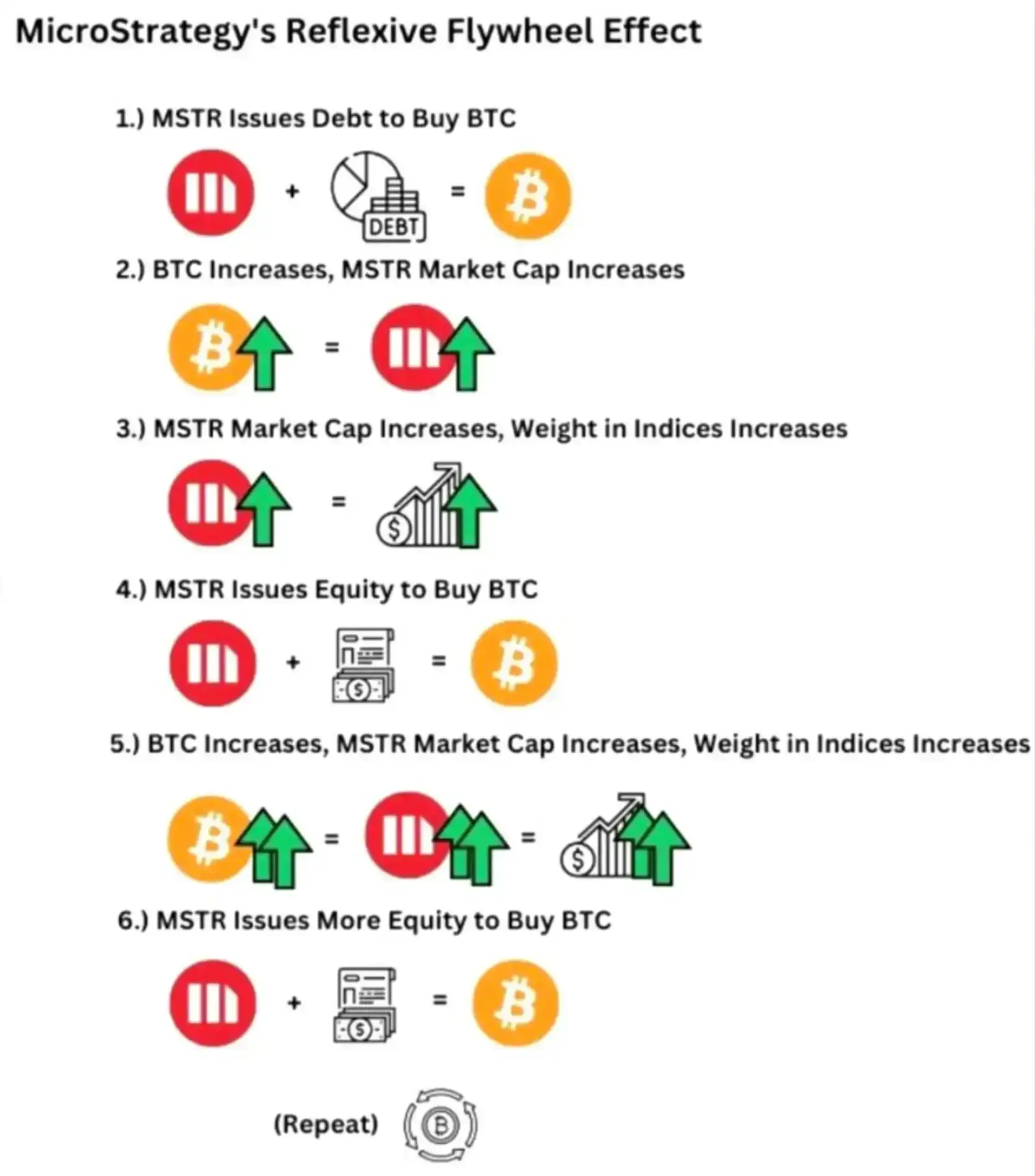

In simple terms, MicroStrategy has previously raised funds to purchase BTC through bond issuance, which means that each share of MSTR represents a certain amount of BTC (also the reason it is seen as the BTC index in U.S. stocks). However, the "premium issuance" model is more straightforward and immediate: when the price of Bitcoin rises and the company's market value increases, MSTR's exchange rate against Bitcoin will generate a premium.

At this point, the company issues more MSTR shares to buy more Bitcoin than the corresponding amount of shares at a premium, which further increases the BTC corresponding to each MSTR share, meaning the company's market value and MSTR's value will also rise, creating a continuous cycle.

In summary: The more MSTR is issued, the more valuable it becomes.

What does this have to do with the Bitcoin bull market? Aside from the fact that MicroStrategy accounts for 5% of the total circulation, the current U.S. stock market seems to be experiencing a paradigm shift. MicroStrategy CEO Michael Saylor has been emphasizing this year that there will be more and more MSTR in the U.S. stock market, claiming that his model is an "infinite money glitch." Initially, many people were skeptical, but recently, as giants like Microsoft have begun to explore "Bitcoin finance," you can feel the wheels of fate starting to turn.

In other words, if Saylor's vision continues to materialize, more and more U.S. companies will adopt "premium issuance" Bitcoin finance, further tying Bitcoin's price to the U.S. stock market. This massive liquidity will be entirely absorbed by BTC, with little relation to other altcoins (this is also one of the reasons why Bitcoin ETF inflows have surged recently while Ethereum ETF remains unaffected).

It is foreseeable that if the crypto industry stops innovating in narrative and practical capabilities, Bitcoin will drift further away from Crypto. In this broader context, the bull market is left with only two betas: one is Bitcoin, and the other is Solana, which absorbs liquidity within the circle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。