Author: Nancy, PANews

Despite facing strict scrutiny and challenges from U.S. regulators, Polymarket gained fame by accurately predicting the U.S. elections and successfully igniting interest in the prediction market space. Behind the rise of Polymarket is strong support from figures like Ethereum co-founder Vitalik Buterin. Now, another decentralized prediction market, TrueMarkets, has also gained Vitalik's favor and endorsement.

On November 19, according to Pionex monitoring, the on-chain address marked as "vitalik.eth" has bridged 32 ETH from the Ethereum chain to Base and minted 400 Patron NFTs.

Vitalik's "endorsement" immediately attracted market attention. Data from OpenSea shows that over 3,300 Patron NFTs were sold in the past 24 hours, with sales amounting to approximately 703 ETH, ranking first in daily trading volume in the market. As of the time of writing, the floor price of Patron NFTs has risen to 0.23 ETH, more than 2.8 times the minting price (0.08 ETH).

According to reports, Patron NFTs are launched by TrueMarkets, a decentralized binary prediction market based on Base that allows users to predict the outcomes of real-world events, aiming to break the information asymmetry related to global news, enabling people to express real-time sentiments about the likelihood of potential outcomes. TrueMarkets plans to release its V1 version by the end of this year.

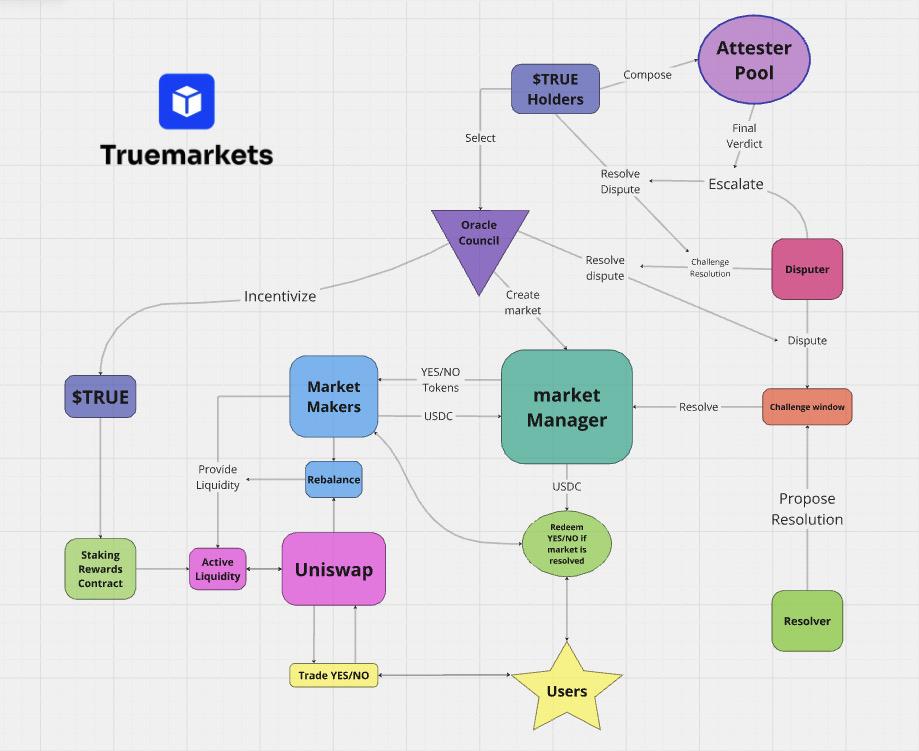

The operational mechanism of TrueMarkets is largely similar to that of prediction platforms like Polymarket, simplifying complex event predictions into two answers: "yes/no," thereby creating a binary trading market. The two answers will be adjusted in real-time based on the perceived odds of the outcome, with traders and market makers providing liquidity to maintain market balance and stability. When the outcome of an event is finally revealed, the tokens matching the correct answer can be redeemed at a value of $1, while the incorrect ones lose all value.

However, TrueMarkets also has its unique features. According to Millie, the project lead of TrueMarkets, in most other prediction markets, minting prediction tokens is usually limited to whitelisted users, but TrueMarkets will ultimately achieve a permissionless model, with market creation facilitated by AI Agents. All transactions on TrueMarkets are completed directly on-chain through Uniswap V3, including trading, liquidity provision, and market creation. Additionally, TrueMarkets uses an oracle established through a protocol to interpret market results, combining decentralized jury pools to achieve accurate decision-making transparently.

It is worth mentioning that TrueMarkets has also opened a challenge window, during which anyone can dispute proposed solutions. To prevent manipulation and ensure the orderly operation of the oracle, TrueMarkets has introduced an important role called Disputer. Specifically, when a prediction result triggers a dispute, a Disputer can challenge it by paying a $250 deposit and stating their reasons for the challenge. If their challenge is accepted, the Disputer not only recovers the deposit but also receives a corresponding reward. To ensure fairness and justice, TrueMarkets has set up a three-stage arbitration mechanism, including challenges to preliminary proposals, oracle committee decisions on disputes, and token holder voting on disputes, with different challenge costs for each stage: $250, $5,000, and holding 250,000 platform tokens (TRUE) in a wallet.

Additionally, while Polymarket has been reported to potentially conduct a token airdrop, the platform has not explicitly stated that it will issue its own token. In contrast, TrueMarkets has announced its tokenomics and will launch its Token Generation Event (TGE) by the end of this year.

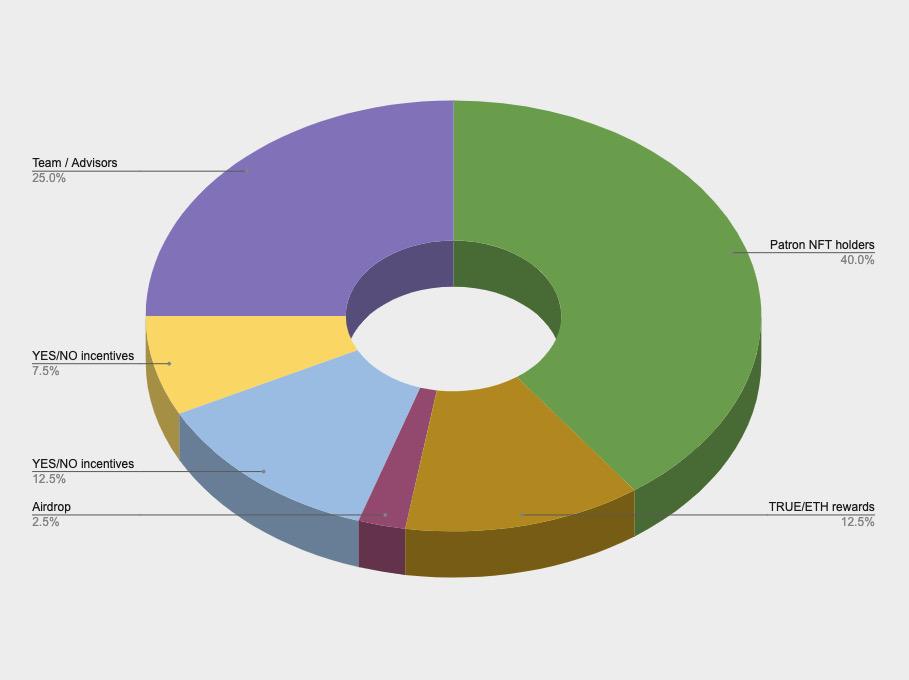

TRUE is introduced as a multifunctional utility token within TrueMarkets, used for controlling protocol fees and governance, among other purposes. The total supply of TRUE is 100 million tokens, of which 40.3% is allocated to holders of Oracle Patron NFTs (15,071) and Truth Seeker Patron NFTs (59), with each NFT corresponding to 2,666.67 TRUE tokens; 2.2% is allocated for airdrops to Discord and beta users; 7.5% is for market incentives; 12.5% will be distributed to TRUE/ETH liquidity providers (LPs) on Base over two years; 12.5% is allocated for oracle incentives; and the remaining 25% will be allocated to the TrueMarkets team and advisors, which will be unlocked linearly over two years.

"Once a prediction market reaches a critical scale, a strong feedback loop will form. The broader the audience, the more accurate the predictions. Elections are a turning point for prediction markets, as this event has proven that such platforms are the most accurate indicators and primary news sources. Looking ahead, it is expected that the world will increasingly rely on prediction markets for news and entertainment, and the more people participate, the stronger the predictive capabilities of the prediction markets will become," Millie stated regarding the future prospects of prediction markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。