MiCA and VARA licenses are compliance tools for Web3 companies to enter the European and Middle Eastern markets.

Written by: Bai Zhen, Song Kewei

With Trump's election and Bitcoin reaching new highs… By the end of 2024, the crypto asset industry is welcoming a new wave of positive signals. As the industry continues to develop, countries are also continuously introducing corresponding regulatory measures, among which the most eye-catching is the "license."

What is a license? In short, a "license" is a "passport" for Web3 companies to engage in crypto business. It allows Web3 companies to conduct crypto-related activities legally and safely while establishing trust with investors and regulatory bodies.

This article will delve into the compliance frameworks of MiCA and VARA, analyzing why for Web3 companies hoping to thrive in regulated markets, obtaining a license is not just an option but a necessity. Understanding this field is crucial for any company or investor looking to succeed in the next chapter of the crypto industry.

MiCA and VARA licenses are compliance tools for Web3 companies to enter the European and Middle Eastern markets

The EU's Markets in Crypto-Assets Regulation (MiCA) is "one of the most comprehensive digital asset regulatory frameworks to date." This regulation aims to provide a clear regulatory environment, reduce compliance costs, and encourage companies to enter the EU crypto market. The MiCA regulatory framework applies to all EU member states. It also applies to three European Free Trade Association (EFTA) member countries (Iceland, Liechtenstein, and Norway) that belong to the European Economic Area (EEA), as they are part of the internal market and are subject to many of the same EU regulations.

The Dubai Virtual Assets Regulatory Authority (VARA) is the world's first independent virtual assets regulatory body, responsible for overseeing the issuance and trading of virtual assets within and outside the Emirate of Dubai. Its policies are leading the regulatory direction for Web3 in the Middle East. VARA's influence is limited to the Emirate of Dubai; other regions of the UAE and the Dubai International Financial Centre are not under its jurisdiction.

Background and Global Impact of MiCA and VARA

- Global Regulatory Trends: MiCA and VARA are landmark events arising from the global regulatory trend. They not only signify strict regulation of the Web3 industry by various countries but may also serve as templates for regulatory frameworks in other nations.

- Strategic Significance of Europe and the Middle East: The European and Middle Eastern markets are key markets for Web3 companies to expand, with a large investor base, innovative ecosystems, and development potential. The guiding role of MiCA and VARA in these two markets may become a barometer for the global market.

- From Regulation to Innovation: MiCA and VARA are not just regulatory tools; they may bring more opportunities for innovation. A standardized market can be a double-edged sword for startups, providing both constraints and incentives.

Business Value of Obtaining MiCA and VARA Licenses

- Compliance and Market Access: Holding MiCA and VARA licenses serves as a legal "passport" for entering the Middle Eastern and European markets, helping companies gain trust in local financial markets and reducing legal barriers to market entry.

- Enhancing Company Image and Market Reputation: In the crypto industry, licenses are not only symbols of compliance but also representations of a company's strength. Web3 companies that obtain these licenses will gain higher recognition in the industry.

- Increasing Possibilities for Cross-Border Expansion: Obtaining MiCA and VARA licenses can help companies operate in different regions, reducing compliance risks associated with cross-border expansion. They provide companies with "cross-border operation licenses" in the EU and Middle Eastern markets.

MiCA vs VARA: A Comparative Analysis of Regulatory Frameworks from the Perspective of License Applications

Different regions have varying regulatory requirements and market demands for Web3 companies, and the roles and importance of MiCA and VARA licenses differ in these areas. Europe may place more emphasis on market transparency and risk prevention, while the Middle East may prioritize rapid innovation and capital flow.

Overview of Licensed Business Activities under the MiCA Framework

MiCA has detailed compliance requirements for the issuance and trading of stablecoins, such as EMTs and ARTs, but due to space limitations, this article will not elaborate on them. Here, we will provide a basic overview of "crypto asset services" under the MiCA framework. "Crypto asset services" refer to any services and activities related to any crypto asset, including:

- Providing custody and administration of crypto-assets on behalf of clients

- Operation of a trading platform for crypto-assets

- Exchange of crypto-assets for funds

- Exchange of crypto-assets for other crypto-assets

- Execution of orders for crypto-assets on behalf of clients

- Placing of crypto-assets

- Reception and transmission of orders for crypto-assets on behalf of clients

- Providing advice on crypto-assets

- Providing portfolio management on crypto-assets

- Providing transfer services for crypto-assets on behalf of clients

Overview of Licensed Business Activities under the VARA Framework

Any entity, whether operating within the Emirate of Dubai or starting from there, whether targeting UAE residents or providing services to global clients allowed to engage in related activities, must apply for and obtain a license from VARA.

Currently, there are 8 types of licensed businesses under the VARA framework, which are:

- Advisory Services: Providing advice on virtual asset-related matters

- Broker-Dealer Services: Facilitating the buying and selling of virtual assets

- Custody Services: Providing custody services for virtual assets to ensure their security (VARA has additional requirements)

- Exchange Services: Operating a virtual asset trading platform

- Lending and Borrowing Services: Facilitating the lending of virtual assets (not yet covered by MiCA)

- Management and Investment Services: Managing and investing virtual assets on behalf of clients

- Transfer and Settlement Services: Facilitating the transfer and settlement of virtual assets

- Virtual Asset Issuance Category 1: Issuance of stablecoins such as Fiat-Referenced Virtual Assets (FRVA)

License applicants can apply for multiple licensed businesses and consolidate them under a single comprehensive license.

Comparison of Licensed Business Scope between MiCA and VARA

As of now, the different licensed businesses covered under the two regulatory frameworks are compared as follows:

From the summary in the table above, it can be seen that MiCA and VARA have different regulatory scopes for licensed business activities.

Regarding Lending and Borrowing Services, VARA provides a channel for applying for this licensed business, but MiCA does not cover it. At least in 2024, MiCA will not provide licensing activities for lending services. Therefore, MiCA does not intend to regulate lending services related to crypto assets, including electronic money tokens, and does not express bias towards applicable national laws in this area.

For Custody Services, VARA has imposed additional regulatory requirements on VASPs. Virtual asset custody services are the only business activities that must be handled separately from other licensed businesses. In this case, a VA custodian must be established as an independent legal entity with a separate license, rather than being consolidated under a comprehensive license like other businesses.

Additionally, it must be ensured that licensed institutions fully comply with the activity requirements of the license from the time of application until the business activities commence.

The Strategic Value of Licenses: Why Web3 Companies Must Plan Ahead

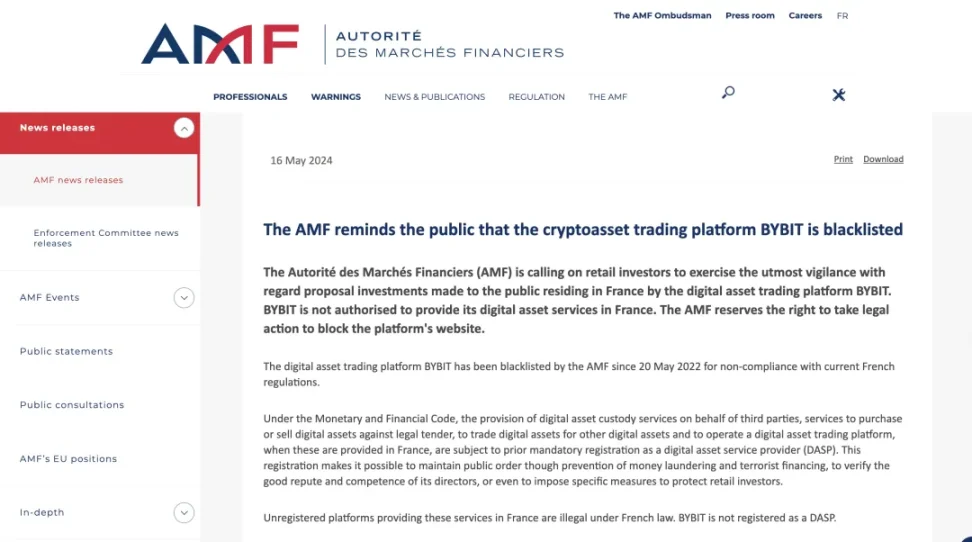

Why do Web3 companies need licenses? The most direct reason is—without a license, they are blacklisted. In May 2024, the French financial regulatory authority Autorité des Marchés Financiers (AMF) stated that due to BYBIT's unauthorized provision of virtual asset services in France, AMF reserves the right to take legal action to block the platform's website.

Tracking Industry Trends and Planning for Licenses in Advance

With the rapid development of the Web3 industry, regulatory authorities around the world are gradually strengthening their oversight of virtual assets and blockchain technology. The regulatory policies and legal frameworks in different regions are constantly changing, putting significant compliance pressure on Web3 companies. If companies do not plan ahead for license applications, they may miss the best window for compliance development, leading to restrictions on their operations and expansion.

- Rapid industry development and regulatory lag: Globally, the Web3 industry is developing rapidly, but regulatory frameworks in various countries often lag behind. This lag may lead to some companies failing to obtain the necessary licenses in a timely manner, resulting in missed market opportunities. Planning for licenses in advance can help companies seize the initiative and gain market share.

- Trend of tightening regulation: Currently, both VARA in the Middle East and MiCA in the EU are intensifying efforts to ensure compliance for various virtual asset-related businesses. Understanding the requirements of these regulatory frameworks in advance and applying for relevant licenses in a timely manner will ensure that companies operate within the legal framework and avoid risks associated with future regulatory tightening.

- Avoiding the risk of sudden policy changes: Governments around the world are gradually shifting towards stricter regulation of the Web3 industry. If companies wait until policies are fully matured before applying for licenses, they often face more cumbersome approval processes and may even risk being denied. Planning for licenses in advance means that companies can respond more calmly to potential future policy changes and regulatory requirements.

Managing Compliance Risks and Reducing Compliance Costs

In the Web3 industry, compliance issues have always been a significant challenge for companies. With the continuous changes in the global regulatory environment, companies that fail to obtain compliance licenses in a timely manner will face a series of legal risks, including penalties, lawsuits, and even business suspensions. By applying for licenses in advance, companies can effectively manage compliance risks and significantly reduce potential compliance costs.

- Avoiding financial losses from compliance risks: If a company fails to hold a legal license and is penalized by regulatory authorities, it may face hefty fines, asset freezes, and even operational interruptions. Holding a compliance license can provide legal protection for companies, reducing legal disputes and financial losses.

- Complexity of the compliance review process: Each country and region may have different regulatory frameworks. Applying for licenses in advance and ensuring compliance with regulatory requirements can help companies avoid being denied or facing complex review processes due to non-compliance. In the long run, this will reduce the costs and time associated with compliance failures.

- Long-term advantages of compliant operations: Compliance is not a one-time task but a continuous process. After obtaining a license, regulatory authorities will regularly review the company. By obtaining a license in advance and passing the review smoothly, companies can operate more steadily and competitively in compliance.

- Simplifying cross-border compliance issues: Web3 companies typically operate internationally, involving regulatory requirements from different countries and regions. Holding licenses from multiple regions can simplify cross-border compliance issues, ensuring that companies operate smoothly in different markets and avoid legal obstacles due to lack of licenses.

Enhancing Brand Image and Driving Financing Cooperation

After the Hong Kong Securities and Futures Commission issued licenses for virtual asset trading platforms this year, HashKey Exchange CEO Livio Weng pointed out that the new regulations effective June 1 will lead to a short-term user overflow effect for licensed institutions as unlicensed platforms are phased out. Currently, HashKey's business side has already perceived significant changes, with new app activations increasing by 267% week-on-week.

In the Web3 industry, trust is one of the key factors in attracting investors and users. Licenses are not only symbols of compliance but also marks of a company's reliability and professionalism. Obtaining a legal license can effectively enhance a company's brand image and bring more financing and cooperation opportunities.

- Enhancing user trust: Due to the characteristics of the industry, users and investors often have certain doubts about the compliance and security of Web3 companies. Holding a legal license can demonstrate the company's compliance to the market, establishing a stronger trust foundation. This trust can not only attract more users but also increase institutional investors' interest in the company.

- Enhancing brand credibility: Compliance licenses represent a company's legitimacy and credibility in the global market. By obtaining regional or international licenses, Web3 companies can effectively establish their brand image and showcase their professionalism in the industry. Especially in a highly competitive market, licenses can help companies stand out.

- Promoting financing and cooperation: Licensed companies are generally more attractive in terms of financing, especially from institutional investors and venture capital. Investors are more inclined to choose compliant companies for investment, as this implies lower legal risks and higher market stability. Through licenses, Web3 companies can effectively secure more financial support.

- Expanding cooperation opportunities: Many business partners, such as financial institutions, technology providers, or multinational companies, are more willing to cooperate with Web3 companies that hold compliance licenses. Licenses not only represent a company's compliance but also convey its maturity and sense of responsibility in the industry. Therefore, obtaining a legal license is an important condition for companies to expand cooperation opportunities.

License Application Analysis: Taking MiCA Stablecoin Issuance as an Example

Under the MiCA regulations, new strict requirements for stablecoin issuers are effective across the EU. This upcoming regulation represents a significant change in the European stablecoin regulatory framework, under which any entity issuing stablecoins in Europe must comply with the MiCA framework. Reactions from institutions vary.

1. Reactions from Licensed Institutions

Circle

In June 2024, US-based stablecoin issuer Circle announced that it is fully compliant with MiCA regulations. The company thus became the first global stablecoin issuer to obtain an Electronic Money Institution (EMI) license under the EU MiCA regulatory framework, allowing it to use its license across the EU. Circle announced that its two main stablecoins, USDC and EURC, now meet the regulatory requirements of the new rules and can be used under the new European regulations. As an EMI registered in France, Circle Mint France will issue its euro-denominated EURC stablecoin "within" the EU and issue USDC from the same entity, providing services to customers across the EU.

SG-Forge

Société Générale's subsidiary Forge (SG-Forge) also announced that it has obtained an electronic money license, and its stablecoin EURCV has now been classified as an electronic money token under MiCA. SG-Forge updated its smart contracts to remove whitelist restrictions, thereby complying with MiCA regulations. This update primarily aims to accelerate settlement speed, enhance security, and expand its application scope on public chains. This allows EURCV to be used in a broader market while providing more liquidity and use cases.

Now that these stablecoin issuers have taken this step and obtained electronic money licenses, we may see other stablecoin companies attempting to gain similar approvals in Europe. This can provide more options for those looking to use stablecoins.

2. Reactions from Unlicensed Institutions

Due to strict requirements for dollar-pegged stablecoins, MiCA faces the risk of many existing currencies being deemed non-compliant and thus forced to exit the EU market. According to MiCA regulations, companies issuing fiat-backed stablecoins must now obtain an electronic money license within the EU. To provide stablecoins in the EU, issuers must register as electronic money institutions or credit institutions. There are several key obligations, such as publishing a white paper, holding liquid reserves with third-party custodians, and reporting the value and composition of reserves.

Many cryptocurrency exchanges operating within the EU have already taken action before the new rules come into effect. They have announced changes to their stablecoin policies and product offerings, creating significant opportunities for licensed electronic money platforms. Major cryptocurrency exchanges such as Uphold, Binance, Bitstamp, Kraken, and OKX have begun delisting non-compliant stablecoins like Tether and DAI for their European customers or have started implementing restrictions on services for EU and EEA users, while other exchanges have committed to doing so in the coming months.

Uphold

In June, New York-based cryptocurrency exchange and custody platform Uphold announced its decision to stop supporting multiple stablecoins in preparation for the MiCA regulations. These stablecoins include Tether, FRAX, GUSD, USD, and TUSD. Starting July 1, 2024, these digital assets will no longer be available on the Uphold platform. Users holding these stablecoins are encouraged to exchange them for other cryptocurrencies before June 28; after that, the cryptocurrency exchange will automatically convert them to USD Coin. If not exchanged by this deadline, these stablecoins will be automatically converted to Circle's USD.

3. HashKey's Attitude: "Licenses First"

HashKey Group COO and HashKey Exchange CEO Livio Weng stated in a recent interview, "We firmly believe that unregulated financial businesses should not be attempted lightly, which is closely tied to our principle of 'long-termism.' All of HashKey's businesses follow the principle of 'license first, then operate.' We have obtained licenses in Japan, Singapore, Hong Kong, and more licenses are in the application process. We always adhere to the philosophy of conducting business only after obtaining regulatory licenses, following the idea that 'no regulation, no finance.'"

It is foreseeable that in the future, the concept of "licenses first" will also penetrate the industry and become an essential part of Web3 companies' business expansion.

Conclusion

This article uses MiCA and VARA licenses as a starting point to compare the differences in licensed business activities between the two, combining practical cases to analyze the necessity of Web3 companies applying for licenses. Of course, regulatory frameworks are not static; as pioneers, VARA and MiCA provide a good model for licensing regulatory policies worldwide, which will have a profound impact on the future of the Web3 industry. For Web3 companies, whether they already hold licenses or have yet to apply for them, they should reassess the risks and costs of licenses in light of their strategic value to support long-term development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。