Written by: Tanay Ved & Matías Andrade Cabieses

Translated by: Shan Ouba, Golden Finance

Key Points:

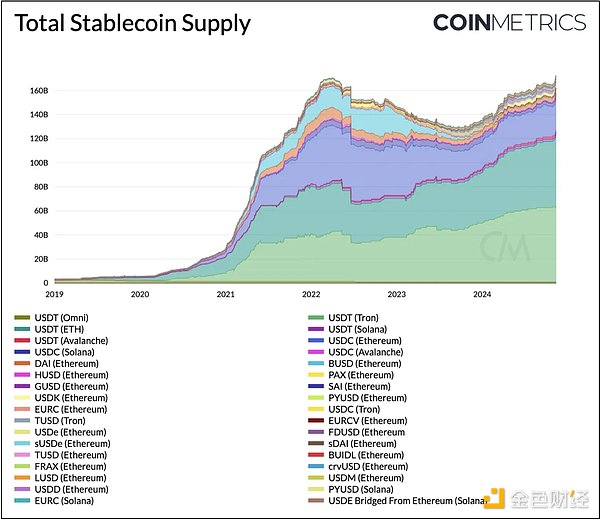

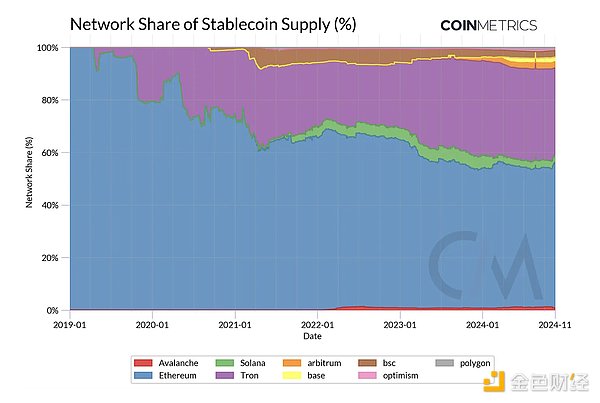

- The total supply of issued stablecoins has expanded to $189 billion, with Tether's USDT accounting for $125 billion (66% of the total supply), while stablecoins issued on Ethereum total $104 billion (55% of the total supply).

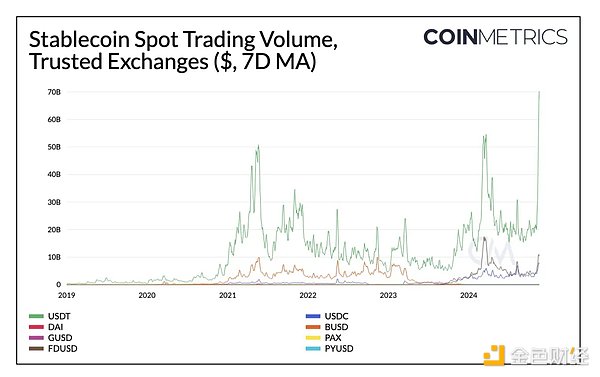

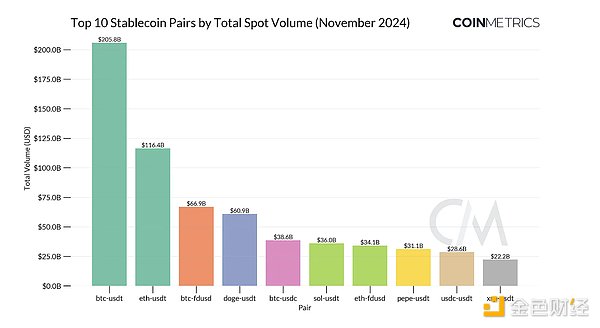

- In addition to serving as a store of value, stablecoins are crucial trading mediums during bull markets. After the elections, stablecoin trading volume across major exchanges surged to $120 billion, with the most traded pairs including BTC, ETH, SOL, and memecoins.

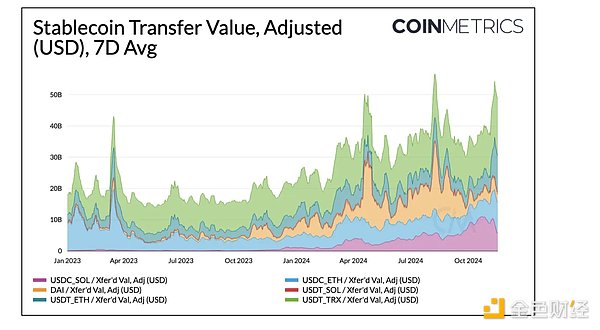

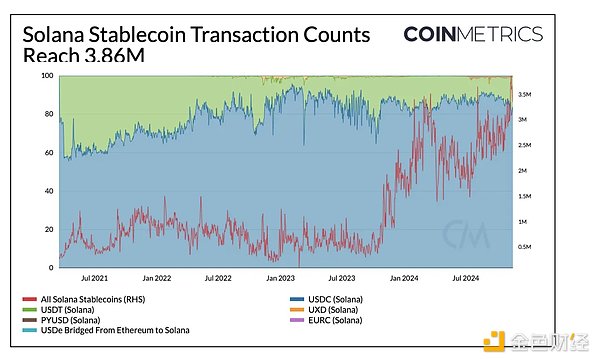

- With adjusted stablecoin transfer volume (in USD) surpassing $50 billion in November, on-chain activity is on the rise. Driven by increased USDC usage, Solana's stablecoin trading volume has reached an all-time high.

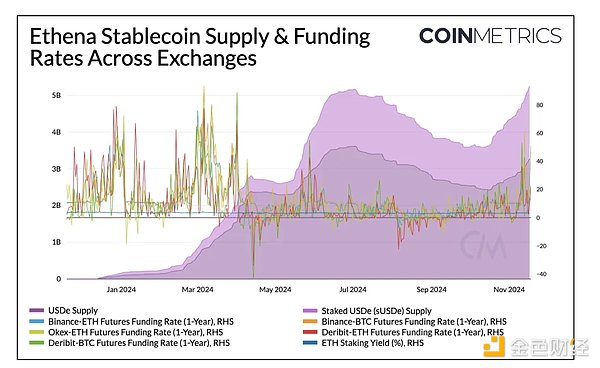

- Fueled by bullish market sentiment and rising financing rates, Ethena's USDe and staked USDe (sUSDe) have seen rapid growth since the third quarter, showcasing the evolving yield-driven dynamics of stablecoins.

Introduction

As the cryptocurrency market enters a bull phase, stablecoins have also regained upward momentum, with total issuance exceeding $189 billion. This influx indicates a growing liquidity environment, as users can capitalize on price increases and opportunities emerging within the on-chain ecosystem. M&A activity in the crypto space is heating up, with Stripe acquiring the stablecoin payment platform Bridge for $1.1 billion in October, and Coinbase acquiring Utopia Labs, further propelling growth in the industry. Stablecoins continue to be a central theme across the financial landscape, poised to become pillars of fintech, payments, and the global financial system.

In this week's Coin Metrics network status report, we delve into the stablecoin sector based on data, exploring its key role as a medium of exchange during bull markets and analyzing on-chain adoption of key metrics.

Stablecoin Overview

The stablecoin sector is continuously expanding in depth and breadth. Following significant profits by existing players like Tether, traditional finance and crypto-native issuers are also entering the market, leading to a steady influx of stablecoins. Meanwhile, stablecoins are establishing a broader footprint across chains, especially as alternative Layer-1 and Layer-2 ecosystems mature. Consequently, Coin Metrics' coverage of stablecoins has expanded to over 35 different stablecoins and continues to grow.

Tether's USDT has a total supply of $125 billion, maintaining the largest share of stablecoin issuance with a market share of 66%. Circle's USDC follows closely with a total supply of $36 billion, holding a market share of 19%. In terms of networks, Ethereum is the blockchain with the most stablecoin issuance, accounting for a total supply of $104 billion (55%). Tron continues to hold a 33% share of stablecoin supply across networks, primarily driven by USDT. Solana and Ethereum's Layer 2 networks (Arbitrum, Base, Optimism) together account for about 7.5% of the total stablecoin supply, reflecting their growing but still emerging stablecoin ecosystems.

Market Surge, Stablecoin Trading Volume Soars

As one of the earliest use cases, stablecoins have proven their role as a medium of exchange in both bull and bear markets. In an upward-trending market, stablecoins serve as a bridge for users to access other tokens within the ecosystem, providing essential liquidity for on-chain and trading activities. During market downturns or periods of volatility, they can also act as a store of value or savings mechanism, allowing users to preserve wealth or earn from on-chain and off-chain sources. This makes stablecoins indispensable across various market conditions, geographies, and time zones.

With the cryptocurrency market rising after the elections, stablecoin trading volume across exchanges has surpassed $120 billion due to increased trading activity. Among them, Tether's USDT accounted for about 80% of the recorded spot trading volume on November 12, totaling $95 billion. FirstDigital USD (FDUSD) also gained significant traction, with daily spot trading volume soaring to $16 billion (about 17% of the total), while Circle's USDC reached $11 billion, setting a record for the highest weekly average spot trading volume to date.

We can further analyze the specific stablecoins and crypto assets driving November's activity. Major assets like BTC, ETH, and SOL, along with memecoins like DOGE and PEPE, prominently feature among the top 10 trading pairs across exchanges. While the dominance of mainstream currencies is not surprising, the influence of memecoins indicates increased retail participation as BTC reaches new price highs. Consequently, the "specialized coins" segment in datonomy™ (including meme coins, privacy coins, and remittance coins) has emerged as the best-performing segment, with a return rate of 63% over the past 30 days.

On-Chain Economic Activity and Usage

Stablecoins play a vital role not only as trading mediums and sources of liquidity on exchanges but also for non-trading use cases, such as facilitating transactions and settling economic value on-chain. Stablecoins are ideal tools for consumer and B2B payments, remittances, wealth storage, or seeking economic stability and access to financial infrastructure, especially in emerging markets.

By leveraging some on-chain metrics, we can better understand how stablecoin-driven economic activity evolves over time and the extent of their usage across different public blockchains.

In November, the weekly adjusted transfer volume of native units between different stablecoin addresses exceeded $50 billion. Among them, $18.2 billion (38%) came from USDT on Tron, and $12.3 billion (23%) came from USDT on Ethereum, both setting new trading volume records. USDC on Ethereum and Solana also showed greater appeal, with transfer volumes on the rise.

Notably, Solana's stablecoin trading volume reached a historic high of 3.86 million transactions in November. USDC continues to be the preferred stablecoin on Solana, accounting for 83% of all stablecoin-related transactions on the network. Due to Solana's lower transaction fees, the average transfer amount for USDC on the network is $20, compared to $1,400 on Ethereum. This has led to a higher transaction count on Solana, with stablecoin trading volume in November reaching 3.86 million transactions, far exceeding Ethereum's 230,000 transactions, despite Ethereum having stronger stablecoin liquidity.

We can utilize several other metrics to understand on-chain stablecoin activity, including the supply held by smart contracts and externally owned accounts (EOAs), stablecoin circulation velocity (turnover rate), active addresses, the number of addresses holding stablecoins above a certain threshold, and supply distribution. These metrics can be further explored using the token dashboard created with our charting tools.

Yield Demand: Higher Financing Rates Drive Ethena's Growth

Another avenue driving demand for stablecoins is the provision of yields, which can serve as a form of passive income or risk management, whether in bull or bear markets. To compete with giants like Tether and Circle in adoption, some stablecoin issuers incentivize stablecoin growth by passing on interest to holders, thereby enhancing their value storage attributes. This encompasses various methods and risk profiles, from passing on partial yields generated from real-world assets (RWAs) like U.S. Treasury bonds to passing on yields from staked on-chain collateral assets like ETH, or in some cases, passing on income generated from operations related to on-chain protocols (for stablecoins issued by the protocol).

Ethena brings a relatively new yield generation method for its synthetic dollar USDe (referred to as "internet bonds"). It combines hedging strategies from centralized exchanges with staking rewards to generate yields while maintaining peg stability. Crypto assets are used as collateral (BTC, ETH) to open short positions in perpetual futures markets, aiming to benefit from positive financing rates. Combining financing and basis, Ethena passes on the yield from ETH staking rewards in the form of interest-bearing tokens, sUSDe.

Notably, there is a close relationship between the supply of USDe across various exchanges and ETH financing rates. In an environment with positive financing rates, the supply of USDe and staked USDe (sUSDe) has increased, while the supply has decreased or stagnated when financing rates turned negative. Interestingly, Ethena recently announced plans to launch USTb, a new stablecoin collateralized by BlackRock's tokenized U.S. Treasury fund BUIDL. This stablecoin aims to serve as a supporting asset for USDe, helping to manage risks during market volatility that leads to weak financing rates. As the fastest-growing stablecoin since the third quarter, Ethena is well-positioned to capitalize on the rising financing rates.

Conclusion

Stablecoins remain the cornerstone of the digital asset ecosystem, driving liquidity, facilitating payments, enabling on-chain economic activity, and serving as tools for savings and wealth preservation. According to multiple metrics, the adoption and usage of stablecoins continue to grow, demonstrating their widespread demand and utility. As stablecoins gain attention, regulatory clarity in areas such as reserve transparency and issuance standards will drive innovation across the ecosystem and promote growth in stablecoin-related businesses. With ongoing positive regulatory efforts in the U.S. and globally, the stage is set for the next phase of growth for stablecoins, potentially reshaping the financial ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。