A comprehensive guide on how to participate in key projects within the Berachain ecosystem.

Written by: Biteye core contributor LouisWang

Edited by: Biteye core contributor Crush

In today's blockchain world, Berachain may be the most "unconventional" project.

Founder Smoky wears a bear head mask every time he appears in public;

The project name "Bera" is a tribute to the famous misspelling of "hodl" in the cryptocurrency world;

While other projects are discussing ZK and new programming languages, they chose to build an EVM-compatible Layer 1 public chain based on Cosmos technology;

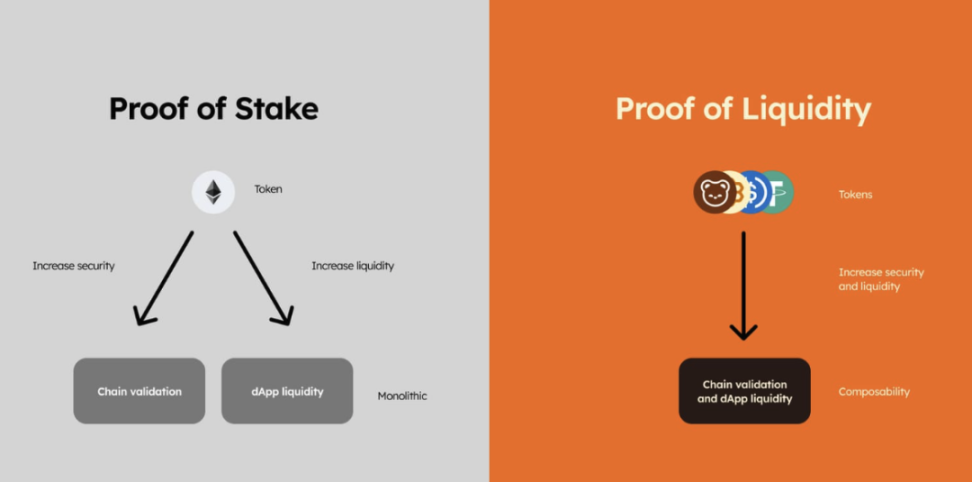

As the trend shifts from POW to POS, they proposed a brand new POL (Proof of Liquidity) mechanism.

Behind these seemingly nonsensical choices lies a profound reflection on the current pain points of public chains.

01 From NFT to Public Chain: A Unique Evolution Story

The story of Berachain begins with an NFT project called "Bong Bears." This seemingly casual NFT series adopted a Rebase mechanism similar to OHM: users holding the original Bong Bears can receive airdrop rights for subsequent series.

This simple design attracted a large number of users to hold long-term, followed by the launch of series like Bond Bears, Boo Bears, Baby Bears, Band Bears, and Bit Bears.

What started as an NFT project eventually evolved into a top-tier public chain project that raised over a hundred million in institutional investment and gained significant attention. What makes it stand out?

02 The Dilemma of Traditional Public Chains and the Innovative Solution of POL

Traditional public chains face a fundamental problem: a large amount of value is locked at the infrastructure level, while the builders who truly create value struggle to receive reasonable returns. Validation nodes and token holders earn substantial rewards through staking, but their contributions are limited to maintaining network security.

For example, some public chains have a FDV as high as $1-10 billion, but their actual TVL is less than $100 million, yet they have to pay over 10% annualized returns to maintain security. This mechanism has led to the emergence of "ghost chains"—high on-chain security but with almost no real applications or activities.

Proof of Liquidity (POL) is a new consensus mechanism proposed by Berachain. Unlike traditional PoS networks that reward users for staking tokens, POL requires users to provide liquidity to specific liquidity pools to earn rewards. In other words, if you want to earn returns in this network, you need to actively participate in ecosystem building rather than simply locking up tokens.

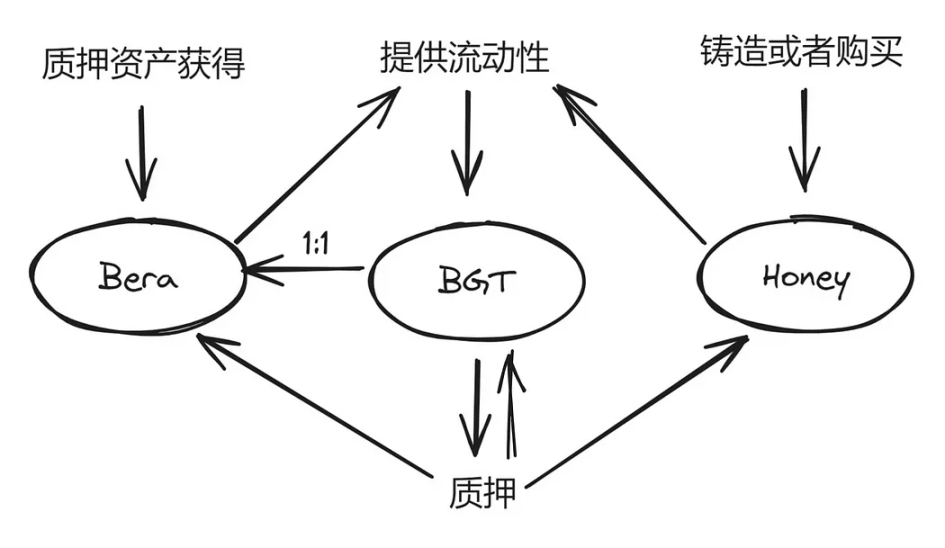

To support this mechanism, Berachain designed a sophisticated three-token system: BGT as a non-transferable governance token that can be converted 1:1 to BERA; BERA is used to pay gas fees and for market transactions;

HONEY is a stablecoin over-collateralized by high-quality assets. These three tokens work together to create a self-sustaining economic model.

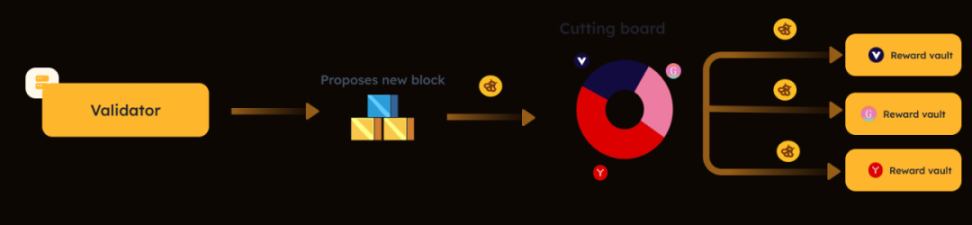

Under the POL mechanism, users earn BGT rewards by providing liquidity, which can be delegated to validation nodes for network validation. Validation nodes not only participate in block generation but also vote to determine the BGT reward distribution ratio for different liquidity pools.

This creates a unique economic model: validation nodes need to carefully consider which projects are most valuable, as their votes directly influence the development direction of the ecosystem.

This mechanism design achieves three key breakthroughs:

First, it directs network value directly to the builders and participants of the ecosystem. Each protocol can independently design how users acquire BGT, creating incentive mechanisms to promote ecosystem development. This direct value distribution model ensures that value-creating actions receive timely and adequate rewards.

Second, it establishes a symbiotic relationship between validation nodes and project parties. The earnings of validation nodes are closely tied to the success of projects, incentivizing them to actively support ecosystem development rather than merely focusing on their own staking rewards.

Finally, it creates a positive incentive cycle. Increased user participation leads to stronger projects, which in turn attract more users and liquidity, forming a virtuous cycle. This mechanism effectively prevents the emergence of "ghost chains," as network value is directly linked to actual activities and utility within the ecosystem.

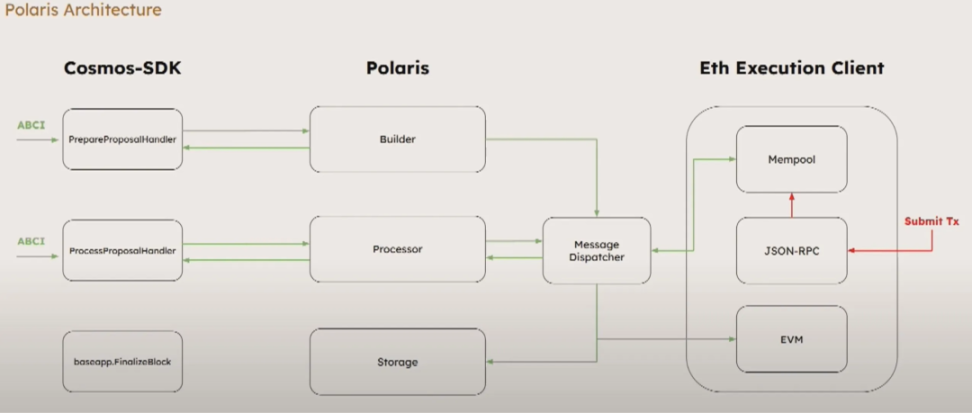

In terms of technical route, Berachain chose to build on Polaris EVM, a decision that brings two major advantages. First, full compatibility with EVM lowers the entry barrier for Ethereum developers; second, as part of the Cosmos ecosystem, Berachain gains strong cross-chain capabilities through the IBC protocol. This technical choice provides a solid foundation for the future expansion of the ecosystem.

03 Community Culture: From Meme to Strong Consensus

The community culture building of Berachain represents a new approach to community operation in the cryptocurrency world. While many new public chains neglect community culture, Berachain has successfully built a community ecosystem with a strong sense of identity and high activity.

This unique community culture is first established on an understanding of Ponzi culture. The Berachain team, initiated by several seasoned DeFi veterans, does not shy away from the Ponzi label but instead faces it with openness and humor. This attitude has garnered more trust and recognition for the project within the community, even though outsiders often compare Berachain to the next Luna, a comparison that overlooks the essential differences in their mechanism designs.

Secondly, there is a deeply ingrained Meme culture. From the project name "Bera" to founder Smokey appearing in a bear head mask at formal events, to the unique terms like "Henlo" and "Ooga Booga" popular in the community, it showcases a culture rich in internet sensibility, perfectly aligning with the current crypto aesthetic, naturally fostering a strong sense of community identity.

Lastly, it should not be forgotten that Berachain originated from an NFT project. From the initial Bong Bears, NFTs have become not just digital assets but also carriers of community culture. Various projects within the ecosystem have spontaneously associated their NFT series with the Bear theme, forming a unified cultural symbol. This cultural identity is directly reflected in the data: the secondary market listing rate for major NFT series is below 2%. Compared to pure tokens, these NFTs carry more cultural attributes and a sense of community belonging.

04 Ecosystem Projects

Berachain has adopted a bold yet practical strategy in ecosystem building: the official team personally develops core infrastructure.

The founding team recognizes that allowing multiple functionally similar DEXs, lending, and derivatives platforms to compete may lead to meaningless internal competition and vicious rivalry.

Therefore, they decided to keep these three most important infrastructures under official control. More importantly, DEXs, lending, and perpetual contract platforms are typically the main sources of revenue in blockchain ecosystems.

By officially operating these services, Berachain can better return profits to BGT holders, providing continuous value support for the governance token and promoting the healthy development of the entire ecosystem.

Currently, Berachain has attracted nearly a hundred projects, with DeFi projects dominating, fully reflecting Berachain's emphasis on liquidity. Fifteen native projects have received support from the bera incubator or VC investment, collectively raising $24.4 million in public financing.

Shogun: Cross-Chain Trading Infrastructure

Shogun has been selected for both the Build-A-Bera program and Binance's S6 incubation project, aiming to solve the core pain points of cross-chain trading.

Currently, cross-chain trading faces multiple challenges: users need to manage multiple wallets, handle gas fees on different chains, choose suitable cross-chain bridges, and deeply understand various ecosystems. This complexity not only increases operational difficulty but can also lead to inefficient transactions or loss of funds.

Shogun addresses these issues through an innovative intent execution system. The system introduces a "solvers" mechanism that maximizes TEV (Trader Extractable Value) by optimizing trading paths.

Specifically, when a trader sets a trading intent, solvers will look for the optimal execution path in a cross-chain environment: for buy orders, they aim to complete purchases at prices below the limit; for sell orders, they seek opportunities to sell above the limit. This mechanism transforms traditional MEV into user benefits while providing a trading experience close to centralized exchanges.

Infrared Finance: Innovative Liquidity Staking

Infrared Finance is based on Berachain's POL mechanism and has redesigned the liquidity staking model on the three-token architecture. The project offers value maximization solutions for BGT holders through POL treasury and iBGT liquidity staking derivatives.

The project has received funding support from investors including Binance Labs.

Kodiak: Efficient Liquidity Management

Kodiak is positioned as the native liquidity hub of Berachain. The project innovatively combines concentrated liquidity and automated liquidity management technologies, aiming to provide the highest quality liquidity services for the ecosystem, thereby supporting the efficient operation of the entire ecosystem. The project has secured $2 million in seed round investment.

Goldilocks: Innovative Fusion of DeFi and NFTfi

Goldilocks has completed a $1.5 million financing round led by Hack VC and Shima Capital, focusing on building DeFi and NFTfi infrastructure. The project consists of two core components:

Goldiswap: A trading platform based on a customized AMM, featuring a dual pool design with FSL (Supportive Liquidity Pool) and PSL (Price Support Liquidity Pool).

Goldilend: A lending platform built around the Bong Bears NFT series. Its innovation lies in the fact that the minimum valuation of NFTs is determined by governance votes from LOCKS token holders, eliminating reliance on oracles and introducing a new value discovery mechanism for NFT finance.

Honeypot Finance: Innovative Trading and Issuance Mechanism

Honeypot Finance has completed multiple rounds of financing totaling $1.3 million, building two core products:

- DreamPad: A token launchpad using the FTO (Fair Token Offering) model. It features zero reservations for project parties, providing 100% of tokens to the market, ensuring maximum fairness.

- HenloDEX: A decentralized exchange using the Batch-A2MM mechanism, effectively preventing sandwich attacks through an innovative trading mechanism while offering limit trading functionality to optimize user trading experience and reduce slippage.

More testnet projects can be queried through BeraLand.

05 Participation Interaction

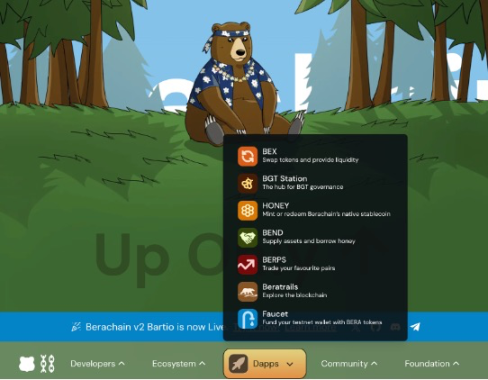

Berachain is currently running the second version of the testnet, Bartio. The most basic interaction participation can refer to the Dapps interface on the official website, as mentioned earlier, all of which are foundational DeFi projects developed by Bera.

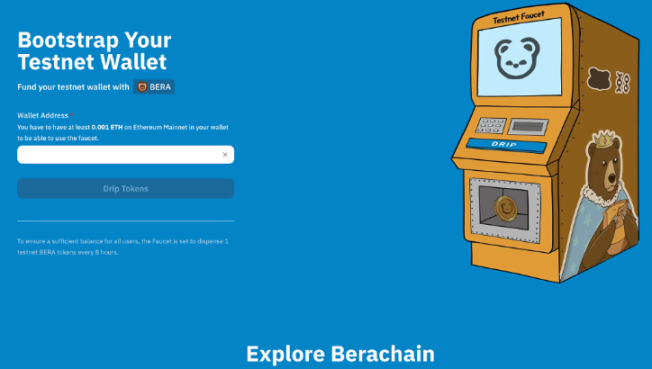

To participate, you need to first claim test tokens from https://bartio.faucet.berachain.com/. There is a small threshold filter; the claiming address must have at least 0.001 ETH balance on the mainnet. Compared to the previous testnet scenario where "water was hard to come by," this round of testnet token claiming is very smooth.

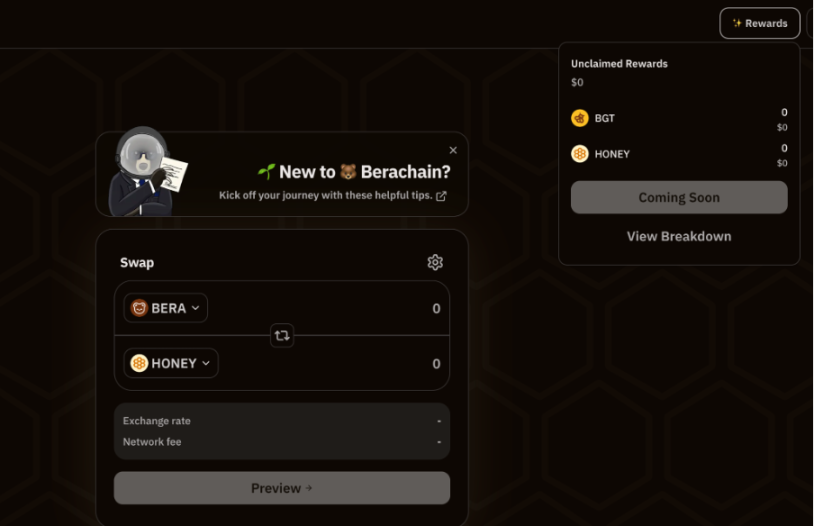

After claiming the testnet tokens, you can perform swap interactions on BEX, exchanging the received $BERA for other tokens to provide liquidity. Note that you need to retain some $BERA for future gas consumption during the exchange.

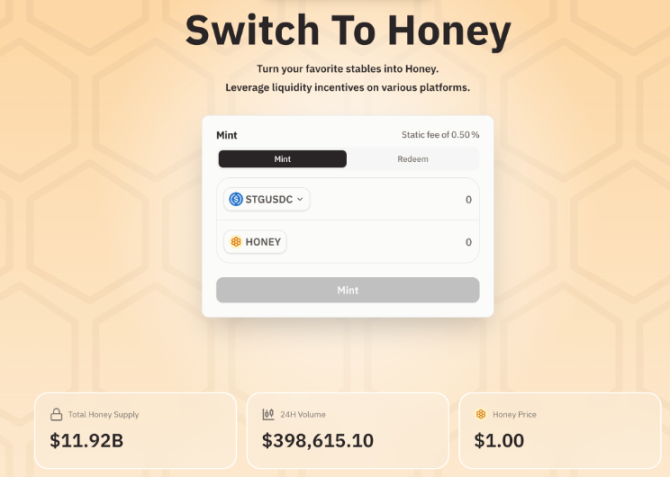

It is recommended to exchange $BERA for stablecoins like Dai or STGUSDC, which can be used in HONEY to mint the stablecoin $HONEY.

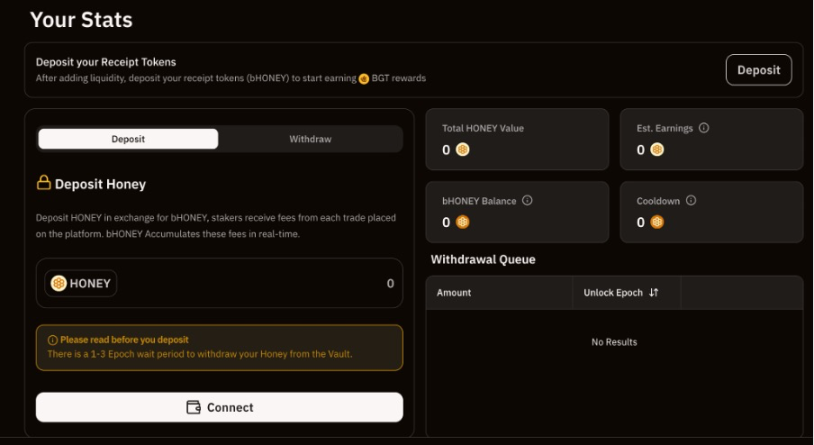

After obtaining $HONEY, stake it in BERP to receive bHONEY, which can then be staked in Station to the corresponding Vault to earn $BGT rewards. You can also use it directly as collateral for derivatives trading in BERP.

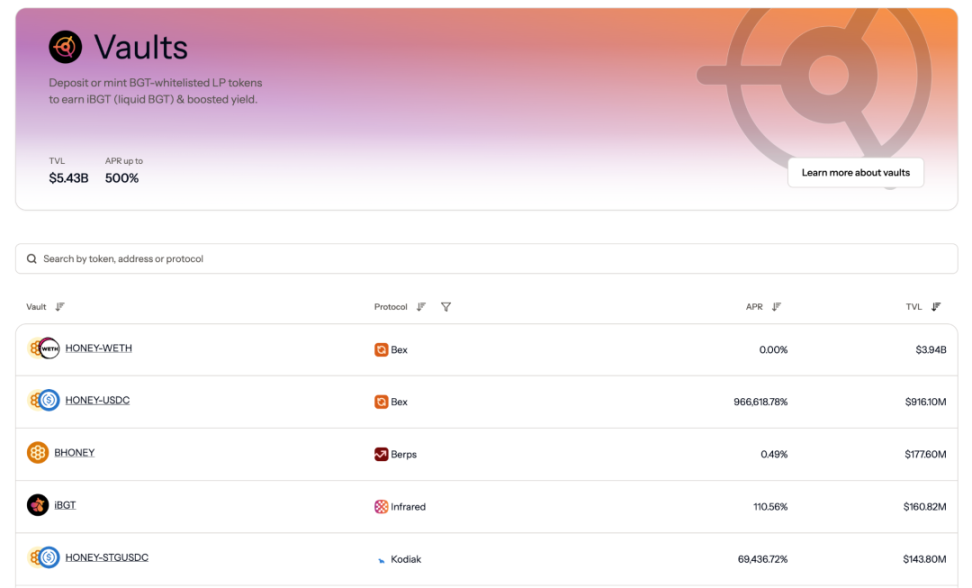

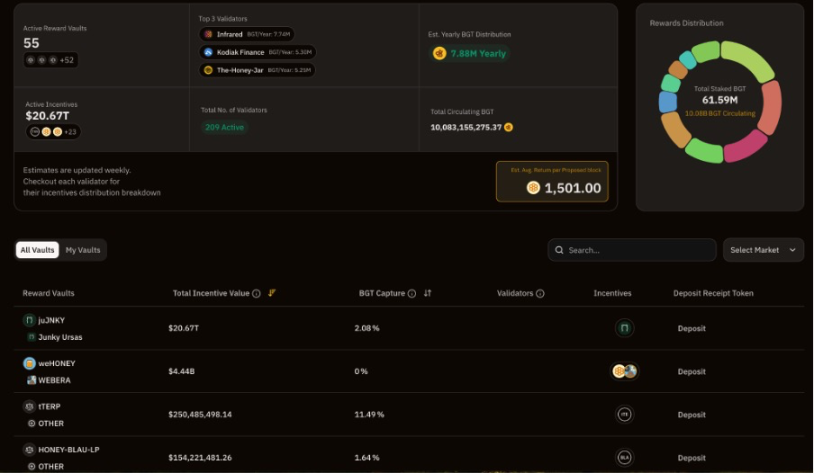

For more project interactions, the Vaults on BGT Station are a great reference. Different Vaults correspond to different interaction projects, and you can assess project popularity based on the BGT Capture metric, interact to obtain corresponding tokens, and then deposit them in Station for earnings.

06 Conclusion

In my view, Berachain is a very crypto-native public chain that deeply understands two core elements of the crypto world: liquidity and community.

The team profoundly understands that the essence of crypto is liquidity. The project directly faces and embraces the Ponzi attributes of "stepping on the left foot while stepping on the right," and through the carefully designed three-token and POL mechanisms, this characteristic will unleash tremendous energy during a bull market. At the same time, the team is well-versed in community building.

While maintaining serious public chain development, it can also gather users and liquidity through meme culture. A public chain with both a user base and ample liquidity, the mainnet launch of Berachain is highly anticipated, as it may bring a new wave of innovation to DeFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。