Only invest funds that you can afford to lose.

Written by: @PixOnChain, JirasanOfficial researcher

Translated by: zhouzhou, BlockBeats

Editor’s note: We are currently in the early stages of a bull market. To truly hold assets until they reach 100 times, one must first understand the challenges of each stage: from $100,000 to $10 million, look for low market cap dark horses, focus on strong themes and active communities; from $1 million to $100 million, have a clear investment logic, build conviction, and hold patiently; from $10 million to $1 billion, this step is the most difficult, requiring a deep understanding of the market and trends, often involving long-term holding. Most importantly, only use funds that you can afford to lose when investing, so you can remain calm during market fluctuations and ensure long-term holding.

Below is the original content (reorganized for better readability):

How to truly hold until 100 times:

First, understand this: not all 100 times are the same.

There are three main scenarios:

- $100,000 - $10 million

- $1 million - $100 million

- $10 million - $1 billion

Each scenario has its unique challenges, and we will break them down one by one.

$100,000 - $10 million

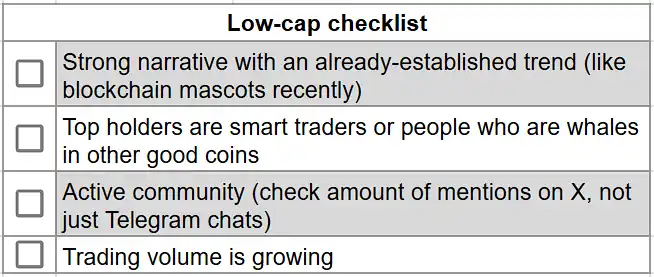

This is the fastest and most common path to 100 times, with multiple tokens' market caps breaking $10 million every day. How to discover potential dark horses? The method is simple, a low market cap coin investment checklist:

- Strong thematic narrative that has formed a trend (e.g., recent blockchain mascots).

- Top holders are smart traders or whales of other quality coins.

- High community activity (check mentions on X, not just Telegram group chats).

- Sustained growth in trading volume.

Pumps from $100,000 to $10 million usually happen quickly, sometimes within days, so all you need to do is place sell orders for your targets without overthinking.

$1 million - $100 million

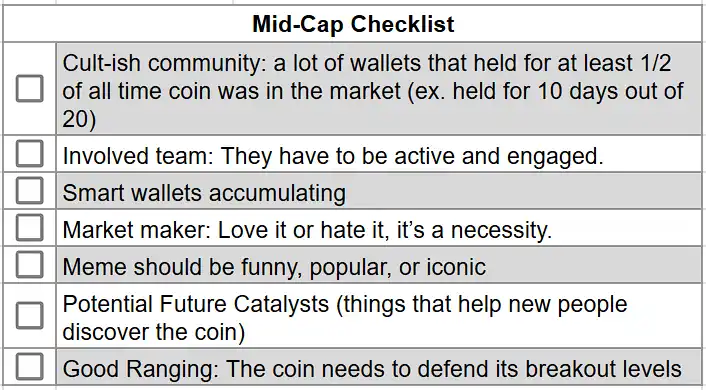

This is where it gets tricky. Tokens moving from $1 million to $100 million must accomplish many things; missing one step can stall the run. What do you need to look for? This is the mid-cap coin checklist:

Fervent community: A large number of wallets hold for more than half of the token's market circulation time (e.g., holding for at least 10 days within 20 days of market circulation).

- Active team: The team must be actively involved and engaged.

- Smart wallets accumulating: Smart money continues to buy in.

- Market cap managers: Like it or not, this is a must.

- Engaging memes: Must be fun, popular, or iconic.

- Potential future catalysts: Factors that can help new users discover the token.

- Good volatility range: The token needs to hold key price levels after breaking out.

To stick with tokens that offer 100 times returns, you need one crucial point: have a clear investment logic. Without it, you will sell at the first drop or small profit; the key lies in conviction.

$10 million - $1 billion

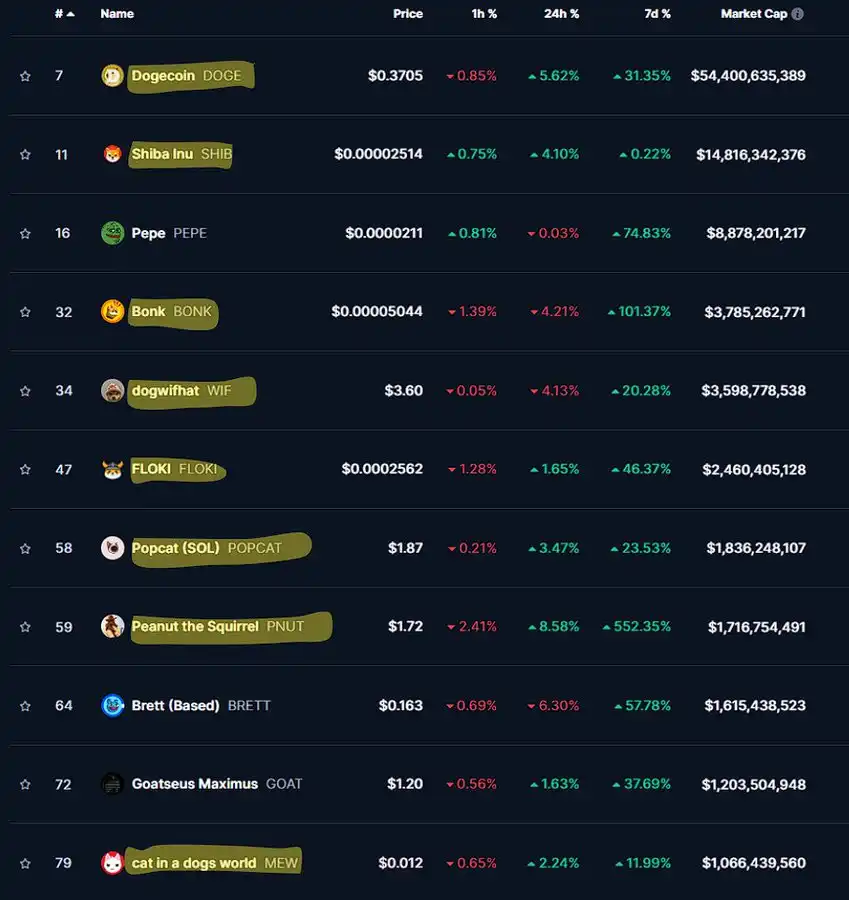

Now we enter uncharted territory. Among all existing memecoins, only 11 currently have a market cap exceeding $1 billion. How did they achieve this? Among the memecoins with a market cap over $1 billion, 73% (8/11) share a common trait: they are all animal-themed. What about the rest? They are pioneers in their respective fields (like GOAT, PEPE, and BRETT).

The most important rule at every level: only invest funds that you can afford to lose. I know this sounds boring, but when your position only accounts for 1-5% of your trading capital, you will sleep more soundly. This is the only way to maintain your holdings through significant volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。