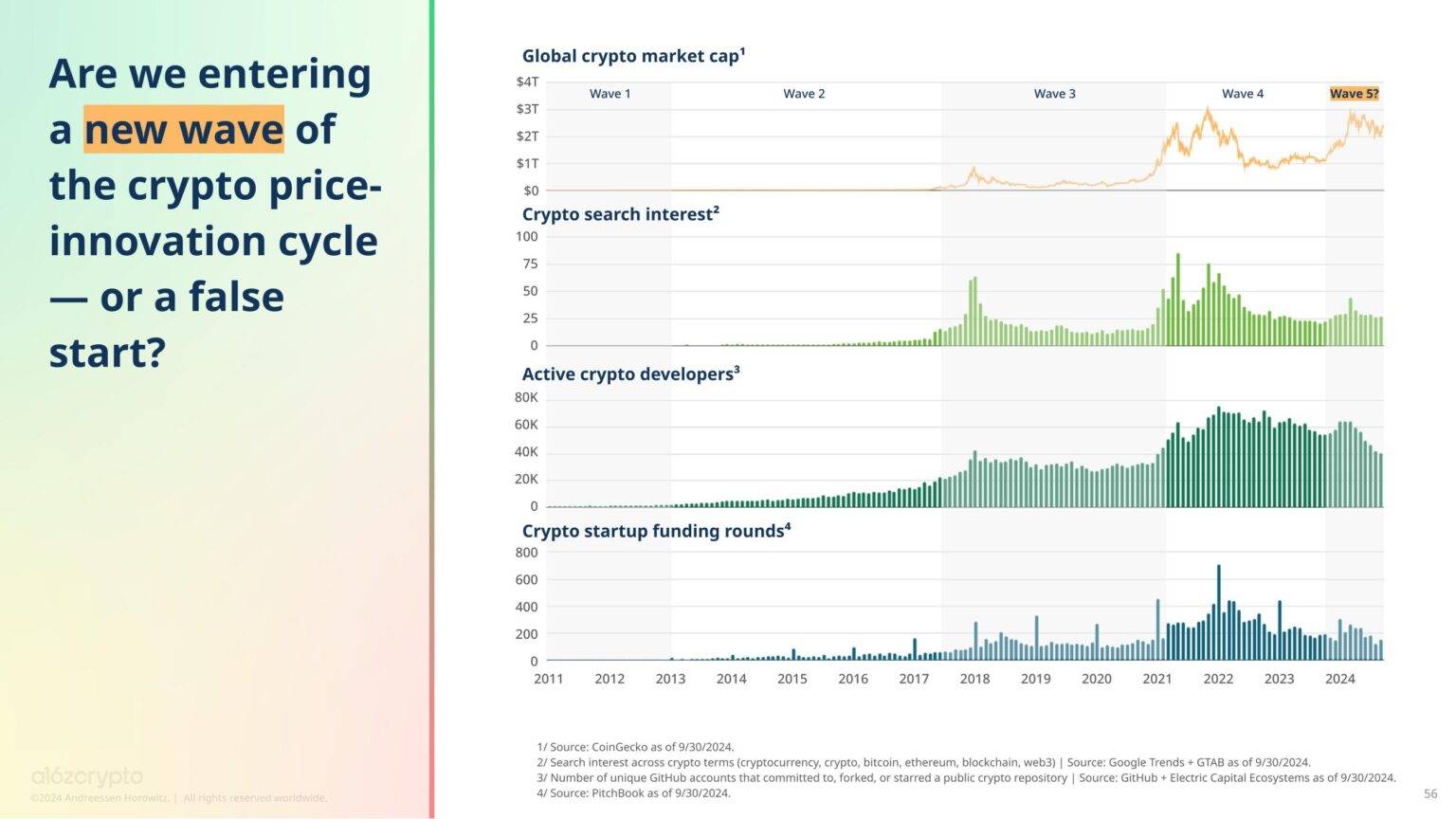

Have we entered the fifth wave of the price-innovation cycle? Time will tell.

Authors: Daren Matsuoka & Robert Hackett & Eddy Lazzarin

Compiled by: Deep Tide TechFlow

Two years ago, when we released the first annual State of Crypto Report, the world was very different from today. At that time, cryptocurrency was not a priority for policymakers. Bitcoin and Ethereum's exchange-traded products (ETPs) had not yet received SEC approval, and Ethereum had not yet transitioned to a more energy-efficient proof of stake. Second-layer (L2) networks aimed at increasing capacity and reducing transaction costs were essentially inactive, and transaction fees on them were much higher than they are now.

Today, things have changed, as shown in our newly released 2024 State of Crypto Report. Our report covers the rise of cryptocurrency as a hot policy topic, numerous technological improvements in blockchain networks, and the latest trends among cryptocurrency builders and users. The report also:

Delves into the emergence of key applications, such as stablecoins—considered one of the "killer apps" of cryptocurrency;

Explores the intersection of cryptocurrency with other technological trends (such as AI, social networks, and gaming);

Provides new data on interest in cryptocurrency in swing states ahead of the U.S. elections, and more.

The 2024 State of Crypto Report also reveals a historic high in crypto activity and analyzes the maturation of blockchain infrastructure, particularly following recent upgrades that significantly reduced on-chain transaction costs, leading to the rise of Ethereum L2 and other high-throughput blockchains.

This year, we also launched a new tool: the a16z Crypto Builder Energy Dashboard. For the first time, we share proprietary data based on our unique perspective, including where "builder energy" is located. The dashboard integrates thousands of data points that have been aggregated and anonymized, sourced from our investment team's research, our CSX startup accelerator program, and other industry tracking. With this tool, anyone can understand the activities and interests of cryptocurrency builders—from which blockchains they are building on, to the types of applications they are developing, and the technologies and locations they are using. We plan to update this data annually as a key component of our annual State of Crypto.

7 Key Takeaways

Cryptocurrency activity and usage have reached historic highs

Cryptocurrency has become a key political issue ahead of the U.S. elections

Stablecoins have found product-market fit

Infrastructure improvements have increased capacity and significantly reduced transaction costs

Decentralized finance (DeFi) remains popular and is growing

Cryptocurrency can address some of AI's most pressing challenges

More scalable infrastructure unlocks new on-chain applications

- Cryptocurrency activity and usage have reached historic highs ----------------

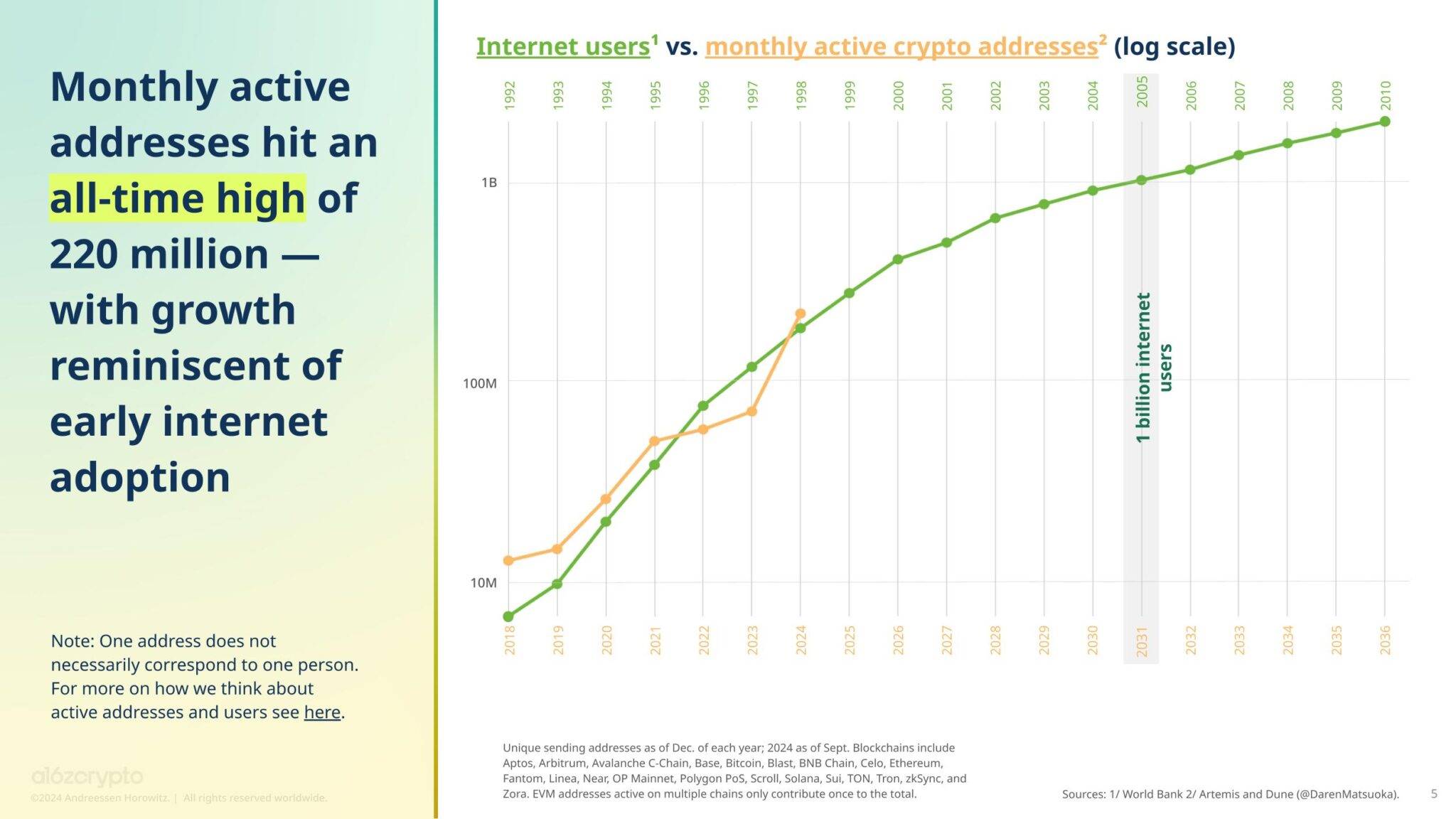

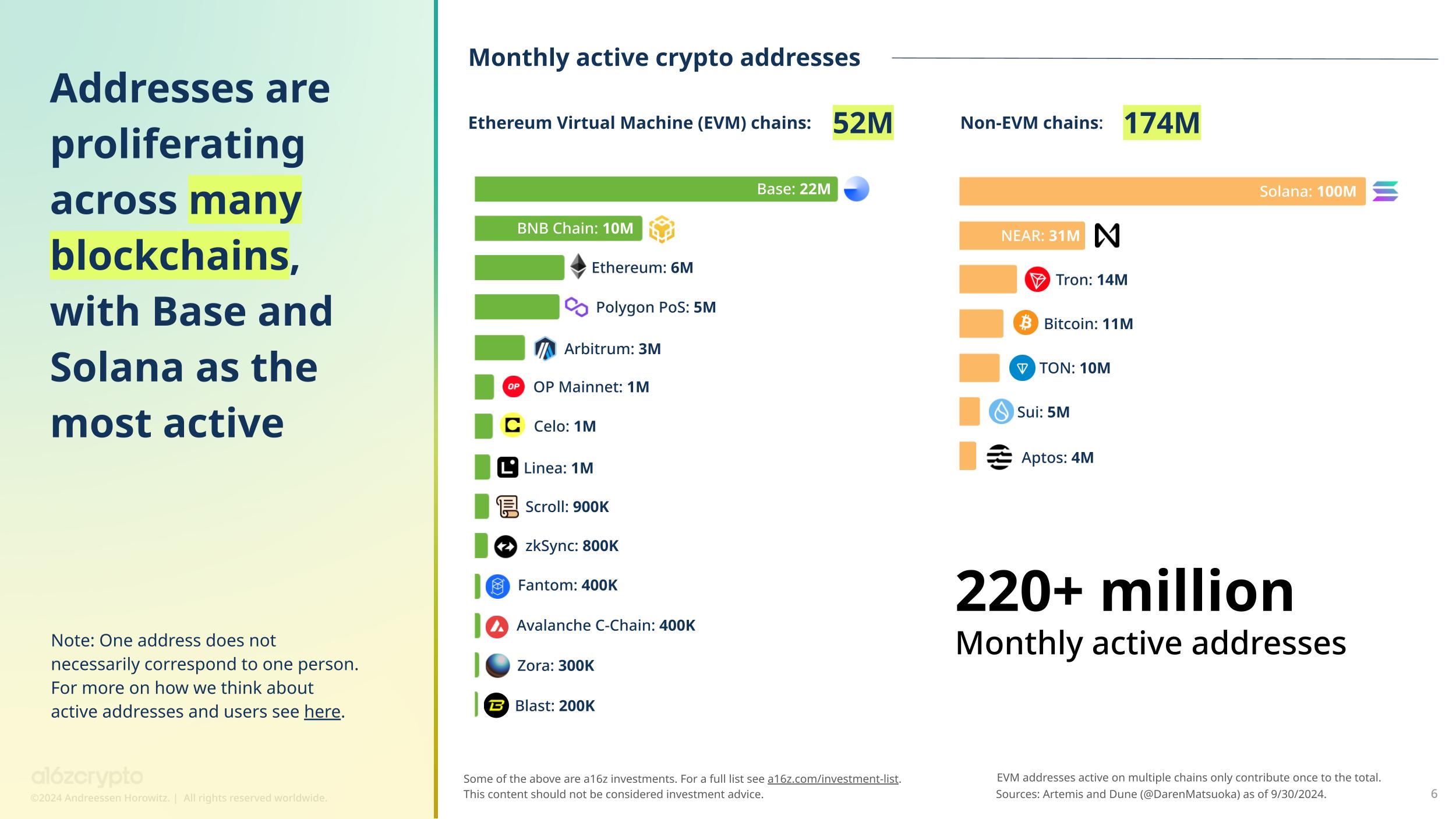

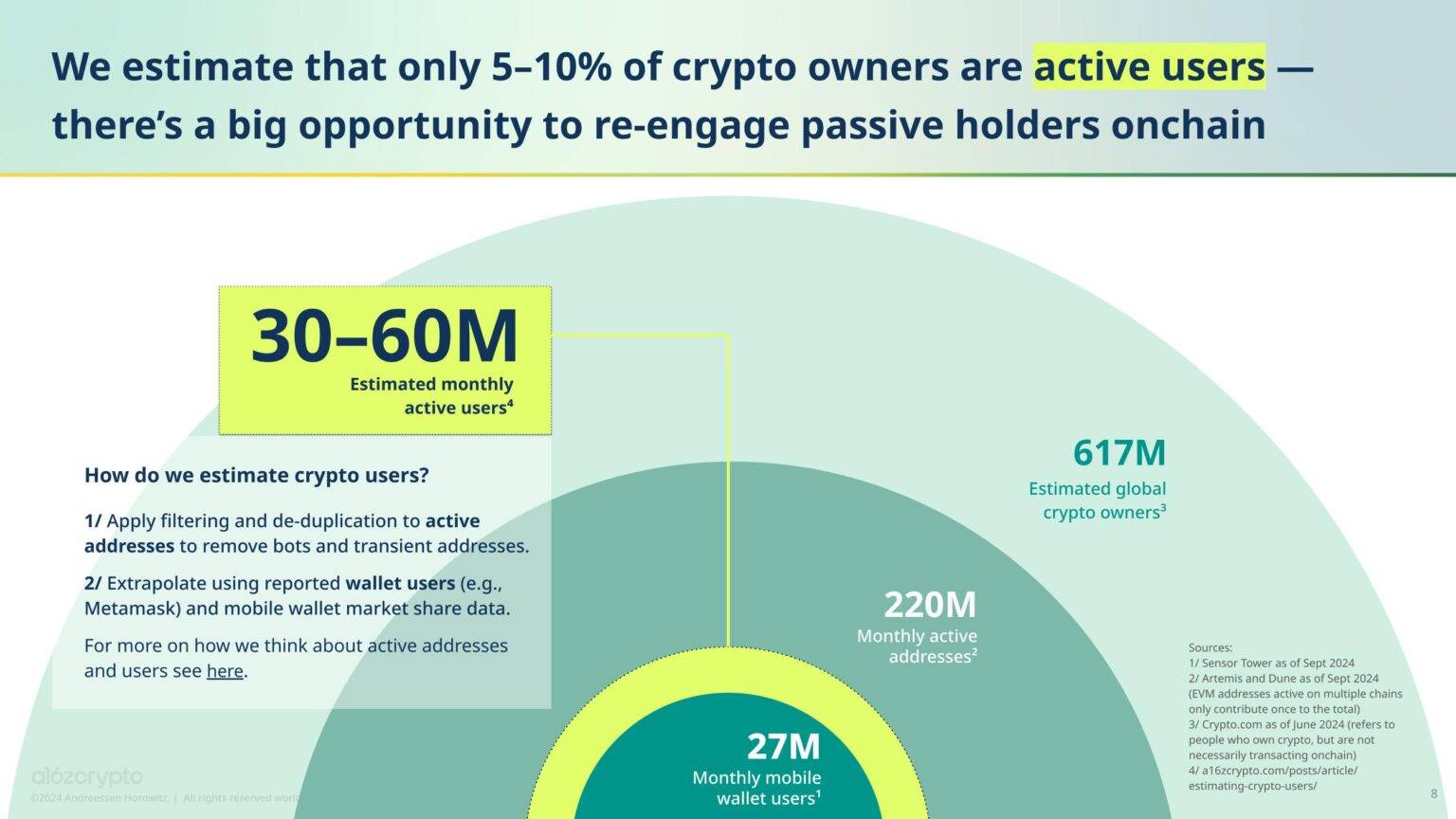

The number of active cryptocurrency addresses reached unprecedented levels in September, with 220 million addresses having interacted with the blockchain at least once, more than tripling since the end of 2023. (As a metric, active addresses are easier to manipulate than other measures. For more on this point, see here.)

This surge in activity is primarily attributed to Solana, which has about 100 million active addresses. Following Solana are NEAR (31 million active addresses), Coinbase's popular L2 network Base (22 million), Tron (14 million), and Bitcoin (11 million). Among Ethereum Virtual Machine (EVM) chains, the most active after Base is Binance's BNB chain (10 million), followed by Ethereum (6 million). (Note: EVM chains calculate the total of 220 million through public key deduplication.)

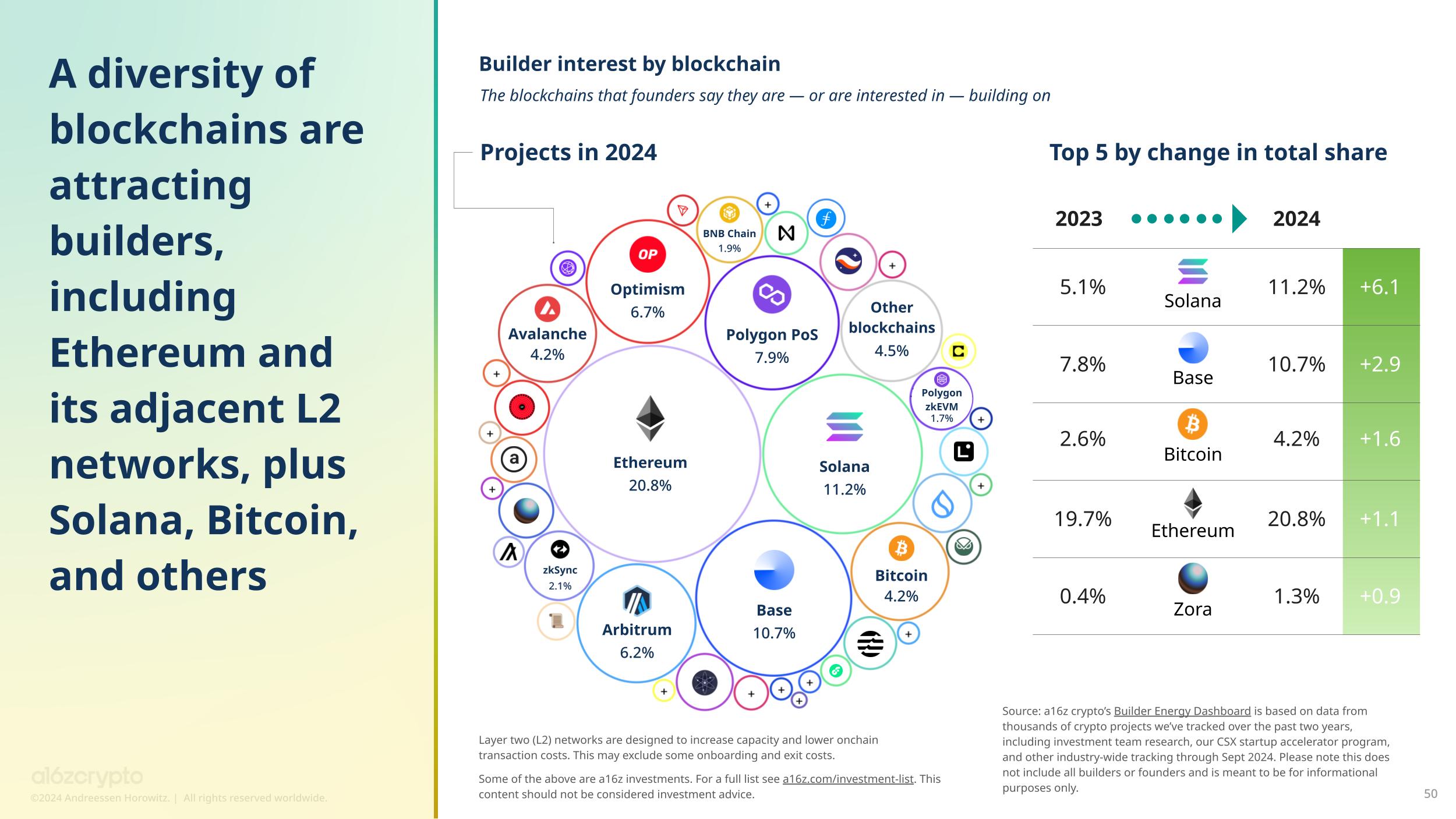

These trends are also reflected in our Builder Energy Dashboard. The largest growth in total builder interest is seen in Solana. Specifically, the total share of founders indicating they are building or interested in building on Solana increased from 5.1% last year to 11.2% this year. Base's total share grew from 7.8% last year to 10.7%, followed by Bitcoin, which increased from 2.6% last year to 4.2%.

In absolute numbers, Ethereum still attracts the most builder interest, accounting for 20.8%, followed by Solana and Base. Next are Polygon (7.9%), Optimism (6.7%), Arbitrum (6.2%), Avalanche (4.2%), and Bitcoin (4.2%).

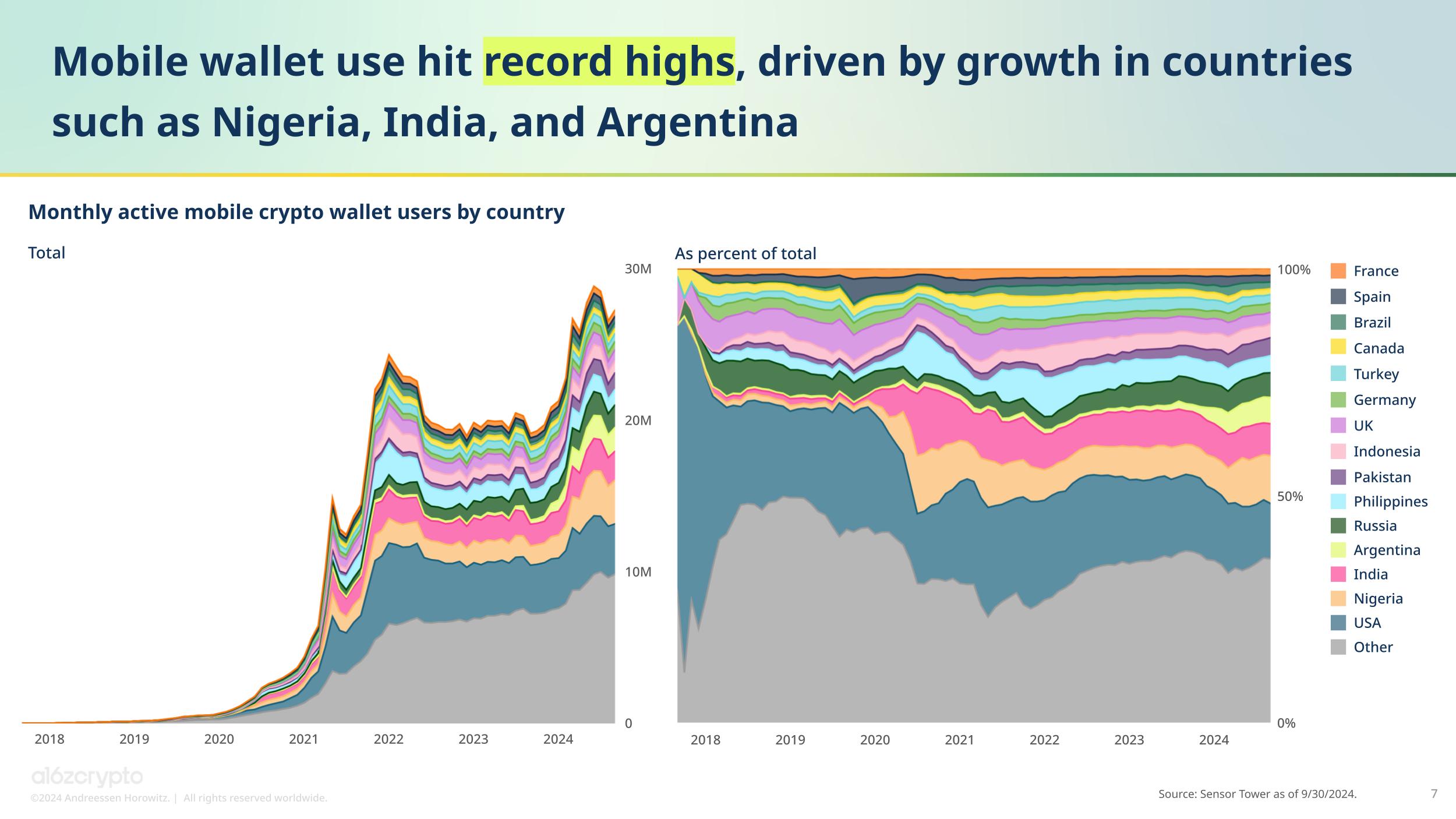

Meanwhile, in June 2024, the number of monthly active mobile wallet users reached a historic high of 29 million. The U.S. accounts for 12% of monthly mobile wallet users, making it the largest market, but its share has declined in recent years due to the growth of global cryptocurrency adoption and more projects seeking compliance by geo-fencing out the U.S.

The use and influence of cryptocurrency continue to expand globally. Outside the U.S., the countries with the most mobile wallet users include Nigeria, which has achieved significant growth in bill payments and retail purchases through a clearer regulatory environment provided by regulatory incubation projects. India has become another important market due to its large population and smartphone penetration, while in Argentina, many residents are turning to cryptocurrency, especially stablecoins, due to currency devaluation.

While active addresses and monthly mobile wallet user numbers are easy to track, accurately measuring the number of active cryptocurrency users is more complex. We estimate that there are approximately 30 million to 60 million monthly active cryptocurrency users globally, representing only 5-10% of the 617 million global cryptocurrency holders estimated by Crypto.com in June 2024. (For more information on the methods behind our estimates, see here.)

This gap highlights the significant potential for interaction with passive cryptocurrency holders. As major infrastructure improvements bring new, engaging applications and user experiences, more dormant cryptocurrency holders may become active.

- Cryptocurrency has become a key political issue ahead of the U.S. elections -------------------

In this election cycle, cryptocurrency has become a focal point of national discussion.

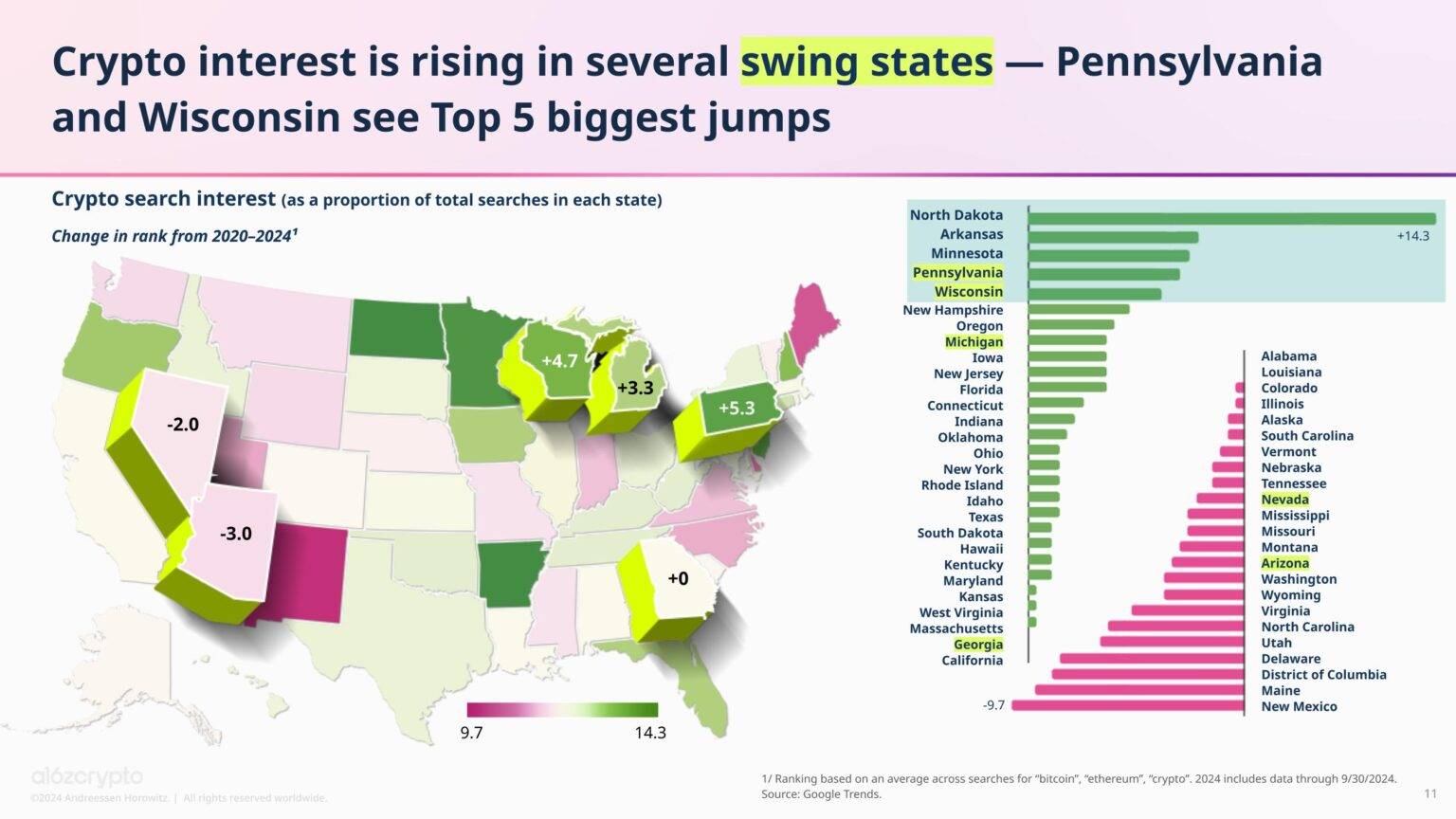

We measured the level of interest in cryptocurrency in swing states. In two key states—Pennsylvania and Wisconsin—expected to be highly competitive in November, cryptocurrency search interest ranks fourth and fifth, respectively, in terms of total search volume on Google Trends since the last election in 2020. Michigan's growth ranks eighth, while Georgia remains unchanged. Meanwhile, interest in Arizona and Nevada has slightly declined since 2020.

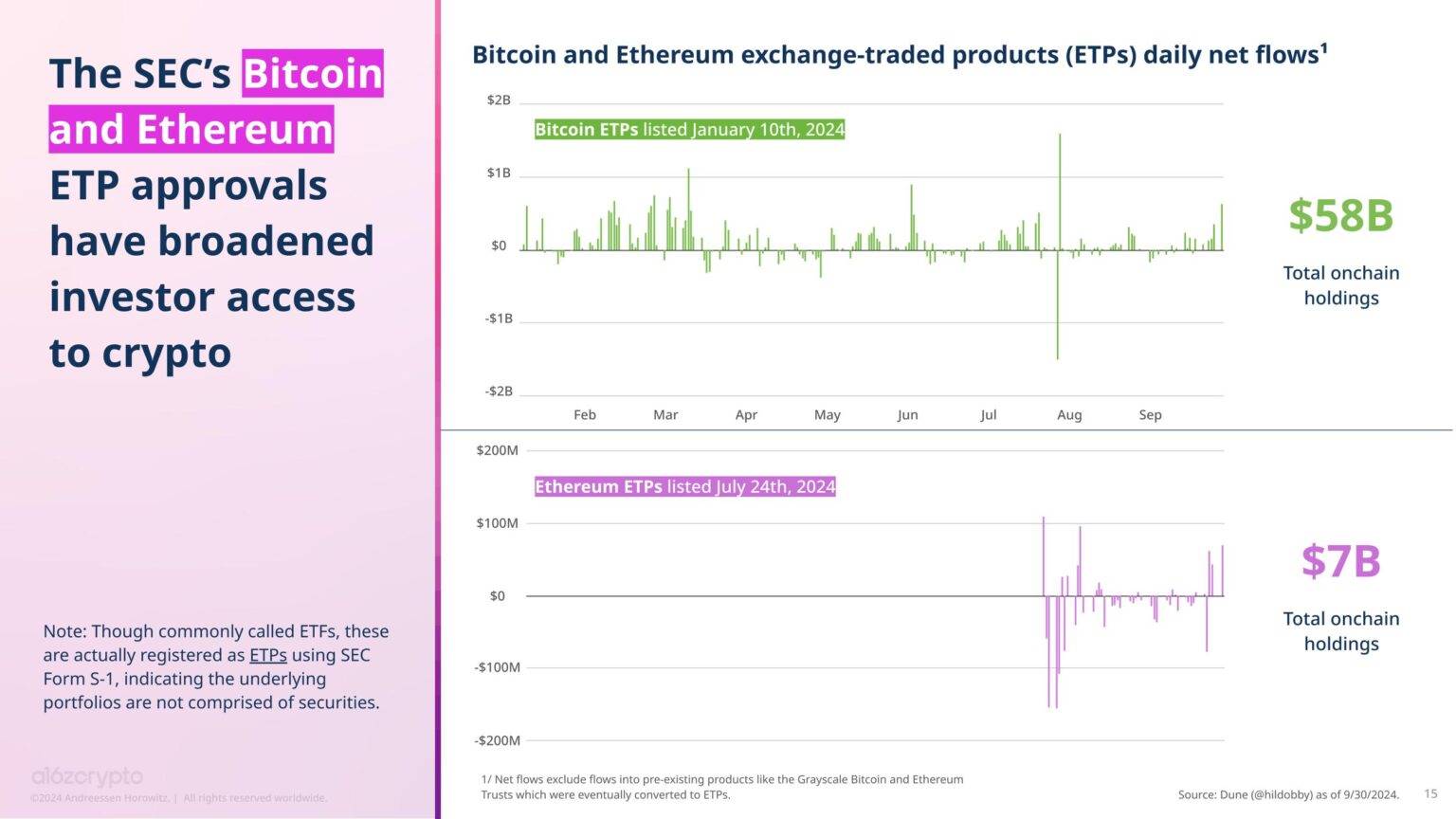

The listing of Bitcoin and Ethereum exchange-traded products (ETPs) may have boosted interest in cryptocurrency this year. These ETPs have expanded investor participation and may increase the number of Americans holding cryptocurrency. Currently, Bitcoin and Ethereum ETPs have $65 billion in on-chain assets. (Note: Although commonly referred to as ETFs, these products are actually registered as ETPs using SEC Form S-1 indicating that the underlying portfolio does not contain securities.)

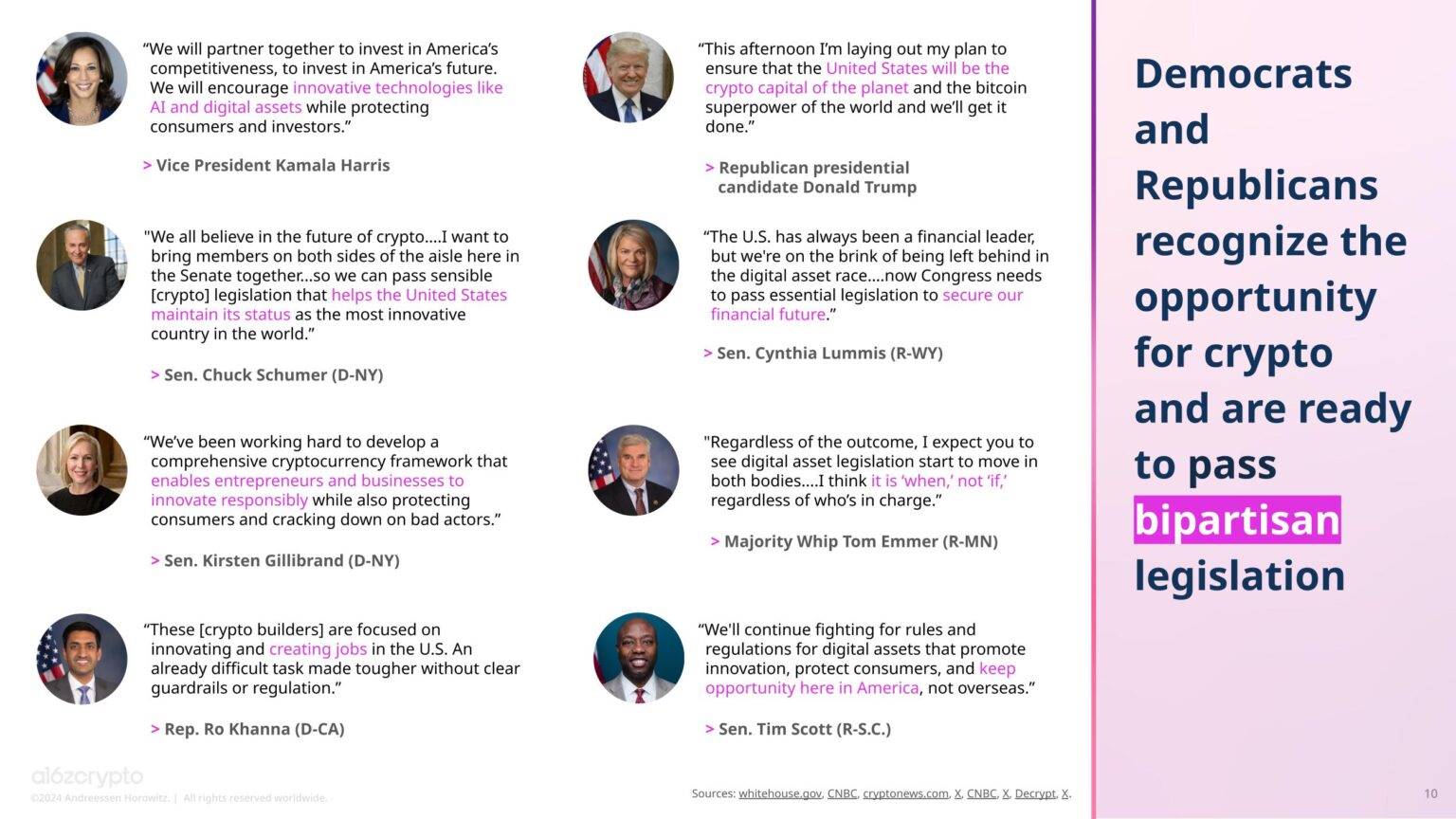

The SEC's approval of ETPs marks an important milestone in cryptocurrency policy. Regardless of which party wins the elections in November, many politicians expect bipartisan cooperation on cryptocurrency legislation to make progress. An increasing number of policymakers and politicians from both parties are taking a positive stance on cryptocurrency.

This year, the cryptocurrency industry has also sparked other significant movements in policy. At the federal level, the House passed the 21st Century Financial Innovation and Technology (FIT21) Act with bipartisan support, with 208 Republicans and 71 Democrats voting in favor. If approved by the Senate, this bill could provide much-needed regulatory clarity for cryptocurrency entrepreneurs.

At the state level, Wyoming passed the Decentralized Non-Profit Corporation (DUNA) Act, which grants legal status to decentralized autonomous organizations (DAOs), allowing blockchain networks to operate legally while maintaining decentralization.

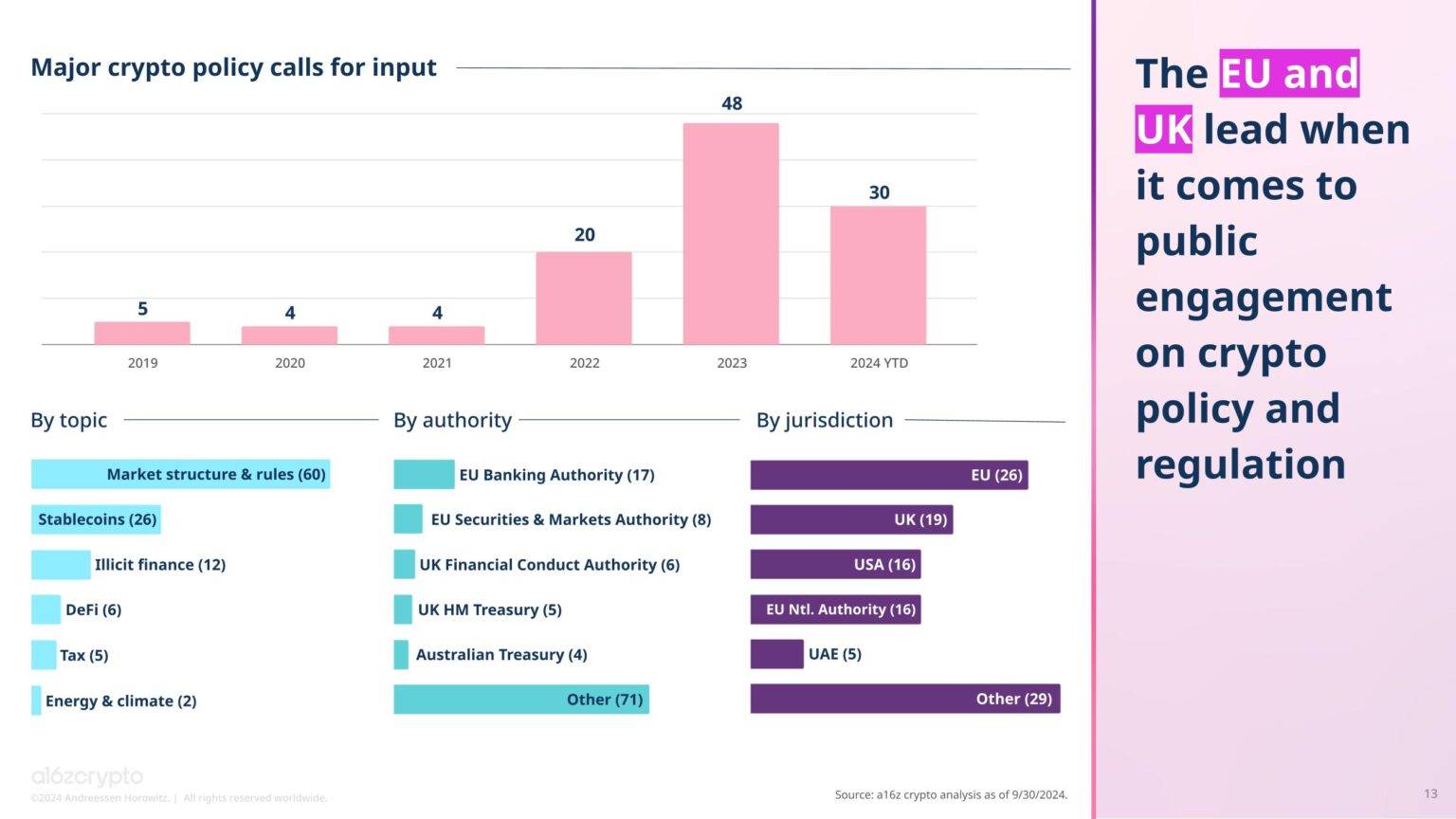

The EU and the UK have been the most proactive in engaging the public on cryptocurrency policy and regulatory issues. Compared to the U.S. Securities and Exchange Commission, various European institutions have issued more calls for public input. Meanwhile, the EU's Markets in Crypto-Assets (MiCA) Regulation is the first comprehensive cryptocurrency-related policy to pass legislation, expected to come into full effect by the end of the year.

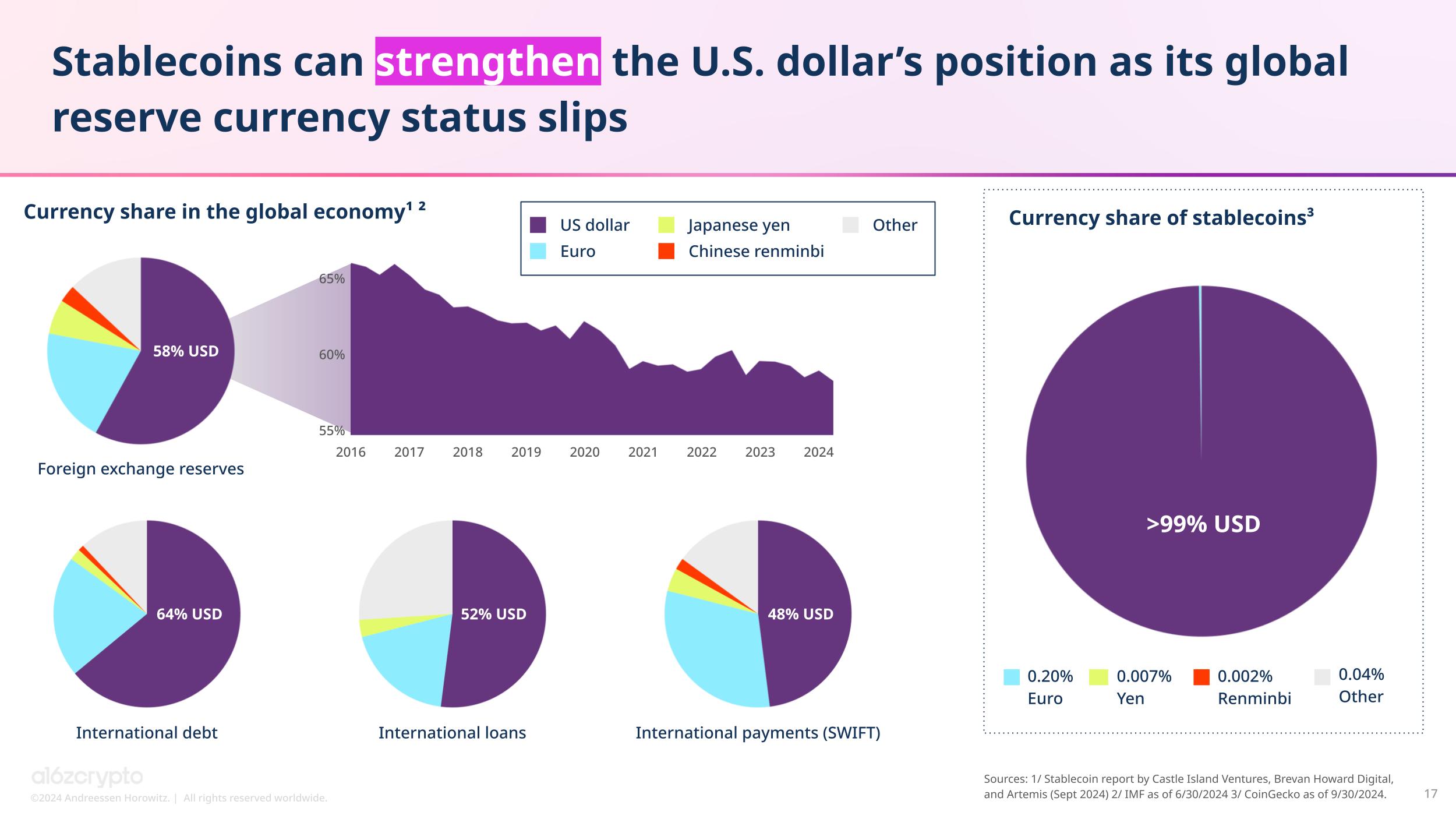

Stablecoins have become one of the most popular cryptocurrency products and a hot topic in policy discussions. Several bills are currently under discussion in Congress. In the U.S., one of the factors driving this trend is that stablecoins can reinforce the international status of the dollar, even as the dollar's position as the global reserve currency has declined. Currently, over 99% of stablecoins are dollar-denominated, far exceeding the second-largest currency, the euro, which accounts for only 0.20%.

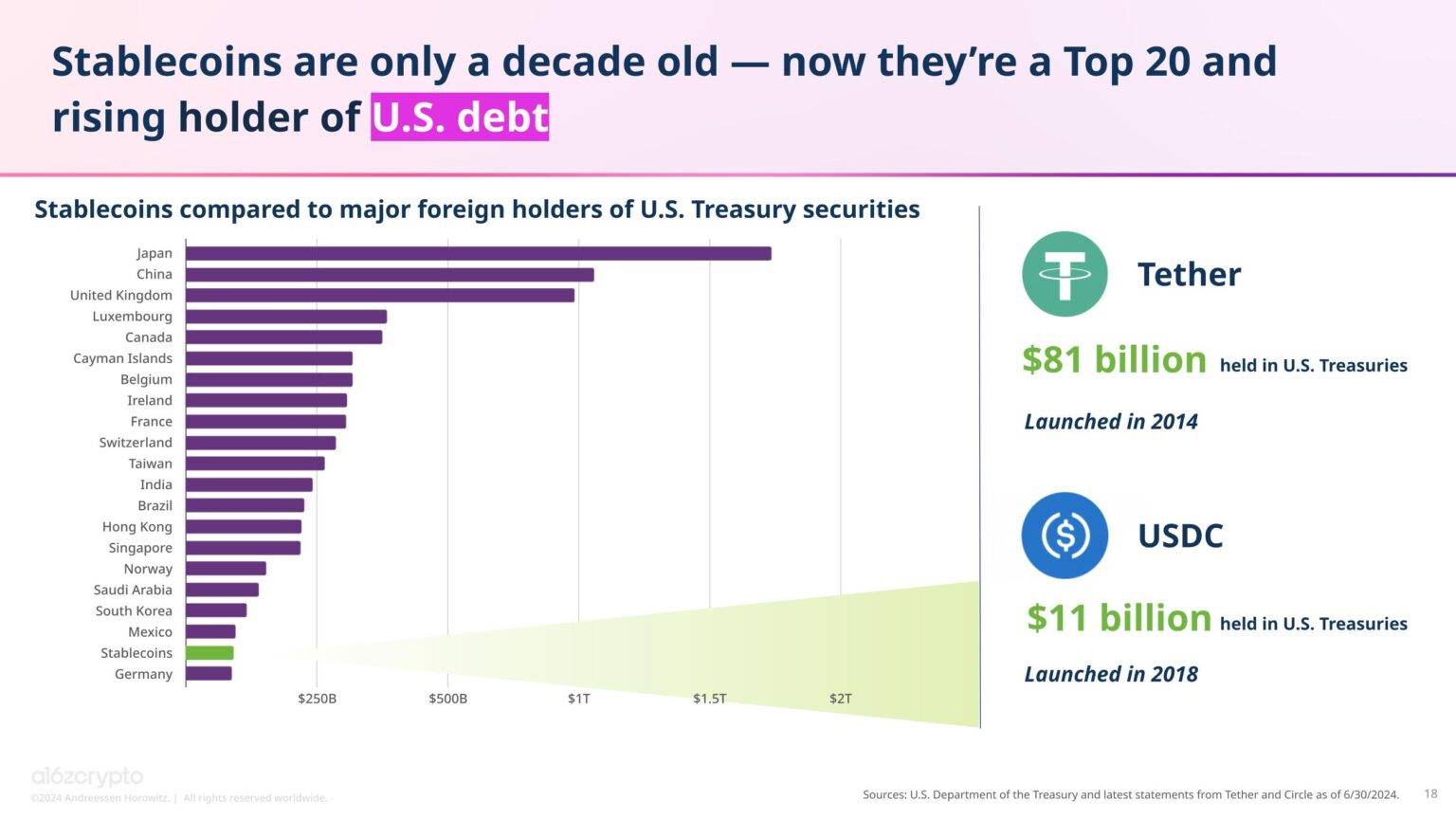

In addition to showcasing the strength of the dollar globally, stablecoins may also enhance the country's financial foundation domestically. Despite being only a decade old, stablecoins have become one of the top 20 holders of U.S. debt, surpassing countries like Germany.

While some countries are exploring central bank digital currencies (CBDCs), the opportunity for stablecoins in the U.S. has matured. Given the discussions and the increasing number of prominent politicians weighing in on cryptocurrency issues, we expect more countries to begin seriously refining their cryptocurrency policies and strategies.

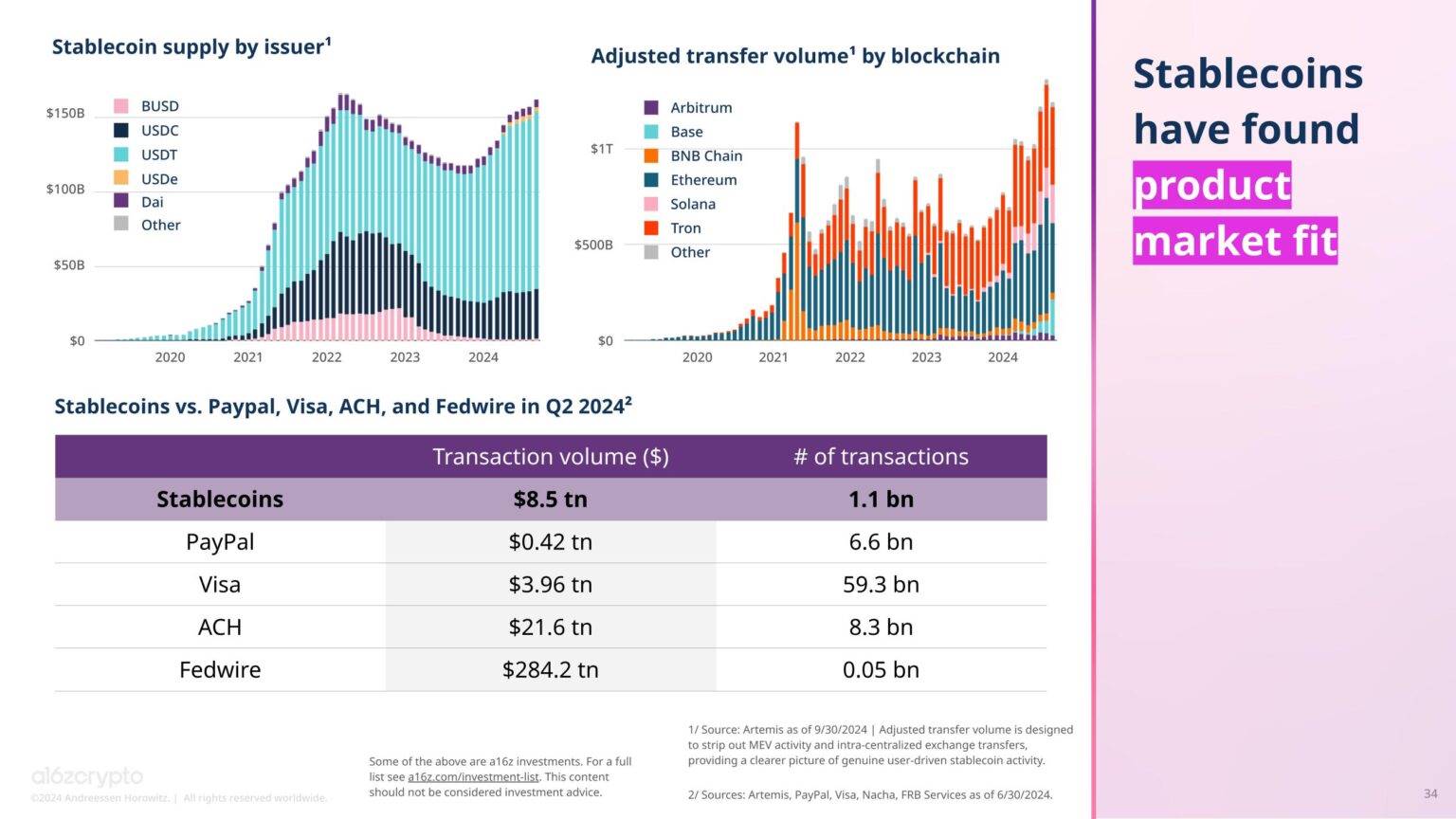

- Stablecoins have found product-market fit ---------------

Stablecoins have become one of the most significant "killer applications" in the cryptocurrency space by enabling fast, inexpensive global payments. As New York Congressman Ritchie Torres stated in a September op-ed for the New York Daily News, the proliferation of dollar stablecoins could represent the largest experiment in financial empowerment for humanity, thanks to the ubiquity of smartphones and blockchain encryption technology.

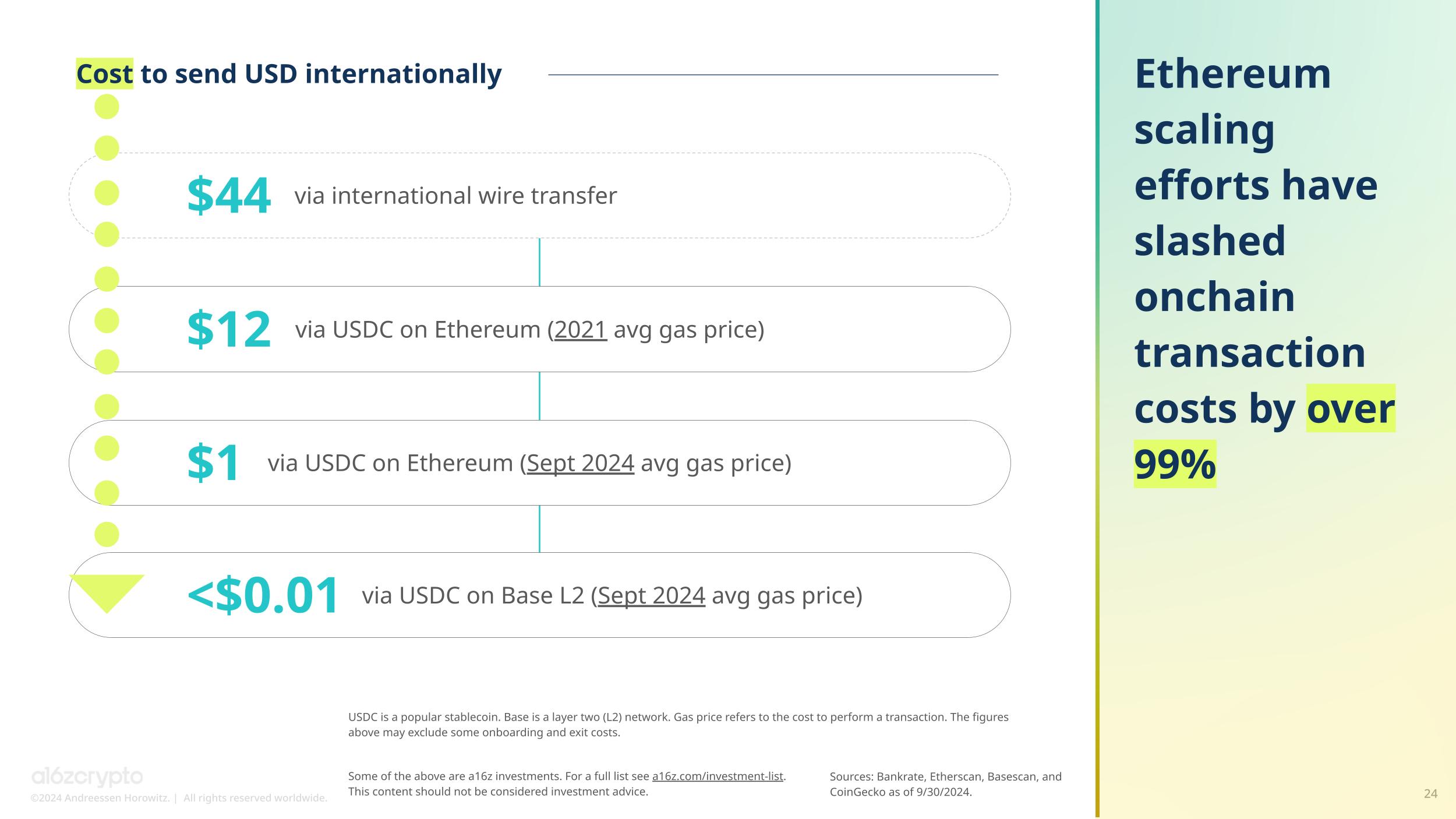

Major scaling upgrades have significantly reduced the costs of cryptocurrency transactions, especially for stablecoin transactions, with reductions exceeding 99% in certain cases. For example, on Ethereum, the average gas fee for USDC (a popular dollar-pegged stablecoin) transactions this month was $1, down from $12 in 2021. On Coinbase's L2 network Base, the average cost of sending USDC is less than one cent.

In contrast, the average cost of sending an international wire transfer is $44.

Stablecoins simplify the process of value transfer. In the second quarter of 2024 (ending June 30), their transaction volume reached $8.5 trillion, involving 1 billion transactions. The transaction volume of stablecoins is more than double that of Visa's $3.9 trillion during the same period. Stablecoins are on par with well-known payment services like Visa, PayPal, ACH, and Fedwire, demonstrating their utility.

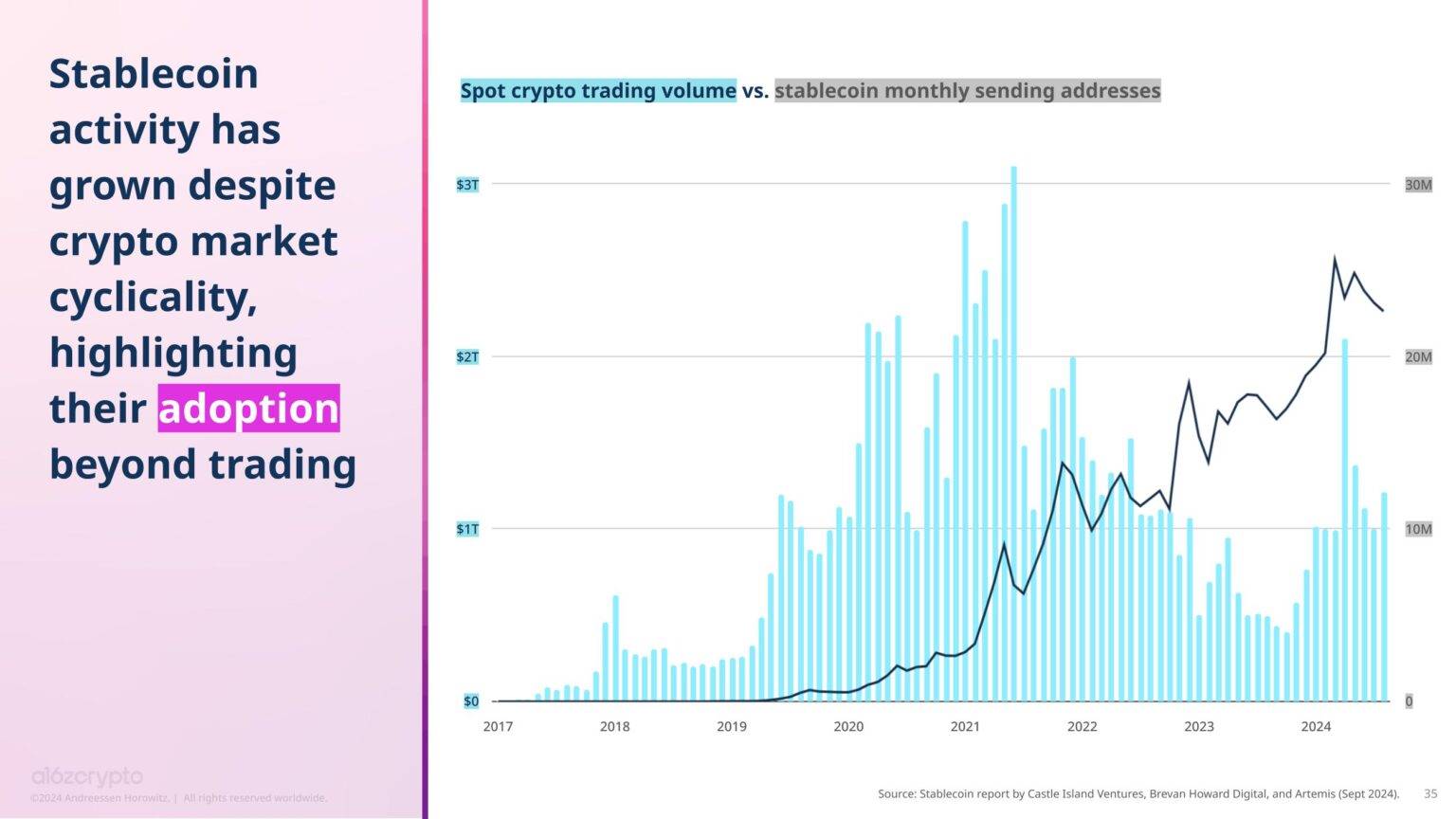

Stablecoins are not just a passing trend. A comparison of stablecoin activity with the volatile market cycles of cryptocurrency reveals that the two seem to have no correlation. In fact, even as spot cryptocurrency trading volumes decline, the number of addresses sending stablecoins each month continues to increase. In other words, people seem to be using stablecoins for more than just trading.

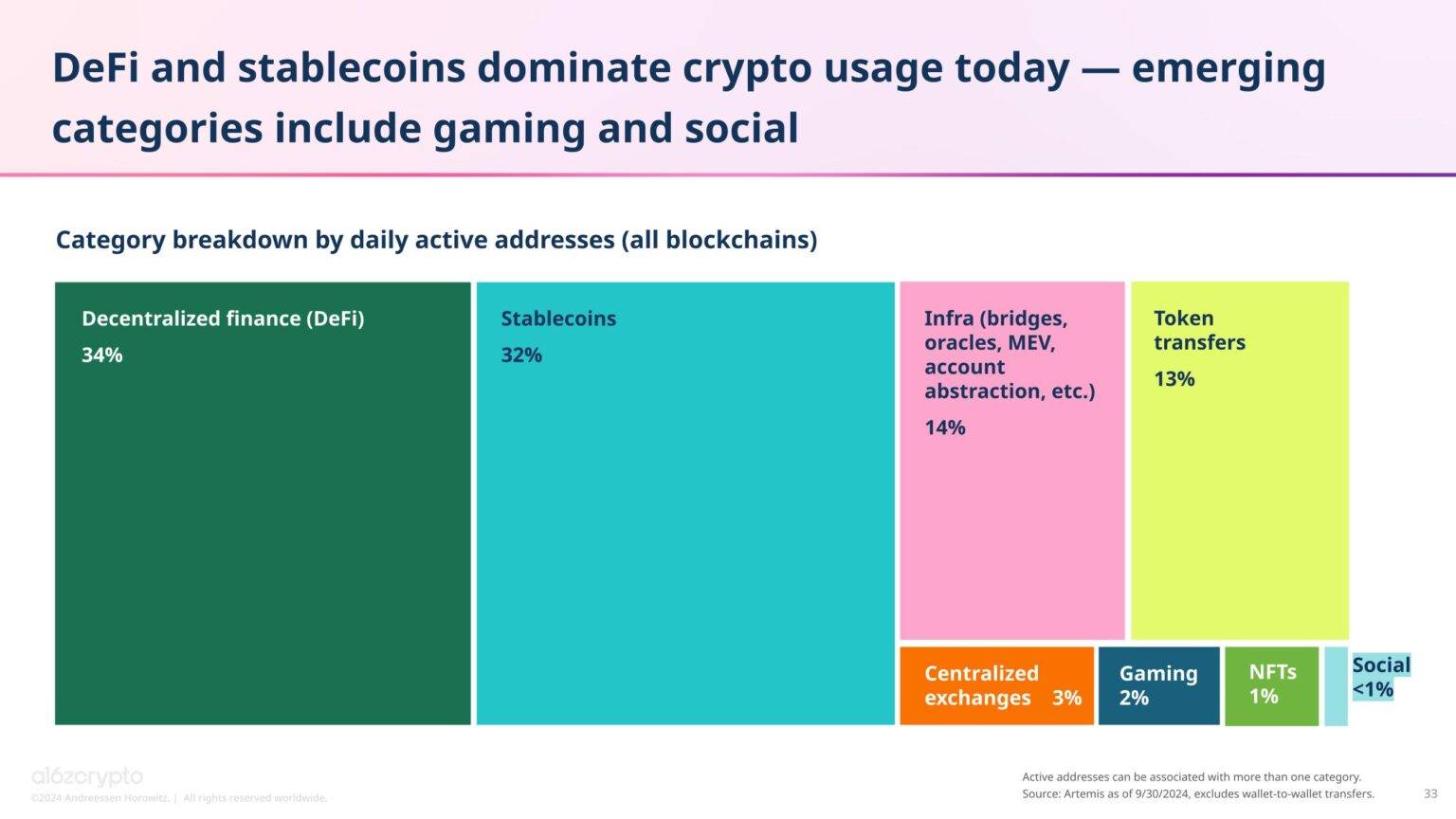

The results of these activities are reflected in usage statistics. Stablecoins account for nearly one-third of daily cryptocurrency usage, reaching 32%, second only to decentralized finance (DeFi) at 34%, as measured by the share of daily active addresses. The remaining cryptocurrency usage is distributed across infrastructure (such as bridges, oracles, maximum extractable value, account abstraction, etc.), token transfers, and some other areas, including emerging applications like gaming, NFTs, and social networks.

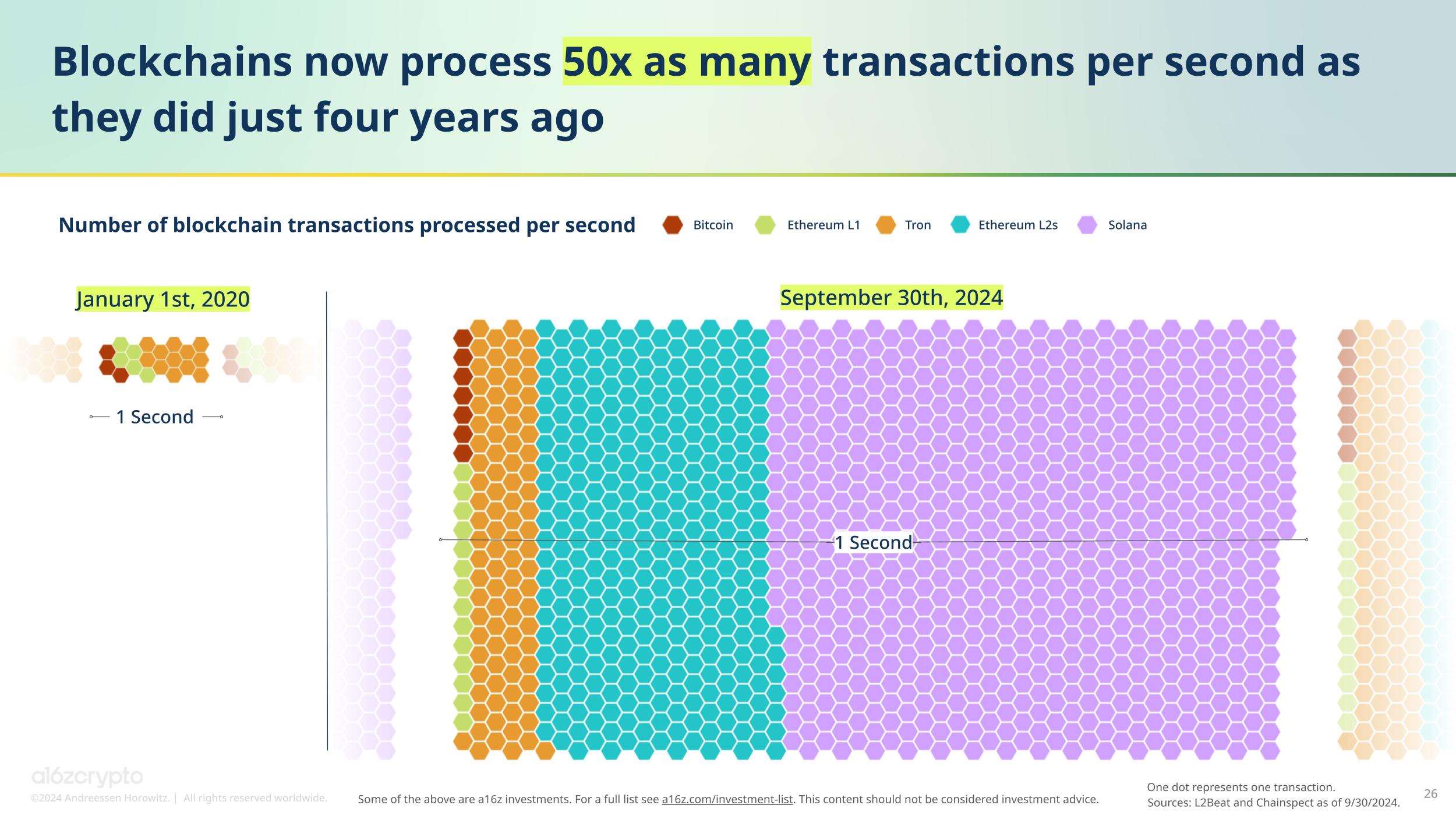

- Infrastructure improvements have not only increased capacity but also significantly reduced transaction costs -------------------------

One reason stablecoins have become so popular and easy to use is the advancement of infrastructure. First, the capacity of blockchains is growing. With the rise of Ethereum L2 networks and other high-throughput blockchains, the number of transactions processed by blockchains per second is more than 50 times what it was four years ago.

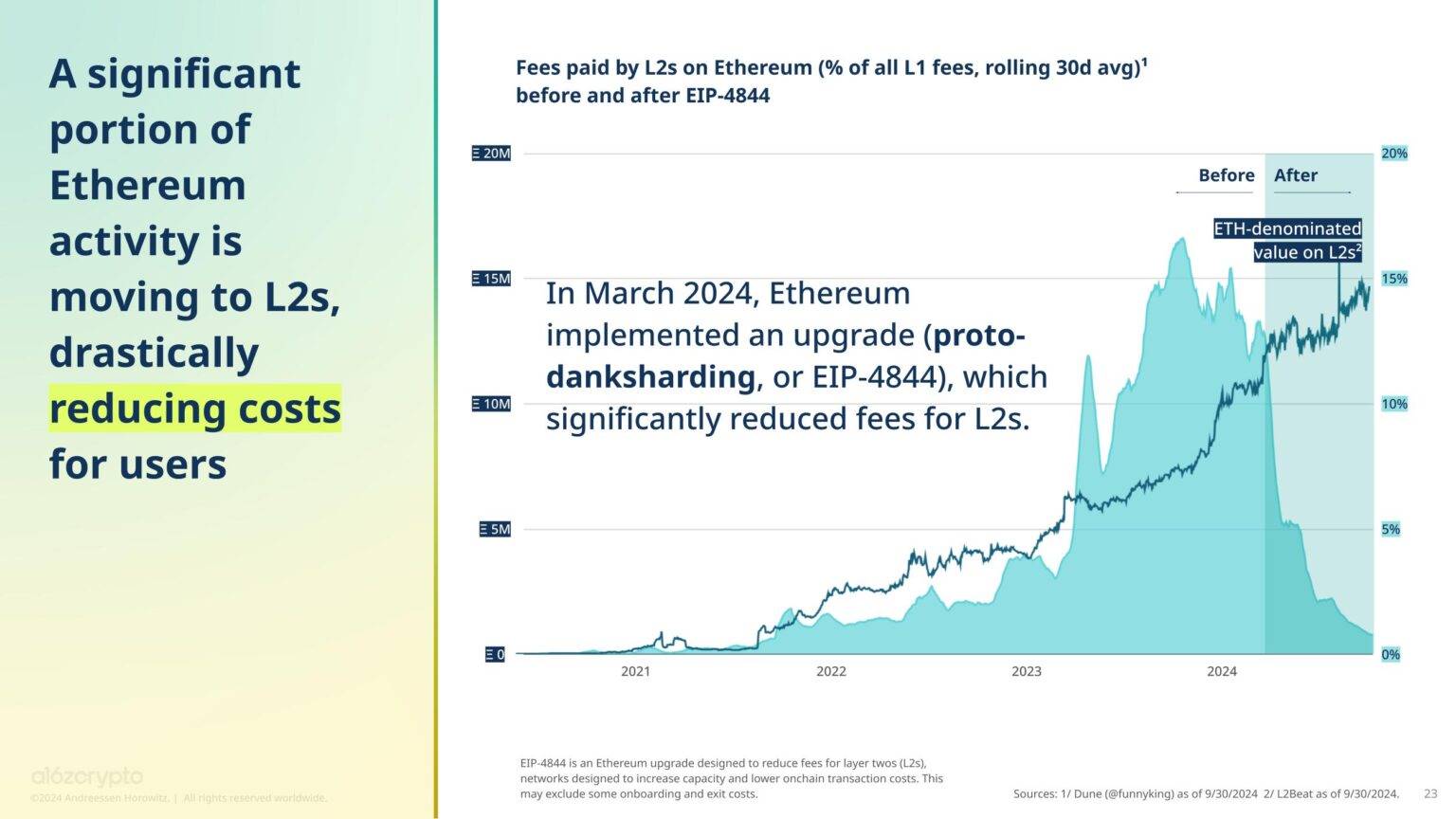

Ethereum's most notable upgrade this year, "Dencun," also known as "protodanksharding" or EIP-4844, implemented in March 2024, significantly reduced fees on L2 networks. Since then, even as the value priced in ETH on L2 continues to rise, the fees paid on Ethereum for L2 have significantly decreased. This means that blockchain networks have not only become more popular but also more efficient.

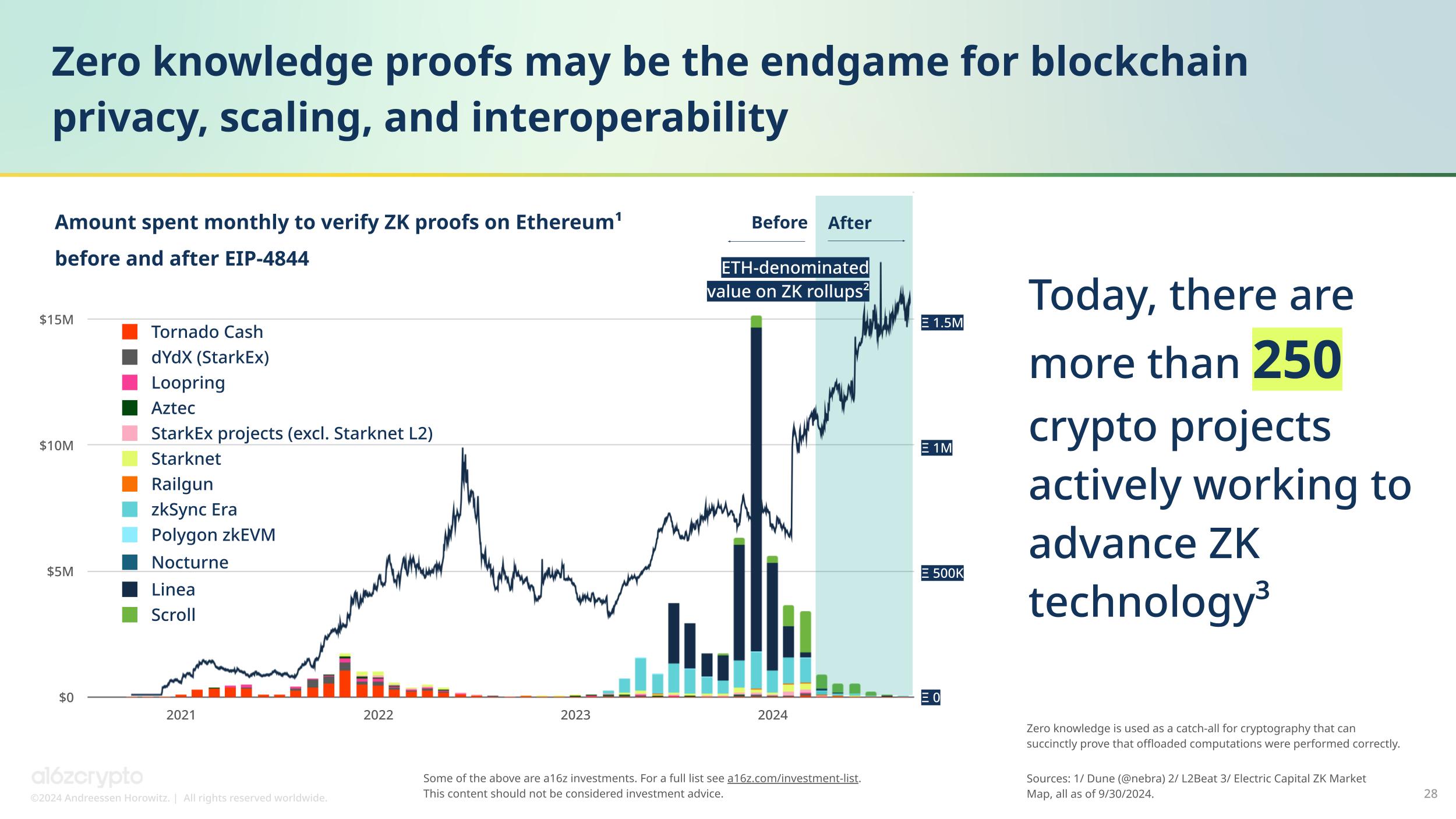

Zero-knowledge (ZK) proofs also show a similar trend, as this technology has significant implications for blockchain scalability, privacy, and interoperability. Although the monthly costs for verifying ZK proofs on Ethereum have decreased, the value on ZK rollups priced in ETH has been increasing. In other words, the cost of ZK proofs is decreasing while their popularity is rising. (Here, we use zero-knowledge as a general term for cryptographic technology that can succinctly prove that computations offloaded to rollup networks are executed correctly.)

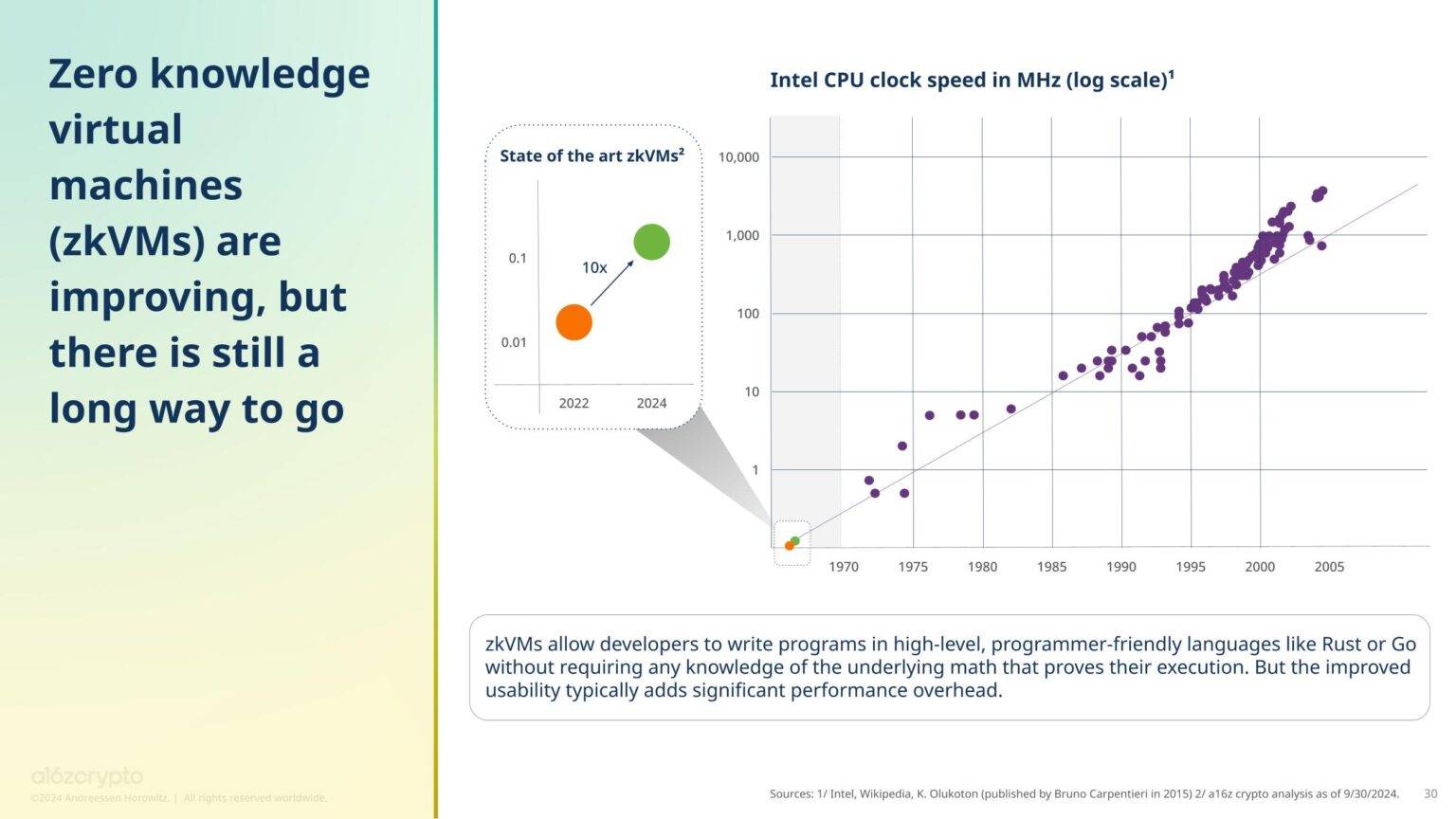

ZK technology holds great potential, providing developers with new avenues for inexpensive, verifiable blockchain computation. However, ZK-based virtual machines (zkVMs) still have a long way to go to catch up with the performance of traditional computers, a humbling observation.

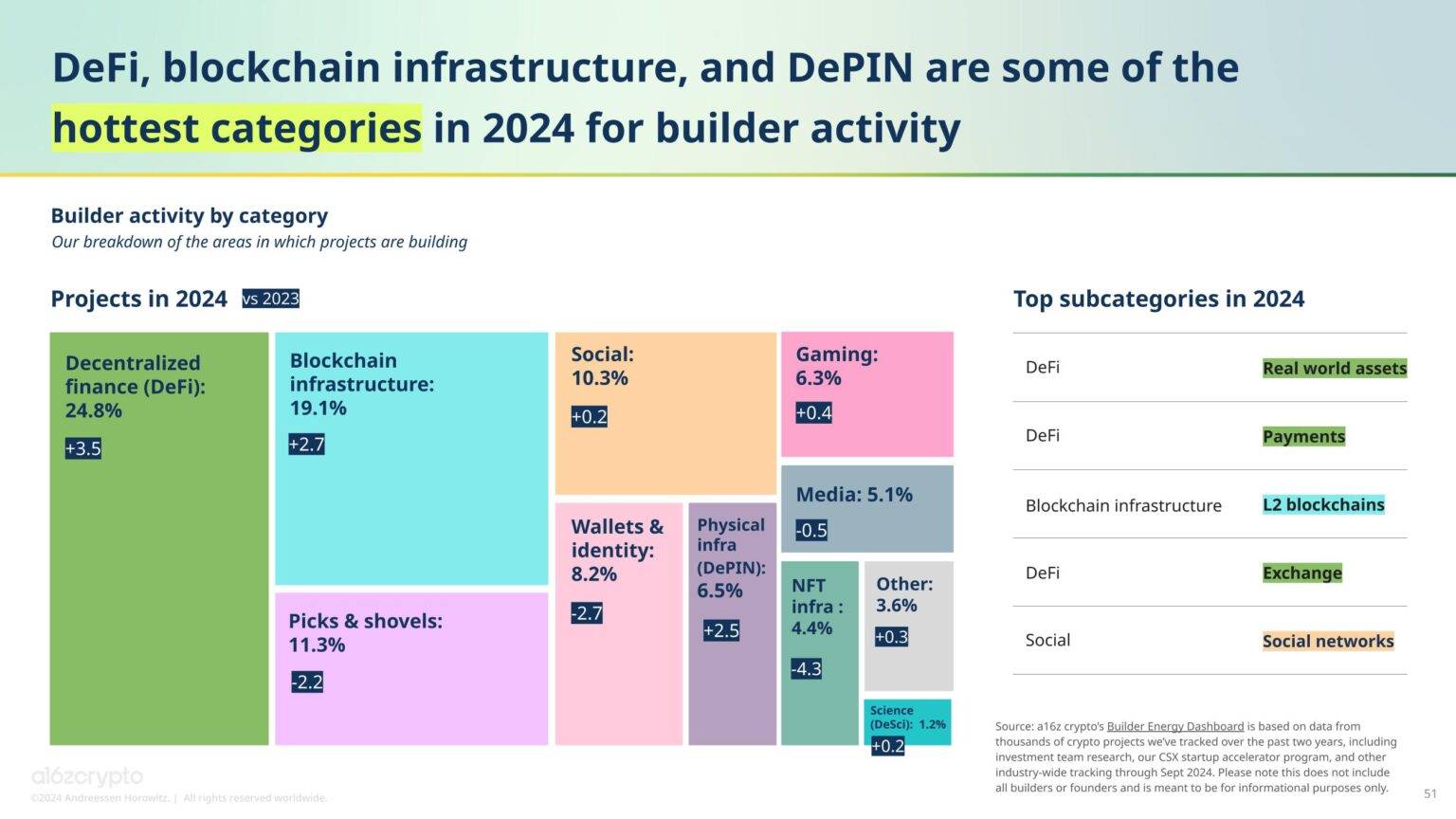

With improvements in infrastructure, blockchain infrastructure has become one of the most popular categories for developers, and L2 has emerged as one of the top 5 hot subcategories we are tracking.

- The popularity of DeFi continues to grow ---------------

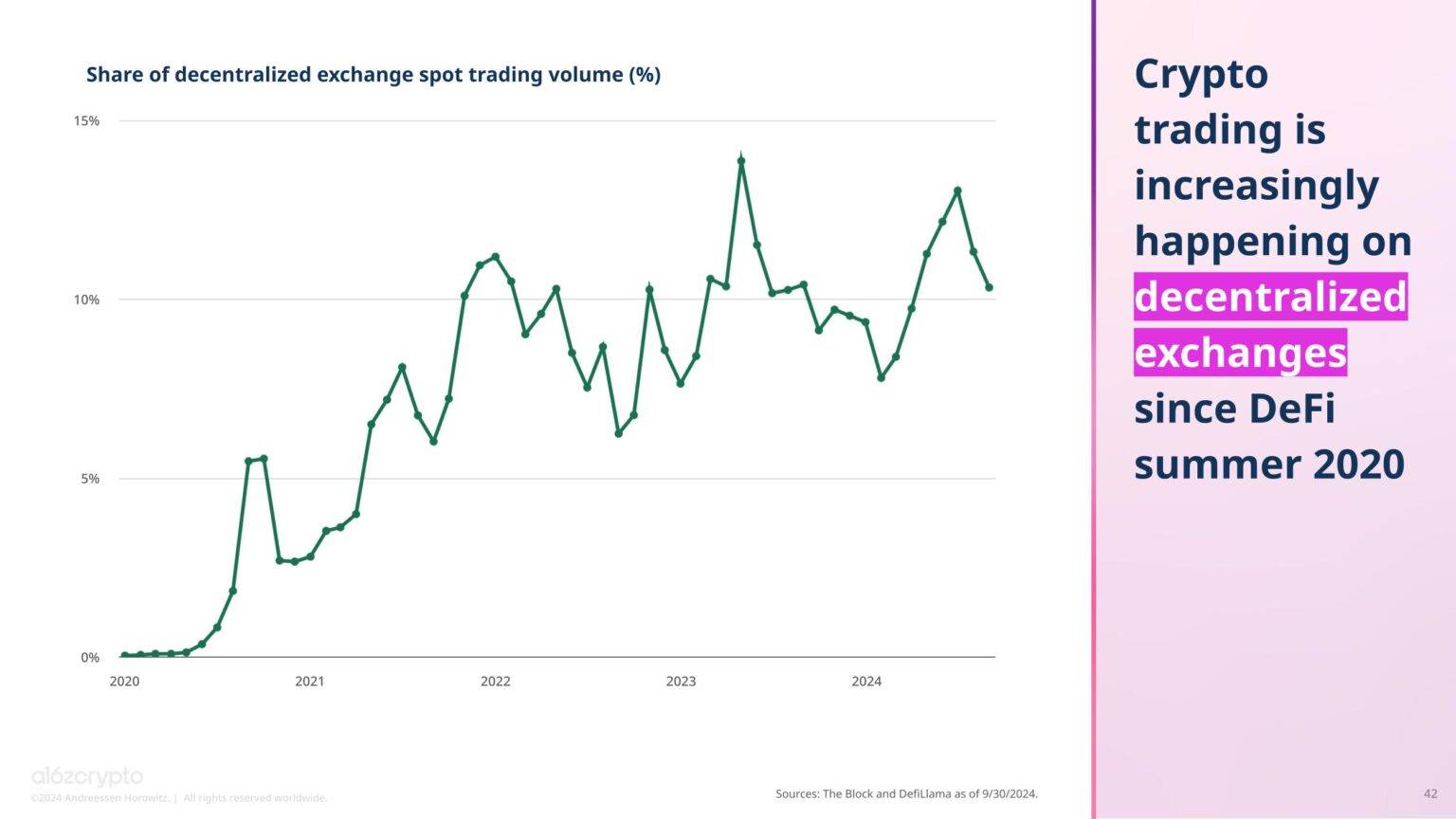

The only category attracting more developers than blockchain infrastructure is decentralized finance (DeFi), which also accounts for the largest share of cryptocurrency usage, representing 34% of daily active addresses. Since the emergence of DeFi in the summer of 2020, decentralized exchanges (DEXs) have captured 10% of spot cryptocurrency trading activity, whereas all such activities occurred on centralized exchanges four years ago.

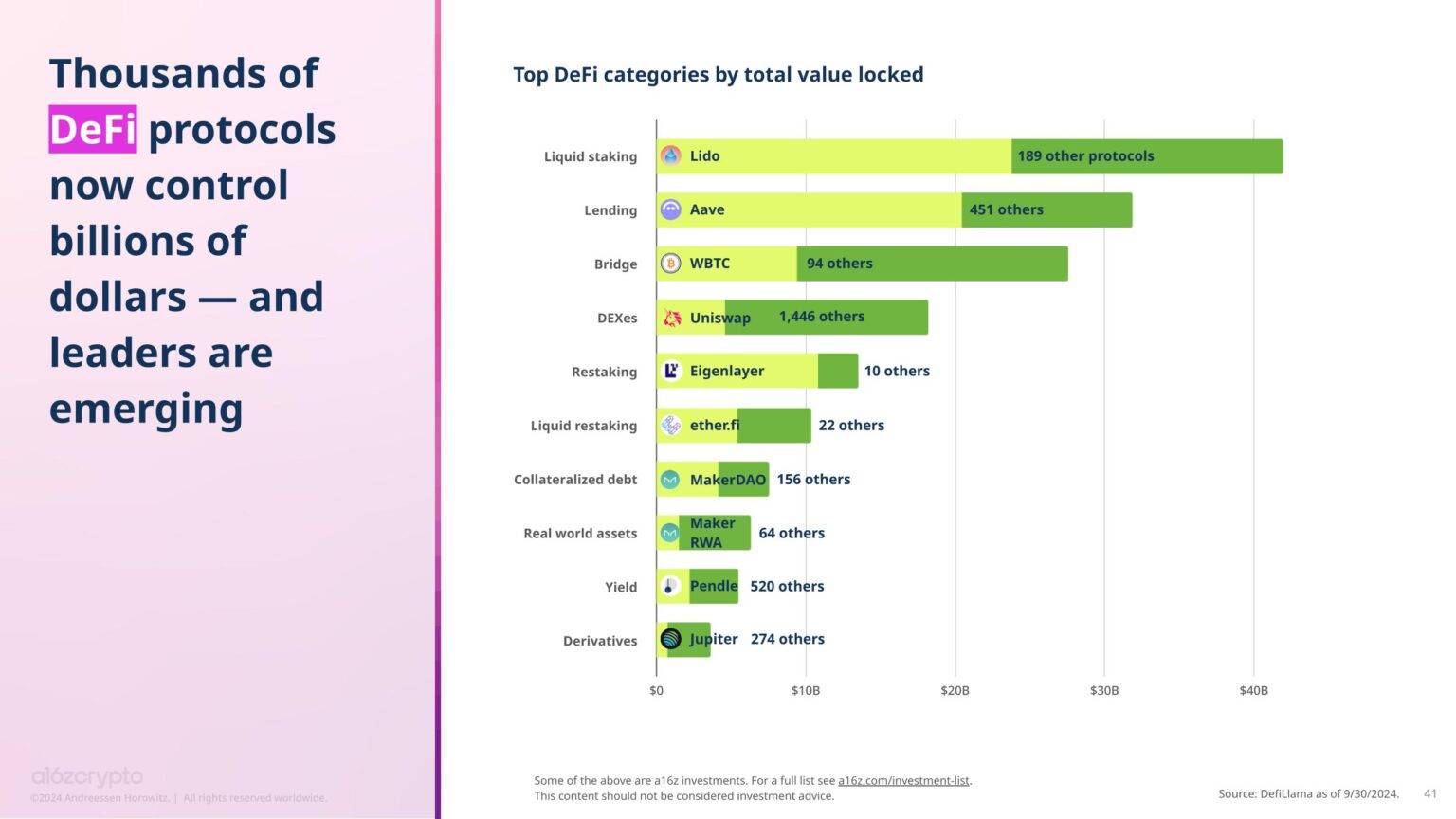

Currently, over $169 billion is locked in thousands of DeFi protocols, with some major DeFi subcategories including staking and lending.

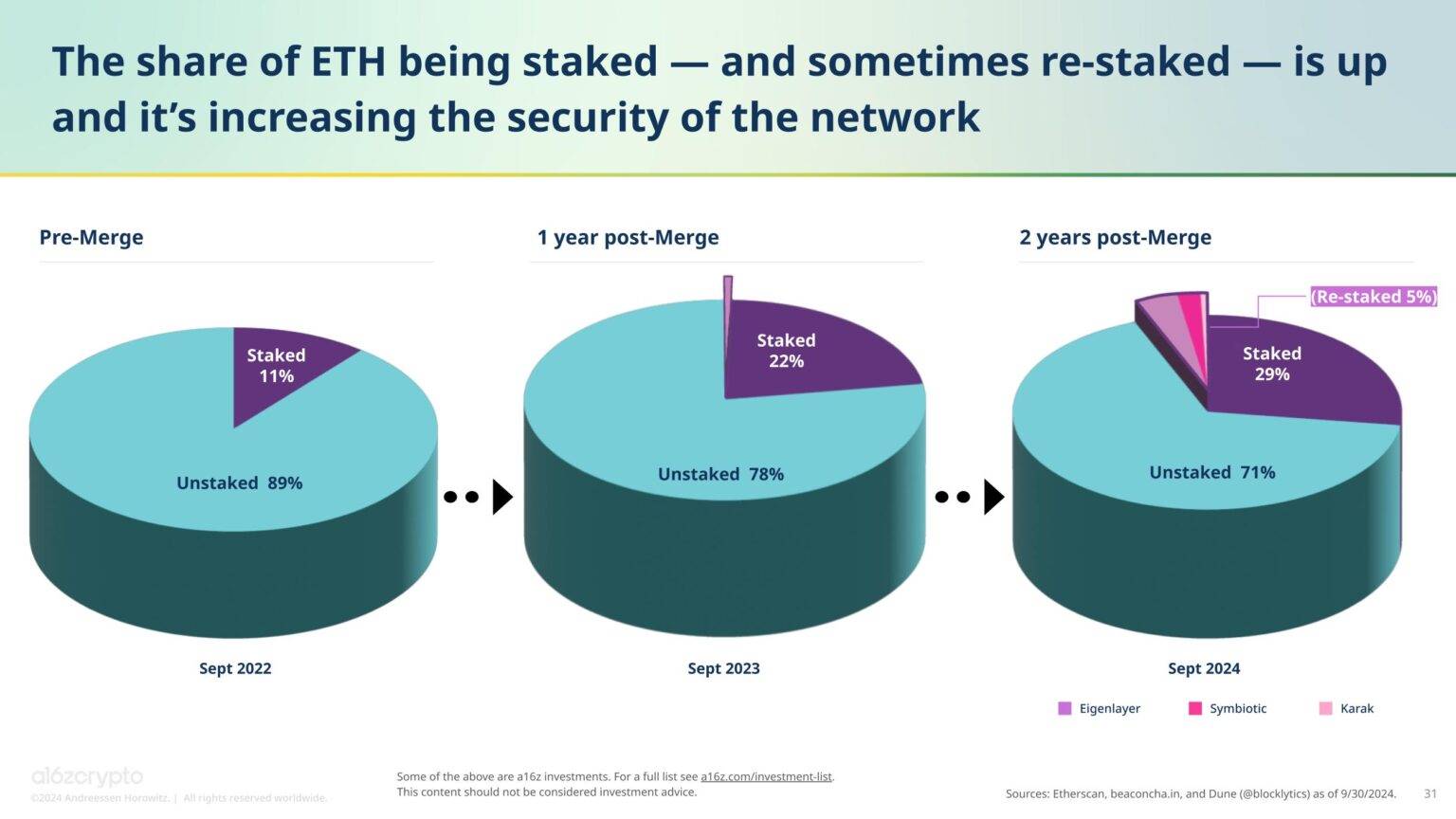

Since Ethereum completed its transition to proof of stake just over two years ago, the network's energy consumption and environmental footprint have significantly decreased. Since then, the share of staked Ethereum has risen from 11% two years ago to 29%, greatly enhancing the network's security.

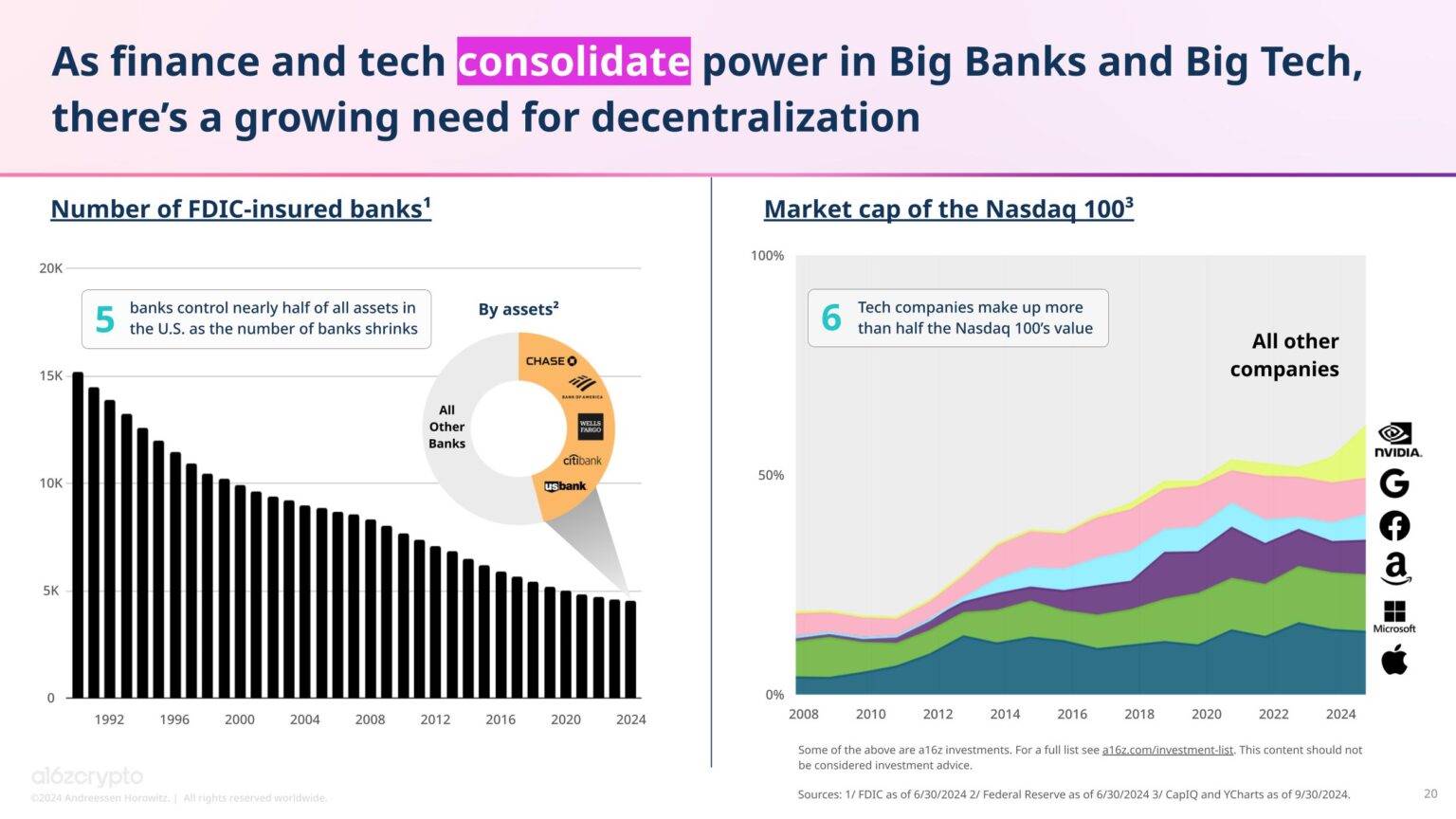

Although still in its early stages, DeFi offers a hopeful alternative to address the trends of centralization and power concentration in the U.S. financial system, where the number of banks has decreased by two-thirds since 1990, with fewer and fewer large banks dominating assets.

- Cryptocurrency can address some of AI's most pressing challenges --------------------

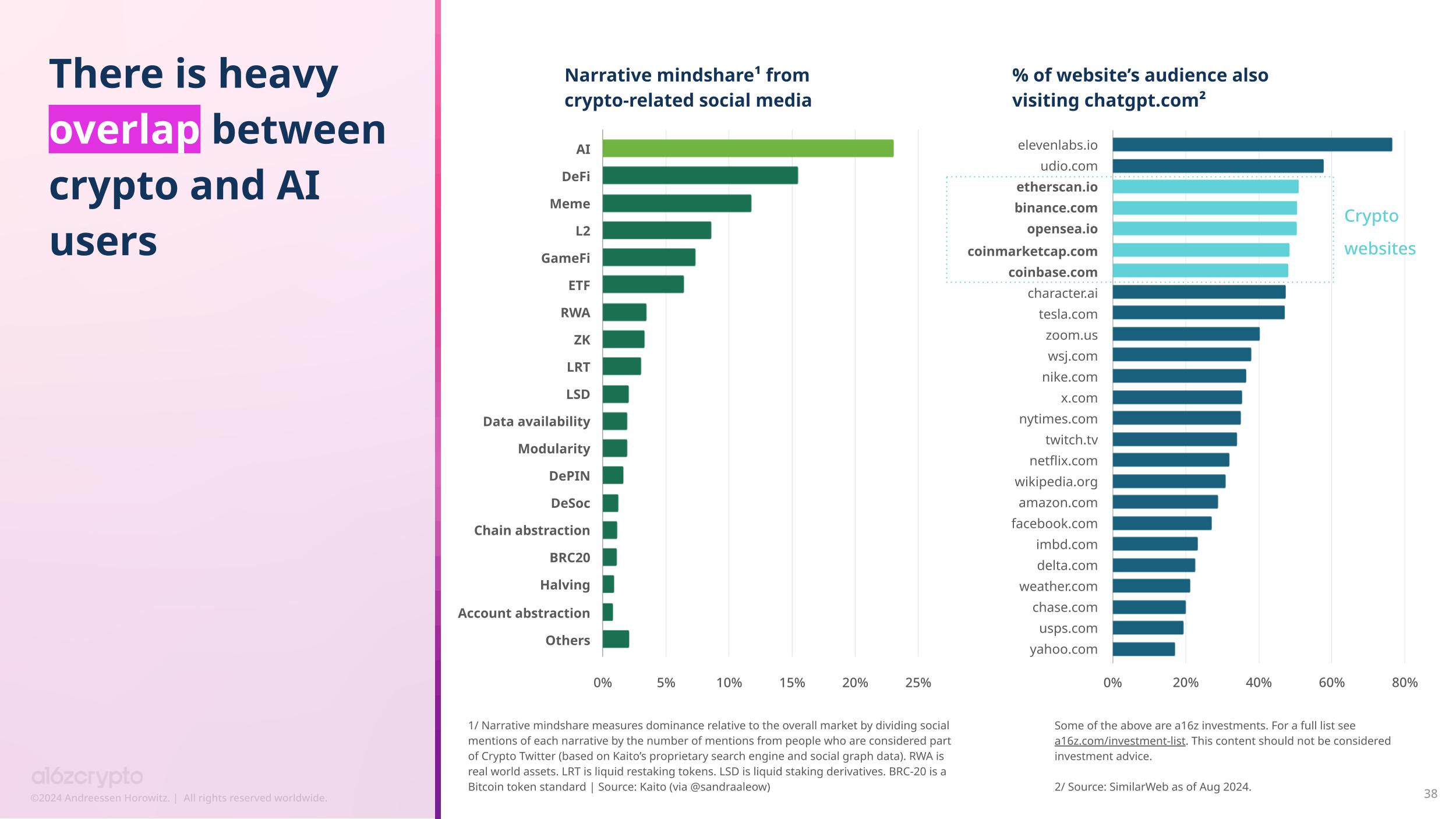

AI is one of the hottest trends this year, not only in the broader tech space but also in the cryptocurrency sector.

AI is one of the trends widely discussed by cryptocurrency influencers on social media. Surprisingly, chatgpt.com has a high visitor overlap with top cryptocurrency websites, indicating a close connection between cryptocurrency and AI users.

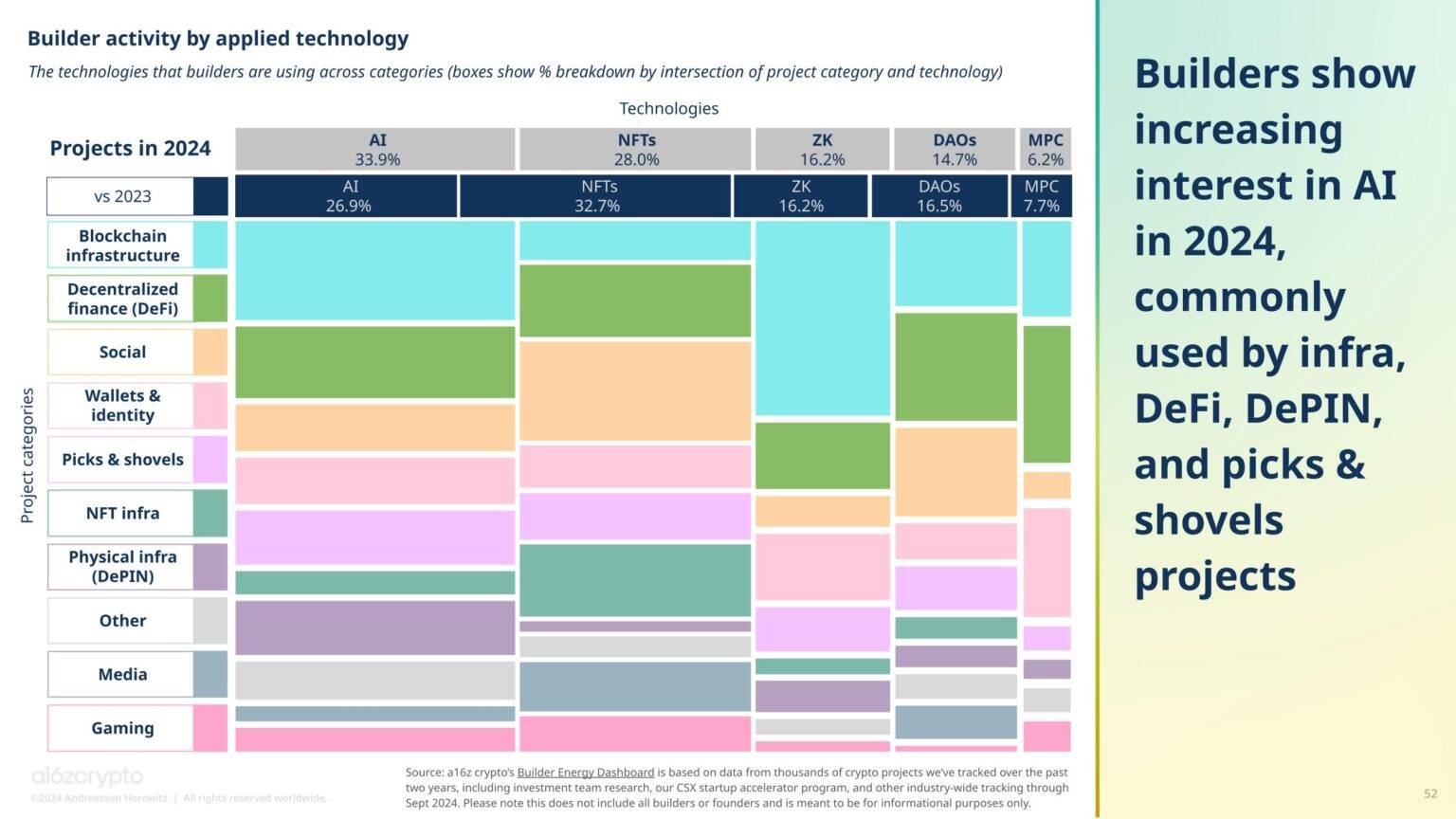

The connection between cryptocurrency developers and AI is also strong. According to our Builder Energy Dashboard, about one-third of cryptocurrency projects—34%—indicate they are using AI, regardless of the category they are building in, an increase from 27% a year ago. The most popular category for applying AI technology is blockchain infrastructure projects.

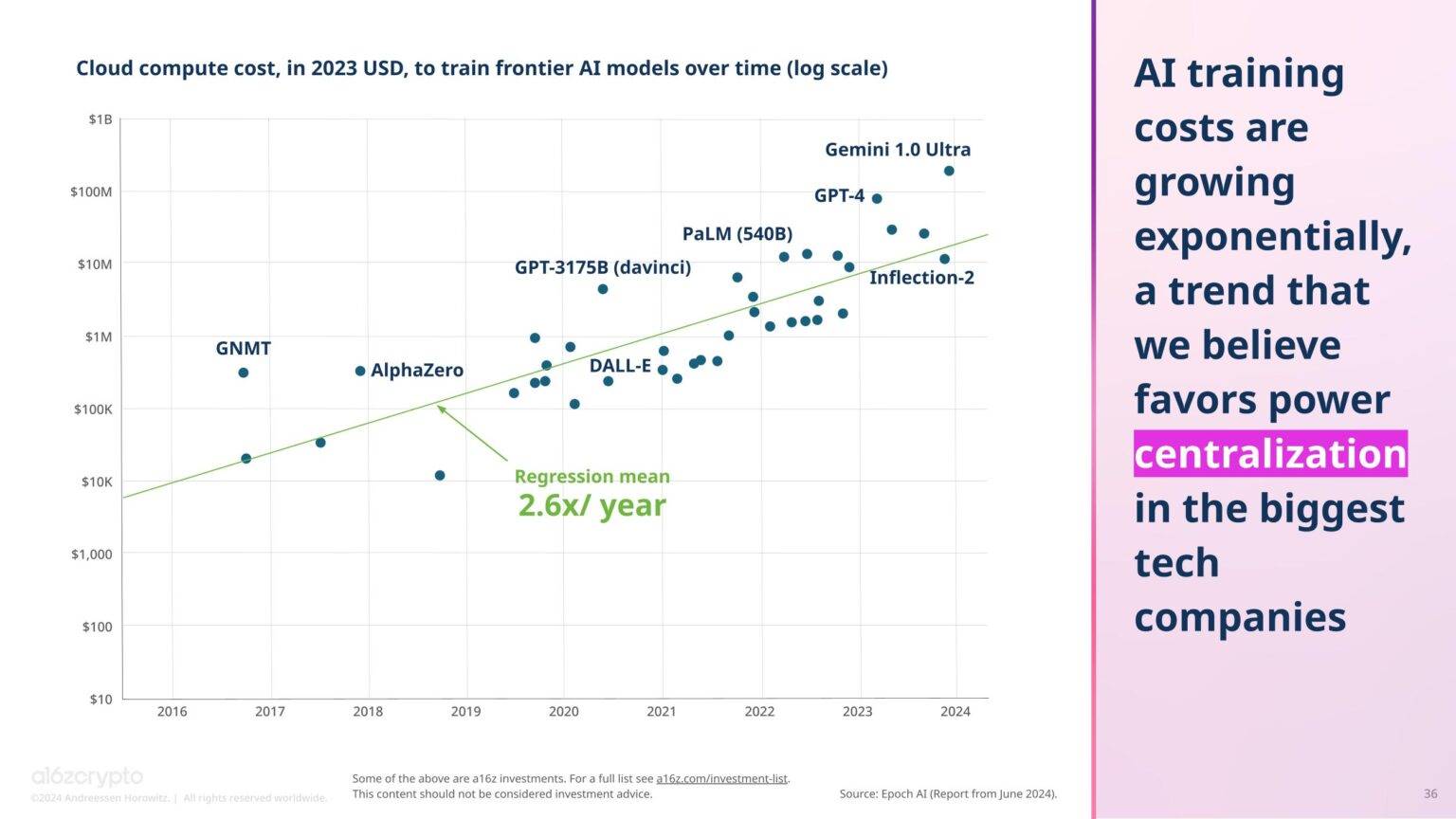

Given that the cost of training cutting-edge AI models has quadrupled annually over the past decade, we believe AI may lead to further concentration of power on the internet. Without intervention, only the largest tech companies may have the capability to train the latest AI models.

The centralization challenges faced by AI are almost the opposite of the decentralization opportunities offered by blockchain. Currently, some cryptocurrency projects are attempting to address these challenges, such as Gensyn (democratizing AI computation), Story (compensating creators through intellectual property tracking), Near (running AI on open-source, user-owned protocols), and Starling Labs (verifying the authenticity and provenance of digital media).

In the coming years, the combination of cryptocurrency and AI may become even closer.

- More scalable infrastructure unlocks new on-chain applications -------------------

With reduced transaction costs and increased blockchain capacity, many potential cryptocurrency consumer applications have become possible.

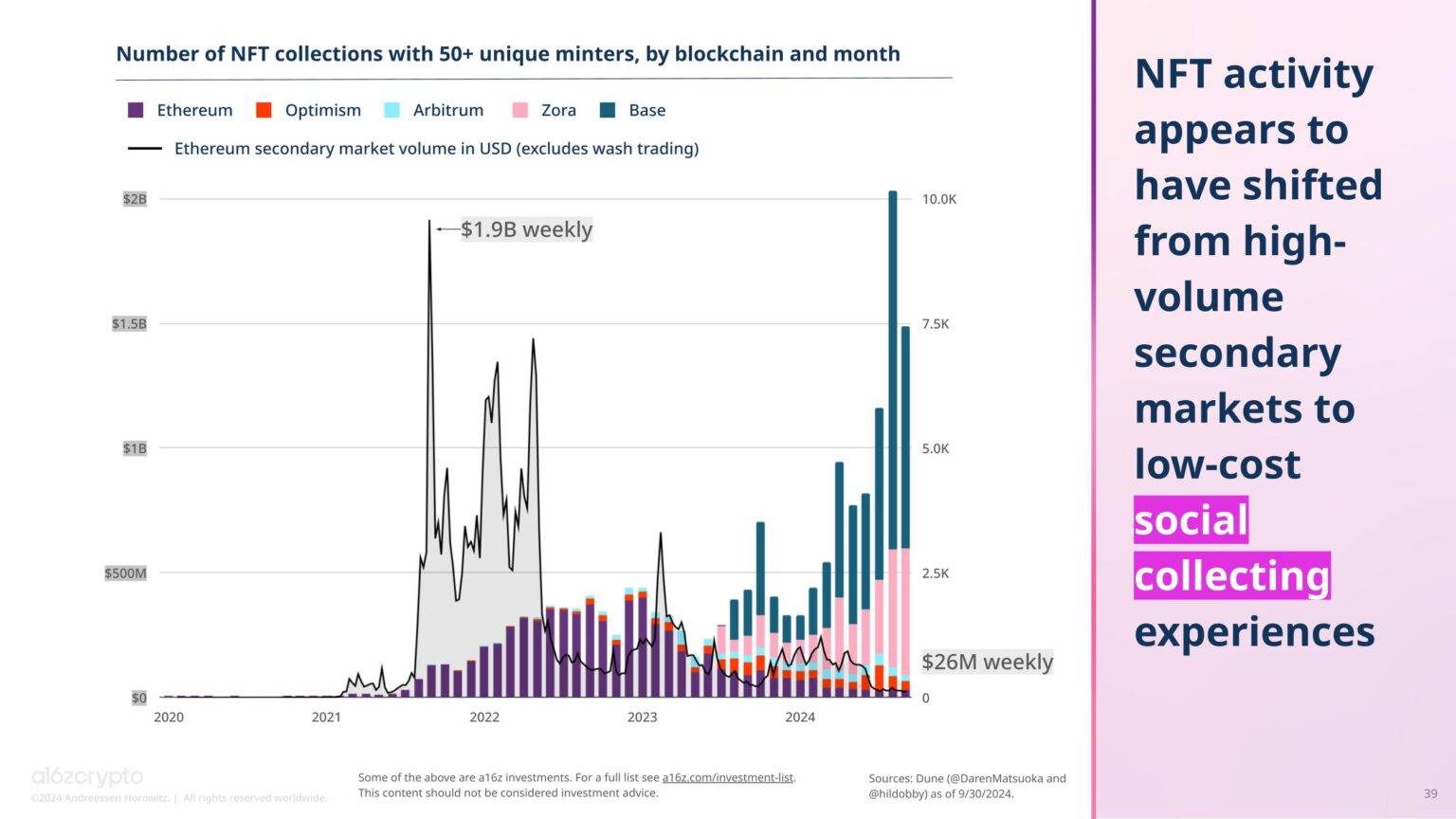

For example, the NFT market has undergone significant changes. A few years ago, due to high cryptocurrency transaction fees, people traded NFTs on the secondary market for billions of dollars. As transaction fees have decreased, this activity has diminished, giving rise to a new trend of minting low-cost NFT collectibles on social applications like Zora and Rodeo.

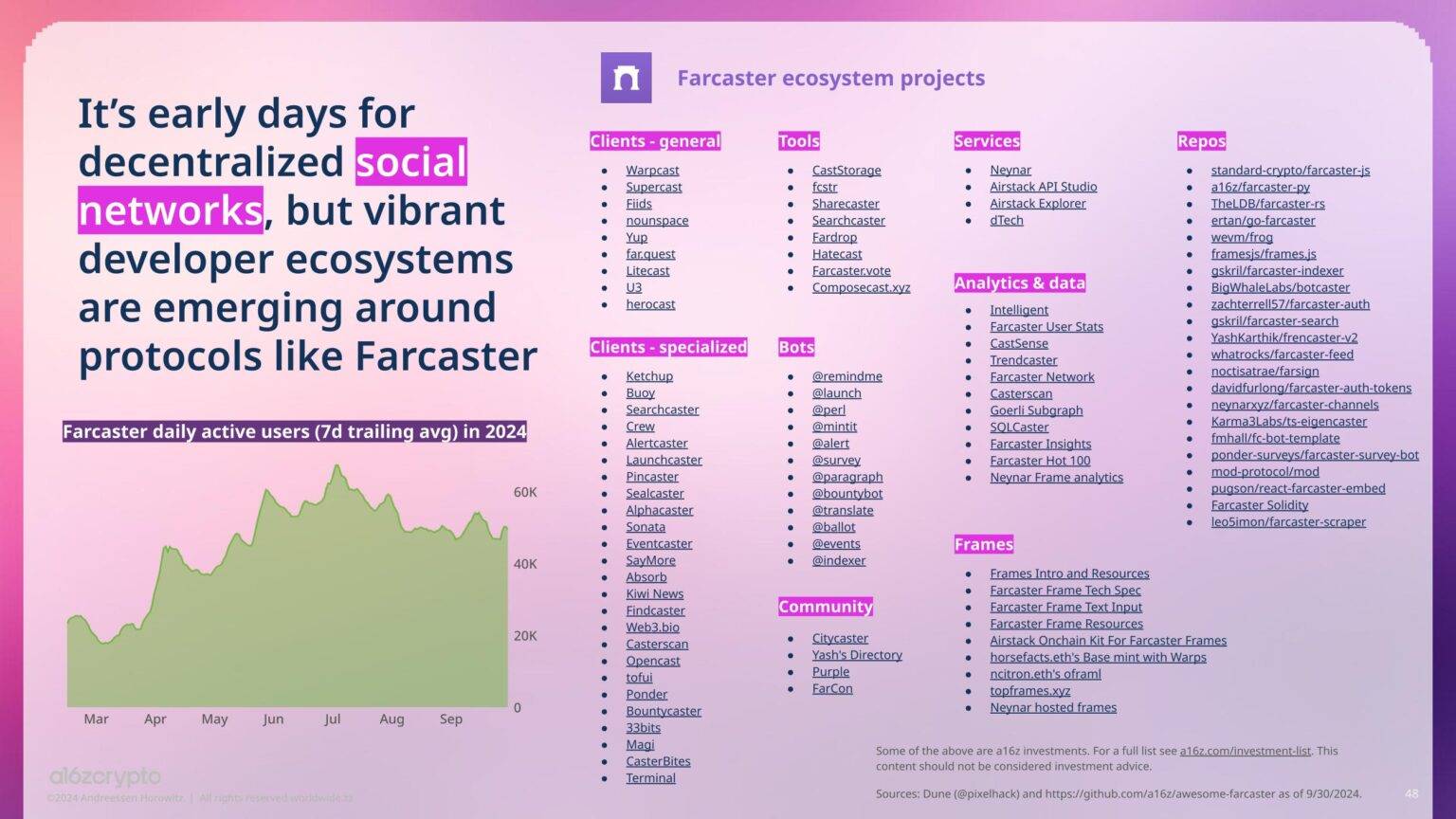

Social networks are another example. Although they currently account for only a small portion of daily on-chain activity, they have attracted significant attention from developers. According to our Builder Energy Dashboard, 10.3% of cryptocurrency projects in 2024 are related to social aspects. In fact, projects related to social networks, such as those associated with Farcaster, are among the top five hottest developer subcategories this year.

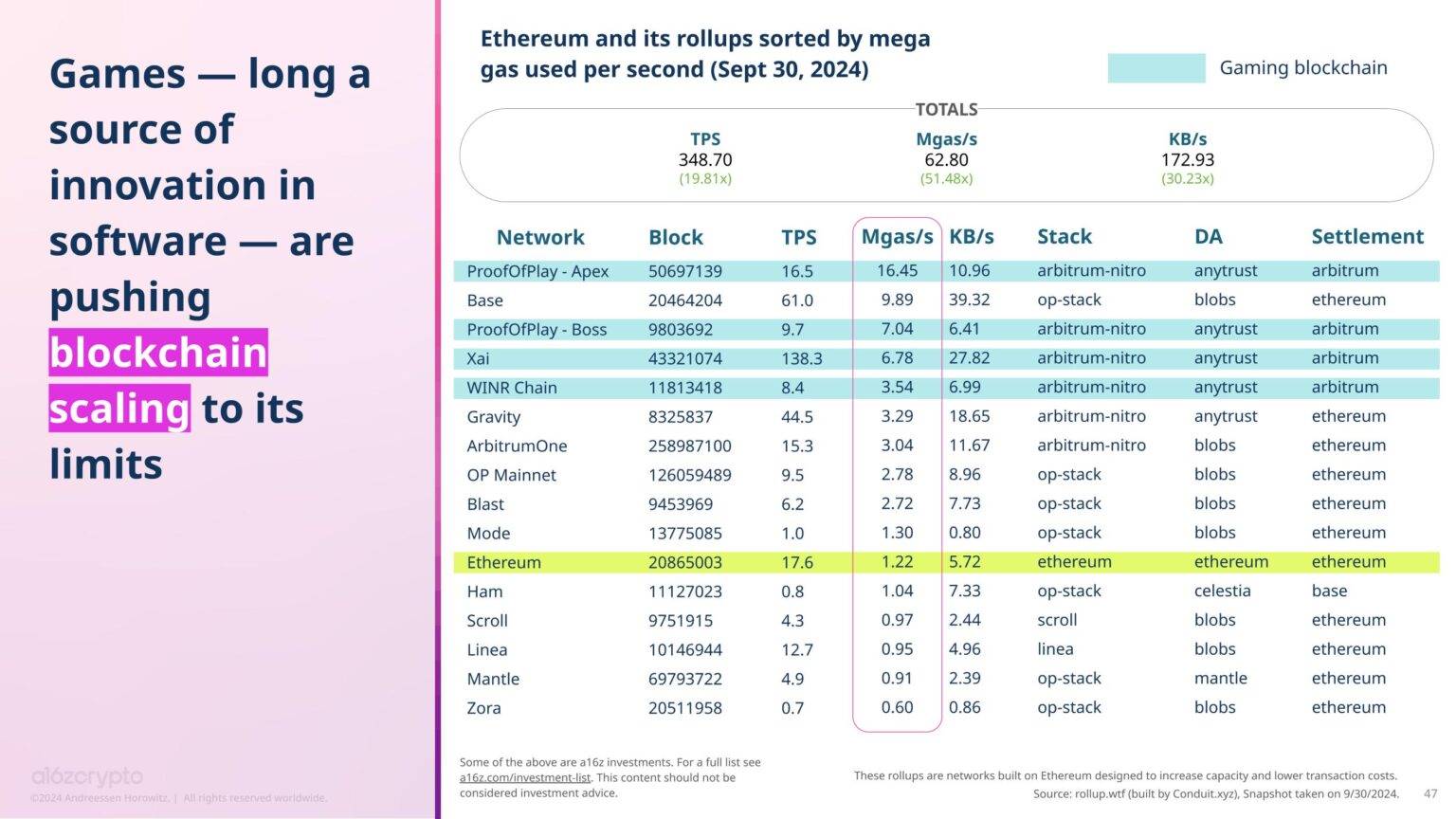

As developers and consumers explore more social experiences, on-chain gaming is challenging the scalability of blockchain. For example, the rollups used by the seafaring adventure RPG Pirate Nation from Proof Of Play consistently consume the most gas among Ethereum rollups.

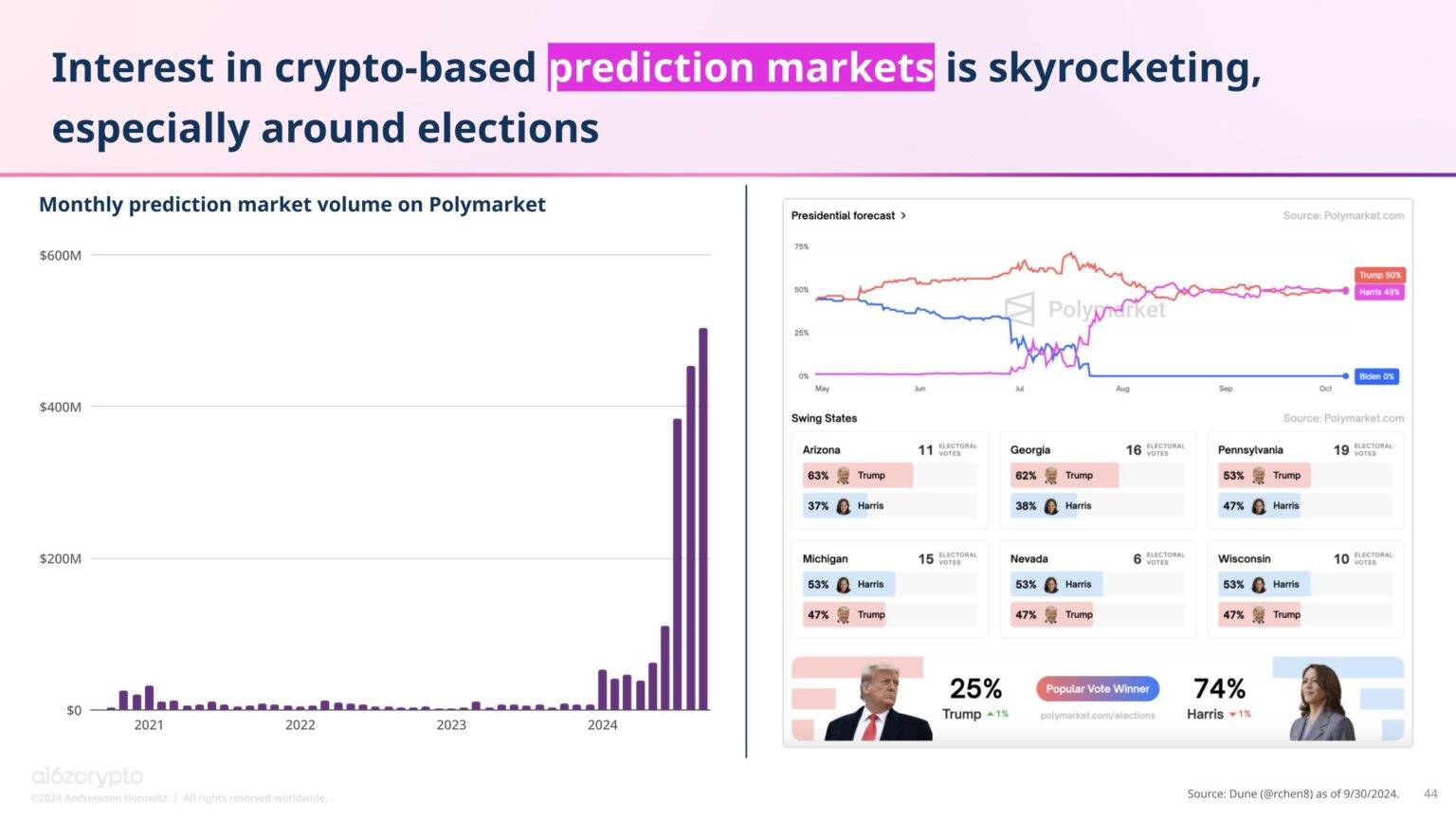

With the November elections approaching, cryptocurrency-based prediction markets are emerging, despite being illegal in the U.S., while the overall prediction market is gaining momentum. For instance, Kalshi, a non-cryptocurrency prediction market registered with the U.S. Commodity Futures Trading Commission, recently won support from a lower court in a federal lawsuit attempting to list election contracts. (As of now, registered exchanges are allowed to offer traditional futures contracts based on elections.)

Consumers are beginning to exhibit new behavior patterns. When blockchain infrastructure is cumbersome and transaction costs are high, these emerging experiences are difficult to realize. With improvements in blockchain along the classic technology price-performance curve, these applications are expected to thrive.

Where does this leave us? Over the past year, cryptocurrency has made significant progress in multiple areas, including policy, technology, and consumer adoption. Policy advancements include the rapid approval and listing of Bitcoin and Ethereum ETPs, as well as the passage of important bipartisan cryptocurrency legislation. Major improvements in infrastructure include scaling upgrades and the rise of Ethereum L2 and other high-throughput blockchains. New applications are also continuously being developed and utilized, from the growth of mainstream products like stablecoins to explorations in emerging fields such as AI, social networks, and gaming.

Whether we have entered the fifth wave of the price-innovation cycle remains to be seen. Regardless, as an industry, cryptocurrency has made undeniable progress over the past year. As demonstrated by ChatGPT, a single breakthrough product can change an entire industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。