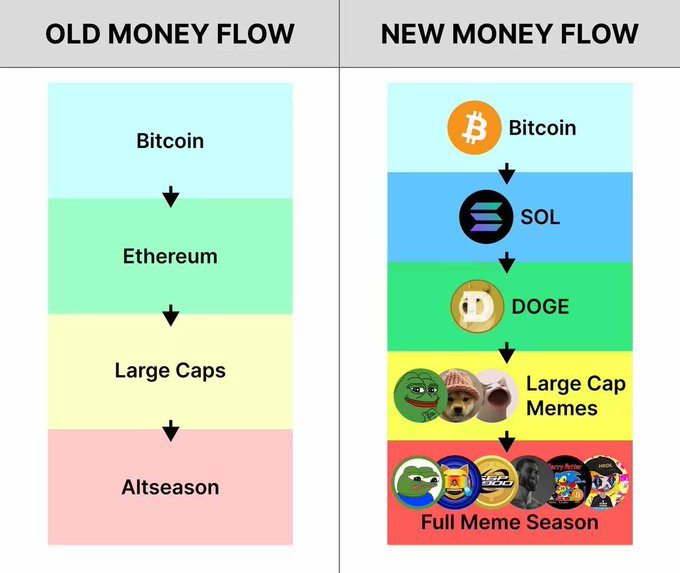

Previously, the asset sector rotation in the market was as follows: external incremental funds would first enter the industry through Bitcoin, then flow to Ethereum, where the DeFi infrastructure of the Ethereum ecosystem would leverage the incremental funds, amplifying the utilization effect of the capital, and finally, it would flow to various popular tokens in new sectors.

However, this bull market is quite special, as the asset sector rotation has changed: Bitcoin surged first, followed by Solana, then Doge, then mainstream meme coins, and finally various meme coins across different chains.

Why has this change occurred?

Firstly, Bitcoin is generally very strong at the beginning of a bull market, especially with the support of the ETF this time, which has led the entire industry.

The external incremental funds for Bitcoin mainly enter through ETFs, which means that the funds have not really entered the crypto space but are isolated in the U.S. stock market.

Ethereum also has ETFs, but the current attention of external incremental funds is focused on Bitcoin, making Ethereum naturally very weak and lacking liquidity.

The surge in Bitcoin has brought unexpected effects to the industry.

Bitcoin is the largest meme coin, a symbol of this decentralized world, and its symbolic significance far exceeds its actual technical use.

Ethereum, as the "world computer," relies more on the development of its ecosystem and practical applications for its value.

Now, it has turned into two major factions: the meme coins represented by BTC and the VC coins represented by ETH.

The market is gradually dividing into two factions, with one group favoring Bitcoin as a speculative asset or a store of value, while the other values the practicality and innovative potential of Ethereum and its ecosystem.

Thus, the unexpected effect of Bitcoin's surge is the meme coin craze, with the speculative faction currently dominating the market; while Ethereum's weakness has temporarily suppressed various practical "value coins."

Meme coins are very quick and volatile, providing a strong sense of participation and excitement.

Market attention is limited; since the utility coins represented by ETH or VC coins (which generally have investment logic and value support) are lying still, people rush into the meme coin casino to play.

The simplicity and entertainment of meme coins make it easier for novice investors to participate.

Additionally, the support of top KOL Elon Musk for Doge has greatly boosted the popularity of meme coins.

The timing (bull market cycle), favorable conditions (the new U.S. government's policy environment loosening), and the right people (Musk's promotion) have all contributed to the explosive popularity of meme coins in this round.

However, assets without value support cannot go far, so after the meme craze, as rationality returns, funds will still seek assets with narratives and imaginative potential, as these assets have greater room for speculation.

Therefore, do not lose heart regarding the VC coins represented by ETH; funds will still flow towards tokens with larger narratives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。