Today (November 21), BTC has shown a strong upward trend, rising 4.87% within 24 hours, with a peak breaking $97,000, leaving only a 3% gap to the $100,000 mark. As the BTC price surpassed $97,000, multiple indicators suggest that its subsequent trend may continue to be bullish.

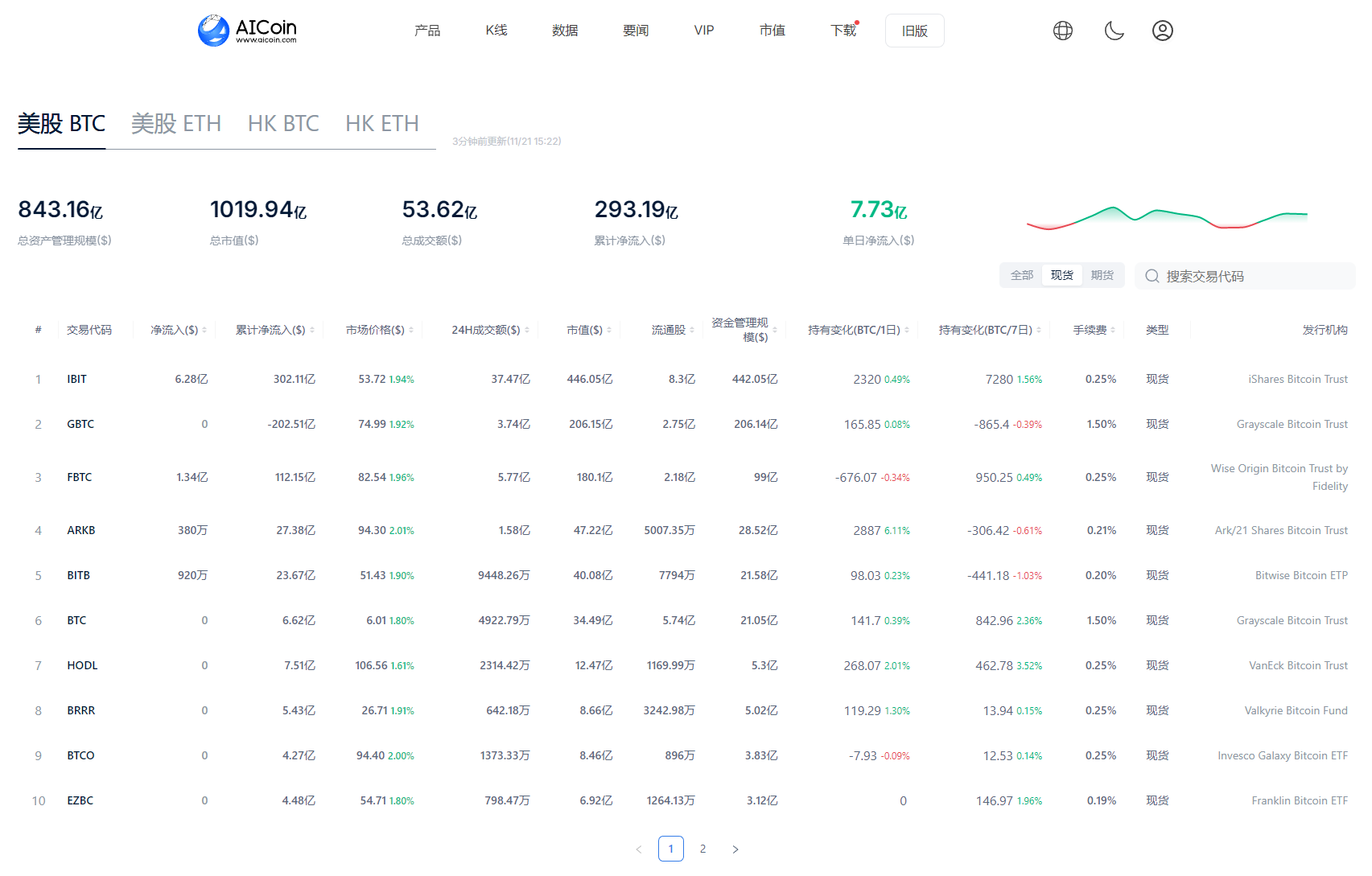

BTC Spot ETF Continues to See Net Inflows, Over $700 Million in a Single Day

According to AICoin (aicoin.com), BTC reached a high of $97,852 today, with a current market cap share of 59.4%. It is currently reported at $97,206, with an RSI14 of 71.7, indicating it is in the overbought zone, and no correction signals have appeared, maintaining a strong status.

The inflow of funds into Bitcoin spot ETFs is an important indicator of market demand. According to AICoin's monitoring, a large amount of capital flowed into the U.S. BTC spot ETF market yesterday (November 20), with a net inflow of $773 million, while the day before (November 19) saw inflows exceeding $800 million, indicating that the market continues to maintain a positive sentiment today.

The major contributor to today's net inflow remains BlackRock's Bitcoin spot ETF IBIT, which saw a net inflow of $627 million in a single day. Fidelity's Bitcoin spot ETF FBTC followed closely with a net inflow of $134 million. Generally, ETF fund inflows have a significant positive correlation with BTC prices.

Image Source: AICoin

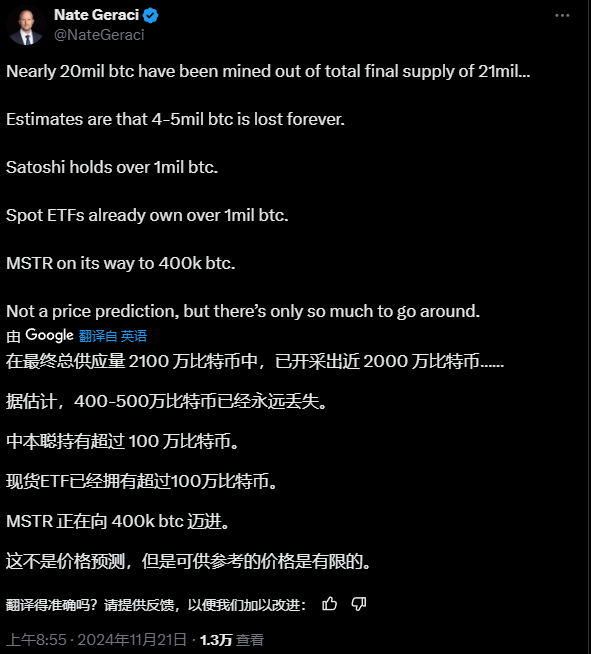

At the same time, Nate Geraci, president of The ETF Store, pointed out that spot ETFs now hold over 1 million Bitcoins, becoming an important component of market liquidity. This trend not only reflects the market's demand for Bitcoin but also demonstrates investors' high trust and acceptance of ETF products, while predicting that the number of Bitcoins held by MicroStrategy (MSTR) is expected to reach 400,000.

Image Source: x

Greed and Fear Index Remains in Greed or Above

The Greed and Fear Index is an important tool for measuring market sentiment, reflecting the current emotional state of investors. When the index shows that market sentiment leans towards greed, it usually indicates that prices may continue to rise. According to AICoin data, the current Greed and Fear Index is 82, indicating extreme greed, and it has remained above 75 since the beginning of this week.

Image Source: AICoin

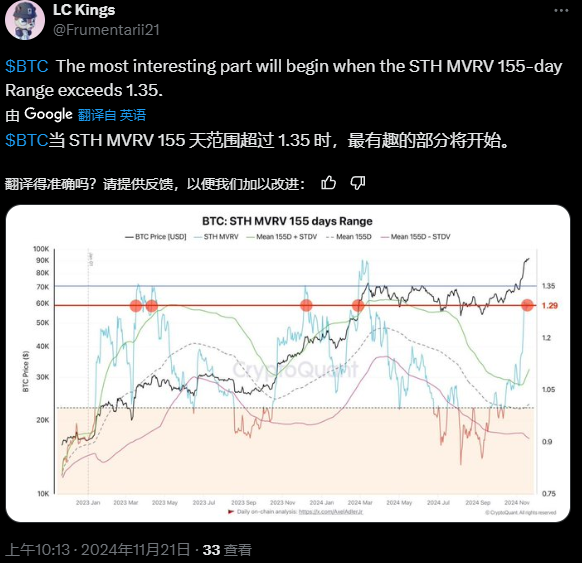

STH MVRV Exceeds 1.35 for 155 Days

STH MVRV (Short-Term Holder Market Value to Realized Value Ratio) is an indicator used to measure the behavior of short-term holders in the Bitcoin market, typically referring to investors who purchased Bitcoin in the past 155 days. This indicator assesses market health by comparing the market value of short-term holders to their realized value.

Currently, BTC's STH MVRV exceeds 1.35. When the STH-MVRV indicator surpasses 1.35, it usually means that the average holding cost of short-term holders is lower than the current market price. Generally, in such cases, short-term holders are in a profitable state, as their purchase price is below the current market price, indicating that there is unlikely to be selling pressure, suggesting that the market may be in a relatively stable state.

Image Source: x

BTC's MVRV (Market Value to Realized Value Ratio) is also an important on-chain analysis indicator used to measure the relationship between market price and BTC's realized price, thereby assessing unrealized profits or losses in the market. The MVRV ratio reveals the average profit multiple of the tokens held by comparing the current market value (MV) to the sum of the realized values (RV) of all on-chain last transactions.

Historically, an MVRV ratio between 2.6 and 5 typically corresponds to market peaks, and an MVRV ratio above 3.7 may indicate that the market is overheated. According to AICoin data monitoring, the current MVRV value is 2.65, indicating that the market is approaching a peak but has not reached the 3.7 level, suggesting that BTC still has room for growth.

Image Source: AICoin

Conclusion

After breaking $97,000, market indicators suggest that BTC is likely to continue rising. The sustained net inflows into spot ETFs, optimistic market sentiment, and the profitable state of short-term holders provide strong support for Bitcoin prices. With the combined effects of these factors, the bullish trend in the Bitcoin market may continue. However, investors should remain vigilant and closely monitor market dynamics to adjust their investment strategies promptly in response to market changes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。