Angry Kid Sells Rug, Community "Justice" Takes Over and Pushes Up.

Author: Ai Yi

Today's on-chain hot topic is a meme coin called Quant, which has surged to a market value of 60 million USD.

Beyond the surge, the highlight comes from the fact that the developer behind this coin is just an underage kid.

In the wave of simple token issuance models from Pumpfun, creating a meme coin has become increasingly easy, and the emotional triggers for everyone are becoming more outrageous:

A kid created a meme, then sold off over 3.3 million USD; subsequently, he replicated the process by issuing two more coins to continue profiting… Humorously speaking, haven't we already achieved Mass Adoption? Even kids can come in and issue coins now.

Renowned on-chain data analyst Ai Yi has compiled a complete timeline and the data behind the kid's coin issuance, and we have organized it as follows from the original post.

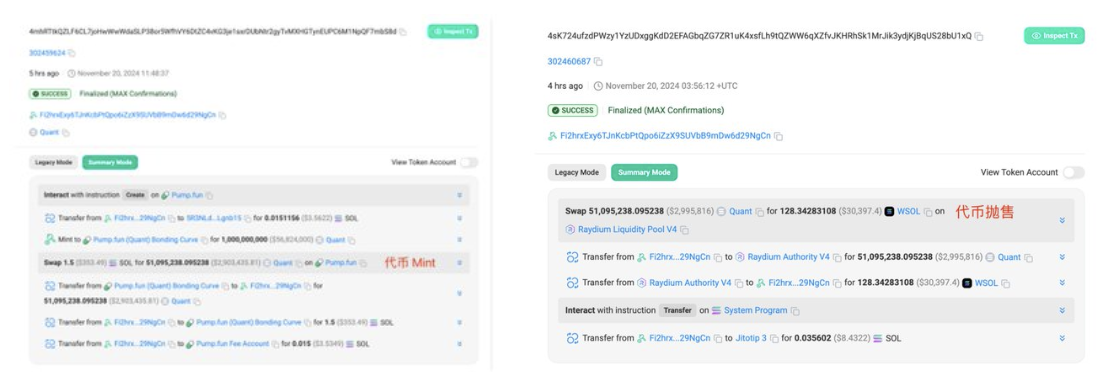

Issuing Quant, Selling Off 3.35 Million

This kid trader's story began when he issued a memecoin called "Quant." With an initial investment of only 1.5 SOL, he acquired 51.09 million tokens, accounting for 5.11% of the total supply. The subsequent developments were astonishing: as the coin price began to rise, he chose to sell all his holdings in one go, earning 128 SOL (approximately 30,000 USD). More dramatically, after completing the transaction, he gave everyone the middle finger, which immediately enraged the entire community.

Subsequently, Quant completed a CTO, and the community took over the token, with the developer exiting.

When the kid sold off those 51.09 million tokens, the return rate reached 8457%, and this portion of tokens is currently valued at 3.35 million USD (of course, if he hadn't sold, the market value wouldn't have skyrocketed), missing out on nearly ten thousand times the return.

After tasting success, he continued to issue $sorry and $lucy, replicating his previous operations and profiting over 24,000 USD again.

The kid's wallet address is as follows:

Fi2hrxExy6TJnKcbPtQpo6iZzX9SUVbB9mDw6d29NgCn

Whale Addresses Drive Quant's Continued Surge

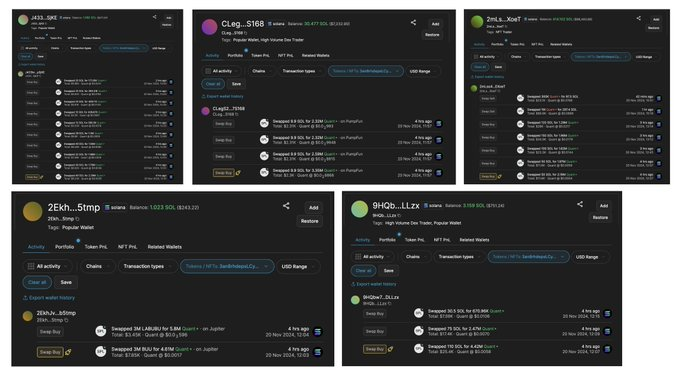

Interestingly, within 7 minutes of the kid's malicious token sell-off at 11:56, five key addresses appeared in the market, collectively investing 56,400 USD and acquiring 4.7% of the total tokens. The actions of these addresses not only stabilized the coin price but also brought over 2.92 million USD in astonishing profits to the holders.

According to Ai Yi's monitoring, these addresses occupy different ranks among the top 10 holders of the token and are significant driving forces behind the coin's surge; however, the top holding address was not the mastermind, as it had already entered during the token's internal trading period.

At the same time, Ai Yi also listed several "just individuals" who drove the surge:

J433tnmDFbCrXwcVcmdiFKAuSuPuB2LTMq2qcRDpSjKE

CLegS2MSiCsBksVazCg4Y7Gz3NqeBK21QyvzK4Q7S168

2EkhJvG7eunHrecNsAijNx8aGcv2Kjd3schd12Gb5tmp

2mLso48BfjuZ4beMT3cP1ZSzm4BWjadfKYhMUUeEXoeT

9HQbw76L1NumMqh7su781go3ug9w8z7poSVoVWGDLLzx

Low Threshold, Deep Waters

The angry kid sells off the rug, and the community "justice" takes over and pushes up.

This story unfolding before our eyes has a touch of magical realism.

In this era where anyone can issue coins, not only has the market entry threshold been significantly lowered, but even minors can easily participate. However, behind this convenience lies various market chaos: from casually issuing coins to malicious dumping, from sky-high surges to massive missed opportunities, every link is testing the wisdom and composure of market participants.

When anyone can issue coins and anyone can form a community, how to find true value in a low-entry environment remains a question every investor needs to ponder.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。