Today (November 21), the price of BTC has reached new highs, approaching $95,000, exciting investors. MicroStrategy, a company highly regarded in the cryptocurrency field, has once again increased its investment in Bitcoin, with its market capitalization surpassing $100 billion for the first time today. The market capitalization of BTC continues to rise, and BTC is heading towards a new peak.

ETF Options Ignite Market, BTC Price Hits New Highs

As of the time of writing, according to the latest market data from AICoin (aicoin.com), BTC has increased by 3.71% in the last 24 hours, reaching a high of $94,977, setting a new historical record, and is currently reported at $94,739.

Image Source: AICoin

One of the reasons for this price increase is the launch of the iShares Bitcoin Trust (IBIT) ETF options by BlackRock on Nasdaq on Tuesday (November 19), marking a milestone moment for the Bitcoin market. On its first trading day, IBIT options attracted nearly $2 billion in notional exposure, a rare figure for a new options product.

Difference Between ETF and ETF Options

An ETF is essentially an investment tool, similar to a basket of stocks or other asset collections, that can be sold at any time and typically tracks a broad market index, allowing investors to achieve a diversified portfolio. It has high liquidity, as it can be bought and sold at any time during exchange hours. ETF options, on the other hand, are financial derivatives that provide the right (but not the obligation) to buy or sell an ETF, allowing investors to control a larger amount of ETF with less capital, offering leverage that can be used to hedge risks or speculate.

Galaxy Digital's research director Thorn predicts that ETF options will help reduce BTC volatility. In a media interview on Tuesday (November 19), he stated, "Over time, Bitcoin ETFs are expected to be held more widely, and volatility will significantly decrease, with options helping to suppress volatility. As the downward trend in volatility takes shape, people will be able to take larger position sizes."

Puell Multiple Indicator Signals Strong Bull Market

Analysis from CryptoQuant indicates that the rare breakout of the Puell Multiple indicator suggests that Bitcoin's price is set to experience a strong upward surge. Historical data shows that whenever this indicator breaks its 365-day moving average, Bitcoin's price tends to rise significantly. Breakouts in March 2019 and January 2020 triggered price increases of 83% and 113%, respectively. Current market conditions suggest that Bitcoin may continue to experience a strong bull market.

CryptoBullet states that the behavior of the Puell Multiple indicator is typically related to Bitcoin's market cycles, providing clues for the asset's next direction. The Puell Multiple is calculated by dividing Bitcoin's daily issuance (in USD) by the 365-day moving average of daily issuance, used to measure miners' profitability and its potential impact on Bitcoin's price.

MicroStrategy's Market Cap Surpasses $100 Billion

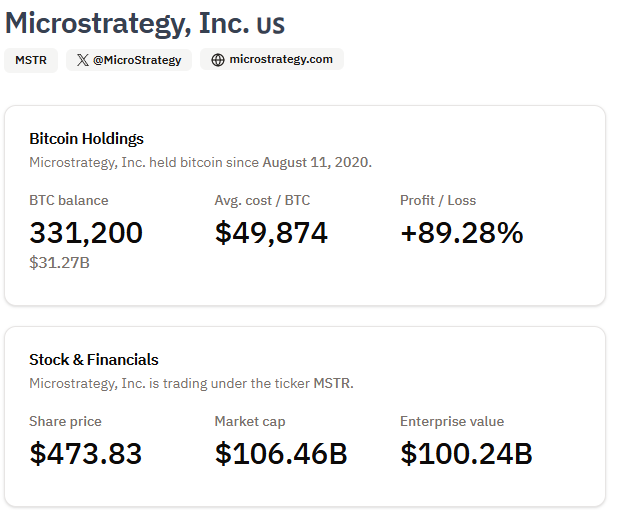

MicroStrategy announced yesterday (November 20) that it would increase the scale of its convertible senior note program for purchasing Bitcoin by nearly 50% to $2.6 billion, to further increase its Bitcoin holdings. From November 11 to 17, MicroStrategy purchased approximately 51,780 Bitcoins, totaling about $4.6 billion. According to the latest data, MicroStrategy currently holds BTC worth over $31 billion.

Image Source: Internet

Today (November 21), MicroStrategy's market capitalization has surpassed $100 billion for the first time, increasing over 650% this year, and MSTR has surpassed SPY and TSLA, becoming the stock with a trading volume exceeding $50 billion in USD value.

Manuel Villegas, a digital asset analyst at Swiss bank Julius Baer, noted in his report that MicroStrategy and other companies announcing similar plans are expected to raise about $43 billion for Bitcoin purchases by the end of 2026. The company's intentions indicate that if Bitcoin prices remain stable, it may acquire all newly mined Bitcoins in the coming years. This undoubtedly injects great confidence into the market and lays a foundation for the long-term price growth of Bitcoin.

Conclusion

The rise in Bitcoin's price and MicroStrategy's increased investment once again demonstrates the market's strong interest in Bitcoin. As more financial institutions get involved, coupled with the approval of Bitcoin ETF options, the ecosystem of Bitcoin and other cryptocurrencies will continue to expand, making the future development of Bitcoin even more promising.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。