Murad: "Memecoins are a test. Treating them as jokes and funny images is a failure. Understanding them as an unstoppable tokenized community is the true insight."

Written by: CMed

The "Speculation" Era of Memecoins

Many people say that this cycle's Solana is the Ethereum of the previous cycle, with a significant piece of evidence being the wealth effect brought by this cycle's Pump.fun, which is reminiscent of the wealth effect from Ethereum's ICO in the last cycle. We have seen many thousandfold and ten-thousandfold coins emerge within just a few days.

Anyone can issue their own Memecoin on Pump.fun, undoubtedly attracting funds to the blockchain, including a considerable amount of Web3 funds that were previously in CEX, as well as a lot of new Web2 funds. There has even emerged Moonshot, a perfect fiat trading platform that connects Web2 and Web3 Memecoins in the last mile.

Related article: "After connecting the last mile of Memecoins, does Moonshot also have a listing effect?"

Perhaps it is precisely because of this "get-rich-quick" effect and the extremely low threshold for token issuance that many people are just "taking a bite and running." Many believe that investing in Memecoins has turned into a speculative game of "passing the parcel," with many Memecoin players thinking that the key to chasing memes is to "run fast."

This wealth effect has attracted many new on-chain users, while the market capitalization of most Memecoins is inflated. Some "hard-to-find angles" can create a lot of FOMO, quickly pushing up market caps, which, when approaching 20 million USD, leads to rapid profit-taking, causing a large number of early holders or project teams to exit, resulting in a swift return to zero. Many Memecoins with a "narrative angle" have gradually shown a "return to zero" pattern after a brief surge.

Interestingly, in Web3, a place where we traditionally perceive information transmission to be extremely fast, it takes a long time to reach consensus and realize value discovery. Many Memecoins that have emerged now have gone through this process. For example, GOAT quickly reached a market cap of around 20 million USD after its token issuance, then rapidly fell back, and after spending a long time around 10 million USD, it was finally discovered for its value and continued to rise. Similarly, Ban reached a market cap of around 5 million USD after its token issuance, then fell over 80% amid PVP and group FUD, only to gather community consensus after more than 20 hours, quickly pushing its market cap up. The same goes for ACT and Pnut, which were "backstabbed by the project team."

Why do these narrative-driven Memecoins take so long for price discovery? Undoubtedly, this is strongly related to the deeply ingrained PVP logic. "Speculators" fear that early holders will "dump for profit" and quickly return to zero, remaining trapped in the "PVP" logic.

However, everything has recently changed.

The "Crypto Gold" Memecoin Boom

Trump's election as President of the United States marked the beginning of the "Crypto Gold" era.

This not only signifies that mainstream cryptocurrencies, represented by Bitcoin, have gained market recognition, with BTC ETFs receiving political backing, leading more U.S. stock investors to invest in the cryptocurrency market, but it also represents a relaxation of cryptocurrency regulation in U.S. politics. The likelihood of DeFi tokens being viewed as "securities" and thus regulated has decreased, allowing Memecoins to enter the investment horizon of U.S. investors.

CoinBase has included Pepe in its listing roadmap, Binance has listed ACT and Pnut, and with Elon Musk's repeated support for the squirrel Peanut on social media, calling for the establishment of a government efficiency department named after Doge, the influence of Memecoins is rapidly expanding and gaining recognition. Undoubtedly, Elon Musk is a staunch supporter of Memecoins, stating, "America is saved by a squirrel and Memecoins."

As Murad once said, "We are at the beginning of the Meme SuperCycle." The average market cap of Memecoins is continuously rising. After CoinBase listed Pepe, its total market cap briefly exceeded 10 billion USD. After Binance listed Pnut and ACT, Pnut's market cap peaked at 2.5 billion USD, currently reaching 1.8 billion USD, ACT's market cap is close to 1 billion USD, Goat's market cap is around 1 billion USD, and Doge's total market cap ranks in the Top 5. The market's recognition of Memecoins is visibly increasing.

On November 13, Moonshot announced on its social platform that the platform's fiat inflow set a new record. "Non-crypto native users are flooding in."

The "Investment" Era of Memecoins

Binance is also making efforts to support the development of Memecoins. The previous logic for listing Memecoins on CEX primarily focused on market cap, supplemented by so-called "Listing Fees." However, Binance's listing of ACT and Pnut signifies a new beginning for CEX's support of Memecoins.

The importance of Memecoins is no longer just their market cap, but rather their community and narrative. After all, ACT, with a total market cap of 20 million USD, can still be listed on top CEXs, and after the announcement, it generated a significant wealth effect. Currently, ACT's market cap is 800 million USD, and individual investors can use information asymmetry to arbitrage more than 10 times through purely manual methods.

This wealth effect not only reflects Binance's recognition and support for the Memecoin industry but also points the way for Memecoin communities. Communities with strong narratives and excellent cultural backgrounds have a good chance of being listed on CEX. We can also see from the recent new projects on Binance that nearly half of the newly listed projects are Memecoins, spreading Memecoin culture through CEX channels and better developing Memecoin culture.

For individual investors, the perspective on investing in memes has changed. It is no longer about rushing into PVP; Memecoins lacking angles and narratives are no longer appealing. Some primary investors believe this is more beneficial for the market, as there is no need to "pan for gold in the muck," stuffing a bunch of coins that cannot launch into the inner market and consuming capital in PVP. Instead, the focus is on angles and narratives, followed by community building and pushing projects onto exchanges, which returns to the essence of Memecoins rather than relying on "getting in early and running fast" to make money.

The market's imagination for Memecoins has been broadened. The previous rapid profit-taking when market caps approached 20 million USD, leading to a mass exit and nearly "returning to zero," has become less common. The market's dividing line for whether a coin is a "golden dog" was once 20 million USD, with many "semi-golden dogs" falling at the 20M threshold.

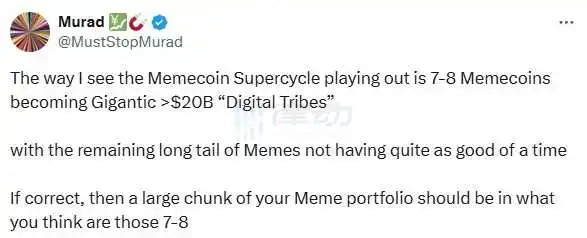

Now, with Pepe preparing to list on CoinBase and a market cap exceeding 10 billion USD, ACT listed on Binance with a market cap over 500 million USD, and GOAT backed by a strong AI meme narrative platform with a market cap exceeding 1 billion USD, Pnut's market cap has surpassed 1.5 billion USD after frequent endorsements from Elon Musk. The market is once again filled with expectations and aspirations for "big golden dogs" with market caps above 1 billion USD. The market is gradually understanding what Murad said about "the trajectory of the Memecoin super cycle being 7-8 Memecoins becoming huge > valued at 20 billion USD digital tribes."

For developers issuing Memecoins, the pricing of Memecoin market caps has increased, reducing the "dump and run" mentality, and fostering more community building and cultural development, as well as improving the integration process with CEX.

This is also good news for individual investors. Investing in memes feels more like an investment. By examining angles and communities, finding early-stage Memecoins with potential, and waiting for price discovery, they can target more Web3 communities or Moonshot's Web2 communities.

There are also many voices of "diamond hands" emerging in the market, with the market positioning Memecoin market caps at billions or even tens of billions of USD. Many say, "Pnut is either 4B or zero; absolutely no selling in between!" The logic of PVP seems to have changed. Early investors who bought Pnut in the inner market have already seen profits exceeding 210,000 times, having gained over 4 million USD from a cost of 0.1 sol, yet they remain steadfast in holding.

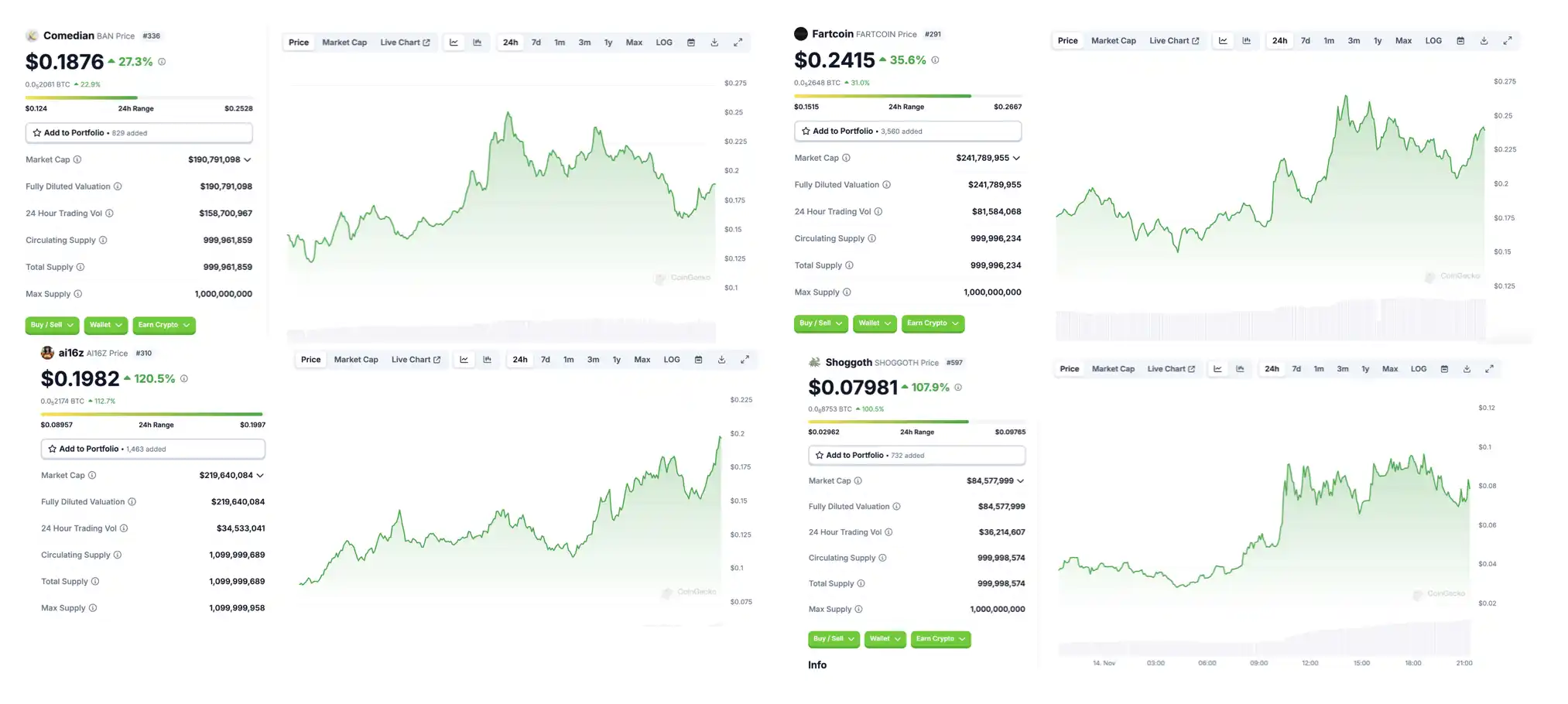

As of the time of writing, many "semi-golden dogs" that once achieved success but ultimately did not fully emerge have seen significant increases in market cap.

Many Memecoin projects that we once thought had "returned to zero" are being rediscovered for their value. Their worth may be unearthed in the expectation of being "Listed on CEX" in the future, and many Memecoins that truly represent a community culture are being issued, returning to the original cultural value of Memecoins. Behind them may be some AI agent, a new "internet celebrity animal," or an eagle that needs to be released.

As Murad said, "Memecoins are a test. Treating them as jokes and funny images is a failure. Understanding them as an unstoppable tokenized community is the true insight." We have already seen signs that the gears of the Meme SuperCycle are slowly starting to turn, as Meme culture steps out of PVP and opens a new chapter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。