Latest market data shows that BTC prices continue to rise, recently breaking the $97,000 mark, with its market cap share climbing to 59.5%. This phenomenon has excited investors, while community players lament that altcoins are being drained by BTC. BTC continues to set new highs, but when will the spring for altcoins arrive?

BTC Breaks $95,000, Market Cap Rises to 59.5%

According to AICoin (aicoin.com) market data, BTC has just broken a new high, reaching a peak of $97,852, with a 24-hour increase of 4.85%, currently valued at $97,132.

In the 4-hour cycle, both DIF and DEA are diverging upwards, and the MACD histogram remains positive and is expanding, indicating bullish signals. The RSI value is 72, entering the overbought zone, but no retracement signals have appeared yet, so caution is needed for potential adjustments. The current price is above EMA7, EMA30, and EMA120, with EMA7 > EMA30 > EMA120, showing a typical bullish arrangement, supporting continued bullish sentiment.

Image Source: AICoin

The significant rise in Bitcoin while altcoins show no signs of improvement has sparked discussions among community players. Cryptocurrency analyst Miles Deutscher also tweeted today that altcoins are currently being drained by Bitcoin.

Image Source: x

When Will Altcoin Season Arrive?

Logic for Altcoin Price Increase

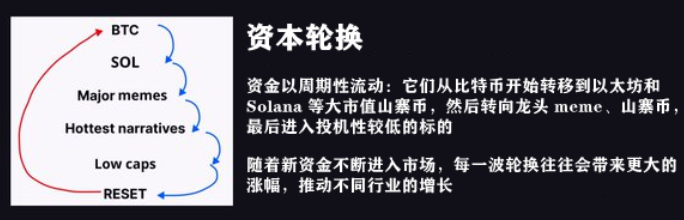

While Bitcoin's price surges, the performance of the altcoin market remains relatively sluggish. WOO X Research states, "Funds will follow the characteristics of market liquidity."

For altcoins to rise, Bitcoin's price typically needs to reach a stable high, making investors willing to shift funds from Bitcoin to altcoins. The flow of funds usually moves from larger assets to smaller ones, meaning Bitcoin must first rise and stabilize to encourage funds to flow into the altcoin market. Wacy also provided a chart to support this view.

Image Source: x

Decline in BTC Dominance (Market Cap Share Decrease)

When Bitcoin's share of the entire cryptocurrency market (known as Bitcoin dominance) falls below a critical level, it indicates that investors are shifting funds into altcoins. This shift typically signals the beginning of altcoin season, as people seek assets with higher potential returns.

Miles Deutscher recently tweeted, "Remember, the real altcoin season can only begin when BTC dominance reverses. Right now, it (BTC market cap share) is still parabolic, so be patient and watch the charts."

Wacy believes that falling below 57% will be key to starting the altcoin season. Currently, BTC's market cap share is 59.5%.

Altcoins Taking Over Trading Volume

In cryptocurrency exchanges, trading volume for altcoins is beginning to exceed that of Bitcoin. For example, trading activities for pairs like ETH/USDT or SOL/USDT may surpass BTC/USDT, indicating that altcoins are becoming the main focus for traders and investors. Currently, BTC's 24-hour trading volume is…

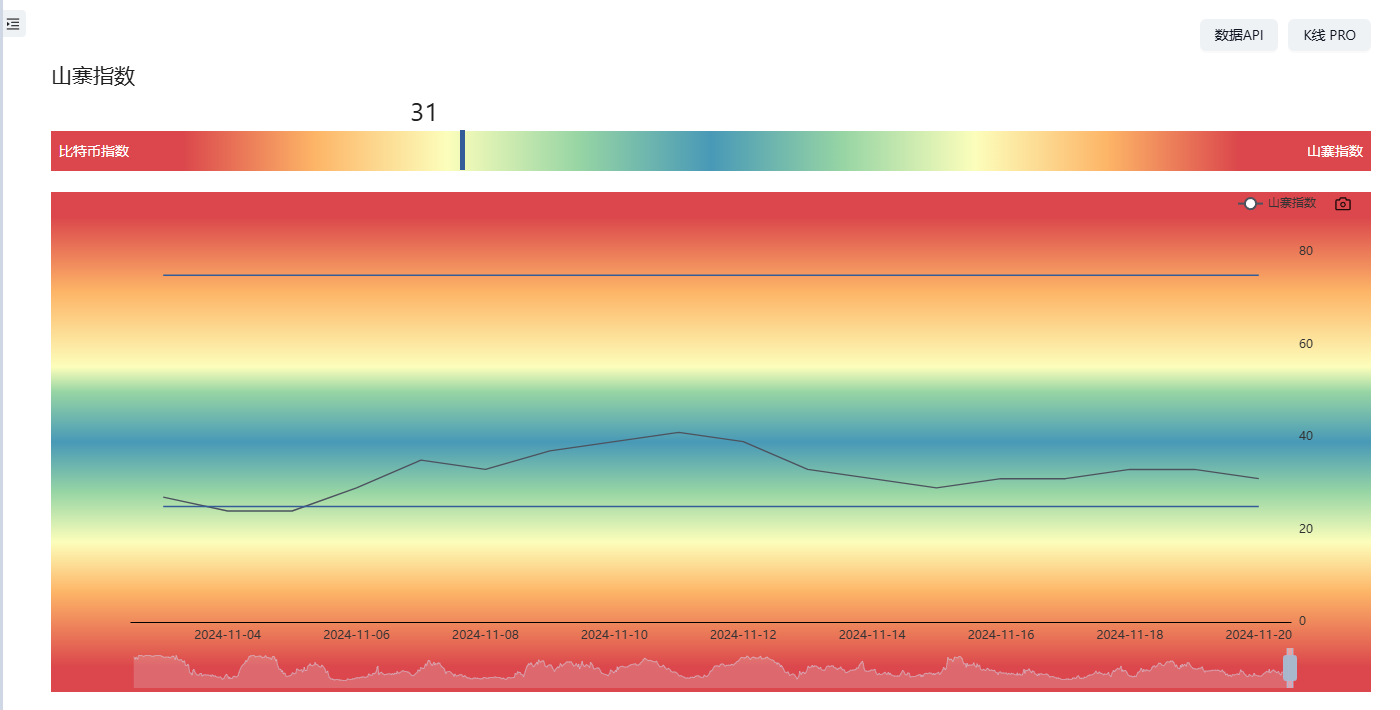

Altcoin Season Index

The Altcoin Season Index (ASI) is an important indicator that measures the performance of altcoins relative to Bitcoin. ASI determines its score by comparing the performance of the top 50 altcoins against Bitcoin over 90 days. Generally, an ASI score above 75 indicates that the market has entered what is known as "altcoin season," while today the altcoin index is only 31, far below 75.

Image Source: Internet

Conclusion

Bitcoin's new high of $95,000 brings exciting signals to the entire cryptocurrency market. However, for altcoin investors, patiently waiting for changes in market fund flows remains key. The response of the altcoin market is relatively slow, and many investors and analysts are closely monitoring the situation, hoping for a new round of upward cycles for altcoins. As market conditions mature and Bitcoin stabilizes, the spring for altcoins may not be far off. Meanwhile, investors should closely watch market indicators and macroeconomic changes to seize the best investment opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。