ETH has been in a long-term slump, and it's time to give everyone a psychological boost.

One viewpoint on the reasons for ETH's prolonged stagnation is that we are currently in a phase of changing hands, where large financial institutions on Wall Street are becoming the new players, gradually taking over the chips from the previous wild speculators.

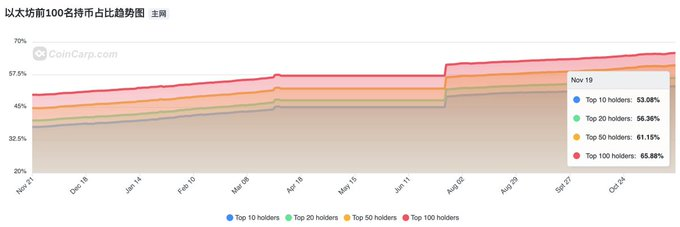

We can also validate this from the data: over the past year, the market share of the top 100 holding addresses has been on the rise, currently reaching 66%, especially after the approval of the ETH ETF, which saw a significant increase.

This indicates that the concentration of ETH is actually increasing. The leading addresses have been buying, yet the price of ETH has not risen, which suggests what?

On one hand, it indicates that the market makers are still present and continuously accumulating; on the other hand, it shows that there is a significant amount of turnover in the market, with not only retail investors shedding their chips but also these leading addresses engaging in internal turnover, which means a change of hands.

It is important to note that ETH and BTC are the only two tokens with ETFs, and ETH has a significant advantage over BTC: staking rewards.

Once the ETF opens up staking rewards or even re-staking, a risk-free yield of at least 3% in terms of coins per year is actually very attractive, especially compared to traditional financial products.

This is the untapped potential of ETH and also the biggest potential benefit.

Naturally, traditional financial institutions will not miss out on this opportunity and have a strong willingness and motivation to become the new players in ETH.

However, ETH has already been the main narrative through two cycles of bull and bear markets, so there are naturally many long-term holders, and the chips are relatively dispersed. Therefore, the turnover of these chips will take a considerable amount of time and requires thorough washing out.

Thus, to keep the price of ETH suppressed in the long term, long-term holders need to shed their chips, for example, by switching to popular tokens like SOL, in order to concentrate the chips into the hands of the new players.

Only after the new players have accumulated enough chips will there be the motivation to drive up the price of ETH.

This is a deliberate strategy.

Therefore, do not part with the truly valuable chips in your hands, namely BTC and ETH. Enduring this long and painful washout is necessary to achieve the long-term gains you truly desire.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。