Market liquidity shows a trend of centralization, and the sentiment for crypto compliance still needs to be realized

Written by: Pzai, Foresight News

As Bitcoin once again reaches a new high of $97,000, its market share in the cryptocurrency market has also hit a new high in three years. Pro-crypto groups under Trump have consistently placed Bitcoin at the core of their crypto strategy, and as the regulatory environment for crypto becomes clearer, various compliant investment methods are being sought after by investors.

Crypto stocks rise, altcoins underperform

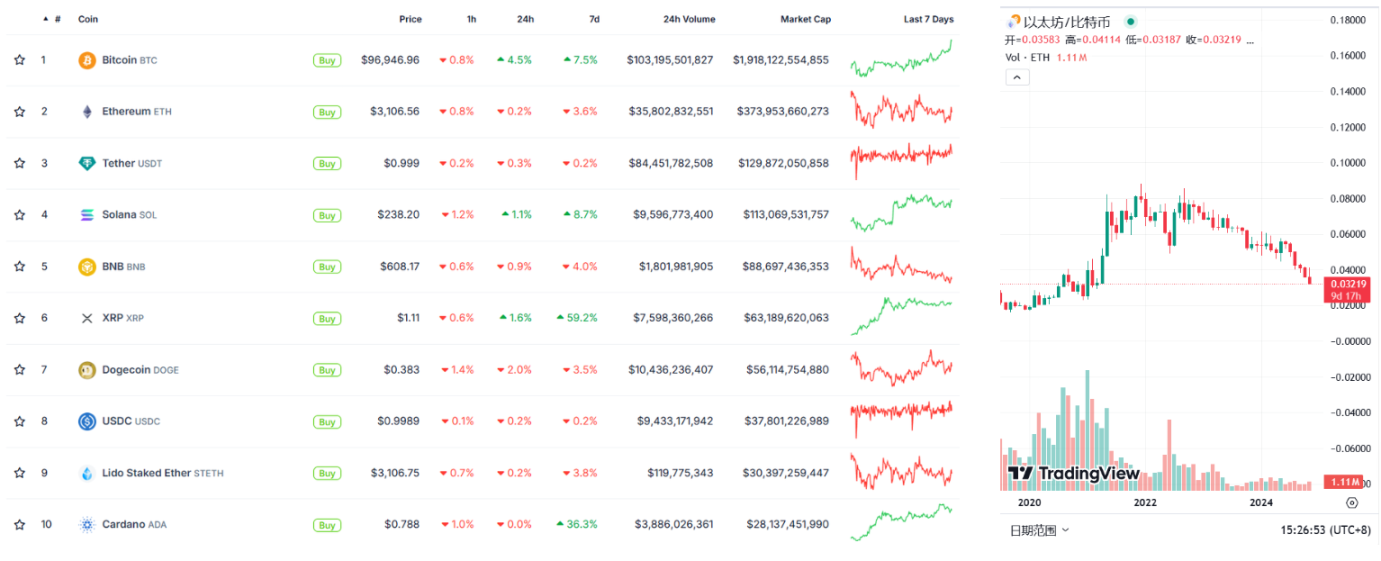

With Bitcoin further consolidating liquidity both on and off exchanges, its market share has reached a recent high of 61.6%. In contrast, the performance of altcoins has mostly declined, with only BTC, SOL, and XRP among the top ten crypto assets showing an increase. The existing compliant entry channels have concentrated liquidity primarily in Bitcoin and its related assets, leading to a shift in liquidity away from altcoins.

Additionally, the exchange rate of Ethereum, the second-largest crypto asset, against Bitcoin has dropped to 0.03217, marking a new low in nearly three years. Its poor price performance has also raised certain doubts within the Chinese community regarding Ethereum and its operational model. As of the time of writing, Ethereum is priced at $3,125, having long been hovering around the $3,000 mark.

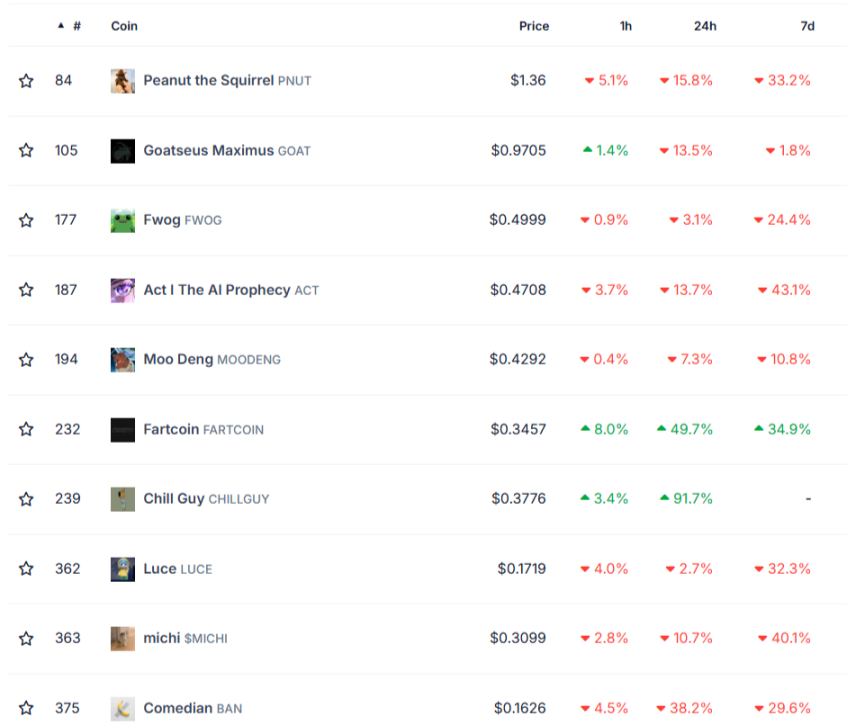

The trend of market polarization is also prominently reflected in the MEME-related markets. In the leading MEME tokens on Solana, the average daily decline is around 5%-10%, indicating a trend of funds flowing back to mainstream assets to some extent.

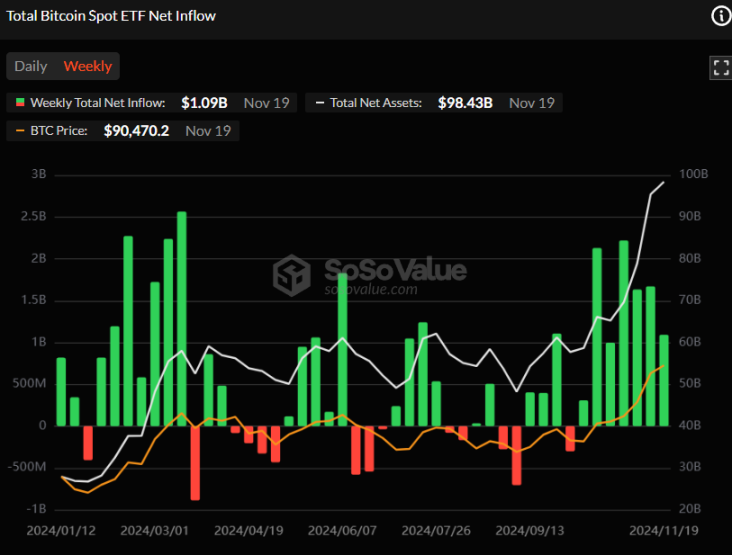

Meanwhile, a significant influx of funds off-exchange is driving a steady rise in Bitcoin prices. Bloomberg senior ETF analyst Eric Balchunas stated that the trading volume of Bitcoin-related stocks has reached $50 billion, equivalent to the average daily trading volume of the entire UK stock market. Among these, MicroStrategy (MSTR) alone contributed $32 billion, while MSTU and MSTX (the two leveraged ETFs of MSTR) combined for $6 billion, surpassing the total trading volume of all spot Bitcoin ETFs. Compared to spot ETFs, investors are more willing to trade with related companies, and MSTR's stock price has also hit a historical high of $504.83, with a market capitalization exceeding $100 billion, and its daily trading volume surpassing Tesla, second only to Nvidia.

As a crypto asset in the US stock market, MSTR has also been quite active recently, including plans to sell $2.6 billion in notes and use the proceeds to purchase Bitcoin. To date, MicroStrategy has already realized an unrealized profit of over $15.5 billion.

In terms of ETFs, net inflows in the past two months have also exceeded $9 billion, reflecting traders' confidence in Bitcoin prices, especially after Trump's election, which further solidified confidence in crypto.

Can the bull market continue?

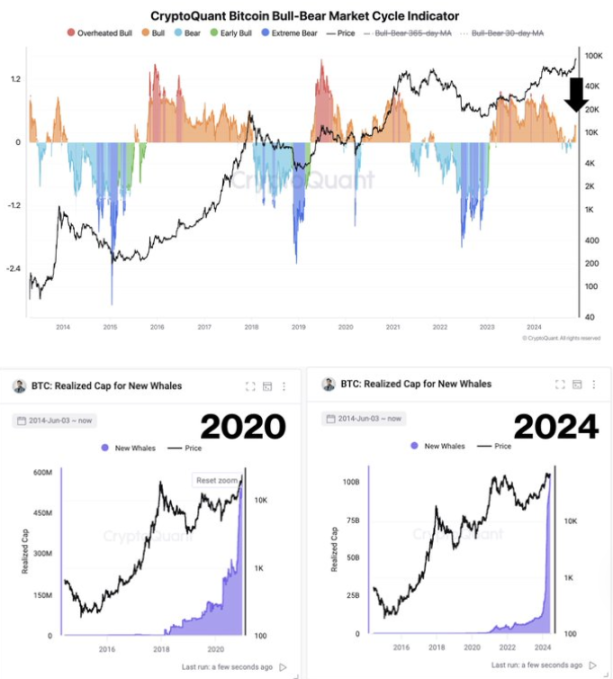

CryptoQuant founder Ki Young Ju analyzed that there is still significant room for a subsequent Bitcoin bull market, as the bull-bear index has recently turned positive. Additionally, the accumulation of whales on-chain is also rising, similar to the situation in 2020. He stated that the upcoming halving cycle, combined with the liquidity from institutional entry, can support certain trends in the future.

Crypto compliance sentiment still needs to be realized

This week, traders are closely watching Trump's appointments for the Secretary of the Treasury and the Chairman of the Securities and Exchange Commission (SEC). According to sources, the Trump team is considering establishing the first crypto-related position in the office, injecting another boost for institutions entering the crypto space.

Currently, popular candidates for the SEC chair include Goody Guillén, who has worked in blockchain legal services at a law firm, as the Trump team seeks a leader who understands the industry and takes a cautious approach to applying securities laws to digital assets until Congress passes clear legislation. Additionally, Howard Lutnick, CEO of Cantor Fitzgerald (which manages most of Tether's reserves), has been nominated by Trump as the new Secretary of Commerce. The company recently announced an initial Bitcoin leveraged financing business of up to $2 billion, reflecting the Trump team's shifting attitude towards integration in the crypto space.

In terms of legislative progress, although there is a growing call within the US Congress for digital asset regulation, actual progress towards forming a specific policy framework remains very limited. In May of this year, the US House of Representatives passed the "Financial Innovation and Technology Act of the 21st Century" (FIT21), aimed at providing federal guidelines for the digital asset industry. However, the bill still faces many challenges, including further coordination and cooperation with the Senate and the executive branch. With the Trump administration taking office, we also look forward to a real breakthrough in crypto compliance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。