Relying on Binance's coin listing strategy and the launch of a series of high-return financial products, it has ensured users' investment returns, which is the "technique" behind Binance's success. The "principle" of Binance's success lies in its unwavering commitment to stand alongside its users.

Written by: Jessy, Golden Finance

The bear market in mid-2024 poses a significant challenge for investors. How can they smoothly navigate through the bear market and accumulate capital to welcome the bull market that may follow Trump's election?

On one hand, it depends on the coin listing strategy of the exchange chosen by the investors and the measures taken to protect investors' interests.

This year, Binance has successfully weathered a series of storms and still holds the top position in the exchange sector. Currently, Binance's user count has surpassed 225 million, with over 40 million new users added this year alone.

Newcomers continue to choose Binance as always. The success in a highly volatile market relies on Binance's coin listing strategy and the launch of a series of high-return financial products, ensuring users' investment returns, which is the "technique" of Binance's success.

The "principle" of Binance's success is its consistent commitment to stand with its users.

Quality-focused Coin Listing Strategy

In 2024, unlike some second- and third-tier exchanges with aggressive coin listing strategies, Binance's listings remain selective, adhering to the principle of focusing on quality rather than quantity.

According to a research report by Animoca Digital Research, in the first three quarters of this year, Binance listed 44 tokens. In contrast, KuCoin and Bybit listed over 150 tokens each, while Bitget listed 339 tokens. Thanks to this selective listing model, Binance achieved the highest returns during the bear market in mid-year.

As of September 2024, the average return rates for these exchanges are Binance -27.00%, Bybit -50.20%, KuCoin -48.30%, and Bitget -46.50%. This indicates that Binance has implemented a more effective selective listing strategy, resulting in relatively better token price performance in a challenging altcoin market environment.

Specifically, Binance has its consistent principles for coin selection. He Yi stated that the principles are threefold: first, to list projects that users need, which have users and traffic; second, to list projects that have been around for a long time; third, to list projects with solid business logic.

In the bear market this year, with insufficient market liquidity, low-market-cap meme coins circulated freely without significant selling pressure from VCs, making them the only option for retail investors at that time. Binance also listed some popular meme tokens.

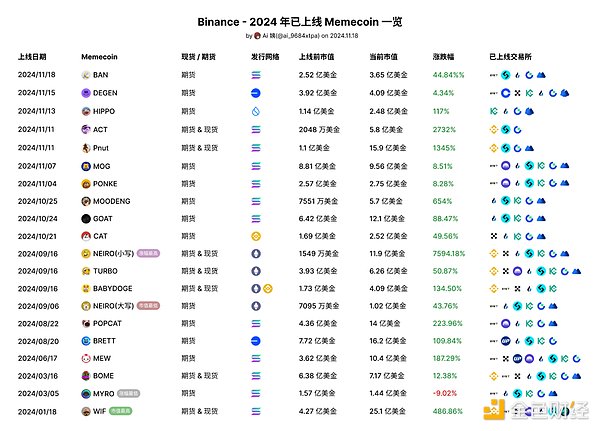

According to data summarized by X user Ai Yi, as of November 18, Binance has listed a total of 20 memecoin projects (including contracts and spot) since the beginning of 2024, with spot trading accounting for 35% of all listed projects. Only one project saw a decline after listing, while the token $NEIRO even surged by 7594%.

The tokens PNUT and ACT, which were listed on Binance on November 11, saw ACT's price soar 16 times within half an hour after listing, with its initial market cap skyrocketing from $20 million to $350 million, and it still had a 72.60% increase after listing, entering the MCAP top 200. PNUT also performed impressively, tripling in just one hour, aligning with market trends and election narratives, and achieving a fourfold increase in market cap, reaching $400 million.

As one of the important narratives in this cycle, meme tokens are undoubtedly something Binance cannot and should not miss.

He Yi mentioned that Binance has reflected internally on meme coins, particularly in the debate over large and small neiro, and due to community criticism, Binance has been more reflective about what constitutes a good MEME, leading to the selection of relatively decentralized and low-market-cap MEME projects.

From the choice of memes, it is evident that Binance consistently considers issues from the users' perspective. Concentrated meme tokens have a higher probability of "cutting leeks," while decentralized and low-market-cap meme projects provide ordinary people with more opportunities to profit.

The other two principles for Binance's coin listings are to list long-standing projects and those with solid business logic. Following these principles, Binance has listed projects like TON, which have solid business logic, as well as concept coins like Arkham related to AI, and Pendle, which has gained renewed attention in the market due to the restaking trend.

These projects themselves possess sustainability, and their value has been validated after undergoing the deep cleansing of the bear market.

Binance's coin listing actions also bring more exposure and liquidity to projects. For both users and projects, this is a win-win situation. Data shows that investing in new coins on Binance, through its strict vetting process, has helped users reduce losses, at least during the bear market this year.

Rich Financial Products Ensure Users Make Money

Data shows that the average ROI for Binance's Launchpool projects this year is 2.13 times. The average valuation of the projects is $326 million, with a total of $929 million raised in Launchpool.

The data is impressive. Generally, traditional trading platforms cannot guarantee users make money. However, on Binance, users holding BNB or FUSD can participate in airdrops for some new projects. This ensures that users can "make money."

In this bull market, Binance has frequently launched Launchpool projects, allowing users holding BNB or FUSD to participate in Launchpool and receive new coin airdrops.

Especially for users holding BNB, they not only benefit from the steady appreciation of BNB but also gain objective "passive income" from rich financial products like Launchpool.

New coin airdrops are not limited to Launchpool; there are also channels like Hodler Airdrop and Megadrop. Additionally, BNB in Binance's Web3 wallet can also participate in new coin airdrops.

For conservative investors, holding a large amount of BNB allows them to enjoy profits from BNB's steady appreciation while also receiving new coin airdrops, achieving multiple benefits.

On the other hand, holding BNB provides stable financial income on the platform, which can hedge against the risks of token price declines during the bear market. In the bull market, users can obtain the hottest tokens at no cost through financial methods like Launchpool, reaping substantial returns while participating in the industry's most popular narratives, helping popular projects with financing and promotion, and contributing to the industry's development.

In addition to the popular Launchpool, Binance offers a variety of other rich financial products. Currently, Binance's financial offerings include Earn, ETH staking, Binance Pool, BNB Yield Pool, DeFi mining, dual currency investment, and more. These products can be categorized into capital-protected and high-yield types to meet various investment needs of users.

Standing Together with Users

He Yi once said that Binance's success is due to its alignment with the pulse of the times and standing together with its users.

Discovering and meeting the needs of users in the industry is the core reason for Binance's success.

The evolution of Launchpool proves this point. Initially, users participating in Binance's Launchpool needed to invest BNB or specific stablecoins into the Launchpool pool and then claim their earnings at the end of the period. However, this year, users can accumulate interest by using BNB to purchase capital-protected earning products, automatically qualifying for rewards from Launchpool, Megadrop, and HODLer airdrops without needing to invest and confirm manually. Additionally, BNB in Binance's Web3 wallet can also participate in new coin airdrops. This move undoubtedly simplifies the participation process and benefits users.

Binance not only meets users' trading needs; it started with trading but goes beyond it. The emergence of products like Earn, Square, Pay, and the Web3 wallet proves that Binance is using a rich array of products to satisfy users' diverse needs in the industry.

Binance Square allows users to understand industry news and find wealth opportunities. Binance Pay enables cryptocurrency to be truly applied in real-world scenarios.

As He Yi said, Binance has always been trying to explore how to bridge the gap and truly popularize blockchain technology, allowing ordinary people to use blockchain, not just trade it. Ordinary users may not know what blockchain technology is, but they can benefit from it.

Binance has great ambitions to support industry development, and the realization of these ambitions relies on recognizing and meeting the needs of the industry and its users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。