This article is edited by the Snap Research Institute team

This article is edited by the Snap Research Institute team

Please indicate the source and link when reprinting

Introduction

In the DeFi world, the TON blockchain is rising at an astonishing speed, and Torch Finance is committed to becoming the preferred liquid staking token and exchange service for stablecoins and yield tokens on TON. This article will introduce how to achieve an annual percentage yield (APY) of up to 80% on the TON blockchain through Torch Finance's leveraged yield farming strategy.

Torch Finance Goals

With the TON Foundation investing $24 million to support liquid staking pools like DeDust and STON, the market demand for high-return strategies is continuously increasing. Torch Finance's leveraged yield farming is launched in response to this demand, providing users with high-yield opportunities in the TON DeFi ecosystem.

Main Products

Leveraged Yield Farming:

This is a yield-enhancing strategy where users provide liquidity to DEX and use leverage to amplify returns. For example, if the base yield is 30% annually, using 3x leverage can yield up to 90% (before interest deductions). Additionally, users only need to invest USDT as a single asset, avoiding complex operations, and can automatically receive rewards, saving time and costs associated with manual withdrawals.

Savings Account:

Users can earn interest by depositing tokens into a savings account, where these funds are lent to participants in leveraged yield farming. The higher the demand, the higher the interest rate. This account is suitable for users who want stable returns while maintaining their token balance.

TriTON:

TriTON is designed with liquidity pools optimized for the exchange of TON, stTON, and tsTON, ensuring users enjoy lower slippage during large transactions. Low slippage trading is particularly important as it effectively reduces costs during frequent asset conversions, thereby enhancing returns. The pool can also dynamically adjust with market demand changes, ensuring liquidity and improving trading efficiency.

Leveraged Yields and Strategies

What are Leveraged Yield Farming and Market Neutral Farming Strategies?

Leveraged yield farming allows investors to borrow additional funds to amplify their yield farming positions. For example:

- Without leverage: You invest $1,000 into DeDust's liquidity pool, assuming an annual yield of 30%, you would earn $300 after one year.

- With 3x leverage: The total position increases to $3,000, and with the same 30% annual yield, the annual return would reach $900.

Leverage strategies can exponentially increase your potential returns but also come with borrowing costs and liquidation risks. Torch Finance provides a simplified platform that allows users to easily manage risks while maximizing returns.

To mitigate the risks associated with price volatility, Torch Finance has introduced a market-neutral farming strategy. This strategy allows users to maintain stable returns regardless of whether asset prices rise or fall, avoiding directional risks.

Operational Example: 3x Leverage Market Neutral Farming Strategy

Suppose you hold 1,000 USDT, and the price of TON is $5. You decide to participate in yield farming with 3x leverage, resulting in a total position of $3,000, where:

- $1,500 is deposited in the liquidity pool in USDT.

- $1,500 is exchanged for TON and deposited in the liquidity pool.

Ultimately, your position's sensitivity to TON price changes is reduced, achieving theoretical market neutrality.

Risks and Risk Management

High returns often come with high risks. When using leverage, special attention should be paid to the following two risks:

- Liquidation Risk: When your debt ratio exceeds 80%, the system will automatically liquidate your position, selling assets to repay the loan.

- Impermanent Loss: When the asset prices in the liquidity pool change relative to the initial prices, it may lead to reduced earnings. Even with a market-neutral strategy, significant fluctuations in TON prices can still affect your final returns.

To help users manage risks, Torch Finance provides a health factor monitoring tool, allowing you to stay informed about the health of your position. During periods of significant price volatility, you can choose to close and reopen positions to rebalance the risk of impermanent loss.

How to Participate

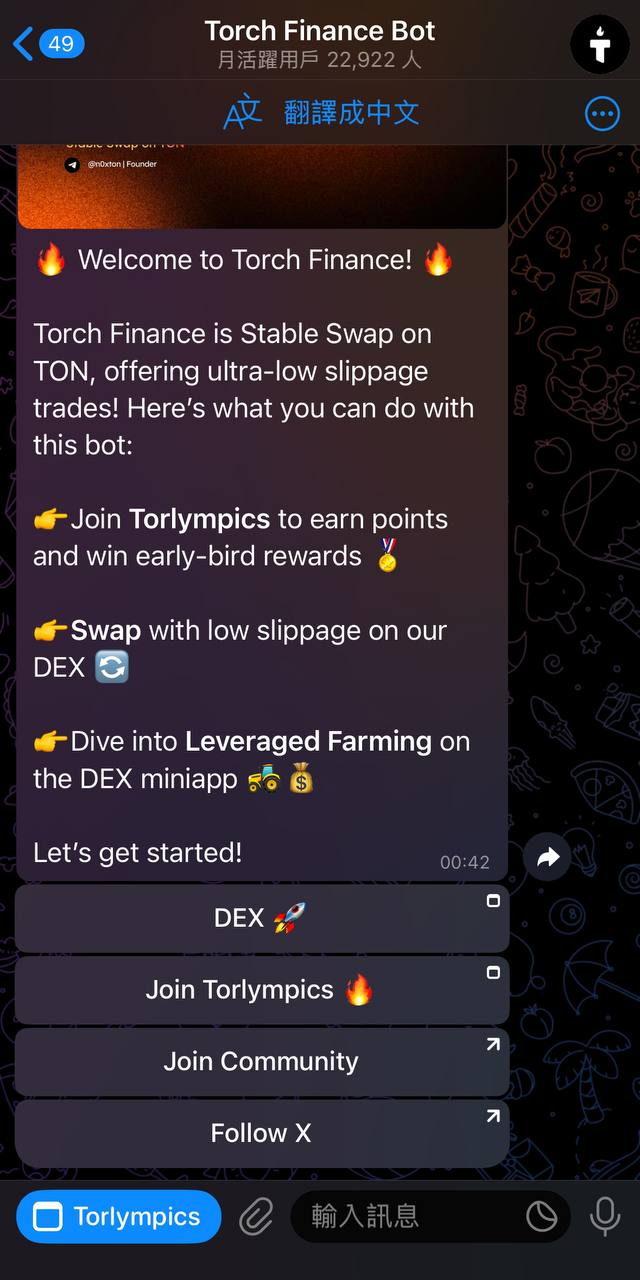

You can use Torch Finance's various product features through Telegram in three simple steps:

- Open Torch Finance's Telegram bot:

- Click on the DEX feature

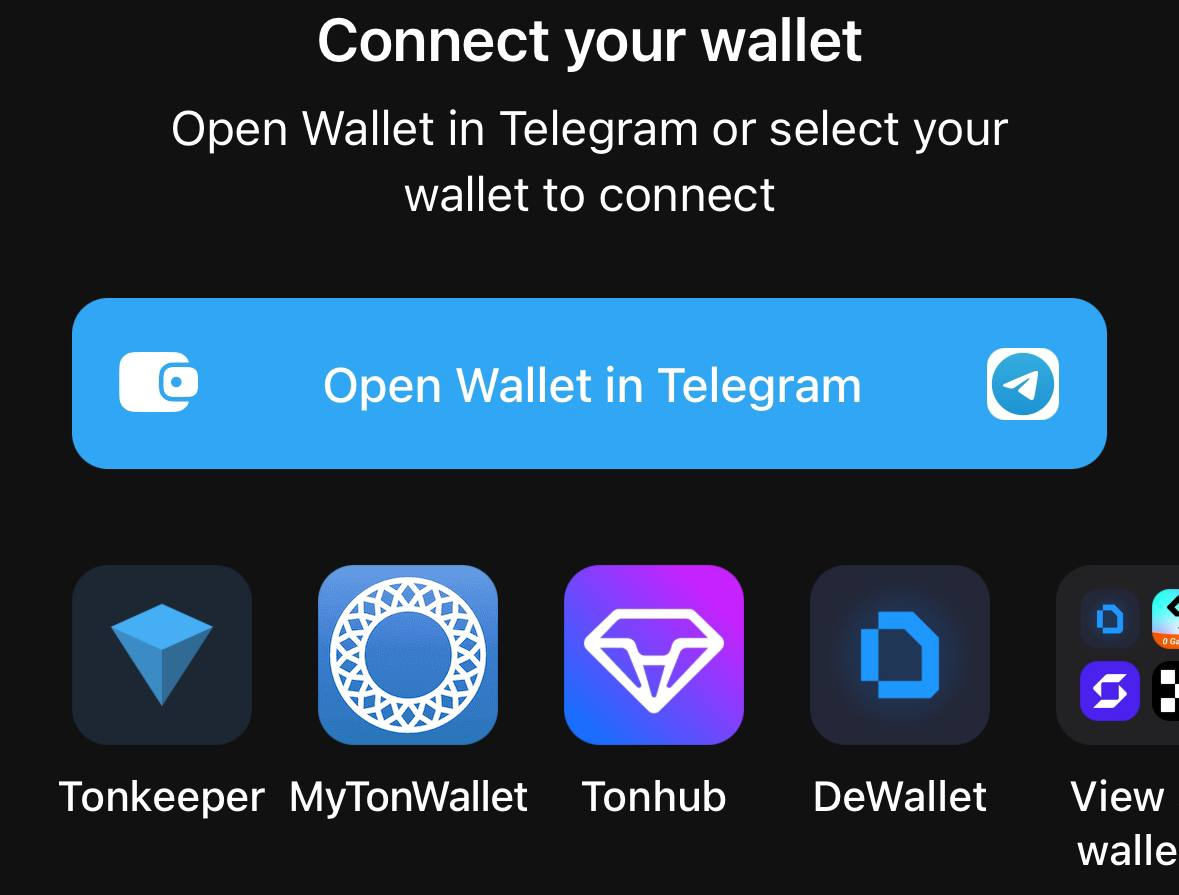

- Connect your wallet, which can be the built-in TON space wallet in Telegram or another wallet that supports the TON blockchain

Snap's Perspective

Torch Finance's leveraged yield farming strategy provides investors with the opportunity to earn high returns on the TON blockchain. Whether through leveraged yield farming or savings, it demonstrates Torch Finance's commitment to simplifying operational processes, allowing users to focus on enhancing returns. However, high returns come with high risks, and liquidation risks and impermanent loss are potential challenges that cannot be ignored. Users are advised to use leverage cautiously, always monitor the health factor, and adjust positions appropriately during market fluctuations to effectively manage risks and ensure investments achieve desired returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。