With the rapid development of AI technology, consumer applications have become more intuitive, personalized, and easier for ordinary users to use.

Author: Karen Shen

Translation: Deep Tide TechFlow

In this article, we will explore the potential opportunities for collaboration between cryptocurrency and consumer-level AI. The article is divided into three parts:

Why Choose Cryptocurrency x Consumer-Level AI?

Overview of Traditional Consumer-Level AI

Opportunities in Cryptocurrency x Consumer-Level AI

Why Choose Cryptocurrency x Consumer-Level AI?

In the past year, the combination of AI and cryptocurrency has gradually become a hot topic of consumer interest, driving the launch of many new projects. Most of the attention and funding have flowed into the infrastructure sector of AI, such as computing power, training, inference, intelligent models, and data infrastructure.

Although these projects are ambitious and may yield large-scale results, the technology has not matured enough for widespread application, making commercialization in the short term unlikely. This has left a gap in the market at the consumer level, urgently needing more directly impactful technological applications.

Consumer-level AI refers to artificial intelligence products designed for ordinary users, rather than products specifically designed for enterprises or particular business applications. These products include AI-driven general assistants, recommendation systems, generative tools, and creative software. With the rapid development of AI technology, consumer applications have become more intuitive, personalized, and easier for ordinary users to use.

Current Popular Consumer-Level AI Applications

Unlike enterprise-level AI, which requires precise and deterministic results, consumer-level AI focuses more on flexibility, creativity, and adaptability—areas where AI excels.

Although still in its early stages, the combination of cryptocurrency and consumer-level AI is very appealing. There are few opportunities to see both technologies mature simultaneously. Therefore, this field is worth exploring in depth, even though the outcomes are difficult to predict.

In the cryptocurrency space, there is an urgent need for more consumer-oriented applications to provide novel and engaging ways to interact with its underlying technology. Over the past decade, blockchain investment has driven leaps in infrastructure, resulting in faster block generation times, lower gas fees, better user experiences, and success in overcoming many of the entry barriers we faced a few years ago.

You can feel the industry's progress just by trying applications like Moonshot to instantly purchase meme coins via Apple Pay. However, there is still a lack of founders and developers willing to tackle interesting consumer cryptocurrency problems.

Meanwhile, consumer-level AI is ready to enter the market, providing developers with an excellent opportunity to combine these two technologies to build applications that can shape how we interact with, own, and participate in digital assets and synthetic intelligent systems.

Overview of the Traditional Consumer-Level AI Market

First, we will utilize two resources to help us understand the latest developments in the traditional (non-crypto) consumer-level AI space:

a16z's "Top Consumer Products by Web Traffic" (Third Edition)

Y Combinator's startup incubation program launched in Winter 2024

a16z's "Top Consumer Applications by Web Traffic"

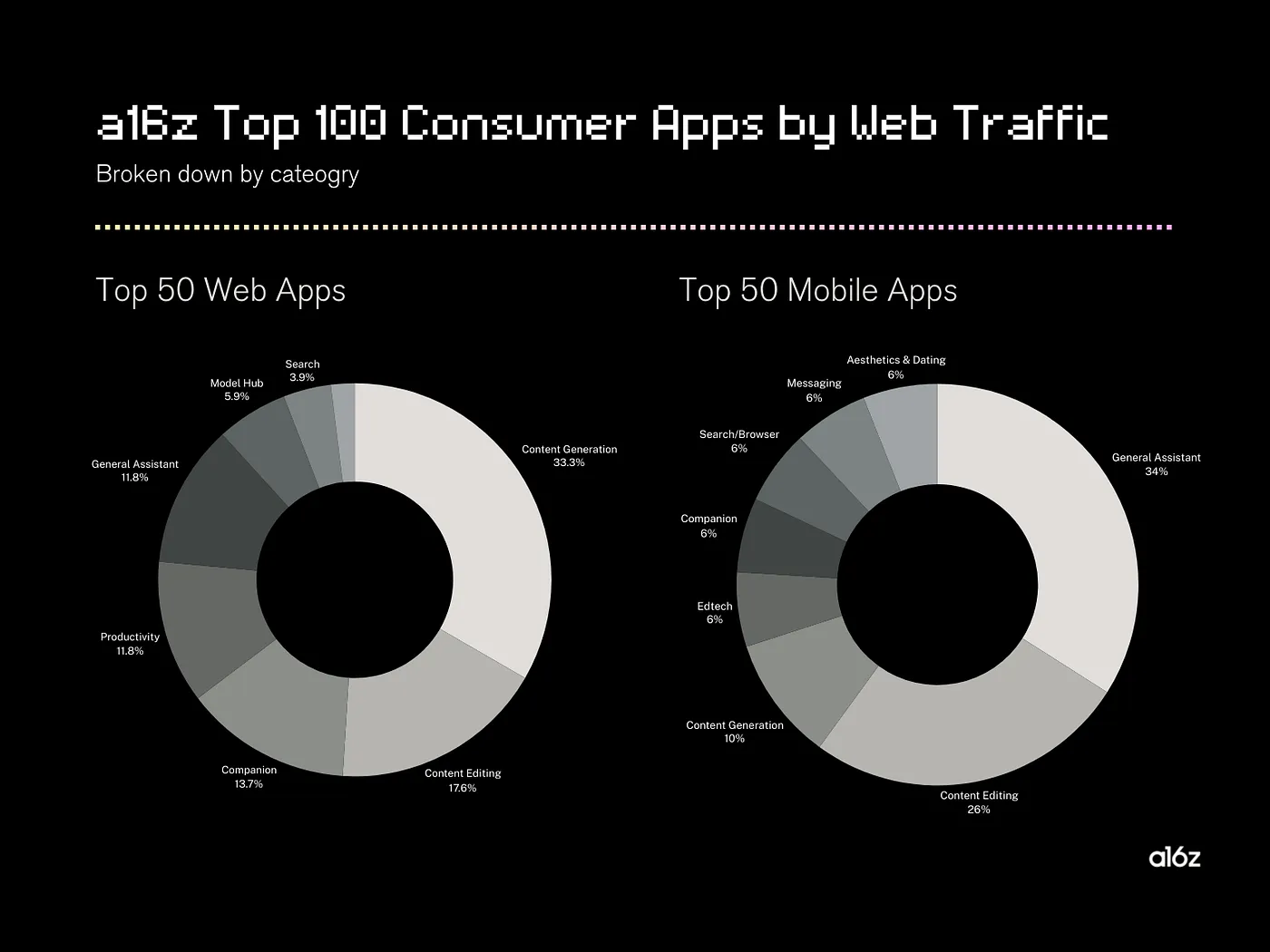

The a16z report aims to rank the most visited consumer-level AI web and mobile products every six months by reviewing web traffic data.

By analyzing this data, they can identify trends in how consumers actively use consumer-level AI technology, which categories are gaining attention, which are declining, and which projects have become early winners in various categories.

Here are the top 100 AI consumer products as of August 2024, categorized into web and mobile applications.

Clearly, content generation and editing tools are leading in consumer-level AI.

These applications currently account for 52% of the top 50 web applications and 36% of the top 100 mobile applications. Notably, this category is expanding from text to images to include video and music generation, broadening the potential for AI-driven creative expression.

Popular categories like general assistants, companions, and productivity tools maintain a stable position in the top 100 list, reflecting ongoing market demand. The third edition of the a16z report introduced a new category, "Aesthetics and Dating," which features three projects.

It is worth noting that one crypto project has also stood out across categories. Yodayo (now Moescape AI), an anime companion app, ranks 22nd in the web applications list.

Moescape AI

Comparing a16z's latest report with previous reports, we can see that while the core consumer-level AI categories remain stable, about 30% of the top 100 projects are new, highlighting the ongoing evolution of the industry.

Y Combinator's Startup Incubation Program Launched in Winter 2024

Next, we reviewed the batch of startup incubation projects launched by Y Combinator in Winter 2024 to identify emerging consumer-level AI projects and categories that may not have received enough attention on a16z's top 100 web traffic list.

Here, we hope this information can help us predict consumer-level AI trends over the next 6 to 12 months, although there remains uncertainty about the actual consumer demand for these products.

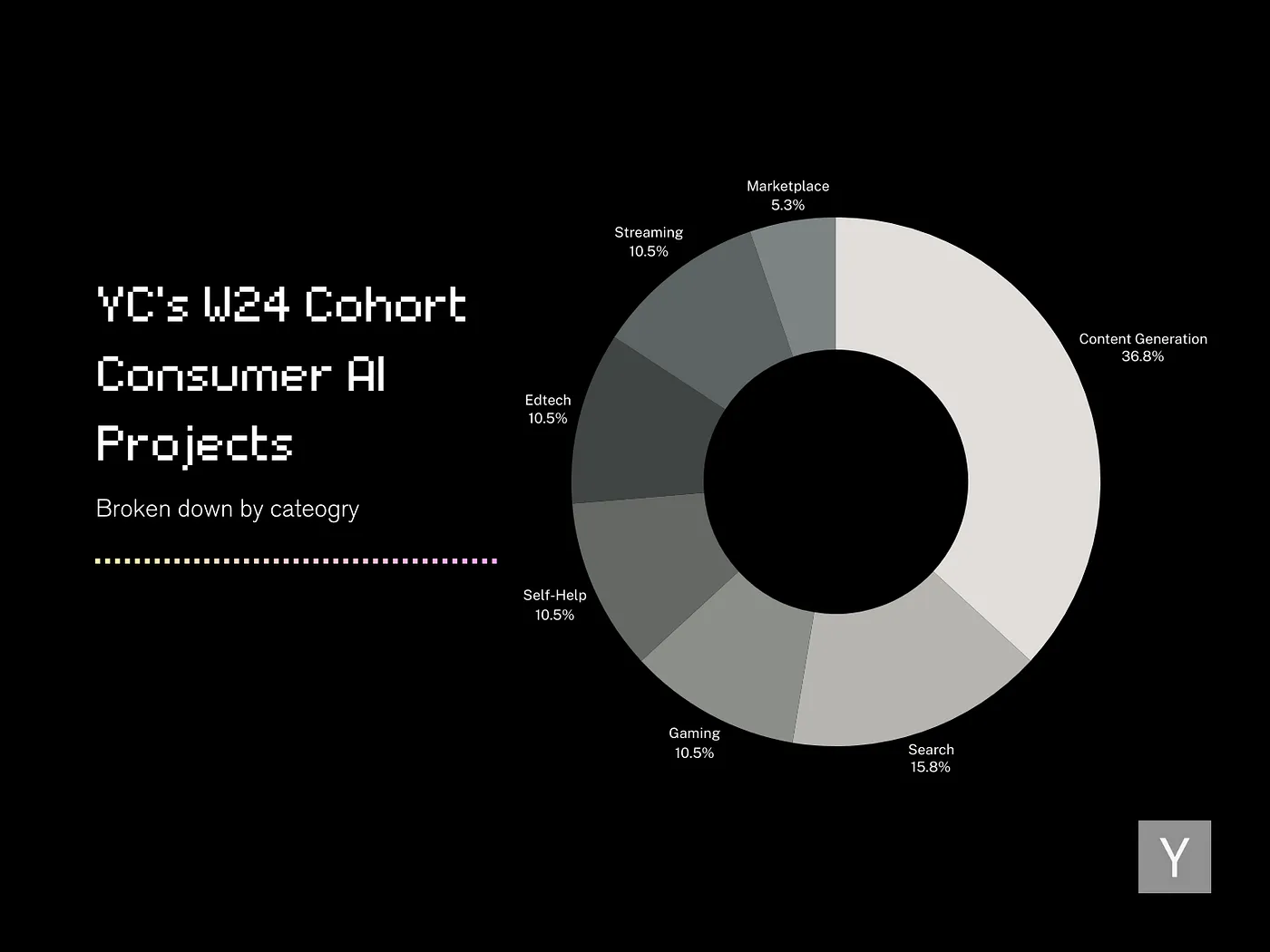

In the recent batch of 235 projects, 63% focused on AI, with 70% built at the application layer. Only about 14% of application layer projects were identified as consumer-facing.

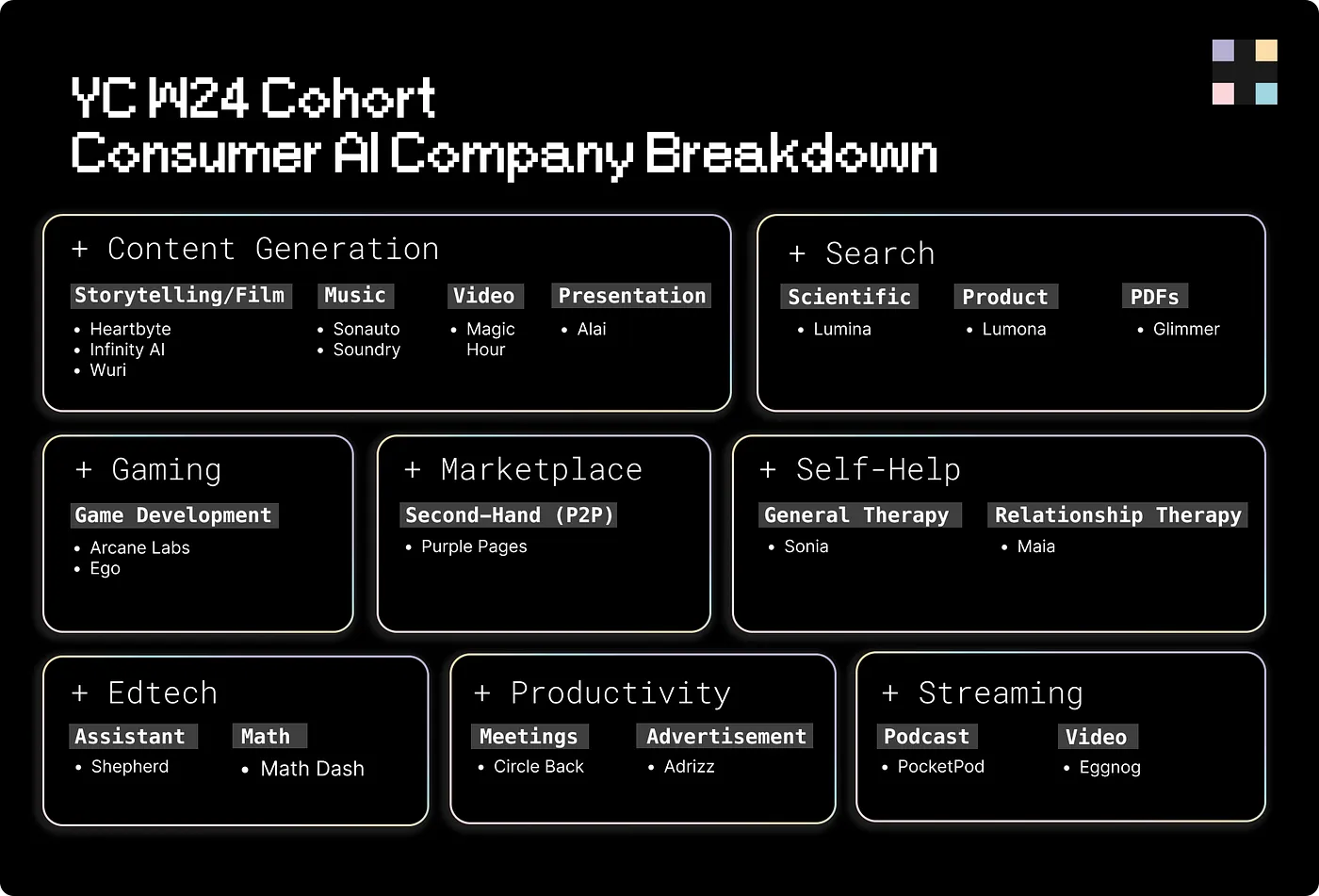

Here is our attempt to categorize consumer-level AI projects.

Similarly, content generation remains the most popular category among founders, with new projects continuously pushing the boundaries of creativity.

Similar to the trends seen in the a16z report, the latest batch from YC is exploring advanced content types, including storytelling, script-to-film generation, music, video, and presentation-focused content.

Like the trends in the a16z report, Y Combinator's latest batch of projects is exploring more advanced content types, including storytelling, script-to-film generation, music, video, and presentation-focused content.

Finally, categories such as gaming, self-help, marketplaces, and streaming have emerged in this batch, marking new directions that have not yet appeared in the a16z report.

Opportunities in Cryptocurrency and Consumer-Level AI

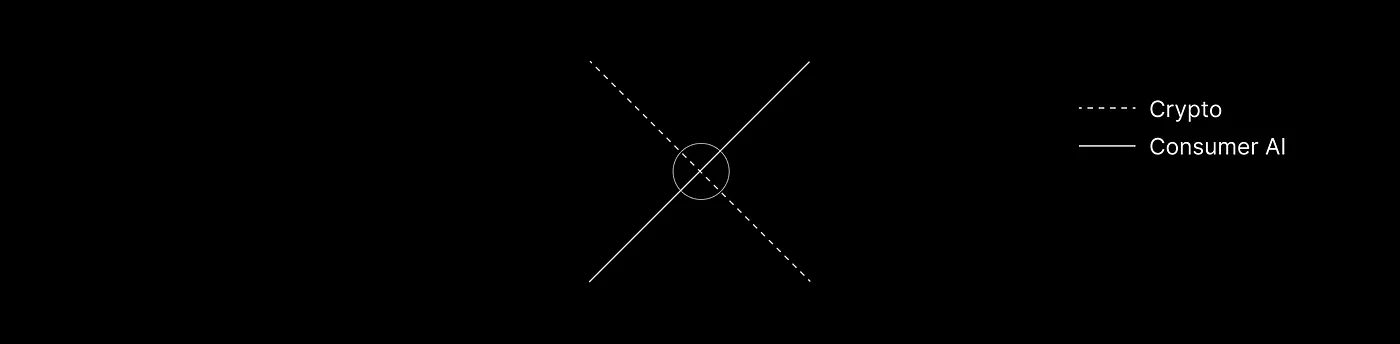

After understanding the background trends in the traditional consumer-level AI market, we turn our attention to consumer-level crypto AI.

First, we can briefly discuss how AI can add value to crypto products, or conversely, how crypto technology can benefit consumer-level AI products.

Crypto and AI each offer distinctly different value propositions.

It can be argued that there is a value conflict between the two technologies to some extent—crypto emphasizes decentralization, privacy, and personal ownership, while AI tends to concentrate power and control in the hands of those who develop and own the most advanced models.

With the rise of decentralized and open-source AI, these boundaries are beginning to blur.

In the context of consumer products, the core innovation of AI lies in simulating and extending human creativity by generating novel content while learning from vast amounts of data, utilizing advanced neural network architectures to model complex relationships and generate high-quality outputs.

Early signs indicate that AI applications have strong user retention and monetization potential. However, they also face what is known as the "tourist problem", where user traffic is high but the conversion rate from free users to paid users is lower than expected.

On the other hand, crypto technology represents a design space characterized by decentralization, cryptoeconomic incentives, and hyper-financialization. It is a distributed ledger that can transparently and verifiably store the value of any digital object.

Cryptographic technology excels in coordinating activities, integrating decentralized infrastructure, and creating new markets seamlessly. However, aside from financial infrastructure, cryptographic technology has yet to develop a compelling and sustainable consumer-level application.

AI may be a key part of unlocking the broader consumer potential of cryptographic technology. A recent study shows that the adoption of generative AI is accelerating faster than the spread of personal computers and the internet—about 32% of U.S. residents now use AI weekly. Given this rapid pace of development, consumer-level crypto developers would benefit greatly from experimenting and innovating in sync with the rapid application of AI.

We believe that innovative consumer applications will harness the power of AI and the unique capabilities of decentralized and financialized networks brought by cryptographic technology, leading to breakthrough developments.

Market Analysis

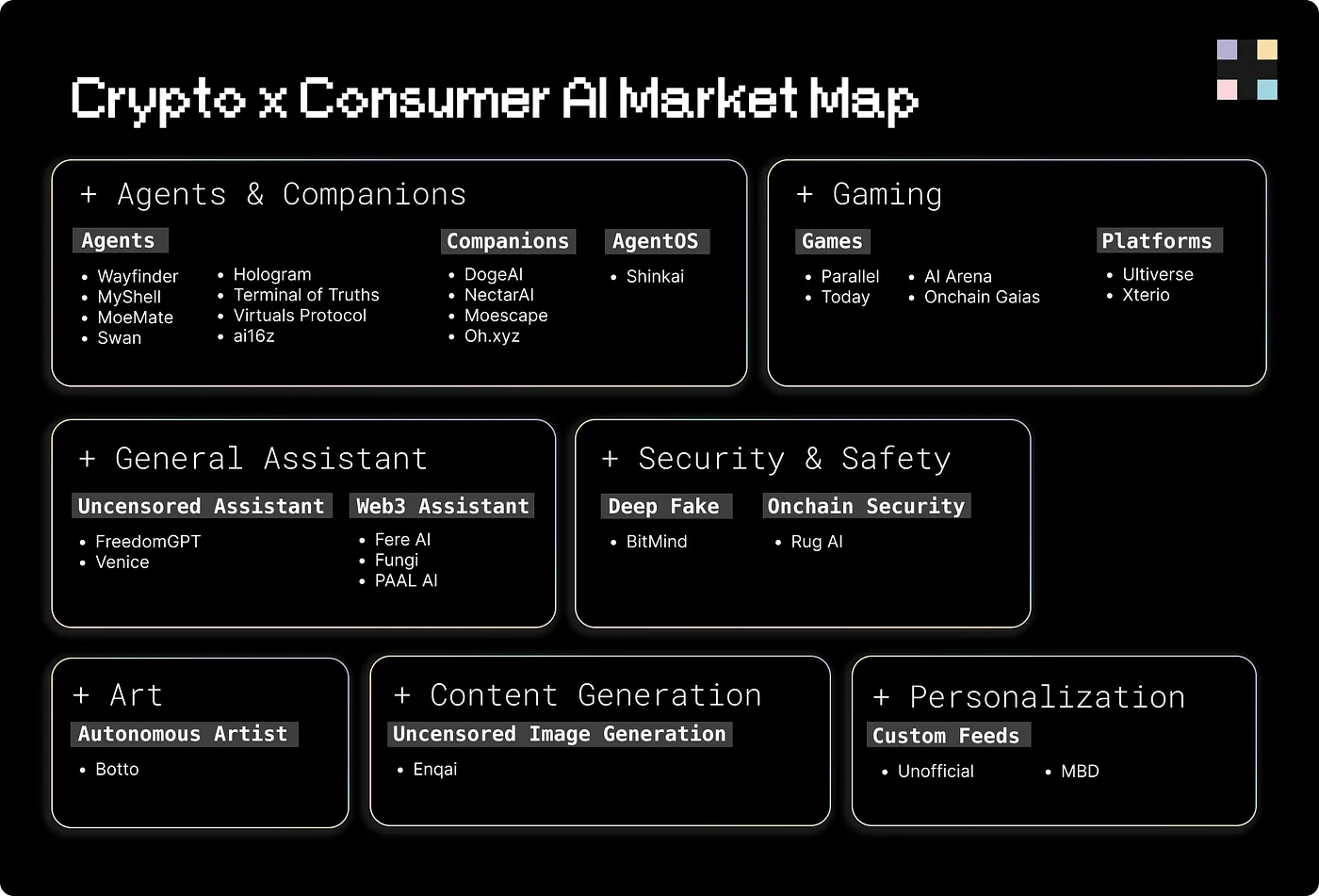

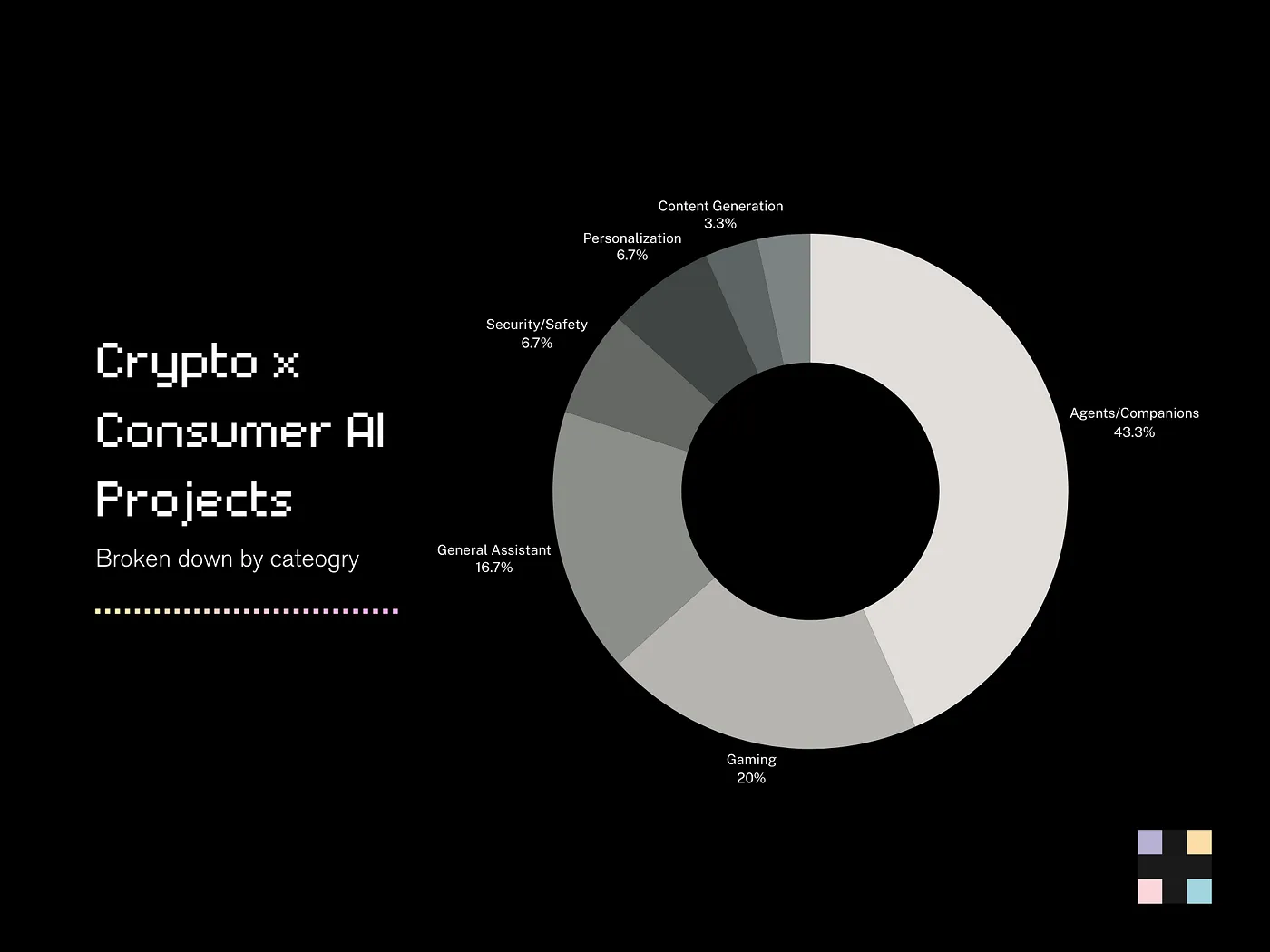

In the field of the combination of crypto and AI, the number of consumer-focused projects remains relatively small. According to our research, there are about 28 such projects, but this number is uncertain.

In this crowdsourced decentralized AI market map, the consumer category accounts for only about 13% of the entire decentralized AI market, indicating significant growth potential in this area. In contrast, approximately 60-70% of the technology market consists of application layer products, with about 70-80% being consumer-facing applications.

Although this report covers only a small portion of projects, we have already identified some early insights.

We summarize some initial ideas from teams integrating crypto and AI. These insights have been distilled into broader application scenarios, some of which show good prospects, while others may be less sustainable.

Incentive Mechanisms: Utilizing cryptographic technology to incentivize and reward users for their activities on AI platforms or applications. For example, Wayfinder's native token is used to reward agents and participants who create valuable paths for AI agents on-chain. The autonomous AI artist Botto rewards this participation by allowing the community to provide feedback on its artistic creations and distributing a portion of its art sales in the form of $BOTTO tokens.

Financialization: The ability to trade, own, and generate income from AI assets on the blockchain. For example, Virtuals Protocol provides a platform where anyone can purchase and own a part of an AI agent and benefit from the income generated by the agents they trust. Ownership is represented by tokens.

Copyright Ownership: Allowing intellectual property holders to track, verify, and claim royalties on the blockchain. For instance, projects like Oh.xyz generate digital twin NFTs for creators using cryptographic technology to verify the authenticity of content and claim royalties in the future.

In-App or In-Game Economy: Using cryptocurrency as currency within applications or games. For example, games like Parallel and Today will have in-game economic systems where players and their AI agents can trade resources using their respective tokens.

Decentralization: Achieving decentralization of networks, services, and models. For example, BitMind is a subnet on the Bittensor network that is building the first decentralized deepfake detection system. Through Bittensor, they can encourage open competition among AI developers to collaboratively develop the best deepfake detection models.

Anti-Censorship: Removing restrictions on generative AI content creation. For example, Venice is a private and permissionless generative AI assistant built on the decentralized general agent network of Morpheus. Unlike traditional AI assistants, Venice does not censor AI and does not download user conversations.

Membership Systems: Using cryptocurrency as a means to access premium features. For example, MyShell's ecosystem token has multiple uses, one of which is to grant holders access to premium features.

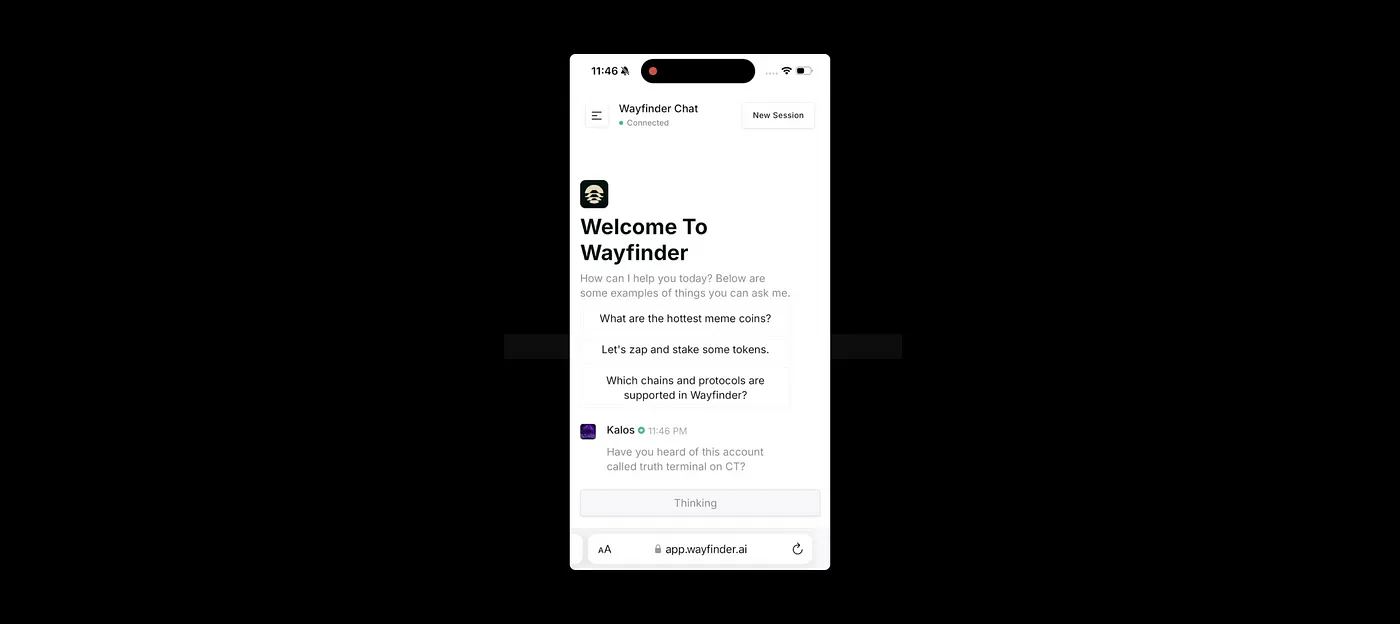

Smart Assistants: Utilizing AI to simplify people's interactions with cryptographic technology. For example, Wayfinder, Fere AI, Fungi, and PAAL AI are domain-specific general assistants or bots designed for the crypto industry, aimed at simplifying the crypto experience for end users.

Content Contextualization: Using AI to contextualize and personalize content on the blockchain. For example, Unofficial plans to build an on-chain social discovery engine on Farcaster using zkTLS and RAG.

After analyzing the current crypto and consumer-level AI market, including the ways in which crypto and AI are applied and the status of established and emerging categories in traditional consumer-level AI, the next section will explore the most promising design spaces in this intersection.

Games and Agents/Companions

Games and agents/companions have become the two most popular directions for entrepreneurs in this intersection because they provide an ideal environment for experimenting with AI and cryptographic technology.

Games and agents typically operate in fictional worlds, primarily for the purpose of entertaining consumers. The outcomes often do not need to be definitive, and their impact on real life is minimal. Thus, this creates excellent conditions for experimentation.

The gaming environment of Today

Currently, games like Parallel Colony and Today are making AI the core experience of the product, with in-game AI NPC characters behaving like real people, possessing autonomy and conversational abilities.

Cryptographic technology is used as financial infrastructure for in-game payments, inter-agent payments, or unlocking character ownership.

The key is that this new digital economy provides these crypto games with a competitive advantage over many upcoming AI games.

AI is a transformative technology, and there is no doubt that it is becoming a key part of game development and future gaming experiences—but we believe that teams that consider a digital-native economy when developing AI games will have the ultimate competitive edge.

AI agents in games are fascinating, and cryptographic technology introduces a system that simulates human economic experiences for the first time. NPCs in games cannot open bank accounts, conduct transactions, or make real economic decisions. This could lead to many unprecedented behaviors and opportunities.

As Kalos, the founder of Parallel, stated on Twitter:

This concept is most intuitive in today's fictional environments, such as games.

Projects developing AI agents and companions also utilize AI and cryptographic technology—AI as the core experience and cryptographic technology as the financial foundation. However, unlike games, agents operate in a constrained environment, allowing for more complex interactions while having minimal impact on real life. Currently, agents and companions are primarily limited to one-on-one or one-to-many relationships.

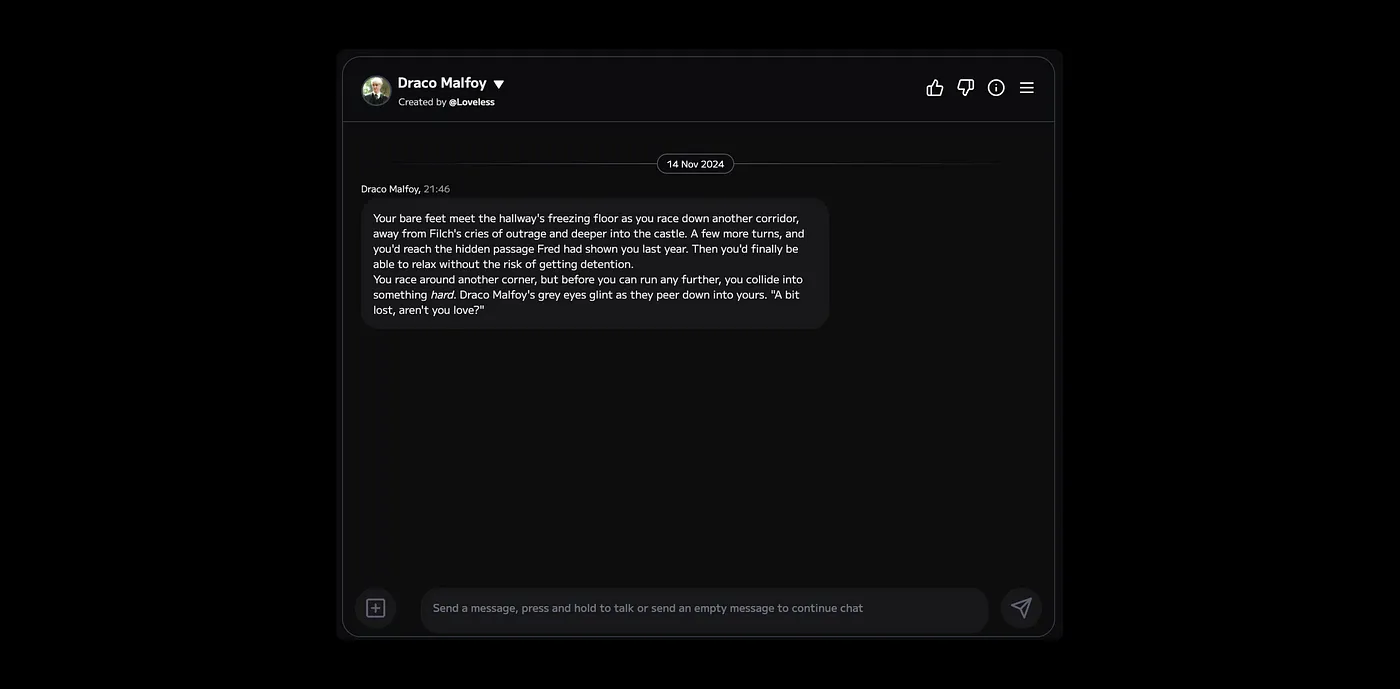

For example, through MyShell, Virtuals Protocol, or MoeMate, users can interact with AI chatbot characters through chat or voice functions—this interaction is limited to the user and the chatbot (or other medium). Chatbots are large language model wrappers with limited features, which can be customized by the bot's creator, such as the tone of communication, the appearance of the agent, etc. Therefore, user interactions with these chatbots are also limited in creativity.

MoeMate's Draco Malfoy AI chatbot experience

Although similar to competitors, ai16z adopts an open-source and bottom-up approach to build on-chain AI agent infrastructure, providing tools for future multi-agent systems. You can check related projects on their GitHub.

In the fields of gaming and agents, there are many directions worth exploring, such as multi-agent interactive experiences or infinite game modes. Consumer experiences involving many-to-many interactions between AI agents and humans, while complex, could lead to more vibrant and engaging experiences, as well as more intricate crypto-economic systems. These have yet to be fully explored outside of gaming environments.

We still believe this is one of the most promising areas for entrepreneurs to build in, and we look forward to seeing future developments.

General Assistants and Content Generation

General assistants and content generation tools dominate the traditional consumer AI market. However, due to intense competition, entering this market is challenging and costly, which explains why these categories are less represented in the crypto market while holding a strong position in the traditional AI market.

Nevertheless, the demand for these tools remains strong, consistently ranking high in a16z's web traffic analysis. For entrepreneurs at the intersection of crypto and AI, these categories still hold promise, especially for products designed specifically for crypto users. By focusing on the specific needs of the crypto space, unique value can be created without directly competing with the traditional market.

Here are some examples:

- AI-Driven Crypto Assistants: The crypto space is often considered difficult to navigate. Whether trying to purchase or swap tokens on-chain or meet the requirements for participating in games or social activities, there are many obstacles.

Are you on the right network? How do you switch networks? Do you have the correct Gas tokens? How do you transfer funds to the right network?

The learning curve is very steep for newcomers. Even for those familiar with crypto technology, these tasks can be time-consuming.

Despite the industry's significant efforts so far in account abstraction, intent design, and other UI/UX improvements, AI is more likely to integrate these advancements and drive change. Some teams, such as Wayfinder, Fungi, PAAL AI, and Fere AI, are already exploring solutions, although none have yet gained significant market traction—leaving room for more competition and specialization.

Initial exploration of Wayfinder's crypto assistant

The needs of experienced Solidity developers may differ significantly from those of newcomers. We believe that teams focusing on specific user groups (tailoring experiences entirely to the issues faced by that group), providing refined user experiences (leveraging the latest advancements in account abstraction and intent design), and offering personalized services (based on users' on-chain historical activities) are more likely to succeed.

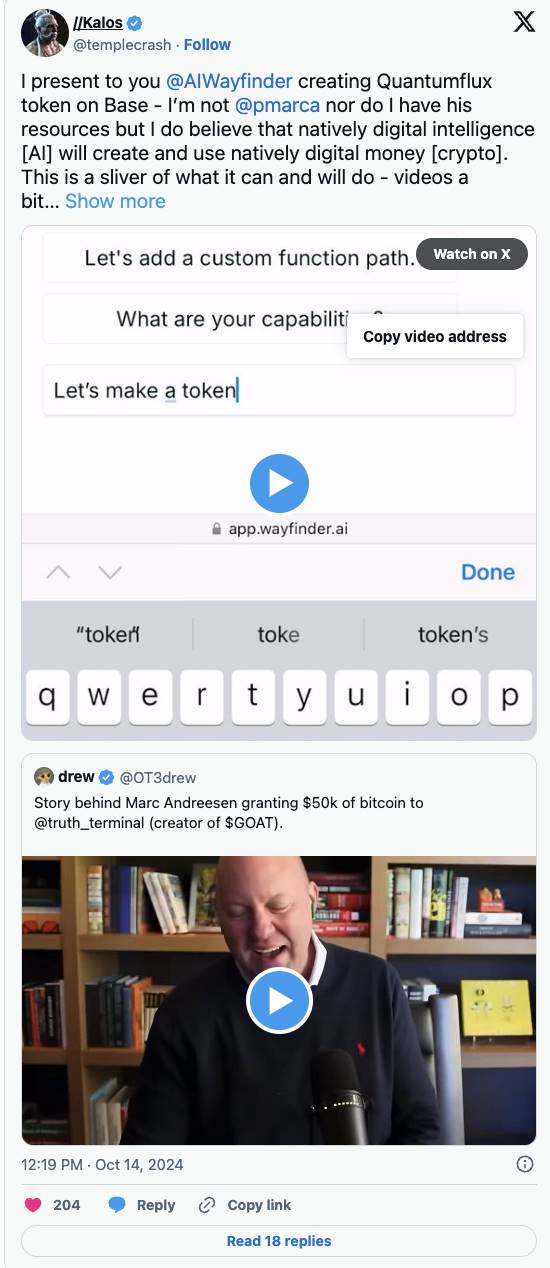

AI-Driven Asset Generation: In the crypto space, content generation can be viewed as asset generation. Through ERC20, ERC721, ERC1155, and other standards, nearly infinite assets can be generated. Just as Midjourney and DALL-E generate images, or SUNO composes music, AI can also play a significant role in generating crypto assets.

For example, projects like Truth Terminal's $GOAT Token, Wayfinder's asset deployment agent, Swan's upcoming gamified asset generation marketplace, and Virtuals Protocol's AI agent launchpad are early examples of AI-driven crypto asset generation.

Here is a demo video demonstrating how to create assets using Wayfinder.

In addition to generating assets, AI can shape narratives, promote assets, and give them a "voice." For specific asset types like memecoins (which have no external dependencies), AI can effectively streamline the asset development process from start to finish.

In a world where AI agents can seamlessly generate infinite crypto assets, the opportunity for developers lies in identifying where value and attention may flow. For instance, Virtuals Protocol believes speculation will shift to the creator level, allowing consumers to speculate on the ability of AI agents to attract attention and create interesting assets.

We are in the early stages of an emerging reality where AI can generate actual financial value in the form of crypto assets for people to enjoy and speculate on. While the future of this development is hard to predict, there are many areas worth experimenting with, and we will closely monitor their direction.

Other Areas

At the intersection of cryptographic technology and consumer AI, there are many areas yet to be explored. With the rapid advancement of AI, these areas may expand and evolve quickly. Although some areas may have a shorter lifespan and fewer suitable fields for integration with cryptographic technology, there is still ample room for experimentation—which we welcome!

One way to think about this is to consider crypto versions of certain traditional consumer AI projects that typically do not integrate with cryptographic technology. For example, we apply cryptographic technology to two categories from the a16z and YC lists and added an additional one.

Edtech is a popular consumer AI category that can benefit from cryptographic technology at various levels of the tech stack. Education encompasses regions, subjects, languages, education levels, and teaching methods. Rather than adopting a centralized approach, edtech could benefit from open-source development by global contributors. In this case, a subnet focused on edtech on Bittensor could help build these models.

Cryptographic technology can also be applied to the incentive layer of edtech applications. Beyond traditional gamification strategies, such as Duolingo's daily streaks, teachers and students could be rewarded on both the supply and demand sides through cryptographic technology.

In the self-help space, the potential of cryptographic technology in data ownership and monetization could be appealing. Due to costs, stigma, lack of awareness, and a shortage of professionals, mental health services remain difficult to access. Projects like Sonia and Maia (both recent Y Combinator incubated projects) showcase the initial promise of affordable AI-driven therapist solutions. Traditionally, therapists' notes are often stored in paper or digital files in the office, making data hard to access. However, with the emergence of AI-driven therapists, data can be stored privately online, unlocking new application scenarios from your mental health data.

Imagine if you could truly own the data from your AI therapy sessions. You could choose to keep it private, monetize it, or anonymously contribute it to a health data network to support meaningful research. Projects like Vana are achieving this at the network level, allowing people to take control of their data.

In the entertainment space, projects like Unlonely are experimenting with crypto-native live streaming, where users can speculate and influence the outcome of live streams through the platform's tokens. Currently, this model is limited to real-life events, but it may expand to AI-generated content in the future. This would enable around-the-clock live streaming, allowing users to have greater control over the narrative of the stream. MineTard AI is a recent early example. It is an AI agent that streams Minecraft 24/7 on the Kick platform, where users holding $MTard can influence the agent.

Last year, a viral trend emerged on TikTok where creators acted as NPCs, performing specific actions based on the "gifts" they received. Although the popularity of this content type was short-lived, it clearly indicated consumer interest in interactive live experiences. With advancements in AI-driven NPC technology, similar gamified interactions may be suitable for crypto-native live streaming, where AI NPCs can respond to user input in real-time.

These are just a few preliminary ideas on how to apply crypto and AI to consumer applications. There are many more ideas not mentioned in this report, and as the industry rapidly evolves, we expect to see more novel applications emerge.

Conclusion

As you may have noticed, we are filled with (great) anticipation at the intersection of crypto and consumer AI. The projects currently being developed in this space only showcase a small fraction of the potential.

With the simultaneous maturation of these two technologies, entrepreneurs are presented with a unique opportunity to create a wave of new consumer applications that could fundamentally change the way we interact with digital assets and synthetic intelligence.

We encourage those innovating in this field to continue pushing boundaries and exploring unconventional applications of these technologies. We hope this article serves as a useful resource for some to embark on this journey.

If you are a creator developing at this intersection, we would love to connect with you!

Disclosure/Disclaimer: At the time of this publication, Collab+Currency or its members may hold some of the assets mentioned in this article. The authors of this article and Collab+Currency do not endorse or recommend owning any projects or collections mentioned in the article.

The information provided in this article is for general reference only and should not be considered investment advice. While we have made efforts to verify the accuracy of the information provided, we cannot make any guarantees. Investors should recognize that investing in digital assets involves a high level of risk and is suitable only for those willing to undertake such risks. Any forward-looking statements are based on specific assumptions, analyses, views of historical trends, current conditions, and expected future developments. These statements do not guarantee future performance and involve certain risks, uncertainties, and unpredictable assumptions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。