Author: AlΞx Wacy, Crypto Researcher

Compiled by: Felix, PANews

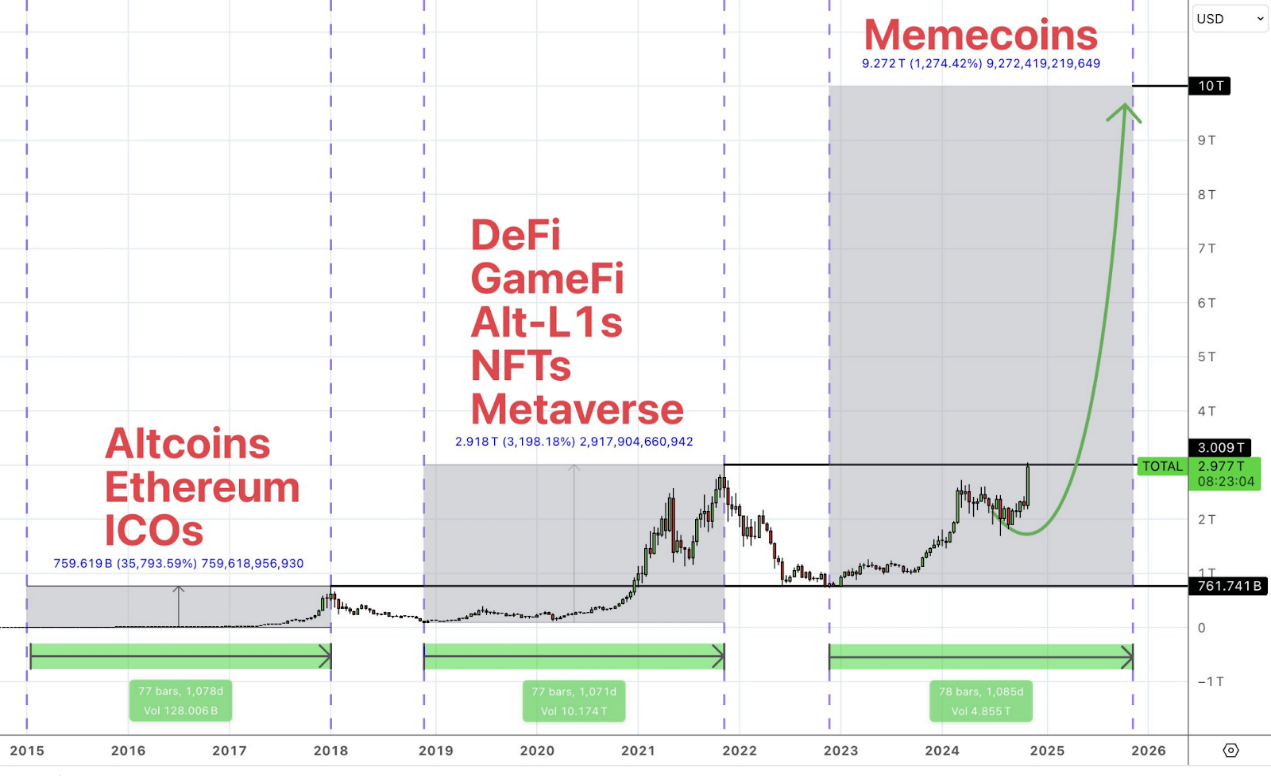

In previous bull markets, all altcoins did not surge simultaneously. This refers not to a 10-30% increase, but to surges of 300-700% or even higher. These rotating surges constitute the entire bull market cycle.

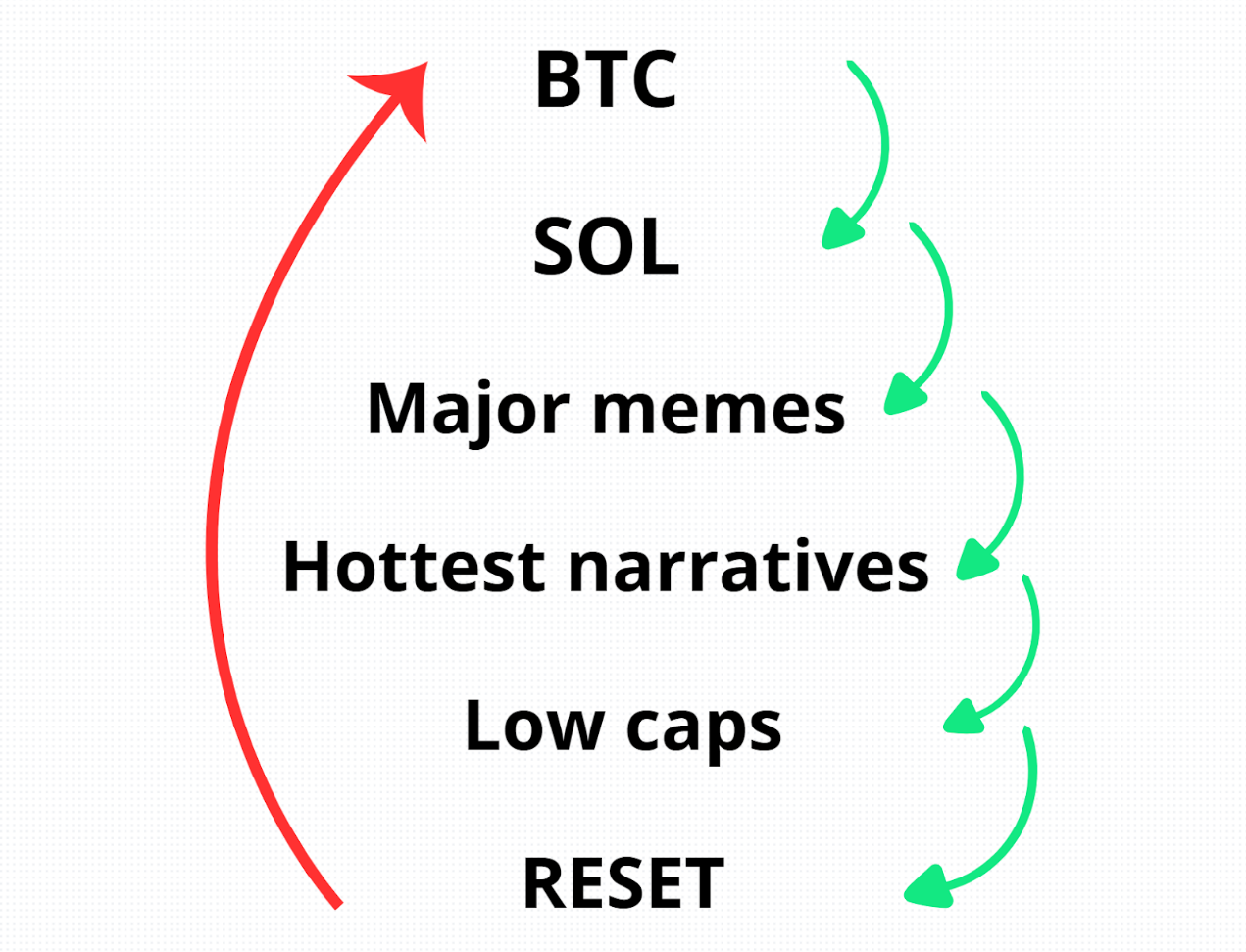

Funds continuously flow between different tokens, which is why altcoin seasons last not just a week, but several months. The previous flow of funds was as follows:

BTC > ETH > High Market Cap Tokens > Low Market Cap Tokens > BTC……

But this model is now outdated; the current flow of funds is more nuanced. Each stage will be discussed in detail below.

Stage One

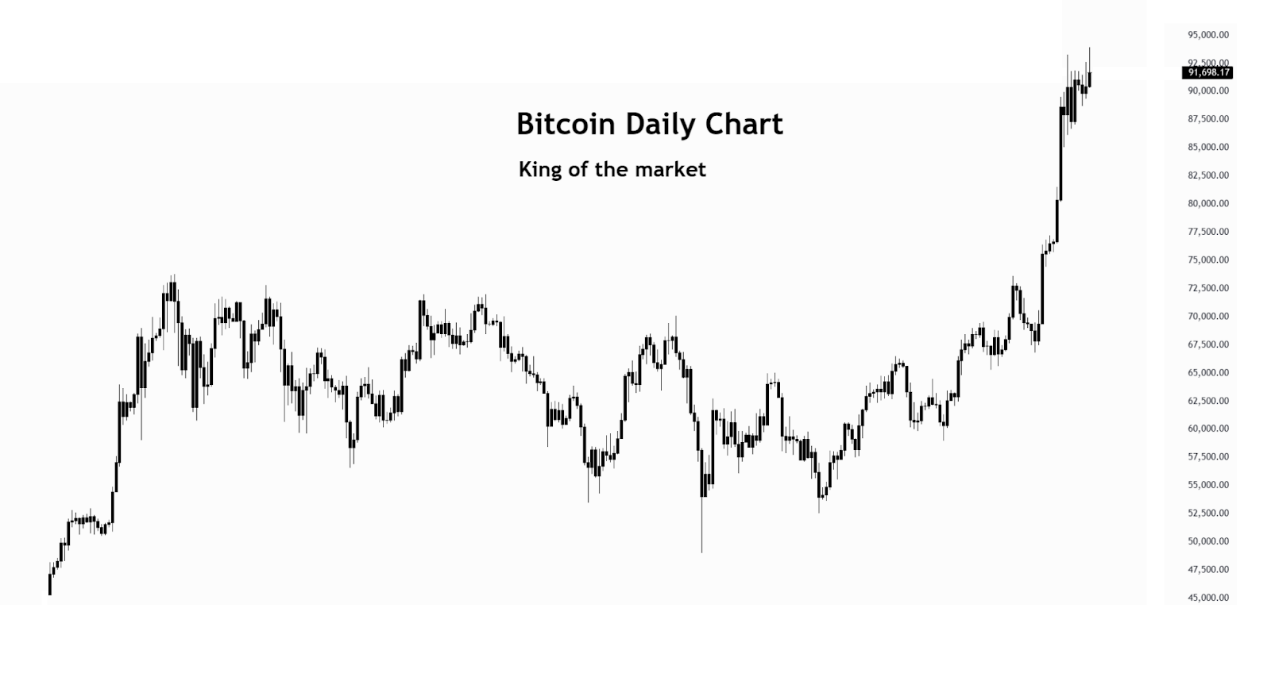

BTC continues to lead as always. Market giants set the trend in crypto, but once BTC stops rising (or its growth slows), other tokens will "take the baton."

Stage Two

SOL, as a standout among altcoins in this cycle, is beginning to rise. Additionally, some major altcoins may follow, but with weaker performance (currently in this stage).

Stage Three

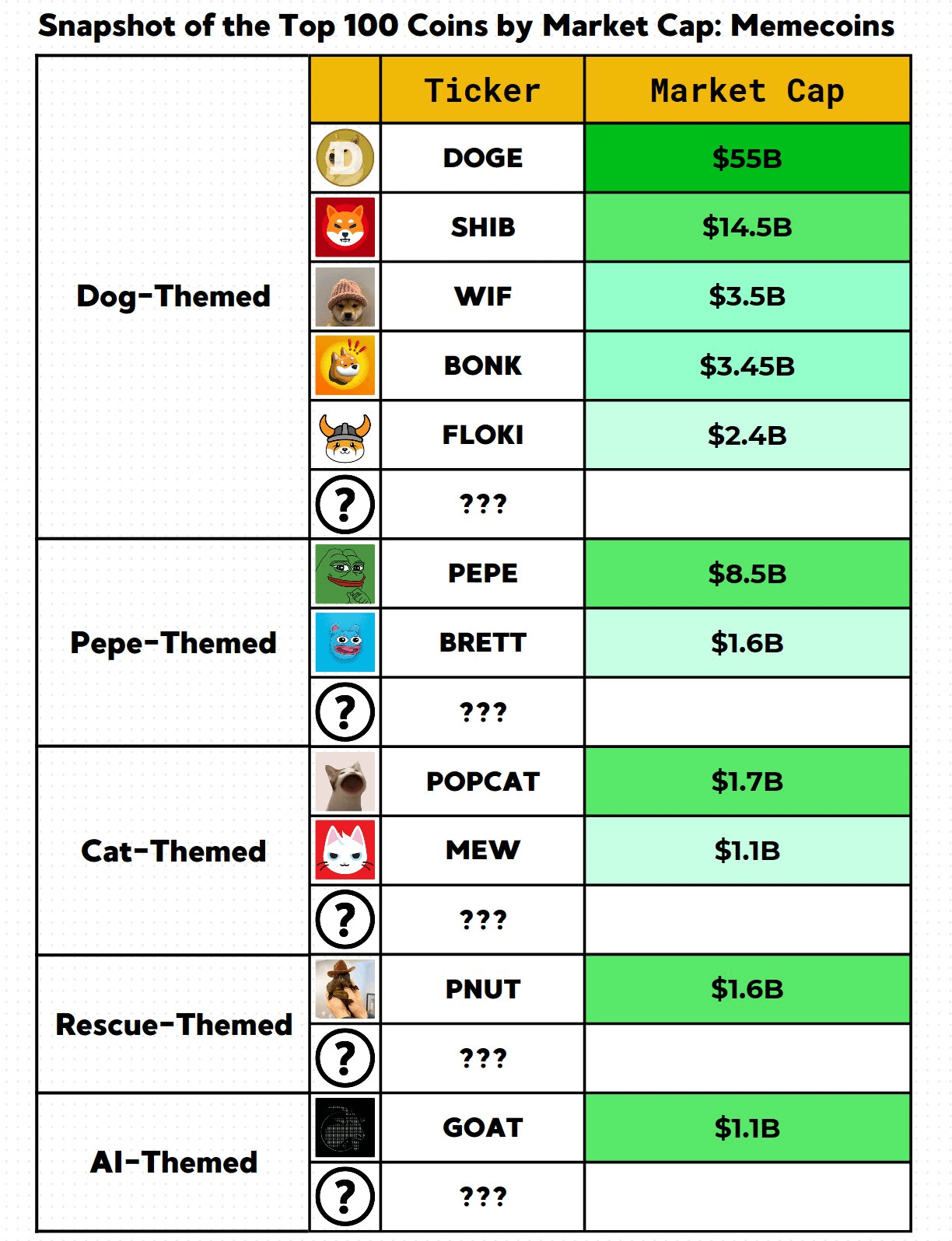

The following tokens may "take the baton" from SOL:

- Mainstream memecoins: DOGE, SHIB, PEPE, WIF, BONK, POPCAT

- Mainstream altcoins: RENDER, SUI, APT, LTC, etc.

Some tokens may perform poorly or explode later.

Stage Four

The most popular narratives dominate this stage. Memecoins, AI, RWA, and combinations of these narratives, such as AI memes and AI x DePIN, etc.

Some narratives may be skipped, and players may find themselves in a dilemma. Therefore, choose wisely.

Stage Five

In this stage, low market cap tokens begin to rise rapidly, even increasing hourly. This stage is the best trading opportunity for solid memecoins and fundamentally strong projects. Choose the best-performing tokens, as market surges and crashes often occur.

Stage Six

Funds flow back to BTC. As the market matures, these cycles become increasingly difficult to predict. Don’t waste this bull market; you still have time to make life-changing money in the next 5-9 months.

But remember one important thing: you can accumulate wealth in two ways:

- Long-term holding of appreciating tokens

- Trading with tokens that rise faster

Historically, less than 1% of those who attempt the second method achieve long-term success.

Therefore, most of your funds should still be held in long-term positions, and if you want to seize every surge opportunity, you should use spare funds (small positions).

Related reading: Why did Memecoins surge first in this bull market? A brief discussion on the new logic of asset sector rotation

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。